Global Oleoresin Market

Market Size in USD Billion

CAGR :

%

USD

1.89 Billion

USD

2.90 Billion

2024

2032

USD

1.89 Billion

USD

2.90 Billion

2024

2032

| 2025 –2032 | |

| USD 1.89 Billion | |

| USD 2.90 Billion | |

|

|

|

|

Oleoresin Market Size

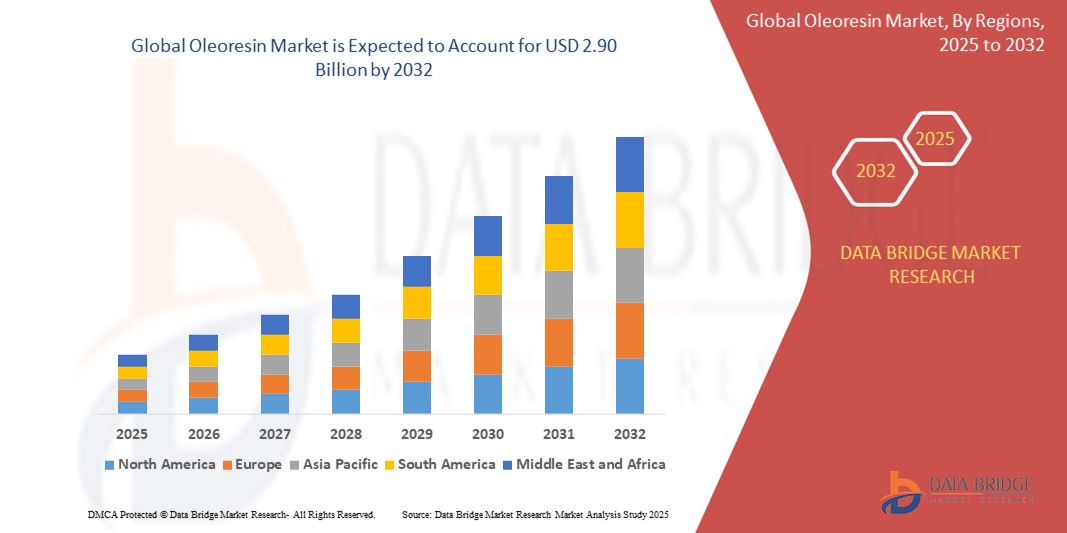

- The global oleoresin market size was valued at USD 1.89 billion in 2024 and is expected to reach USD 2.90 billion by 2032, at a CAGR of 5.45% during the forecast period

- The market growth is largely fuelled by the rising demand for natural ingredients, increasing application in the food and beverage industry, and a growing consumer preference for clean-label products

Oleoresin Market Analysis

- The oleoresin market is presently shaped by a broad global preference for natural, plant-derived ingredients across various consumer products

- This widespread demand is actively fostering advancements in extraction technologies and broadening the scope of applications for these concentrated spice extracts

- Asia-Pacific dominated the oleoresin market with the largest revenue share of 36.2% in 2024, driven by the abundant availability of raw materials, increasing spice exports, and growing food processing industries in countries such as India, China, and Indonesia

- North America region is expected to witness the highest growth rate in the global oleoresin market, driven by the increasing demand for natural food additives, growing health-conscious consumer base, and rising applications in nutraceuticals and personal care products

- The paprika segment dominated the market with the largest revenue share of 29.6% in 2024, driven by its widespread use as a natural coloring and flavoring agent in processed foods, snacks, and meat products. Its strong pigment concentration, heat stability, and clean-label appeal have made paprika oleoresin a top choice among food manufacturers seeking natural alternatives to synthetic additives

Report Scope and Oleoresin Market Segmentation

|

Attributes |

Oleoresin Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oleoresin Market Trends

“Rising Demand for Natural and Clean-Label Ingredients”

- Consumers are actively seeking products with transparent and simple ingredient lists, moving away from artificial additives

- For instance, many food and beverage companies are reformulating their products to remove synthetic colorants and flavors, replacing them with natural alternatives such as paprika oleoresin for vibrant hues or black pepper oleoresin for a spicy kick

- This preference for naturalness is driven by increased health consciousness and a desire for products perceived as safer and healthier

- Oleoresins provide a concentrated form of natural flavors and colors, making them efficient and effective replacements for their synthetic counterparts

- The clean-label movement encompasses not just food but also extends to personal care and pharmaceutical products, creating broader market opportunities

- Strict regulations concerning synthetic additives in certain markets also compel manufacturers to opt for natural ingredients, including oleoresins, to comply with food safety and quality standards

Oleoresin Market Dynamics

Driver

“Rising Demand for Natural Food Ingredients”

- Rising global health consciousness is driving both consumers and manufacturers to prefer natural, minimally processed food ingredients over synthetic additives, which supports the growing demand for oleoresins

- Oleoresins, being concentrated extracts of spices and herbs, provide a strong combination of flavor, color, and aroma while preserving the natural characteristics of the source, making them ideal for replacing artificial additives in foods, beverages, sauces, and ready meals

- They are also valued for their long shelf life, consistency in quality, and ability to enhance sensory appeal without compromising the nutritional value of products

- The popularity of ethnic and spicy cuisines, especially in Western countries, is fueling demand for spice-based oleoresins

- For instance, paprika and chili oleoresins are increasingly used in flavored snack coatings and seasonings

- The growing trend toward plant-based and organic food products is boosting the need for clean-label ingredients, encouraging food manufacturers to invest in R&D for oleoresin applications due to their versatility and compatibility with natural formulations

Restraint/Challenge

“Fluctuating Raw Material Prices and Supply Constraints”

- Volatility in raw material prices and irregular supply of spices and herbs presents a significant barrier to the oleoresin market’s growth

- Oleoresins are extracted from crops such as chili, paprika, turmeric, ginger, and pepper, which are grown in specific climatic regions and are highly sensitive to environmental conditions such as rainfall, temperature, and soil health

- Climate change, natural disasters, and pest outbreaks can lead to reduced yields and inconsistent crop quality, directly affecting raw material availability and driving price fluctuations

- For instance, erratic monsoons in India—one of the leading producers of turmeric and chili—have caused notable disruptions in spice supply, impacting oleoresin production and cost stability

- In addition, challenges such as geopolitical tensions, trade restrictions, and labor shortages further strain the supply chain, forcing producers to grapple with rising costs and delivery uncertainties, especially in industries that demand consistent quality and timely fulfillment

Oleoresin Market Scope

The market is segmented on the basis of source, application, extraction process, and raw material.

- By Source

On the basis of source, the oleoresin market is segmented into paprika, capsicum, seed spices, turmeric, herbs, ginger, cinnamon and cassia, and others. The paprika segment dominated the market with the largest revenue share of 29.6% in 2024, driven by its widespread use as a natural coloring and flavoring agent in processed foods, snacks, and meat products. Its strong pigment concentration, heat stability, and clean-label appeal have made paprika oleoresin a top choice among food manufacturers seeking natural alternatives to synthetic additives.

The turmeric segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by its growing recognition for anti-inflammatory and antioxidant properties. Increasing demand for functional foods, health supplements, and plant-based formulations is accelerating the use of turmeric oleoresin across multiple applications.

- By Application

On the basis of application, the oleoresin market is segmented into food and beverages, pharmaceuticals and nutraceuticals, personal care products, and feed. The food and beverages segment held the largest revenue share in 2024, owing to the rising demand for natural flavoring and coloring agents in sauces, seasonings, bakery, and dairy products. Manufacturers are increasingly using oleoresins for their superior sensory impact and stability.

The pharmaceuticals and nutraceuticals segment is expected to witness the fastest growth rate from 2025 to 2032, supported by the growing interest in botanical extracts for therapeutic, immunity-boosting, and preventive health purposes, particularly in herbal medicine and dietary supplements.

- By Extraction Process

On the basis of extraction process, the oleoresin market is segmented into solvent extraction and supercritical fluid extraction process. The solvent extraction segment captured the largest revenue share in 2024, due to its cost-effectiveness and ability to yield high concentrations of flavor and color compounds. It remains the most widely adopted method in commercial oleoresin production.

The supercritical fluid extraction process is expected to witness the fastest growth rate from 2025 to 2032, driven by its cleaner and eco-friendly attributes. The absence of toxic residues, precise extraction control, and enhanced purity of oleoresins make it increasingly attractive for high-end food, cosmetic, and pharmaceutical applications.

- By Raw Material

On the basis of raw material, the oleoresin market is segmented into leaves, seeds, flowers, roots, berries, and others. The seeds segment dominated the market in 2024 with the highest revenue share, owing to the large-scale extraction of oleoresins from cumin, coriander, and fennel, which are staples in global spice trade and flavoring industries.

The roots segment is expected to witness the fastest growth rate from 2025 to 2032, led by the rising use of ginger and turmeric root oleoresins in wellness, skincare, and functional nutrition sectors. Their bioactive compounds and health-promoting attributes are key contributors to growing demand.

Oleoresin Market Regional Analysis

- Asia-Pacific dominated the oleoresin market with the largest revenue share of 36.2% in 2024, driven by the abundant availability of raw materials, increasing spice exports, and growing food processing industries in countries such as India, China, and Indonesia

- Consumers and manufacturers in the region are increasingly adopting natural flavoring and coloring agents due to rising health awareness and demand for clean-label food product

- Government support for spice cultivation, along with the region's role as a key supplier of turmeric, paprika, ginger, and other spice-based raw materials, strengthens Asia-Pacific’s position as a leading hub in the oleoresin supply chain

China Oleoresin Market Insight

The China oleoresin market is expanding rapidly, driven by the growing demand for natural food additives, traditional medicine formulations, and herbal supplements. As consumer awareness of health and wellness rises, there is an increasing shift toward natural colorants and flavor enhancers derived from spices. China’s strong manufacturing infrastructure, combined with expanding food processing and nutraceutical sectors, supports robust market growth. In addition, the country’s push for sustainable agriculture and the domestic availability of key raw materials, such as chili and ginger, contribute to China’s rising prominence in the global oleoresin industry.

Japan Oleoresin Market Insight

The Japan oleoresin market is expected to witness the fastest growth rate from 2025 to 2032, supported by the country’s focus on clean-label products and premium food quality standards. Japanese consumers prefer natural and minimally processed ingredients, which drives the adoption of oleoresins in sauces, instant meals, and traditional seasonings. The country’s aging population is also boosting demand for functional foods and supplements containing turmeric and herbal oleoresins. Furthermore, advancements in food technology and interest in natural flavor solutions for packaged food products are likely to sustain growth in Japan’s oleoresin market.

Europe Oleoresin Market Insight

The Europe oleoresin market is expected to witness the fastest growth rate from 2025 to 2032, supported by strict food safety regulations and a growing demand for natural additives across food, cosmetics, and pharmaceutical sectors. Rising preference for plant-based and non-GMO ingredients is prompting manufacturers in countries such as Germany, France, and the Netherlands to substitute synthetic additives with oleoresins, especially in processed foods and herbal supplements.

Germany Oleoresin Market Insight

The Germany oleoresin market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing adoption of botanical extracts in the nutraceuticals and personal care industries. As a leading market for clean-label products, Germany continues to attract demand for oleoresins due to their natural origin and functional properties. Investment in sustainable sourcing and R&D innovations by local companies further support market expansion.

U.K. Oleoresin Market Insight

The U.K. oleoresin market is poised for notable growth during the forecast period, fueled by the increasing preference for plant-based ingredients across the food, pharmaceutical, and personal care sectors. Consumer demand for spice-infused ready-to-eat meals and herbal health products is rising. In addition, the market is benefiting from a strong presence of clean-label product manufacturers and growing imports of high-quality spice extracts. The country’s dynamic retail sector and rising interest in ethnic cuisines also contribute to the expanding use of oleoresins in flavor enhancement and natural preservation.

North America Oleoresin Market Insight

The North America oleoresin market is expected to witness the fastest growth rate from 2025 to 2032, driven by rising demand for natural ingredients in packaged foods, beverages, and pharmaceuticals. The U.S. and Canada are witnessing increased consumer interest in ethnic cuisines and herbal wellness trends, which are pushing manufacturers to use spice-derived oleoresins. Regulatory approvals and product innovation in natural food preservatives are also contributing to the market’s momentum.

U.S. Oleoresin Market Insight

The U.S. oleoresin market leads the North American region, supported by the food and beverage industry's shift toward natural flavoring and clean-label ingredients. The growth of the dietary supplements and functional food sectors further accelerates demand for turmeric, paprika, and capsicum oleoresins. Moreover, strong R&D capabilities and increasing preference for organic and non-synthetic additives are shaping market opportunities across diverse applications.

Oleoresin Market Share

The Oleoresin industry is primarily led by well-established companies, including:

- Akay Group Ltd. (Turkey)

- Synthite Industries Ltd. (India)

- AVT Naturals (India)

- PT. INDESSO AROMA (Indonesia)

- VidyaHerbs (India)

- Ungerer & Company (U.S.)

- KANCOR (India)

- Plant Lipids (India)

- Gazignaire (France)

- Universal Oleoresins (India)

- Hawkins Watts Limited (New Zealand)

- Ozone Naturals (India)

- TMV Aroma (India)

- MRT GREEN PRODUCTS (India)

- Naturite Agro Products Ltd. (India)

- Gurjar Phytochem Pvt. Ltd. (India)

- Ambe Phytoextracts Pvt. Ltd. (India)

- Paras Perfumers (India)

- Paprika Oleo's India Limited (India)

- Kalsec Inc. (U.S.)

Latest Developments in Global Oleoresin Market

- In August 2023, Divi's and Algalif collaborated to develop concentrated beadlets of sustainable natural astaxanthin, sourced from microalgae. This initiative aims to harness astaxanthin oleoresin through a naturally derived process, catering primarily to renewable energy sources. The collaboration underscores a commitment to sustainability in nutraceutical and pharmaceutical applications, leveraging natural ingredients for enhanced product offerings

- In July 2023, KLK OLEO launched Shade Vivid Orange-OS, a novel 100% oil-soluble, plant-based color derived from non-GMO paprika. This addition to their Exberry portfolio addresses the growing demand for clean-label ingredients, providing an alternative to artificial colors and paprika oleoresin across various applications. The innovation highlights KLK OLEO's commitment to meeting consumer preferences for natural and sustainable food color solutions

- In January 2022, Givaudan acquired a 48% stake in Nanovetores Group from The Criatec Fund, signaling a strategic move to strengthen its foothold in the beauty products market. This acquisition enhances Givaudan's capabilities in delivering innovative solutions for the cosmetics industry, leveraging Nanovetores' expertise in nanotechnology for active ingredients. The investment underscores Givaudan's strategy to expand its portfolio and technological capabilities in the rapidly evolving beauty and personal care sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oleoresin Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oleoresin Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oleoresin Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.