Global Niobium Market

Market Size in USD Billion

CAGR :

%

USD

2.08 Billion

USD

3.23 Billion

2024

2032

USD

2.08 Billion

USD

3.23 Billion

2024

2032

| 2025 –2032 | |

| USD 2.08 Billion | |

| USD 3.23 Billion | |

|

|

|

|

Niobium Market Size

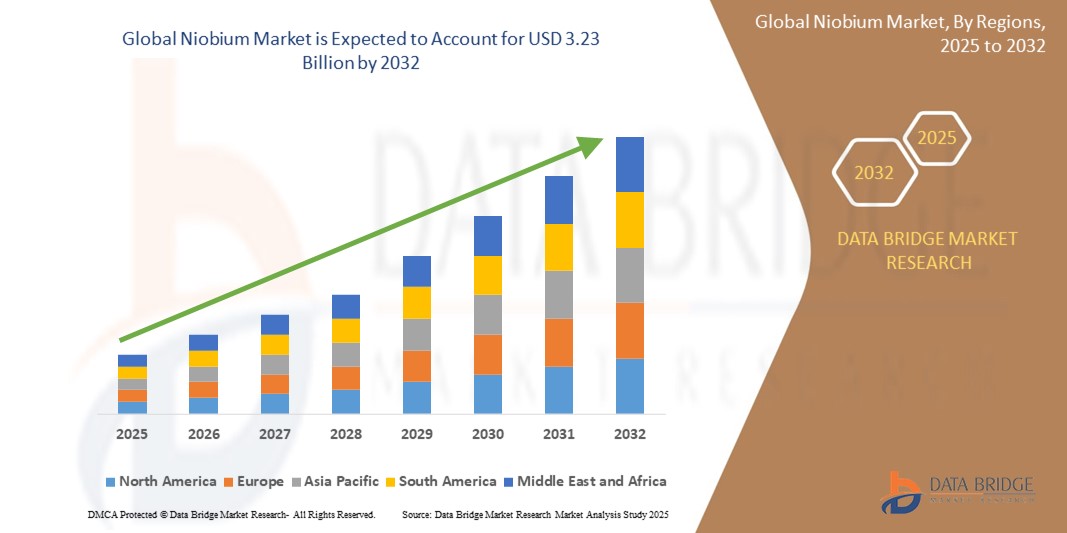

- The global niobium market was valued at USD 2.08 billion in 2024 and is expected to reach USD 3.23 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 6.00%, primarily driven by the growing demand for high-performance materials in industries like aerospace, electronics, and automotive

- This growth is supported by factors such as increased infrastructure development, rising demand for high-strength, lightweight alloys, and technological advancements in niobium-based materials

Niobium Market Analysis

- Niobium is a critical element used in high-performance alloys, providing exceptional strength, corrosion resistance, and lightweight properties. It is essential in industries such as aerospace, automotive, electronics, and infrastructure development

- The demand for niobium is significantly driven by its increasing use in the manufacturing of steel alloys, particularly in high-strength, low-alloy (HSLA) steel for construction, transportation, and energy sectors. Additionally, the growing adoption of niobium in the aerospace industry is boosting its market demand

- The North America region, specifically Brazil, stands out as a dominant producer of niobium, controlling over 90% of global production. This gives the region a strong influence over global pricing and availability of the metal

- For instance, Brazil's vast niobium reserves and production capabilities continue to play a major role in meeting the global demand for niobium, particularly in the steel and electronics sectors

- Globally, niobium is regarded as one of the most important materials for creating high-strength alloys and advanced materials, and its importance is only expected to increase as infrastructure development, demand for lightweight vehicles, and technological advancements continue to grow

Report Scope and Niobium Market Segmentation

|

Attributes |

Niobium Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

North America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Niobium Market Trends

"Increasing Use of Niobium in High-Performance Alloys"

- One prominent trend in the global niobium market is the growing use of niobium in high-performance alloys, particularly in aerospace, automotive, and construction industries

- Niobium is increasingly being incorporated into steel and titanium alloys to enhance strength, durability, and resistance to heat and corrosion, making it ideal for critical applications in industries such as aerospace and defense

- For instance, niobium is widely used in jet engine parts, gas turbines, and spacecraft components due to its excellent high-temperature properties, making it essential for advanced technological applications.

- The trend towards more lightweight and stronger materials is driving the demand for niobium, as industries seek improved performance in materials while reducing weight and enhancing efficiency

- This trend is revolutionizing material design in multiple industries, expanding the scope for niobium applications and increasing its demand for the production of high-performance alloys globally

Niobium Market Dynamics

Driver

"Growing Use in Electronics and Superconducting Applications"

- The increasing integration of advanced technologies and the miniaturization of electronic devices are driving the demand for niobium in the electronics sector

- Niobium is a critical material used in the production of capacitors, especially in compact and high-performance electronic components found in smartphones, tablets, medical devices, and wearable technologies

- Niobium-based capacitors offer high reliability, long lifespan, and superior performance in compact sizes, making them ideal for next-generation electronic applications.

- Moreover, niobium’s role in superconducting materials, particularly in the form of niobium-tin (Nb₃Sn) and niobium-titanium (NbTi) alloys, is crucial for producing powerful magnetic fields in MRI machines, particle accelerators, and other advanced scientific equipment

For instance,

- In 2023, a report by the Institute of Electronics and Nanotechnology highlighted that niobium capacitors are gaining traction in consumer electronics due to their stability, low leakage current, and high volumetric efficiency

- Additionally, in 2022, the European Organization for Nuclear Research (CERN) announced new investments in superconducting technologies using niobium-tin alloys, further reinforcing niobium's relevance in cutting-edge scientific applications

- As innovation accelerates across sectors like healthcare, consumer electronics, and quantum research, the strategic importance of niobium in electronics and superconducting applications is expected to drive sustained market growth.

Opportunity

"Growing Demand for Niobium in Electric Vehicle (EV) and Renewable Energy Sectors"

- The rising global demand for electric vehicles (EVs) and renewable energy systems is creating new market opportunities for niobium, particularly in the production of high-performance alloys used in EV batteries and wind turbines

- Niobium's role in enhancing the efficiency and durability of lithium-ion batteries, as well as its application in energy-efficient systems, is driving its adoption in the rapidly growing EV and renewable energy markets

- The push for sustainable energy solutions and green technologies is leading to an increased demand for advanced materials like niobium, which contribute to higher energy storage capacity, longer battery life, and greater efficiency in renewable energy infrastructure

- Niobium’s strength and resistance to corrosion are also making it an ideal material for critical components in wind turbines, further boosting its demand within the renewable energy sector

For instance,

- In January 2024, a report by the International Renewable Energy Agency (IREA) highlighted that the growing investments in clean energy technologies, including wind and solar power, are accelerating the demand for niobium to manufacture durable and high-performance alloys used in renewable energy equipment

- In December 2023, according to a report by the Global EV Battery Association, the integration of niobium in EV batteries enhances energy storage, reduces battery degradation, and increases the overall lifespan of electric vehicle batteries, making it a vital material for the expanding electric vehicle market

- As a result of these trends, the demand for niobium in both the electric vehicle and renewable energy sectors presents a significant growth opportunity in the global niobium market

Restraint/Challenge

"High Production Costs and Limited Availability of Niobium Mines"

- The high production costs associated with extracting and refining niobium pose a significant challenge for the market, especially in regions where the raw material is not readily available

- Niobium mining is complex and resource-intensive, which can drive up the price of the material, limiting its adoption in industries that are sensitive to material costs, such as electronics and automotive manufacturing

- The limited number of niobium mines worldwide further restricts supply and increases the vulnerability of the niobium market to supply chain disruptions, leading to price volatility

For instance,

- In October 2023, a report from the World Niobium Council stated that the high costs of niobium extraction, due to the complex processing and transportation involved, are adding significant financial pressure to manufacturers reliant on this material for high-performance alloys

- In March 2024, according to a report from the International Metal Research Association (IMRA), the concentration of niobium production in a small number of countries (notably Brazil) creates a vulnerability in the global supply chain. Any disruptions in these regions can lead to higher costs and supply shortages, impacting the industries that depend on niobium for critical applications

- Consequently, these high production costs and supply limitations can hinder the broader adoption of niobium in various applications, particularly in industries where cost-effectiveness is a primary concern. This presents a challenge to the growth of the global niobium market

Niobium Market Scope

The market is segmented on the basis of occurrence, type, application, and end-user industry

|

Segmentation |

Sub-Segmentation |

|

By Occurrence |

|

|

By Type |

|

|

By Application |

|

|

By End-User Industry |

|

Niobium Market Regional Analysis

“North America is the Dominant Region in the Niobium Market"

- North America dominates the global niobium market, primarily due to Brazil's leading role as the largest producer and exporter of niobium. Brazil holds a significant share of global niobium production, making it the key supplier for various industries like aerospace, automotive, and electronics

- The demand for high-performance alloys, especially in industries requiring strong, lightweight materials such as aerospace and defense, is driving the region's dominance. This is also fueled by the growing emphasis on the development of advanced materials for cutting-edge technologies

- North America benefits from strong government support in terms of investments in mining infrastructure, and its well-established position as a dominant player continues to solidify the region’s hold on the global niobium market

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the niobium market, driven by rapid industrialization, expanding manufacturing capabilities, and the increasing adoption of high-strength materials in sectors like automotive, electronics, and construction

- Key countries such as China, India, and Japan are emerging as significant players due to their growing demand for niobium-based alloys, particularly in automotive and infrastructure projects. This demand is being propelled by the rise of electric vehicle production and renewable energy solutions

- China, as the world’s largest consumer of metals and alloys, continues to be a major market for niobium, driving demand for high-strength, corrosion-resistant materials. India's expanding automotive and infrastructure sectors further contribute to the region's rapid growth

- The increasing presence of global niobium suppliers, along with improved access to advanced alloy production technologies, is contributing to the region's market expansion. This trend is expected to continue as Asia-Pacific emerges as a significant growth hub for niobium applications

Niobium Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- CBMM (Brazil)

- China Minmetals Corporation (China)

- Jiuquan Iron & Steel (Group) Company (China)

- Anglo American plc (United Kingdom)

- Glencore International AG (Switzerland)

- Companhia Brasileira de Metalurgia e Mineração (CBMM) (Brazil)

- Korea Zinc Co., Ltd. (North Korea)

- VSB Group (Austria)

- NioCorp Developments Ltd. (Canada)

- Iamgold Corporation (Canada)

- Xstrata (Switzerland)

- Sumitomo Metal Mining Co., Ltd. (Japan)

- Jiangxi Copper Company Limited (China)

- Mineração Taboca S.A. (Brazil)

- TCM Group (China)

- Hunan Nonferrous Metals Corporation (China)

- Vale S.A. (Brazil)

- Titanium Metals Corporation (U.S.)

- Freeport-McMoRan (U.S.)

- Metallo-Chimique (Belgium)

Latest Developments in Global Niobium Market

- In December 2022, CBMM announced a strategic investment of USD 80 million to significantly increase its niobium oxide production capacity, expanding from 500 tons to 3,000 tons by 2024. In partnership with Echion Technologies, CBMM will establish a state-of-the-art niobium oxide facility at its Araxá plant in Minas Gerais, Brazil. This move aligns with CBMM’s long-term goal of achieving a niobium oxide production capacity of 40,000 tons by 2030. This expansion is poised to strengthen CBMM’s position in the global niobium market, supporting the growing demand for high-performance materials, particularly in industries such as automotive, aerospace, and energy

- In January 2022, Kymera International finalized the acquisition of Telex Metals, a prominent global supplier of tantalum, tungsten, and niobium particulates. This strategic acquisition enables Kymera to broaden its product portfolio by incorporating tantalum and niobium materials, thereby enhancing its market presence. This move strengthens Kymera’s position in the global niobium market, allowing the company to tap into the growing demand for niobium-based materials, particularly in high-performance applications such as aerospace, electronics, and energy sectors

- In March 2022, CBMM entered into a strategic partnership with Horwin Brasil, a leading manufacturer of electric motorcycles, to advance clean energy access and promote electromobility in Brazil. The collaboration focused on integrating niobium-based lithium-ion batteries into electric two-wheel vehicles. As part of the partnership, CBMM invested 70 million reais in 2022, with an anticipated sale of 500 tons of niobium oxide. The company's long-term objective is to significantly increase niobium product sales to 50,000 tons by 2030. This partnership underscores CBMM's growing commitment to the global niobium market, particularly in the rapidly expanding electric vehicle sector

- In April 2021, NioCorp Developments Ltd confirmed the successful acquisition of a land parcel designated for the Elk Creek Superalloy Materials Project. This project, focused on the production of niobium, will enable the company to significantly expand its niobium portfolio in the global market. This strategic move strengthens NioCorp's position within the growing niobium market, as demand for high-performance materials, particularly in aerospace, automotive, and energy sectors, continues to rise

- In October 2019, H.C. Starck Tantalum and Niobium introduced its Amtrinsic tantalum and niobium metal powder range specifically designed for additive manufacturing. This strategic product launch enables the company to broaden its product portfolio and cater to the growing demand in advanced manufacturing sectors. The introduction of these high-quality powders is highly relevant to the global niobium market, as it supports the increasing adoption of additive manufacturing technologies across industries such as aerospace, automotive, and medical devices

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Niobium Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Niobium Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Niobium Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.