Global On Board Charger Market

Market Size in USD Billion

CAGR :

%

USD

7.39 Billion

USD

26.32 Billion

2024

2032

USD

7.39 Billion

USD

26.32 Billion

2024

2032

| 2025 –2032 | |

| USD 7.39 Billion | |

| USD 26.32 Billion | |

|

|

|

|

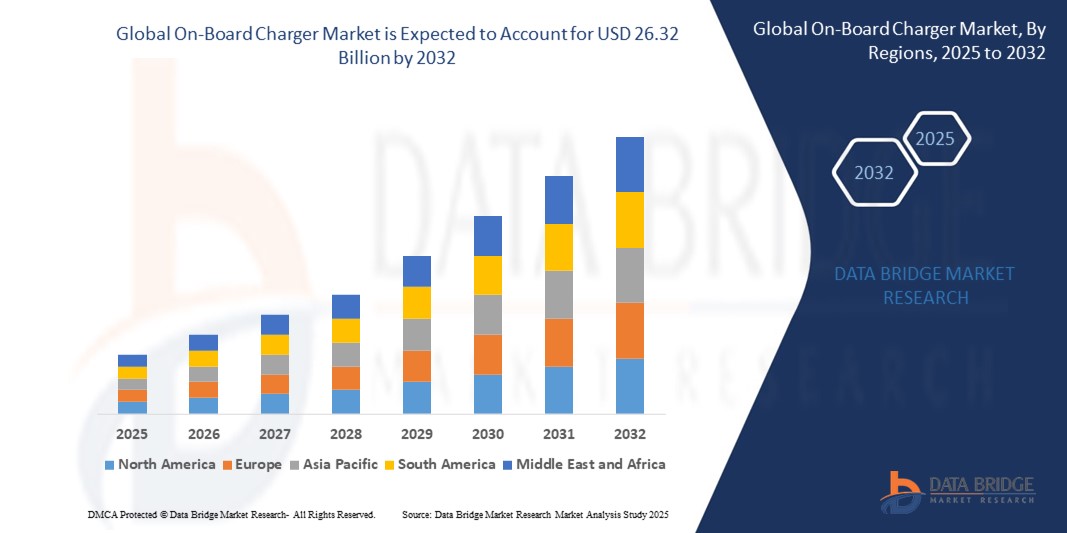

What is the Global On-Board Charger Market Size and Growth Rate?

- The global on-board charger market size was valued at USD 7.39 billion in 2024 and is expected to reach USD 26.32 billion by 2032, at a CAGR of 17.20% during the forecast period

- The on-board charger (OBC) market is evolving rapidly due to technological advancements aimed at improving electric vehicle (EV) performance and charging efficiency. One of the latest methods is bi-directional charging, which enables vehicles to both draw power from and return power to the grid, boosting overall energy efficiency and creating new opportunities in vehicle-to-grid (V2G) applications. Silicon carbide (SiC) technology is increasingly being adopted in OBCs, allowing for higher energy efficiency, compact design, and reduced thermal management needs

What are the Major Takeaways of On-Board Charger Market?

- Another advancement is the integration of fast-charging capabilities, which reduces charging time and enhances user convenience. This is particularly important for boosting EV adoption, as range anxiety remains a concern. Wireless on-board chargers are also being developed to offer even more seamless charging experiences, although they are in the early stages of market penetration

- The market is expected to see robust growth as EV sales rise and governments push for greener transportation solutions. The continuous advancement in charger efficiency and performance will be pivotal in supporting this growth trajectory

- North America dominated the on-board charger market with the largest revenue share of 36.01% in 2024, driven by rising electric vehicle (EV) adoption, robust charging infrastructure, and strong government incentives for clean mobility solutions

- Asia-Pacific is projected to grow at the fastest CAGR of 14.57% from 2025 to 2032, driven by a rising middle class, growing environmental awareness, and rapid electrification of transport in major economies such as China, India, and Japan

- The Less than 11 kW segment dominated the market with the largest revenue share of 58.9% in 2024, primarily due to its widespread use in residential charging and compatibility with most early and mid-range EV models

Report Scope and On-Board Charger Market Segmentation

|

Attributes |

On-Board Charger Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the On-Board Charger Market?

“AI-Driven Charging Intelligence and Vehicle-to-Grid Integration”

- A major trend redefining the on-board charger (OBC) market is the integration of artificial intelligence (AI) and Vehicle-to-Grid (V2G) technologies to enhance charging efficiency, predictive maintenance, and grid interactivity. AI is being embedded into on-board chargers systems to optimize charging behavior, adapt to user routines, and manage energy distribution in real-time

- For instance, Infineon Technologies and Delta Electronics are working on AI-enabled on-board chargers that adjust power delivery based on battery health, driving behavior, and ambient conditions, extending battery life and reducing energy waste

- V2G-compatible On-Board Chargers allow electric vehicles to consume and supply electricity back to the grid, creating bidirectional power flow. Companies such as Siemens and Hitachi are piloting smart OBC systems that use AI to regulate grid load balancing, especially during peak demand

- The fusion of AI and V2G in on-board chargers empowers both residential and commercial EV users to contribute to grid resilience while benefiting from dynamic energy pricing models and automated energy management

- As EV adoption accelerates, such intelligent and interactive charging solutions are expected to become a standard, particularly in smart cities and fleet electrification initiatives

- This trend is transforming the on-board chargers landscape from a passive power component to an active enabler of energy efficiency, grid stability, and predictive diagnostics

What are the Key Drivers of On-Board Charger Market?

- The surge in global EV sales, driven by environmental regulations and sustainability goals, is significantly boosting demand for advanced on-board chargers that support fast, safe, and efficient charging

- For instance, in January 2025, Toyota Industries Corporation announced a partnership with BRUSA Elektronik to develop compact high-power On-Board Chargers for next-gen EV platforms, targeting both passenger and commercial vehicles

- OBCs are increasingly essential for managing the AC to DC conversion required for EV battery charging, making them integral to the EV powertrain. Their ability to support multi-voltage platforms and interoperability with diverse power sources enhances EV flexibility and global market fit

- Government incentives, emission regulations, and infrastructure investments (such as the U.S. Bipartisan Infrastructure Law) are fueling the production of EVs and thus creating a scalable opportunity for on-board chargers manufacturers

- The shift toward high-power on-board chargers (11kW–22kW) to reduce charging time, combined with innovations in silicon carbide (SiC) and gallium nitride (GaN) semiconductors, is further propelling the market forward across both OEM and aftermarket segments

Which Factor is challenging the Growth of the On-Board Charger Market?

- A key challenge for the OBC market is the technological complexity and cost implications associated with high-performance charger development and integration. Advanced OBCs require expensive components, such as SiC-based power modules, which increase overall EV production costs

- For instance, while companies such as STMicroelectronics are developing cost-effective SiC MOSFETs for OBCs, the mass adoption of such technologies is constrained by their premium pricing and supply chain limitations

- In addition, thermal management of compact, high-wattage OBC units remains a technical bottleneck, especially in smaller EVs where space is limited. Poor thermal control can reduce charging efficiency and reliability

- The lack of global standardization in charging protocols, voltage requirements, and connector types also hinders OBC design universality. Manufacturers must customize OBCs for specific regional markets, complicating scalability and increasing time-to-market

- Addressing these challenges requires sustained R&D in modular and scalable OBC architectures, industry-wide collaboration on interoperability standards, and policies that support localization of component manufacturing to reduce dependency on high-cost imports

How is the On-Board Charger Market Segmented?

The market is segmented on the basis of power output, vehicle type, and propulsion type.

- By Power Output

On the basis of power output, the on-board charger market is segmented into Less than 11 kW, 11 kW to 22 kW, and More than 22 kW. The Less than 11 kW segment dominated the market with the largest revenue share of 58.9% in 2024, primarily due to its widespread use in residential charging and compatibility with most early and mid-range EV models. These chargers offer sufficient charging capacity for daily commuting and are cost-effective to install, making them ideal for home users and smaller commercial fleets.

The More than 22 kW segment is projected to witness the fastest growth from 2025 to 2032, driven by increasing demand for fast charging solutions in commercial and public charging infrastructure. This higher power range significantly reduces charging time, especially for larger vehicles such as buses, vans, and heavy-duty trucks.

- By Vehicle Type

On the basis of vehicle type, the on-board charger market is segmented into Passenger Car, Buses, Vans, Medium and Heavy Duty Vehicles, Boats, and Others. The Passenger Car segment held the largest market revenue share of 65.4% in 2024, supported by the surge in electric passenger vehicle sales worldwide and the integration of advanced charging components by OEMs. Increased consumer awareness, government incentives, and growing EV infrastructure also contribute to this segment’s dominance.

The Medium and Heavy Duty Vehicles segment is expected to witness the highest CAGR during the forecast period due to the electrification of logistics fleets and public transport systems, which require robust, high-capacity OBCs for efficient operation and minimal downtime.

- By Propulsion Type

On the basis of propulsion type, the on-board charger market is segmented into Battery Electric Vehicle (BEV) and Plug-in Hybrid Electric Vehicle (PHEV). The Battery Electric Vehicle (BEV) segment dominated the market with the largest revenue share of 71.2% in 2024, owing to the rising adoption of fully electric vehicles that rely solely on onboard chargers for energy replenishment. The transition away from internal combustion engines and increased investments in zero-emission transportation support the BEV segment's growth.

The Plug-in Hybrid Electric Vehicle (PHEV) segment is expected to witness the fastest growth from 2025 to 2032, fueled by consumer interest in dual-powered flexibility and longer driving ranges, especially in regions where charging infrastructure is still developing.

Which Region Holds the Largest Share of the On-Board Charger Market?

- North America dominated the on-board charger market with the largest revenue share of 36.01% in 2024, driven by rising electric vehicle (EV) adoption, robust charging infrastructure, and strong government incentives for clean mobility solutions

- The region benefits from early technological advancements, widespread consumer awareness, and aggressive investment by automakers and utilities in Level 2 and Level 3 charging capabilities

- Supportive federal policies such as the U.S. Inflation Reduction Act and Canada’s EV infrastructure plans continue to fuel demand, positioning On-Board Chargers as a core component of the e-mobility ecosystem

U.S. On-Board Charger Market Insight

The U.S. dominated North America’s revenue share in 2024, bolstered by the rapid expansion of EV charging stations, growing consumer preference for electric mobility, and strong presence of automotive OEMs and tech innovators. The country’s push for zero-emission transportation and tax credits for EV purchases have significantly boosted market uptake. Furthermore, home-based Level 2 charging installations are growing, reinforcing the demand for efficient on-board charging systems.

Europe On-Board Charger Market Insight

The Europe market is projected to grow steadily throughout the forecast period, led by ambitious CO₂ reduction targets and stringent emission regulations under the EU Green Deal. The surge in electric vehicle registrations, particularly in Germany, France, and the Netherlands, is driving the deployment of on-board charging units. Automakers are increasingly integrating bi-directional and higher kW OBCs to meet EU compliance and consumer expectations for faster charging and vehicle-to-grid (V2G) support.

U.K. On-Board Charger Market Insight

The U.K. on-board charger market is expected to grow at a notable CAGR, supported by the country’s 2035 ban on new internal combustion engine vehicles and national EV infrastructure plans. The rise in plug-in hybrid and fully electric car sales, along with incentives for residential charger installations, is accelerating OBC demand. British consumers are leaning toward intelligent charging technologies that ensure optimal performance and energy efficiency.

Germany On-Board Charger Market Insight

In Germany, the on-board charger market is expanding due to the country’s position as a leading automotive innovator and its push toward climate-neutral transportation. The availability of public-private EV infrastructure funding and automakers such as BMW, Volkswagen, and Mercedes-Benz ramping up EV production further support OBC adoption. Integration of advanced 11 kW and 22 kW OBCs in new EV models is also gaining momentum across residential and commercial segments.

Which Region is the Fastest Growing in the On-Board Charger Market?

Asia-Pacific is projected to grow at the fastest CAGR of 14.57% from 2025 to 2032, driven by a rising middle class, growing environmental awareness, and rapid electrification of transport in major economies such as China, India, and Japan. Strong government support, including subsidies for EV purchases and infrastructure expansion, is accelerating the adoption of on-board chargers. The region also benefits from domestic manufacturing capabilities and lower production costs, making advanced OBCs more accessible. Asia-Pacific’s role as a global EV production and export hub enhances its competitiveness in the global On-Board Charger market.

Japan On-Board Charger Market Insight

The Japan market is witnessing strong growth, underpinned by the country’s commitment to becoming carbon-neutral by 2050 and its leadership in EV innovation. Consumers are increasingly adopting high-efficiency charging systems in both urban and rural settings. Integration with renewable energy systems and support for V2H (Vehicle-to-Home) technologies is also enhancing the appeal of next-gen on-board chargers in the Japanese market.

China On-Board Charger Market Insight

China held the largest revenue share in Asia-Pacific in 2024, driven by the country’s dominance in EV manufacturing, aggressive electrification targets, and urban mobility reforms. The government’s new energy vehicle (NEV) incentives and expansion of nationwide charging networks are boosting the use of on-board chargers. Domestic giants such as BYD and NIO are equipping their vehicles with advanced OBCs, fueling both domestic consumption and export potential.

Which are the Top Companies in On-Board Charger Market?

The on-board charger industry is primarily led by well-established companies, including:

- BRUSA Elektronik (Switzerland)

- Bel Fuse Inc. (U.S.)

- Current Ways (U.S.)

- TOYOTA INDUSTRIES CORPORATION (Japan)

- innolectric AG (Switzerland)

- Eaton (U.S.)

- Cicero Design GmbH (Germany)

- Xepics Italia SRL (Italy)

- AVID Technology Limited (U.K.)

- Infineon Technologies AG (Germany)

- STMicroelectronics (Switzerland)

- Hangzhou Aodi Electronic Control Co., Ltd. (China)

- ABB (Switzerland)

- Delta Energy Systems (Taiwan)

- Siemens (Germany)

- HYUNDAI CORPORATION (South Korea)

- Toshiba Infrastructure Systems & Solutions Corporation (Japan)

- Hitachi, Ltd. (Japan)

- Ficosa Internacional SA (Spain)

What are the Recent Developments in Global On-Board Charger Market?

- In March 2024, VMAX selected Infineon Technologies AG’s CoolSiC hybrid discrete components, including the TRENCHSTOP 5 Fast-Switching IGBT and CoolSiC Schottky Diode, for its 6.6 kW on-board chargers. Infineon’s D²PAK package combines ultra-fast IGBTs with SiC diodes, optimizing performance and power density for VMAX’s next-generation OBC/DCDC chargers

- In November 2023, BorgWarner signed a deal with a major North American OEM to supply its bi-directional 800V onboard charger (OBC) for premium BEV platforms. Featuring silicon carbide (SiC) power switches, this technology boosts efficiency, power density, and safety, with production starting in January 2027

- In July 2023, Stellantis, in collaboration with Saft and the French National Center for Scientific Research, developed an electric vehicle charging solution that omits inverters and on-board chargers. This innovation reduces vehicle weight and improves efficiency, posing a challenge to the traditional on-board charger market by introducing alternative technologies

- In April 2022, Faraday Future Intelligent Electric Inc. partnered with Meta System to supply onboard power management modules for the FF 91 EV and upcoming FF 81 vehicles. Meta System’s charger offers 15.2 kW AC charging capability, enhancing the FF 91’s and FF 81’s charging performance and efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.