Global Ocular Pain Topical Ointments Market

Market Size in USD Million

CAGR :

%

USD

103.48 Million

USD

185.65 Million

2024

2032

USD

103.48 Million

USD

185.65 Million

2024

2032

| 2025 –2032 | |

| USD 103.48 Million | |

| USD 185.65 Million | |

|

|

|

|

Ocular Pain Topical Ointments Market Size

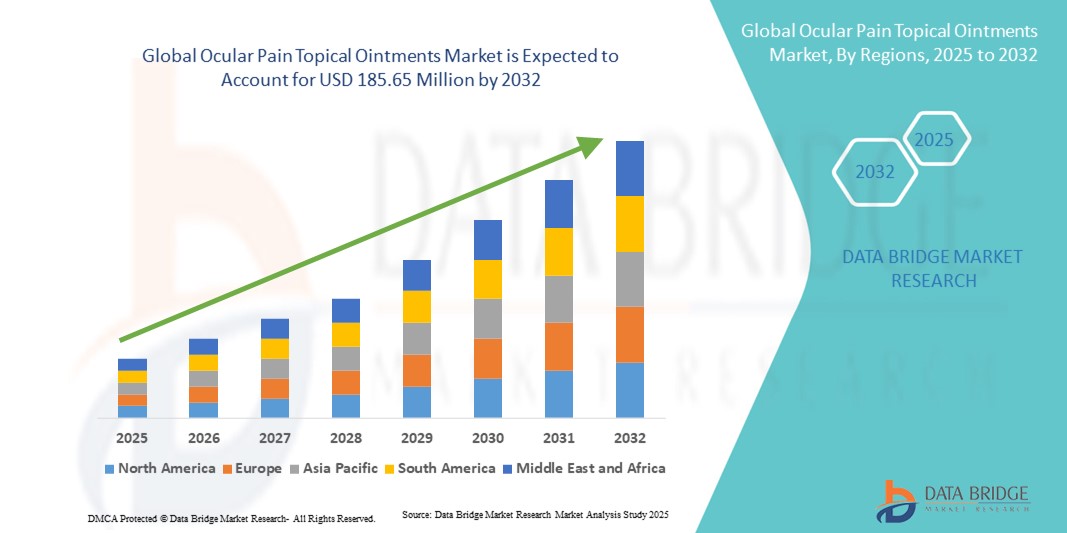

- The global ocular pain topical ointments market size was valued at USD 103.48 million in 2024 and is expected to reach USD 185.65 million by 2032, at a CAGR of 7.58% during the forecast period

- The market growth is primarily driven by the rising prevalence of ocular disorders, post-operative eye pain cases, and corneal injuries, which are creating sustained demand for effective pain-relieving topical formulations

- In addition, increasing patient preference for targeted, non-invasive therapies along with ongoing advancements in preservative-free and combination ointments are positioning these products as a key option in ophthalmic care. These factors together are accelerating the adoption of ocular pain topical ointments, thereby fueling overall market expansion

Ocular Pain Topical Ointments Market Analysis

- Ocular pain topical ointments, designed to provide localized relief for post-operative eye pain, corneal injuries and ocular surface disorders, are becoming essential components of ophthalmic care due to their targeted action, non-invasive nature, and capacity to improve patient comfort and recovery outcomes

- The increasing demand for these ointments is primarily fueled by the rising incidence of ophthalmic surgeries and ocular surface diseases, growing patient preference for safer, preservative-free and combination formulations, and technological innovations in drug delivery systems

- North America dominated the ocular pain topical ointments market in 2024 with 39.6% of global revenues, supported by advanced healthcare infrastructure, high surgical volumes and strong innovation pipelines in ophthalmic pharmaceuticals and device-drug combinations

- Asia-Pacific is expected to be the fastest-growing region over the forecast period, driven by rising healthcare access, increasing awareness of ocular health, and growing volumes of affordable and generic topical ophthalmic products in countries such as China, India and Japan

- The NSAID ointments segment held the largest market share of 35.5% in 2024, owing to their established clinical efficacy in post-operative inflammation and pain management, broad acceptance among ophthalmologists, and favorable safety profile for short-term use

Report Scope and Ocular Pain Topical Ointments Market Segmentation

|

Attributes |

Ocular Pain Topical Ointments Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ocular Pain Topical Ointments Market Trends

Shift Towards Preservative-Free and Combination Formulations

- A significant and accelerating trend in the global ocular pain topical ointments market is the increasing preference for preservative-free formulations and advanced combinations, which reduce ocular surface toxicity and enhance therapeutic effectiveness

- For instance, preservative-free NSAID ointments are gaining traction in post-operative care, providing effective pain relief while minimizing adverse effects, whereas corticosteroid-antibiotic combinations are increasingly prescribed for surgical and trauma-related eye pain

- Pharmaceutical innovation is driving the development of ointments with sustained-release bases, improving drug residence time on the ocular surface and reducing the frequency of application for patients

- In addition, preservative-free unit-dose packaging formats are being adopted by key players to address patient safety concerns, aligning with regulatory recommendations and enhancing user compliance in ophthalmic care

- This trend towards safer, more effective, and convenient topical solutions is reshaping ophthalmic prescribing habits and boosting adoption across both developed and emerging markets worldwide

- Consequently, companies such as Bausch + Lomb and Novartis are focusing on preservative-free innovations and multi-action ointments to strengthen their presence and meet evolving patient needs in ocular pain management

Ocular Pain Topical Ointments Market Dynamics

Driver

Rising Surgical Volumes and Growing Prevalence of Ocular Disorders

- The increasing number of ophthalmic surgeries, including cataract, LASIK, and corneal procedures, is a significant driver for the demand of ocular pain topical ointments to manage post-operative inflammation and discomfort

- For instance, in March 2024, Alcon expanded its ophthalmic care portfolio with new anti-inflammatory topical formulations targeting post-surgical pain relief, highlighting the strategic importance of innovation in this segment

- As the global burden of ocular surface diseases such as dry eye syndrome and allergic conjunctivitis continues to rise, demand for effective topical pain relief ointments is expanding among both patients and healthcare providers

- Furthermore, patient preference for localized, non-invasive pain management methods over systemic therapies makes topical ointments a critical first-line solution in ophthalmic care settings

- The convenience of direct ocular application, rapid onset of action, and reduced systemic side effects are key factors driving widespread adoption in both hospital and retail pharmacy channels globally

- The growing presence of generics and wider availability of advanced branded formulations are further enhancing affordability and accessibility, accelerating market penetration worldwide

Restraint/Challenge

Adverse Effects and Stringent Regulatory Pathways

- Concerns related to ocular irritation, blurred vision, or hypersensitivity reactions from prolonged use of certain topical ointments pose challenges to broader market acceptance

- For instance, reports of corneal epithelial toxicity linked with preserved formulations have made both physicians and patients cautious about their long-term application in ocular pain management

- Addressing these safety issues through preservative-free technologies, advanced bases, and patient education is critical for improving compliance and building trust in topical ointment therapies

- In addition, the stringent regulatory approval pathways for ophthalmic drugs, particularly in the U.S. and Europe, prolong time-to-market and increase R&D costs for pharmaceutical manufacturers

- The relatively high cost of advanced preservative-free or combination ointments compared to generics can act as a barrier for adoption, especially in cost-sensitive markets across Asia-Pacific and Latin America

- Overcoming these challenges through innovation, strategic pricing, and compliance with global regulatory standards will be essential for sustaining growth in the ocular pain topical ointments market

Ocular Pain Topical Ointments Market Scope

The market is segmented on the basis of product, indication, end user, and distribution channel.

- By Product

On the basis of product, the ocular pain topical ointments market is segmented into NSAIDs ointments, corticosteroid ointments, local anesthetic ointments, antibiotic + analgesic combination ointments, and lubricant ointments. The NSAIDs ointments segment dominated the market with the largest revenue share of 35.5% in 2024, driven by their proven clinical efficacy in reducing inflammation and pain following cataract, LASIK, and other ophthalmic surgeries. Ophthalmologists widely prescribe NSAID ointments as they offer targeted relief without the systemic side effects associated with oral analgesics. Their cost-effectiveness and availability in both branded and generic forms further strengthen their adoption. In addition, strong clinical evidence supporting NSAID efficacy in short-term ocular pain management has made them a standard of care in developed healthcare markets. This dominance is reinforced by the high surgical procedure volumes in North America and Europe.

The lubricant ointments segment is anticipated to witness the fastest growth rate from 2025 to 2032, fueled by rising cases of dry eye syndrome and ocular surface discomfort worldwide. Increasing screen time, environmental stressors, and an aging population are major contributors to this demand surge. Lubricant ointments are gaining favor among patients for their preservative-free, long-lasting hydration and safety profile, especially for chronic use. Online pharmacies and OTC availability are expanding access, supporting rapid growth in both developed and emerging economies. The affordability of generics in this segment is further boosting adoption across price-sensitive markets such as Asia-Pacific and Latin America.

- By Indication

On the basis of indication, the market is segmented into post-operative ocular pain, corneal abrasion, dry eye, allergic conjunctivitis, and acute traumatic ocular pain. The post-operative ocular pain segment dominated the market in 2024, supported by the large number of cataract and refractive surgeries performed globally. These procedures often require effective short-term pain management, where topical ointments such as NSAIDs and corticosteroids are first-line therapies. High patient compliance, rapid pain relief, and wide physician adoption make this indication the primary revenue contributor. Advanced healthcare systems in North America and Europe, coupled with growing surgery rates in Asia-Pacific, further reinforce the segment’s dominance. The strong clinical endorsement of ointments for post-surgical recovery continues to drive sustained demand.

The dry eye segment is projected to witness the fastest growth during the forecast period, propelled by the global surge in dry eye prevalence due to lifestyle changes, digital device overuse, and rising aging populations. Patients increasingly prefer ointments for their long-lasting lubricating effect, especially during nighttime use. The trend toward preservative-free and combination lubricants is also boosting innovation in this segment. With growing awareness campaigns and the availability of OTC lubricant ointments, adoption is expanding rapidly across both developed and emerging economies. The expanding e-commerce channel for dry eye relief products further accelerates segment growth.

- By End User

On the basis of end user, the market is segmented into hospitals & ophthalmology clinics, ambulatory surgical centers, retail pharmacies, and online pharmacies. The hospitals & ophthalmology clinics segment dominated the market in 2024, owing to the high prescription volumes generated by specialists managing post-surgical and trauma-related ocular pain. Hospitals serve as the primary point of care for complex ocular conditions, where physicians prescribe NSAID, corticosteroid, and anesthetic ointments for immediate and effective pain relief. The presence of advanced surgical facilities and strong procurement frameworks ensures steady demand from this segment. Moreover, hospitals act as gateways for patients transitioning to retail and online pharmacy channels for continued therapy. Their dominance is reinforced by their role in prescribing branded, higher-value formulations.

The online pharmacies segment is expected to register the fastest growth rate from 2025 to 2032, driven by the rising trend of digital healthcare and the growing demand for convenience in medicine access. Online platforms are expanding availability of both prescription refills and OTC ointments, particularly lubricants and preservative-free formulations. Cost savings, home delivery, and wider product variety are key factors enhancing consumer adoption. This channel is particularly expanding in Asia-Pacific and Europe, where regulatory frameworks are increasingly supporting e-pharmacy operations. The rapid digitalization of healthcare, along with consumer preference for hassle-free access, makes online pharmacies the fastest-growing end user segment.

- By Distribution Channel

On the basis of distribution channel, the market is segmented into hospital pharmacies, retail pharmacies, online pharmacies, and direct institutional procurement. The hospital pharmacies segment held the largest share in 2024, as most post-operative and trauma-related ocular pain ointments are initially dispensed through hospital-based pharmacies. These settings ensure immediate access to prescribed treatments following surgeries or emergency interventions. Strong collaboration between ophthalmologists and in-house pharmacies reinforces dominance, as patients are more such as to fill their prescriptions on-site. Hospital pharmacies also play a critical role in procuring specialized branded ointments not always available in retail settings. Their dominance is particularly strong in North America and Europe, where healthcare systems are hospital-centric.

The online pharmacies segment is expected to be the fastest-growing distribution channel during the forecast period, propelled by consumer preference for digital platforms, affordability, and the availability of a broad product portfolio. Rising smartphone penetration, coupled with increasing trust in e-commerce healthcare platforms, is enabling greater adoption of online purchasing. OTC lubricant ointments and preservative-free formulations are particularly popular in this channel, as patients seek convenient solutions for chronic conditions such as dry eye. The COVID-19 pandemic accelerated this trend, and regulatory support for digital healthcare access in Asia-Pacific and Europe is expected to drive rapid future growth.

Ocular Pain Topical Ointments Market Regional Analysis

- North America dominated the ocular pain topical ointments market in 2024 with 39.6% of global revenues, supported by advanced healthcare infrastructure, high surgical volumes and strong innovation pipelines in ophthalmic pharmaceuticals and device-drug combinations

- Patients in the region benefit from better access to prescription and OTC ointments, with increasing awareness about eye health and rising diagnosis rates for ocular surface diseases contributing to higher demand

- This dominance is further reinforced by favorable healthcare expenditure, the presence of leading pharmaceutical manufacturers, and an expanding online pharmacy distribution ecosystem, making North America the key hub for ocular pain topical ointments

U.S. Ocular Pain Topical Ointments Market Insight

The U.S. ocular pain topical ointments market captured the largest revenue share of 79% in 2024 within North America, driven by a high number of ophthalmic surgeries, strong adoption of prescription therapies, and widespread availability of advanced formulations. Rising cases of corneal abrasions and dry eye disease, coupled with increased post-operative care needs, are fueling demand. The preference for prescription-strength NSAID and corticosteroid ointments, supported by robust R&D activity and availability through hospital and retail pharmacies, continues to expand the market. Moreover, digital pharmacy platforms and strong insurance coverage further enhance patient access across the U.S.

Europe Ocular Pain Topical Ointments Market Insight

The Europe ocular pain topical ointments market is projected to grow at a steady CAGR throughout the forecast period, supported by an aging population and rising incidence of ocular surface disorders. Growing awareness of eye care, coupled with stricter healthcare guidelines and reimbursement frameworks, is boosting demand for prescription ointments. European consumers also value preservative-free and combination formulations due to rising concerns about long-term ocular health. Adoption is notable across both hospitals and retail pharmacy chains, with growth supported by increasing clinical trials and broader physician acceptance of topical pain therapies in post-surgical care.

U.K. Ocular Pain Topical Ointments Market Insight

The U.K. ocular pain topical ointments market is anticipated to grow at a noteworthy CAGR, supported by the increasing burden of dry eye disease and ocular allergies. Rising surgical interventions such as cataract and LASIK procedures are fueling higher demand for post-operative ointments. Strong NHS-backed treatment adoption, along with consumer preference for convenient access through retail and online pharmacies, supports growth. In addition, awareness campaigns around ocular health and technological advances in formulation are contributing to a growing shift towards advanced pain-relief ointments in the U.K.

Germany Ocular Pain Topical Ointments Market Insight

The Germany ocular pain topical ointments market is expected to expand at a significant CAGR during the forecast period, fueled by strong healthcare infrastructure and emphasis on high-quality formulations. The market is supported by widespread ophthalmology practices and patient demand for effective pain relief post ocular surgeries. Germany’s innovation-driven pharmaceutical industry is actively developing preservative-free ointments and combination formulations to improve compliance and safety. The adoption of topical analgesics is also rising in outpatient and ambulatory surgical centers, reflecting the shift towards less invasive care models.

Asia-Pacific Ocular Pain Topical Ointments Market Insight

The Asia-Pacific ocular pain topical ointments market is projected to grow at the fastest CAGR of 23% during 2025 to 2032, supported by rising cataract surgeries, increasing prevalence of eye injuries, and higher healthcare access in emerging economies. Countries such as China, India, and Japan are witnessing a surge in demand due to growing awareness of ocular health and wider availability of cost-effective generic ointments. Government-backed healthcare reforms and the expansion of online pharmacy platforms are further driving accessibility. The affordability of products, coupled with local manufacturing initiatives, is broadening adoption across both urban and rural populations.

Japan Ocular Pain Topical Ointments Market Insight

The Japan ocular pain topical ointments market is gaining momentum due to the country’s high elderly population, frequent ocular surgeries, and cultural emphasis on preventive eye care. Demand is driven by growing cases of dry eye disease and ocular surface disorders. Integration of innovative preservative-free formulations, alongside strong hospital pharmacy networks, supports the adoption of advanced topical analgesics. The Japanese market is also increasingly focused on patient comfort and safety, with rising investment in R&D for longer-lasting pain relief ointments.

India Ocular Pain Topical Ointments Market Insight

The India ocular pain topical ointments market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid urbanization, rising middle-class income, and growing prevalence of ocular trauma and post-surgical care needs. India represents a significant hub for generic ophthalmic ointment manufacturing, ensuring wide product affordability and availability. Increasing adoption of topical pain-relief products in both hospital and retail pharmacy channels, coupled with strong government-led healthcare initiatives, is fueling growth. The rise of e-pharmacy platforms further enhances accessibility, making India a key growth driver within the Asia-Pacific market.

Ocular Pain Topical Ointments Market Share

The Ocular Pain Topical Ointments industry is primarily led by well-established companies, including:

- Bausch + Lomb (U.S.)

- Alcon (Switzerland)

- Santen Pharmaceutical Co., Ltd. (Japan)

- KALA BIO. (U.S.)

- Cipla (India)

- Lupin (India)

- Sun Pharmaceutical Industries Ltd. (India)

- Dr. Reddy’s Laboratories Ltd. (India)

- Glenmark Pharmaceuticals Ltd. (India)

- Teva Pharmaceutical Industries Ltd. (Israel)

- Aurobindo Pharma Limited (India)

- SIFI S.p.A. (Italy)

- Eyenovia, Inc. (U.S.)

- Eyevance Pharmaceuticals, LLC (U.S.)

- Dompé (Italy)

- Novagali Pharma (France)

- Otsuka Pharmaceutical Co., Ltd. (Japan)

- Akorn Operating Company LLC. (U.S.)

- Hikma Pharmaceuticals PLC (U.K.)

What are the Recent Developments in Global Ocular Pain Topical Ointments Market?

- In July 2025, Lupin launched a generic loteprednol etabonate ophthalmic suspension in the United States. Lupin, the Mumbai-based pharmaceutical company, introduced a generic version of loteprednol etabonate ophthalmic suspension (a corticosteroid used to treat post-operative eye inflammation and pain, and allergic conjunctivitis)

- In January 2025, Kala Pharmaceuticals’ Eysuvis (loteprednol ophthalmic formulation) was spotlighted as a novel FDA-approved corticosteroid for ocular surface disease. Eysuvis (loteprednol) is notable as the first ocular corticosteroid approved by the FDA specifically for treatment of dry eye flares, tying directly into the ocular surface pain and inflammation domain

- In October 2024, OKYO Pharma announced the dosing of the first patient in a Phase 2 clinical trial of topical OK-101 for neuropathic corneal pain. OKYO Pharma Ltd disclosed that the first patient has been dosed in a randomized, double-masked, placebo-controlled Phase 2 study of OK-101, marking the first clinical trial of a therapy targeting neuropathic corneal pain (NCP)

- In March 2024, the U.S. FDA approved clobetasol propionate ophthalmic suspension 0.05% for post-operative ocular inflammation and pain. The FDA approval of clobetasol propionate 0.05% ophthalmic suspension marked the first ophthalmic steroid approved in over 15 years. It is indicated specifically for post-operative inflammation and pain following ocular surgery, addressing a core indication in ocular pain management

- In February 2024, Lupin received FDA approval for a generic equivalent of BromSite (bromfenac ophthalmic solution 0.07%). Lupin’s ANDA for bromfenac ophthalmic solution 0.07% was approved, offering a lower-cost generic alternative to Bausch + Lomb’s PROLENSA, which is indicated for post-operative inflammation and ocular pain

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.