Global Non Surgical Procedures Market

Market Size in USD Billion

CAGR :

%

USD

81.50 Billion

USD

256.33 Billion

2024

2032

USD

81.50 Billion

USD

256.33 Billion

2024

2032

| 2025 –2032 | |

| USD 81.50 Billion | |

| USD 256.33 Billion | |

|

|

|

|

Non-Surgical Procedures Market Size

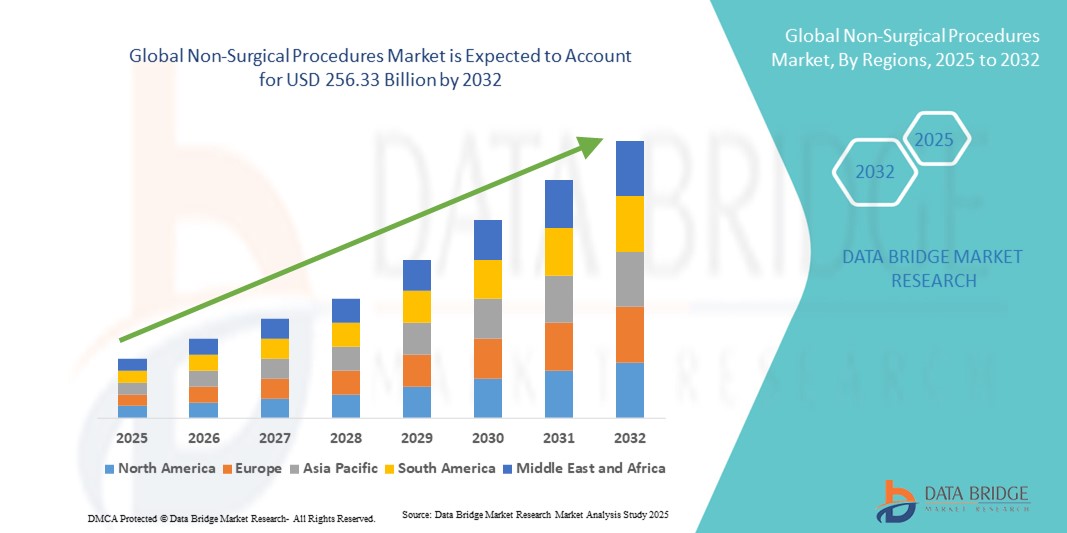

- The global non-surgical procedures market size was valued at USD 81.50 billion in 2024 and is expected to reach USD 256.33 billion by 2032, at a CAGR of 15.40% during the forecast period

- The market growth is primarily driven by the rising preference for minimally invasive and non-invasive treatments in aesthetic and medical fields, supported by advancements in technologies such as lasers, injectables, and energy-based devices

- In addition, increasing consumer demand for safe, cost-effective, and less recovery-intensive solutions is positioning non-surgical procedures as a preferred alternative to traditional surgeries. These combined dynamics are significantly propelling the adoption of non-surgical treatments, thereby accelerating the overall industry expansion

Non-Surgical Procedures Market Analysis

- Non-surgical procedures, including injectables, laser treatments, and energy-based therapies, are becoming essential in modern aesthetic and medical practices due to their minimally invasive nature, shorter recovery times, and growing patient preference for less complex treatments compared to traditional surgeries

- The surging demand for non-surgical procedures is largely fueled by the rising focus on aesthetics, increasing awareness of preventive healthcare, and rapid advancements in medical technology that enhance safety, precision, and outcomes

- North America dominated the non-surgical procedures market with the largest revenue share of 39% in 2024, supported by high healthcare expenditure, strong presence of leading aesthetic service providers, and early adoption of advanced minimally invasive techniques, particularly in the U.S., where the popularity of botulinum toxin and dermal fillers continues to rise

- Asia-Pacific is expected to be the fastest growing region in the non-surgical procedures market during the forecast period, driven by increasing medical tourism, expanding middle-class population, and rising disposable incomes

- Injectable segment dominated the non-surgical procedures market with a market share of 46.7% in 2024, led by the popularity of botulinum toxin and dermal fillers, which are widely used for wrinkle reduction, facial rejuvenation, and volume restoration

Report Scope and Non-Surgical Procedures Market Segmentation

|

Attributes |

Non-Surgical Procedures Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Non-Surgical Procedures Market Trends

Rising Popularity of Minimally Invasive Aesthetic Enhancements

- A major and accelerating trend in the global non-surgical procedures market is the surging popularity of minimally invasive and non-invasive treatments such as botulinum toxin, dermal fillers, chemical peels, and laser therapies. These procedures are being increasingly preferred for their ability to deliver visible results with minimal downtime compared to traditional surgeries

- For instance, Allergan Aesthetics’ Botox and Juvederm line of fillers continue to dominate the global injectable segment due to their proven safety and effectiveness, while innovative devices such as Cutera’s Secret PRO are combining CO2 lasers and RF microneedling to enhance skin rejuvenation outcomes

- Advancements in technology are enabling more precise, customizable, and longer-lasting results, with trends such as hyaluronic acid-based fillers tailored for specific facial areas and laser devices equipped with AI-driven safety features

- In addition, social media influence and celebrity-driven trends are fueling consumer demand, particularly among millennials and Gen Z, who are seeking preventive aesthetics earlier in life. Clinics are increasingly marketing “lunchtime procedures” that can be performed quickly with minimal disruption to daily routines

- This shift towards natural-looking, subtle enhancements is reshaping consumer expectations, with providers focusing on delivering results that emphasize rejuvenation rather than dramatic alterations

- Consequently, global players such as Revance, AbbVie, and Cynosure are investing heavily in product innovation and expanding accessibility, reflecting the strong demand for non-surgical treatments across both developed and emerging markets

Non-Surgical Procedures Market Dynamics

Driver

Growing Demand for Aesthetic and Preventive Healthcare Solutions

- The rising consumer emphasis on physical appearance, coupled with greater societal acceptance of aesthetic procedures, is a strong driver for the expansion of the non-surgical procedures market

- For instance, in March 2024, AbbVie announced expanded approvals for its Juvederm collection of fillers in key international markets, reinforcing global adoption and boosting consumer trust in branded injectables

- Preventive aesthetics is also becoming a key motivator, as younger demographics increasingly pursue treatments such as Botox and skin boosters to delay signs of aging

- Furthermore, the affordability of non-surgical procedures compared to invasive surgeries, coupled with reduced risks and faster recovery times, is making them an attractive option across diverse patient groups

- Integration of non-surgical procedures into wellness and dermatology clinics is further broadening accessibility, fueling adoption across both urban and semi-urban populations worldwide

Restraint/Challenge

Safety Concerns and Regulatory Compliance Hurdles

- Despite strong growth, the market faces challenges related to safety risks, side effects, and regulatory oversight. Complications such as skin irritation, swelling, or uneven results from injectables and energy-based devices can reduce consumer confidence

- For instance, reports of adverse effects in unregulated cosmetic clinics have heightened calls for stricter compliance with medical standards and training certifications

- Navigating varying regulatory frameworks across regions adds complexity for global players, with approval timelines and safety guidelines differing significantly between the U.S., EU, and Asia-Pacific markets

- In addition, the high costs associated with branded products, coupled with the influx of counterfeit and low-quality alternatives in some markets, pose hurdles to adoption among cost-sensitive consumers

- Overcoming these challenges through stricter regulatory enforcement, enhanced practitioner training, consumer education on safe practices, and innovation in affordable, reliable solutions will be critical for sustaining long-term market growth

Non-Surgical Procedures Market Scope

The market is segmented on the basis of product type, material type, gender, usability, indication, procedure, practitioners, service provider, and distribution channel.

- By Product Type

On the basis of product type, the non-surgical procedures market is segmented into injectable, non-injectables, facial rejuvenation, nonsurgical skin tightening, microdermabrasion, laser skin resurfacing, and others. The Injectables segment dominated the market with the largest revenue share of 46.7% in 2024, owing to their unmatched popularity for aesthetic corrections such as wrinkle reduction, lip enhancement, and facial contouring. Products such as botulinum toxin and dermal fillers offer quick, minimally invasive results that align with consumer demand for non-surgical anti-aging solutions. In addition, the availability of a wide range of injectable formulations, regulatory approvals, and continuous product launches by global players such as AbbVie (Botox, Juvederm) and Revance are reinforcing their dominance. Strong consumer trust in established brands, combined with the growing culture of “preventive aesthetics,” is further boosting injectable adoption worldwide.

The Nonsurgical Skin Tightening segment is projected to grow at the fastest CAGR during 2025–2032, driven by the rising desire for youthful skin and body contouring without surgical intervention. This segment benefits from technological innovations such as ultrasound-based Ultherapy, radiofrequency-based Thermage, and hybrid systems that improve skin elasticity and tone. Increasing consumer comfort with energy-based treatments, coupled with visible but natural-looking outcomes, is driving rapid adoption across both developed and emerging markets. In addition, the expansion of non-invasive body sculpting procedures in medical spas and beauty clinics is making skin tightening more accessible to younger demographics and working professionals who seek minimal downtime.

- By Material Type

On the basis of material type, the non-surgical procedures market is segmented into natural and synthetic. The Synthetic segment dominated the market with the largest revenue share of 58.7% in 2024, primarily due to the extensive usage of hyaluronic acid-based fillers, botulinum toxin, and other synthetic formulations that deliver predictable and reliable results. These products are widely approved by regulatory authorities such as the FDA and EMA, ensuring strong safety standards and consumer trust. Dermatologists and aesthetic doctors often prefer synthetic products because they allow for precise treatment customization and produce consistent aesthetic outcomes. Furthermore, continuous innovation in synthetic injectables, including longer-lasting fillers and combination therapies, further secures their leading role in the global market.

The Natural segment is expected to grow at the fastest CAGR during 2025–2032, as consumer demand shifts toward sustainable, organic, and biocompatible solutions. Treatments such as autologous fat transfer, platelet-rich plasma (PRP), and collagen-stimulating therapies are increasingly gaining traction for their natural integration with the body and reduced risk of adverse reactions. The clean beauty movement and rising awareness of non-toxic, natural solutions are pushing this segment forward, particularly among younger and health-conscious patients. In addition, ongoing research in regenerative medicine and biologically derived fillers is expected to expand the adoption of natural-based non-surgical treatments, driving strong growth in the coming years.

- By Gender

On the basis of gender, the non-surgical procedures market is segmented into male and female. The Female segment dominated the market with the largest share of 72.4% in 2024, supported by cultural emphasis on beauty, greater awareness of aesthetic treatments, and a strong inclination toward preventive anti-aging solutions. Women are the primary consumers of injectables such as Botox and dermal fillers, along with treatments such as chemical peels and laser resurfacing. Social media and celebrity influence further drive demand, particularly for facial rejuvenation procedures that help maintain youthful appearances. In addition, the expansion of women-focused medical spas and beauty clinics has contributed to strengthening this segment’s leadership globally.

The Male segment is projected to be the fastest-growing during 2025–2032, driven by changing cultural perceptions and rising acceptance of cosmetic enhancements among men. Increasingly, men are opting for wrinkle treatments, hair restoration, body contouring, and non-invasive fat reduction to maintain a youthful and fit appearance. Clinics are creating male-focused offerings, such as “Brotox” (Botox for men), to specifically address this growing demographic. Furthermore, men’s rising participation in professional and social settings where appearance plays a role in confidence and competitiveness is encouraging market adoption. Together, these factors are propelling the male category as the fastest-growing consumer group.

- By Usability

On the basis of usability, the non-surgical procedures market is segmented into professional use and direct patient. The Professional Use segment held the largest market share of 83.1% in 2024, reflecting the dominance of clinics, hospitals, and medical spas in delivering safe, complex non-surgical procedures. Patients prefer trained professionals for treatments such as fillers, laser therapies, and advanced skin tightening, which require precision and expertise. Professional oversight also reduces risks and builds consumer trust, making it the primary channel for high-value aesthetic procedures. The continued expansion of dermatology clinics and cosmetic centers, especially in urban regions, reinforces the segment’s leadership position in the market.

The Direct Patient segment is anticipated to record the fastest CAGR during 2025–2032, owing to the increasing popularity of at-home devices and DIY solutions for skincare and rejuvenation. Products such as LED therapy masks, handheld microdermabrasion devices, and home-use radiofrequency tools are gaining rapid adoption among consumers seeking affordable and convenient alternatives. The COVID-19 pandemic accelerated this trend, as consumers became more comfortable with self-care treatments at home. Moreover, the growing availability of FDA-approved devices for direct use has reduced consumer hesitation and is expected to expand this segment further.

- By Indication

On the basis of indication, the non-surgical procedures market is segmented into skin lightening, facial aesthetic, body contouring, reconstructive, and others. The Facial Aesthetic segment dominated the market with the largest share of 51.6% in 2024, given its role as the most common treatment area in aesthetic medicine. Procedures such as Botox, fillers, laser resurfacing, and chemical peels are highly sought after for wrinkle reduction, volume restoration, and overall facial rejuvenation. The strong cultural and social importance of facial appearance, coupled with its visibility, ensures sustained consumer demand across all age groups. The rising influence of social media and beauty standards is further fueling market adoption in this category.

The Body Contouring segment is expected to be the fastest-growing during 2025–2032, fueled by rising global obesity rates, post-weight loss cosmetic demands, and technological advancements in fat reduction and sculpting devices. Non-invasive procedures such as cryolipolysis (CoolSculpting), ultrasound, and RF-based fat reduction are increasingly preferred due to their safety and efficiency. The growing focus on fitness and body image, particularly among millennials and Gen Z, is accelerating demand for body contouring solutions. Furthermore, expanding adoption in medical spas and emerging markets is expected to further drive growth.

- By Procedure

On the basis of procedure, the non-surgical procedures market is segmented into body care, face care, and skin care. The face care segment dominated the market in 2024 with a share of 48.2%, as consumers overwhelmingly seek facial rejuvenation treatments such as injectables, laser resurfacing, and skin tightening. The visibility of facial improvements, combined with cultural emphasis on youthful looks, makes face care the most popular and consistent revenue contributor. Dermatologists and aesthetic clinics prioritize facial offerings due to their high demand and proven effectiveness. In addition, the preventive trend among younger patients further strengthens face care’s dominance in the global market.

The Skin Care segment is projected to grow at the fastest CAGR during 2025–2032, driven by rising awareness of overall skin health and growing popularity of procedures that target pigmentation, acne scars, sun damage, and texture improvement. Non-invasive methods such as microneedling, laser skin resurfacing, and chemical peels are increasingly used for preventive and corrective purposes. Social media campaigns and influencer marketing around glowing, healthy skin are further boosting consumer interest. The expansion of affordable skin care solutions in both clinics and at-home devices is expected to make this segment a leading growth driver.

- By Practitioners

On the basis of practitioners, the non-surgical procedures market is segmented into dermatologists, aesthetic doctors, plastic surgeons, independent aesthetic professionals, and others. The Dermatologists segment held the largest revenue share of 37.5% in 2024, driven by consumer trust in board-certified experts to perform safe and effective procedures. Dermatologists are often the first choice for injectables, resurfacing, and rejuvenation due to their medical expertise and access to advanced technologies. Patients value professional oversight and the ability to combine aesthetic improvements with medical skin care. This credibility and clinical advantage ensure dermatologists remain dominant players in the non-surgical procedures market.

The independent aesthetic professionals segment is expected to grow at the fastest CAGR during 2025–2032, fueled by the rise of medical spas, freelance practitioners, and wellness centers offering affordable, convenient, and accessible services. Expanding training and certification programs are equipping more professionals to perform procedures such as fillers, Botox, and skin rejuvenation. Younger patients and budget-conscious consumers are increasingly opting for independent practitioners due to lower costs and flexible service options. This democratization of aesthetic care is accelerating the expansion of this segment worldwide.

- By Service Provider

On the basis of service provider, the non-surgical procedures market is segmented into hospitals, medical spas and beauty centers, cosmetic centers, dermatology clinics, homecare setting, and others. The Medical Spas and Beauty Centers segment dominated with the largest share of 41.3% in 2024, reflecting their popularity as accessible venues offering professional non-surgical aesthetic services combined with wellness experiences. They provide a comfortable, non-clinical environment that appeals to consumers seeking both safety and luxury. Medical spas also bridge the gap between dermatology clinics and beauty centers, making them attractive to both premium and mid-income consumers. Their expansion across North America, Europe, and Asia-Pacific ensures sustained dominance.

The Homecare Setting segment is projected to register the fastest CAGR during 2025–2032, supported by the rising adoption of at-home skincare devices and beauty technologies. The convenience of performing treatments such as LED therapy, microdermabrasion, and skin tightening at home is driving strong interest, particularly among tech-savvy and time-constrained consumers. FDA-cleared devices are enhancing consumer trust, while e-commerce platforms are boosting accessibility worldwide. The rising trend of self-care, amplified during the pandemic, continues to push home-based non-surgical treatments forward as a key growth driver.

- By Distribution Channel

On the basis of distribution channel, the non-surgical procedures market is segmented into direct tender and retail sales. The Retail Sales segment dominated the market in 2024 with a share of 62.8%, due to the availability of aesthetic products and devices through pharmacies, e-commerce platforms, and aesthetic clinics. Consumers increasingly rely on retail outlets and online platforms for purchasing skincare devices, cosmetic injectables (where legally allowed), and maintenance products. The convenience of online buying, coupled with promotional campaigns and influencer marketing, is boosting retail channel strength. This makes it the leading contributor to market revenues.

The Direct Tender segment is projected to grow at the fastest CAGR during 2025–2032, as hospitals, dermatology clinics, and cosmetic centers procure large quantities of fillers, lasers, and professional-use devices through institutional contracts. Bulk purchasing reduces costs, ensures consistent supply, and strengthens vendor–provider partnerships. As non-surgical treatments expand across hospitals and specialty centers worldwide, direct tender sales are expected to increase significantly. The rising preference for long-term supplier agreements and institutional product standardization further supports the segment’s robust growth outlook.

Non-Surgical Procedures Market Regional Analysis

- North America dominated the non-surgical procedures market with the largest revenue share of 39% in 2024, supported by high healthcare expenditure, strong presence of leading aesthetic service providers, and early adoption of advanced minimally invasive techniques, particularly in the U.S., where the popularity of botulinum toxin and dermal fillers continues to rise

- Consumers in the region show strong preference for minimally invasive cosmetic solutions such as Botox, dermal fillers, and laser skin resurfacing, largely influenced by rising awareness of personal aesthetics, celebrity-driven trends, and social media influence

- The high disposable income levels, well-established healthcare infrastructure, and wide accessibility of qualified dermatologists and plastic surgeons further boost the adoption of non-surgical aesthetic procedures

U.S. Non-Surgical Procedures Market Insight

The U.S. non-surgical procedures market captured the largest revenue share of 79% in 2024 within North America, fueled by the rising popularity of minimally invasive treatments such as Botox, dermal fillers, and laser-based therapies. Consumers are increasingly prioritizing aesthetic enhancement with shorter recovery times and reduced risks compared to surgical alternatives. Strong social media influence, celebrity endorsements, and widespread awareness of personal aesthetics continue to drive demand. Moreover, technological integration in dermatology clinics and med-spas, alongside the preference for outpatient procedures, is significantly contributing to the U.S. market expansion.

Europe Non-Surgical Procedures Market Insight

The Europe non-surgical procedures market is projected to expand at a substantial CAGR throughout the forecast period, driven by stringent regulatory standards and the growing acceptance of aesthetic treatments. Increasing urbanization and the demand for professional skin rejuvenation solutions are fostering adoption across the region. European consumers place strong emphasis on anti-aging treatments, body contouring, and facial rejuvenation procedures, with a growing interest in natural and non-invasive methods. Medical tourism, especially in countries such as Spain, Turkey, and Poland, is also strengthening the market outlook for Europe.

U.K. Non-Surgical Procedures Market Insight

The U.K. non-surgical procedures market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by the growing demand for aesthetic services such as lip fillers, skin tightening, and facial rejuvenation. Rising awareness of skin health, coupled with increasing concerns over aging, are encouraging both men and women to opt for cosmetic enhancements. The strong presence of advanced dermatology clinics, combined with widespread access to med-spa services, supports market expansion. In addition, the U.K.’s strong digital marketing and influencer-driven culture accelerates adoption of cosmetic injectables and skincare treatments.

Germany Non-Surgical Procedures Market Insight

The Germany non-surgical procedures market is expected to expand at a considerable CAGR during the forecast period, driven by the population’s focus on wellness, aesthetics, and eco-conscious solutions. German consumers demonstrate high awareness of dermatological advancements, supporting demand for non-invasive skin rejuvenation and body contouring treatments. The integration of advanced technologies such as laser resurfacing and ultrasound-based skin tightening has become more prevalent in dermatology and aesthetic clinics. Furthermore, Germany’s emphasis on precision healthcare and privacy-focused solutions aligns well with consumer expectations, further strengthening adoption.

Asia-Pacific Non-Surgical Procedures Market Insight

The Asia-Pacific non-surgical procedures market is poised to grow at the fastest CAGR of 23.4% during 2025 to 2032, driven by rapid urbanization, rising disposable incomes, and a growing beauty-conscious population. Countries such as China, Japan, and India are witnessing increasing demand for skin lightening, body contouring, and facial aesthetic procedures. Government initiatives promoting digital health and medical tourism, alongside strong cosmetic innovation hubs in South Korea and Japan, are fueling market growth. The affordability and accessibility of non-surgical treatments are expanding adoption across a wider consumer base.

Japan Non-Surgical Procedures Market Insight

The Japan non-surgical procedures market is gaining momentum due to the country’s deep-rooted beauty culture, aging population, and advanced skincare innovations. Japanese consumers place a significant emphasis on anti-aging solutions, with injectables and laser therapies gaining strong acceptance. The market also benefits from cutting-edge technologies in dermatology and the integration of non-surgical procedures with holistic wellness. Furthermore, demand for minimally invasive solutions for both men and women is growing, supported by the country’s preference for precise, natural-looking aesthetic outcomes.

India Non-Surgical Procedures Market Insight

The India non-surgical procedures market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to the rising middle-class population, rapid urbanization, and increasing acceptance of aesthetic procedures. India has emerged as one of the fastest-growing markets for cosmetic injectables, skin-lightening treatments, and body contouring procedures. The government’s push toward smart healthcare infrastructure and the rise of affordable med-spas have widened accessibility. In addition, the strong influence of social media, Bollywood celebrities, and beauty influencers continues to play a crucial role in propelling the market.

Non-Surgical Procedures Market Share

The non-surgical procedures industry is primarily led by well-established companies, including:

- GALDERMA (Switzerland)

- AbbVie Inc. (U.K.

- Merz North America, Inc. (U.S.)

- InMode Ltd. (U.S.)

- Lumenis Be Ltd. (Israel)

- Alma Lasers Ltd. (Israel)

- Venus Concept Inc. (Canada)

- Hugel Co., Ltd. (South Korea)

- Sofwave Medical Ltd. (U.S.)

- Classys Inc. (South Korea)

- Cynosure LLC (U.S.)

- Cutera, Inc. (U.S.)

- Candela Medical (U.S.)

- Revance Therapeutics, Inc. (U.S.)

- Suneva Medical, Inc. (U.S.)

- BTL Industries Ltd. (Czech Republic)

- Syneron Medical Ltd. (Israel)

- Zeltiq Aesthetics, Inc. (U.S.)

- Medytox Inc. (South Korea)

- Revance Therapeutics, Inc. (U.S.)

What are the Recent Developments in Global Non-Surgical Procedures Market?

- In May 2025, The Laser Lounge Spa in Sarasota, Florida, launched advanced medical-grade non-surgical aesthetic treatments, aimed at meeting the surging local demand for professionally administered, minimally invasive skincare and beauty solutions. The new offerings include injectables, light-based therapies, and customized protocols by licensed clinicians

- In April 2025, Bausch Health and its aesthetics division Solta Medical introduced Fraxel FTX at the ASLMS 2025 Annual Conference in Orlando. This next-gen laser resurfacing device features dual-wavelength technology (1550 nm erbium-glass + 1927 nm thulium lasers), integrated cooling, a lighter ergonomic handpiece, and intelligent tracking for enhanced precision. It aims to deliver superior skin rejuvenation treating sun damage, wrinkles, and pigmentation with comfort and minimal downtime

- In February 2025, New York’s IT Intelligent Treatment hosted the unveiling of SomaCell, the first notable non-surgical facelift innovation in the U.S. since the advent of Ultherapy. The launch event, led by founder Kim Laudati, featured a live demonstration and a Page Six Style interview. SomaCell leverages a patented approach to facial regeneration that is minimally invasive and suitable across genders, ethnicities, and skin types

- In January 2025, during CES Unveiled 2025 in Las Vegas, FlowBeams from the Netherlands showcased pioneering needle-free injection technology. Using a laser to create a bubble that propels medication through the skin at high speed, this innovation could potentially revolutionize cosmetic and medical injections for vaccines, insulin, and aesthetic treatments without needles signifying a major step toward non-invasive delivery systems

- In March 2024, at the Aesthetic & Anti-Aging Medicine World Congress (AMWC), Galderma unveiled pivotal clinical data on its new Restylane SHAYPE, powered by NASHA HD technology for chin retrusion correction, along with positive outcomes from its neuromodulator portfolio including RelabotulinumtoxinA (a ready-to-use liquid formulation). These developments highlight Galderma’s latest injectable innovations beyond facial treatments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.