Global Mobile Telecommunications Services Market

Market Size in USD Billion

CAGR :

%

USD

1,800.23 Billion

USD

2,245.29 Billion

2024

2032

USD

1,800.23 Billion

USD

2,245.29 Billion

2024

2032

| 2025 –2032 | |

| USD 1,800.23 Billion | |

| USD 2,245.29 Billion | |

|

|

|

|

Mobile Telecommunications Services Market Size

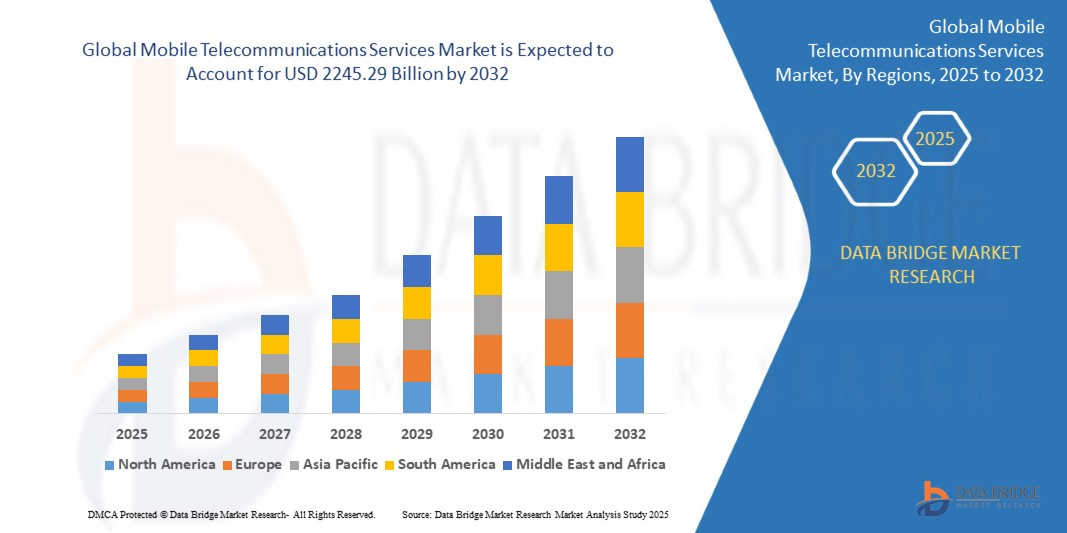

- The global mobile telecommunications services market was valued at USD 1800.23 billion in 2024 and is expected to reach USD 2245.29 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 2.80%, primarily driven by the increasing demand for high-speed internet and mobile data services

- This growth is driven by rapid adoption of smartphones, and the growing reliance on mobile devices for communication, entertainment, and business activities

Mobile Telecommunications Services Market Analysis

- The mobile telecommunications services sector is experiencing rapid growth, driven by factors such as increased smartphone usage, improved internet access, and the shift towards mobile-based communication. This surge is particularly beneficial for both consumers and businesses, enabling seamless connectivity and empowering digital economies to thrive

- The market's expansion is also supported by the growing adoption of emerging technologies such as 5G, cloud computing, and edge computing, which enhance the speed, reliability, and efficiency of mobile networks. In addition, increased investments in infrastructure and the rollout of 5G networks are setting the stage for new services and applications in industries such as IoT, autonomous vehicles, and smart cities

- For instance, in the U.S., Verizon has been rolling out 5G Ultra Wideband in key markets, offering enhanced speed and capacity, which is expected to drive the adoption of next-gen mobile applications across sectors

- The market is being further shaped by strategic collaborations between telecom providers and technology companies, which are driving the development of mobile-first services such as cloud-based communications, mobile payment platforms, and AI-powered customer service tools. These innovations are transforming the way businesses and consumers interact, creating new revenue streams for telecom operators

Report Scope and Mobile Telecommunications Services Market Segmentation

|

Attributes |

Mobile Telecommunications Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis |

Mobile Telecommunications Services Market Trends

“Expansion of 5G Connectivity and Network Infrastructure”

- A significant trend in the mobile telecommunications services market is the global rollout of 5G networks, offering ultra-fast data speeds, reduced latency, and greater capacity to support advanced mobile applications and IoT ecosystems

- The demand for 5G is being driven by industries such as healthcare, automotive, and smart cities that rely on high-performance connectivity for real-time operations and remote services

- For instance, in September 2024, Verizon Communications announced the integration of wireless and wired services after acquiring Frontier Communications to expand its 5G service reach in the U.S.

- Telecom providers are heavily investing in 5G spectrum licenses and infrastructure upgrades to support next-gen services such as AR/VR, cloud gaming, and autonomous vehicles

- This trend is reshaping the mobile telecom landscape by enabling seamless connectivity, opening new revenue streams, and positioning service providers for future digital transformation

Mobile Telecommunications Services Market Dynamics

Driver

“Proliferation of Mobile-Based Entertainment and Streaming Services”

- The surge in demand for video streaming, mobile gaming, and on-demand content is driving higher mobile data consumption, boosting revenues for telecom service providers

- The availability of affordable smartphones and high-speed internet has accelerated the shift toward mobile entertainment, especially in emerging markets

- Partnerships between telecom operators and OTT platforms (e.g., Netflix, Amazon Prime, Spotify) are enabling bundled services that enhance customer loyalty and ARPU (average revenue per user)

- For instance, in March 2024, Airtel India partnered with Disney+ Hotstar to offer free streaming subscriptions bundled with mobile data plans, boosting user retention and data usage

- This driver is expected to propel continuous investment in network performance and content delivery infrastructure to meet consumer expectations

Opportunity

“Enterprise Adoption of Unified Communication Services”

- Businesses across sectors are increasingly adopting unified communication and collaboration (UC&C) tools, such as VoIP, video conferencing, and cloud telephony, as part of digital workplace transformation

- Mobile telecom service providers have the opportunity to tap into the enterprise segment by offering customized UCaaS (Unified Communications as a Service) and mobile-first communication solutions

- The shift to remote and hybrid work models has expanded the need for mobile connectivity, cloud-based PBX systems, and secure enterprise mobility solutions

- For instance, in February 2023, AT&T and ServiceNow co-developed the Telecom Network Inventory tool to help telecoms streamline 5G and fiber deployments, improving enterprise network management

- As enterprise mobility rises, this segment presents a lucrative growth opportunity for telecom operators to diversify service portfolios and build long-term partnerships

Restraint/Challenge

“High Capital Expenditure for Infrastructure Upgrades”

- The deployment of advanced networks such as 5G and fiber optics demands massive investment in spectrum acquisition, base stations, data centers, and network maintenance

- For many telecom companies, especially in developing regions, the cost of infrastructure development can limit service expansion and affect profitability

- Long return on investment (ROI) periods and regulatory hurdles also add pressure on operators to balance spending with sustainable growth strategies

- For instance, in December 2024, Vodafone UK and Three UK finalized a £16.5 billion merger to consolidate infrastructure resources and reduce operational costs amidst rising network investment demands

- Addressing this challenge will require strategic partnerships, public funding support, and phased rollout plans to ensure cost-effective infrastructure development across markets

Mobile Telecommunications Services Market Scope

The market is segmented on the basis of type of service type and solution.

|

Segmentation |

Sub-Segmentation |

|

By Service Type

|

|

|

By Solution |

|

Mobile Telecommunications Services Market Regional Analysis

“Asia-Pacific is the Dominant Region in the Mobile Telecommunications Services Market”

- Rapid urbanization and growing smartphone penetration in countries such as China, India, and Japan are significantly driving the growth of mobile telecommunications services in the Asia-Pacific region

- The region’s increasing adoption of 5G technology is boosting demand for high-speed data services, enhancing mobile service offerings

- Government initiatives and investments in improving digital infrastructure are accelerating the expansion of mobile telecommunications networks in the region

- Asia-Pacific’s dominant position in the mobile telecommunications services market is expected to continue due to its large population, increasing technological advancements, and strong economic growth

“North America is projected to register the Highest Growth Rate”

- North America is expected to have the highest growth rate in the mobile telecommunications services market during the forecast period

- This growth is driven by an increase in demand for internet-based communication services, particularly among small and medium-sized enterprises (SMEs) in the region

- The adoption of unified communication services and cloud technologies, such as VoIP, unified communications, and voice & video conferencing, are major trends in the industry

- These trends are fueling the expansion of mobile telecommunications services in North America, positioning the region for strong growth in the coming years

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- AT&T Intellectual Property (U.S.)

- Alphabet Inc. (U.S.)

- Amazon Inc. (U.S.)

- Apple Inc. (U.S.)

- Baidu (China)

- Mavenir (U.S.)

- Thales (Netherlands)

- Google LLC (U.S.)

- InMobi (India)

- Kongzhong Corp (China)

- Comviva (India)

- Mobily (Saudi Arabia)

- Vodafone Group (U.K.)

- Cisco Systems Inc. (U.S.)

- ZTE Corporation (China)

- Huawei Technologies Co. Ltd. (China)

- Sequans Communications (France)

Latest Developments in Global Mobile Telecommunications Services Market

- In December 2024, Vodafone UK and Three UK received approval from the Competition and Markets Authority (CMA) for their USD 18.75 billion merger. This merger reduces the number of major mobile operators in the UK from four to three, resulting in a new market leader with approximately 29 million customers. The deal includes commitments such as expanding the 5G network and implementing price caps to protect consumers, ensuring a balance between competition and customer protection

- In December 2024, Bharti Airtel, a leading telecom operator in India, entered into a multi-billion-dollar agreement with Ericsson to enhance its 4G and 5G network coverage nationwide. The deployment of Ericsson’s equipment, scheduled to begin in 2025, aims to meet the rising demand for 5G services and will leverage Ericsson's centralized and Open RAN-ready solutions for improved network performance. This strategic partnership, built over two decades, aims to strengthen Airtel’s network infrastructure and future-proof its services

- In September 2024, Verizon Communications announced its USD 20 billion all-cash acquisition of Frontier Communications. This acquisition is part of Verizon’s strategy to integrate its wireless and wired networks, enhancing its consumer services and supporting long-term growth. The move is expected to streamline Verizon's service offerings, combining wireless, internet, and TV services into comprehensive subscription packages, which is set to help reduce customer churn

- In February 2023, AT&T Inc. and ServiceNow, a leading software company, launched a telecom product designed to help Communication Service Providers (CSPs) manage their inventory of 5G and fiber networks. The ServiceNow Telecom Network Inventory was developed with strategic insights and technical input from AT&T Inc. and is available globally to telecom companies. This new product will support telecom companies in streamlining their network management and enhancing operational efficiency

- In May 2023, Verizon Communications Inc. announced plans to deploy 5G Ultra Wideband in multiple markets across the U.S. states of Wisconsin, Illinois, Ohio, Arizona, Pennsylvania, and West Virginia, utilizing up to 100 MHz of the C-Band spectrum it recently acquired. Verizon intends to expand its bandwidth once the licensed spectrum is fully available by the end of 2023, which will enable them to provide higher capacity and faster speeds for consumers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.