Global Non Alcoholic Steatohepatitis Market

Market Size in USD Billion

CAGR :

%

USD

6.06 Billion

USD

145.33 Billion

2025

2033

USD

6.06 Billion

USD

145.33 Billion

2025

2033

| 2026 –2033 | |

| USD 6.06 Billion | |

| USD 145.33 Billion | |

|

|

|

|

Non-alcoholic Steatohepatitis Market Size

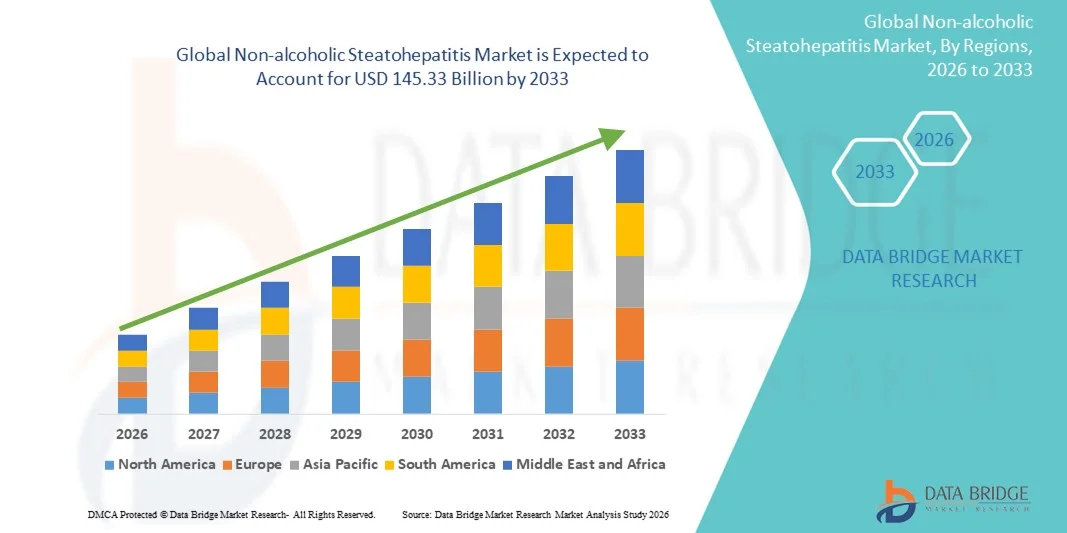

- The global non-alcoholic steatohepatitis market size was valued at USD 6.06 billion in 2025 and is expected to reach USD 145.33 billion by 2033, at a CAGR of 48.76% during the forecast period

- The market growth is largely fueled by the rising prevalence of obesity, type 2 diabetes, and metabolic syndrome, which are major risk factors for Non-alcoholic Steatohepatitis (NASH). In addition, advancements in diagnostic tools, including non-invasive biomarkers, imaging technologies, and AI-driven models, are enabling early detection and improved patient management

- Furthermore, increasing investments by biopharmaceutical companies in the development of effective NASH therapeutics—such as antifibrotic agents, metabolic modulators, and combination therapies—are driving strong pipeline progress. Rising awareness among healthcare providers and patients, coupled with government initiatives for liver disease management, is boosting adoption of NASH treatment solutions

Non-alcoholic Steatohepatitis Market Analysis

- Non-alcoholic Steatohepatitis (NASH) therapies, offering advanced treatment options for liver inflammation and fibrosis, are increasingly vital components of modern healthcare due to their ability to target underlying metabolic pathways, improve patient outcomes, and reduce progression to cirrhosis or liver failure

- The escalating demand for NASH solutions is primarily fueled by the rising prevalence of obesity, type 2 diabetes, and metabolic syndrome, growing awareness among healthcare providers and patients, and increasing investments in novel therapeutics and clinical trials

- North America dominated the non-alcoholic steatohepatitis market with the largest revenue share of 42.55% in 2025, supported by advanced healthcare infrastructure, high adoption of novel therapeutics, strong clinical trial activity, and significant per-patient treatment spending

- Asia-Pacific is expected to be the fastest growing region in the non-alcoholic steatohepatitis market during the forecast period, projected to record a CAGR from 2026 to 2033, driven by rising disease prevalence, expanding healthcare investments, and growing access to advanced therapies in countries such as China, India, and Japan

- The Hospital Pharmacy segment dominated with a revenue share of 45.1% in 2025, as hospitals are the primary centers for prescription NASH therapies

Report Scope and Non-alcoholic Steatohepatitis Market Segmentation

|

Attributes |

Non-alcoholic Steatohepatitis Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Non-alcoholic Steatohepatitis Market Trends

Rising Focus on Non-invasive Diagnostics and Combination Therapies

- A major and accelerating trend in the global non-alcoholic steatohepatitis market is the growing emphasis on non-invasive diagnostic tools, biomarkers, and combination therapies to manage the disease more effectively. Researchers and pharmaceutical companies are increasingly focusing on developing therapies that target multiple pathways of NASH progression, including fibrosis, inflammation, and metabolic dysfunction

- For instance, in February 2023, Genfit reported positive results from its Phase III RESOLVE-IT trial, showing that its elafibranor therapy significantly improved liver histology in NASH patients without worsening fibrosis. This demonstrates the industry’s focus on combination and multi-targeted approaches to treatment

- Another key trend is the advancement of precision medicine approaches, where patient stratification based on genetic, metabolic, and lifestyle factors is being used to design more personalized treatment regimens

- In November 2022, Madrigal Pharmaceuticals initiated a Phase IIb study of MGL-3196 (resmetirom), targeting patients with specific lipid and metabolic profiles, highlighting the market’s focus on precision therapies

- In addition, there is increasing collaboration between pharmaceutical companies and diagnostic firms to develop integrated treatment-and-monitoring solutions, which can help track disease progression and therapy response in real time

Non-alcoholic Steatohepatitis Market Dynamics

Driver

Growing Prevalence of Obesity and Metabolic Disorders

- The increasing prevalence of obesity, type 2 diabetes, and metabolic syndrome worldwide is a key driver for NASH market growth. Lifestyle changes, sedentary behavior, and unhealthy dietary habits have contributed to the rising incidence of fatty liver disease, which can progress to NASH

- For instance, in September 2022, the World Health Organization highlighted that over 650 million adults globally are obese, underscoring the escalating demand for effective NASH therapeutics to address related liver complications

- Another driver is the growing awareness among healthcare providers and patients about the long-term risks of untreated NASH, including cirrhosis and liver cancer, which is prompting early diagnosis and treatment

- In July 2023, Intercept Pharmaceuticals launched an educational initiative across Europe to raise awareness among hepatologists about the importance of early NASH detection and intervention

- The rising investment in research and development by leading pharmaceutical companies for NASH therapies is also propelling market growth. For instance, in May 2021, Novo Nordisk expanded its NASH research pipeline through a $250 million investment in preclinical and clinical studies

Restraint/Challenge

Complex Disease Pathophysiology and Regulatory Hurdles

- Despite significant advancements, the development of effective NASH therapies is challenged by the complex and multifactorial nature of the disease. NASH involves a combination of metabolic, inflammatory, and fibrotic processes, making it difficult to design drugs with consistent efficacy across diverse patient populations

- For instance, in January 2024, the FDA issued guidance emphasizing the need for validated non-invasive endpoints in NASH clinical trials, highlighting the regulatory challenges pharmaceutical companies face before obtaining drug approvals

- High costs associated with drug development and clinical trials for NASH therapies are another key challenge, particularly for small and mid-sized biotech companies attempting to compete with established pharmaceutical players

- In March 2022, Gilead Sciences announced that its Phase III trial for selonsertib failed to meet primary endpoints, illustrating the high risk and uncertainty in NASH drug development

- In addition, lack of standardized diagnostic criteria in some regions delays patient recruitment and complicates market adoption, affecting the overall commercial potential of new NASH therapies

- Finally, patient adherence to long-term therapies is a concern, as lifestyle modification remains a key component of treatment, and non-compliance can reduce real-world effectiveness of pharmacological interventions

Non-alcoholic Steatohepatitis Market Scope

The market is segmented on the basis of drug type, sales channel, disease cause, and end user.

- By Drug Type

On the basis of drug type, the Global Non-alcoholic Steatohepatitis market is segmented into Vitamin E and Pioglitazone, Ocaliva, Elafibranor, Selonsertib and Cenicriviroc, Obeticholic Acid, and Others. The Obeticholic Acid segment dominated the largest market revenue share of 38.5% in 2025, driven by its proven efficacy in improving liver histology and reducing fibrosis in NASH patients. Strong clinical trial evidence, regulatory approvals, and physician confidence contribute to its widespread adoption. Patients with moderate-to-severe NASH are prioritized for this therapy, increasing prescription volumes. The drug’s inclusion in treatment guidelines and combination therapy options further strengthen its market position. Hospitals and specialty clinics favor Obeticholic Acid for its predictable pharmacokinetic profile. Pharmaceutical marketing initiatives and reimbursement coverage enhance accessibility. Ongoing research and post-marketing studies support physician trust. The segment benefits from high patient adherence due to once-daily oral administration. Distribution through hospital pharmacies ensures robust supply. The growing prevalence of NASH in developed and emerging markets underpins sustained growth. Strong brand recognition and physician familiarity maintain dominance.

The Selonsertib and Cenicriviroc segment is expected to witness the fastest CAGR of 22.4% from 2026 to 2033, owing to their novel antifibrotic and anti-inflammatory mechanisms. Positive outcomes from late-stage clinical trials are encouraging adoption. Combination therapy potential with existing NASH drugs drives physician interest. Patient awareness campaigns and advocacy programs accelerate uptake. Emerging markets show high demand due to increasing NASH diagnosis rates. Regulatory incentives for breakthrough therapies further support market entry. Pharma investment in marketing, education, and distribution increases visibility. Homecare and outpatient settings are beginning to adopt these therapies. Favorable reimbursement policies enhance affordability. Digital health solutions facilitate patient adherence. Partnerships with specialty pharmacies expand access. Physician confidence rises as real-world evidence accumulates.

- By Sales Channel

On the basis of sales channel, the market is segmented into Hospital Pharmacy, Online Providers, and Retail Pharmacy. The Hospital Pharmacy segment dominated with a revenue share of 45.1% in 2025, as hospitals are the primary centers for prescription NASH therapies. Centralized procurement and controlled dispensing ensure patient safety. Physicians prefer hospital-based treatment for moderate-to-severe cases requiring monitoring. Hospital pharmacies integrate with hepatology departments for coordinated care. Insurance coverage for hospital-dispensed medications encourages utilization. Strong supply chain and bulk purchasing support revenue. Hospitals provide clinical guidance for therapy adherence. Institutional trust and reputation increase physician prescribing. Hospital pharmacy networks offer access to rare or high-cost drugs. Training programs for staff improve patient outcomes. Ongoing partnerships with pharma enhance therapy adoption. Structured follow-up and monitoring maintain dominance.

The Online Providers segment is expected to witness the fastest CAGR of 19.8% from 2026 to 2033, driven by telemedicine growth and patient preference for home delivery. Convenient access to therapies reduces hospital visits. Increased smartphone and internet penetration support e-pharmacy adoption. Online platforms provide subscription-based refills for chronic therapy adherence. Direct-to-patient delivery enhances accessibility, particularly in remote areas. Patient assistance programs encourage affordability and uptake. Digital marketing campaigns improve awareness. Online providers can offer competitive pricing compared with traditional pharmacies. E-prescribing integration ensures safe and timely delivery. Telehealth consultations complement therapy initiation. Specialty drugs are increasingly available via online channels. Regulatory support and pandemic-driven adoption boost growth.

- By Disease Cause

On the basis of disease cause, the market is segmented into Hypertension, Heart Disease, High Blood Lipid, Type 2 Diabetes, and Obesity. The Type 2 Diabetes segment dominated the largest market share of 34.7% in 2025, due to the strong link between insulin resistance and NASH progression. Diabetes screening programs drive early NASH diagnosis. Patients with comorbid diabetes are prioritized for therapy. Antidiabetic drugs with liver-beneficial effects support treatment integration. Physician awareness and multidisciplinary management strengthen adoption. Hospital and clinic settings provide structured care pathways. Insurance coverage and reimbursement increase accessibility. Clinical guidelines highlight NASH management in diabetes care. Education programs improve patient adherence. Rising global prevalence of diabetes sustains demand. Early intervention improves liver outcomes, reinforcing therapy uptake. Collaboration with endocrinology and hepatology teams maintains dominance.

The Obesity segment is expected to witness the fastest CAGR of 21.5% from 2026 to 2033, driven by rising obesity prevalence globally. Obesity management programs and lifestyle interventions increase therapy adoption. Combination treatments targeting weight and liver outcomes enhance efficacy. Bariatric surgery patients often receive adjunct NASH therapies. Awareness campaigns link obesity with liver disease, accelerating adoption. Homecare and outpatient services expand access. Government initiatives support preventive care. Pharma investments in patient education increase therapy uptake. Clinical trial data demonstrate obesity-targeted efficacy. Physician confidence in treatment improves. Insurance and reimbursement programs support affordability. Digital health monitoring tools improve patient adherence. Social media and health advocacy programs further drive awareness.

- By End User

On the basis of end user, the market is segmented into Hospitals, Clinics, and Homecare Settings. The Hospitals segment accounted for the largest market share of 42.3% in 2025, due to the presence of specialized hepatology departments. Hospitals provide multidisciplinary care and supervision for advanced NASH therapies. Centralized pharmacy and treatment protocols ensure compliance. Hospitals facilitate clinical monitoring for safety and efficacy. Physician trust and institutional protocols drive adoption. Partnerships with pharma for clinical trials support early access. Insurance coverage encourages patient uptake. Hospital-based programs improve adherence. Patient education is integrated into care plans. Data collection supports real-world evidence generation. Research collaborations enhance therapy validation. Structured follow-up programs maintain dominance.

The Homecare Settings segment is expected to witness the fastest CAGR of 20.7% from 2026 to 2033, driven by patient-centric care trends and remote monitoring. Convenience of therapy at home reduces hospital visits. Telehealth consultations support initiation and adherence. Home-delivery pharmacy services improve access. Patient assistance programs enhance affordability. Digital adherence tools ensure compliance. Education initiatives for caregivers accelerate adoption. Chronic therapy management favors homecare settings. Pandemic-driven shifts increased homecare preference. Monitoring devices enable remote physician oversight. Physician confidence grows with real-world data. Community-based programs encourage uptake. Insurance reimbursement for homecare therapies expands adoption.

Non-alcoholic Steatohepatitis Market Regional Analysis

- North America dominated the non-alcoholic steatohepatitis market with the largest revenue share of 42.55% in 2025, supported by advanced healthcare infrastructure, high adoption of novel therapeutics, strong clinical trial activity, and significant per-patient treatment spending

- Consumers and healthcare providers in the region are increasingly focused on early diagnosis, advanced therapies, and comprehensive liver disease management programs, driving demand for innovative NASH treatment solutions

- This widespread adoption is further supported by strong government initiatives, high R&D investments, and the presence of leading pharmaceutical and biotechnology companies, establishing North America as the largest market for Non-alcoholic Steatohepatitis therapeutics

U.S. Non-alcoholic Steatohepatitis Market Insight

The U.S. non-alcoholic steatohepatitis market captured the largest revenue share of 80.5% in 2025 within North America, driven by widespread adoption of advanced pharmacological therapies, high prevalence of metabolic disorders, and strong clinical trial activity. Increasing focus on personalized medicine, patient-centric care, and early-stage interventions is further boosting market growth.

Europe Non-alcoholic Steatohepatitis Market Insight

The Europe non-alcoholic steatohepatitis market is projected to expand steadily during the forecast period, supported by growing awareness of liver diseases, stringent healthcare regulations, and increasing adoption of innovative treatment options. Countries such as the U.K. and Germany are key contributors due to strong healthcare infrastructure and government-led initiatives promoting early diagnosis and treatment.

U.K. Non-alcoholic Steatohepatitis Market Insight

The U.K. non-alcoholic steatohepatitis market is anticipated to grow at a notable CAGR, driven by high adoption of novel therapies, growing patient awareness, and government programs targeting metabolic and liver-related disorders. The presence of specialized liver clinics and robust clinical trial networks further supports market expansion.

Germany Non-alcoholic Steatohepatitis Market Insight

Germany non-alcoholic steatohepatitis market is expected to witness significant growth due to rising prevalence of obesity and type 2 diabetes, strong healthcare spending, and the increasing availability of advanced NASH therapeutics. High R&D investments and focus on innovative treatment protocols are supporting market adoption.

Asia-Pacific Non-alcoholic Steatohepatitis Market Insight

The Asia-Pacific non-alcoholic steatohepatitis market is expected to grow at the fastest CAGR during the forecast period (2026–2033), driven by increasing disease prevalence, expanding healthcare infrastructure, and rising investments in advanced therapies across countries such as China, India, and Japan.

Japan Non-alcoholic Steatohepatitis Market Insight

The Japan non-alcoholic steatohepatitis market is witnessing growth due to high prevalence of metabolic syndrome, strong healthcare infrastructure, and increased patient awareness programs. Government support for liver disease management and access to clinical trials for novel therapeutics are key growth factors.

China Non-alcoholic Steatohepatitis Market Insight

China non-alcoholic steatohepatitis market accounted for a significant share in Asia-Pacific, supported by rising liver disease prevalence, expanding hospital networks, increasing government initiatives for early diagnosis and treatment, and strong adoption of advanced pharmacological therapies. Growing investments in biotech and pharmaceutical R&D are further propelling market growth.

Non-alcoholic Steatohepatitis Market Share

The Non-alcoholic Steatohepatitis industry is primarily led by well-established companies, including:

- Madrigal Pharmaceuticals (U.S.)

- Viking Therapeutics (U.S.)

- Genfit (France)

- Eli Lilly (U.S.)

- Pfizer (U.S.)

- Johnson & Johnson (U.S.)

- Boehringer Ingelheim (Germany)

- Merck & Co. (U.S.)

- Takeda Pharmaceutical (Japan)

- Shire (U.K.)

- Novartis (Switzerland)

- AstraZeneca (U.K.)

- AbbVie (U.S.)

- Sanofi (France)

- Bristol-Myers Squibb (U.S.)

- Cirius Therapeutics (U.S.)

Latest Developments in Global Non-alcoholic Steatohepatitis Market

- In March 2024, Rezdiffra (resmetirom) — developed by Madrigal Pharmaceuticals — received approval from the U.S. Food and Drug Administration (FDA) for the treatment of adults with non-cirrhotic NASH and moderate to advanced liver fibrosis. This was the first‑ever regulatory approval of a therapy specifically for NASH, marking a historic milestone in a disease‑area long devoid of approved drugs

- In April 2024, the investigational oral drug FXR314 (from Organovo Holdings) reported positive results in a mid‑stage (Phase II) study: patients receiving FXR314 experienced up to 22.8% reduction in liver fat over 16 weeks — substantially more than placebo (which saw ~6.1% reduction) — and showed improved liver function without worsening fibrosis or safety issues. This outcome raised optimism for a new, potentially effective therapeutic option in NASH

- In June 2025, regulatory reports showed that the overall NASH/MASH treatment market is positioned for rapid growth: according to a market‑forecast by DataM Intelligence, the NASH/MASH treatment market was valued at USD 7.87 billion in 2024 and is projected to reach USD 31.76 billion by 2033, driven by increasing prevalence of metabolic syndrome, obesity, type‑2 diabetes and liver disease worldwide

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.