Global Non Invasive Glucose Monitoring Devices Market

Market Size in USD Billion

CAGR :

%

USD

1.76 Billion

USD

4.66 Billion

2024

2032

USD

1.76 Billion

USD

4.66 Billion

2024

2032

| 2025 –2032 | |

| USD 1.76 Billion | |

| USD 4.66 Billion | |

|

|

|

|

Non-Invasive Glucose Monitoring Devices Market Size

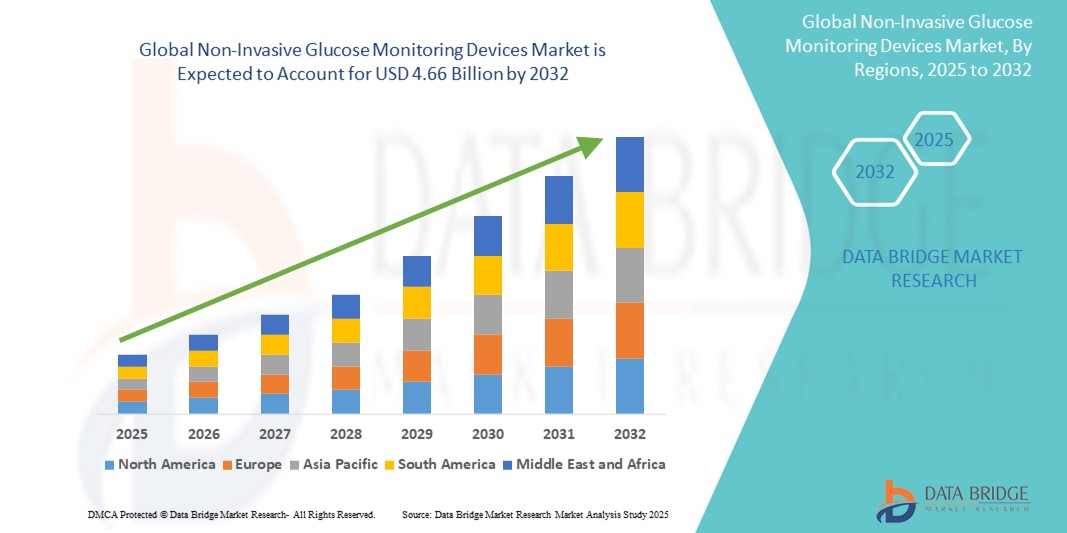

- The global non-invasive glucose monitoring devices market size was valued at USD 1.76 billion in 2024 and is expected to reach USD 4.66 billion by 2032, at a CAGR of 12.90% during the forecast period

- The market growth is largely fueled by the rising global prevalence of diabetes and the increasing demand for pain-free, convenient, and continuous blood glucose monitoring solutions, especially among aging populations and tech-savvy users

- Furthermore, advancements in sensor technologies and wearable health monitoring devices are positioning non-invasive glucose monitors as a revolutionary alternative to traditional finger-prick methods. These drivers are propelling innovation and accelerating product adoption, thereby significantly boosting the industry's growth

Non-Invasive Glucose Monitoring Devices Market Analysis

- Non-invasive glucose monitoring devices, which measure blood glucose levels without skin penetration, are emerging as transformative solutions in diabetes management due to their enhanced comfort, reduced infection risk, and real-time monitoring capabilities that improve patient compliance and outcomes in both personal and clinical settings

- The escalating demand for non-invasive glucose monitors is primarily fueled by the global rise in diabetes prevalence, increasing awareness of preventive healthcare, and the growing preference for painless and user-friendly monitoring alternatives to traditional finger-prick methods

- North America dominated the non-invasive glucose monitoring devices market with the largest revenue share of 37.7% in 2024, characterized by a well-established healthcare infrastructure, strong adoption of digital health technologies, and a high incidence of diabetes, with the U.S. experiencing robust growth supported by regulatory support and investments from medtech innovators focusing on wearable biosensors and mobile health integration

- Asia-Pacific is expected to be the fastest growing region in the non-invasive glucose monitoring market during the forecast period due to expanding diabetic populations, growing middle-class awareness, and increasing access to advanced healthcare technologies

- The wearable devices segment dominated the non-invasive glucose monitoring market with a market share of 43.7% in 2024, driven by consumer demand for continuous, real-time monitoring and the ease of integrating biosensors into smartwatches, patches, and fitness bands for convenient, everyday health tracking

Report Scope and Non-Invasive Glucose Monitoring Devices Market Segmentation

|

Attributes |

Non-Invasive Glucose Monitoring Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Non-Invasive Glucose Monitoring Devices Market Trends

“Rising Adoption of Wearable Biosensors and AI-Driven Health Insights”

- A significant and accelerating trend in the global non-invasive glucose monitoring devices market is the growing integration of wearable biosensors with artificial intelligence (AI) and mobile health platforms, enabling real-time, personalized glucose tracking without the need for invasive finger-prick testing. This convergence is elevating user convenience and healthcare decision-making

- For instance, companies such asKnow Labs and Movano Health are developing wearable devices that utilize radiofrequency and optical sensor technologies, offering continuous, non-invasive glucose readings and integration with smartphones and wearables such as fitness bands and smartwatches

- AI integration enhances device performance by enabling predictive analytics based on historical glucose trends, lifestyle data, and user behavior, allowing for more proactive diabetes management. Some systems are also exploring AI-enabled alerts for hypoglycemic or hyperglycemic events, providing early warnings to users and caregivers

- These technologies allow users to seamlessly integrate glucose monitoring with broader health tracking, including activity levels, diet, and sleep, delivering a holistic health profile through a unified app interface. This trend is reshaping expectations for glucose monitoring by combining convenience, data intelligence, and preventive care capabilities

- Startups and medtech innovators such as DiaMonTech and BioIntelliSense are also focusing on non-invasive sensors that connect with digital health platforms and wearables, offering both medical-grade monitoring and lifestyle-focused analytics. These integrations enhance user engagement, especially among tech-savvy diabetic and prediabetic populations

- As consumers increasingly demand painless, intelligent, and user-friendly health solutions, the adoption of AI-powered, wearable, and interconnected non-invasive glucose monitors is accelerating across both chronic care and wellness segments, positioning them as key tools in the future of digital diabetes management

Non-Invasive Glucose Monitoring Devices Market Dynamics

Driver

“Increasing Diabetes Prevalence and Shift Toward Preventive, User-Centric Monitoring”

- The rapidly rising global prevalence of diabetes, coupled with the demand for less invasive, more patient-friendly monitoring solutions, is a key driver of the non-invasive glucose monitoring devices market

- For instance, according to the International Diabetes Federation (IDF), over 530 million people were living with diabetes in 2024, a number expected to rise significantly over the next decade. This growing diabetic population is fueling the need for more comfortable, accessible, and continuous glucose monitoring options

- Traditional glucose testing methods—such as finger-prick or implantable sensors—are often seen as painful, inconvenient, or invasive, prompting patients and healthcare providers to seek alternative technologies that support long-term adherence and improved quality of life

- The non-invasive nature of emerging devices addresses these concerns by offering solutions that do not break the skin, reduce infection risk, and can be used discreetly in day-to-day life

- In addition, the shift toward digital and preventive healthcare is making non-invasive devices more appealing. These systems often pair with smartphone apps and digital health platforms, empowering users to track and manage their condition proactively. This aligns with broader healthcare trends focused on remote monitoring and personalized care, further driving adoption

Restraint/Challenge

“Accuracy Limitations and Regulatory Approval Complexity”

- One of the primary challenges facing the non-invasive glucose monitoring devices market is ensuring consistent accuracy and reliability across diverse patient populations, physiological conditions, and environmental settings

- Invasive methods that directly sample interstitial or blood glucose, non-invasive technologies rely on indirect measurements such as optical or electromagnetic signals, which are more susceptible to interference from hydration levels, skin conditions, or ambient light

- For instance, despite promising prototypes, several companies have faced delays in product commercialization due to challenges in achieving consistent clinical-grade accuracy, which is a critical benchmark for regulatory approval and market trust

- Regulatory compliance is another barrier, as agencies such as the FDA and CE require robust clinical validation to ensure safety and efficacy. Securing these approvals for novel sensing methods can be time-consuming and expensive, limiting the speed at which products can enter the market

- Furthermore, consumer skepticism about the accuracy of non-invasive methods compared to traditional glucose meters can slow adoption, particularly among long-term diabetics and healthcare professionals accustomed to existing tools

- Addressing these challenges through advanced signal processing algorithms, multi-sensor fusion, and rigorous clinical trials is vital. Building partnerships with regulatory bodies and engaging in transparent communication about accuracy benchmarks will also be key to accelerating acceptance and long-term growth

Non-Invasive Glucose Monitoring Devices Market Scope

The market is segmented on the basis of technology, modality, application, and end user.

- By Technology

On the basis of technology, the non-invasive glucose monitoring devices market is segmented into optical sensors, electromagnetic sensors, transdermal technology, enzymatic technology, ultrasound, and others. The optical sensors segment dominated the market with the largest revenue share of 31.5% in 2024, attributed to its accuracy, maturity, and the wide range of wearable and non-contact applications using near-infrared and Raman spectroscopy. These sensors are widely adopted due to their ability to provide real-time readings without the need for blood samples, improving patient comfort and long-term adherence.

The electromagnetic sensors segment is projected to witness the fastest growth from 2025 to 2032, driven by innovation in microwave and radiofrequency-based devices that offer non-contact glucose monitoring with promising clinical accuracy. This method is increasingly attractive for integration into wristbands and other wearables, providing a competitive edge in both the consumer and clinical segments.

- By Modality

On the basis of modality, the non-invasive glucose monitoring devices market is segmented into wearable devices, non-wearable devices, and implantable devices. The wearable devices segment led the market with the highest revenue share of 43.7% in 2024, owing to strong consumer demand for continuous monitoring, lifestyle integration, and ease of use. Smartwatches, patches, and wristbands dominate this space, offering real-time feedback and syncing capabilities with smartphones and digital health platforms.

The implantable devices segment is expected to experience the fastest growth over the forecast period. These devices offer long-term, minimally disruptive monitoring and are increasingly being adopted in clinical research and chronic care settings due to their potential for high accuracy and reduced user input.

- By Application

On the basis of application, the non-invasive glucose monitoring devices market is segmented into diabetes management, sports & fitness, clinical research, and wellness monitoring. The diabetes management segment accounted for the largest market share in 2024, as the primary end-use of non-invasive glucose monitoring technologies is to support ongoing management of Type 1 and Type 2 diabetes. Increasing global diabetic population and rising healthcare burden are key drivers for this segment.

The sports & fitness segment is expected to grow at the fastest rate from 2025 to 2032, driven by rising health consciousness among non-diabetic users who want to monitor glucose fluctuations for performance, metabolic health, and preventive care. Integration with fitness wearables and lifestyle apps is contributing to growth in this segment.

- By End User

On the basis of end user, the non-invasive glucose monitoring devices market is segmented into home care settings, hospitals, clinics, diagnostic centers, and research institutes. The home care settings segment led the market in 2024 with the highest revenue share, supported by the global trend toward remote monitoring and self-care among diabetic patients. User-friendly devices, mobile app compatibility, and telemedicine integration have made home-based monitoring highly preferred.

The research institutes segment is projected to grow at the fastest CAGR through 2032, driven by increasing R&D in non-invasive biosensing technologies and clinical trials for device validation. Academic and commercial research institutions are at the forefront of developing the next generation of glucose monitoring solutions, fueling segment expansion.

Non-Invasive Glucose Monitoring Devices Market Regional Analysis

- North America dominated the non-invasive glucose monitoring devices market with the largest revenue share of 37.7% in 2024, characterized by a well-established healthcare infrastructure, strong adoption of digital health technologies, and a high incidence of diabetes

- Consumers in North America prioritize the comfort, accuracy, and real-time data accessibility offered by non-invasive monitoring solutions, which are often integrated with mobile health apps, wearables, and broader wellness ecosystems

- This growing adoption is further supported by rising awareness of preventive healthcare, increasing investments in medtech innovation, and supportive regulatory frameworks, positioning non-invasive glucose monitoring devices as essential tools for both chronic disease management and proactive wellness tracking

U.S. Non-Invasive Glucose Monitoring Devices Market Insight

The U.S. non-invasive glucose monitoring devices market captured the largest revenue share of 78% in 2024 within North America, fueled by the high incidence of diabetes, strong healthcare spending, and the rapid adoption of digital health tools. Consumers increasingly prefer painless, real-time glucose monitoring alternatives, and the presence of major medtech companies investing in wearable biosensor innovation is accelerating growth. Moreover, integration with mobile health platforms and the proliferation of AI-driven insights are further enhancing user adoption, particularly in remote patient monitoring and personal wellness management.

Europe Non-Invasive Glucose Monitoring Devices Market Insight

The Europe non-invasive glucose monitoring devices market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by the rising burden of diabetes and a strong regulatory push toward non-invasive, patient-friendly solutions. European nations are investing in preventive healthcare and chronic disease management, fostering demand for advanced monitoring devices. Consumers value data transparency and integration with national health systems, and increasing adoption in both homecare and clinical research settings is contributing to steady market growth across the region.

U.K. Non-Invasive Glucose Monitoring Devices Market Insight

The U.K. non-invasive glucose monitoring devices market is anticipated to grow at a noteworthy CAGR during the forecast period, propelled by increasing awareness of diabetes and government efforts toward digital health transformation. With rising interest in telehealth and home-based care, non-invasive glucose monitoring is becoming a preferred option among patients and providers alike. In additionn, the integration of such devices into NHS-supported wellness programs and growing consumer preference for non-intrusive, app-connected health tracking are supporting the market’s expansion.

Germany Non-Invasive Glucose Monitoring Devices Market Insight

The Germany non-invasive glucose monitoring devices market is expected to expand at a considerable CAGR, driven by its strong healthcare infrastructure and a tech-forward population focused on accuracy and innovation. The country’s emphasis on data privacy and clinical validation aligns well with the development of secure, reliable non-invasive glucose monitoring solutions. Demand is growing rapidly in both consumer wellness and clinical diagnostics, supported by research institutions and health insurers favoring minimally invasive, patient-centered approaches.

Asia-Pacific Non-Invasive Glucose Monitoring Devices Market Insight

The Asia-Pacific non-invasive glucose monitoring devices market is poised to grow at the fastest CAGR of 24% from 2025 to 2032, fueled by surging diabetes prevalence, urbanization, and technological innovation in countries such asIndia, China, and Japan. Government-backed digital health initiatives and expanding healthcare access are driving awareness and adoption of user-friendly, wearable glucose monitoring tools. The region's growing role as a hub for device manufacturing and R&D further boosts affordability and local availability, enhancing penetration across urban and semi-urban populations.

Japan Non-Invasive Glucose Monitoring Devices Market Insight

The Japan non-invasive glucose monitoring devices market is gaining momentum due to a strong focus on innovation, a super-aged society, and increasing interest in digital health monitoring. The demand for seamless, accurate, and painless glucose monitoring is rising as elderly populations seek more convenient diabetes care tools. Integration with smart home and wellness platforms, as well as healthcare provider-supported monitoring, is strengthening adoption across both consumer and clinical settings.

India Non-Invasive Glucose Monitoring Devices Market Insight

The India non-invasive glucose monitoring devices market accounted for the largest market revenue share in Asia Pacific in 2024, driven by the country’s high diabetes burden, growing middle class, and digital health awareness. The increasing popularity of wearable health tech and mobile health apps is accelerating the uptake of non-invasive glucose monitors, particularly in urban centers. Government initiatives around smart healthcare and domestic innovation in affordable biosensor technologies are playing a pivotal role in expanding market access across a diverse consumer base.

Non-Invasive Glucose Monitoring Devices Market Share

The non-invasive glucose monitoring devices industry is primarily led by well-established companies, including:

- Know Labs, Inc. (U.S.)

- DiaMonTech GmbH (Germany)

- Afon Technology (U.K.)

- Glucotrack (Israel)

- Occuity (U.K.)

- Quantum Operation Inc. (Japan)

- GlucoModicum Oy (Finland)

- Nemaura (U.K.)

- Apple Inc. (U.S.)

- Samsung Electronics Co., Ltd. (South Korea)

- Echo Therapeutics, Inc. (U.S.)

- BioIntelliSense, Inc. (U.S.)

- Movano Inc. (U.S.)

- Dassault Systèmes (France)

- TaiDoc Technology Corporation (Taiwan)

- Abbott Laboratories (U.S.)

- Medtronic Ireland)

- Bayer AG (Germany)

What are the Recent Developments in Global Non-Invasive Glucose Monitoring Devices Market?

- In April 2024, Know Labs, Inc., a U.S.-based medical technology company, announced the successful completion of clinical validation trials for its Bio-RFID sensor technology. Designed to measure blood glucose levels non-invasively using radiofrequency spectroscopy, the trials demonstrated promising accuracy results, marking a critical step toward FDA submission. This development reflects Know Labs' commitment to transforming diabetes management with painless, real-time glucose monitoring solutions for both clinical and personal use

- In March 2024, DiaMonTech GmbH, a German-based healthtech innovator, secured a new round of funding to accelerate the commercialization of its non-invasive glucose monitoring device, which uses infrared laser-based technology. The company is focused on launching a portable consumer device with clinical-grade accuracy. This milestone signifies increasing investor confidence in non-invasive technologies and supports the broader push toward more accessible, user-friendly glucose monitoring tools in the European market

- In February 2024, Afon Technology, a UK-based medical device company, introduced the prototype of its non-invasive glucose monitoring wearable at the Arab Health 2024 Exhibition in Dubai. The device, designed as a wrist-worn band, continuously monitors glucose without skin penetration and delivers data through a mobile app. This unveiling positions Afon Technology as a key player in the global shift toward connected, non-invasive diabetes management solutions, particularly in emerging and tech-forward markets

- In January 2024, Movano Health, based in California, announced advancements in its smart ring platform that incorporates non-invasive glucose monitoring along with other vital health metrics. The company is targeting both diabetic and non-diabetic users with a holistic wellness approach. This innovation represents the growing convergence of consumer electronics and medical-grade biosensing technologies, aiming to broaden market reach beyond traditional healthcare users

- In December 2023, Apple Inc. reportedly progressed further in its long-term initiative to integrate non-invasive glucose sensing into future Apple Watch models. Leveraging optical absorption spectroscopy, Apple’s prototype efforts reflect the tech industry’s increasing interest in preventive healthcare tools. While still in R&D, this potential integration has captured significant attention and could redefine mainstream adoption of non-invasive glucose monitoring on a global scale

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.