Global Neryl Acetate Market

Market Size in USD Billion

CAGR :

%

USD

65.28 Billion

USD

128.17 Billion

2024

2032

USD

65.28 Billion

USD

128.17 Billion

2024

2032

| 2025 –2032 | |

| USD 65.28 Billion | |

| USD 128.17 Billion | |

|

|

|

|

What is the Global Neryl Acetate Market Size and Growth Rate?

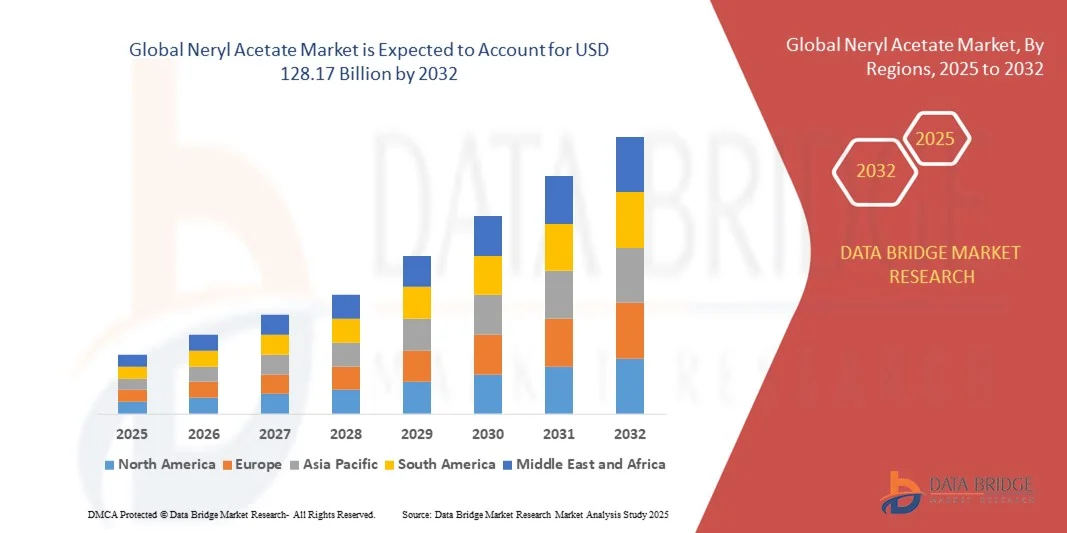

- The global Neryl Acetate market size was valued at USD 65.28 billion in 2024 and is expected to reach USD 128.17 billion by 2032, at a CAGR of 8.80% during the forecast period

- Growing population along with the increasing per capita consumption and spending is the vital factor escalating the market growth, also rising per capita income spend by the population in luxury items and stationery is pushing the demand for high end perfumes and other personal care products, rising continuous changing consumer tests in terms of fragrances and rising demand for unique fragrances from growing population in Asian countries, improving economies in numerous regions and extensive demand from the various end-user industries are the major factors among others driving the neryl acetate market

What are the Major Takeaways of Neryl Acetate Market?

- Rising research and development activities in the market and rising technological advancements in the production techniques will further create new opportunities for the neryl acetate market

- However, rising disturbances in supply chain and market disruption due to rising prevalence of Covid-19 is the vital factor among others acting as a restraint, and will further challenge the growth of neryl acetate market

- Asia-Pacific dominated the neryl acetate market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, a growing middle-class population, and increasing adoption of technologically advanced and high-performance fragrance and personal care products

- The North America Neryl Acetate market is poised to grow at the fastest CAGR of 9.54% during the forecast period of 2025 to 2032, driven by rising demand for natural and high-quality fragrance ingredients, growth in the personal care and cosmetics sector, and increasing consumer preference for premium formulations

- The 95% purity segment dominated the market with the largest revenue share of 45.6% in 2024, driven by its widespread use across fragrance and personal care applications due to cost-effectiveness and acceptable performance standards

Report Scope and Neryl Acetate Market Segmentation

|

Attributes |

Neryl Acetate Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Neryl Acetate Market?

Integration of Smart Technology and Automation

- A prominent and accelerating trend in the global neryl acetate market is the integration of smart technology and automation within manufacturing, formulation, and application processes. This trend is enhancing operational efficiency, reducing waste, and improving product consistency across various end-use industries

- For instance, advanced Neryl Acetate production units now employ AI-driven process monitoring to optimize temperature, reaction times, and purity levels, ensuring superior product quality and reduced operational downtime

- AI-based analytics also help predict equipment maintenance needs, reducing unplanned production interruptions. Similarly, IoT-enabled systems allow real-time monitoring of raw material usage, energy consumption, and environmental emissions, promoting sustainability

- The adoption of smart automation enables manufacturers to streamline workflows, improve supply chain visibility, and meet the growing demand for high-purity Neryl Acetate in cosmetic, fragrance, and chemical applications

- This shift toward automated and intelligent production is reshaping industry expectations, compelling companies such as Takasago International and Eastman Chemical to invest in AI-enabled production technologies

- Consequently, the demand for Neryl Acetate with enhanced process control and automated quality monitoring is rising rapidly across chemical, fragrance, and personal care sectors

What are the Key Drivers of Neryl Acetate Market?

- The increasing global demand for fragrances, personal care products, and high-performance chemical intermediates is driving the adoption of Neryl Acetate. Its versatile applications in perfumes, skin-care formulations, and flavor enhancers make it highly sought after

- For instance, in 2024, Eastman Chemical implemented advanced Neryl Acetate production methods to meet rising cosmetic industry demand, highlighting the strategic importance of scalable and consistent supply

- Rising consumer awareness of natural and high-purity ingredients also fuels growth, as manufacturers increasingly prefer Neryl Acetate for premium fragrance and cosmetic formulations

- The growing personal care and household products sector, especially in Asia-Pacific and North America, is boosting demand for Neryl Acetate in surfactants, emulsifiers, and polymer additives

- Moreover, its multifunctional applications in flavor, fragrance, and industrial chemicals provide manufacturers with diverse revenue streams, further accelerating market adoption

- Easy integration into formulation processes, combined with consistent performance and eco-friendly properties, strengthens Neryl Acetate’s position as a key ingredient across multiple end-use industries

Which Factor is Challenging the Growth of the Neryl Acetate Market?

- High production costs and the complexity of achieving consistent high-purity neryl acetate pose challenges for smaller manufacturers, limiting broader adoption

- For instance, fluctuations in raw material prices, such as nerolidol and acetic acid, can increase production costs and reduce profit margins for neryl acetate suppliers

- Regulatory compliance and safety standards, particularly in the fragrance and personal care sectors, require strict adherence to quality protocols, creating barriers for new entrants

- In addition, environmental concerns related to solvent usage and chemical waste during production may limit expansion in regions with stringent ecological regulations

- While automation and process optimization are addressing efficiency issues, the relatively higher capital expenditure for advanced manufacturing units can slow market entry, especially in developing regions

- Overcoming these challenges through cost-effective production technologies, sustainable sourcing of raw materials, and innovation in eco-friendly Neryl Acetate formulations will be vital for long-term market growth

How is the Neryl Acetate Market Segmented?

The market is segmented on the basis of product and application.

- By Product

On the basis of product, the neryl acetate market is segmented into 95% purity, 98% purity, and 99% purity. The 95% purity segment dominated the market with the largest revenue share of 45.6% in 2024, driven by its widespread use across fragrance and personal care applications due to cost-effectiveness and acceptable performance standards. Manufacturers and formulators prefer 95% purity Neryl Acetate for commercial perfumery and deodorant applications where minor impurities do not affect product quality.

The 99% purity segment is anticipated to witness the fastest CAGR of 22.3% from 2025 to 2032, fueled by the increasing demand for premium and high-performance personal care and pharmaceutical products. High-purity Neryl Acetate ensures superior fragrance stability, chemical consistency, and compatibility with sensitive formulations, making it increasingly preferred in luxury cosmetics and high-end pharmaceutical applications.

- By Application

On the basis of application, the neryl acetate market is segmented into perfumes, deodorants, pharmaceuticals, creams, lotions, soap and shampoo, and other personal care products. The perfumes segment accounted for the largest market revenue share of 38.7% in 2024, supported by rising global demand for fragrances and increasing consumer focus on personal grooming. Perfume manufacturers prefer Neryl Acetate for its natural citrus-woody aroma, stability, and blending versatility, making it an essential ingredient in high-quality fragrances.

The deodorants segment is expected to witness the fastest CAGR of 21.8% from 2025 to 2032, driven by the growing awareness of hygiene, lifestyle changes, and the rising demand for functional, long-lasting deodorant formulations. Neryl Acetate’s versatility in personal care and its ability to impart pleasant fragrance in deodorants, soaps, and lotions is fueling its adoption across a wide range of applications.

Which Region Holds the Largest Share of the Neryl Acetate Market?

- Asia-Pacific dominated the neryl acetate market with the largest revenue share of 42.5% in 2024, driven by rapid urbanization, a growing middle-class population, and increasing adoption of technologically advanced and high-performance fragrance and personal care products

- Consumers in the region are increasingly seeking premium ingredients such as Neryl Acetate for perfumes, deodorants, and skincare formulations due to rising disposable incomes and growing awareness of high-quality personal care

- The widespread adoption is further supported by the expansion of manufacturing capabilities, presence of key local and global producers, and favorable government policies promoting chemical and personal care industries, establishing neryl acetate as a critical component in cosmetic, pharmaceutical, and fragrance applications

China Neryl Acetate Market Insight

The China neryl acetate market accounted for the largest revenue share in Asia-Pacific in 2024, fueled by rapid urbanization, rising disposable income, and increasing consumer preference for premium fragrance and personal care products. The country is a major manufacturing hub for Neryl Acetate, making the ingredient both accessible and cost-effective. In addition, the surge in smart, health-conscious, and high-end cosmetic product consumption is driving demand across residential, commercial, and industrial applications.

Japan Neryl Acetate Market Insight

The Japan neryl acetate market is expanding steadily, driven by the country’s advanced cosmetics industry, high standards for fragrance and personal care products, and increasing urban population. Japanese consumers prefer high-purity and sustainably sourced ingredients, and Neryl Acetate’s versatility in perfumery, deodorants, and skincare is boosting adoption. The integration of premium ingredients in luxury cosmetics and pharmaceutical formulations is further fueling growth in the region.

Which Region is the Fastest Growing Region in the Neryl Acetate Market?

The North America neryl acetate market is poised to grow at the fastest CAGR of 9.54% during the forecast period of 2025 to 2032, driven by rising demand for natural and high-quality fragrance ingredients, growth in the personal care and cosmetics sector, and increasing consumer preference for premium formulations. High disposable income, awareness of quality personal care products, and an expanding cosmetics and fragrance industry are key factors driving market expansion.

U.S. Neryl Acetate Market Insight

The U.S. neryl acetate market captured the largest share within North America in 2024, with strong demand from perfumery, deodorants, and cosmetic manufacturers. The growing popularity of high-end skincare and fragrance products, coupled with technological advances in formulation and sourcing of natural ingredients, is significantly driving the market. The increasing trend toward sustainable and eco-friendly ingredients further supports the adoption of Neryl Acetate in premium personal care formulations.

Canada Neryl Acetate Market Insight

The Canada neryl acetate market is experiencing notable growth due to rising awareness about personal care and cosmetics, increasing investments in premium fragrance production, and the expanding natural and organic product market. The adoption of Neryl Acetate in perfumes, deodorants, and skincare products is being driven by consumer demand for unique and long-lasting fragrance profiles, further supporting overall market growth in the region.

Which are the Top Companies in Neryl Acetate Market?

The neryl acetate industry is primarily led by well-established companies, including:

- Takasago International Corporation (Japan)

- Privi Speciality Chemicals Limited (India)

- Eastman Chemical Company (U.S.)

- Celanese Corporation (U.S.)

- Wacker Chemie AG (Germany)

- Prasol Chemicals Pvt. Ltd. (India)

- The Good Scents Company (tgsc) (U.S.)

- Prodasynth (U.K.)

- Citrus and Allied Essences Ltd (India)

- Solventis (France)

- Teknor Apex (U.S.)

- Producers Chemical Company (U.S.)

- CABB GmbH (Germany)

- SolvChem (U.S.)

- Jiangsu SOPO (Group) Co., Ltd (China)

- Esterindia (India)

- Acros Organics B.V.B.A. (Belgium)

- Terpenes UK (U.K.)

- Glentham Life Sciences Limited (U.K.)

- Augustus Oils Ltd (U.K.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Neryl Acetate Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Neryl Acetate Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Neryl Acetate Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.