Global Online Clothing Rental Market

Market Size in USD Billion

CAGR :

%

USD

2.61 Billion

USD

39.93 Billion

2024

2032

USD

2.61 Billion

USD

39.93 Billion

2024

2032

| 2025 –2032 | |

| USD 2.61 Billion | |

| USD 39.93 Billion | |

|

|

|

|

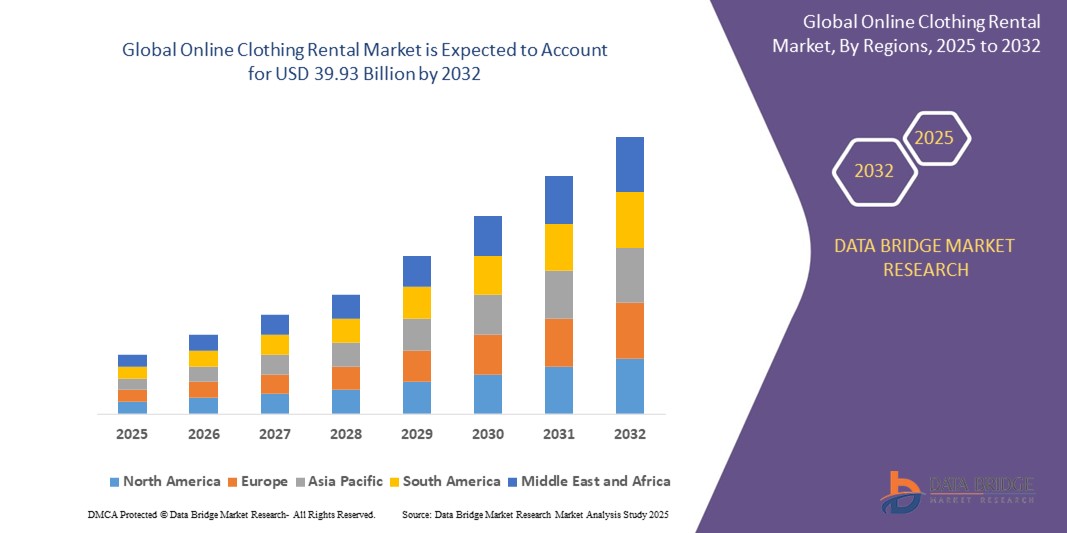

What is the Global Online Clothing Rental Market Size and Growth Rate?

- The global online clothing rental market size was valued at USD 2.61 billion in 2024 and is expected to reach USD 39.93 billion by 2032, at a CAGR of 40.60% during the forecast period

- The online clothing rental market flourishes due to convenience and sustainability, offering designer outfits without ownership constraints. This fosters a circular economy, reducing fashion waste while saving money and space for customers. Its benefits, including affordability, variety, and environmental responsibility, make it a favored choice for modern consumers, including men’s rental clothes

What are the Major Takeaways of Online Clothing Rental Market?

- Clothing rental offers budget-conscious consumers access to premium designer items at a fraction of their retail price. For instance, renting a designer dress for a special occasion might cost only a fraction of its retail price, allowing individuals to indulge in luxury fashion without breaking the bank

- This cost-effective solution enables shoppers to maintain a stylish wardrobe without the financial commitment of purchasing expensive garments outright

- North America dominated the global online clothing rental market in 2024, capturing the largest revenue share of 38.7%, driven by rising consumer focus on sustainable fashion, increasing popularity of shared economy models, and the rapid expansion of digital platforms offering rental services

- Asia-Pacific online clothing rental market is projected to grow at the fastest CAGR of 25.6% from 2025 to 2032, fueled by rapid urbanization, growing middle-class population, and rising fashion consciousness among younger demographics

- The Trousers and Jeans segment dominated the online clothing rental market with the largest revenue share of 27.4% in 2024, attributed to the high demand for versatile, everyday fashion options suitable for both casual and formal occasions

Report Scope and Online Clothing Rental Market Segmentation

|

Attributes |

Online Clothing Rental Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Online Clothing Rental Market?

“Rising Popularity of Affordable Fashion with Sustainability Focus”

- A major trend transforming the global online clothing rental market is the increasing consumer shift toward affordable fashion that aligns with environmental sustainability and conscious consumption

- Millennials and Gen Z consumers, in particular, are embracing rental fashion as a solution to reduce waste, lower carbon footprints, and combat the environmental impact of fast fashion

- Leading rental platforms are expanding their eco-friendly offerings by introducing circular business models, garment recycling partnerships, and subscription services promoting wardrobe variety without ownership

- For instance, several providers now offer curated rental collections made from organic fabrics, recycled materials, or sustainably sourced textiles, catering to both fashion needs and environmental awareness

- Global movements promoting circular fashion, waste reduction, and carbon neutrality are reinforcing the adoption of online clothing rentals as a practical alternative to traditional apparel purchases

- This sustainability-driven trend is expected to revolutionize how consumers access fashion, creating long-term opportunities for rental platforms focused on eco-conscious, affordable, and flexible wardrobe solutions

What are the Key Drivers of Online Clothing Rental Market?

- Growing demand for cost-effective, flexible, and sustainable fashion solutions is a primary driver of the online clothing rental market worldwide, as consumers increasingly seek variety without committing to ownership

- For instance, in February 2024, Rent the Runway announced an expansion of its designer rental collections, integrating more sustainable brands and offering inclusive sizing to meet diverse consumer preferences

- The rising influence of social media trends, influencer culture, and the desire for frequent wardrobe updates for events, travel, and daily wear are accelerating the adoption of clothing rental platforms globally

- Increasing awareness of fashion’s environmental impact, coupled with affordability concerns in the face of economic uncertainty, is propelling rental services as an alternative to fast fashion purchases

- Furthermore, digital advancements in AI-based sizing tools, personalized recommendations, and subscription models are enhancing user experience and retention, driving market growth

- The growth of e-commerce, urbanization, and consumer demand for convenience continues to expand the reach of online clothing rental platforms across metropolitan areas and younger demographics

Which Factor is challenging the Growth of the Online Clothing Rental Market?

- The logistical complexities and operational costs associated with inventory management, garment maintenance, and reverse logistics present significant challenges to the online clothing rental market

- For instance, high cleaning, repair, and transportation expenses can reduce profitability for rental platforms, especially for high-end or delicate garments that require careful handling

- In addition, concerns around hygiene, garment quality, and timely delivery may deter certain consumer segments, particularly in regions with limited infrastructure or lower digital penetration

- The market also faces competition from the growing resale (pre-owned clothing) market, offering consumers sustainable alternatives with full ownership at competitive prices

- Moreover, limited awareness and cultural barriers around renting fashion in certain developing regions restrict market expansion beyond urban, tech-savvy consumer groups

- Addressing these challenges will require strategic investments in advanced logistics, partnerships for eco-friendly garment care, consumer education, and scalable technology to ensure seamless, high-quality rental experiences

How is the Online Clothing Rental Market Segmented?

The market is segmented on the basis of product type, business model, consumer orientation, and end-user.

- By Product Type

On the basis of product type, the online clothing rental market is segmented into Knitwear, Trousers and Jeans, Jumpsuits, Suits and Blazers, Coats and Jackets, Skirt and Shorts, and Ethnic Wear. The Trousers and Jeans segment dominated the Online Clothing Rental market with the largest revenue share of 27.4% in 2024, attributed to the high demand for versatile, everyday fashion options suitable for both casual and formal occasions. Trousers and jeans rentals are popular among consumers seeking affordability and wardrobe flexibility without long-term ownership.

The Coats and Jackets segment is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing demand for premium outerwear rentals, particularly for seasonal needs, special events, and fashion-conscious urban consumers.

- By Business Model

On the basis of business model, the online clothing rental market is segmented into Standalone Model and Subscription Model. The Subscription Model segment accounted for the largest market revenue share of 61.8% in 2024, supported by growing consumer preference for flexible, cost-effective fashion access and curated wardrobe options. Subscription models allow users to rotate outfits regularly, enhancing variety and reducing the environmental impact of fast fashion.

The Standalone Model segment is anticipated to register the fastest CAGR from 2025 to 2032, fueled by rising demand for one-time rentals for events such as weddings, parties, and business functions, where consumers prioritize occasion-specific attire without the commitment of ongoing subscriptions.

- By Consumer Orientation

On the basis of consumer orientation, the online clothing rental market is segmented into Men, Women, and Kids. The Women segment dominated the market with the largest revenue share of 62.5% in 2024, driven by higher participation rates in fashion rentals, diverse product availability, and increasing focus on sustainability and wardrobe experimentation among female consumers.

The Men segment is projected to witness the fastest growth rate from 2025 to 2032, owing to the growing awareness of men’s fashion, the expansion of formalwear rental services, and the rising trend of sustainable, affordable wardrobe options for men in urban areas.

- By End-User

On the basis of end-user, the online clothing rental market is segmented into Business-to-Business (B2B), Business-to-Consumer (B2C), and Consumer-to-Consumer (C2C). The Business-to-Consumer (B2C) segment dominated the market with the largest revenue share of 69.4% in 2024, attributed to the rapid growth of rental platforms offering direct-to-consumer services, user-friendly mobile apps, and flexible rental terms catering to individual fashion needs.

The Consumer-to-Consumer (C2C) segment is anticipated to witness the fastest CAGR from 2025 to 2032, supported by the increasing popularity of peer-to-peer clothing rental platforms, which enable users to rent, lend, and monetize their personal wardrobes while promoting sustainable fashion consumption.

Which Region Holds the Largest Share of the Online Clothing Rental Market?

- North America dominated the global online clothing rental market in 2024, capturing the largest revenue share of 38.7%, driven by rising consumer focus on sustainable fashion, increasing popularity of shared economy models, and the rapid expansion of digital platforms offering rental services. The region's strong purchasing power and emphasis on affordability, convenience, and reducing fashion waste support widespread market adoption

- Countries such as the U.S. and Canada are leading, backed by well-established rental platforms, growing acceptance of subscription models, and heightened awareness around circular fashion and environmental impact

- In addition, evolving consumer preferences for flexible wardrobe options, event-specific clothing rentals, and high-end designer attire without ownership burdens continue to drive significant growth in the North American Online Clothing Rental market

U.S. Online Clothing Rental Market Insight

The U.S. online clothing rental market secured the largest revenue share within North America in 2024, attributed to the country’s tech-savvy consumer base, large urban population, and strong culture of convenience-driven fashion consumption. Leading platforms are offering a wide variety of product types, from formalwear to everyday fashion, supported by flexible rental plans, fast delivery, and easy returns. Growing environmental consciousness, coupled with demand for premium, occasion-based, and sustainable clothing, continues to boost market expansion across the U.S.

Canada Online Clothing Rental Market Insight

The Canada online clothing rental market is expected to grow steadily, supported by rising demand for affordable, high-quality fashion alternatives, increasing awareness around sustainability, and the growing adoption of shared economy platforms. Canadian consumers are embracing both subscription-based and one-time rental options for events, workwear, and casual fashion, driven by convenience, cost savings, and environmental benefits.

Which Region is the Fastest Growing Region in the Online Clothing Rental Market?

Asia-Pacific online clothing rental market is projected to grow at the fastest CAGR of 25.6% from 2025 to 2032, fueled by rapid urbanization, growing middle-class population, and rising fashion consciousness among younger demographics. Increasing internet penetration, expanding e-commerce platforms, and the growing influence of Western fashion trends are accelerating market growth across key countries such as China, India, and Japan. In addition, environmental concerns, affordability challenges, and growing acceptance of rental culture among millennials and Gen Z consumers are driving adoption across both casual and occasion-specific clothing rentals.

China Online Clothing Rental Market Insight

China led the Asia-Pacific online clothing rental market in 2024, supported by rising disposable incomes, a booming urban population, and the increasing popularity of fashion-sharing platforms. Chinese consumers are embracing the flexibility and sustainability of rental services, particularly for high-end, designer fashion and event-based attire. The integration of AI-driven personalization, seamless mobile apps, and eco-friendly practices is further boosting market expansion.

India Online Clothing Rental Market Insight

The India online clothing rental market is experiencing rapid growth, driven by a young, fashion-conscious population, increasing smartphone penetration, and rising environmental awareness. Affordable access to premium fashion for weddings, parties, and professional settings is fueling demand for both subscription and pay-per-use rental models. The market benefits from expanding startup ecosystems and growing acceptance of sustainable fashion alternatives among urban consumers.

Japan Online Clothing Rental Market Insight

The Japan online clothing rental market is witnessing steady growth, supported by the country’s minimalist fashion culture, demand for premium, high-quality clothing, and rising emphasis on sustainable consumption. Japanese consumers are increasingly opting for rental services to access seasonal fashion, formalwear, and luxury brands, with a growing preference for digital platforms offering convenience and curated wardrobe solutions.

Which are the Top Companies in Online Clothing Rental Market?

The online clothing rental industry is primarily led by well-established companies, including:

- Rent the Runway (U.S.)

- Omapal Technologies Private Limited (India)

- GlamCorner (Australia)

- UNION STATION KANSAS CITY (U.S.)

- Etiquette Formal Hire Ltd. (U.K.)

- Le Tote, Inc. (U.S.)

- Flyrobe (India)

- Chic by Choice (Portugal)

- La Reina (U.S.)

- STYLE LEND (U.S.)

- Gwynnie Bee Inc. (U.S.)

- AEO Management Co. (U.S.)

- Poshmark, Inc. (U.S.)

- Envoged (India)

- Secoo Holding (China)

- Share Wardrobe (U.S.)

What are the Recent Developments in Global Online Clothing Rental Market?

- In May 2023, ASOS, a British online fashion retailer, launches its inaugural rental collection, offering over 180 styles focused on women's occasion wear. The range includes attire for wedding guests, bridal wear, and bridesmaid dresses, catering to diverse body types with options in curve, petite, and tall sizes

- In April 2022, Flyrobe partners with Franchise Mart for franchise expansion under RENT IT BAE, an online premium rental service. This collaboration aims to bring the latest fashion trends directly to customers' doorsteps, enhancing convenience and accessibility to upscale fashion

- In December 2021, Flyrobe, a fashion rental business, surpasses 1.0 million customers amid its recovery from the pandemic. Currently operating in 30 Indian cities, the company's milestone underscores the resilience of the rental fashion industry and its enduring appeal to consumers seeking cost-effective style solutions

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.