Global Nursing Homes And Long Term Care Facilities Market

Market Size in USD Billion

CAGR :

%

USD

1.19 Billion

USD

2.37 Billion

2024

2032

USD

1.19 Billion

USD

2.37 Billion

2024

2032

| 2025 –2032 | |

| USD 1.19 Billion | |

| USD 2.37 Billion | |

|

|

|

|

Nursing Homes and Long-Term Care Facilities Market Size

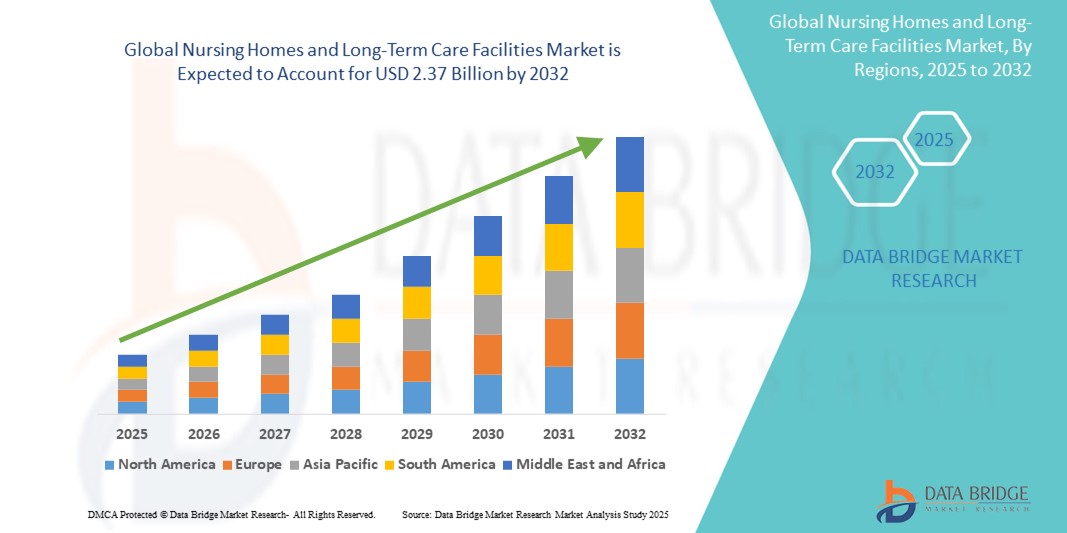

- The global nursing homes and long-term care facilities market was valued at USD 1.19 billion in 2024 and is expected to reach USD 2.37 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 9.00%, primarily driven by rising demand for elderly care and chronic disease management

- This growth is supported by factors such as the aging global population, increasing incidence of chronic conditions like Alzheimer's and diabetes, and government initiatives to improve senior healthcare infrastructure

- Additionally, advancements in remote patient monitoring, digital health solutions, and integrated care models are reshaping the long-term care landscape and enhancing patient outcomes

Nursing Homes and Long-Term Care Facilities Market Analysis

- Nursing homes and long-term care facilities are essential components of the healthcare continuum, offering residential care and medical support for individuals with chronic illnesses, disabilities, or aging-related conditions. These facilities provide a combination of healthcare services and assistance with daily activities to ensure a safe, supportive living environment

- The demand for long-term care is significantly driven by the growing elderly population, increasing prevalence of neurodegenerative diseases such as Alzheimer’s and Parkinson’s, and rising incidences of chronic conditions like heart disease, diabetes, and arthritis

- The North America region stands out as one of the dominant regions for nursing homes and long-term care facilities, attributed to its well-established insurance systems, higher healthcare expenditure, and expanding base of geriatric patients

- For instance, the number of individuals aged 65 and older in the U.S. continues to grow rapidly. This demographic shift is prompting both public and private investment in long-term care infrastructure, from skilled nursing facilities to assisted living communities

- Globally, long-term care facilities are regarded as one of the most critical segments within the eldercare ecosystem, second only to in-home care services. They play a pivotal role in addressing complex medical needs, reducing hospital readmissions, and enhancing quality of life for aging individuals

Report Scope and Nursing Homes and Long-Term Care Facilities Market Segmentation

|

Attributes |

Nursing Homes and Long-Term Care Facilities Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework. |

Nursing Homes and Long-Term Care Facilities Market Trends

“Increasing Integration of Smart Healthcare Technologies”

- One prominent trend in the global nursing homes and long-term care facilities market is the increasing integration of smart healthcare technologies such as wearable devices, remote patient monitoring, and AI-driven health management systems

- These technologies enhance the quality of care by enabling continuous health tracking, early detection of medical issues, and personalized treatment plans for residents

- For instance, smart wearables and remote sensors allow caregivers to monitor vital signs like heart rate, oxygen levels, and mobility in real time, ensuring immediate response to potential health risks, especially for residents with chronic conditions

- Integration with digital health platforms also improves care coordination, streamlines communication among healthcare teams, and facilitates more efficient documentation and reporting

- This trend is transforming traditional long-term care models into more proactive, tech-enabled systems, leading to better health outcomes, increased operational efficiency, and higher patient and family satisfaction

Nursing Homes and Long-Term Care Facilities Market Dynamics

Driver

“Growing Demand Driven by Aging Population and Chronic Illnesses”

- The rapidly aging global population is one of the most significant drivers of the growing demand for nursing homes and long-term care facilities

- Older adults are more likely to suffer from chronic conditions such as arthritis, cardiovascular diseases, dementia, and mobility impairments, which require continuous care and support in dedicated facilities

- Long-term care facilities offer comprehensive medical and personal care services tailored to elderly individuals who may not be able to live independently, making them essential as life expectancy increases

- Advances in medicine have also contributed to longer lifespans, leading to an increased need for sustained and specialized eldercare, particularly in high-income and middle-income countries

For instance,

- In October 2023, according to a report published by the World Health Organization (WHO), the global population aged 60 years and older is expected to double by 2050, reaching 2.1 billion, with a particularly sharp rise in low- and middle-income countries

- In March 2022, the United Nations Department of Economic and Social Affairs projected that individuals aged 65 and above will make up nearly 30% of the population in several developed countries by 2050, further emphasizing the need for scalable long-term care solutions

- As a result, the increasing prevalence of age-related conditions and the need for continuous medical support are fueling the demand for nursing homes and long-term care facilities worldwide, positioning the sector for sustained growth

Opportunity

“Integration of Artificial Intelligence and Predictive Analytics”

- The integration of AI and predictive analytics presents a significant opportunity in the nursing homes and long-term care facilities market, enabling providers to offer smarter, more personalized care for residents

- AI-powered platforms can analyze large volumes of resident health data to predict potential health declines, enabling early intervention and reducing hospital readmissions

- These technologies support caregivers by automating administrative tasks, monitoring vital signs, detecting fall risks, and providing alerts for irregular patterns, improving both safety and operational efficiency

For instance,

- In February 2024, according to a report published in the Journal of the American Medical Directors Association (JAMDA), AI algorithms were successfully used to predict hospital readmissions and infections in long-term care residents, allowing staff to act preventively and improve health outcomes

- In September 2023, a study from the National Institutes of Health (NIH) highlighted how AI-driven monitoring systems in care homes significantly lowered fall incidents by identifying high-risk residents and alerting staff in real-time

- The adoption of AI in long-term care not only enhances the quality of care but also helps address staffing challenges by streamlining workflows, ultimately leading to better resource management, improved patient satisfaction, and enhanced quality of life for elderly residents

Restraint/Challenge

“High Operational Costs and Staffing Shortages Impacting Market Growth”

- The high operational costs associated with running nursing homes and long-term care facilities pose a significant challenge to the market, particularly in regions with limited government funding or insurance support

- These costs include staff salaries, medical supplies, facility maintenance, and regulatory compliance, which can strain budgets and affect the affordability and profitability of care services

- Additionally, the shortage of skilled healthcare workers such as nurses, therapists, and caregivers continues to challenge the market, as facilities struggle to meet the growing demand for care while maintaining high-quality services

For instance,

- In January 2024, a report published by the National Investment Center for Seniors Housing & Care (NIC) highlighted that labor shortages and high employee turnover rates in the U.S. have led to increased operational costs, with some facilities facing staffing shortages that impact the quality of care delivered

- In December 2023, an article published by the World Health Organization (WHO) pointed out that the rising demand for long-term care services, combined with a limited workforce, places pressure on facilities in both developed and developing countries, leading to higher costs and constrained access to care

- Consequently, these challenges can limit the ability of many long-term care providers to expand their services, raise the quality of care, or invest in new technologies, hindering overall market growth and affecting the quality of care for residents

Nursing Homes and Long-Term Care Facilities Market Scope

The market is segmented on the basis of product and mode of delivery.

|

Segmentation |

Sub-Segmentation |

|

By Product |

|

|

By Mode of Delivery |

|

Nursing Homes and Long-Term Care Facilities Market Regional Analysis

“North America is the Dominant Region in the Nursing Homes and Long-Term Care Facilities Market”

- North America dominates the nursing homes and long-term care facilities market, driven by its well-established healthcare infrastructure, high demand for senior care services, and strong presence of leading care facility providers

- The U.S. holds a significant share of the market due to the growing elderly population, increasing prevalence of chronic conditions, and high rates of long-term care service utilization

- The availability of robust insurance systems (e.g., Medicare and Medicaid) and ongoing investments in aging-in-place technologies further strengthen the market

- Additionally, the increasing demand for specialized care such as memory care for dementia and Alzheimer's patients, coupled with the expanding number of assisted living and skilled nursing facilities, is contributing to the region's market growth

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to experience the highest growth rate in the nursing homes and long-term care facilities market, driven by rapid improvements in healthcare infrastructure, increasing awareness of eldercare needs, and rising elderly populations

- Countries like China, India, and Japan are emerging as key markets due to the increasing number of aging individuals who require specialized care and long-term support

- Japan, with its advanced healthcare system and high life expectancy, remains a critical market for long-term care facilities, continuing to lead in the adoption of high-quality elderly care solutions and specialized dementia care

- In China and India, the growing elderly populations, coupled with the increasing prevalence of age-related diseases, are driving investments in both public and private long-term care infrastructure. The expanding presence of international care providers and the increasing affordability of eldercare services further contribute to market growth in these countries

Nursing Homes and Long-Term Care Facilities Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Brookdale Senior Living (U.S.)

- Welltower Inc. (U.S.)

- HCA Healthcare (U.S.)

- Atria Management Company (U.S.)

- Genesis HealthCare (U.S.)

- Sunrise Senior Living (U.S.)

- LHC Group (U.S.)

- Amedisys Inc. (U.S.)

- Visiting Angels (U.S.)

- Comfort Keepers (U.S.)

- Encompass Health (U.S.)

- Kindred Healthcare (U.S.)

- Brookhaven Hospice (U.S.)

- Curo Health Services (U.S.)

- Visiting Physicians Association (U.S.)

- VITAS Healthcare (U.S.)

- SavaSeniorCare (U.S.)

- Five Star Senior Living (U.S.)

- National HealthCare Corporation (NHC) (U.S.)

- Life Care Centers of America (U.S.)

Latest Developments in Global Nursing Homes and Long-Term Care Facilities Market

- In March 2024, EvergreenHealth formed a partnership with a local technology firm to implement an innovative remote patient monitoring system designed to improve care coordination and patient outcomes. This collaboration aims to leverage advanced technology to enhance real-time monitoring, providing healthcare providers with timely data to make informed decisions and deliver more effective care. This initiative is particularly relevant to the global nursing homes and long-term care facilities market, as it highlights the growing integration of digital health solutions in long-term care settings

- In September 2023, Singapore Life Limited entered into a strategic collaboration with the Agency for Integrated Care (AIC) and Homage to enhance access to long-term care services in Singapore. This partnership aims to offer a more comprehensive and integrated care model, focusing on improving the quality of support for the elderly and individuals requiring long-term care services. The initiative seeks to streamline the delivery of care, making it more accessible and efficient for patients in need. This collaboration is particularly relevant to the global nursing homes and long-term care facilities market, as it reflects the increasing trend of integrating digital health solutions and collaboration between private and public sectors to address the growing demand for eldercare

- In May 2023, Omega Healthcare successfully acquired 18 skilled nursing home facilities located in West Virginia for USD 233 million. This acquisition significantly enhances Omega Healthcare’s operational capabilities, ensuring the seamless management and continued high-quality service delivery at these facilities. It further strengthens the company's presence in the region and expands its portfolio of care offerings. This strategic move is particularly relevant to the global nursing homes and long-term care facilities market, as it underscores the ongoing consolidation within the sector and the growing demand for high-quality, skilled care services

- In July 2022, the Centers for Medicare & Medicaid Services (CMS) introduced an enhanced Nursing Home Five-Star Quality Rating System. This updated system incorporates additional data on nursing home staffing levels, specifically focusing on weekend staffing rates for nurses, as well as information on annual turnover rates among nurses and administrators. These updates provide a more comprehensive and accurate assessment of nursing home quality, helping consumers make better-informed decisions regarding care options. This development is highly relevant to the global nursing homes and long-term care facilities market, as it emphasizes the increasing importance of staffing levels and employee retention in evaluating the quality of care

- In February 2022, Extendicare, a leading Canadian provider of long-term care services, completed the acquisition of a 15% managed interest in 24 long-term care homes previously operated by Revera. In addition, Extendicare entered into a redevelopment joint venture with Axium, which effectively doubled its assisted living portfolio, bringing the total number of long-term care facilities to 56. This strategic expansion significantly enhances Extendicare’s market presence and capabilities. This move is highly relevant to the global nursing homes and long-term care facilities market, reflecting the ongoing trend of market consolidation and strategic partnerships within the sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.