Global Online Food Delivery Market

Market Size in USD Billion

CAGR :

%

USD

71.18 Billion

USD

262.18 Billion

2024

2032

USD

71.18 Billion

USD

262.18 Billion

2024

2032

| 2025 –2032 | |

| USD 71.18 Billion | |

| USD 262.18 Billion | |

|

|

|

|

What is the Global Online Food Delivery Market Size and Growth Rate?

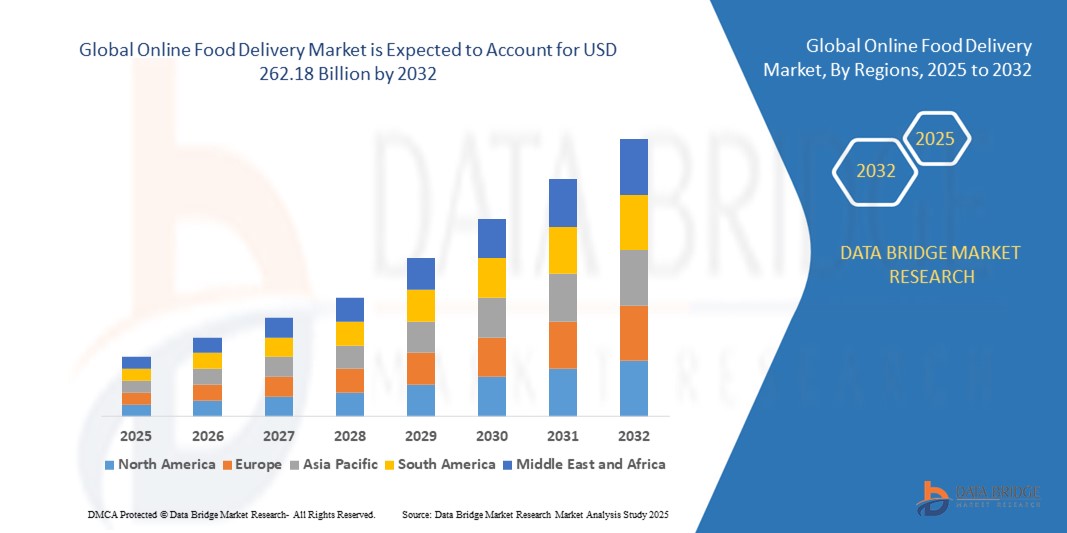

- The global online food delivery market size was valued at USD 71.18 billion in 2024 and is expected to reach USD 262.18 billion by 2032, at a CAGR of 17.70% during the forecast period

- The online food delivery market is rapidly expanding, driven by convenience, urbanization, and technology. Dominated by key players such as Uber Eats, DoorDash, and Deliveroo, it's characterized by fierce competition, aggressive marketing, and evolving consumer preferences

- The market is projected to continue growing globally, fueled by digitalization and changing lifestyles, with innovations such as drone delivery and meal subscription services shaping its future

What are the Major Takeaways of Online Food Delivery Market?

- Online food delivery platforms provide a hassle-free solution for busy individuals craving restaurant-quality meals without the hassle of cooking or leaving their homes. This unparalleled convenience fuels the steady growth of the global online food delivery market as more consumers opt for the ease and simplicity of ordering food with just a few taps on their smartphones

- The relentless march of technology continuously transforms the online food delivery landscape. From sophisticated AI algorithms powering personalized recommendations to seamless mobile apps offering intuitive user interfaces, technological advancements enhance every aspect of the customer experience. These innovations attract more users and improve retention rates, driving the expansion of online food delivery platforms worldwide

- North America dominated the online food delivery market with the largest revenue share of 37.91% in 2024, driven by the increasing penetration of smartphones, digital payment adoption, and the rising trend of convenience-based dining

- Asia-Pacific online food delivery market is poised to grow at the fastest CAGR of 8.2% during 2025–2032, driven by rising urbanization, young consumer demographics, and smartphone affordability in countries such as China, India, and Japan

- The Platform-to-Consumer segment dominated the online food delivery market with the largest market revenue share of 56.4% in 2024, driven by the widespread adoption of aggregator apps such as Uber Eats, Deliveroo, and Just Eat that provide consumers access to multiple restaurants through a single platform

Report Scope and Online Food Delivery Market Segmentation

|

Attributes |

Online Food Delivery Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Online Food Delivery Market?

Enhanced Convenience Through AI and Voice Integration

- A significant trend in the global online food delivery market is the integration of artificial intelligence (AI) and voice-controlled ecosystems such as Amazon Alexa, Google Assistant, and Apple Siri. These innovations are making ordering food faster, more personalized, and more convenient

- For instance, users can now place, track, or repeat food orders through voice commands, eliminating the need to manually browse apps. AI algorithms also analyze past orders, dietary preferences, and delivery timings to provide personalized recommendation

- In 2024, Domino’s Pizza partnered with Amazon Alexa to allow users to reorder their favorite meals via simple voice commands, while Uber Eats integrated AI-driven chatbots to streamline order tracking

- The seamless connection of food delivery platforms with smart home ecosystems allows customers to control orders alongside other daily tasks, strengthening the habit of app-based food ordering

- This trend is redefining customer expectations, pushing companies such as Grab Holdings and Delivery Hero to expand AI-driven personalization, predictive delivery times, and hands-free ordering systems

- As consumers increasingly prioritize speed, convenience, and automation, AI and voice integration will remain a central force shaping the future of the Online Food Delivery market

What are the Key Drivers of Online Food Delivery Market?

- The growing demand for convenience and time-saving solutions, especially among urban professionals, is driving the rapid adoption of online food delivery services

- For instance, in May 2024, DoorDash introduced an AI-powered recommendation engine that analyzes user habits and local restaurant data to improve food suggestions, boosting customer satisfaction

- Rising smartphone penetration and widespread internet access are enabling easy app-based ordering, while an expanding base of working professionals and students seeks quick meal solutions

- In addition, the popularity of digital payments and loyalty programs is encouraging repeat orders and greater customer engagement across platforms.

- The ability to access a wide variety of cuisines, compare prices, and schedule deliveries makes online platforms an attractive alternative to traditional dining

- With increasing partnerships between restaurants, cloud kitchens, and delivery platforms, the online food delivery market is positioned for sustained growth across both developed and emerging economies

Which Factor is Challenging the Growth of the Online Food Delivery Market?

- A major challenge in the online food delivery market is profitability and cost management. High competition among platforms, combined with the rising cost of delivery logistics, driver incentives, and discounts, often reduces margins

- For instance, in 2024, Just Eat Takeaway reported margin pressures due to increased rider costs and intense competition in the European market

- Consumer concerns about food quality, packaging, and late deliveries also impact customer retention, as negative experiences often lead to switching between platforms

- In addition, cybersecurity risks such as data breaches of payment information and user accounts create trust concerns among customers, particularly in developing regions

- The relatively high delivery charges compared to dining out or self-pickup further discourage price-sensitive consumers, limiting broader adoption

- Overcoming these challenges requires companies to optimize logistics through AI, invest in better packaging solutions, enhance data security, and introduce affordable subscription models that balance costs with customer expectations

How is the Online Food Delivery Market Segmented?

The market is segmented on the basis of type and payment method.

- By Type

On the basis of type, the online food delivery market is segmented into Restaurant-to-Consumer and Platform-to-Consumer. The Platform-to-Consumer segment dominated the online food delivery market with the largest market revenue share of 56.4% in 2024, driven by the widespread adoption of aggregator apps such as Uber Eats, Deliveroo, and Just Eat that provide consumers access to multiple restaurants through a single platform. This model appeals to customers due to convenience, variety, discounts, and loyalty programs. It also offers restaurants increased reach without investing heavily in their own delivery infrastructure.

The Restaurant-to-Consumer segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by the rapid digital transformation of traditional restaurant chains and the rise of in-house apps and websites. Leading players such as Domino’s Pizza and McDonald’s are investing in direct delivery systems to enhance brand loyalty, reduce aggregator commissions, and maintain customer data ownership.

- By Payment Method

On the basis of payment method, the online food delivery market is segmented into Cash on Delivery (COD) and Online Payments. The Online Payments segment held the largest market revenue share of 61.7% in 2024, driven by the rapid adoption of digital wallets, credit/debit cards, and UPI systems across developed and emerging markets. Increasing smartphone penetration, government initiatives promoting cashless economies, and the convenience of secure, instant transactions have significantly boosted this segment. Loyalty points, cashback offers, and one-click checkout options further enhance adoption.

The Cash on Delivery (COD) segment is expected to witness the fastest CAGR from 2025 to 2032, especially in emerging economies where trust in online payments is still evolving. COD remains a preferred choice for first-time users and regions with limited digital payment penetration. However, over time, COD’s share is expected to decline as digital literacy improves and consumers shift toward faster, contactless transactions.

Which Region Holds the Largest Share of the Online Food Delivery Market?

- North America dominated the online food delivery market with the largest revenue share of 37.91% in 2024, driven by the increasing penetration of smartphones, digital payment adoption, and the rising trend of convenience-based dining

- Consumers in the region highly value the time-saving, wide menu choices, and promotional discounts offered by online delivery platforms, making them a preferred option over traditional dine-in

- This widespread adoption is further supported by high disposable incomes, strong internet infrastructure, and growing partnerships with restaurants and cloud kitchens, positioning online food delivery services as a mainstream dining solution

U.S. Online Food Delivery Market Insight

U.S. online food delivery market captured the largest revenue share in 2024 within North America, fueled by the popularity of apps such as Uber Eats, DoorDash, and Grubhub. Consumers are increasingly prioritizing speed, multiple cuisine options, and subscription-based delivery services. The growing trend of contactless delivery, digital payment integration, and AI-driven recommendations further boosts the industry. Moreover, the expansion of virtual kitchens and partnerships with grocery delivery platforms is significantly contributing to market growth.

Europe Online Food Delivery Market Insight

Europe online food delivery market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by urbanization, busy lifestyles, and the shift towards digital platforms. Consumers in Europe are drawn to eco-friendly packaging, healthier menu options, and localized delivery platforms. The region is experiencing significant growth in residential, corporate, and student housing segments, with online delivery platforms becoming essential in both large metropolitan cities and mid-tier towns.

U.K. Online Food Delivery Market Insight

U.K. online food delivery market is anticipated to grow at a noteworthy CAGR during the forecast period, driven by high smartphone penetration, demand for convenience, and digital-first consumer behavior. Concerns about quick service and affordability are encouraging customers to choose online platforms. The U.K.’s robust e-commerce infrastructure, extensive restaurant partnerships, and growing cloud kitchen ecosystem are expected to continue to stimulate market growth.

Germany Online Food Delivery Market Insight

Germany online food delivery market is expected to expand at a considerable CAGR during the forecast period, fueled by rising digital adoption, preference for cashless payments, and the popularity of diverse cuisine options. Germany’s well-developed logistics infrastructure and emphasis on sustainability promote the adoption of eco-friendly food delivery solutions. The integration of online delivery platforms with loyalty programs and advanced tracking systems is also becoming increasingly prevalent.

Which Region is the Fastest Growing Region in the Online Food Delivery Market?

Asia-Pacific online food delivery market is poised to grow at the fastest CAGR of 8.2% during 2025–2032, driven by rising urbanization, young consumer demographics, and smartphone affordability in countries such as China, India, and Japan. The region’s growth is supported by government-led digitalization initiatives, expanding middle-class income levels, and increasing internet penetration, making online food delivery a mass-market service.

Japan Online Food Delivery Market Insight

Japan online food delivery market is gaining momentum due to its tech-savvy population, demand for convenience, and aging society. The market emphasizes timely service, integration with smart payment apps, and partnerships with convenience store chains. In addition, the growth of subscription-based meal services and collaboration with grocery delivery platforms is fueling expansion in both residential and corporate sectors.

China Online Food Delivery Market Insight

China online food delivery market accounted for the largest revenue share in Asia-Pacific in 2024, driven by the country’s massive urban population, digital-first consumer mindset, and dominance of platforms such as Meituan and Ele.me. With a strong push towards smart cities, AI-powered logistics, and drone deliveries, China stands as one of the most advanced online food delivery markets globally. The availability of affordable delivery services and aggressive promotional campaigns further propel adoption across urban and rural regions.

Which are the Top Companies in Online Food Delivery Market?

The online food delivery industry is primarily led by well-established companies, including:

- Delivery Hero SE (Germany)

- Grab Holdings Inc. (Singapore)

- Just Eat Holding Limited (U.K.)

- Demae-Can Co., Ltd (Japan)

- Uber Technologies Inc. (U.S.)

- Roofoods Ltd (Deliveroo) (U.K.)

- Yum! Brands Inc. (U.S.)

- Delivery.com, LLC (U.S.)

- Domino's Pizza, Inc. (U.S.)

What are the Recent Developments in Global Online Food Delivery Market?

- In April 2024, Uber Eats partnered with Waymo to introduce autonomous rides in Phoenix, and also launched deliveries through Waymo’s self-driving vehicles. The collaboration included select merchants such as Princess Pita, Filiberto’s, and Bosa Donuts. This move highlights Uber’s focus on leveraging autonomous technology to enhance delivery efficiency

- In April 2024, Zomato introduced a "large order fleet," an all-electric delivery system designed specifically to manage orders for groups or events of up to 50 people. This initiative reflects Zomato’s commitment to sustainability and catering to bulk-order customer needs

- In April 2024, DoorDash Inc. reported enabling over 180,000 orders using reusable packaging across its operations in countries where DoorDash and Wolt are active. The company is collaborating with DeliverZero in the United States to expand this number. This effort underscores DoorDash’s dedication to promoting eco-friendly practices in food delivery

- In October 2021, Uber Technologies Inc. acquired Drizly, initiating the integration of their complementary delivery apps and services. This acquisition strengthened Uber’s presence in the online food and beverage delivery space

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.