Global Networked Audio Products Market

Market Size in USD Billion

CAGR :

%

USD

7.96 Billion

USD

12.87 Billion

2025

2033

USD

7.96 Billion

USD

12.87 Billion

2025

2033

| 2026 –2033 | |

| USD 7.96 Billion | |

| USD 12.87 Billion | |

|

|

|

|

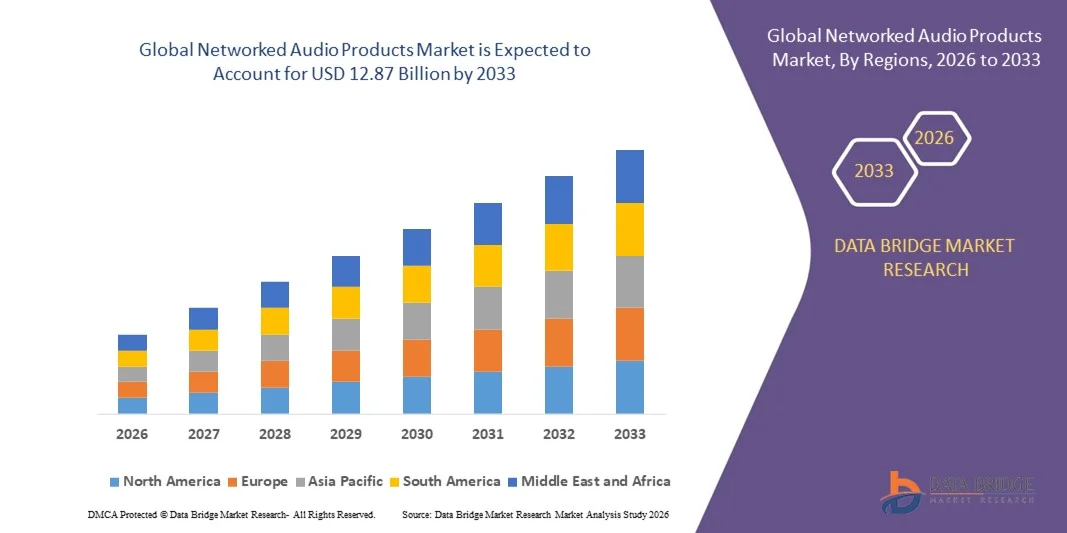

What is the Global Networked Audio Products Market Size and Growth Rate?

- The global networked audio products market size was valued at USD 7.96 billion in 2025 and is expected to reach USD 12.87 billion by 2033, at a CAGR of 6.20% during the forecast period

- The increased R&D expenditure by OEMS for growth of new and advanced networked audio devices is one of the primary factors driving the networked audio products market growth rate

- Moreover, the increase in use of audio devices in commercial sector as well as the growing need for smart homes is driven by the high demand for energy conservation, convenience, and connectivity amongst home devices are also fueling the growth of the networked audio products market

- Also, the market is largely driven by the technologically advanced features incorporated in devices with the increasing popularity of audio technologies. While, the networked audio devices ease the communication between networked devices using the home network and provide easy streaming of content, such as videos and music which is also one of the major factors driving the growth of the networked audio products market

What are the Major Takeaways of Networked Audio Products Market?

- The rising disposable incomes and rapid surge in global demand for infotainment devices are also highly impacting the growth of the networked audio products market

- Likewise, the increasing demand from the food industry is also boosting the growth of the target market. Moreover, the key manufacturers are investing in R&D of networked audio products to offer an efficient product which is also fueling the market growth

- Asia-Pacific dominated the networked audio products market with the largest revenue share of 41.8% in 2025, driven by rapid urbanization, rising disposable incomes, and increasing adoption of smart home and IoT-enabled entertainment devices

- North America is projected to witness the fastest growth rate of 10.4% during 2026–2033, driven by the rising integration of smart home ecosystems, streaming platforms, and voice-controlled devices

- The Bluetooth segment dominated the market with the largest revenue share of 44.8% in 2025, owing to its wide compatibility, ease of connectivity, and affordability across diverse consumer electronics

Report Scope and Networked Audio Products Market Segmentation

|

Attributes |

Networked Audio Products Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Networked Audio Products Market?

Integration of Smart Connectivity and Voice-Enabled Technologies

- The networked audio products market is witnessing a strong shift toward smart connectivity and multi-room audio integration, driven by the growing adoption of IoT-enabled devices and smart home ecosystems. Consumers increasingly prefer wireless, voice-controlled, and seamlessly connected audio systems that enhance convenience and user experience

- For instance, Sonos Inc. and Yamaha Corporation have introduced smart speakers compatible with Amazon Alexa, Google Assistant, and Apple AirPlay 2, offering synchronized playback and cross-platform control across multiple rooms. These advancements reflect the market’s ongoing transition toward intelligent, adaptive, and user-friendly audio environments

- The trend of integrating AI-driven sound optimization and cloud-based streaming capabilities is gaining traction, as consumers seek superior sound quality with automated calibration features. Such systems can personalize listening experiences based on room acoustics and user preferences

- Manufacturers are focusing on energy-efficient designs, compact aesthetics, and eco-friendly materials to appeal to sustainability-conscious consumers while reducing carbon footprint. Integration of recyclable components and low-power connectivity protocols such as Bluetooth LE Audio is becoming increasingly common

- Collaborations between audio brands and smart home ecosystem developers are fueling the evolution of unified entertainment platforms. For instance, Samsung and Google have strengthened their interoperability efforts to allow smoother cross-device audio control within connected homes

- As smart home adoption expands globally, the convergence of voice assistants, AI analytics, and seamless connectivity will remain the defining trend shaping the Networked Audio Products market’s technological and design evolution

What are the Key Drivers of Networked Audio Products Market?

- The rising penetration of smart home devices and the proliferation of wireless communication technologies such as Wi-Fi 6 and Bluetooth 5.3 are primary growth drivers of the networked audio products market. Consumers are increasingly investing in connected audio systems that enhance entertainment experiences and integrate with digital ecosystems

- For instance, in 2025, Samsung Electronics reported significant growth in its SmartThings platform integration, boosting demand for connected audio devices across the U.S. and European households

- Expanding consumer demand for high-resolution streaming, combined with rapid advancements in 5G networks, is promoting the use of cloud-based, multi-room, and portable audio systems

- The rising popularity of home entertainment, podcasting, and remote work is amplifying demand for versatile and compact audio devices that deliver studio-grade sound quality

- Manufacturers are increasingly focusing on aesthetic design and acoustic engineering, blending functionality with modern home décor trends to attract premium consumers

- As disposable incomes rise and smart infrastructure becomes mainstream, the market will continue benefiting from the integration of AI, IoT, and immersive sound technologies, which enhance connectivity and audio performance. Continuous innovation in design, compatibility, and energy efficiency will reinforce global market expansion

Which Factor is Challenging the Growth of the Networked Audio Products Market?

- High product costs, limited interoperability, and connectivity inconsistencies present significant challenges for the networked audio products market. The integration of advanced wireless technologies, voice assistants, and high-fidelity sound components often leads to elevated production and retail prices, limiting accessibility in price-sensitive regions

- For instance, in 2024, several mid-tier manufacturers in Asia and Europe faced compatibility issues between Amazon Alexa, Google Home, and proprietary smart home systems, leading to fragmented user experiences

- Cybersecurity concerns and data privacy issues also hinder adoption, as connected audio devices can potentially expose personal data if not adequately secured

- Frequent firmware updates and network connectivity disruptions affect performance reliability, creating barriers to consumer confidence and long-term satisfaction

- The lack of standardization across communication protocols such as ZigBee, Z-Wave, and Wi-Fi complicates cross-brand integration and product interoperability, discouraging ecosystem expansion

- To address these challenges, manufacturers are investing in unified connectivity frameworks, advanced encryption systems, and adaptive firmware optimization. Collaborative efforts toward open-standard development and secure device ecosystems are expected to enhance reliability and accessibility, ensuring sustainable market growth over the coming years

How is the Networked Audio Products Market Segmented?

The market is segmented on the basis of product type and application.

- By Product Type

On the basis of product type, the networked audio products market is segmented into AirPlay, Bluetooth, Digital Living Network Alliance (DLNA), Play-Fi, and Sonos. The Bluetooth segment dominated the market with the largest revenue share of 44.8% in 2025, owing to its wide compatibility, ease of connectivity, and affordability across diverse consumer electronics. Bluetooth-enabled devices offer flexible pairing with smartphones, tablets, and smart TVs, making them highly popular for both home and portable audio applications. Advancements such as Bluetooth 5.3 and LE Audio have enhanced data transfer efficiency and sound quality, further boosting adoption.

The AirPlay segment is anticipated to witness the fastest CAGR from 2026 to 2033, driven by the rising integration of Apple’s wireless ecosystem and the growing demand for high-fidelity, lossless audio streaming. Increasing preference for multi-room connectivity and seamless synchronization across Apple devices continues to accelerate the growth of the AirPlay segment globally.

- By Application

On the basis of application, the networked audio products market is segmented into household, commercial, office, and others. The household segment dominated the market with the largest revenue share of 57.2% in 2025, driven by the widespread adoption of smart home technologies and increasing consumer demand for immersive entertainment experiences. Rising disposable income, coupled with the popularity of wireless speakers, smart TVs, and streaming platforms, has strengthened product penetration in residential settings. In addition, the trend toward voice-controlled, multi-room audio systems has further amplified household usage.

The commercial segment is expected to grow at the fastest CAGR from 2026 to 2033, supported by the expanding use of networked audio in hospitality venues, retail outlets, and corporate events. Growing emphasis on enhanced sound systems for customer engagement and ambient music solutions is fueling demand. Businesses are increasingly adopting Wi-Fi-enabled and cloud-managed audio systems, propelling commercial segment growth globally.

Which Region Holds the Largest Share of the Networked Audio Products Market?

- Asia-Pacific dominated the networked audio products market with the largest revenue share of 41.8% in 2025, driven by rapid urbanization, rising disposable incomes, and increasing adoption of smart home and IoT-enabled entertainment devices

- The region’s strong consumer electronics manufacturing base, coupled with expanding internet penetration and 5G deployment, has accelerated the adoption of connected audio technologies

- Furthermore, the presence of key industry players, rising smart speaker installations, and growing demand for wireless and multiroom audio systems have reinforced Asia-Pacific’s leadership in the global market

China Networked Audio Products Market Insight

China remains a dominant force in the Asia-Pacific market due to its vast electronics manufacturing ecosystem, robust R&D infrastructure, and strong consumer demand for connected home technologies. The growing middle-class population and preference for integrated smart entertainment systems are propelling market expansion. Local and global brands are investing in AI-driven, high-fidelity audio solutions, enhancing the smart home experience. In addition, the country’s focus on smart city initiatives and digital transformation continues to boost the uptake of networked audio devices.

Japan Networked Audio Products Market Insight

Japan stands out for its technological advancements and early adoption of connected audio systems. The presence of leading audio brands, high-speed internet connectivity, and strong consumer inclination toward premium home entertainment have positioned Japan as a key contributor. Manufacturers are integrating advanced sound processing, AI-assisted controls, and home automation compatibility. The country’s emphasis on innovation and miniaturized high-quality components ensures a steady increase in demand for networked audio products.

India Networked Audio Products Market Insight

India is emerging as one of the fastest-growing markets within Asia-Pacific, supported by rising internet penetration, increasing smart home adoption, and affordable product availability. Growing investments by domestic and international electronics brands in wireless speakers, soundbars, and home theater systems are driving market growth. Expanding e-commerce platforms and growing tech-savvy consumers are enhancing product accessibility, while government initiatives such as “Digital India” are creating favorable conditions for connected audio adoption.

North America Networked Audio Products Market Insight

North America is projected to witness the fastest growth rate of 10.4% during 2026–2033, driven by the rising integration of smart home ecosystems, streaming platforms, and voice-controlled devices. Consumers are increasingly investing in high-end, multiroom audio systems that offer convenience and immersive experiences. The region’s technological innovation, strong purchasing power, and early adoption of AI and IoT solutions continue to fuel rapid expansion. Moreover, collaborations between tech giants and audio manufacturers are shaping the next generation of connected entertainment systems across the U.S. and Canada.

U.S. Networked Audio Products Market Insight

The U.S. holds the largest share in the North American market, supported by growing consumer preference for wireless, AI-enabled, and voice-activated audio solutions. The presence of global tech companies and premium audio brands has accelerated market innovation. Expanding residential automation projects and demand for high-fidelity, connected sound systems are driving growth. The U.S. market continues to lead in smart speaker sales and streaming device integration, setting trends for the global industry.

Canada Networked Audio Products Market Insight

Canada contributes significantly to the regional market, driven by increasing demand for seamless audio connectivity in residential and commercial environments. Consumers are embracing multiroom sound systems and voice-controlled devices integrated with popular streaming platforms. The country’s expanding broadband infrastructure and focus on energy-efficient smart devices support the steady adoption of networked audio products. Local distributors and global brands are investing in customized solutions to cater to diverse consumer preferences.

Europe Networked Audio Products Market Insight

The Europe market is growing steadily, fueled by strong consumer interest in home automation and sustainable smart devices. Countries such as Germany, the U.K., and France are leading in adoption due to mature infrastructure and preference for high-end entertainment systems. The European market emphasizes design, audio quality, and energy efficiency, aligning with EU sustainability goals. Increasing adoption of wireless audio technologies and integration with AI platforms continues to support market expansion.

Germany Networked Audio Products Market Insight

Germany is the largest market in Europe, driven by strong engineering capabilities, technological expertise, and growing demand for advanced in-home entertainment systems. German consumers prioritize sound precision and sustainability, encouraging manufacturers to develop energy-efficient, high-performance products. Integration of IoT-based audio systems in smart homes and corporate spaces further enhances market penetration.

U.K. Networked Audio Products Market Insight

The U.K. market is expanding due to a growing preference for compact, multiroom, and voice-activated audio systems. Increasing adoption of AI assistants and integration with music streaming platforms such as Spotify and Apple Music is shaping demand. Manufacturers are focusing on elegant, eco-friendly designs with enhanced acoustic performance to cater to the U.K.’s design-conscious consumers. The post-Brexit flexibility in import and innovation policies is further strengthening market competitiveness.

Which are the Top Companies in Networked Audio Products Market?

The networked audio products industry is primarily led by well-established companies, including:

- Pioneer Corporation (Japan)

- SAMSUNG (South Korea)

- Sonos Inc. (U.S.)

- Yamaha Corporation (Japan)

- Sony India (India)

- Cambridge Audio (U.K.)

- Cirrus Logic, Inc. (U.S.)

- Sound United, LLC (U.S.)

- Grace Digital (U.S.)

- Logitech (Switzerland)

- Naim Audio (U.K.)

- IntelliTouch On-Hold Plus (U.S.)

- QSC, LLC (U.S.)

- Aimil Ltd (India)

- Roku, Inc. (U.S.)

- RH Consulting (U.K.)

- Guangzhou DSPPA Audio Co., Ltd. (China)

- Sherwood (U.S.)

- TEAC (Japan)

- TOA Electronics Europe GmbH (Germany)

What are the Recent Developments in Global Networked Audio Products Market?

- In June 2025, Sennheiser launched the BTD 700 Bluetooth dongle featuring LE-Audio and Auracast support, priced at USD 59.95, marking a significant step in enhancing wireless audio connectivity and device compatibility

- In May 2025, JBL unveiled three Summit Series loudspeakers at HIGH END Munich 2025, with prices ranging from USD 19,995 to 44,995, demonstrating the company’s commitment to premium, high-fidelity audio solutions for audiophiles

- In April 2025, JBL introduced the Tour ONE M3 headphones equipped with a Smart Tx transmitter, priced at EUR 399.99, offering advanced wireless transmission and superior sound quality for professional and casual listeners asuch as

- In March 2025, JBL rolled out the Flip 7 and Charge 6 portable speakers with AI Sound Boost technology, enhancing audio performance and delivering smarter, adaptive sound experiences, highlighting JBL’s focus on innovation in portable audio devices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.