Global Next Generation Sequencing Data Analysis Market

Market Size in USD Billion

CAGR :

%

USD

1.06 Billion

USD

3.65 Billion

2024

2032

USD

1.06 Billion

USD

3.65 Billion

2024

2032

| 2025 –2032 | |

| USD 1.06 Billion | |

| USD 3.65 Billion | |

|

|

|

|

Next Generation Sequencing Data Analysis Market Size

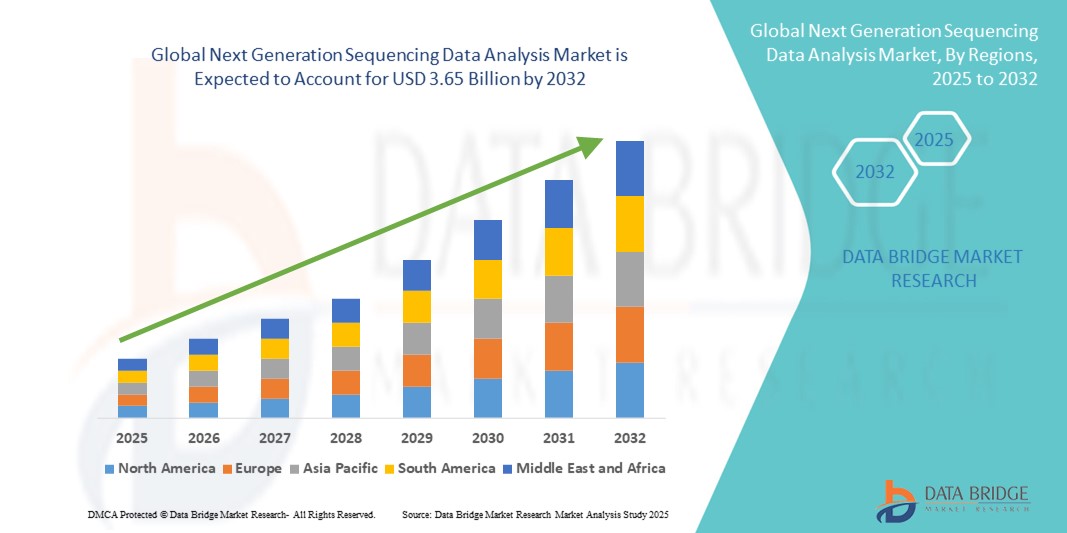

- The global next generation sequencing data analysis market size was valued at USD 1.06 billion in 2024 and is expected to reach USD 3.65 billion by 2032, at a CAGR of 16.70% during the forecast period

- The market growth is largely fueled by the growing adoption of next-generation sequencing technologies across clinical diagnostics, oncology, and precision medicine, driving an urgent need for efficient and scalable data analysis solutions to manage vast genomic datasets

- Furthermore, advancements in bioinformatics tools, machine learning algorithms, and cloud-based platforms are enabling faster, more accurate interpretations of complex sequencing data. These converging factors are accelerating the uptake of next generation sequencing data analysis solutions, thereby significantly boosting the industry's growth

Next Generation Sequencing Data Analysis Market Analysis

- Next Generation Sequencing (NGS) data analysis, enabling the interpretation of vast genomic datasets, is increasingly pivotal in personalized medicine, oncology, rare disease diagnostics, and infectious disease surveillance due to its ability to deliver rapid, high-throughput genomic insights

- The rising demand for NGS data analysis is primarily driven by the surge in sequencing output, growing clinical application of genomics, declining sequencing costs, and increasing investments in bioinformatics platforms and AI-driven analytical tools

- North America dominated the next generation sequencing data analysis market with the largest revenue share of 49.4% in 2024, characterized by advanced healthcare infrastructure, substantial R&D expenditure, and strong presence of genomics research institutions and service providers, with the U.S. leading adoption across oncology and population genomics programs

- Asia-Pacific is expected to be the fastest growing region in the next generation sequencing data analysis market during the forecast period, growing at a CAGR of 17.9%, due to the expanding genomics research landscape, rising healthcare IT investments, and government-backed precision medicine initiatives in countries such as China and India

- The In-house data analysis segment dominated the next generation sequencing data analysis market with a revenue share of 58.7% in 2024, driven by large research institutions and clinical laboratories seeking better control, faster turnaround times, and data security. Organizations with sufficient computational infrastructure and trained bioinformaticians prefer to build and operate customized pipelines in-house

Report Scope and Next Generation Sequencing Data Analysis Market Segmentation

|

Attributes |

Next Generation Sequencing Data Analysis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Next Generation Sequencing Data Analysis Market Trends

Rising Demand for Advanced Analytical Solutions in the Next Generation Sequencing (NGS) Data Analysis Market

- A significant and accelerating trend in the global next generation sequencing (NGS) data analysis market is the integration of advanced computational tools and bioinformatics pipelines to manage and interpret the increasing volume of sequencing data

- For instance, leading NGS platforms are now offering end-to-end analysis solutions that include base calling, alignment, variant calling, and annotation, streamlining workflows and reducing turnaround times for clinical and research applications

- Cloud-based NGS data analysis platforms are gaining traction, offering scalability, data security, and accessibility across institutions and geographies, thereby improving collaborative research and multi-center clinical studies

- Machine learning and statistical modeling are being incorporated to improve the accuracy of variant interpretation, particularly for rare mutations and structural variants, which are difficult to detect using traditional methods

- Automated secondary and tertiary analysis solutions are reducing the dependency on bioinformatics experts, enabling broader adoption of NGS technologies in diagnostics labs, hospitals, and emerging markets

- The growing complexity of multi-omics datasets is driving demand for integrated platforms that can process, analyze, and visualize data from genomics, transcriptomics, and epigenomics simultaneously, promoting a holistic view of biological systems

- Moreover, regulatory agencies are encouraging the development of standardized pipelines for clinical-grade NGS data interpretation, further propelling the demand for validated and compliant analysis tools in clinical genomics

Next Generation Sequencing Data Analysis Market Dynamics

Driver

Growing Need for Advanced Genomic Insights in Healthcare and Research

- The increasing demand for precision medicine and personalized therapeutics is a key driver fueling the growth of the next generation sequencing (NGS) data analysis market. As genomic data becomes integral to disease diagnostics and drug development, there is a growing need for sophisticated tools that can interpret large volumes of sequencing data accurately and efficiently

- For instance, in April 2024, Thermo Fisher Scientific launched upgraded AI-powered bioinformatics solutions aimed at simplifying clinical genomic workflows, enhancing speed and accuracy in data interpretation. Such innovations by major players are anticipated to accelerate market expansion

- The expanding utility of NGS in clinical applications such as oncology, rare diseases, and infectious disease monitoring further reinforces the demand for high-throughput, scalable data analysis platforms

- In addition, the widespread use of NGS technologies in academic and translational research settings requires robust analytical pipelines capable of managing primary, secondary, and tertiary data analysis processes

- Automation, integration with AI/ML algorithms, and real-time data processing are also gaining traction as essential features, increasing the adoption of in-house and cloud-based NGS data analysis tools across healthcare and biotech sectors

- The growth of large-scale population genomics projects and national genome initiatives globally is driving further investment into cutting-edge NGS data analysis platforms that can handle complex datasets while ensuring data accuracy and compliance with regulatory standards

Restraint/Challenge

Data Privacy, Complexity of Analysis, and Cost Constraints

- Despite its transformative potential, the NGS data analysis market faces key challenges, particularly in data security and cost of implementation. Handling and storing vast volumes of sensitive genetic information raises concerns regarding data privacy, consent, and compliance with stringent regulatory frameworks such as HIPAA and GDPR

- For instance, security breaches in healthcare data infrastructure have raised red flags among clinical institutions and patients, potentially hindering adoption. Companies must ensure their platforms offer secure, encrypted environments for genomic data processing and sharing

- Furthermore, the complexity of data analysis requires highly skilled personnel and computational infrastructure, making it difficult for smaller research labs and hospitals with limited resources to implement advanced NGS workflows

- The high cost associated with commercial NGS analysis software, cloud computing services, and the integration of AI-based tools also limits widespread use, particularly in low- and middle-income regions

- To address these concerns, market players are focusing on offering modular, user-friendly solutions and open-source platforms that balance performance and affordability

- Overcoming challenges related to standardization, data interoperability, and user training will be critical for the broader adoption of NGS data analysis solutions and for maximizing their impact in both research and clinical settings

Next Generation Sequencing Data Analysis Market Scope

The market is segmented on the basis of type, procedure and services, workflow, mode and end user.

- By Type

On the basis of type, the Next Generation Sequencing (NGS) Data Analysis market is segmented into Whole Genome Sequencing, Whole Exome Sequencing, Targeted Sequencing, RNA Sequencing, and Others. The Whole Genome Sequencing segment dominated the market with the largest revenue share of 35.8% in 2024, driven by its comprehensive coverage, ability to identify novel variants, and increasing usage in both research and clinical diagnostics. Its high resolution and falling costs are making whole genome sequencing more accessible for population-level genomic studies and rare disease investigations.

The RNA Sequencing segment is expected to witness the fastest CAGR of 20.4% from 2025 to 2032, owing to rising interest in transcriptomic profiling, biomarker discovery, and cancer research. The ability of RNA sequencing to detect gene expression patterns, alternative splicing events, and non-coding RNAs makes it highly valuable for functional genomics and disease mechanism studies.

- By Product & Services

On the basis of product & services, the NGS Data Analysis market is segmented into NGS Commercial Software, NGS Services, and NGS Data Analysis Workbenches. The NGS Commercial Software segment accounted for the largest market revenue share of 42.5% in 2024, due to the rising demand for user-friendly, integrated solutions that offer efficient data interpretation, variant annotation, and reporting tools. These platforms are widely adopted in clinical diagnostics and research for their scalability and regulatory compliance.

The NGS Services segment is expected to register the fastest CAGR of 18.9% from 2025 to 2032, driven by increasing outsourcing of bioinformatics analysis to specialized providers, particularly by small-to-medium-sized research organizations lacking in-house expertise. Service providers offer end-to-end workflows, including pipeline customization, cloud computing solutions, and technical support, enhancing data accuracy and workflow efficiency.

- By Workflow

On the basis of workflow, the NGS Data Analysis market is segmented into primary data analysis, secondary data analysis, and tertiary data analysis. The secondary data analysis segment dominated the market with the largest revenue share of 41.6% in 2024, attributed to its critical role in sequence alignment, variant calling, and genome assembly. The need for precise and high-throughput analytical capabilities in clinical applications such as cancer genomics and rare disease diagnosis further supports segment growth.

The tertiary data analysis segment is projected to register the fastest CAGR of 19.8% from 2025 to 2032, propelled by the demand for advanced interpretation tools that enable clinical decision-making. Tertiary analysis supports the annotation, prioritization, and visualization of variants, and is increasingly integrated into precision medicine workflows, enhancing diagnosis, treatment selection, and patient outcomes.

- By Mode

On the basis of mode, the NGS Data Analysis market is segmented into in-house and outsourced. The in-house segment held the largest revenue share of 58.7% in 2024, driven by large research institutions and clinical laboratories seeking better control, faster turnaround times, and data security. Organizations with sufficient computational infrastructure and trained bioinformaticians prefer to build and operate customized pipelines in-house.

The outsourced segment is expected to exhibit the fastest CAGR of 17.5% from 2025 to 2032, due to growing demand among academic and emerging biotech firms for cost-effective, scalable solutions. Outsourcing enables access to expert analysis, reduces infrastructure burden, and accelerates project timelines, making it an attractive model for data-heavy NGS applications.

- By End User

On the basis of end user, the NGS Data Analysis market is segmented into Academic Research, Clinical Research, Hospitals and Clinics, Pharma & Biotech Companies, and Others. The Academic Research segment dominated the market with the largest revenue share of 39.3% in 2024, owing to continued government and institutional funding, extensive genomic research initiatives, and the high volume of data generated in research projects.

The Pharma & Biotech Companies segment is projected to grow at the fastest CAGR of 18.2% from 2025 to 2032, driven by rising adoption of NGS in drug discovery, target validation, and clinical trial stratification. These companies leverage NGS analysis to uncover genetic insights that facilitate the development of targeted therapies and personalized medicine approaches.

Next Generation Sequencing Data Analysis Market Regional Analysis

- North America dominated the next generation sequencing data analysis market with the largest revenue share of 49.4% in 2024, characterized by advanced healthcare infrastructure, substantial R&D expenditure, and strong presence of genomics research institutions and service providers, with the U.S. leading adoption across oncology and population genomics programs

- The region’s commitment to personalized medicine, combined with favorable government initiatives such as the NIH’s All of Us Research Program, has significantly driven the demand for scalable, AI-integrated NGS data analytics platforms

- Furthermore, major U.S.-based companies are investing in cloud-based and hybrid NGS data analysis tools that enhance scalability, security, and interoperability with EHR systems, fueling further growth

U.S. Next Generation Sequencing Data Analysis Market Insight

The U.S. next generation sequencing data analysis market held the largest share of 44.35% in 2024 within the North American NGS data analysis market, driven by robust sequencing volume, high prevalence of cancer, and active collaborations among biotech firms, academia, and government bodies. The increasing integration of AI and machine learning algorithms in NGS data interpretation, coupled with FDA support for NGS-based diagnostics, has further accelerated market adoption. Additionally, the presence of key players such as Thermo Fisher Scientific, Illumina, and DNAnexus continues to contribute to U.S. market leadership.

Europe Next Generation Sequencing Data Analysis Market Insight

The European next generation sequencing data analysis market is projected to grow steadily, supported by the region’s regulatory harmonization under the In Vitro Diagnostic Regulation (IVDR) and increasing government funding in genomics projects. Countries such as Germany, France, and the U.K. are witnessing a surge in clinical application of NGS, particularly in rare disease diagnosis and pharmacogenomics. Adoption is also propelled by the availability of open-source bioinformatics tools and the expanding academic bioinformatics ecosystem across the continent.

U.K. Next Generation Sequencing Data Analysis Market Insight

The U.K. next generation sequencing data analysis market is witnessing rapid growth due to ongoing national genomic initiatives such as Genomics England, which supports large-scale sequencing programs for rare diseases and cancer. The country’s emphasis on integrating genomic data with the NHS framework, along with increasing investments in AI-driven analytics platforms, is expected to significantly boost the adoption of advanced NGS data interpretation tools.

Germany Next Generation Sequencing Data Analysis Market Insight

The Germany next generation sequencing data analysis market is experiencing considerable growth, driven by its well-funded research institutions, clinical adoption of genomics in oncology, and strong focus on data security compliance (GDPR). Increasing demand for customized genomic workflows and bioinformatics pipelines from academic and diagnostic labs is stimulating market innovation and partnerships in the country.

Asia-Pacific Next Generation Sequencing Data Analysis Market Insight

The Asia-Pacific next generation sequencing data analysis market is poised to grow at the fastest CAGR of 17.9% from 2025 to 2032, propelled by the region’s emerging genomics research infrastructure, growing patient pools, and government-led precision medicine initiatives. Countries such as China, India, and Japan are actively investing in localized sequencing facilities and cloud-based genomic data analysis platforms. Collaborations between global NGS companies and regional providers are also expanding access to bioinformatics services.

Japan Next Generation Sequencing Data Analysis Market Insight

The Japan next generation sequencing data analysis market is expanding due to the government’s push for personalized healthcare, integration of genomic data into clinical workflows, and the country’s aging population driving demand for genetic testing. Local adoption is supported by advancements in AI-based genomic interpretation tools and strong academic-industry partnerships focusing on rare disease and cancer research.

China Next Generation Sequencing Data Analysis Market Insight

The China next generation sequencing data analysis market dominated the Asia-Pacific region in terms of revenue share in 2024, supported by large-scale genomic projects such as China’s Precision Medicine Initiative and robust sequencing output by local giants such as BGI Genomics. The country’s rapid digital transformation in healthcare, coupled with rising investments in cloud-based genomics data platforms and expanding clinical applications of NGS in hospitals, is propelling strong market growth.

Next Generation Sequencing Data Analysis Market Share

The next generation sequencing data analysis industry is primarily led by well-established companies, including:

- Thermo Fisher Scientific, Inc. (U.S.)

- QIAGEN (Germany)

- Illumina, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd. (Switzerland)

- Agilent Technologies, Inc. (U.S.)

- Bio-Rad Laboratories, Inc. (U.S.)

- Pierian (India)

- Precigen (Germany)

- Partek Incorporated (U.S.)

- Eurofins Scientific (Luxembourg)

- PacBio (U.S.)

- DNASTAR (U.S.)

- Congenica Ltd. (U.K.)

- Fabric Genomics, Inc. (U.S.)

- DNAnexus Inc. (U.S.)

Latest Developments in Global Next Generation Sequencing Data Analysis Market

- In April 2025, GeneDx agreed to acquire AI‑powered genomic interpretation firm Fabric Genomics for up to USD 51 million. This strategic move positions GeneDx to enhance its cloud-based data analysis capabilities and accelerate scalable, accurate genomic interpretation—especially vital in fast-paced areas such as neonatal intensive care units. The acquisition underscores a shift toward integrated AI-human intelligence in NGS workflows, improving access to high-throughput genetic diagnostics

- In June 2024, Illumina introduced DRAGEN v4.3, featuring multigenome mapping, ancestry-aware pipelines for 128 global populations, AI-powered variant interpretation tools (such as SpliceAI and PrimateAI‑3D), and custom reference genome creation—enhancing analytical accuracy and diversity inclusion

- In November 2024, Illumina unveiled Constellation Mapped Reads technology at the ASHG conference, a revolutionary whole-genome sequencing workflow that eliminates the need for library preparation and supports ultra-long read phasing. Early access rollout is scheduled for early 2025

- In January 2024, DNAnexus, a leading U.S.-based cloud genomics company, partnered with Intelliseq to integrate the iFlow engine into its Precision Health Data Cloud. This provides a one-click automated solution for somatic and hereditary variant interpretation and clinical reporting

- In 2021, Cerba Research announced the launch of new tools to improve R&D for vaccine development against infectious diseases, including COVID-19

- In 2021, Swift Biosciences, a pioneer in the development of NGS library preparation genomics kits for clinical, translational, and academic research, was acquired by Integrated DNA Technologies (IDT)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.