Global Online On Demand Home Services Market

Market Size in USD Billion

CAGR :

%

USD

4.35 Billion

USD

8.06 Billion

2024

2032

USD

4.35 Billion

USD

8.06 Billion

2024

2032

| 2025 –2032 | |

| USD 4.35 Billion | |

| USD 8.06 Billion | |

|

|

|

|

Online On-Demand Home Services Market Size

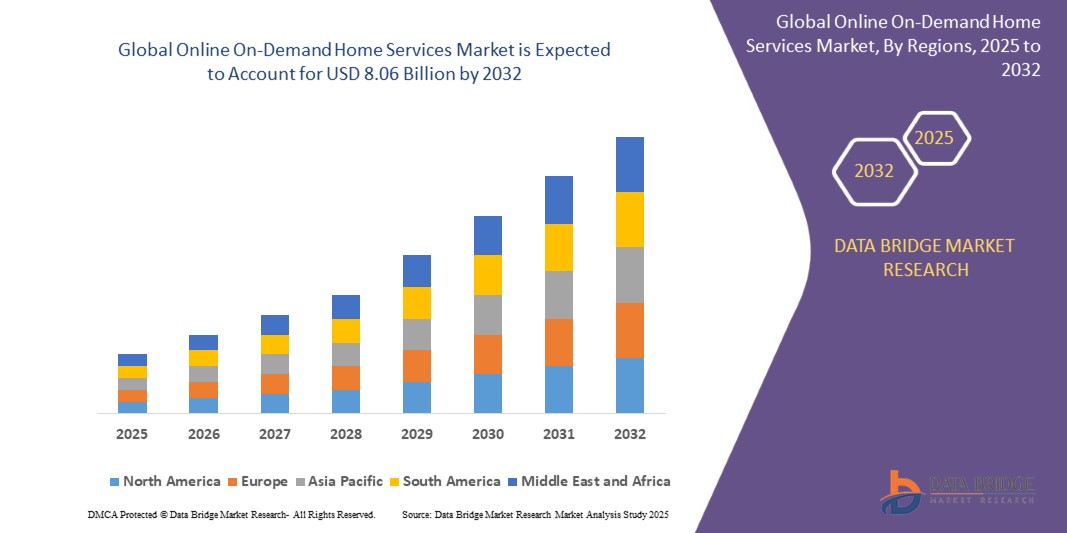

- The global online on-demand home services market was valued at USD 4.35 billion in 2024 and is expected to reach USD 8.06 billion by 2032

- During the forecast period of 2025 to 2032 the market is likely to grow at a CAGR of 8.00%, primarily driven by factors such as the expanding gig economy, rising urban population, and technological advancements in service delivery platforms

- The market is further fueled by increasing disposable incomes, changing lifestyles, and greater smartphone adoption, making on-demand services more accessible and desirable globally

Online On-Demand Home Services Market Analysis

- Online on-demand home services platforms are digital solutions that connect consumers with professional service providers for a wide range of household needs, including cleaning, plumbing, electrical repairs, beauty services, and appliance maintenance. These platforms are increasingly vital in today’s convenience-driven, digitally connected world

- The demand for online on-demand home services is being significantly driven by urbanization, busy lifestyles, and the increasing preference for contactless, at-home services. Additionally, millennials and Gen Z consumers, who are more tech-savvy, form a major user base for these services

- The Asia-Pacific region stands out as one of the fastest-growing markets for online on-demand home services, propelled by its large urban population, expanding middle class, and rising smartphone penetration

- For instance, platforms such as Urban Company in India and Helping in Southeast Asia have witnessed rapid growth due to increased consumer trust and digital payment adoption

- Globally, online on-demand home services are now considered a core segment within the broader gig economy, ranking just behind ride-sharing and food delivery in terms of user engagement and market size. These services play a pivotal role in shaping the future of work and consumer behavior in the home services sector

Report Scope and Online On-Demand Home Services Market Segmentation

|

Attributes |

Online On-Demand Home Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Online On-Demand Home Services Market Trends

“Rising Integration of AI, Automation, and IoT in Service Platforms”

- One prominent trend in the global online on-demand home services market is the increasing integration of artificial intelligence (AI), automation, and Internet of Things (IoT) into service platforms

- These technologies enhance operational efficiency, streamline service delivery, and provide users with a more personalized and seamless experience through intelligent matchmaking and real-time updates

- For instance, AI-driven platforms can automatically assign the most suitable service provider based on past performance, location, and customer preferences, reducing wait times and improving satisfaction

- IoT-enabled devices also support predictive maintenance and remote diagnostics, especially in appliance repair and home security services, allowing for proactive solutions and minimizing service disruptions

- This trend is transforming the traditional home services ecosystem, enabling greater scalability, improving customer retention, and fueling the demand for tech-driven solutions in both mature and emerging markets

Online On-Demand Home Services Market Dynamics

Driver

“Increasing Consumer Demand for Convenience and Time Savings”

- The growing demand for on-demand home services is largely driven by the increasing consumer preference for convenience, time savings, and ease of access to services

- Busy lifestyles, particularly among urban populations, have led consumers to seek services that can be easily booked and delivered without leaving the comfort of their homes

- This trend is particularly strong among millennials and Gen Z, who are more tech-savvy and accustomed to using mobile apps to manage daily tasks

- As people seek to optimize their time for work and leisure, on-demand home services that allow quick scheduling and real-time updates are in high demand

- The increasing adoption of smartphones and digital payment methods further drives this demand, making it easier for consumers to book and pay for services instantly

For instance,

- In 2023, a report from Statista highlighted that 42% of U.S. adults aged 18-34 used home services apps for tasks such as cleaning, repairs, and maintenance, further emphasizing the growing demand for convenience-driven solutions

- This shift towards online platforms is creating a booming market for home service providers, propelling the growth of the on-demand home services industry

Opportunity

“Growth Potential in Subscription-Based and Bundled Home Service Models”

- The online on-demand home services market is witnessing growing interest in subscription-based and bundled service models, offering customers convenience, cost-efficiency, and ongoing support for recurring household needs

- These models allow users to subscribe to regular services—such as weekly cleaning, monthly maintenance, or seasonal pest control—helping platforms build customer loyalty and create predictable revenue streams

- By offering customizable packages that combine multiple services (such as, cleaning + laundry + gardening), platforms can differentiate themselves in a competitive market and appeal to value-conscious consumers

For instance,

In late 2024, UrbanClap (now Urban Company) launched a “HomeCare Plus” subscription in select cities, allowing users to book bundled services with flexible scheduling and discounts, resulting in a 25% increase in repeat customer retention In early 2025, Handy expanded its monthly subscription offering in the U.S., reporting a 40% rise in active users opting for bundled service plans, especially among working professionals and families

- As consumers increasingly seek hassle-free, long-term service solutions, subscription and bundled models present a strong opportunity for platforms to boost customer lifetime value, reduce churn, and enhance user satisfaction through consistent, high-quality service delivery By capitalizing on these opportunities and leveraging technological advancements, businesses in the global online on-demand home services market have significant opportunities to scale and expand, meeting the evolving needs of modern consumers

Restraint/Challenge

“High operational costs Hindering Market Penetration”

- High operational costs associated with running online on-demand home services platforms pose a significant challenge, especially for new businesses and smaller service providers

- These platforms require investment in technology, infrastructure, marketing, and customer acquisition, which can be a substantial financial burden for startups and businesses with limited resources

- The cost of maintaining high service standards, ensuring a seamless user experience, and managing logistics can often be prohibitive, leading to profitability challenges for many businesses in the market

For instance,

- In December 2024, according to a report published by The Global Business Journal, one of the primary concerns surrounding the high operational costs in the online on-demand home services market is its potential to limit the ability of new businesses to enter the market and scale effectively. The initial financial burden associated with these platforms can restrict their growth and market reach, affecting overall competition and innovation

- As a result, these cost barriers can create inequalities in access to on-demand services, with larger companies benefiting from economies of scale while smaller players struggle to keep up, hindering the overall development and expansion of the market

Online On-Demand Home Services Market Scope

The market is segmented on the basis of platforms, services, and type

|

Segmentation |

Sub-Segmentation |

|

By Platforms |

|

|

By Services |

|

|

By Type |

|

Online On-Demand Home Services Market Regional Analysis

“North America is the Dominant Region in the Online On-Demand Home Services Market”

- North America leads the online on-demand home services market, driven by a high adoption of digital platforms, advanced technology infrastructure, and a well-developed e-commerce ecosystem

- The U.S. holds a significant share of the market, fueled by strong consumer demand for convenience, rising disposable incomes, and an increasing preference for outsourcing household tasks

- The presence of major market players and platforms further strengthens the market, with large investments in technology, service innovation, and customer acquisition strategies

- Additionally, the growing trend of remote work, busy lifestyles, and increased focus on home improvement services are propelling market expansion across the region

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is expected to witness the highest growth rate in the online on-demand home services market, driven by rapid urbanization, increasing smartphone penetration, and a rise in internet usage

- Countries such as China, India, and Japan are emerging as key markets, with a large population base, growing disposable incomes, and changing consumer behavior towards on-demand services

- Japan, with its technologically advanced infrastructure and high demand for quality services, remains a crucial market for online platforms offering home services. The adoption of these platforms is growing as consumers seek convenient solutions for household tasks

- China and India, with their vast population and rising urbanization, are witnessing an increase in demand for home services across various sectors, including cleaning, maintenance, and personal care. Government initiatives and investments in digital services are further driving market growth in these countries

Online On-Demand Home Services Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Taskrabbit (U.S.)

- Helpling (Germany)

- Angi (U.S.)

- Thumbtack (U.S.)

- Handy Technologies (U.S.)

- UrbanClap (Urban Company) (India)

- HomeAdvisor (U.S.)

- Handy (U.S.)

- Zaarly (U.S.)

- Takl (U.S.)

- Homejoy (U.S.)

- Cleanify (U.S.)

- Tidy (U.S.)

- GoShare (U.S.)

- Lugg (U.S.)

- Bellhops (U.S.)

- Moverbase (U.S.)

- Dolly (U.S.)

- GoPuff (U.S.)

- Mr. Right (India)

Latest Developments in Global Online On-Demand Home Services Market

- In January 2025, LawnPRO Partners, a platform specializing in residential lawn care treatments, as well as tree, shrub, and pest control services, backed by HCI Equity Partners, announced the acquisition of Green Image Lawn Care. This marks LawnPRO's tenth acquisition as part of its rapid expansion strategy. While the financial details of the transaction were not disclosed, Green Image, headquartered in York and Lancaster, PA, provides a wide range of services, including lawn care, fertilization, soil testing, tree and shrub care, and flea, tick, and mosquito control for both residential and commercial clients. This acquisition reflects a broader trend in the global Online On-Demand Home Services Market, where platforms are increasingly consolidating through strategic acquisitions to strengthen their market position and diversify service offerings

- In October 2023, Yelp announced a USD 40 million investment to expand its home-services division, which includes professionals such as electricians, plumbers, and movers. This strategic initiative is designed to capitalize on the sustained demand for home services, which now represents approximately 60% of Yelp's revenue, while also addressing the decline in advertising spend from the restaurant sector. This initiative aligns with the broader trends in the global Online On-Demand Home Services Market, where companies are investing heavily to meet the increasing consumer demand for convenient, high-quality home services

- In August 2023, ServiceTitan Inc., a software company catering to the building trade, launched its initial public offering (IPO) at $101 per share. The stock surged by as much as 42% from its initial offering price, raising over $625 million in the process. This performance reflects a larger trend seen in the global Online On-Demand Home Services Market, where companies are increasingly attracting investor interest due to the growing demand for digital platforms offering home-related service

- In August 2021, Microsoft Corporation formed a strategic partnership with Aera Technology, a provider of digital automation solutions. This collaboration combines Microsoft Azure with Aera's cognitive operating system, enabling the integration of digital twin capabilities. These capabilities allow for virtual representations of real-world objects within automated processes, enhancing operational efficiency and decision-making. This partnership aligns with broader technological trends, including advancements in the global online on-demand home services market, where companies are increasingly adopting digital technologies to improve product development, customer experience, and supply chain management

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.