Global Oat Bran Market

Market Size in USD Billion

CAGR :

%

USD

8.29 Billion

USD

12.54 Billion

2024

2032

USD

8.29 Billion

USD

12.54 Billion

2024

2032

| 2025 –2032 | |

| USD 8.29 Billion | |

| USD 12.54 Billion | |

|

|

|

|

Oat Bran Market Size

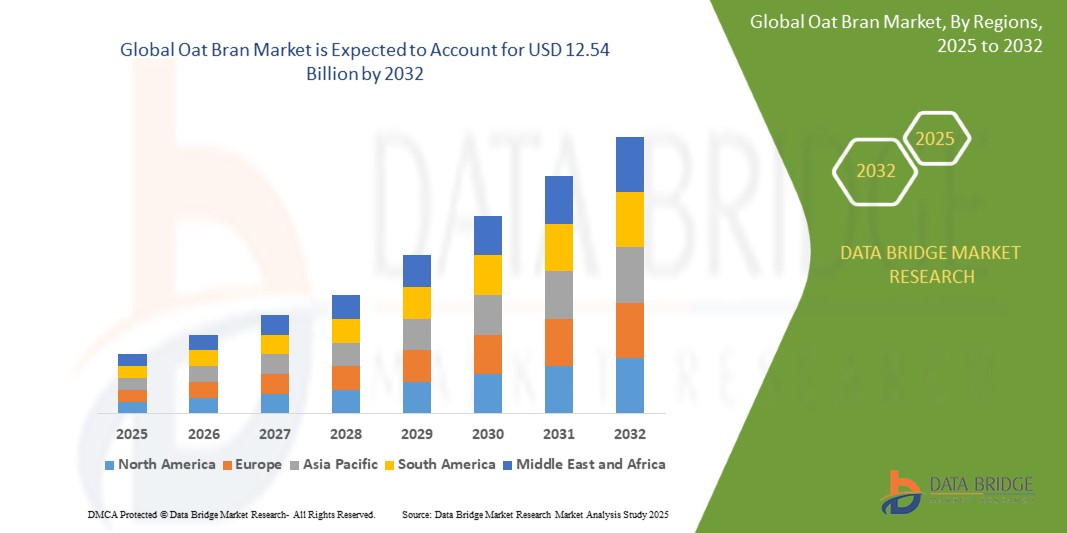

- The global oat bran market size was valued at USD 8.29 billion in 2024 and is expected to reach USD 12.54 billion by 2032, at a CAGR of 5.30% during the forecast period

- The market growth is largely fuelled by the rising consumer awareness regarding the health benefits of dietary fiber, growing demand for functional food ingredients, and increasing prevalence of cardiovascular diseases and diabetes

Oat Bran Market Analysis

- The growing adoption of oat bran in bakery, snacks, and breakfast cereals due to its cholesterol-lowering and digestive health benefits is contributing to market expansion

- Demand is further bolstered by the clean-label and plant-based nutrition trends, with oat bran being perceived as a natural and sustainable ingredient

- North America dominated the oat bran market with the largest revenue share in 2024, driven by rising health consciousness and an increasing shift toward fiber-rich diets among consumers

- Asia-Pacific region is expected to witness the highest growth rate in the global oat bran market, driven by a shift toward preventive healthcare, rising disposable incomes, and government initiatives promoting healthy eating habits

- The normal oat bran segment dominated the market with the largest market revenue share in 2024, driven by its affordability, easy availability, and widespread use in mainstream food products. Food manufacturers and consumers often prefer normal oat bran for its versatility in cereals, baked goods, and ready-to-eat snacks. Its nutrient profile, particularly high soluble fiber content, enhances its appeal as a staple ingredient in health-focused products

Report Scope and Oat Bran Market Segmentation

|

Attributes |

Oat Bran Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oat Bran Market Trends

“Rising Popularity of Plant-Based Diets Driving Oat Bran Consumption”

- The global shift toward plant-based diets is increasing demand for oat bran as a natural, vegan-friendly source of nutrition

- Oat bran is widely recognized for its high fiber content and heart health benefits, appealing to health-conscious consumers

- Food manufacturers are innovating with oat bran in vegan snacks, cereals, and plant-based beverages to attract new-age consumers

- The clean-label nature of oat bran, with minimal processing and no artificial additives, aligns well with modern food preferences

- For instance, oat bran-enriched granolas and porridges are being launched in the U.S. and Europe to cater to the vegan market

Oat Bran Market Dynamics

Driver

“Increasing Health Awareness and Dietary Fiber Demand”

- Consumers are increasingly seeking foods high in dietary fiber to combat lifestyle-related health conditions such as obesity and diabetes

- Oat bran, rich in beta-glucan, helps reduce cholesterol and regulate blood sugar levels, making it a preferred functional food ingredient

- The growing demand for digestive health products has encouraged brands to introduce oat bran in cereals, bakery goods, and snacks

- Government health campaigns across countries are emphasizing fiber intake, further pushing the demand for oat-based products

- For instance, in the U.K., high-fiber oat bran cereals have gained prominent shelf space due to their heart health positioning

Restraint/Challenge

“Fluctuating Raw Material Prices and Supply Chain Disruptions”

- Oat production is sensitive to unpredictable weather patterns and regional growing conditions, causing irregularities in supply

- Price fluctuations in oats impact the overall cost of oat bran products, affecting both manufacturers and consumers

- Global supply chain issues such as transportation delays, geopolitical tensions, and freight costs disrupt timely delivery

- Smaller producers find it challenging to maintain profitability and consistent production amid fluctuating raw material prices

- For instance, extreme droughts in Canada in 2021 caused oat shortages, resulting in price surges for oat-based products in North America

Oat Bran Market Scope

The market is segmented on the basis of product type, grind, application, and distribution channel.

• By Product Type

On the basis of product type, the oat bran market is segmented into organic oat bran and normal oat bran. The normal oat bran segment dominated the market with the largest market revenue share in 2024, driven by its affordability, easy availability, and widespread use in mainstream food products. Food manufacturers and consumers often prefer normal oat bran for its versatility in cereals, baked goods, and ready-to-eat snacks. Its nutrient profile, particularly high soluble fiber content, enhances its appeal as a staple ingredient in health-focused products.

The organic oat bran segment is expected to witness the fastest growth rate from 2025 to 2032, propelled by increasing consumer demand for clean-label and chemical-free food products. Health-conscious individuals and environmentally aware consumers are driving the uptake of organic oat bran across multiple regions. Its adoption is also gaining traction in the premium product category, especially in markets with strict organic certification standards.

• By Grind

On the basis of grind, the oat bran market is segmented into fine oat bran, coarse oat bran, and steel-cut oat bran. The fine oat bran segment accounted for the largest market revenue share in 2024 due to its widespread use in bakery products and infant foods. Its smooth texture and ease of blending make it suitable for health drinks, porridges, and energy bars.

The steel-cut oat bran segment is expected to witness the fastest growth rate from 2025 to 2032, owing to rising consumer interest in traditional and minimally processed foods. Steel-cut variants are preferred in premium breakfast cereals and artisanal food items for their rich texture and nutrient density.

• By Application

On the basis of application, the oat bran market is segmented into food industry, bakery and confectionaries, animal feed, healthcare, and personal use. The food industry segment led the market in 2024, supported by the growing use of oat bran in breakfast cereals, protein supplements, and dietary fiber-rich foods.

The healthcare segment is expected to witness the fastest growth rate from 2025 to 2032, attributed to the increasing application of oat bran in cholesterol-lowering and blood sugar-regulating formulations. Oat bran is being explored in nutraceutical and pharmaceutical applications due to its functional benefits, further expanding its scope in the wellness industry.

• By Distribution Channel

On the basis of distribution channel, the oat bran market is segmented into online sales, hypermarkets and supermarkets, convenience store, food specialty store, and others. The hypermarkets and supermarkets segment held the dominant market share in 2024, backed by bulk availability and the convenience of in-person purchase. These outlets offer multiple brands and product varieties, increasing customer accessibility and trust.

The online sales segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the growing popularity of e-commerce platforms. Consumers prefer online channels for their ease of product comparison, home delivery, and access to organic or specialty oat bran varieties not available in local stores.

Oat Bran Market Regional Analysis

- North America dominated the oat bran market with the largest revenue share in 2024, driven by rising health consciousness and an increasing shift toward fiber-rich diets among consumers

- Consumers across the region are highly focused on preventive healthcare and nutrition, which has resulted in higher demand for oat-based products, including oat bran, due to their cholesterol-lowering and digestive health benefits

- The expansion of clean-label food product offerings and strong retail penetration further supports the widespread adoption of oat bran products in North America, especially in the U.S. and Canada

U.S. Oat Bran Market Insight

The U.S. oat bran market accounted for the largest revenue share in 2024 within North America, propelled by increasing awareness regarding the nutritional benefits of oats and an expanding consumer base for gluten-free, heart-healthy products. With strong backing from health-focused marketing and robust demand from the functional food segment, oat bran continues to grow in popularity among U.S. consumers. The market is also being supported by innovations in ready-to-eat cereals, bakery items, and personalized nutrition formats incorporating oat bran.

Europe Oat Bran Market Insight

The Europe oat bran market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing demand for plant-based and clean-label products. European consumers are becoming more mindful of diet and lifestyle, driving the adoption of oat bran in various food and beverage applications. Growth is further encouraged by sustainability-conscious buying behavior, a strong regulatory framework favoring high-fiber foods, and the rise of organic oat bran production across the region.

U.K. Oat Bran Market Insight

The U.K. oat bran market is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing focus on gut health, vegan nutrition, and fiber-enriched diets. British consumers are shifting toward foods that help manage lifestyle-related conditions, such as obesity and high cholesterol. The inclusion of oat bran in breakfast cereals, plant-based bakery goods, and dietary supplements is gaining momentum, with major retailers introducing private-label health products containing oat bran.

Germany Oat Bran Market Insight

Germany's oat bran market is expected to witness the fastest growth rate from 2025 to 2032, due to a strong preference for organic and sustainable nutrition. German consumers exhibit a high awareness of the link between dietary fiber and long-term health, especially digestive wellness. Oat bran products are increasingly found in health food stores, vegan supermarkets, and online wellness platforms. The country's advanced food processing industry and demand for local, traceable ingredients are also supporting the growing application of oat bran in bakery, dairy alternatives, and personal wellness products.

Asia-Pacific Oat Bran Market Insight

The Asia-Pacific oat bran market is expected to witness the fastest growth rate from 2025 to 2032, driven by rapid urbanization, changing dietary habits, and increasing health awareness in countries such as China, India, and Japan. Rising disposable incomes and growing interest in Western-style functional foods are boosting oat bran adoption. Local manufacturers and international brands are increasingly investing in oat bran-based offerings across snacks, beverages, and breakfast categories.

Japan Oat Bran Market Insight

Japan’s oat bran market is expected to witness the fastest growth rate from 2025 to 2032, fueled by consumer interest in functional and high-fiber foods as part of a balanced diet. The population’s focus on digestive health and longevity aligns with oat bran's nutritional properties, supporting its adoption in traditional and modern food formats. Innovative product launches such as oat bran-enriched rice substitutes, soups, and bakery items are gaining popularity, particularly among health-conscious middle-aged and elderly consumers.

China Oat Bran Market Insight

China is expected to dominate the Asia-Pacific oat bran market, driven by rising health awareness, rapid urbanization, and a surge in demand for convenient, nutritious foods. As dietary fiber becomes a key element in addressing digestive and weight-related health concerns, oat bran-based products are seeing high uptake in the country. The expansion of e-commerce platforms and domestic manufacturing capacity also supports widespread availability and affordability, strengthening China's position as a leading consumer and producer in the regional market.

Oat Bran Market Share

The Oat Bran industry is primarily led by well-established companies, including:

- The Quaker Oats Company (U.S.)

- Blue Lake Milling Pty Ltd (Australia)

- Grain Millers, Inc. (U.S.)

- Morning Foods Ltd (U.K.)

- General Mills, Inc. (U.S.)

- Avena Foods Limited (Canada)

- Richardson International (Canada)

- CEREALTO SIRO KIND (Spain)

- Premier Nutrition Company, LLC (Germany)

- Nestlé SA (Switzerland)

- Molino Spadoni spa (Italy)

- WEETABIX (U.K.)

- Valsemøllen (Denmark)

- Grillon D'Or (France)

- Clif Bar & Company (U.S.)

- Associated British Foods plc (U.K.)

- DANONE SA (Switzerland)

Latest Developments in Global Oat Bran Market

- In February 2022, Above Food Corp. acquired Sonic Milling Systems, Ltd., renowned for innovative hydrodynamic-cavitation technology. Utilizing pressure and water, this technology disintegrates various ingredients, facilitating clean label liquid production. Above Food Corp. harnessed it to create oat beverages, creamers, and concentrates for North American markets

- In February 2022, MOMA, a British oat milk company, launched two chilled oat milk varieties: semi and whole. Available initially at 220 Waitrose stores, with expansion to Ocado and Morrisons, these products boast barista-quality texture and are UK-made, distinct from concentrate-based alternatives

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oat Bran Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oat Bran Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oat Bran Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.