Global Naphtha Market

Market Size in USD Billion

CAGR :

%

USD

177.67 Billion

USD

242.04 Billion

2024

2032

USD

177.67 Billion

USD

242.04 Billion

2024

2032

| 2025 –2032 | |

| USD 177.67 Billion | |

| USD 242.04 Billion | |

|

|

|

|

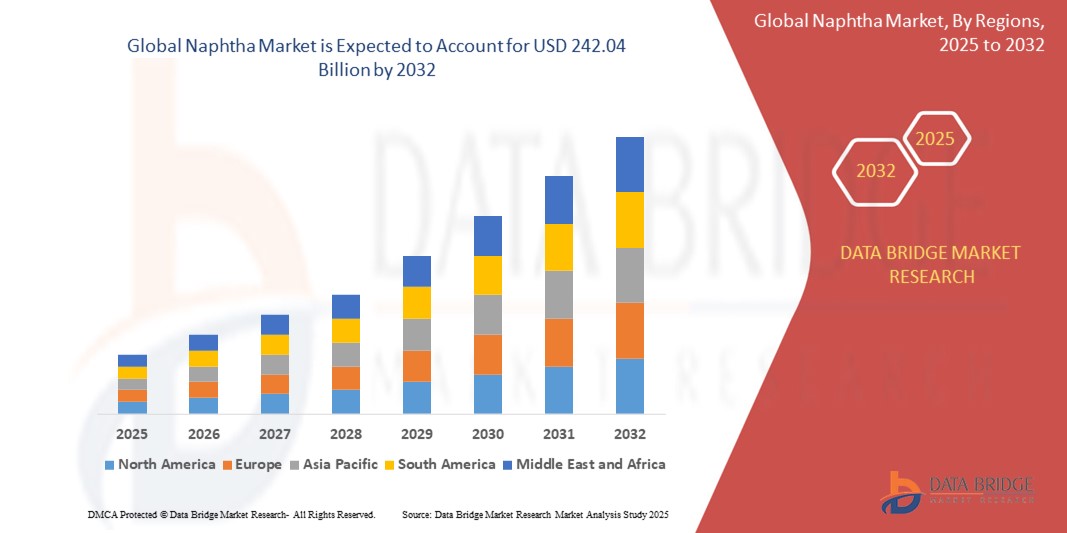

What is the Global Naphtha Market Size and Growth Rate?

- The global naphtha market size was valued at USD 177.67 billion in 2024 and is expected to reach USD 242.04 billion by 2032, at a CAGR of3.94% during the forecast period

- In the petrochemical industry, naphtha plays a crucial role as a primary feedstock for the production of ethylene and other olefins through steam cracking processes. Ethylene is a fundamental building block for a wide range of chemical products, including plastics, resins, and synthetic fibers

- Naphtha's composition, rich in hydrocarbons, makes it an ideal precursor for steam cracking, where high temperatures and steam are used to break down the molecules into smaller, more valuable components such as ethylene

What are the Major Takeaways of Naphtha Market?

- The capacity and configuration of refineries determine the production levels of naphtha. Refineries with high naphtha yields contribute to ample supply, while those with lower yields may experience supply constraints. Moreover, shifts in crude oil prices and availability affect refining economics, influencing naphtha production and pricing

- Thus, understanding and responding to refining industry dynamics is essential for stakeholders in the naphtha market to anticipate supply fluctuations and pricing trends

- Asia-Pacific dominated the naphtha market with the largest revenue share of 44.3% in 2024, driven by the region's strong petrochemical industry, rapid industrial expansion, and rising demand for plastic and chemical products

- Europe naphtha market is projected to grow at the fastest CAGR of 11.8% from 2025 to 2032, driven by increasing investments in petrochemical modernization, recycling technologies, and the transition toward low-carbon and circular economy practices

- The Light Naphtha segment dominated the Naphtha market with the largest revenue share of 58.3% in 2024, attributed to its widespread use as a primary feedstock in petrochemical production, particularly for manufacturing ethylene, propylene, and aromatics

Report Scope and Naphtha Market Segmentation

|

Attributes |

Naphtha Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Naphtha Market?

“Shift toward Naphtha Integration in Petrochemical and Energy Transition Processes”

- A prominent trend shaping the global naphtha market is its increasing integration in petrochemical production, especially for manufacturing ethylene, propylene, and other key olefins vital to plastics and chemical industries

- Growing focus on energy transition strategies has also positioned Naphtha as a transitional feedstock, as refiners and chemical companies seek low-emission alternatives and enhanced operational flexibility

- For instance, in January 2024, TotalEnergies announced investments to boost Naphtha cracking capacity at its Antwerp facility, supporting the production of bio-based and recycled polymers in line with sustainability goals

- In addition, the market is witnessing technological upgrades in steam crackers and refining processes to optimize Naphtha usage, improve efficiency, and reduce carbon emissions in large-scale petrochemical operations

- This trend aligns with global efforts to reduce dependency on traditional fossil fuels while addressing the rising demand for plastics, packaging, and specialty chemicals in diverse sectors such as automotive, construction, and consumer goods

What are the Key Drivers of Naphtha Market?

- The escalating demand for ethylene, propylene, aromatics, and other petrochemical derivatives, primarily driven by growth in the plastics, packaging, automotive, and construction industries, is a significant driver of Naphtha consumption

- For instance, in March 2024, SABIC expanded its integrated petrochemical operations in Saudi Arabia to increase Naphtha-based olefin and polymer production, catering to rising global demand for lightweight and sustainable materials

- The market is also propelled by growing investments in refining and petrochemical integration, allowing companies to enhance profitability, feedstock flexibility, and resilience in volatile energy markets

- Emerging economies, particularly in Asia-Pacific, are witnessing rapid urbanization and industrialization, boosting the consumption of Naphtha for both fuel blending and petrochemical applications

- In addition, policy initiatives promoting bio-naphtha and circular economy practices are driving research and development of renewable Naphtha alternatives derived from biomass or recycled waste, supporting sustainability goals

Which Factor is challenging the Growth of the Naphtha Market?

- A key challenge limiting the growth of the Naphtha market is the increasing competition from alternative feedstocks such as ethane, propane, and bio-based materials, which offer cost and environmental advantages, particularly in North America

- The high price volatility of crude oil, which directly influences Naphtha costs, creates operational uncertainties for petrochemical producers reliant on Naphtha as a primary feedstock

- Furthermore, tightening global regulations on carbon emissions and fossil fuel usage are pushing industries to diversify away from traditional hydrocarbon-based Naphtha, demanding costly process modifications or feedstock shift

- For instance, in 2024, the European Union introduced stricter climate policies under the Green Deal framework, compelling chemical manufacturers to explore low-carbon alternatives, impacting long-term Naphtha demand

- The technical and economic challenges associated with scaling up bio-naphtha production, coupled with limited supply chains in developing regions, further restrain market expansion

- Addressing these barriers will require enhanced R&D for alternative feedstocks, energy-efficient production technologies, and policy support to ensure Naphtha remains relevant in the evolving energy and petrochemical landscape

How is the Naphtha Market Segmented?

The market is segmented on the basis of type, process, application, and end-user industry.

• By Type

On the basis of type, the Naphtha market is segmented into Light Naphtha and Heavy Naphtha. The Light Naphtha segment dominated the Naphtha market with the largest revenue share of 58.3% in 2024, attributed to its widespread use as a primary feedstock in petrochemical production, particularly for manufacturing ethylene, propylene, and aromatics. Light Naphtha's lower boiling range makes it ideal for steam cracking, driving demand in the plastics and chemical industries.

The Heavy Naphtha segment is expected to witness notable growth from 2025 to 2032, driven by its critical role in reforming processes for producing high-octane gasoline and aromatic compounds essential for fuels and industrial applications.

• By Process

On the basis of process, the Naphtha market is segmented into Gasoline Blending, Naphtha Reforming, Steam Cracking, and Others. The Steam Cracking segment accounted for the largest market revenue share of 46.7% in 2024, fueled by its dominant role in producing key petrochemical building blocks such as ethylene, propylene, and butadiene, essential for plastics, packaging, and synthetic rubber production.

The Naphtha Reforming segment is projected to grow significantly from 2025 to 2032, owing to increasing demand for high-octane reformates used in gasoline blending and the production of aromatic chemicals.

• By Application

On the basis of application, the Naphtha market is segmented into Chemicals, Energy and Fuel, and Others. The Chemicals segment dominated the market with the largest revenue share of 61.5% in 2024, as Naphtha serves as a vital raw material for manufacturing olefins, aromatics, and other petrochemical derivatives that form the foundation of plastics, synthetic fibers, and resins.

The Energy and Fuel segment is anticipated to experience robust growth from 2025 to 2032, driven by Naphtha's use as a blending component in gasoline and as a transitional energy source in evolving fuel markets.

• By End-User Industry

On the basis of end-user industry, the Naphtha market is segmented into Petrochemical, Agriculture, Paints and Coatings, Aerospace, and Others. The Petrochemical segment dominated the market with the largest revenue share of 68.9% in 2024, owing to the sector's significant consumption of Naphtha for the production of ethylene, propylene, aromatics, and other derivatives critical to the plastics, packaging, and chemicals industries.

The Aerospace segment is expected to grow at the fastest CAGR from 2025 to 2032, supported by the rising demand for high-performance materials and specialty chemicals derived from Naphtha, essential for aerospace manufacturing and maintenance applications.

Which Region Holds the Largest Share of the Naphtha Market?

- Asia-Pacific dominated the Naphtha market with the largest revenue share of 44.3% in 2024, driven by the region's strong petrochemical industry, rapid industrial expansion, and rising demand for plastic and chemical products

- The region's significant investments in refining capacity, steam crackers, and integrated petrochemical complexes are accelerating Naphtha consumption, especially in countries such as China, India, Japan, and South Korea

- The increasing use of Naphtha for producing ethylene, propylene, and aromatics, coupled with favorable government policies supporting industrial growth and export-driven manufacturing, reinforces Asia-Pacific’s leadership in the global market

China Naphtha Market Insight

The China Naphtha market accounted for the largest revenue share within Asia-Pacific in 2024, supported by the country's robust petrochemical sector, large-scale refinery expansions, and growing plastics production. China’s focus on energy security, self-sufficiency in chemical feedstocks, and investment in modern steam cracking technologies continue to boost Naphtha demand for both domestic consumption and export-oriented industries.

India Naphtha Market Insight

The India Naphtha market is witnessing strong growth, fueled by expanding refining capacity, increasing demand for petrochemicals, and the government's emphasis on reducing import dependency for key chemical products. Ongoing infrastructure projects, urbanization, and industrialization, along with rising consumption of plastics and synthetic materials, are creating significant opportunities for Naphtha utilization across the country.

Which Region is the Fastest Growing Region in the Naphtha Market?

Europe Naphtha market is projected to grow at the fastest CAGR of 11.8% from 2025 to 2032, driven by increasing investments in petrochemical modernization, recycling technologies, and the transition toward low-carbon and circular economy practices. The region's growing focus on producing sustainable polymers, bio-based chemicals, and recycled plastics is boosting demand for both traditional and renewable Naphtha as a critical feedstock. Major developments such as green hydrogen projects, refinery upgrades, and policy incentives under the European Green Deal are reshaping the petrochemical value chain, driving demand for Naphtha in applications aligned with energy efficiency and environmental goals.

Germany Naphtha Market Insight

The Germany Naphtha market is experiencing rapid growth, supported by investments in advanced chemical manufacturing, recycling initiatives, and refinery integration projects. As a key player in Europe’s industrial and chemical sectors, Germany’s emphasis on sustainability, innovation, and resource efficiency is accelerating the adoption of Naphtha for both conventional and bio-based petrochemical production.

Which are the Top Companies in Naphtha Market?

The Naphtha industry is primarily led by well-established companies, including:

- Chevron Corporation (U.S.)

- Reliance Industries Limited (India)

- Shell Chemicals (U.S.)

- SABIC (Saudi Arabia)

- BP PLC (U.K.)

- Exxon Mobil Corporation (U.S.)

- China Petrochemical Corporation (China)

- Indian Oil Corporation Ltd (India)

- Novatek (Russia)

- Mitsubishi Chemical Corporation (Japan)

- Lotte Chemical Corporation (South Korea)

- Mangalore Refinery & Petrochemicals Ltd. (India)

- NOVA Chemicals Corporate (Canada)

- Formosa Plastics Corporation (Taiwan)

- LG Chem (South Korea)

- Petróleos Mexicanos (Mexico)

- Vitol (Netherlands)

What are the Recent Developments in Global Naphtha Market?

- In July 2023, Exxon Mobil Corporation announced the acquisition of Denbury Inc., a company renowned for its expertise in carbon capture, utilization, and storage (CCS) solutions, along with enhanced oil recovery technologies. This strategic move enhances Exxon Mobil’s capabilities in emissions reduction and supports its long-term commitment to advancing low-carbon technologies. The acquisition reinforces Exxon Mobil’s position as a leader in the global energy transition

- In May 2023, Chevron Corporation resumed its oil operations in Venezuela with the objective of increasing production and expediting efforts to repatriate outstanding debt, which Natixis anticipates will be fully settled by the end of 2025. This development marks a significant step toward stabilizing energy supplies and restoring operational presence in the region. Chevron’s resumption of activities reflects its focus on unlocking new growth opportunities in Latin America

- In October 2022, LG Chem implemented a temporary seven-week shutdown of its Naphtha crackers in South Korea to carry out essential maintenance operations. While the move temporarily affected petrochemical supplies, it highlights the company’s dedication to ensuring equipment reliability, operational safety, and long-term production efficiency. This proactive approach strengthens LG Chem’s reputation for product quality and sustainable operations

- In May 2022, BP PLC entered into a 10-year offtake agreement with U.K.-based Clean Planet Energy to support the development of facilities capable of converting hard-to-recycle waste plastics into circular petrochemical feedstocks and ultra-low sulfur diesel (ULSD). The initiative aligns with BP’s broader sustainability goals and fosters innovation in waste management and clean fuel production. This agreement showcases BP’s commitment to advancing circular economy solutions within the energy sector

- In November 2021, Exxon Mobil revealed its investment in a multi-billion-dollar chemical complex located in Guangdong province, China, aimed at increasing its production capacity by 1.6 million tonnes per year. The expansion is designed to leverage the rising demand for petrochemicals within China’s rapidly growing industrial sector. This investment underscores Exxon Mobil’s strategic focus on strengthening its footprint in key Asian markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL NAPHTHA MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL NAPHTHA MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL NAPHTHA MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 RAW MATERIAL COVERAGE

5.2 PRODUCTION CONSUMPTION ANALYSIS

5.3 IMPORT EXPORT SCENARIO

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 PORTER’S FIVE FORCES

5.6 VENDOR SELECTION CRITERIA

5.7 PESTEL ANALYSIS

5.8 REGULATION COVERAGE

5.8.1 PRODUCT CODES

5.8.2 CERTIFIED STANDARDS

5.8.3 SAFETY STANDARDS

5.8.3.1. MATERIAL HANDLING & STORAGE

5.8.3.2. TRANSPORT & PRECAUTIONS

5.8.3.3. HARAD IDENTIFICATION

6 PRICE INDEX

7 PRODUCTION CAPACITY OVERVIEW

8 SUPPLY CHAIN ANALYSIS

8.1 OVERVIEW

8.2 LOGISTIC COST SCENARIO

8.3 IMPORTANCE OF LOGISTICS SERVICE PROVIDERS

9 CLIMATE CHANGE SCENARIO

9.1 ENVIRONMENTAL CONCERNS

9.2 INDUSTRY RESPONSE

9.3 GOVERNMENT’S ROLE

9.4 ANALYST RECOMMENDATIONS

10 GLOBAL NAPHTHA MARKET, BY PRODUCT, 2022-2031, (USD MILLION) (KILO TONS)

10.1 OVERVIEW

10.2 LIGHT NAPHTHA

10.2.1 LIGHT NAPHTHA, BY CATEGORY

10.2.1.1. NATURAL GASOLINE

10.2.1.2. CONDENSATE SPLITTING

10.2.1.3. CRUDE DISTILLATION

10.2.1.4. HYDROCRACKING

10.2.1.5. HYDROTREATING

10.3 HEAVY NAPHTHA

10.3.1 HEAVY NAPHTHA, BY CATEGORY

10.3.1.1. CONDENSATE SPLITTING

10.3.1.2. CRUDE DISTILLATION

10.3.1.3. HYDROCRACKING

10.3.1.4. HYDROTREATING

11 GLOBAL NAPHTHA MARKET, BY PROCESS, 2022-2031, (USD MILLION) (KILO TONS)

11.1 OVERVIEW

11.2 GASOLINE BLENDING

11.3 NAPHTHA REFORMING

11.4 PETROCHEMICAL FEEDSTOCK

11.5 STEAM CRACKING

11.6 OTHERS

12 GLOBAL NAPHTHA MARKET, BY APPLICATION, 2022-2031, (USD MILLION) (KILO TONS)

12.1 OVERVIEW

12.2 CHEMICALS PROCESSING

12.3 FUEL

12.3.1 POWER DISTRIBUTION

12.3.2 FERTILIZERS

12.3.3 OTHERS

12.4 DRY-CLEANING SOLVENTS

12.5 PAINTS SOLVENTS

12.6 OTHERS

13 GLOBAL NAPHTHA MARKET, BY END-USE, 2022-2031, (USD MILLION) (KILO TONS)

13.1 OVERVIEW

13.2 PETROCHEMICALS

13.2.1 BY PRODUCT

13.2.1.1. LIGHT NAPHTHA

13.2.1.2. HEAVY NAPHTHA

13.3 AUTOMOTIVE

13.3.1 BY PRODUCT

13.3.1.1. LIGHT NAPHTHA

13.3.1.2. HEAVY NAPHTHA

13.4 AGRICULTURE

13.4.1 BY PRODUCT

13.4.1.1. LIGHT NAPHTHA

13.4.1.2. HEAVY NAPHTHA

13.5 PAINTS AND COATINGS

13.5.1 BY PRODUCT

13.5.1.1. LIGHT NAPHTHA

13.5.1.2. HEAVY NAPHTHA

13.6 AEROSPACE AND DEFENSE

13.6.1 BY PRODUCT

13.6.1.1. LIGHT NAPHTHA

13.6.1.2. HEAVY NAPHTHA

13.7 CONSTRUCTION

13.7.1 BY PRODUCT

13.7.1.1. LIGHT NAPHTHA

13.7.1.2. HEAVY NAPHTHA

13.8 CONSUMER GOODS

13.8.1 BY PRODUCT

13.8.1.1. LIGHT NAPHTHA

13.8.1.2. HEAVY NAPHTHA

13.9 ENGINEERING

13.9.1 BY PRODUCT

13.9.1.1. LIGHT NAPHTHA

13.9.1.2. HEAVY NAPHTHA

13.1 OTHERS

13.10.1 BY PRODUCT

13.10.1.1. LIGHT NAPHTHA

13.10.1.2. HEAVY NAPHTHA

14 GLOBAL NAPHTHA MARKET, BY GEOGRAPHY, 2022-2031, (USD MILLION) (KILO TONS)

GLOBAL NAPHTHA MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

14.1 NORTH AMERICA

14.1.1 U.S.

14.1.2 CANADA

14.1.3 MEXICO

14.2 EUROPE

14.2.1 GERMANY

14.2.2 U.K.

14.2.3 ITALY

14.2.4 FRANCE

14.2.5 SPAIN

14.2.6 SWITZERLAND

14.2.7 RUSSIA

14.2.8 TURKEY

14.2.9 BELGIUM

14.2.10 NETHERLANDS

14.2.11 REST OF EUROPE

14.3 ASIA-PACIFIC

14.3.1 JAPAN

14.3.2 CHINA

14.3.3 SOUTH KOREA

14.3.4 INDIA

14.3.5 SINGAPORE

14.3.6 THAILAND

14.3.7 INDONESIA

14.3.8 MALAYSIA

14.3.9 PHILIPPINES

14.3.10 AUSTRALIA AND NEW ZEALAND

14.3.11 HONG KONG

14.3.12 TAIWAN

14.3.13 REST OF ASIA-PACIFIC

14.4 SOUTH AMERICA

14.4.1 BRAZIL

14.4.2 ARGENTINA

14.4.3 REST OF SOUTH AMERICA

14.5 MIDDLE EAST AND AFRICA

14.5.1 SOUTH AFRICA

14.5.2 EGYPT

14.5.3 SAUDI ARABIA

14.5.4 UNITED ARAB EMIRATES

14.5.5 ISRAEL

14.5.6 REST OF MIDDLE EAST AND AMERICA

15 GLOBAL NAPHTHA MARKET, COMPANY LANDSCAPE

15.1 COMPANY SHARE ANALYSIS: GLOBAL

15.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

15.3 COMPANY SHARE ANALYSIS: EUROPE

15.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

15.5 MERGERS AND ACQUISITIONS

15.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

15.7 EXPANSIONS

15.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

16 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

17 GLOBAL NAPHTHA MARKET COMPANY PROFILES

17.1 PAO NOVATEK

17.1.1 COMPANY SNAPSHOT

17.1.2 REVENUE ANALYSIS

17.1.3 PRODUCT PORTFOLIO

17.1.4 RECENT UPDATES

17.2 MANGALORE REFINERY & PETROCHEMICALS LTD.

17.2.1 COMPANY SNAPSHOT

17.2.2 PRODUCT PORTFOLIO

17.2.3 PRODUCT PORTFOLIO

17.2.4 RECENT UPDATES

17.3 EXXONMOBIL

17.3.1 COMPANY SNAPSHOT

17.3.2 PRODUCT PORTFOLIO

17.3.3 PRODUCT PORTFOLIO

17.3.4 RECENT UPDATES

17.4 LOTTE CHEMICAL CORPORATION

17.4.1 COMPANY SNAPSHOT

17.4.2 PRODUCT PORTFOLIO

17.4.3 RECENT UPDATES

17.5 SAUDI ARABIAN OIL CO.

17.5.1 COMPANY SNAPSHOT

17.5.2 PRODUCT PORTFOLIO

17.5.3 RECENT UPDATES

17.6 MITSUBISHI CHEMICAL CORPORATION

17.6.1 COMPANY SNAPSHOT

17.6.2 PRODUCT PORTFOLIO

17.6.3 RECENT UPDATES

17.7 SABIC

17.7.1 COMPANY SNAPSHOT

17.7.2 PRODUCT PORTFOLIO

17.7.3 RECENT UPDATES

17.8 SHELL

17.8.1 COMPANY SNAPSHOT

17.8.2 REVENUE ANALYSIS

17.8.3 PRODUCT PORTFOLIO

17.8.4 RECENT UPDATES

17.9 INDIA OIL CORPORATION LTD

17.9.1 COMPANY SNAPSHOT

17.9.2 REVENUE ANALYSIS

17.9.3 PRODUCT PORTFOLIO

17.9.4 RECENT UPDATES

17.1 CHINA NATIONAL PETROLEUM CORPORATION

17.10.1 COMPANY SNAPSHOT

17.10.2 REVENUE ANALYSIS

17.10.3 PRODUCT PORTFOLIO

17.10.4 RECENT UPDATES

17.11 CHEVRON

17.11.1 COMPANY SNAPSHOT

17.11.2 REVENUE ANALYSIS

17.11.3 PRODUCT PORTFOLIO

17.11.4 RECENT UPDATES

17.12 ENEOS CORPORATION

17.12.1 COMPANY SNAPSHOT

17.12.2 REVENUE ANALYSIS

17.12.3 PRODUCT PORTFOLIO

17.12.4 RECENT UPDATES

17.13 MARATHON PETROLEUM CORPORATION

17.13.1 COMPANY SNAPSHOT

17.13.2 REVENUE ANALYSIS

17.13.3 PRODUCT PORTFOLIO

17.13.4 RECENT UPDATES

17.14 HALDIA PETROCHEMICALS LIMITED (HPL)

17.14.1 COMPANY SNAPSHOT

17.14.2 REVENUE ANALYSIS

17.14.3 PRODUCT PORTFOLIO

17.14.4 RECENT UPDATES

17.15 FORMOSA PETROCHEMICAL CORPORATION

17.15.1 COMPANY SNAPSHOT

17.15.2 REVENUE ANALYSIS

17.15.3 PRODUCT PORTFOLIO

17.15.4 RECENT UPDATES

17.16 OBEROI REFINING INDUSTRY PVT.LTD.

17.16.1 COMPANY SNAPSHOT

17.16.2 REVENUE ANALYSIS

17.16.3 PRODUCT PORTFOLIO

17.16.4 RECENT UPDATES

17.17 OPAC REFINERIES

17.17.1 COMPANY SNAPSHOT

17.17.2 REVENUE ANALYSIS

17.17.3 PRODUCT PORTFOLIO

17.17.4 RECENT UPDATES

17.18 DAKOTA GASIFICATION COMPANY

17.18.1 COMPANY SNAPSHOT

17.18.2 REVENUE ANALYSIS

17.18.3 PRODUCT PORTFOLIO

17.18.4 RECENT UPDATES

18 CONCLUSION

19 QUESTIONNAIRE

20 RELATED REPORTS

21 ABOUT DATA BRIDGE MARKET RESEARCH

Global Naphtha Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Naphtha Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Naphtha Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.