Global Nitrogen Trifluoride Nf3 And Fluorine Gas F2 Market

Market Size in USD Billion

CAGR :

%

USD

3.79 Billion

USD

4.31 Billion

2024

2032

USD

3.79 Billion

USD

4.31 Billion

2024

2032

| 2025 –2032 | |

| USD 3.79 Billion | |

| USD 4.31 Billion | |

|

|

|

|

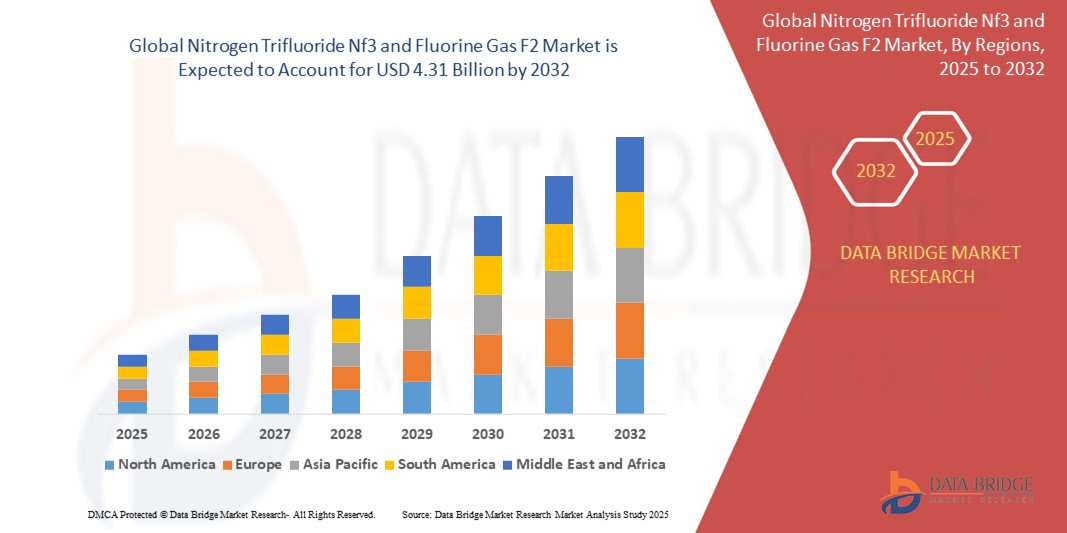

What is the Global Nitrogen Trifluoride Nf3 and Fluorine Gas F2 Market Size and Growth Rate?

- The global nitrogen trifluoride Nf3 and fluorine gas F2 market size was valued at USD 3.79 billion in 2024 and is expected to reach USD 4.31 billion by 2032, at a CAGR of 1.60% during the forecast period

- The market for nitrogen trifluoride (NF3) and fluorine gas (F2) is witnessing steady growth, driven by their widespread applications across various industries. NF3 is primarily used to produce high-purity silicon for semiconductors, flat panel displays, and solar cells, among others

- The growing demand for electronic devices, coupled with the increasing adoption of solar energy, is fueling the demand for NF3. Similarly, F2 is used in producing uranium hexafluoride (UF6) for nuclear fuel and in manufacturing various chemicals. The market is also benefiting from the expanding electronics and chemical industries globally

What are the Major Takeaways of Nitrogen Trifluoride Nf3 and Fluorine Gas F2 Market?

- The market is experiencing rapid growth, driven by increasing consumer demand for electronic devices such as smartphones, tablets, and laptops. These devices require semiconductors, which are crucial components in their manufacture. NF3 and F2 are used in the cleaning and etching processes during semiconductor production, making them essential for the electronics industry. As the demand for electronic devices continues to rise, so does the need for NF3 and F2, driving market growth

- Asia-Pacific dominated the nitrogen trifluoride (NF₃) and fluorine gas (F₂) market with the largest revenue share of 69.6% in 2024, driven by the region's well-established semiconductor manufacturing hubs, strong solar energy investments, and growing demand for advanced electronics

- North America nitrogen trifluoride (NF₃) and fluorine gas (F₂) market is poised to grow at the fastest CAGR of 13.8% during the forecast period from 2025 to 2032, driven by increasing demand for semiconductor fabrication, solar energy installations, and clean energy technologies

- The Electrolyzing Synthesis segment dominated the nitrogen trifluoride (NF₃) and fluorine gas (F₂) market with the largest market revenue share of 61.4% in 2024, driven by its ability to produce ultra-high-purity gases essential for semiconductor and electronics manufacturing

Report Scope and Nitrogen Trifluoride Nf3 and Fluorine Gas F2 Market Segmentation

|

Attributes |

Nitrogen Trifluoride Nf3 and Fluorine Gas F2 Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Nitrogen Trifluoride Nf3 and Fluorine Gas F2 Market?

“Increased Adoption of NF₃ and F₂ in Semiconductor Manufacturing for Advanced Electronics”

- A major and rapidly emerging trend in the global nitrogen trifluoride (NF₃) and fluorine gas (F₂) market is the increasing demand for these gases in the semiconductor industry, particularly for the manufacturing of advanced chips, displays, and photovoltaic panels. Their superior etching and cleaning properties are critical for maintaining the precision required in next-generation electronics

- For instance, semiconductor manufacturers are significantly increasing the consumption of NF₃ and F₂ for plasma etching, chamber cleaning, and thin-film deposition processes used in the production of high-performance microchips, OLED panels, and solar cells

- As the global demand for consumer electronics, 5G infrastructure, electric vehicles, and renewable energy technologies accelerates, the need for high-purity specialty gases such as NF₃ and F₂ is rising, supporting faster production cycles and improved device reliability

- In addition, leading players such as Linde plc and Air Products are investing heavily in expanding their specialty gas production capabilities to meet the stringent quality standards and growing volume requirements of the semiconductor industry

- With advancements in chip manufacturing technology and the global push toward digital transformation, the integration of NF₃ and F₂ in electronics production processes is set to expand further, driving significant market growth over the coming years

What are the Key Drivers of Nitrogen Trifluoride Nf3 and Fluorine Gas F2 Market?

- The booming semiconductor and flat panel display industries remain the primary growth drivers for the NF₃ and F₂ market, as these gases are essential for precision cleaning, etching, and material deposition in chip fabrication and display production

- For instance, in March 2024, SK Materials announced an investment to expand its NF₃ production capacity to support the growing demand from South Korean semiconductor foundries and display manufacturers

- The surge in solar photovoltaic (PV) installations worldwide, driven by the renewable energy transition, is also fueling the need for NF₃ in the cleaning processes of solar panel manufacturing lines. Its effectiveness in maintaining production efficiency and product quality enhances its adoption

- Furthermore, stringent environmental regulations in some regions are leading manufacturers to adopt NF₃ and F₂ for their relatively lower global warming potential (GWP) compared to legacy cleaning gases, promoting their use as more sustainable alternatives in high-tech production lines

Which Factor is challenging the Growth of the Nitrogen Trifluoride Nf3 and Fluorine Gas F2 Market?

- A key challenge for the NF₃ and F₂ market is the growing regulatory and environmental concerns related to the greenhouse gas emissions associated with these substances, particularly NF₃, which, despite its lower leakage rates, has a high GWP if released into the atmosphere

- For instance, various countries, especially in Europe, are implementing stricter emissions monitoring and reporting requirements for NF₃ under frameworks such as the Kyoto Protocol and subsequent climate agreements, raising compliance costs for manufacturers

- In addition, the highly toxic and reactive nature of Fluorine Gas poses significant handling, storage, and transportation risks, requiring specialized equipment and safety protocols, which increase operational complexities and costs for end-users

- Moreover, the market faces competition from alternative cleaning and etching gases with lower environmental impact, prompting manufacturers to invest in research and development to improve NF₃ and F₂ production efficiency, recycling capabilities, and emissions control technologies

- Overcoming these regulatory, safety, and environmental challenges through technological innovations, process optimization, and sustainable practices will be essential for the continued growth and global acceptance of NF₃ and F₂ in high-tech industries

How is the Nitrogen Trifluoride Nf3 and Fluorine Gas F2 Market Segmented?

The market is segmented on the basis of type, NF3 application, and F2 application.

• By Type

On the basis of type, the nitrogen trifluoride (NF₃) and fluorine gas (F₂) market is segmented into Chemical Synthesis and Electrolyzing Synthesis. The Electrolyzing Synthesis segment dominated the Nitrogen Trifluoride (NF₃) and Fluorine Gas (F₂) market with the largest market revenue share of 61.4% in 2024, driven by its ability to produce ultra-high-purity gases essential for semiconductor and electronics manufacturing. The demand for electrolyzing synthesis is further propelled by its environmentally friendly process and efficiency in generating large-scale NF₃ and F₂ with minimal impurities, critical for high-end industrial applications.

The Chemical Synthesis segment is anticipated to witness the fastest growth rate from 2025 to 2032, supported by its cost-effectiveness and scalability for bulk production. With rising demand from emerging markets and increased consumption in general industrial processes, chemical synthesis remains a viable solution for large-volume, cost-sensitive applications.

• By Nitrogen Trifluoride (NF₃) Application

On the basis of application, the nitrogen trifluoride (NF₃) market is segmented into Semiconductor Displays, Flat Panel Displays, and Solar Cells. The Semiconductor Displays segment held the largest market revenue share of 47.9% in 2024, driven by the critical role of NF₃ in plasma cleaning and etching processes for advanced semiconductor manufacturing. The segment benefits from ongoing growth in consumer electronics, 5G infrastructure, and computing technologies demanding precision-engineered microchips.

The Solar Cells segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the global shift toward renewable energy and the rising deployment of solar photovoltaic systems. NF₃’s use in cleaning thin-film solar panel production lines ensures higher efficiency, durability, and performance of solar modules, making it a vital material for the green energy transition.

• By Fluorine Gas (F₂) Application

On the basis of application, the fluorine gas (F₂) market is segmented into Uranium Enrichment, Electronic Cleaning, and Sulphur Hexafluoride Production. The Uranium Enrichment segment dominated the market with the largest market revenue share of 42.6% in 2024, driven by the essential role of F₂ in producing uranium hexafluoride (UF₆), a critical compound for nuclear fuel production. Rising global energy demand and the expansion of nuclear power generation continue to fuel segment growth.

The Electronic Cleaning segment is projected to witness the fastest CAGR from 2025 to 2032, propelled by the increasing need for high-purity cleaning agents in semiconductor fabrication and precision electronics manufacturing. Fluorine gas offers superior efficiency in removing contaminants, supporting the production of defect-free microchips and electronic components in advanced technology industries.

Which Region Holds the Largest Share of the Nitrogen Trifluoride Nf3 and Fluorine Gas F2 Market?

- Asia-Pacific dominated the nitrogen trifluoride (NF₃) and fluorine gas (F₂) market with the largest revenue share of 69.6% in 2024, driven by the region's well-established semiconductor manufacturing hubs, strong solar energy investments, and growing demand for advanced electronics

- Countries such as China, Japan, South Korea, and Taiwan lead in the consumption of NF₃ and F₂ due to their dominance in semiconductor displays, flat panel displays, and solar cell production, which are the primary applications of these gases

- In addition, favorable government initiatives, rising technological adoption, and the presence of key global electronics manufacturers have further strengthened Asia-Pacific's leadership position in the market

China Nitrogen Trifluoride (NF₃) and Fluorine Gas (F₂) Market Insight

China nitrogen trifluoride (NF₃) and fluorine gas (F₂) market accounted for the largest revenue share within Asia-Pacific in 2024, driven by the country's leadership in semiconductor fabrication, solar panel manufacturing, and flat-panel display production. With strong domestic demand for electronics and renewable energy, China continues to invest heavily in next-generation technologies where NF₃ and F₂ play a critical role. Furthermore, the Chinese government’s focus on smart city development and sustainable industries is boosting demand for high-purity specialty gases.

Japan Nitrogen Trifluoride (NF₃) and Fluorine Gas (F₂) Market Insight

Japan nitrogen trifluoride (NF₃) and fluorine gas (F₂) market is experiencing robust growth, supported by the country’s advanced electronics industry, strong R&D infrastructure, and emphasis on technological precision. Japan remains a key player in semiconductor and solar cell manufacturing, which drives consistent demand for NF₃ and F₂ gases used in etching, cleaning, and energy-efficient production processes. In addition, Japan’s focus on environmental sustainability and smart infrastructure projects is creating new avenues for market expansion.

South Korea Nitrogen Trifluoride (NF₃) and Fluorine Gas (F₂) Market Insight

South Korea nitrogen trifluoride (NF₃) and fluorine gas (F₂) market is witnessing significant expansion, fueled by the country's global leadership in semiconductor and display panel production. Major South Korean tech giants are increasing investment in advanced chip manufacturing, OLED displays, and solar energy projects, all of which heavily rely on NF₃ and F₂ gases. Government initiatives to strengthen domestic chip supply chains and export capabilities are further boosting market growth.

Which Region is the Fastest Growing Region in the Nitrogen Trifluoride (NF₃) and Fluorine Gas (F₂) Market?

North America nitrogen trifluoride (NF₃) and fluorine gas (F₂) market is poised to grow at the fastest CAGR of 13.8% during the forecast period from 2025 to 2032, driven by increasing demand for semiconductor fabrication, solar energy installations, and clean energy technologies. The region's strategic focus on reshoring chip manufacturing, combined with investments in renewable energy, is boosting the consumption of specialty gases such as NF₃ and F₂ essential for these industries.

U.S. Nitrogen Trifluoride (NF₃) and Fluorine Gas (F₂) Market Insight

U.S. nitrogen trifluoride (NF₃) and fluorine gas (F₂) market captured the largest revenue share in North America in 2024, driven by robust developments in semiconductor fabs, the Inflation Reduction Act's support for solar energy, and growing technological advancements. With increased focus on domestic semiconductor production, particularly in collaboration with key global players, the U.S. market for NF₃ and F₂ gases is expected to witness rapid growth to meet rising industrial demand.

Canada Nitrogen Trifluoride (NF₃) and Fluorine Gas (F₂) Market Insight

Canada nitrogen trifluoride (NF₃) and fluorine gas (F₂) market is anticipated to grow steadily, supported by the country’s investments in clean energy infrastructure, emerging semiconductor research initiatives, and demand for sustainable industrial processes. Canada's participation in North America's renewable energy goals and focus on high-tech manufacturing are creating incremental demand for NF₃ and F₂ gases across multiple applications.

Which are the Top Companies in Nitrogen Trifluoride Nf3 and Fluorine Gas F2 Market?

The nitrogen trifluoride Nf3 and fluorine gas F2 industry is primarily led by well-established companies, including:

- AkzoNobel N.V. (Netherlands)

- PPG Industries Inc. (U.S.)

- The Sherwin-Williams Company (U.S.)

- RPM International Inc. (U.S.)

- NIPSEA Group (Japan)

- Arkema (France)

- Cardolite Corporation (U.S.)

- BASF SE (Germany)

- Evonik Industries AG (Germany)

- Reichhold LLC 2 (U.S.)

- DSM (Netherlands)

- Qualipoly Chemical Corp. (Taiwan)

- Arakawa Chemical Industries, Ltd. (Japan)

- Alberdingk Boley, Inc. (U.S.)

- Eternal Materials Co., Ltd. (Taiwan)

- Wacker Chemie AG (Japan)

- DIC CORPORATION (Japan)

What are the Recent Developments in Global Nitrogen Trifluoride Nf3 and Fluorine Gas F2 Market?

- In March 2023, Daikin Industries revealed plans to build a new fluorine production facility in Japan, which is scheduled to commence operations in 2025 to cater to the surging demand for fluorine in the electronics sector. This initiative is expected to strengthen Daikin’s leadership in the specialty gas market and support the global semiconductor supply chain

- In June 2022, SK Materials Co., a prominent NF3 manufacturer from South Korea, and Japan's Showa Denko K.K. announced a strategic partnership to explore business opportunities in the U.S. semiconductor materials market, with plans to establish a high-purity gas production facility in the U.S. This development is aimed at addressing the rising demand for NF3 in North America and boosting both companies' regional market share

- In January 2022, Honeywell confirmed the successful acquisition of Solvay's Fluorine Products division, aimed at broadening Honeywell's advanced materials and specialty chemical portfolio. This acquisition strengthens Honeywell's capabilities to meet the evolving needs of global industries, particularly in electronics and energy sectors

- In December 2021, Solvay announced the acquisition of Henkel's fluorine-based products business, which encompasses refrigerants, solvents, and other specialty fluorine products. This acquisition enables Solvay to expand its fluorine solutions portfolio and reinforces its position in the specialty chemicals market

- In February 2021, data from the Korea International Trade Association reported that Hyosung Chemical, recognized as the world’s second-largest NF3 producer with an annual capacity of 4,550 tons, significantly increased its exports to the global chip and display industries. The company shipped approximately 4,000 tons of NF3 in 2020, marking a substantial rise from 3,000 tons in 2019, strengthening Hyosung’s footprint in high-growth electronics markets

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Nitrogen Trifluoride Nf3 And Fluorine Gas F2 Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Nitrogen Trifluoride Nf3 And Fluorine Gas F2 Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Nitrogen Trifluoride Nf3 And Fluorine Gas F2 Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.