Global Ocular Pain Oral Treatment Market

Market Size in USD Million

CAGR :

%

USD

35.21 Million

USD

62.33 Million

2024

2032

USD

35.21 Million

USD

62.33 Million

2024

2032

| 2025 –2032 | |

| USD 35.21 Million | |

| USD 62.33 Million | |

|

|

|

|

Ocular Pain Oral Treatment Market Size

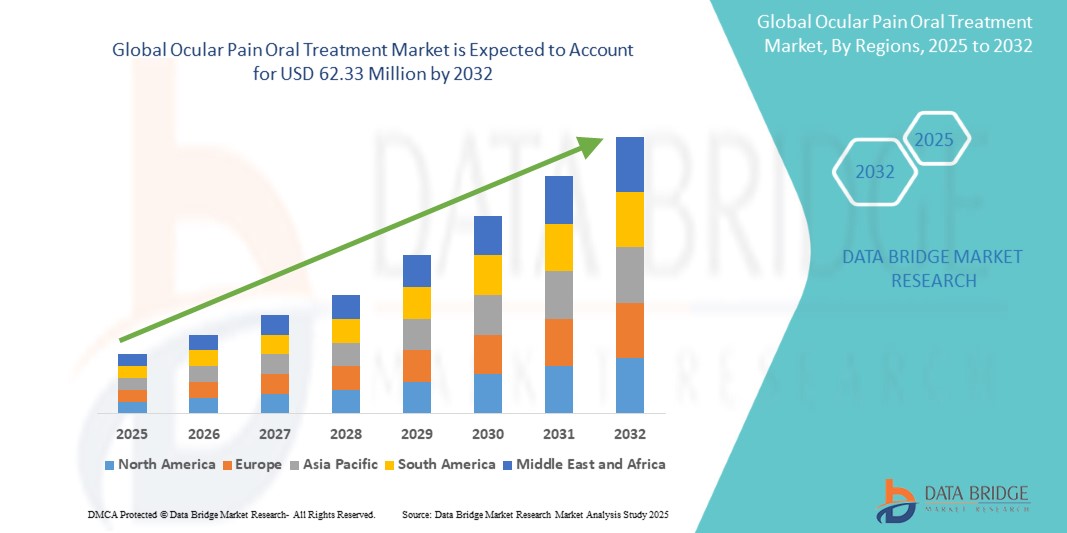

- The global ocular pain oral treatment market size was valued at USD 35.21 Million in 2024 and is expected to reach USD 62.33 Million by 2032, at a CAGR of 7.40% during the forecast period

- The market growth is largely fueled by increasing prevalence of ocular pain conditions, rising awareness of eye health, and advancements in oral treatment formulations, leading to higher adoption of effective therapies in both clinical and retail settings

- Furthermore, growing consumer demand for convenient, safe, and fast-acting oral treatments for ocular pain is driving market expansion. These factors are accelerating the uptake of novel therapeutic solutions, thereby significantly boosting the industry’s growth

Ocular Pain Oral Treatment Market Analysis

- The Ocular Pain Oral Treatment market is witnessing substantial growth globally, driven by increasing prevalence of ocular disorders, rising geriatric population, and advancements in pharmaceutical formulations

- The escalating demand for effective and patient-friendly oral treatment options is primarily fueled by growing awareness about ocular health, rising incidence of chronic eye conditions, and the availability of novel drug delivery mechanisms

- North America dominated the ocular pain oral treatment market with the largest revenue share of 45.14% in 2024, characterized by high healthcare expenditure, strong presence of key pharmaceutical players, and advanced research infrastructure, with the U.S. experiencing substantial growth in ocular pain oral treatment approvals and prescription rates, particularly for chronic ocular conditions such as glaucoma and dry eye syndrome

- Asia-Pacific is expected to be the fastest-growing region in the ocular pain oral treatment market during the forecast period due to increasing urbanization, rising prevalence of eye disorders, growing healthcare access, and higher disposable incomes in emerging economies such as China and India

- The oral medications segment dominated the oular pain oral treatment market with the largest revenue share of 62.1% in 2024, due to systemic treatment convenience, ease of dosing, and high patient compliance

Report Scope and Ocular Pain Oral Treatment Market Segmentation

|

Attributes |

Ocular Pain Oral Treatment Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ocular Pain Oral Treatment Market Trends

Enhanced Convenience and Advanced Treatment Options

- A significant and accelerating trend in the global ocular pain oral treatment market is the development of innovative oral formulations that improve patient convenience, efficacy, and adherence. These advancements are enhancing the overall treatment experience for patients suffering from ocular pain

- For instance, recent launches of fast-acting oral analgesics and combination therapies allow patients to manage ocular discomfort more efficiently, reducing the need for multiple medications or frequent dosing schedules

- The integration of patient-centric features, such as easy-to-swallow tablets, liquid gels, and controlled-release formulations, ensures that treatments are not only effective but also convenient for a wide range of patient populations

- Pharmaceutical companies are increasingly focusing on research-driven innovations to deliver targeted therapies that address the underlying causes of ocular pain, rather than providing only temporary relief

- The growing availability of over-the-counter oral treatments, alongside prescription options, is expanding accessibility and empowering patients to manage mild to moderate ocular pain at home

- This trend toward more effective, user-friendly, and versatile oral treatment options is fundamentally reshaping patient expectations for ocular pain management, driving growth across both clinical and retail channels worldwide

Ocular Pain Oral Treatment Market Dynamics

Driver

Growing Need Due to Rising Prevalence of Ocular Disorders and Increasing Healthcare Awareness

- The increasing prevalence of ocular disorders, including glaucoma, dry eye syndrome, and post-surgical eye pain, coupled with growing healthcare awareness among patients and healthcare providers, is a significant driver for the heightened demand for ocular pain oral treatments

- For instance, in April 2024, a leading pharmaceutical company announced the launch of an advanced oral formulation for post-operative ocular pain, offering improved bioavailability and faster relief. Such initiatives by key companies are expected to drive the Ocular Pain Oral Treatment industry growth in the forecast period

- As patients and clinicians become more aware of the complications associated with untreated ocular pain, oral treatment options that provide effective, long-lasting relief are being increasingly preferred, creating a strong demand for novel formulations

- Furthermore, the growing focus on patient-centric therapies and personalized medicine is encouraging pharmaceutical companies to develop oral ocular pain solutions that are easy to administer, well-tolerated, and compatible with other treatments

- The convenience of oral administration, compatibility with multi-drug regimens, and the ability to improve patient adherence are key factors propelling the adoption of Ocular Pain Oral Treatment products in both hospital and outpatient settings. The trend towards advanced formulation technologies and increasing availability of user-friendly treatment options further contribute to market growth

Restraint/Challenge

Concerns Regarding High Costs and Regulatory Approvals

- The relatively high cost of advanced ocular pain oral treatment formulations poses a challenge to broader market penetration, particularly in price-sensitive regions or for patients with limited insurance coverage. The cost factor may limit adoption despite the demonstrated clinical benefits

- For instance, the approval process for novel ocular pain oral formulations can be lengthy and complex, making some healthcare providers cautious in prescribing newly launched products until extensive safety and efficacy data are available

- Addressing these challenges through patient education on the benefits of advanced oral treatments, government and insurance support, and the development of cost-effective generic alternatives is crucial for market expansion

- While prices for generic and over-the-counter options are more accessible, premium oral formulations that offer enhanced efficacy, faster relief, or improved bioavailability often come with higher price tags

- The perceived premium for innovative ocular pain treatments can still hinder adoption, especially among patients who do not see an immediate need for advanced therapeutic features

- Overcoming these challenges through streamlined regulatory approvals, improved patient access programs, and the development of affordable treatment options will be vital for sustained growth in the Ocular Pain Oral Treatment market

Ocular Pain Oral Treatment Market Scope

The market is segmented on the basis of type, route of administration, drug class, end user, and distribution channel.

• By Type

On the basis of type, the ocular pain oral treatment market is segmented into acute ocular pain and chronic ocular pain. The acute ocular pain segment dominated the largest market revenue share of 57.3% in 2024, driven by the high prevalence of temporary ocular discomfort caused by infections, allergies, minor injuries, and post-surgical pain. Patients and healthcare providers prefer immediate-acting oral therapies to alleviate discomfort quickly, which ensures high adoption in both clinical and home settings. Acute treatments are widely available as over-the-counter medications, allowing patients to manage symptoms conveniently without frequent medical visits. The segment benefits from strong awareness campaigns emphasizing early intervention and the importance of pain relief. Hospitals, specialty clinics, and home healthcare providers increasingly rely on these oral treatments due to their fast action and ease of administration. Combination therapies for acute pain further strengthen the market dominance. The convenience, patient compliance, and extensive clinical validation of acute ocular pain treatments consolidate this segment’s leadership in the market.

The chronic ocular pain segment is expected to witness the fastest CAGR of 10.5% from 2025 to 2032. Rising prevalence of long-term ocular disorders such as dry eye syndrome, uveitis, and neuropathic ocular pain is driving demand for sustained treatment options. Patients require consistent and effective therapies for prolonged relief, creating opportunities for innovative oral formulations. Increasing investments in personalized medicine and chronic ocular pain management solutions further boost market growth. Chronic oral therapies are also gaining traction due to advancements in drug delivery systems that improve bioavailability and reduce side effects. Growing awareness among healthcare providers about the need for long-term ocular pain management encourages adoption in hospitals, specialty clinics, and home healthcare settings. Expansion of clinical research and development focusing on chronic ocular conditions supports faster adoption. The segment’s growth is reinforced by government initiatives promoting better eye care and long-term treatment strategies.

• By Route of Administration

On the basis of route of administration, the ocular pain oral treatment market is segmented into oral medications, topical treatments, and parenteral administration. The oral medications segment dominated with the largest revenue share of 62.1% in 2024, due to systemic treatment convenience, ease of dosing, and high patient compliance. Oral treatments allow patients to manage therapy at home or in clinical settings with minimal intervention. Hospitals and specialty clinics widely recommend oral formulations for both acute and chronic ocular pain. Fast-acting tablets and liquid gels enhance patient adherence and provide rapid relief. Oral medications are compatible with combination therapies, which further increase efficacy and adoption. Availability through retail pharmacies, hospital pharmacies, and online channels strengthens market penetration. The established clinical preference for oral treatments and extensive physician recommendations consolidate dominance in this segment.

The topical treatments segment is expected to register the fastest CAGR of 9.8% from 2025 to 2032, driven by localized administration that targets the affected eye directly, reducing systemic side effects. Innovations in gels, drops, and sustained-release formulations improve patient comfort and treatment efficiency. Topical therapies are particularly suitable for mild to moderate ocular pain and localized inflammation. Increasing research and development in advanced topical delivery systems is fueling adoption. Growing patient preference for non-invasive treatment options supports segment growth. Healthcare providers recommend topical therapies in combination with oral treatments for optimized care. Expansion in home care and outpatient services further accelerates the segment’s growth. Regulatory approvals for new topical formulations enhance confidence and increase uptake.

• By Drug Class

On the basis of drug class, the ocular pain oral treatment market is segmented into analgesics, anti-inflammatory drugs, antibiotics, and immunomodulators. The analgesics segment dominated with a revenue share of 54.6% in 2024, driven by immediate pain-relieving effects and widespread availability for managing mild to moderate ocular discomfort. Hospitals, specialty clinics, and home care settings rely heavily on oral analgesics for rapid symptom management. Combination therapies that include analgesics and anti-inflammatory agents further strengthen the segment. Ease of administration, patient familiarity, and high compliance rates contribute to dominance. Marketing campaigns and physician recommendations actively promote analgesic use. Strong adoption in both acute and post-surgical ocular pain scenarios consolidates market leadership. The segment benefits from continuous innovation in formulation and delivery methods.

The anti-inflammatory drugs segment is expected to witness the fastest CAGR of 11.2% from 2025 to 2032, fueled by the rising prevalence of inflammatory ocular conditions. Oral anti-inflammatory drugs reduce swelling and discomfort effectively, supporting rapid adoption in hospitals and specialty clinics. Novel formulations with improved safety profiles encourage physician and patient acceptance. Increasing awareness of targeted treatment options for ocular inflammation drives growth. The segment is supported by clinical research highlighting the benefits of long-term inflammation management. Integration into personalized treatment plans for chronic ocular conditions accelerates uptake. Expanded access through retail and online pharmacies boosts growth. The segment’s potential for combination therapies further enhances market opportunities.

• By End User

On the basis of end user, the ocular pain oral treatment market is segmented into hospitals, specialty clinics, home healthcare settings, and ocular pain centers. The hospitals segment dominated with a revenue share of 48.3% in 2024, due to high patient volumes seeking immediate diagnosis and treatment for ocular pain. Hospitals provide access to a wide range of oral treatment options for both acute and chronic conditions. Integration with hospital pharmacy systems ensures consistent supply and easy accessibility. Hospitals also offer physician oversight, improving treatment effectiveness and patient adherence. Clinical adoption of advanced oral therapies strengthens segment dominance. Awareness campaigns and treatment guidelines further promote usage in hospital settings. High patient trust and convenience in hospitals reinforce market leadership.

The home healthcare settings segment is expected to witness the fastest CAGR of 12.1% from 2025 to 2032, driven by the growing trend of self-medication and an increasing elderly population. Home-accessible oral treatments provide convenience and autonomy for patients managing ocular pain. Telehealth and remote monitoring support proper usage and adherence. Growing patient preference for non-hospital treatment options encourages adoption. Easy-to-use packaging and dosing formats increase patient compliance. Awareness of home-based ocular pain management solutions is rising steadily. Expansion of home healthcare services strengthens market growth. New product launches targeted at home use accelerate uptake in this segment.

• By Distribution Channel

On the basis of distribution channel, the ocular pain oral treatment market is segmented into hospital pharmacies, retail pharmacies, online pharmacies, and direct tender. The retail pharmacies segment dominated with a revenue share of 53.7% in 2024, due to widespread accessibility for both over-the-counter and prescription oral treatments. Retail pharmacies provide convenience, pharmacist guidance, and a broad product range. They are highly preferred by patients seeking immediate treatment for acute or chronic ocular pain. Competitive pricing, regional penetration, and strong consumer trust further enhance dominance. Retail channels offer rapid access for urgent needs and facilitate repeat purchases. Marketing campaigns and promotions increase patient engagement. Accessibility in urban and semi-urban areas supports consistent growth.

The online pharmacies segment is expected to witness the fastest CAGR of 13.4% from 2025 to 2032, fueled by increasing e-commerce penetration and home delivery convenience. Patients prefer online purchases for discreet, fast, and flexible access to oral treatments. Wide product variety and competitive pricing support adoption. Telehealth consultations complement online pharmacy services. Growing awareness of digital healthcare services drives uptake. Expansion of internet access and mobile applications accelerates sales. Regulatory approvals for online distribution increase consumer confidence. Technological integration for order tracking and repeat purchase further strengthens segment growth.

Ocular Pain Oral Treatment Market Regional Analysis

- North America dominated the ocular pain oral treatment market with the largest revenue share of 45.14% in 2024, characterized by high healthcare expenditure, a strong presence of leading pharmaceutical companies, and advanced research infrastructure

- The experienced substantial growth in ocular pain oral treatment approvals and prescription rates, particularly for chronic ocular conditions such as glaucoma, dry eye syndrome, and post-operative ocular pain

- Increasing awareness of ocular health, combined with established healthcare networks and well-developed reimbursement frameworks, supports sustained market adoption in the region

U.S. Ocular Pain Oral Treatment Market Insight

The U.S. ocular pain oral treatment market captured the largest revenue share in 2024 within North America, driven by a growing focus on chronic ocular conditions and the rising prevalence of eye disorders. The country’s robust clinical trial ecosystem and advanced pharmaceutical R&D facilities accelerate the development and approval of novel oral therapies. High patient awareness and strong prescription practices further support rapid market growth. In addition, continuous innovation in formulations and targeted therapies for specific ocular pain conditions is expected to sustain demand throughout the forecast period.

Europe Ocular Pain Oral Treatment Market Insight

The Europe ocular pain oral treatment market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by stringent healthcare regulations, increasing prevalence of ocular disorders, and rising healthcare expenditure. The region shows significant growth across hospitals, specialized clinics, and outpatient care centers, with demand for oral treatments increasing due to their ease of administration, high patient compliance, and effectiveness in managing ocular pain and chronic eye conditions. European pharmaceutical players are investing in R&D to introduce advanced oral therapies targeting both acute and chronic ocular pain.

U.K. Ocular Pain Oral Treatment Market Insight

The U.K. ocular pain oral treatment market is anticipated to grow at a noteworthy CAGR during the forecast period, fueled by rising prevalence of glaucoma, dry eye syndrome, and other ocular conditions. Increasing awareness among patients and healthcare providers, along with government support for healthcare innovations, is encouraging the adoption of oral ocular pain treatments. The market is further strengthened by the presence of specialized ophthalmology clinics and robust healthcare infrastructure.

Germany Ocular Pain Oral Treatment Market Insight

The Germany ocular pain oral treatment market is expected to expand at a considerable CAGR during the forecast period, supported by high healthcare spending, a strong pharmaceutical industry, and a focus on innovation in ocular therapies. Advanced clinical research networks, government initiatives supporting healthcare development, and collaborations between research institutes and pharmaceutical companies drive the introduction of novel oral treatments for ocular pain. The market is particularly active in chronic eye disorders and post-operative care.

Asia-Pacific Ocular Pain Oral Treatment Market Insight

The Asia-Pacific ocular pain oral treatment market is expected to register the fastest CAGR from 2025 to 2032, driven by increasing urbanization, rising prevalence of eye disorders, expanding healthcare access, and higher disposable incomes in emerging economies such as China and India. Government initiatives to improve healthcare infrastructure, rising awareness of ocular health, and expansion of pharmaceutical manufacturing hubs contribute to the rapid market growth. Oral ocular pain treatments are increasingly adopted due to their convenience, patient compliance, and growing availability of innovative formulations.

Japan Ocular Pain Oral Treatment Market Insight

The Japan ocular pain oral treatment market is gaining momentum due to the country’s aging population, increasing prevalence of ocular conditions, and high healthcare standards. Rising demand for effective oral therapies for chronic eye diseases, coupled with well-established healthcare infrastructure and advanced pharmaceutical R&D, is accelerating market growth. Increasing clinical research and specialized ophthalmology services further enhance adoption.

China Ocular Pain Oral Treatment Market Insight

The China ocular pain oral treatment market accounted for the largest revenue share in Asia-Pacific in 2024, driven by rapid urbanization, growing prevalence of ocular disorders, an expanding middle class, and increasing healthcare awareness. China’s large patient population, coupled with strong domestic pharmaceutical capabilities and government support for healthcare innovations, promotes widespread adoption of oral ocular pain treatments. Continuous introduction of new oral therapies for chronic and post-operative ocular conditions is expected to sustain market growth through the forecast period.

Ocular Pain Oral Treatment Market Share

The ocular pain oral treatment industry is primarily led by well-established companies, including:

- Ocular Therapeutix, Inc. (U.S.)

- KALA BIO (U.S.)

- Oculis (Switzerland)

- Surface Ophthalmics (U.S.)

- Formosa Pharmaceuticals. Inc. (Taiwan)

- Salvat (Spain)

- OCUVEX THERAPEUTICS INC. (U.S.)

- EyePoint Pharmaceuticals, Inc. (U.S.)

- Sun Pharmaceutical Industries Ltd (India)

- Bausch Health Companies Inc. (Canada)

- Alcon Inc. (Switzerland)

- Novartis AG (Switzerland)

- Pfizer Inc. (U.S.)

- Cipla Inc. (India)

Latest Developments in Global Ocular Pain Oral Treatment Market

- In October 2021, Ocular Therapeutix announced that the U.S. Food and Drug Administration (FDA) approved a supplemental New Drug Application (sNDA) for Dextenza (dexamethasone ophthalmic insert) 0.4 mg for the treatment of ocular itching associated with allergic conjunctivitis. This approval expanded the indications for Dextenza, which was previously approved for ocular inflammation and pain following ophthalmic surgery

- In January 2021, Kala Pharmaceuticals commenced the promotional launch of EYSUVIS (loteprednol etabonate ophthalmic suspension) 0.25% in the United States. EYSUVIS became the first and only FDA-approved medicine for the short-term (up to two weeks) treatment of the signs and symptoms of dry eye disease. The launch marked a significant advancement in the management of dry eye disease

- In March 2024, the U.S. FDA approved Eyenovia's eye drops, containing the potent topical steroid clobetasol propionate, for reducing inflammation and pain in patients post-eye surgery. Eyenovia acquired the U.S. commercial rights to the drug from Taiwan-based Formosa Pharmaceuticals in August 2023. The approval followed positive data from late-stage studies involving patients who had cataract surgery

- In May 2025, Formosa Pharmaceuticals announced a licensing agreement with Apotex Inc. for the commercialization of clobetasol propionate ophthalmic suspension (APP13007) in Mexico. The formulation, approved by the U.S. FDA in 2024, enables a convenient dosing regimen while providing rapid and sustained relief of inflammation and pain following ocular surgery

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.