Global Nephrology Drugs Market

Market Size in USD Billion

CAGR :

%

USD

14.32 Billion

USD

21.01 Billion

2024

2032

USD

14.32 Billion

USD

21.01 Billion

2024

2032

| 2025 –2032 | |

| USD 14.32 Billion | |

| USD 21.01 Billion | |

|

|

|

|

Nephrology Drugs Market Analysis

The nephrology drugs market has seen significant growth due to the increasing prevalence of kidney diseases, including chronic kidney disease (CKD) and end-stage renal disease (ESRD). The market is driven by advancements in drug development and a rising patient population requiring dialysis and transplantation. Key therapeutic segments include drugs for CKD management, such as angiotensin-converting enzyme (ACE) inhibitors, angiotensin receptor blockers (ARBs), erythropoiesis-stimulating agents (ESAs), and phosphate binders.

Emerging drug classes, such as SGLT2 inhibitors and novel immunosuppressants, are expanding treatment options and offering enhanced efficacy in disease management. The growth is also spurred by increased awareness of kidney diseases, improving diagnostics, and enhanced healthcare access.

Moreover, the aging global population contributes significantly to the rise in kidney-related conditions, boosting demand for nephrology drugs. However, the market faces challenges such as high treatment costs, regulatory hurdles, and the need for personalized medicine. Despite these challenges, the nephrology drugs market is expected to continue expanding, driven by innovation, partnerships between pharmaceutical companies, and increased healthcare investments. The increasing focus on precision medicine and biotechnology-based treatments is poised to shape the market’s future trajectory.

Nephrology Drugs Market Size

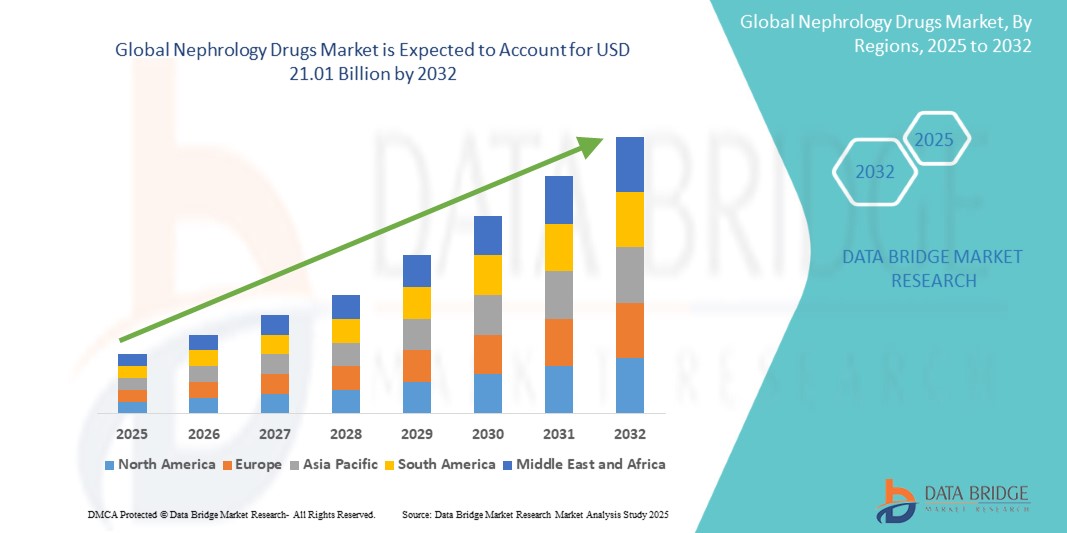

The global Nephrology Drugs market size was valued at USD 14.32 billion in 2024 and is projected to reach USD 21.01 billion by 2032, with a CAGR of 4.91% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework.

Nephrology Drugs Market Trends

“Growing Adoption of Novel Therapies”

A key trend in the nephrology drugs market is the growing adoption of novel therapies, particularly SGLT2 inhibitors. These drugs, initially developed for diabetes, have shown promising results in managing chronic kidney disease (CKD) and preventing progression to end-stage renal disease (ESRD). SGLT2 inhibitors, such as empagliflozin and dapagliflozin, have been recognized for their ability to reduce proteinuria and improve kidney function in patients with CKD, even in those without diabetes. This class of drugs has gained significant attention due to their multifaceted benefits, including heart and kidney protection, which aligns with the increasing shift towards comprehensive, multi-disease treatments. The growing body of clinical evidence supporting their efficacy in slowing kidney disease progression is leading to their expanded use in nephrology. As a result, this trend is expected to drive market growth, with more drug approvals and greater uptake of these innovative therapies in treatment regimens.

Report Scope and Nephrology Drugs Market Segmentation

|

Attributes |

Nephrology Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico, Germany, France, U.K., Italy, Russia, Spain, Denmark, Sweden, Norway, Rest of Europe, China, Japan, India, South Korea, Australia, Thailand, Rest of Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Nigeria, Egypt, Kuwait, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America |

|

Key Market Players |

Abbott (U.S.), AbbVie Inc. (U.S.), Amgen Inc. (U.S.), AstraZeneca (UK), Bayer AG (Germany), Boehringer Ingelheim International GmbH (Germany), Bristol-Myers Squibb Company (U.S.), DAIICHI SANKYO COMPANY, LIMITED (Japan), Dr. Reddy’s Laboratories Ltd. (India), F. Hoffmann-La Roche Ltd (Switzerland), Genentech, Inc. (U.S.), Gilead Sciences, Inc. (U.S.), GLENMARK PHARMACEUTICALS LTD. (India), GSK plc. (UK), Johnson & Johnson Services, Inc. (U.S.), Merck & Co., Inc. (U.S.), Lilly (U.S.), Novartis AG (Switzerland), Pfizer Inc. (U.S.) and Sanofi (France) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Nephrology Drugs Market Definition

Nephrology drugs are medications used to treat various kidney-related conditions and disorders, primarily focusing on diseases such as chronic kidney disease (CKD), end-stage renal disease (ESRD), glomerulonephritis, and nephrotic syndrome. These drugs aim to manage symptoms, slow disease progression, improve kidney function, or treat complications associated with kidney dysfunction. Common categories of nephrology drugs include diuretics, antihypertensives (such as ACE inhibitors, ARBs), erythropoiesis-stimulating agents (ESAs), phosphate binders, and immunosuppressive drugs.

Nephrology Drugs Market Dynamics

Drivers

- Increasing Prevalence of Kidney Diseases

The rising global incidence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) has significantly contributed to the growth of the nephrology drugs market. Factors such as aging populations, the prevalence of diabetes, hypertension, and obesity are key drivers of kidney-related conditions. According to the World Health Organization, CKD affects over 10% of the global population. For instance, drugs such as SGLT2 inhibitors (e.g., empagliflozin) have been increasingly used in treating CKD, offering kidney and cardiovascular protection. The increasing burden of kidney diseases requires a consistent supply of effective treatment options, thus fueling the demand for nephrology drugs. As the incidence of CKD and related complications grows, the market continues to see a surge in demand for innovative treatments, driving overall market growth.

- Advancements in Drug Development

Significant advancements in drug development are accelerating the nephrology drugs market. The emergence of novel therapies, such as complement inhibitors such as iptacopan for IgAN and sparsentan for primary IgAN, is transforming treatment paradigms. For instance, in 2023, iptacopan (Fabhalta) received FDA approval for primary immunoglobulin A nephropathy (IgAN), a rare kidney disorder. In addition, therapies such as SGLT2 inhibitors and targeted therapies for kidney diseases are improving patient outcomes by slowing disease progression and reducing proteinuria. These breakthroughs are filling critical gaps in existing treatment regimens, providing doctors with more personalized and effective treatment options. As more innovative drugs are introduced, the nephrology drugs market is poised for continued growth, driven by improved clinical outcomes and expanded treatment options.

Opportunities

- Expanding Treatment Options for Rare Kidney Diseases

The growing focus on rare kidney diseases presents a significant opportunity for the nephrology drugs market. With advancements in precision medicine, treatments for conditions such as primary immunoglobulin A nephropathy (IgAN) and focal segmental glomerulosclerosis (FSGS) are becoming more accessible. For instance, the approval of iptacopan (Fabhalta) for IgAN in 2024 marks a major step in addressing unmet needs for rare kidney disorders. These diseases often have limited therapeutic options, creating a demand for novel treatments that target the underlying disease mechanisms. As the understanding of rare kidney conditions improves, the market for specialized treatments will expand, driving growth. The success of such treatments opens the door for further research and development in the nephrology sector, providing opportunities for pharmaceutical companies to innovate and capture a growing patient population.

- Growth of Personalized Medicine in Nephrology

Personalized medicine, which tailors treatment based on an individual’s genetic profile or disease characteristics, presents a promising opportunity for the nephrology drugs market. Advancements in biomarkers and genetic testing are paving the way for more targeted therapies that can improve outcomes for patients with kidney diseases. An instance is the development of drugs that target specific molecular pathways, such as complement inhibitors for IgAN. These therapies offer more precise treatment options compared to traditional, one-size-fits-all approaches. As more research supports the efficacy of personalized treatments, healthcare systems and pharmaceutical companies are increasingly adopting this approach. The shift towards personalized medicine enhances the market potential by offering improved efficacy, fewer side effects, and better patient outcomes, thereby expanding the overall market and driving demand for targeted nephrology therapies.

Restraints/Challenges

- Limited Awareness and Diagnosis of Kidney Diseases

A key restraint in the nephrology drugs market is the limited awareness and late diagnosis of kidney diseases. Chronic kidney disease (CKD) often progresses silently without noticeable symptoms until it reaches advanced stages, making early detection challenging. As a result, many patients are diagnosed late, reducing the effectiveness of treatment options available. In countries with lower healthcare infrastructure, this problem is even more pronounced. The lack of early diagnosis limits the demand for nephrology drugs, as fewer people are identified as needing treatment in the earlier, more treatable stages of kidney disease. For instance, conditions such as IgAN may not be diagnosed until they cause significant kidney damage, reducing the impact of available therapies. The limited awareness of kidney diseases and the subsequent delay in diagnosis hinder the widespread use of nephrology drugs, affecting overall market growth and slowing the adoption of new treatments.

- Drug Resistance and Limited Efficacy of Existing Treatments

A major challenge facing the nephrology drugs market is the development of drug resistance and the limited efficacy of existing treatments. For chronic kidney diseases such as glomerulonephritis and nephrotic syndrome, patients may develop resistance to long-term drug regimens, making it harder to manage disease progression effectively. For instance, while drugs such as ACE inhibitors and ARBs are standard treatments for CKD, their long-term use often leads to diminishing returns as the disease progresses, requiring stronger or more targeted therapies. In addition, new treatments for conditions such as IgAN or FSGS may only be effective in a subset of patients, complicating treatment decisions. This challenge necessitates continuous innovation to develop more effective drugs and improve patient outcomes. Despite the growth in novel therapies, the ongoing issue of drug resistance limits the market's ability to achieve consistent and widespread success, impacting the long-term market potential.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Nephrology Drugs Market Scope

The market is segmented on the basis of drug class, route of administration, and distribution channel. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Drug Class

- ACE Inhibitors

- Angiotensin Receptor Blockers (ARBs)

- B-Blockers

- Calcium Channel Blockers

- Loop Diuretics

- Erythropoietin Stimulating Agents (ESAs)

- Phosphate Binders

- Others

Route of Administration

- Oral

- Subcutaneous

- Intravenous

Distribution Channel

- Hospital Pharmacies

- Retail Pharmacies

- Online Pharmacies

Nephrology Drugs Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, drug class, route of administration, and distribution channel as referenced above.

The countries covered in the market report are U.S., Canada and Mexico, Germany, France, U.K., Italy, Russia, Spain, Denmark, Sweden, Norway, Rest of Europe, China, Japan, India, South Korea, Australia, Thailand, Rest of Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Nigeria, Egypt, Kuwait, Rest of Middle East and Africa, Brazil, Argentina and Rest of South America.

North America, particularly the U.S., is expected to dominate the nephrology drugs market. This is due to several factors, including the high prevalence of chronic kidney disease (CKD) and end-stage renal disease (ESRD) in the region, advanced healthcare infrastructure, and a strong focus on research and development. The U.S. has a large aging population, which is more susceptible to kidney diseases, and an increasing incidence of diabetes and hypertension, both of which contribute to the rise in CKD cases.

Asia-Pacific (APAC) is expected to exhibit the highest growth rate in the nephrology drugs market. This is largely due to the rapidly increasing prevalence of chronic kidney disease (CKD) and a growing burden of lifestyle-related factors, such as diabetes, hypertension, and obesity, which contribute to kidney disorders. With a large and aging population in countries such as China, India, and Japan, the demand for nephrology drugs is set to rise significantly. In addition, there is a growing awareness of kidney diseases and an improving healthcare infrastructure in several APAC countries, leading to increased access to treatment.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Nephrology Drugs Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Nephrology Drugs Market Leaders Operating in the Market Are:

- Abbott (U.S.)

- AbbVie Inc. (U.S.)

- Amgen Inc. (U.S.)

- AstraZeneca (UK)

- Bayer AG (Germany)

- Boehringer Ingelheim International GmbH (Germany)

- Bristol-Myers Squibb Company (U.S.)

- DAIICHI SANKYO COMPANY, LIMITED (Japan)

- Dr. Reddy’s Laboratories Ltd. (India)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Genentech, Inc. (U.S.)

- Gilead Sciences, Inc. (U.S.)

- GLENMARK PHARMACEUTICALS LTD. (India)

- GSK plc. (UK)

- Johnson & Johnson Services, Inc. (U.S.)

- Merck & Co., Inc. (U.S.)

- Lilly (U.S.)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Sanofi (France)

Latest Developments in Nephrology Drugs Market

- In September 2024, Travere Therapeutics, Inc. announced that the U.S. Food and Drug Administration (FDA) has granted full approval for FILSPARI (sparsentan) to slow the decline in kidney function in adults with primary IgAN who are at risk of disease progression. FILSPARI had previously received accelerated approval in February 2023 based on the surrogate marker of proteinuria. The full approval follows positive long-term confirmatory results from the PROTECT Study, which demonstrated that FILSPARI significantly slowed the decline in kidney function over two years compared to irbesartan.

- In August 2024, Bayer announced the initiation of the ALPINE-1 study, a Phase II clinical trial investigating BAY3283142, an experimental soluble guanylate cyclase (sGC) activator, in patients with chronic kidney disease (CKD). CKD is a progressive condition that impacts over 10% of the global population, affecting around 850 million people worldwide.

- In August 2024, Novartis announced that the U.S. Food and Drug Administration (FDA) has granted accelerated approval for Fabhalta (iptacopan), a first-in-class complement inhibitor, to reduce proteinuria in adults with primary immunoglobulin A nephropathy (IgAN) who are at risk of rapid disease progression. This is typically defined by a urine protein-to-creatinine ratio (UPCR) of ≥1.5 g/g. Fabhalta specifically targets the alternative complement pathway of the immune system, which, when excessively activated in the kidneys, is believed to play a role in the development of IgAN.

- In December 2023, Merck announced that the U.S. Food and Drug Administration (FDA) had approved WELIREG, an oral hypoxia-inducible factor-2 alpha (HIF-2α) inhibitor, for the treatment of adult patients with advanced renal cell carcinoma (RCC) after they have received a programmed death receptor-1 (PD-1) or programmed death-ligand 1 (PD-L1) inhibitor and a vascular endothelial growth factor tyrosine kinase inhibitor (VEGF-TKI).

- In September 2023, the U.S. Food and Drug Administration (FDA) granted approval for Jardiance (empagliflozin) 10 mg tablets to help reduce the risk of sustained decline in estimated glomerular filtration rate (eGFR), end-stage kidney disease, cardiovascular death, and hospitalization in adults with chronic kidney disease (CKD) who are at risk of progression.

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.