Global Neuropathic Ocular Pain Market

Market Size in USD Million

CAGR :

%

USD

310.00 Million

USD

582.34 Million

2024

2032

USD

310.00 Million

USD

582.34 Million

2024

2032

| 2025 –2032 | |

| USD 310.00 Million | |

| USD 582.34 Million | |

|

|

|

|

Neuropathic Ocular Pain Market Size

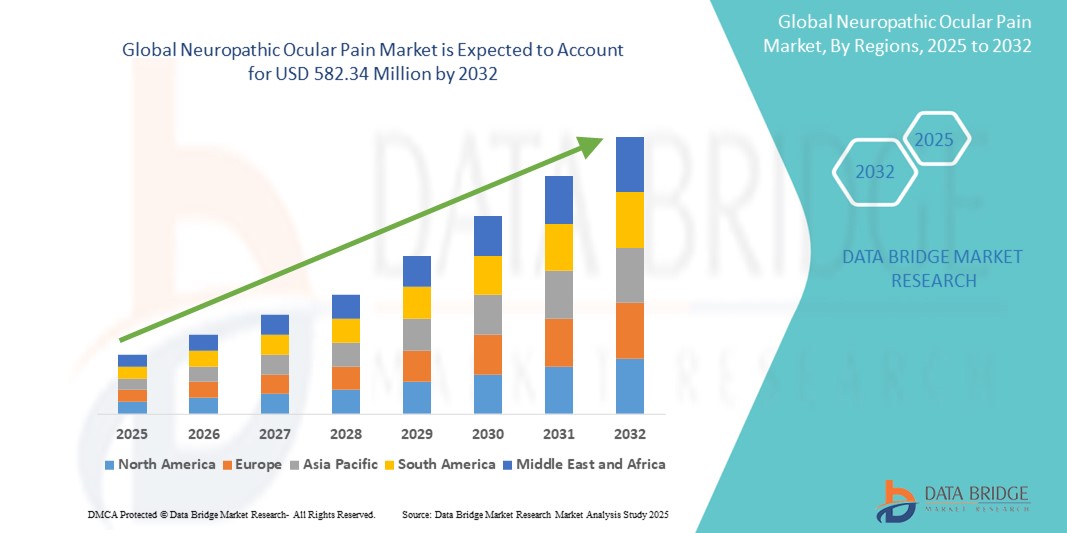

- The global neuropathic ocular pain market size was valued at USD 310.00 million in 2024 and is expected to reach USD 582.34 million by 2032, at a CAGR of 8.20% during the forecast period

- The market growth is largely driven by increasing awareness and diagnosis of neuropathic eye conditions, coupled with advancements in ocular pain management therapies across clinical settings

- Furthermore, the growing prevalence of diabetes, dry eye syndrome, and post-surgical nerve damage is increasing the demand for effective pain-relief solutions. These combined factors are propelling innovation and expanding therapeutic adoption, significantly accelerating the market's growth trajectory

Neuropathic Ocular Pain Market Analysis

- Neuropathic ocular pain, characterized by nerve-related discomfort in the eye, is gaining clinical attention as a distinct and challenging condition requiring specialized diagnosis and treatment, particularly in patients with dry eye syndrome, post-surgical complications, and systemic neuropathic disorders

- The rising demand for effective treatment options is primarily fueled by increasing awareness among healthcare providers, growing patient populations with chronic ocular conditions, and ongoing research into neuroinflammation and pain modulation mechanisms

- North America dominated the neuropathic ocular pain market with the largest revenue share of 35.3% in 2024, characterized by advanced healthcare infrastructure, a higher prevalence of diabetes and ocular surgeries, and the early adoption of innovative therapies and diagnostic tools across the U.S. and Canada

- Asia-Pacific is expected to be the fastest growing region in the neuropathic ocular pain market during the forecast period due to increasing healthcare investments, growing elderly population, and expanding access to ophthalmic care

- Non‑steroidal anti‑inflammatory drugs (NSAIDs) segment dominated the neuropathic ocular pain market with a market share of 30.5% in 2024, driven by its widespread use in managing inflammation and ocular surface pain, alongside ongoing efforts to enhance ocular drug delivery systems

Report Scope and Neuropathic Ocular Pain Market Segmentation

|

Attributes |

Neuropathic Ocular Pain Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Neuropathic Ocular Pain Market Trends

“Emergence of Precision Medicine and Neurodiagnostic Tools”

- A significant and emerging trend in the global neuropathic ocular pain market is the integration of precision medicine and advanced neurodiagnostic tools to tailor treatments based on individual patient profiles and underlying nerve dysfunction. This personalized approach is reshaping diagnosis and therapeutic strategies for chronic ocular pain conditions

- For instance, in vivo confocal microscopy (IVCM) is increasingly utilized to visualize corneal nerve fiber alterations in real time, aiding in the differential diagnosis between nociceptive and neuropathic ocular pain. Devices such as the Heidelberg Retina Tomograph with Rostock Cornea Module are becoming critical tools in ophthalmic diagnostics

- Precision medicine in this domain includes identifying patient-specific biomarkers, pain response profiles, and genetic predispositions to customize treatment regimens—ranging from systemic neuromodulators to topical neuroprotective agents. Ongoing clinical research is also exploring biologics and novel formulations that target TRPV1 receptors and other neuroinflammatory pathways

- The integration of advanced diagnostics with patient-specific therapies allows for earlier and more accurate intervention, reducing treatment resistance and improving long-term outcomes. Wearable ocular sensors and AI-based symptom tracking apps are also emerging to monitor patient-reported outcomes and nerve-related changes over time

- This shift toward highly individualized care is redefining clinical management of neuropathic ocular pain, prompting both established pharmaceutical companies and emerging biotech firms to invest in neuro-ophthalmic innovation. Companies focusing on ocular neuroinflammation and personalized pain management are poised to capture significant market share as demand for more effective and precise therapies rises

- The demand for solutions that combine diagnostic precision with targeted, patient-centric treatments is growing across both developed and emerging healthcare systems, signaling a transformative shift in how neuropathic ocular pain is addressed globally

Neuropathic Ocular Pain Market Dynamics

Driver

“Rising Prevalence of Chronic Ocular Conditions and Advancements in Pain Management”

- The increasing global prevalence of chronic ocular conditions such as dry eye disease, diabetic retinopathy, and post-surgical nerve damage is a major driver behind the growing demand for neuropathic ocular pain management solutions

- For instance, in February 2024, Dompé Farmaceutici announced the expansion of its research on cenegermin (nerve growth factor eye drops) to explore broader applications in neuropathic eye pain, marking a significant step in neuro-regenerative therapy

- As ophthalmologists and pain specialists gain a deeper understanding of corneal nerve dysfunction and neuroinflammation, more patients are being accurately diagnosed with neuropathic ocular pain, increasing the demand for targeted treatments beyond conventional anti-inflammatories

- Furthermore, the development of non-opioid neuromodulators, novel topical agents, and biologics aimed at modulating pain pathways is accelerating therapeutic innovation, enhancing both efficacy and safety profiles for long-term management

- The integration of neuropathic pain diagnosis into routine ophthalmic evaluations, along with rising patient awareness of persistent eye pain not explained by surface pathology, is encouraging earlier intervention. These trends, coupled with increased clinical research and investment in ocular pain solutions, are expected to drive substantial growth in the neuropathic ocular pain market during the forecast period

Restraint/Challenge

“Diagnostic Complexity and Limited Therapeutic Standardization”

- One of the key challenges limiting broader adoption and effective management in the neuropathic ocular pain market is the diagnostic complexity associated with distinguishing neuropathic pain from other ocular surface disorders, such as dry eye or allergic conjunctivitis, due to overlapping symptoms and the lack of widely accepted diagnostic protocols

- For instance, many patients remain undiagnosed or misdiagnosed for extended periods, often undergoing ineffective treatments for dry eye before being properly evaluated for neuropathic origins, which delays appropriate care and contributes to disease burden

- This lack of standardized diagnostic tools and clinical criteria presents a hurdle for ophthalmologists and general practitioners, who may not be equipped with advanced diagnostic technologies such as in vivo confocal microscopy or corneal esthesiometers. It also impacts clinical trial enrollment and the development of targeted therapies

- Moreover, the absence of a unified treatment algorithm and the variability in patient response to neuromodulators, antidepressants, or topical agents make it difficult to establish consistent therapeutic outcomes. Limited insurance coverage for off-label medications further complicates access for patients, especially in developing healthcare systems

- While ongoing research and clinical awareness efforts are improving the diagnostic landscape, addressing these challenges through the development of clear diagnostic guidelines, broader clinician education, and more robust clinical evidence will be essential for unlocking the market’s full potential and improving patient outcomes

Neuropathic Ocular Pain Market Scope

The market is segmented on the basis of drug class and distribution channel

- By Drug Class

On the basis of drug class, the neuropathic ocular pain market is segmented into steroids, non-steroidal anti-inflammatory drugs (NSAIDs), antidepressants, anticonvulsants, opioids, and others. The NSAIDs segment dominated the market with the largest market revenue share of 30.5% in 2024, owing to their widespread use in first-line ocular pain management and inflammation reduction. NSAIDs, such as ketorolac and bromfenac, are frequently prescribed in both topical and systemic forms for relieving neuropathic ocular symptoms and preventing secondary inflammatory complications. Their accessibility, cost-effectiveness, and established safety profile contribute to their continued preference among ophthalmologists and general practitioners alike.

The anticonvulsants segment is anticipated to witness the fastest growth rate from 2025 to 2032, driven by increasing clinical focus on targeting neuropathic pain pathways through agents such as gabapentin and pregabalin. These drugs offer promising results in chronic ocular pain cases that do not respond to conventional anti-inflammatories, supporting their rising adoption across specialized pain and ophthalmic care settings.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, and online pharmacies. The hospital pharmacies segment accounted for the highest market share in 2024, as most prescriptions for neuropathic ocular pain are initiated in specialized eye care or tertiary hospital settings. These facilities are often equipped to handle complex diagnoses and provide access to prescription-only therapies such as neuromodulators and off-label compounds that require specialist oversight.

The online pharmacies segment is projected to grow at the fastest rate through 2032. This is driven by the increasing digitalization of healthcare services, expanding e-prescription adoption, and patient preference for home delivery of chronic pain medications. Online platforms also facilitate access to less commonly stocked drugs for rare or underdiagnosed conditions such as neuropathic ocular pain, making them a key growth channel in the market’s future landscape.

Neuropathic Ocular Pain Market Regional Analysis

- North America dominated the neuropathic ocular pain market with the largest revenue share of 35.3% in 2024, driven by advanced healthcare infrastructure, a higher prevalence of diabetes and ocular surgeries, and the early adoption of innovative therapies and diagnostic tools across the U.S. and Canada

- Patients and clinicians in the region benefit from advanced diagnostic tools, greater access to specialized treatments including neuromodulators and off-label drug therapies, and strong support for research and development initiatives targeting ocular neuropathic conditions

- This widespread adoption is further supported by high healthcare expenditure, a growing geriatric population vulnerable to chronic ocular pain, and increasing patient demand for effective, long-term pain management solutions, establishing North America as a key market for both therapeutic innovation and clinical care in neuropathic ocular pain

U.S. Neuropathic Ocular Pain Market Insight

The U.S. neuropathic ocular pain market captured the largest revenue share of 42.5% in 2024 within North America, driven by increasing awareness of neuropathic ocular conditions among healthcare providers and patients. Advanced diagnostic capabilities, widespread availability of treatment options including neuromodulators and analgesics, and high healthcare expenditure are key growth factors. The rising prevalence of dry eye disease and related ocular surface disorders further fuels demand for effective neuropathic pain management therapies. Strong investment in research and development and growing adoption of personalized medicine approaches also significantly contribute to market expansion.

Europe Neuropathic Ocular Pain Market Insight

The Europe neuropathic ocular pain market is expected to register substantial growth at a notable CAGR throughout the forecast period, supported by increasing geriatric populations and rising incidence of chronic ocular pain conditions. The enforcement of strict regulatory frameworks for drug approvals and growing government initiatives aimed at improving ocular health are driving market growth. In addition, increasing adoption of advanced treatments in countries such as Germany, France, and the U.K., along with heightened patient awareness about ocular neuropathic pain, are boosting the demand for novel therapeutic options.

U.K. Neuropathic Ocular Pain Market Insight

The U.K. neuropathic ocular pain market is projected to grow steadily during the forecast period, owing to growing emphasis on early diagnosis and treatment of ocular neuropathic pain. Rising investments in ophthalmic research and increasing patient awareness campaigns are key drivers. The market growth is further supported by expanding access to innovative pharmaceuticals and a healthcare infrastructure focused on chronic pain management. The U.K.’s active participation in clinical trials for novel analgesics and neuromodulatory therapies also positively influences market dynamics.

Germany Neuropathic Ocular Pain Market Insight

The Germany’s neuropathic ocular pain market is anticipated to grow at a considerable CAGR, driven by technological advancements in diagnostic methods and a strong healthcare system focused on specialized eye care. Increasing demand for non-invasive treatment modalities and the presence of key pharmaceutical companies investing in neuropathic pain therapies underpin growth. The country’s commitment to innovation and patient-centric care is fostering adoption of targeted drug classes, including antidepressants and anticonvulsants, for effective management of ocular neuropathic pain.

Asia-Pacific Neuropathic Ocular Pain Market Insight

The Asia-Pacific neuropathic ocular pain market is poised to grow at the fastest CAGR from 2025 to 2032, driven by increasing prevalence of ocular diseases, rising healthcare expenditure, and expanding ophthalmic healthcare infrastructure in countries such as China, India, and Japan. Growing patient awareness and improving access to advanced therapies are key growth factors. Government initiatives aimed at enhancing eye care services and growing investments by pharmaceutical companies in the region further support market expansion.

Japan Neuropathic Ocular Pain Market Insight

The Japan’s neuropathic ocular pain market is gaining momentum due to a high aging population prone to ocular surface disorders and neuropathic pain conditions. Increasing focus on innovative treatment approaches and early diagnosis supports growth. The country’s advanced healthcare system and strong emphasis on research and development facilitate rapid adoption of novel pharmacological therapies, including neuromodulators and non-steroidal anti-inflammatory drugs.

India Neuropathic Ocular Pain Market Insight

The India accounted for the largest market revenue share in the Asia-Pacific region in 2024, driven by increasing awareness about neuropathic ocular pain and rising cases of dry eye syndrome and ocular surface diseases. Expanding healthcare infrastructure, affordability of emerging therapies, and government programs focused on eye health contribute to growth. The country’s large population base and increasing access to specialized ophthalmic care make it a significant market for neuropathic ocular pain treatments.

Neuropathic Ocular Pain Market Share

The neuropathic ocular pain industry is primarily led by well-established companies, including:

- Bausch + Lomb (U.S.)

- AbbVie Inc. (U.S.)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- HOYA Corporation (Japan)

- Santen Pharmaceutical Co., Ltd. (Japan)

- Sun Pharmaceutical Industries Ltd. (India)

- Regeneron Pharmaceuticals, Inc. (U.S.)

- Fresenius Kabi AG (Germany)

- Ipsen (France)

- Mitsubishi Tanabe Pharma Corporation (Japan)

- Aerie Pharmaceuticals, Inc. (U.S.)

- Alcon Inc. (Switzerland)

- Bayer AG (Germany)

- Eagle Pharmaceuticals, Inc. (U.S.)

- Kala Pharmaceuticals, Inc. (U.S.)

- Ophthotech Corporation (U.S.)

- Laboratoires Théa (France)

- Glaukos Corporation (U.S.)

What are the Recent Developments in Global Neuropathic Ocular Pain Market?

- In April 2025, OKYO Pharma was granted Fast Track designation by the FDA for urcosimod (formerly OK-101) for the treatment of neuropathic corneal pain (NCP). This designation is a significant step, as it allows for more frequent communication with the FDA and potentially an expedited review process. Urcosimod, a lipid conjugated chemerin peptide agonist, targets immune and neuronal cells involved in the inflammatory response and pain transmission

- In February 2024, OKYO Pharma received FDA approval for an Investigational New Drug (IND) for OK-101, marking a significant milestone as the first such clearance for a drug specifically targeting neuropathic corneal pain (NCP), an orphan disease. OK-101 is designed to address the underlying pathophysiological mechanisms of NCP, aiming to provide more effective and targeted relief. This development underscores the growing focus on novel drug candidates for this often-misunderstood condition

- In February 2024, Ocular Therapeutix, Inc. collaborated with AffaMed Therapeutics, a clinical-stage biopharmaceutical company, to launch DEXTENZA, a U.S. FDA-approved product for the management of ocular pain, in Greater China, South Korea, and the ASEAN region. This collaboration highlights efforts to expand the reach of approved therapies and address ocular pain in diverse global markets

- In July 2022, AbbVie reportedly invested over USD 2 billion in ocular research, emphasizing its commitment to addressing unmet needs in eye care, including chronic ocular pain. This substantial investment from a major pharmaceutical company signals a strong belief in the market's potential and a push for more effective solutions

- In January 2021, IACTA Pharmaceuticals, Inc. launched the world's first epithelial protective drug harnessing endogenous analgesia, a novel class of non-opioid compounds, for the treatment of acute and chronic ocular pain. This innovation reflects a trend towards developing alternative pain management strategies with potentially fewer side effects than traditional options

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.