Global Nitrogen Fertilizers Market

Market Size in USD Billion

CAGR :

%

USD

64.52 Billion

USD

88.99 Billion

2024

2032

USD

64.52 Billion

USD

88.99 Billion

2024

2032

| 2025 –2032 | |

| USD 64.52 Billion | |

| USD 88.99 Billion | |

|

|

|

|

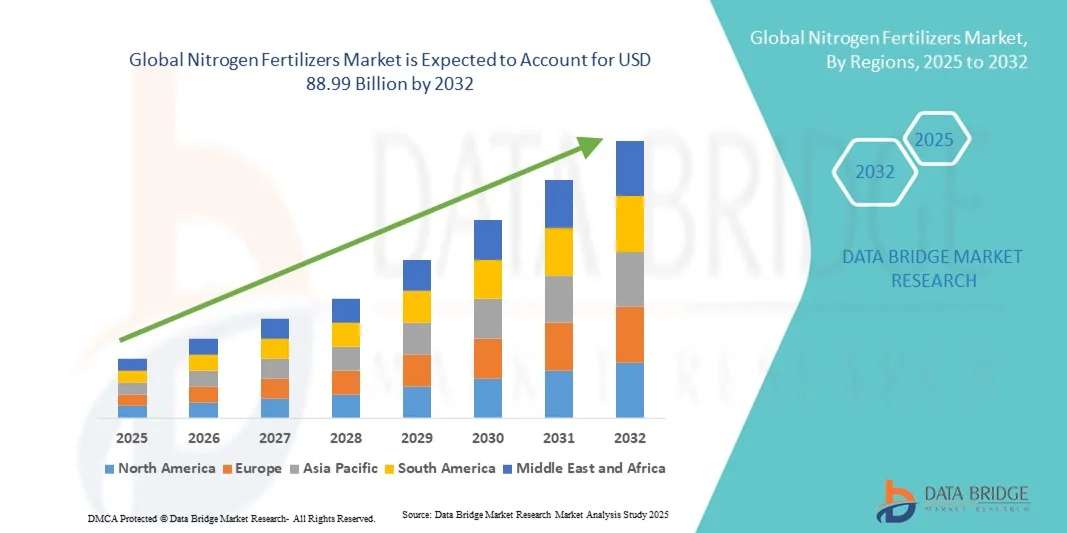

What is the Global Nitrogen Fertilizers Market Size and Growth Rate?

- The global nitrogen fertilizers market size was valued at USD 64.52 billion in 2024 and is expected to reach USD 88.99 billion by 2032, at a CAGR of 4.10% during the forecast period

- The nitrogen fertilizer market is such asly to gain growth, due to the increasing food demand because of the growing population and the government funding for the handling of advanced techniques and fertilizer for high efficiency, so as to meet the increasing demand. Also the rapidly rising popularity of commercial agriculture across the world is expected to drive the market for nitrogen fertilizers

- As the agriculture industry has been witnessing an increase in the demand for nitrogen fertilizers to supply proper nutrition to the food crops, thus escalating their yield. Moreover, factors such rising need to increase productivity and to level yield and fertilizer intensity as well as the growing awareness regarding soil profile and nutritional balance are the key determinants fueling the growth of the target market

What are the Major Takeaways of Nitrogen Fertilizers Market?

- Favorable government schemes and subsidization in rising economies encouraging the usage of the product in agricultural activities owing to its cost-effective nature will also enhance the nitrogen fertilizers market growth trends over the forecast period

- Also, the nitrogen fertilizers are gaining footing across the world in agriculture sector due to their capacity to support in rapid growth of plants also these fertilizers promote healthy development of foliage as well as fruits, which in turn is boosting the growth of the nitrogen fertilizers market. Furthermore, the major farmers all across the globe are increasing the use of nitrogen fertilizers

- The rising awareness regarding nutritional balance and soil profile as well as the growing need to grow the efficiency and fertilizer strength gaps is also projected to thrust the use of nitrogen fertilizers

- Asia-Pacific dominated the nitrogen fertilizers market with the largest revenue share of 39.69% in 2024, driven by rapid agricultural expansion, increasing crop demand, and adoption of modern farming practices

- The North America nitrogen fertilizers market is poised to grow at the fastest CAGR of 10.68% during the forecast period of 2025 to 2032, driven by technological advancements in agriculture, the adoption of precision farming practices, and increasing demand for organic and high-quality crop production

- The Urea segment dominated the market with a revenue share of 42.8% in 2024, driven by its high nitrogen content, affordability, and widespread adoption across multiple crop types

Report Scope and Nitrogen Fertilizers Market Segmentation

|

Attributes |

Nitrogen Fertilizers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Nitrogen Fertilizers Market?

Precision Agriculture and Sustainable Farming Practices

- A significant and accelerating trend in the global nitrogen fertilizers market is the adoption of precision agriculture technologies and sustainable farming practices. Farmers are increasingly leveraging digital tools, IoT sensors, and satellite monitoring to optimize fertilizer application, minimize wastage, and improve crop yields

- For instance, companies such as Yara and Nutrien are offering smart fertilizer solutions that integrate soil nutrient analysis and GPS-based application systems, allowing precise nitrogen delivery according to crop requirement

- Enhanced product formulations, including slow-release and controlled-release nitrogen fertilizers, enable efficient nutrient utilization while reducing environmental impact. In addition, innovations in liquid and stabilized nitrogen fertilizers provide better adaptability across diverse crop types and climatic conditions

- The integration of digital agriculture with nitrogen fertilizer application allows farmers to track fertilizer usage, predict crop performance, and make data-driven decisions

- This trend toward smart, sustainable, and efficient nitrogen fertilizer usage is reshaping agricultural practices globally. Consequently, companies are focusing on environmentally friendly products that boost productivity while minimizing runoff and greenhouse gas emissions

- The demand for precision-driven, sustainable nitrogen fertilizers is rapidly increasing across both developed and emerging markets as farmers aim to enhance efficiency, profitability, and environmental stewardship

What are the Key Drivers of Nitrogen Fertilizers Market?

- Rising global food demand due to population growth and changing dietary habits is a primary driver for nitrogen fertilizer consumption, as farmers require higher yields to meet food security needs

- For instance, in 2024, Nutrien Ltd. expanded its nitrogen production capacity in North America to meet growing demand from cereal and vegetable crops

- Increasing awareness of soil nutrient deficiencies and the importance of nitrogen for crop growth is encouraging farmers to adopt scientifically formulated fertilizers

- Government initiatives and subsidies promoting modern agriculture practices and efficient fertilizer use are further boosting market growth

- The convenience of specialized nitrogen fertilizers, such as urea, ammonium nitrate, and stabilized nitrogen, allows precise nutrient management, enhancing productivity and reducing environmental risks

Which Factor is Challenging the Growth of the Nitrogen Fertilizers Market?

- Environmental concerns regarding nitrogen runoff, water contamination, and greenhouse gas emissions pose significant challenges to market growth

- For instance, strict regulations in the European Union and U.S. on nitrogen application have made compliance mandatory, affecting fertilizer usage patterns

- The fluctuating prices of raw materials such as natural gas, which is critical for nitrogen production, can raise production costs and limit affordability for small-scale farmers

- Adoption of sustainable alternatives, such as organic fertilizers, also competes with traditional nitrogen fertilizers, potentially limiting market expansion

- Overcoming these challenges requires eco-friendly formulations, precision application technologies, and government support to ensure that nitrogen fertilizers remain efficient, affordable, and environmentally compliant

How is the Nitrogen Fertilizers Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

- By Product Type

On the basis of product type, the nitrogen fertilizers market is segmented into Urea, Ammonia, Ammonium Nitrate, Ammonium Sulphate, Calcium Ammonium Nitrate (CAN), and Others. The Urea segment dominated the market with a revenue share of 42.8% in 2024, driven by its high nitrogen content, affordability, and widespread adoption across multiple crop types. Urea is particularly favored in developing regions due to its cost-effectiveness and compatibility with both soil and foliar applications. Farmers rely on urea for cereals, oilseeds, and vegetable crops to ensure rapid growth and higher yields.

The Ammonium Nitrate segment is anticipated to witness the fastest growth rate of 19.5% from 2025 to 2032, driven by increasing adoption in large-scale commercial farming, high crop responsiveness, and suitability for mechanized fertilizer application. The expanding need for high-efficiency nitrogen fertilizers, coupled with regulatory support for crop productivity, is expected to drive the overall growth of this segment.

- By Crop Type

On the basis of crop type, the nitrogen fertilizers market is segmented into Cereals and Grains, Oilseeds and Pulses, Fruits and Vegetables, and Others. The Cereals and Grains segment dominated the market with a revenue share of 45.2% in 2024, as these staple crops consume the largest share of global nitrogen fertilizers to achieve high yields and meet food security demands. Wheat, rice, and maize are particularly dependent on nitrogen-rich fertilizers for optimal productivity.

The Fruits and Vegetables segment is expected to witness the fastest CAGR of 20.3% from 2025 to 2032, fueled by the growing demand for high-quality produce, adoption of commercial horticulture, and enhanced focus on nutrient management in perishable crops. Precision application of nitrogen fertilizers in these crops ensures improved yield, taste, and nutrient content, supporting market expansion in both developed and emerging regions.

- By Form

On the basis of form, the nitrogen fertilizers market is segmented into Granular, Liquid, and Prilled forms. The Granular segment dominated the market with a revenue share of 46.1% in 2024, owing to its ease of storage, uniform application, and suitability for mechanized sowing. Granular nitrogen fertilizers are widely preferred by large-scale farmers for cereals, oilseeds, and pulse crops, offering controlled nutrient release.

The Liquid segment is projected to witness the fastest CAGR of 18.7% from 2025 to 2032, driven by the increasing adoption of fertigation, precision farming, and integration with drip irrigation systems. Liquid nitrogen fertilizers provide uniform distribution, quick absorption, and compatibility with foliar feeding, making them highly efficient for high-value crops, horticulture, and greenhouse cultivation.

- By Mode of Application

On the basis of application mode, the nitrogen fertilizers market is segmented into Soil, Foliar, and Fertigation. The Soil application segment dominated the market with a revenue share of 48.5% in 2024, as traditional nitrogen fertilizers are primarily applied directly to the soil for staple crops such as cereals and oilseeds. Soil application allows for bulk nutrient delivery and is cost-effective for large farms.

The Fertigation segment is expected to witness the fastest CAGR of 22.1% from 2025 to 2032, propelled by the rising adoption of modern irrigation systems, greenhouse farming, and precision agriculture techniques. Fertigation enables precise nutrient management, reduces wastage, and ensures efficient nitrogen uptake, particularly in high-value crops such as fruits, vegetables, and horticulture, supporting increased yields and profitability.

Which Region Holds the Largest Share of the Nitrogen Fertilizers Market?

- Asia-Pacific dominated the nitrogen fertilizers market with the largest revenue share of 39.69% in 2024, driven by rapid agricultural expansion, increasing crop demand, and adoption of modern farming practices

- Farmers and agribusinesses in the region prioritize high-efficiency nitrogen fertilizers to improve yields, ensure food security, and enhance soil fertility

- This widespread adoption is further supported by government subsidies, growing investment in agritech, and the presence of large-scale fertilizer manufacturers, establishing nitrogen fertilizers as a critical input for both staple and high-value crops

China Nitrogen Fertilizers Market Insight

The China nitrogen fertilizers market captured the largest revenue share of 76% in 2024 within Asia-Pacific, fueled by the expansion of cereal, vegetable, and oilseed cultivation. The country’s focus on food security, rapid mechanization, and precision agriculture practices are driving high fertilizer adoption. Moreover, strong domestic production and export capabilities further support market growth in China.

India Nitrogen Fertilizers Market Insight

The India nitrogen fertilizers market is projected to expand at a substantial CAGR during the forecast period, primarily driven by government initiatives promoting crop productivity, increased fertilizer subsidies, and adoption of high-yield varieties. The rising focus on sustainable farming techniques and awareness about efficient nitrogen use is boosting demand across cereals, pulses, and horticulture applications.

Japan Nitrogen Fertilizers Market Insight

The Japan nitrogen fertilizers market is anticipated to grow at a noteworthy CAGR, driven by advanced farming techniques, limited arable land, and a preference for high-efficiency fertilizers. The integration of fertilizers with modern irrigation and precision agriculture solutions is also supporting adoption in both commercial and high-value crop sectors.

Which Region is the Fastest Growing Region in the Nitrogen Fertilizers Market?

The North America nitrogen fertilizers market is poised to grow at the fastest CAGR of 10.68% during the forecast period of 2025 to 2032, driven by technological advancements in agriculture, the adoption of precision farming practices, and increasing demand for organic and high-quality crop production. The region’s focus on sustainable nutrient management and smart farming solutions is accelerating nitrogen fertilizer consumption.

U.S. Nitrogen Fertilizers Market Insight

The U.S. nitrogen fertilizers market is gaining momentum due to mechanized farming, adoption of controlled-release fertilizers, and advanced crop monitoring systems. Large-scale farms are increasingly integrating nitrogen fertilizers with precision irrigation and soil management solutions, ensuring optimized crop yields and reduced environmental impact.

Canada Nitrogen Fertilizers Market Insight

The Canada nitrogen fertilizers market accounted for significant growth in North America, attributed to increasing demand for cereal, oilseed, and vegetable crops. Supportive government policies, coupled with investment in sustainable and high-efficiency fertilizers, are driving adoption among commercial and large-scale agricultural producers.

Which are the Top Companies in Nitrogen Fertilizers Market?

The nitrogen fertilizers industry is primarily led by well-established companies, including:

- Yara (Norway)

- EuroChem Group (Switzerland)

- CF Industries Holdings Inc. (U.S.)

- Nutrien Ltd. (Canada)

- OCP (Morocco)

- Koch Fertilizer, LLC (U.S.)

- Coromandel International Limited (India)

- Bunge Limited (U.S.)

- Agrium, Inc. (Canada)

- AgroCare (India)

- Guichon Valves (Canada)

- Sinofert Holdings Limited (China)

- CVR Partners, LP (U.S.)

- OCI Nitrogen (Netherlands)

- The Fertilizer Institute (U.S.)

- Ekhande Agro Fertilizers Pvt Ltd (India)

- ICL Fertilizers (Israel)

- PJSC Togliattiazot (Russia)

- Borealis AG (Austria)

- SABIC (Saudi Arabia)

What are the Recent Developments in Global Nitrogen Fertilizers Market?

- In December 2024, Grupa Azoty launched eNpluS, a granular nitrogen fertilizer enriched with calcium and sulfur, broadening its product portfolio. This initiative supports the company’s ongoing strategy to enhance its offerings and better meet evolving consumer needs, strengthening its market position

- In April 2024, Nitricity Inc., a California-based startup specializing in climate-smart nitrogen fertilizers, initiated its latest field test. The milestone marked the first tonnage delivery of Nitricity’s locally produced liquid calcium nitrate product, signaling a significant scale-up from previous small deliveries. The effort was in collaboration with Elemental Excelerator, Olam Food Ingredients (OFI), and the Madera/Chowchilla Resource Conservation District, demonstrating the company’s commitment to sustainable fertilizer solutions

- In January 2024, the ANWIL division of the ORLEN Group completed construction of its third nitrogen fertilizer production plant, boosting Poland’s food security and reducing reliance on fertilizer imports. The project increased production capacity by 50% and expanded the company’s product range, marking the largest investment in ANWIL’s history and in the region, reinforcing its market leadership

- In April 2023, SABIC Agri-Nutrients Company acquired a 49% stake in ETG Inputs Holdco Limited, part of the ETC Group, for USD 320 million. This acquisition aligns with SABIC’s strategy to integrate the agri-nutrients value chain and distribution network, enhancing its operational efficiency and market presence

- In August 2022, Koch invested approximately USD 30 million in its Kansas nitrogen plant to increase UAN production by 35,000 tons annually, addressing growing demand across western Kansas and eastern Colorado. This expansion strengthens Koch’s regional supply capabilities and supports market growth

- In March 2022, EuroChem Group purchased 51.48% of the shares in Brazilian distributor Fertilizantes Heringer SA, enhancing its production and distribution capacity in Brazil. The acquisition consolidates EuroChem’s presence in the South American nitrogen fertilizers market and improves its operational reach

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.