Global Neurovascular Accessory Devices Market

Market Size in USD Million

CAGR :

%

USD

785.34 Million

USD

1,077.28 Million

2025

2033

USD

785.34 Million

USD

1,077.28 Million

2025

2033

| 2026 –2033 | |

| USD 785.34 Million | |

| USD 1,077.28 Million | |

|

|

|

|

Neurovascular Accessory Devices Market Size

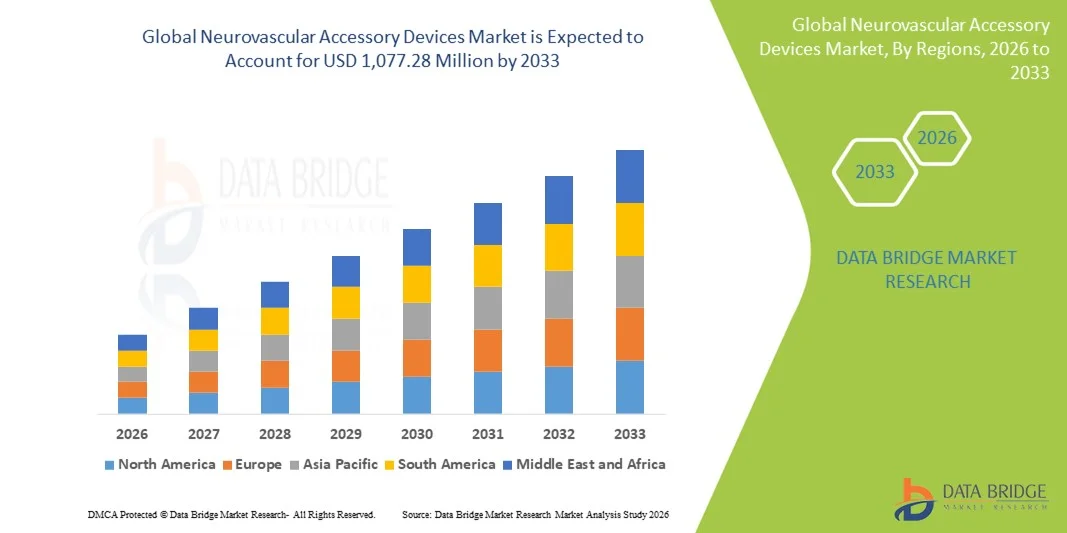

- The global neurovascular accessory devices market size was valued at USD 785.34 million in 2025 and is expected to reach USD 1,077.28 million by 2033, at a CAGR of 4.03% during the forecast period

- The market growth is largely fueled by the rising prevalence of neurovascular disorders, such as ischemic and hemorrhagic strokes, cerebral aneurysms, and arteriovenous malformations, which is driving increased adoption of minimally invasive endovascular procedures and supportive accessory devices

- Furthermore, advancements in imaging technologies, procedural techniques, and demand for integrated, high-performance accessory solutions are establishing neurovascular accessory devices as essential tools in modern neurointerventional suites. These converging factors are accelerating the uptake of accessory devices, thereby significantly boosting the industry's growth

Neurovascular Accessory Devices Market Analysis

- Neurovascular accessory devices, including guidewires, microcatheters, stent retrievers, and embolic coils used in minimally invasive procedures for stroke, aneurysms, and other neurovascular conditions, are increasingly vital components of modern interventional neurology due to their role in enhancing procedural precision, improving patient outcomes, and supporting the shift toward minimally invasive treatments

- The escalating demand for neurovascular accessory devices is primarily fueled by the rising prevalence of neurovascular diseases, expanding adoption of minimally invasive procedures, and increasing investments in stroke care infrastructure and clinical research

- North America dominated the neurovascular accessory devices market with the largest revenue share of 38.5% in 2025, characterized by advanced healthcare infrastructure, favorable reimbursement policies, and early adoption of cutting-edge technologies, with the U.S. experiencing substantial growth in device utilization across hospitals and specialized stroke centers

- Asia-Pacific is expected to be the fastest-growing region in the neurovascular accessory devices market during the forecast period due to increasing incidence of neurovascular disorders, rapid expansion of healthcare facilities, rising healthcare expenditures, and growing awareness of advanced interventional treatments in countries such as China, Japan, and India

- Ischemic stroke segment dominated the neurovascular accessory devices market with a market share of 34.7% in 2025, driven by the increasing prevalence of ischemic strokes globally and the growing adoption of minimally invasive neurothrombectomy procedures that improve patient outcomes and reduce recovery times

Report Scope and Neurovascular Accessory Devices Market Segmentation

|

Attributes |

Neurovascular Accessory Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Neurovascular Accessory Devices Market Trends

Advancements in AI-Assisted and Robotic-Guided Procedures

- A significant and accelerating trend in the global neurovascular accessory devices market is the growing integration of artificial intelligence (AI) and robotic-assisted systems in minimally invasive neurovascular procedures, enhancing procedural precision, safety, and efficiency

- For instance, the Corindus CorPath GRX platform allows physicians to remotely guide neurovascular catheters and devices with robotic precision, reducing procedural risks and improving patient outcomes

- AI integration in these devices enables predictive navigation, automated detection of vascular anomalies, and optimization of device deployment strategies, improving success rates and reducing complication risks

- The seamless combination of neurovascular accessory devices with imaging and navigation platforms facilitates real-time procedural adjustments, enabling clinicians to plan, execute, and monitor interventions with higher accuracy

- This trend towards more intelligent, precise, and automated neurovascular interventions is reshaping expectations among clinicians and hospitals, prompting manufacturers such as Stryker and Medtronic to develop AI-enabled microcatheters and stent retrievers with advanced tracking and guidance capabilities

- The adoption of AI-assisted and robotic-guided neurovascular procedures is increasing across both developed and emerging markets, as hospitals and specialty centers prioritize procedural efficiency, patient safety, and improved clinical outcomes

- Rising collaborations between device manufacturers and software companies are enabling continuous software updates and device learning, creating smarter systems that adapt to diverse neurovascular anatomies and procedural scenarios

Neurovascular Accessory Devices Market Dynamics

Driver

Rising Prevalence of Neurovascular Disorders and Minimally Invasive Procedures

- The increasing incidence of ischemic strokes, aneurysms, and other neurovascular conditions, coupled with the growing preference for minimally invasive treatments, is a significant driver of demand for neurovascular accessory devices

- For instance, in March 2025, Medtronic announced an expansion of its neurovascular device portfolio to support stroke treatment programs, aiming to improve patient access to advanced interventional therapies

- As hospitals and stroke centers adopt these advanced devices, clinicians benefit from higher procedural success rates, faster patient recovery, and reduced complication risks compared to traditional open surgery

- Furthermore, government initiatives promoting stroke care infrastructure, reimbursement schemes, and increasing hospital investments are making neurovascular accessory devices integral to modern interventional procedures

- The growing demand for specialized procedures, such as neurothrombectomy and coiling, alongside the rising number of stroke intervention programs globally, is further propelling adoption of guidewires, microcatheters, and stent retrievers

- For instance, training programs and workshops for interventional neurologists on the latest device technologies are increasing adoption rates in hospitals across North America and Europe

- Rising awareness among patients and caregivers about minimally invasive stroke treatments is also driving hospitals to invest in advanced neurovascular accessory devices to meet clinical demand

- Collaborations between device manufacturers and clinical research centers are accelerating innovation, introducing more efficient and safer devices, thereby stimulating market growth

Restraint/Challenge

High Device Costs and Regulatory Compliance Barriers

- Concerns regarding the high cost of advanced neurovascular accessory devices and stringent regulatory requirements pose significant challenges to broader market adoption

- For instance, reports indicate that the premium pricing of robotic-assisted microcatheters and AI-enabled stent retrievers can limit access in price-sensitive hospitals or emerging markets

- Ensuring regulatory compliance, including FDA and CE approvals for safety and efficacy, requires extensive clinical trials and validation, often delaying product launches and increasing development costs

- While some manufacturers, such as Stryker and Terumo, have introduced cost-effective microcatheter options, high-end devices with AI and robotic integration remain expensive, hindering widespread adoption

- Overcoming these challenges through streamlined regulatory pathways, hospital training programs, and cost-reduction strategies will be crucial for market expansion, particularly in emerging regions where stroke incidence is rising

- For instance, hospitals may be reluctant to adopt new devices without proven reimbursement support, creating a barrier for market penetration in certain countries

- Limited skilled personnel trained in robotic-assisted and AI-integrated neurovascular procedures can slow adoption rates, even when devices are available and clinically approved

- Ongoing cybersecurity and data privacy concerns regarding AI-enabled neurovascular devices can also pose adoption challenges, requiring robust encryption and secure device management

Neurovascular Accessory Devices Market Scope

The market is segmented on the basis of disease pathology, process, therapeutic applications, and end-use.

- By Disease Pathology

On the basis of disease pathology, the neurovascular accessory devices market is segmented into aneurysm, arteriovenous malformation (AVM), ischemic stroke, stenosis, and others. The ischemic stroke segment dominated the market with the largest revenue share of 34.7% in 2025, driven by the high prevalence of ischemic strokes globally and the growing adoption of minimally invasive neurothrombectomy procedures. Hospitals and specialized stroke centers prefer advanced guidewires, microcatheters, and stent retrievers for precise clot removal, resulting in improved patient outcomes and reduced recovery times. Increasing awareness of stroke symptoms and early intervention programs further fuels procedural demand. The segment also benefits from government initiatives supporting stroke treatment infrastructure, reimbursement policies, and rising investments in hospital-based neurointerventional programs. Furthermore, technological advancements in device accuracy, AI-assisted navigation, and imaging integration enhance the procedural success rate, reinforcing dominance.

The aneurysm segment is expected to witness the fastest growth from 2026 to 2033, driven by increasing diagnosis rates of cerebral aneurysms and expanding use of coiling, stenting, and flow diversion procedures. Advancements in microcatheter and embolic coil designs provide safer and more efficient treatment options. Rising patient awareness and preventive screening programs contribute to higher treatment adoption. Hospitals and specialty centers are investing in training and new equipment to manage aneurysm cases effectively. The growing trend of minimally invasive treatments replacing traditional microsurgical clipping is also accelerating demand. As a result, this segment is poised for rapid expansion in emerging and developed markets.

- By Process

On the basis of process, the market is segmented into neurothrombectomy, cerebral angiography, carotid endarterectomy, stenting, microsurgical clipping, coiling, and flow diversion. The neurothrombectomy segment dominated the market in 2025 with the highest revenue share of 31.2%, fueled by its critical role in acute ischemic stroke management. Hospitals increasingly prefer neurothrombectomy for rapid clot removal, minimizing brain damage and improving survival rates. Advanced guidewires, aspiration catheters, and stent retrievers enhance procedural precision. The segment benefits from rising stroke incidence, especially in aging populations. Integration with AI-enabled imaging platforms and real-time navigation systems further increases procedural efficiency. Training programs for interventional neurologists are expanding globally, enabling greater adoption and reinforcing market dominance.

The coiling segment is expected to witness the fastest growth from 2026 to 2033, driven by the rising prevalence of brain aneurysms and the adoption of minimally invasive endovascular techniques. Technological improvements in detachable coils and microcatheters enable safer and more effective aneurysm management. Increasing patient preference for minimally invasive procedures over open surgery supports market growth. Hospitals are expanding their neurointerventional suites and staff training to accommodate coiling procedures. Collaborations between device manufacturers and clinical centers are introducing innovative coils with improved deliverability. Consequently, coiling procedures are projected to grow rapidly across developed and emerging markets.

- By Therapeutic Applications

On the basis of therapeutic applications, the market is segmented into brain aneurysm, stenosis, and ischemic strokes. The ischemic stroke application dominated the market with a revenue share of 35.1% in 2025, driven by the high clinical demand for neurothrombectomy and endovascular clot retrieval procedures. Hospitals and specialized stroke centers rely on advanced neurovascular accessory devices to achieve rapid reperfusion and reduce disability. Government programs promoting stroke awareness, prevention, and treatment are boosting adoption. Integration with robotic-assisted navigation systems and AI-enabled imaging further improves procedural outcomes. Rising stroke incidence in both developed and developing countries ensures steady demand. Clinical studies demonstrating better outcomes with minimally invasive stroke interventions strengthen market dominance.

The brain aneurysm application is expected to witness the fastest growth from 2026 to 2033, supported by increased diagnosis through imaging and preventive screening. Hospitals are adopting coiling, flow diversion, and stenting techniques to replace traditional surgical methods. Technological advancements in embolic coils, microcatheters, and stents improve procedural safety and efficiency. Training programs for neurointerventionalists are expanding to meet rising demand. Patient preference for minimally invasive approaches over open surgery accelerates adoption. Partnerships between device manufacturers and healthcare providers are introducing innovative aneurysm treatment solutions, driving rapid growth.

- By End-Use

On the basis of end-use, the market is segmented into hospitals, ambulatory surgical centers, and clinics. The hospitals segment dominated the market with a 54.6% share in 2025, owing to the concentration of advanced neurointerventional procedures in well-equipped facilities. Hospitals have specialized stroke centers, advanced imaging, and trained interventional neurologists capable of performing complex procedures such as neurothrombectomy and coiling. High patient volumes and critical care infrastructure make hospitals the preferred end-use segment for device adoption. Hospitals also invest in AI-enabled and robotic-assisted devices to improve precision and procedural outcomes. Supportive reimbursement policies for advanced neurovascular procedures further drive hospital adoption. As a result, hospitals continue to lead in revenue contribution for neurovascular accessory devices.

The ambulatory surgical centers segment is expected to witness the fastest growth from 2026 to 2033, fueled by increasing outpatient procedures and minimally invasive neurovascular treatments. Advancements in compact, portable, and cost-effective devices allow procedures outside traditional hospital settings. Rising demand for shorter recovery times, convenience, and reduced hospital stays drives adoption. Specialty outpatient centers are expanding capabilities for neurointerventional procedures, particularly for aneurysm and stenosis treatments. Increasing collaborations between device manufacturers and ambulatory centers introduce efficient, user-friendly devices suitable for outpatient care. Consequently, ambulatory surgical centers are projected to grow rapidly in market share.

Neurovascular Accessory Devices Market Regional Analysis

- North America dominated the neurovascular accessory devices market with the largest revenue share of 38.5% in 2025, characterized by advanced healthcare infrastructure, favorable reimbursement policies, and early adoption of cutting-edge technologies

- Hospitals and specialized stroke centers in the region highly value the precision, safety, and improved patient outcomes offered by neurovascular accessory devices, including guidewires, microcatheters, stent retrievers, and embolic coils

- This widespread adoption is further supported by favorable reimbursement policies, government initiatives promoting stroke care, the availability of trained interventional neurologists, and the integration of AI-assisted and robotic-guided devices, establishing neurovascular accessory devices as essential tools for modern interventional neurology in both acute and elective procedures

U.S. Neurovascular Accessory Devices Market Insight

The U.S. neurovascular accessory devices market captured the largest revenue share of 79% in 2025 within North America, fueled by the high prevalence of ischemic strokes and cerebral aneurysms and the widespread adoption of minimally invasive procedures. Hospitals and specialized stroke centers are increasingly prioritizing advanced guidewires, microcatheters, and stent retrievers to improve patient outcomes and procedural precision. The growing trend of robotic-assisted and AI-guided interventions, combined with supportive reimbursement policies, further propels the market. Moreover, the integration of neurovascular accessory devices with advanced imaging and navigation systems is significantly contributing to the expansion of the market.

Europe Neurovascular Accessory Devices Market Insight

The Europe neurovascular accessory devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising incidence of stroke and aneurysm cases and stringent regulatory approvals promoting safe device adoption. Increasing awareness of minimally invasive treatments, coupled with the demand for advanced neurointerventional procedures, is fostering adoption across hospitals and specialty centers. European clinicians are also drawn to devices that improve procedural accuracy and patient recovery. The region is experiencing significant growth across hospital and outpatient settings, with neurovascular accessory devices being incorporated into both new clinical programs and upgraded interventional suites.

U.K. Neurovascular Accessory Devices Market Insight

The U.K. neurovascular accessory devices market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by the increasing prevalence of neurovascular disorders and the rising adoption of minimally invasive procedures. Concerns regarding stroke-related morbidity and mortality are encouraging hospitals and specialty centers to invest in advanced neurovascular accessory devices. The U.K.’s robust healthcare infrastructure, coupled with training programs for interventional neurologists and widespread use of robotic-guided procedures, is expected to continue stimulating market growth.

Germany Neurovascular Accessory Devices Market Insight

The Germany neurovascular accessory devices market is expected to expand at a considerable CAGR during the forecast period, fueled by increasing awareness of advanced stroke treatments and rising adoption of endovascular interventions. Germany’s well-developed hospital infrastructure, combined with a focus on technological innovation and patient safety, promotes the adoption of guidewires, microcatheters, and stent retrievers. The integration of neurovascular accessory devices with AI-assisted imaging platforms is also becoming increasingly prevalent, with hospitals prioritizing precise, minimally invasive solutions for neurovascular interventions.

Asia-Pacific Neurovascular Accessory Devices Market Insight

The Asia-Pacific neurovascular accessory devices market is poised to grow at the fastest CAGR of 23% during the forecast period of 2026 to 2033, driven by rising incidence of stroke and aneurysms, increasing urbanization, and growing healthcare expenditure in countries such as China, Japan, and India. The region’s expanding network of hospitals and specialty stroke centers, supported by government initiatives promoting advanced healthcare infrastructure, is driving adoption. Furthermore, as APAC becomes a hub for manufacturing and distributing neurovascular accessory devices, affordability and accessibility are improving, expanding usage across both established and emerging markets.

Japan Neurovascular Accessory Devices Market Insight

The Japan neurovascular accessory devices market is gaining momentum due to the country’s advanced healthcare system, high technological adoption, and demand for minimally invasive neurovascular interventions. Hospitals and specialty centers are increasingly adopting AI-assisted and robotic-guided microcatheters and stent retrievers to improve procedural efficiency and patient outcomes. The growing number of stroke intervention programs, combined with an aging population and emphasis on preventive care, is fueling market growth. Integration of neurovascular accessory devices with imaging and navigation systems further enhances procedural precision and clinical confidence.

India Neurovascular Accessory Devices Market Insight

The India neurovascular accessory devices market accounted for the largest market revenue share in Asia-Pacific in 2025, attributed to the rising prevalence of neurovascular disorders, increasing investments in hospital infrastructure, and rapid adoption of minimally invasive procedures. India is witnessing growth in specialized stroke centers and interventional neurology programs, supporting higher demand for guidewires, microcatheters, and stent retrievers. Government initiatives promoting digital healthcare, training programs for interventional neurologists, and availability of cost-effective neurovascular devices are key factors propelling the market in India.

Neurovascular Accessory Devices Market Share

The Neurovascular Accessory Devices industry is primarily led by well-established companies, including:

- Medtronic (Ireland)

- Stryker (U.S.)

- Penumbra, Inc. (U.S.)

- MicroVention, Inc. (U.S.)

- Boston Scientific Corporation (U.S.)

- Terumo Neuro & Peripheral Vascular Systems (Japan)

- ASAHI INTECC CO., LTD. (Japan)

- Merit Medical Systems, Inc. (U.S.)

- W. L. Gore & Associates, Inc. (U.S.)

- MicroPort Scientific Corporation (China)

- Rapid Medical (Israel)

- Integra LifeSciences Holdings Corporation (U.S.)

- Teleflex LLC (U.S.)

- Cook (U.S.)

- Perflow Medical (Israel)

- NP Medical, Inc. (U.S.)

- MIVI Neuroscience Inc (U.S.)

- Acandis GmbH & Co. KG (Germany)

- OrbusNeich Medical Group Holdings Limited (Hong Kong)

What are the Recent Developments in Global Neurovascular Accessory Devices Market?

- In September 2025, Rapid Medical™ announced that its DRIVEWIRE™ 24 steerable guidewire surpassed 1,000 neurovascular procedure cases in North America and received CE Mark approval for use in Europe, highlighting strong clinical adoption and expanding regulatory acceptance of next‑generation steerable access technology for complex neurovascular interventions

- In June 2025, Johnson & Johnson MedTech announced the U.S. launch of its next‑generation CEREGLIDE™ 92 Catheter System, designed for large distal access and enhanced visibility in acute ischemic stroke interventions, representing continued innovation in aspiration and support catheters for neurovascular care

- In April 2025, Terumo Neuro, a global neurovascular innovation leader, received Premarket Approval (PMA) from the U.S. Food and Drug Administration (FDA) for its first dual‑layer micromesh Carotid Stent System, marking the first dual‑layer micromesh carotid stent approved in the United States and offering physicians a clinically proven option to improve outcomes in carotid artery disease and reduce stroke risk among high‑risk patients

- In September 2024, Royal Philips announced FDA approval of its enhanced 160 cm LumiGuide endovascular navigation wire, which uses Fiber Optic RealShape (FORS) technology to provide real‑time 3D visualization of guidewires and catheters, enabling clinicians to navigate complex neurovascular anatomy with reduced radiation and improved precision during interventional procedures

- In May 2024, Scientia Vascular received U.S. FDA clearance for two novel neurovascular catheters the Plato 17 DMSO‑compatible microcatheter and the Socrates 38 aspiration catheter, expanding the portfolio of cleared devices aimed at improving reach, deliverability, and treatment outcomes in ischemic stroke care

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.