Global Nutraceutical Excipients Market

Market Size in USD Billion

CAGR :

%

USD

2.40 Billion

USD

4.25 Billion

2024

2032

USD

2.40 Billion

USD

4.25 Billion

2024

2032

| 2025 –2032 | |

| USD 2.40 Billion | |

| USD 4.25 Billion | |

|

|

|

|

Nutraceutical Excipients Market Size

- The global nutraceutical excipients market size was valued at USD 2.40 billion in 2024 and is expected to reach USD 4.25 billion by 2032, at a CAGR of 7.4% during the forecast period

- The market growth is largely fueled by increasing consumer awareness of health and wellness, rising demand for functional foods and dietary supplements, and technological advancements in excipients that enhance solubility, stability, and bioavailability of nutraceutical products

- Furthermore, growing preference for natural, clean-label, and plant-based ingredients is driving manufacturers to adopt innovative excipient solutions, while rising demand across North America, Europe, and Asia Pacific is accelerating the uptake of nutraceutical excipients, thereby significantly boosting the industry's growth

Nutraceutical Excipients Market Analysis

- Nutraceutical excipients, serving as functional additives in dietary supplements and functional foods to improve stability, bioavailability, and manufacturability, are increasingly essential components of modern nutraceutical formulations due to their role in enhancing product efficacy, shelf life, and consumer acceptance

- The rising demand for nutraceutical excipients is primarily fueled by growing health and wellness awareness, increasing consumption of dietary supplements and functional foods, and advancements in excipient technologies that improve solubility, stability, and controlled release of active ingredients

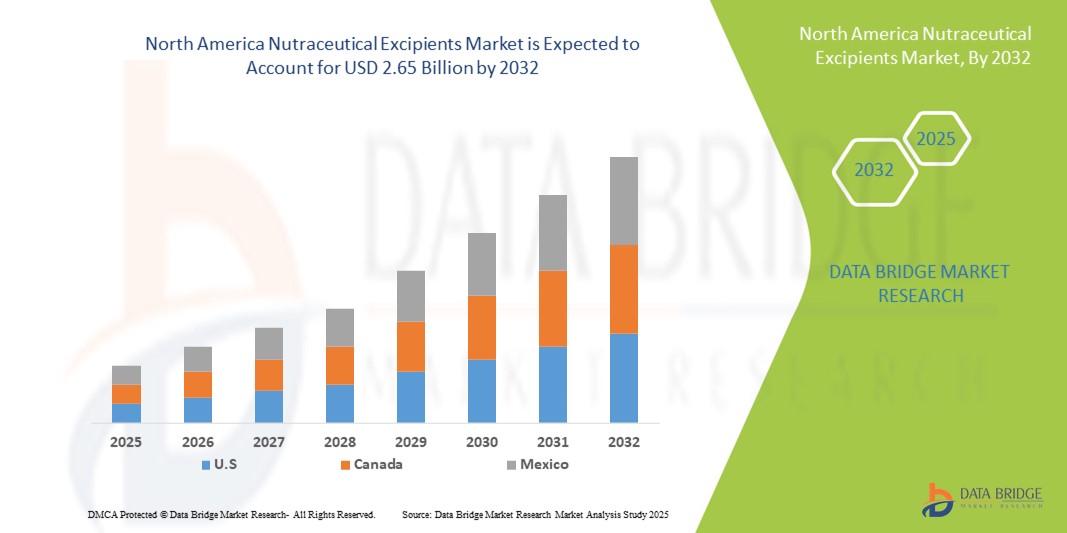

- North America dominated the nutraceutical excipients market with the largest revenue share of 34.6% in 2024, driven by a large health-conscious population, advanced healthcare infrastructure, and a strong presence of key industry players, with the U.S. witnessing substantial adoption of innovative excipient solutions in both dietary supplements and fortified foods

- Asia-Pacific is expected to be the fastest-growing region in the nutraceutical excipients market during the forecast period due to increasing health awareness, rising disposable incomes, and expanding nutraceutical consumption in countries such as China and India

- Fillers & diluents segment dominated the nutraceutical excipients market with a market share of 53.5% in 2024, driven by their widespread use in tablet and capsule formulations to achieve desired volume, consistency, and stability across diverse nutraceutical products

Report Scope and Nutraceutical Excipients Market Segmentation

|

Attributes |

Nutraceutical Excipients Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Nutraceutical Excipients Market Trends

Rising Preference for Natural and Functional Ingredients

- A significant trend in the global nutraceutical excipients market is the growing adoption of natural, plant-based, and functional excipients in dietary supplements and functional foods. These excipients not only enhance product stability, solubility, and bioavailability but also align with consumer demand for clean-label and “free-from” products

- For instance, companies such as Roquette and DuPont have developed plant-derived excipients that improve the texture and shelf life of tablets and powders while meeting regulatory and consumer expectations for natural ingredients

- Functional excipients enable advanced formulations, such as controlled-release supplements and enhanced nutrient absorption, making products more effective and appealing to health-conscious consumers

- The integration of these excipients into dietary supplements facilitates product differentiation, offering manufacturers the ability to provide value-added benefits while maintaining formulation stability

- This trend is shaping consumer expectations for nutraceutical products, as modern consumers increasingly seek supplements that are both effective and composed of naturally sourced ingredients

- The demand for natural and functional excipients is rising across both mature markets such as North America and emerging regions such as Asia-Pacific, driven by health awareness and growing interest in preventive healthcare

Nutraceutical Excipients Market Dynamics

Driver

Increasing Demand for Dietary Supplements and Functional Foods

- The rising global consumption of dietary supplements, protein powders, vitamin formulations, and functional foods is a key driver for the nutraceutical excipients market

- For instance, in 2024, companies such as Kerry Group and Ingredion expanded their excipient portfolios to support advanced formulations in protein supplements and probiotics, responding to growing consumer demand

- Consumers’ focus on wellness, preventive healthcare, and personalized nutrition is encouraging manufacturers to innovate with excipients that enhance solubility, stability, and bioavailability of active ingredients

- The adoption of fortified foods and functional beverages also boosts the requirement for reliable excipients that ensure consistent product quality, taste, and texture

- The trend toward convenient, ready-to-consume, and high-efficacy supplements is further propelling market growth, especially in regions with high health awareness such as North America and Europe

Restraint/Challenge

Regulatory Compliance and Formulation Complexity

- Navigating stringent regulatory requirements for nutraceutical excipients, including safety, labeling, and functional claims, presents a challenge to market growth. Excipients must comply with various regional regulations such as FDA, EFSA, and other local authorities

- For instance, discrepancies in permitted excipient types or concentrations across countries can complicate global product formulations and increase compliance costs for manufacturers

- In addition, formulating nutraceuticals with multiple active ingredients while maintaining stability, solubility, and palatability is technically challenging, especially for high-potency or sensitive ingredients

- High-quality natural excipients often come at a premium price compared to synthetic alternatives, which can increase production costs and limit accessibility in price-sensitive markets

- Overcoming these challenges through robust formulation research, regulatory expertise, and the development of cost-effective natural excipients will be essential for sustained market growth

Nutraceutical Excipients Market Scope

The market is segmented on the basis of type, end product, form, excipient source, and distribution channel.

- By Type

On the basis of type, the nutraceutical excipients market is segmented into flavoring agents, coloring agents, sweeteners, coating agents, buffers, solvents, carriers, antifoams, gliding agents, wetting agents, thickeners/gelling agents, preservatives, binders, disintegrates, lubricants, fillers & diluents, and others. The fillers & diluents segment dominated the market with the largest revenue share of 53.5% in 2024. This dominance is due to their extensive use in tablets and capsules to achieve desired volume, uniformity, and stability of active ingredients. They are crucial for ensuring consistent dosage and manufacturing efficiency. Manufacturers also prefer fillers & diluents for their compatibility with various nutraceutical formulations. Strong adoption across protein, vitamin, and mineral supplements further supports this segment. The segment benefits from their cost-effectiveness and long shelf life, making them essential for large-scale production.

The binders segment is anticipated to witness the fastest growth during the forecast period. Binders are critical in holding ingredients together, enhancing tablet integrity, and reducing breakage. Increasing demand for high-dose and solid dosage forms fuels their adoption. Natural and functional binders are gaining popularity due to the clean-label trend. Manufacturers are using innovative binders to improve solubility and bioavailability of active ingredients. The segment growth is further supported by rising health-conscious consumer demand globally.

- By End Product

On the basis of end product, the nutraceutical excipients market is segmented into prebiotics, probiotics, protein & amino acid supplements, mineral supplements, vitamin supplements, omega-3 supplements, and other supplements. The protein & amino acid supplements segment dominated the market in 2024, driven by rising fitness trends, health awareness, and demand for muscle recovery products. Excipients in these supplements enhance stability, taste masking, and bioavailability. Tablets, capsules, and powders benefit from consistent dosage due to these excipients. Manufacturers prioritize excipients that support shelf life and efficacy. Strong demand from sports nutrition and dietary supplement sectors further reinforces dominance. This segment is particularly significant in North America and Europe due to high health-conscious populations.

The omega-3 supplements segment is expected to witness the fastest growth during the forecast period. Increasing awareness of cardiovascular, cognitive, and anti-inflammatory benefits drives adoption. Specialized excipients prevent oxidation and enhance bioavailability of fatty acids. Functional beverages, soft gels, and fortified foods contribute to growth. Manufacturers are innovating with emulsifiers and stabilizers to maintain efficacy. The segment growth is strongest in Asia-Pacific and North America due to increasing health-conscious consumers.

- By Form

On the basis of form, the nutraceutical excipients market is segmented into dry and liquid forms. The dry form segment dominated the market in 2024 due to stability, versatility, and ease of handling in tablets, capsules, and sachets. Dry excipients simplify manufacturing, storage, and transport while maintaining consistent dosage. They are preferred in protein, vitamin, and mineral supplements. Manufacturers also favor dry forms for cost-effectiveness and long shelf life. Strong global demand and established manufacturing practices reinforce dominance. The segment benefits from its adaptability across various supplement types and regions.

The liquid form segment is expected to witness the fastest growth during the forecast period. Rising demand in pediatric, geriatric, and functional beverage applications drives growth. Liquid excipients enhance taste, solubility, and absorption in syrups, beverages, and liquid supplements. Ready-to-consume formulations and convenience further accelerate adoption. Manufacturers are innovating formulations to improve stability and bioavailability. Growth is particularly strong in emerging markets and developed regions with high liquid supplement demand.

- By Excipient Source

On the basis of excipient source, the nutraceutical excipients market is segmented into natural and synthetic sources. The natural excipients segment dominated the market in 2024 due to growing preference for clean-label, organic, and plant-based ingredients. Natural excipients are considered safer and environmentally friendly. They are widely used in protein, probiotic, and vitamin supplements. Manufacturers emphasize natural sources to meet regulatory standards and consumer expectations. The segment benefits from strong consumer awareness of health and sustainability. North America and Europe are the key markets for natural excipients due to high demand for organic products.

The synthetic excipients segment is expected to witness the fastest growth during the forecast period. Synthetic excipients provide consistent quality, cost-effectiveness, and scalability for large-scale production. They are preferred in functional and fortified supplements requiring precise dosing and stability. The segment is growing rapidly in emerging markets and industrial-scale manufacturing. Manufacturers leverage synthetic excipients to optimize production efficiency and meet growing global demand. This growth is supported by innovations in functional synthetic excipients.

- By Distribution Channel

On the basis of distribution channel, the nutraceutical excipients market is segmented into direct tender, retail sales, and others. The retail sales segment dominated the market in 2024, accounting for approximately 79% of the market share. Retail channels include supermarkets, pharmacies, and health stores, offering convenience and accessibility to consumers. Over-the-counter purchasing drives strong consumer adoption. Manufacturers leverage retail networks to reach urban and semi-urban populations effectively. Retail sales support brand visibility and market penetration. High health awareness among consumers reinforces the dominance of this channel globally.

The direct tender segment is expected to witness the fastest growth during the forecast period. Bulk procurement by hospitals, clinics, and institutional buyers drives adoption. Increasing preventive healthcare initiatives and institutional use of nutraceuticals fuel demand. Manufacturers focus on direct supply agreements to streamline distribution and reduce costs. Consistent product availability for large-scale institutional consumption further supports growth. The segment is expanding rapidly in emerging markets with growing healthcare infrastructure.

Nutraceutical Excipients Market Regional Analysis

- North America dominated the nutraceutical excipients market with the largest revenue share of 34.6% in 2024, driven by a large health-conscious population, advanced healthcare infrastructure, and a strong presence of key industry players, with the U.S. witnessing substantial adoption of innovative excipient solutions in both dietary supplements and fortified foods

- Consumers in the region show strong preference for clean-label, natural, and high-quality excipients that enhance product stability, bioavailability, and sensory properties of nutraceutical products

- The widespread adoption of protein powders, vitamins, minerals, and probiotic supplements supports consistent demand for excipients across various formulations. This dominance is further supported by advanced manufacturing infrastructure, well-established regulatory frameworks, and a strong presence of key market players in the region

U.S. Nutraceutical Excipients Market Insight

The U.S. nutraceutical excipients market captured the largest revenue share of 35% in 2024 within North America, driven by the high consumption of dietary supplements, protein powders, vitamins, and functional foods. Consumers increasingly prefer clean-label, plant-based, and high-quality excipients that enhance stability, bioavailability, and taste. The widespread adoption of personalized nutrition and preventive healthcare further propels demand. Strong R&D capabilities and advanced manufacturing infrastructure support the development of innovative excipients. The presence of leading global players and regulatory frameworks that encourage safe and effective formulations also drive market growth. Moreover, rising awareness of wellness trends and fitness programs significantly contributes to excipient adoption across various nutraceutical products.

Europe Nutraceutical Excipients Market Insight

The Europe nutraceutical excipients market is projected to grow at a significant CAGR during the forecast period, primarily driven by stringent regulations, health-conscious consumer behavior, and increasing demand for functional foods and dietary supplements. Urbanization and rising disposable incomes encourage the adoption of natural and clean-label excipients. The market sees strong growth in protein, vitamin, and mineral supplements, as manufacturers emphasize stability, bioavailability, and product quality. European consumers prefer excipients that support sustainable and eco-friendly formulations. The incorporation of advanced excipients into both new product launches and reformulated products strengthens the market presence.

U.K. Nutraceutical Excipients Market Insight

The U.K. nutraceutical excipients market is expected to expand at a notable CAGR during the forecast period, fueled by growing awareness of health and wellness, preventive healthcare, and fitness trends. Concerns regarding nutrient efficacy and product quality encourage manufacturers to adopt high-quality excipients that improve stability and bioavailability. The robust retail and e-commerce infrastructure enables wider accessibility of dietary supplements and functional foods. Home and commercial supplement manufacturers increasingly prefer excipients that meet clean-label and natural ingredient standards. Regulatory compliance with EFSA and local authorities also ensures product safety and consumer confidence. Strong urban health-conscious populations further stimulate market growth.

Germany Nutraceutical Excipients Market Insight

The Germany nutraceutical excipients market is expected to grow at a considerable CAGR during the forecast period, driven by the increasing focus on preventive healthcare, digital health trends, and high demand for quality nutraceuticals. German consumers favor natural, high-purity, and sustainable excipients that enhance product safety, efficacy, and shelf life. Advanced infrastructure and a strong emphasis on innovation support the development of specialized excipients for protein, vitamin, and probiotic supplements. The adoption of fortified foods and functional beverages further strengthens demand. Integration of excipients into modern nutraceutical formulations aligns with consumer expectations for safety and performance. Sustainability and regulatory compliance remain key considerations for market growth.

Asia-Pacific Nutraceutical Excipients Market Insight

The Asia-Pacific nutraceutical excipients market is poised to grow at the fastest CAGR of 12% during the forecast period, driven by rising health awareness, rapid urbanization, and increasing disposable incomes in countries such as China, India, and Japan. Government initiatives promoting preventive healthcare and dietary supplement consumption support market expansion. The region is witnessing growing demand for protein, omega-3, and vitamin supplements, increasing the requirement for stable, bioavailable, and functional excipients. Rising investments in manufacturing infrastructure and cost-effective production enhance accessibility. Consumers are increasingly inclined toward clean-label and natural products, further boosting market growth.

Japan Nutraceutical Excipients Market Insight

The Japan nutraceutical excipients market is gaining momentum due to the country’s health-conscious population, aging demographics, and high adoption of functional foods and dietary supplements. Consumers demand excipients that improve absorption, stability, and taste in liquid and solid formulations. The growing number of nutraceutical products integrated with personalized nutrition plans drives market growth. Integration of excipients in fortified beverages, protein supplements, and vitamins is increasing. Manufacturers focus on high-quality natural excipients to meet regulatory standards. Japan’s preference for innovative, effective, and safe formulations supports the adoption of advanced excipients in both residential and commercial sectors.

India Nutraceutical Excipients Market Insight

The India nutraceutical excipients market accounted for the largest market revenue share in Asia-Pacific in 2024, fueled by rapid urbanization, a growing middle class, and increased health awareness. The country is a key market for dietary supplements, functional foods, and fortified beverages. Affordable excipient options and the presence of domestic manufacturers encourage widespread adoption. The push toward preventive healthcare, fitness trends, and government initiatives for nutrition enhancement boost demand for protein, vitamin, and mineral supplements. Manufacturers increasingly adopt natural and functional excipients to meet consumer expectations. Expansion of retail and e-commerce channels enhances accessibility, further driving market growth.

Nutraceutical Excipients Market Share

The nutraceutical excipients industry is primarily led by well-established companies, including:

- JRS Pharma (Germany)

- DFE Pharma (Germany)

- Roquette Frères (France)

- SPI Pharma (U.S.)

- Lubrizol (U.S.)

- MEGGLE Group GmbH (Germany)

- Colorcon, Inc. (U.S.)

- Seppic S.A. (France)

- Kerry Group plc (Ireland)

- KLK Kolb Sdn Bhd (Malaysia)

- Lactalis Ingredients (France)

- Lipoid GmbH (Germany)

- Akums Drugs & Pharmaceuticals Ltd. (India)

- ACG Worldwide (India)

- Strides Pharma Science Limited (India)

- Gattefossé S.A.S. (France)

- IOI Oleo GmbH (Germany)

- BENEO (Germany)

- Vikram Thermo (India) Limited. (India)

- FUJIFILM Diosynth Biotechnologies (U.S.)

What are the Recent Developments in Global Nutraceutical Excipients Market?

- In April 2025, IMCD announced plans to unveil innovative pharma and nutraceutical formulations at FCE Pharma 2025 in São Paulo, highlighting their technical expertise and regional capabilities in the nutraceutical sector

- In September 2024, Shin-Etsu SE Tylose and LBB Specialties announced a distribution partnership for cellulose excipients in the Pharma Excipients and Nutra Ingredients markets. Effective November 1, 2024, this collaboration spans LBBS' Life Sciences and Food & Nutrition verticals across the United States, Canada, the Caribbean, and Central America

- In April 2024, Roquette announced its participation in Vitafoods Europe 2024, where it showcased an innovative addition to its LYCAGEL plant-based softgel excipient range. The new offering utilizes hydroxypropyl pea starch, catering to the growing demand for vegetarian and vegan dietary supplements. This development underscores Roquette's commitment to sustainable and clean-label solutions in the nutraceutical industry

- In April 2024, Qiagen announced a partnership with Helix to integrate its QIAseq NGS technology with Helix’s population genomics expertise. This collaboration aims to enhance the development of precise diagnostic tools for hereditary diseases, indirectly influencing the nutraceutical excipients market by promoting personalized nutrition and supplement formulations

- In April 2023, Ingredion has expanded its pharma and nutraceuticals business by acquiring two pharmaceutical excipients companies based in India. Part of the Company's Nutrition, Health, and Wellness platform, the pharma and nutraceutical business offers functional excipients, anhydrous dextrose and mannitol-based active pharmaceutical ingredients. The acquisition of Amishi Drugs & Chemicals (AD&C) and Mannitab Pharma Specialities will grow the Company's pharmaceutical-grade ingredient portfolio to serve a nearly USD 1.5 billion global market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.