Global Oat Milk Market

Market Size in USD Billion

CAGR :

%

USD

3.92 Billion

USD

12.13 Billion

2024

2032

USD

3.92 Billion

USD

12.13 Billion

2024

2032

| 2025 –2032 | |

| USD 3.92 Billion | |

| USD 12.13 Billion | |

|

|

|

|

Oat Milk Market Size

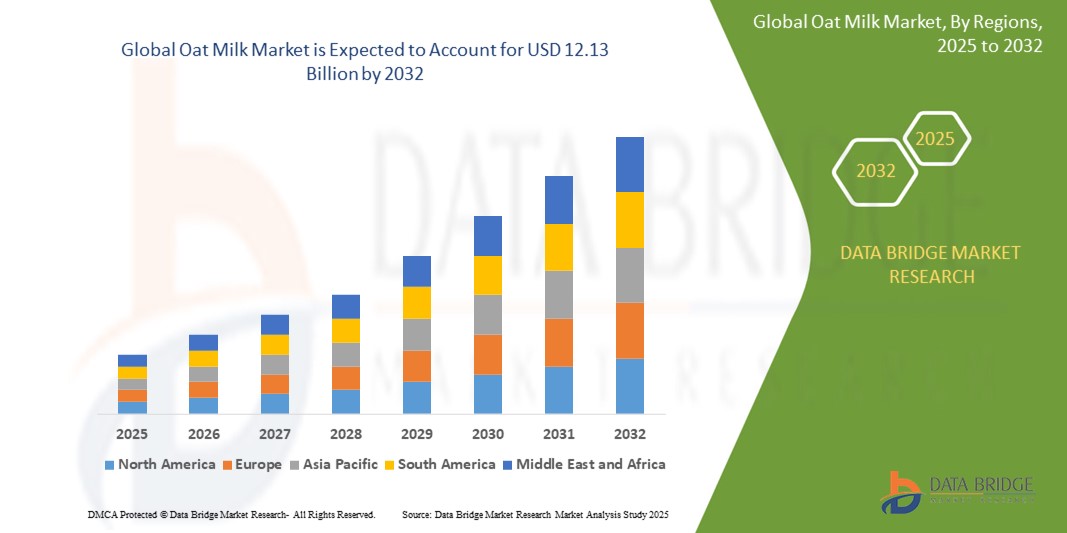

- The global oat milk market size was valued at USD 3.92 billion in 2024 and is expected to reach USD 12.13 billion by 2032, at a CAGR of 15.15% during the forecast period

- The market growth is largely fueled by the rising consumer shift toward plant-based diets and increasing awareness of lactose intolerance and dairy-related health concerns, positioning oat milk as a preferred dairy alternative across diverse demographics

- Furthermore, growing demand for sustainable, environmentally friendly food options and the expanding presence of oat milk in retail shelves, cafés, and foodservice channels are accelerating product adoption, thereby significantly boosting the industry’s growth

Oat Milk Market Analysis

- Oat milk, derived from whole oats and known for its creamy texture and mild flavor, is becoming an increasingly popular plant-based dairy alternative across global markets due to its nutritional benefits, sustainability profile, and versatility in both food and beverage applications

- The escalating demand for oat milk is primarily fueled by the growing prevalence of lactose intolerance, rising adoption of vegan and flexitarian diets, and increasing consumer preference for environmentally friendly and health-conscious food options

- Asia-Pacific dominated the oat milk market with a share of 45.5% in 2024, due to rising lactose intolerance rates, growing vegan population, and expanding urban middle class adopting plant-based diets

- North America is expected to be the fastest growing region in the oat milk market with a share of during the forecast period due to rising interest in veganism, plant-based nutrition, and sustainable food production

- Conventional segment dominated the market with a market share of 70.5% in 2024, due to its widespread availability, cost-effectiveness, and suitability for mass-market consumption. Conventional oat milk is often preferred by manufacturers for large-scale production as it involves lower input costs, making it more affordable for end consumers across supermarkets and cafes

Report Scope and Oat Milk Market Segmentation

|

Attributes |

Oat Milk Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oat Milk Market Trends

“Rise of Clean Label Products”

- A significant and accelerating trend in the global oat milk market is the growing consumer demand for clean label products that contain simple, natural, and easily recognizable ingredients. This movement reflects heightened health consciousness and a preference for minimally processed foods.

- For instance, major brands such as Oatly and Califia Farms highlight “no added sugar,” “non-GMO,” and “gluten-free” claims on their packaging to align with consumer expectations for transparency and health. Similarly, Elmhurst emphasizes its use of only a few natural ingredients with no gums or emulsifiers

- Clean label oat milk is gaining traction among consumers seeking alternatives free from synthetic additives, preservatives, and allergens. The use of recognizable ingredients such as oats, water, and salt appeals to label-conscious shoppers

- Brands are also expanding their portfolios to include organic and certified vegan products to reinforce consumer trust and brand loyalty. As a result, clean label positioning has become a key marketing strategy in both retail and foodservice channels

- The demand for clean, transparent, and sustainable plant-based beverages is fundamentally reshaping product formulation strategies. Companies are investing in reformulation efforts to eliminate artificial ingredients while maintaining taste and functionality

- The rapid rise of clean label oat milk is being driven by health-conscious consumers across North America, Europe, and Asia-Pacific, who increasingly associate ingredient transparency with higher nutritional quality and ethical food production practices

Oat Milk Market Dynamics

Driver

“Plant-Based Diet Trend”

- The increasing popularity of plant-based diets driven by health, environmental, and ethical concerns is a major driver of growth in the oat milk market

- For instance, oat milk is being widely adopted as a dairy alternative in households, cafés, and restaurants due to its creamy texture and nutritional benefits such as high fiber content and low cholesterol. Brands such as Oatly, Nestlé, and Danone are expanding production to meet growing global demand

- As consumers reduce or eliminate animal products, oat milk offers a sustainable and accessible substitute, particularly among vegans, lactose-intolerant individuals, and flexitarians seeking variety in their beverage choices

- The market is further supported by endorsements from nutritionists, increased media visibility, and product placement in high-profile coffee chains, reinforcing its image as a health-forward beverage

- Its lower environmental impact compared to almond and dairy milk strengthens its appeal among eco-conscious consumers seeking food options with minimal carbon and water footprints

Restraint/Challenge

“Taste and Texture Preferences”

- Despite its rising popularity, oat milk still faces resistance from some consumers due to taste and texture preferences when compared to dairy milk or other plant-based alternatives

- For instance, individuals accustomed to the rich mouthfeel of dairy or the distinct flavors of soy and almond milk may find oat milk too mild or grainy in consistency, which can limit repeat purchases in certain segments

- Achieving consistent taste and mouthfeel across product batches remains a challenge for manufacturers, especially when using clean label formulations without emulsifiers or stabilizers

- Texture inconsistency and sedimentation are also concerns, particularly in barista applications or when oat milk is used in cooking. Addressing these technical challenges while maintaining clean label integrity is essential to expanding market share. Companies are investing in advanced processing techniques such as enzymatic hydrolysis and ultra-filtration to improve mouthfeel and product stability without compromising nutritional value

- Overcoming these sensory barriers through innovation, taste optimization, and consumer education will be critical for broadening oat milk’s appeal across diverse age groups and dietary preferences

Oat Milk Market Scope

The market is segmented on the basis of source, type, distribution channel, application, packaging, product type, and format.

• By Source

On the basis of source, the oat milk market is segmented into organic and conventional. The conventional segment held the largest revenue share of 70.5% in 2024 due to its widespread availability, cost-effectiveness, and suitability for mass-market consumption. Conventional oat milk is often preferred by manufacturers for large-scale production as it involves lower input costs, making it more affordable for end consumers across supermarkets and cafes.

The organic segment is expected to witness the fastest growth rate from 2025 to 2032, driven by the rising consumer inclination towards clean-label products and health-conscious eating. Growing awareness about the harmful effects of pesticides and synthetic additives is prompting consumers to opt for organic oat milk, especially in developed markets where demand for sustainably produced, non-GMO, and chemical-free beverages is surging.

• By Type

On the basis of type, the oat milk market is segmented into flavoured, unflavoured, and others. The unflavoured segment dominated the market revenue in 2024 due to its versatile application across cooking, baking, and beverage preparation without altering taste profiles. It is often the preferred choice among consumers looking for dairy alternatives that are neutral in flavor and free from added sugars or sweeteners.

The flavoured segment is projected to grow at the fastest CAGR from 2025 to 2032, driven by increasing product innovation and the rising popularity of indulgent, plant-based drinks among younger consumers. Flavoured variants such as vanilla, chocolate, and coffee are gaining traction due to their enhanced taste and appeal, especially in on-the-go beverage categories and specialty cafés.

• By Distribution Channel

On the basis of distribution channel, the market is bifurcated into online and offline. The offline segment accounted for the largest market share in 2024 owing to the dominance of supermarkets, hypermarkets, and convenience stores in consumer grocery shopping patterns. Brick-and-mortar stores provide the advantage of immediate availability and the opportunity for consumers to compare product offerings physically.

The online segment is anticipated to experience the highest growth rate from 2025 to 2032, propelled by the increasing penetration of e-commerce platforms and the convenience of home delivery. Direct-to-consumer brand models and subscription-based oat milk services are gaining momentum, supported by digital marketing and changing consumer behavior favoring contactless shopping.

• By Application

On the basis of application, the oat milk market is segmented into food and beverages. The beverages segment held the dominant share in 2024 due to the extensive use of oat milk as a dairy alternative in lattes, smoothies, and ready-to-drink (RTD) health beverages. Oat milk’s creamy texture and naturally sweet flavor make it highly preferred by cafés, baristas, and individual consumers alike.

The food segment is expected to register notable growth over the forecast period due to the rising incorporation of oat milk in recipes such as oatmeal, baked goods, soups, and sauces. As plant-based eating becomes more mainstream, oat milk’s use as an ingredient in food preparation is expanding, particularly in vegan and lactose-free meal formulations.

• By Packaging

On the basis of packaging, the market is segmented into carton, bottle, and others. The carton segment led the market with a share of 45.5% in 2024, attributed to its eco-friendly appeal and widespread usage in retail shelf-stable products. Carton packaging is lightweight, recyclable, and ideal for transporting oat milk over long distances without refrigeration, making it highly suitable for both retailers and consumers.

The bottle segment is projected to grow at a rapid pace from 2025 to 2032 due to its rising application in premium and refrigerated oat milk products. Glass and PET bottles enhance shelf appeal and are often used by brands to convey product quality and freshness, especially in specialty health food stores and cafes.

• By Product Type

On the basis of product type, the market is segmented into regular/full fat and reduced fat. The regular/full fat segment accounted for the largest share in 2024 due to its rich mouthfeel and higher demand in the café and barista segment. Full fat oat milk mimics the texture and performance of dairy milk, making it an ideal choice for frothing and foam in coffee beverages.

The reduced fat segment is projected to grow at the highest rate over the forecast period, fueled by growing consumer preferences for lower-calorie and heart-healthy alternatives. Health-focused individuals and diet-conscious consumers increasingly seek reduced fat oat milk as part of balanced and weight-conscious meal plans.

• By Format

On the basis of format, the market is segmented into shelf-stable and refrigerated. The shelf-stable segment dominated the market revenue in 2024, owing to its long shelf life and convenience in storage and transportation. These products are widely available across offline and online retail channels and are favored by consumers for pantry stocking and travel.

The refrigerated segment is expected to witness the fastest growth from 2025 to 2032, driven by the increasing availability of fresh oat milk in chilled sections of supermarkets and a growing consumer perception that refrigerated products are fresher and more natural. Refrigerated oat milk is often seen as premium and aligns with the clean-label trend.

Oat Milk Market Regional Analysis

- Asia-Pacific dominated the oat milk market with the largest revenue share of 45.5% in 2024, driven by rising lactose intolerance rates, growing vegan population, and expanding urban middle class adopting plant-based diets

- The region’s robust café culture, increased health awareness, and the availability of local oat milk brands are major contributors to market expansion

- Government initiatives promoting plant-based alternatives and domestic oat cultivation, coupled with the growing presence of online grocery platforms, are accelerating oat milk adoption across urban and semi-urban areas

Japan Oat Milk Market Insight

The Japan oat milk market is growing due to heightened consumer interest in functional, digestive-friendly plant-based beverages that align with traditional low-dairy diets. Minimalist packaging, local flavor preferences, and an aging demographic seeking heart-healthy alternatives contribute to demand. Domestic brands are collaborating with café chains and retail stores to broaden accessibility and product familiarity.

China Oat Milk Market Insight

China held the largest share in Asia-Pacific in 2024, driven by increased adoption of dairy alternatives among lactose-intolerant consumers and growing youth interest in Western-style coffee beverages using oat milk. Strategic partnerships between domestic oat milk brands and coffeehouse chains, along with government support for domestic grain processing, are fueling rapid market penetration.

Europe Oat Milk Market Insight

Europe’s oat milk market is expected to grow at a significant CAGR over the forecast period, fueled by stringent environmental regulations, strong vegan trends, and well-established recycling infrastructure. Consumers are increasingly choosing oat milk over almond or soy due to its lower environmental impact and creamy texture, making it the preferred option in cafés and retail across Northern and Western Europe.

U.K. Oat Milk Market Insight

The U.K. market is poised for steady growth, supported by widespread availability of branded oat milk products in supermarkets, rising popularity of plant-based diets, and strong demand from the coffee and foodservice sectors. Consumers are becoming more ingredient-conscious, prompting brands to expand clean-label, no-added-sugar variants with functional health claims.

Germany Oat Milk Market Insight

Germany is witnessing significant oat milk market growth driven by a strong eco-conscious consumer base and innovation in organic plant-based beverages. High per capita consumption of dairy alternatives, coupled with support for regional oat farming and recyclable packaging, is bolstering demand. Local manufacturers are launching premium oat milk products tailored for barista applications and health-focused retail.

North America Oat Milk Market Insight

North America is projected to grow at the fastest CAGR from 2025 to 2032, propelled by rising interest in veganism, plant-based nutrition, and sustainable food production. Increased consumer demand for non-GMO, gluten-free, and heart-healthy options is driving oat milk sales, particularly in urban centers. The region’s mature retail landscape and strong presence of oat milk brands support wide-scale distribution and product diversification.

U.S. Oat Milk Market Insight

The U.S. oat milk market held the largest revenue share in North America in 2024, fueled by mainstream adoption across retail chains, specialty cafés, and health-conscious households. High awareness of lactose intolerance, clean-label trends, and the push toward environmentally friendly consumption are reinforcing oat milk’s popularity. Innovations in flavor, format, and added nutrients are expanding the U.S. market across demographics.

Oat Milk Market Share

The oat milk industry is primarily led by well-established companies, including:

- PACIFIC FOODS OF OREGON, LLC. (U.S.)

- Oatly (Sweden)

- Califia Farms (U.S.)

- Danone (France)

- HP HOOD LLC (U.S.)

- PepsiCo (U.S.)

- HAPPY PLANET FOODS (Canada)

- Drinks Brokers Ltd (U.K.)

- Alpro (Belgium)

- The Quaker Oats Company (U.S.)

- Pureharvest (Australia)

- The Kraft Heinz Company (U.S.)

- Yili Industrial Group Company Limited (China)

- China Mengniu Dairy Company Limited (China)

- Mother Dairy Fruit & Vegetable Pvt. Ltd. (India)

- Nestlé (Switzerland)

- Fonterra Co-operative Group (New Zealand)

- Lactalis International (France)

- Dean Foods (U.S.)

- Hiland (U.S.)

- Umang Daries Pvt. Ltd. (India)

- DAIRY FARMERS OF AMERICA (U.S.)

- FrieslandCampina (Netherlands)

- LALA BRANDED PRODUCTS, LLC (U.S.)

- Oy Karl Fazer Ab (Finland)

- RISO SCOTTI S.p.A. (Italy)

- Elmhurst Milked Direct LLC (U.S.)

- Rude Health (U.K.)

Latest Developments in Global Oat Milk Market

- In May 2024, Nestlé Singapore launched OAT and ALMOND & OAT drinks, enhancing its portfolio of nutritious beverages. These new drinks are fortified with essential nutrients such as vitamins B2, B3, and D, along with calcium, catering to health-conscious consumers seeking dairy alternatives. The introduction of these beverages reflects Nestlé's strategy to address the growing demand for plant-based options while ensuring nutritional value and taste

- In January 2024, Oatly unveiled two new oat milk variants: Unsweetened Oatmilk and Super Basic Oatmilk. Both products are designed to offer enhanced nutritional benefits without sacrificing flavor. This launch aligns with Oatly's mission to provide delicious and nutritious dairy alternatives, appealing to consumers who prioritize health and taste. The introduction of these variants signifies Oatly's ongoing innovation in the oat milk segment

- In October 2023, Califia Farms announced a partnership with Starbucks to create a new line of oat milk beverages exclusively available at Starbucks locations. This collaboration aims to enhance Califia Farms' visibility in the coffee and beverage industry, tapping into the growing consumer interest in plant-based options. The initiative is expected to strengthen Califia's brand presence while providing Starbucks customers with innovative and tasty oat milk offerings

- In September 2023, Elmhurst 1920 formed a partnership with Whole Foods Market to launch a new line of exclusive organic oat milk products. This collaboration is designed to enhance Elmhurst's reach in the natural and organic grocery segment, catering to health-conscious consumers. By aligning with Whole Foods, Elmhurst aims to leverage the retailer’s strong market presence, providing customers with high-quality, organic oat milk options

- In July 2023, Coca-Cola announced the acquisition of a minority stake in Oatly, the prominent Swedish oat milk producer. This strategic investment is aimed at expanding Coca-Cola's beverage portfolio, allowing the company to tap into the rapidly growing oat milk market. The partnership is expected to enhance Oatly's resources and distribution capabilities, facilitating broader access to its innovative oat-based products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oat Milk Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oat Milk Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oat Milk Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.