Global Nano And Micro Satellite Market

Market Size in USD Billion

CAGR :

%

USD

3.71 Billion

USD

11.43 Billion

2024

2032

USD

3.71 Billion

USD

11.43 Billion

2024

2032

| 2025 –2032 | |

| USD 3.71 Billion | |

| USD 11.43 Billion | |

|

|

|

|

Nano and Micro Satellite Market Analysis

The nano and micro satellite market has witnessed significant advancements in miniaturization technologies, enabling compact designs with enhanced functionality. The integration of 3D printing has revolutionized satellite manufacturing, reducing production time and costs. In addition, modular satellite architectures now allow for scalable designs and flexible missions. Innovations in propulsion systems, such as electric and chemical propulsion, improve orbital maneuverability and extend satellite lifespans.

These technologies are widely used in earth observation, communication, and scientific research. For instance, high-resolution imaging for environmental monitoring or disaster response is made more accessible by nano and micro satellites. Furthermore, they support the growing demand for IoT connectivity in remote areas.

The market's growth is fueled by cost reductions, private-sector involvement, and rising small satellite constellations such as SpaceX’s Starlink. Governments are also increasingly investing in these satellites for defense and surveillance purposes. By 2030, the nano and micro satellite market is projected to experience exponential growth, driven by its versatile applications and continuous technological evolution.

Nano and Micro Satellite Market Size

The global nano and micro satellite market size was valued at USD 3.71 billion in 2024 and is projected to reach USD 11.43 billion by 2032, with a CAGR of 15.1% during the forecast period of 2025 to 2032. In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis.

Nano and Micro Satellite Market Trends

“Rising Demand for Earth Observation”

One key trend in the nano and micro satellite market is the growing use of these satellites for Earth observation applications. Governments, research institutions, and private companies increasingly deploy nano and micro satellites for climate monitoring, disaster management, and resource mapping. For instance, in March 2021, Rocket Lab USA launched seven small satellites into Earth’s orbit as part of its dedicated mission. This payload included a designed for Earth observation satellites, two "internet of things" nanosatellites, and three experimental satellites. Among the payloads was a CubeSat developed for the U.S. Army’s Space and Missile Defense Command (SMDC), showcasing Rocket Lab's contribution to both commercial and military space missions. The demand for real-time data for agriculture, urban planning, and defense further accelerates the adoption of these compact satellites, pushing the market towards consistent growth.

Report Scope and Nano and Micro Satellite Market Segmentation

|

Attributes |

Nano and Micro Satellite Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Planet Labs, Inc. (U.S.), Spire Global (U.S.), Surrey Satellite Technology (U.K.), Swarm Technologies, Inc. (U.S.), SpaceQuest, Ltd. (U.S.), L3Harris Technologies, Inc. (U.S.), CommSat (U.S.), German Orbital Systems GmbH (Germany), ViaSat, Inc. (U.S.), GomSpace (Denmark), Sky and Space Global (U.K.), Astrocast (Switzerland), Lockheed Martin Corporation (U.S.), Sierra Nevada Corporation (U.S.), AAC Clyde Space (Sweden), Dauria Aerospace (Russia), Axelspace Corporation (Japan), Space Global (U.S.), and SpaceWorks Enterprises, Inc. (U.S.) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Nano and Micro Satellite Market Definition

Nano and micro satellites are small-scale spacecraft designed for various purposes, including research, communication, and Earth observation. Nano satellites typically weigh between 1 and 10 kilograms, while micro satellites range from 10 to 100 kilograms. Their compact size and lower production costs make them ideal for deploying in clusters or as part of satellite constellations. These satellites use advanced miniaturized technology, such as microprocessors and lightweight materials, to perform functions similar to larger satellites. Often launched using ride-sharing missions, they enable cost-effective access to space. Nano and micro satellites support applications in disaster management, environmental monitoring, and global connectivity.

Nano and Micro Satellite Market Dynamics

Drivers

- Growing Adoption in Telecommunications

The nano and micro satellite market is significantly driven by the rising demand for high-speed, global internet connectivity. Satellite constellations, such as SpaceX's Starlink and OneWeb, aim to provide seamless internet access to remote and underserved areas, enhancing global communication infrastructure. For instance, Starlink has launched thousands of small satellites to establish a global broadband network, addressing connectivity gaps in rural regions. Similarly, OneWeb focuses on offering high-speed internet to areas with limited terrestrial connectivity. This growing reliance on nano and micro satellites in telecommunications is accelerating market growth by creating opportunities for satellite manufacturers, launch service providers, and telecommunication service companies worldwide.

- Expanding Proliferation of Commercial Space Initiatives

The growing involvement of private companies in small satellite missions is a key driver for the nano and micro satellite market. Firms such as SpaceX, Rocket Lab, and Planet Labs are actively launching small satellite constellations to provide global communication, imaging, and data services. For instance, Planet Labs' fleet of CubeSats delivers real-time Earth observation data for industries such as agriculture and forestry. Similarly, Amazon's Project Kuiper plans to deploy over 3,000 small satellites for global broadband connectivity. These initiatives highlight the shift toward commercial space ventures, fostering competition, reducing costs, and creating a robust ecosystem, thereby driving the market's growth.

Opportunities

- Expanding IoT Connectivity Needs

The rising adoption of IoT devices in agriculture, logistics, and remote monitoring creates a significant opportunity for nano and micro satellite markets. These satellites provide reliable communication networks in regions where terrestrial infrastructure is unavailable or costly. For instance, small satellites enable precision farming by connecting IoT sensors in fields, optimizing water usage and crop yields. Similarly, industries such as shipping benefit from real-time tracking of vessels in remote oceanic areas. Companies such as Swarm Technologies and Lacuna Space are already leveraging small satellites to deliver affordable IoT connectivity solutions globally. This demand for seamless IoT networks fosters innovative satellite deployments, driving market growth.

- Advancements in Satellite Miniaturization

Advancements in satellite miniaturization have opened new opportunities in the nano and micro satellite market. Innovations in temperature sensor technology, such as advanced imaging and environmental sensors, allow smaller satellites to provide high-quality data previously reserved for larger counterparts. Microelectronics improvements have led to more power-efficient and compact components, enhancing satellite capabilities while reducing size and weight. In addition, innovations in propulsion systems, such as electric thrusters, enable precise orbital control for smaller satellites, expanding their mission possibilities. For instance, the Planet Labs’ Dove satellites use miniaturized sensors to deliver high-resolution Earth imagery, catering to a wide range of applications such as agriculture, disaster response, and urban planning. These advancements make small satellites a viable option for more industries.

Restraints/Challenges

- Limited Payload Capacity

The small size of nano and micro satellites significantly restricts their payload capacity, which hinders their ability to perform advanced or heavy tasks. This limitation prevents them from carrying sophisticated instruments or large communication systems, making them unsuitable for certain applications such as high-resolution Earth observation or complex scientific experiments. Consequently, industries requiring heavy payloads, such as defense, telecommunications, and advanced research, are often unable to utilize these smaller satellites. As a result, the market for nano and micro satellites faces a constraint in attracting large-scale commercial and government missions, limiting their growth potential and application scope in specialized sectors.

- Limited Lifespan

The limited lifespan of nano and micro satellites is a significant restraint in the market. Due to their smaller size, these satellites are typically built with less robust components and limited power resources, resulting in shorter operational lifespans compared to larger satellites. This shorter lifespan necessitates more frequent replacements, which increases costs and complicates long-term mission planning. In addition, the limited durability can hinder the effectiveness of sustained operations, particularly for missions that require long-term data collection or continuous communication. As a result, the market faces challenges related to sustainability, with high maintenance and replacement costs, impacting the adoption of nano and micro satellites for extended missions.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Nano and Micro Satellite Market Scope

The market is segmented on the basis of component, mass, application and vertical. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Component

- Hardware

- Software

- Data Processing

- Launch Services

Mass

- 1 Kg – 10 Kg (Nanosatellites)

- 11 Kg – 100 Kg (Microsatellites)

Application

- Communications

- Reconnaissance

- Scientific Research

- Earth Observation

- Remote Sensing

- Climate

- Mapping and Navigation

Vertical

- Media and Entertainment Sector

- BFSI

- Healthcare Sector

- Transportation

- Public Sector

- Manufacturing Sector

- Retail Sector

- IT and Telecom Sector

- Energy and Utilities

- Others

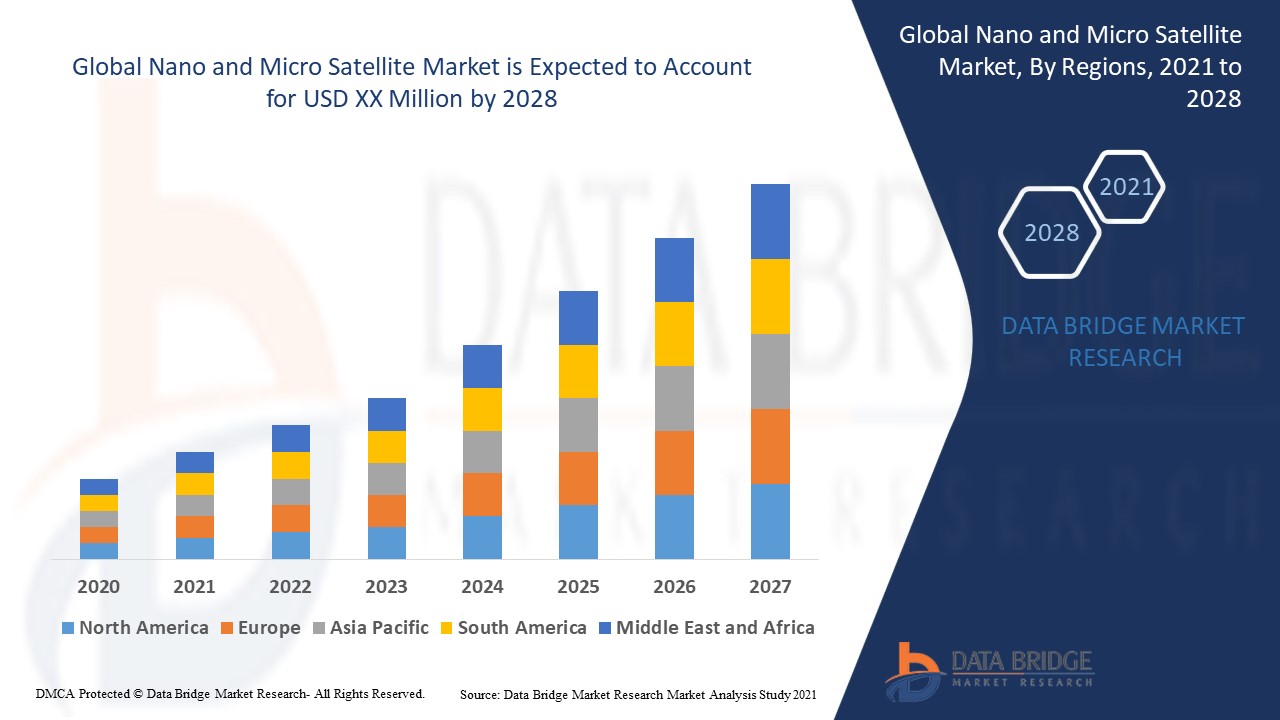

Nano and Micro Satellite Market Regional Analysis

The market is analysed and market size insights and trends are provided by component, mass, application and vertical as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

Europe is expected to dominate the nano and micro satellite market due to advancements in technology. The region's strong growth in launch services, software, and data processing capabilities is set to further drive the market's expansion throughout the forecast period.

Asia-Pacific is expected to dominate the nano and microsatellite market, driven by rising demand for satellite-based communication services and navigation systems in China, India, and Japan. The region's growing technological advancements and investments in space exploration further boost market expansion.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Nano and Micro Satellite Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Nano and Micro Satellite Market Leaders Operating in the Market Are:

- Planet Labs, Inc. (U.S.)

- Spire Global (U.S.)

- Surrey Satellite Technology (U.K.)

- Swarm Technologies, Inc. (U.S.)

- SpaceQuest, Ltd. (U.S.)

- L3Harris Technologies, Inc. (U.S.)

- CommSat (U.S.)

- German Orbital Systems GmbH (Germany)

- ViaSat, Inc. (U.S.)

- GomSpace (Denmark)

- Sky and Space Global (U.K.)

- Astrocast (Switzerland)

- Lockheed Martin Corporation (U.S.)

- Sierra Nevada Corporation (U.S.)

- AAC Clyde Space (Sweden)

- Dauria Aerospace (Russia)

- Axelspace Corporation (Japan)

- Space Global (U.S.)

- SpaceWorks Enterprises, Inc. (U.S.)

Latest Developments in Nano and Micro Satellite Market

- In May 2022, LeoStella successfully delivered two advanced satellites to BlackSky at New Zealand's Rocket Lab Launch Complex 1. This collaboration significantly enhanced BlackSky's growing constellation, increasing its capacity for rapid Earth observation and improving its revisit capabilities. The addition of these satellites supports BlackSky’s mission of providing real-time data services to its clients, further strengthening its position in the small satellite market

- In March 2022, The China Aerospace Science and Technology Corporation (CASC) achieved a major milestone with the successful launch of the Tiankun-2 satellites. These satellites were placed into low-Earth polar orbit during the debut mission of the Long March 6A rocket. This launch highlighted China's advancing capabilities in satellite deployment, further expanding its space exploration ambitions and enhancing its Earth observation technologies

- In March 2021, Rocket Lab USA launched seven small satellites into Earth’s orbit as part of its dedicated mission. This payload included a microsatellite designed for Earth observation, two "internet of things" nanosatellites, and three experimental satellites. Among the payloads was a CubeSat developed for the U.S. Army’s Space and Missile Defense Command (SMDC), showcasing Rocket Lab's contribution to both commercial and military space missions

- In June 2020, NanoAvionics announced a partnership with Exolaunch for a collaborative mission on SpaceX's Falcon 9 small satellite-dedicated rideshare. The mission was set to launch six 6U nanosatellites into orbit in December 2020. This collaboration aimed to showcase NanoAvionics' expertise in satellite manufacturing and deployment, enhancing its presence in the rapidly growing small satellite industry and demonstrating SpaceX's rideshare mission capabilities

- In June 2020, Kepler Communications, in collaboration with Space Flight Laboratory (SFL), launched its Operational Nanosatellite Constellation project. The goal was to leverage SFL’s design and manufacturing expertise to develop an advanced satellite constellation. This partnership aims to provide global connectivity, with Kepler aiming to deliver cost-effective and high-bandwidth communication services, contributing to the expansion of satellite network technologies in the commercial space sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.