Global Oilfield Chemicals Market

Market Size in USD Billion

CAGR :

%

USD

25.21 Billion

USD

34.25 Billion

2021

2029

USD

25.21 Billion

USD

34.25 Billion

2021

2029

| 2022 –2029 | |

| USD 25.21 Billion | |

| USD 34.25 Billion | |

|

|

|

|

Oilfield Chemicals Market Analysis and Size

Oil and Natural Gas Corporation (ONGC) is estimated to invest USD 2.73 billion in drilling oil and gas wells in 2019, according to India Brand Equity Foundation (IBEF). The increased oil and gas exploration and developments in deep-water drilling operations will further boost demand for oilfield chemicals during the projection period 2023-2030. Therefore, the significant expansion in oil and gas exploration projects is expected to enhance the demand for oilfield chemicals.

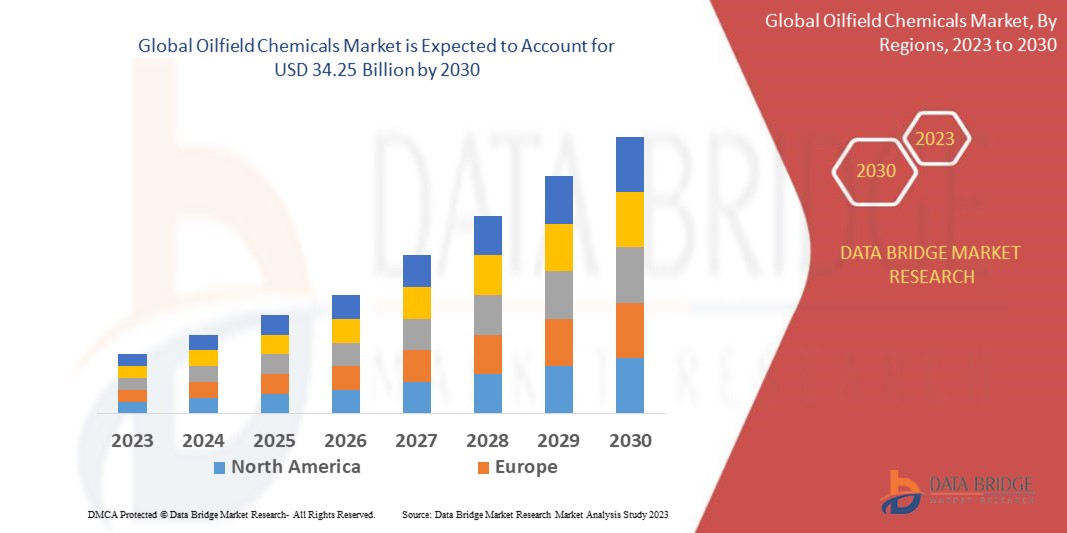

Data Bridge Market Research analyses that the global oilfield chemicals market which was USD 25.21 billion in 2022, is expected to reach USD 34.25 billion by 2030, and is expected to undergo a CAGR of 3.9% during the forecast period of 2023 to 2030. “Rheology Modifiers” dominates the type segment of the global oilfield chemicals market due to their crucial role in controlling fluid properties for enhanced oil and gas production and well performance. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Oilfield Chemicals Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2023 to 2030 |

|

Base Year |

2022 |

|

Historic Years |

2021 (Customizable to 2015-2020) |

|

Quantitative Units |

Revenue in USD Million, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Gellants and Viscosifiers, Biocides, Lubricants/Friction Reducers, Rheology Modifiers, Corrosion and Scale Inhibitors, Demulsifiers, Scavengers, Polymers, Fluid Loss Additives, Surfactants, Foamers, Pour Point Depressant, Others), Application (Upstream, Midstream, Downstream), Location (Onshore, Offshore) |

|

Countries Covered |

U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, and Rest of Middle East and Africa |

|

Market Players Covered |

BASF SE (Germany), Clariant (Switzerland), Dow. (U.S.), Halliburton (U.S.), Schlumberger Limited (U.S.), Nouryon (Netherlands), Baker Hughes Company (U.S.), Kemira (Finland), Huntsman International LLC (U.S.), Croda plc (U.K.), Albermarle Corporation (U.S.), Chevron Philips Chemical Company LLC (U.S.), Innospec (U.S.), NOV Inc., (U.S.), Geo (U.S.), KRATON CORPORATION(U.S.), Thermax Limited(India), Oleon N.V. (Belgium), Ashland (U.S.), PureChem Services (Canada), Stepan Company (U.S.), Elementis plc (U.S.) |

|

Market Opportunities |

|

Market Definition

Oilfield chemicals are certain chemical compounds used to improve the effectiveness and efficiency of operations associated in an oilfield site. These chemicals find their application under drilling, production, completion, and several other operations under these conditions. These chemicals are used in the purification of equipment, machines, oil itself and the oil sites.

Global Oilfield Chemicals Market Dynamics

Driver

- Surging Oil Production and Exploration

Oilfield chemicals are in high demand as oil production and exploration operations increase. Oilfield chemicals demand is predicted to rise further as shale oil and gas drilling and production expands and deep-water and ultra-deep-water drilling projects expand. Oil and Natural Gas Corporation (ONGC) is estimated to invest US$ 2.73 billion in drilling oil and gas wells in 2019, according to India Brand Equity Foundation (IBEF). Foreign investors are projected to have opportunities to engage in petroleum and natural gas projects worth USD 300 billion in India by 2022, as the country seeks to reduce its dependency on oil imports by 10%. As a result, the demand for oilfield chemicals is likely to rise as oil and gas exploration projects increase over the forecast period.

Opportunity

- Growing Strategies and Eco-Friendly Chemicals

Furthermore, key players in the market are focused on adopting strategies such as technological development and collaborations, extend profitable opportunities to the market players in the forecast period of 2023 to 2030. Additionally, the emergence of eco-friendly oilfield chemicals will further expand the future growth of the global oilfield chemicals market.

Restraint/Challenge

- Environmental Concerns

In order to process oil, gas, and water gathered from reservoirs, a number of chemicals are used. This treated water contains a number of chemicals that, when released, can harm vegetation and fauna. These environmental concerns are projected to restrain the worldwide global oilfield chemicals market during the forecast period 2023-2030. This factor is projected to impede the expansion of the oilfield chemicals industry.

This global oilfield chemicals market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, the impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the global oilfield chemicals market contact Data Bridge Market Research for an Analyst Brief, our team will help you make an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions. Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Development

- In June 2023, Aether Industries, a specialty chemical manufacturer, has signed a Letter of Intent (LoI) with a prominent US-based global oilfield services company to become a strategic supplier and contract manufacturing partner. This move is expected to bring significant growth to the oilfield chemicals market, as Aether will manufacture four essential products for the customer, with a substantial portion supplied to India's domestic oil and gas applications, aligning with the 'Make in India' initiative.

Global Oilfield Chemicals Market Scope

The global oilfield chemicals market is segmented on the basis of type, application and location. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Gellants and Viscosifiers

- Biocides

- Lubricants/Friction Reducers

- Rheology Modifiers

- Corrosion and Scale Inhibitors

- Demulsifiers

- Scavengers

- Polymers

- Fluid Loss Additives

- Surfactants

- Foamers

- Pour Point Depressant

- Others

Application

- Upstream

- Midstream

- Downstream

Location

- Onshore

- Offshore

Global Oilfield Chemicals Market Regional Analysis/Insights

The global oilfield chemicals market is analysed and market size insights and trends are provided by type, application and location as referenced above.

The countries covered in the global oilfield chemicals market report are U.S., Canada, Mexico, Brazil, Argentina, Rest of South America, Germany, France, Italy, U.K., Belgium, Spain, Russia, Turkey, Netherlands, Switzerland, Rest of Europe, Japan, China, India, South Korea, Australia, Singapore, Malaysia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific, U.A.E, Saudi Arabia, Egypt, South Africa, Israel, Rest of Middle East and Africa.

North America region is dominating the global oilfield chemicals market due to the rise in the workover and completion and production sector applications and rise in the usage and demand for shale gas from the various industry verticals within the region.

Asia-Pacific region had the highest growth rate in the global oilfield chemicals market due to the rise in the usage and demand for shale gas from the various industry verticals, increase in the levels of urbanization and population within the region.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends, and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, the impact of domestic tariffs, and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Global Oilfield Chemicals Market Share Analysis

The global oilfield chemicals market competitive landscape provides details by competitors. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width, and breadth, application dominance. The above data points provided are only related to the companies' focus related to the global oilfield chemicals market.

Some of the major players operating in the global oilfield chemicals market are:

- BASF SE (Germany)

- Clariant (Switzerland)

- Dow. (U.S.)

- Halliburton (U.S.)

- Schlumberger Limited (U.S.)

- Nouryon (Netherlands)

- Baker Hughes Company (U.S.)

- Kemira (Finland)

- Huntsman International LLC (U.S.)

- Croda plc (U.K.)

- Albermarle Corporation (U.S.)

- Chevron Philips Chemical Company LLC (U.S.)

- Innospec (U.S.)

- NOV Inc., (U.S.)

- Geo (U.S.)

- KRATON CORPORATION (U.S.)

- Thermax Limited (India)

- Oleon N.V. (Belgium)

- Ashland (U.S.)

- PureChem Services (Canada)

- Stepan Company (U.S.)

- Elementis plc (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oilfield Chemicals Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oilfield Chemicals Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oilfield Chemicals Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.