Global Opacifiers Market

Market Size in USD Billion

CAGR :

%

USD

21.96 Billion

USD

36.07 Billion

2024

2032

USD

21.96 Billion

USD

36.07 Billion

2024

2032

| 2025 –2032 | |

| USD 21.96 Billion | |

| USD 36.07 Billion | |

|

|

|

|

Opacifiers Market Size

-

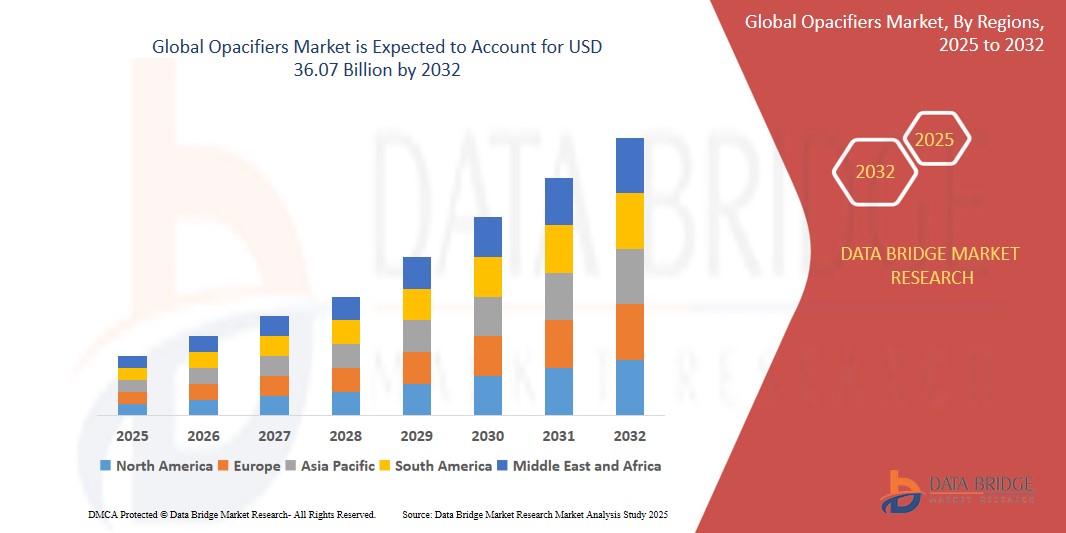

The global Opacifiers market size was valued at USD 21.96 billion in 2024 and is expected to reach USD 36.07 billion by 2032, at a CAGR of 6.4% during the forecast period

-

The market growth is largely fueled by the increasing adoption of advanced formulations in paints, coatings, and personal care products, as well as ongoing technological advancements in material sciences

- Furthermore, the rising demand for high-performance, aesthetically appealing, and environmentally sustainable solutions across various industries—including construction, automotive, and cosmetics—is propelling the need for efficient opacifying agents. These converging factors are accelerating the uptake of Opacifiers solutions, thereby significantly boosting the industry's growth

Opacifiers Market Analysis

- Opacifiers, which are substances added to products to render them opaque and improve their visual appeal, functionality, and coverage, are becoming increasingly critical across industries such as paints & coatings, plastics, ceramics, personal care, and paper. Their role in enhancing product performance and consumer appeal makes them essential components in both industrial and consumer applications.

- The growing demand for visually appealing and high-performance products—especially in sectors like construction, automotive, packaging, and cosmetics—is significantly driving the adoption of opacifiers. Additionally, sustainability concerns and the need for eco-friendly formulations are pushing manufacturers to develop advanced, non-toxic, and efficient opacifying agents.

- North America dominates the Opacifiers market with the largest revenue share of 38.2% in 2025, fueled by early adoption of advanced materials, robust industrial infrastructure, and the presence of leading manufacturers and R&D centers. The U.S., in particular, is witnessing strong growth in the use of opacifiers in the personal care and construction sectors, driven by consumer preferences and innovation in product formulations.

- Asia-Pacific is expected to be the fastest growing region in the Opacifiers market during the forecast period, driven by rapid urbanization, growing construction activities, and rising disposable incomes. Emerging economies like China and India are leading this growth due to increasing demand for consumer goods, cosmetics, and infrastructure development.

- The Titanium Dioxide (TiO₂) segment is expected to dominate the Opacifiers market with a market share of 47.81% in 2025, owing to its superior opacity, brightness, and widespread use across paints, coatings, plastics, and personal care products. Its versatility and high refractive index make it the preferred choice for manufacturers globally

Report Scope and Opacifiers Market Segmentation

|

Attributes |

Opacifiers Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Opacifiers Market Trends

“Sustainability and Regulatory Compliance Driving Product Innovation”

- A significant and accelerating trend in the global Opacifiers market is the growing emphasis on sustainability, environmental compliance, and the transition toward eco-friendly opacifying agents. Stricter regulations across regions like Europe and North America are pushing manufacturers to develop formulations with lower environmental impact, reduced VOC content, and improved biodegradability.

- For instance, companies such as Evonik Industries AG and Croda International Plc are innovating with bio-based and naturally derived opacifiers for applications in personal care and coatings, aligning with rising consumer awareness about health and environmental impacts.

- The European Union’s restrictions on certain grades of Titanium Dioxide (TiO₂) in food and cosmetic products have triggered a market-wide shift toward alternative opacifying materials, including zinc oxide, calcium carbonate, and synthetic polymers. This shift is reshaping R&D priorities and driving the diversification of raw material portfolios.

- Additionally, brands operating in the cosmetics and home care industries are seeking clean-label, non-toxic opacifiers to meet consumer expectations and regulatory frameworks such as REACH and EPA Safer Choice. This demand is compelling chemical manufacturers to adopt green chemistry principles in both product design and manufacturing processes.

- The integration of sustainability certifications and life-cycle analysis (LCA) is becoming standard practice, with companies differentiating their products through eco-labels and carbon footprint transparency.

- This trend toward environmentally conscious innovation is fundamentally transforming the Opacifiers market, positioning sustainability not just as a compliance requirement but as a major driver of competitive advantage and long-term growth.

Opacifiers Market Dynamics

Driver

“Growing Demand Across End-Use Industries Due to Aesthetic and Functional Requirements”

- The increasing need for enhanced visual appeal, product coverage, and opacity performance across a variety of industries—including paints & coatings, plastics, ceramics, personal care, and paper—is a major driver fueling the demand for opacifiers globally.

- For instance, in March 2024, Tronox Holdings plc announced capacity expansion for its Titanium Dioxide (TiO₂) production to meet rising demand in the paints and plastics industries, especially in fast-developing regions such as Asia-Pacific. These strategic moves by key players are expected to support overall market growth.

- As consumer expectations for high-performance and premium-quality products grow, manufacturers are incorporating opacifiers to enhance not only the look and feel but also the durability and protective characteristics of final goods. This is especially critical in sectors such as automotive coatings, construction materials, and personal care formulations.

- Furthermore, the construction boom in emerging economies, paired with rising urbanization, is increasing the use of decorative and functional coatings, driving demand for high-opacity solutions that offer UV resistance, chemical stability, and color retention.

- The role of opacifiers in cost optimization—by reducing the amount of pigment or resin required in formulations—also contributes to their increasing adoption in industrial applications.

- This multifaceted demand across industries, driven by both functional utility and aesthetic enhancement, is a strong force propelling the global Opacifiers market forward.

Restraint/Challenge

“Regulatory Challenges and Health Concerns Surrounding Key Raw Materials”

- Stringent environmental and health regulations regarding the use of certain opacifying agents—particularly Titanium Dioxide (TiO₂)—pose significant challenges to the global Opacifiers market. Regulatory bodies in regions such as the European Union have raised concerns over the potential carcinogenic effects of inhaling TiO₂ particles in powdered form, leading to stricter labeling requirements and usage restrictions.

- For instance, in 2022, the European Commission classified TiO₂ as a Category 2 carcinogen by inhalation, prompting several industries to explore alternative materials. This has created uncertainty and additional compliance costs for manufacturers dependent on TiO₂-based opacifiers.

- Navigating these regulations requires continuous investment in research and reformulation, increasing operational costs and delaying product development timelines. Companies are compelled to invest in toxicological studies, new material sourcing, and safer manufacturing practices to meet evolving global standards.

- Additionally, the limited availability and price volatility of raw materials such as TiO₂ and zinc oxide—exacerbated by geopolitical tensions and supply chain disruptions—add further constraints to market growth, particularly for small and mid-sized manufacturers.

- While the industry is gradually transitioning toward sustainable and safer alternatives, the current dependence on traditional opacifiers and the complexity of switching to new formulations remain significant barriers.

- Overcoming these challenges will require robust regulatory strategies, diversification of raw material supply, and greater innovation in non-toxic, eco-friendly opacifying technologies to ensure long-term market stability and growth.

Opacifiers Market Scope

The market is segmented on the basis of type, and application.

- By Type

On the basis of type, the Opacifiers market is segmented into Titanium Dioxide, Opaque Polymers, Zircon, Zinc Oxide, Cerium Oxide, Antimony Trioxide, Tin Oxide, and Arsenic Trioxide. Titanium Dioxide (TiO₂) dominates the largest market revenue share of 47.81% in 2025, owing to its superior opacity, brightness, and high refractive index. Widely used across industries such as paints and coatings, plastics, and personal care, TiO₂ remains the most preferred opacifying agent due to its cost-effectiveness and performance. Despite growing regulatory concerns, its unmatched properties continue to drive demand.

The Opaque Polymers segment is anticipated to witness the fastest growth rate of 8.9% from 2025 to 2032, driven by their increasing use as a TiO₂ alternative in cost-sensitive applications. Opaque polymers are gaining popularity in water-based paints, paper coatings, and personal care formulations for offering similar opacity at reduced pigment levels, aligning with sustainability and economic considerations.

- By Application

On the basis of application, the Opacifiers market is segmented into Paint and Coatings, Plastics, Ceramics, Paper, Inks, Fibres, Personal Care, Home Care, Glass, and Others. The Paint and Coatings segment held the largest market revenue share in 2025, due to the extensive use of opacifiers like Titanium Dioxide for providing whiteness, hiding power, and durability to architectural and industrial coatings. The rising construction activity and growing automotive production are major drivers of this segment.

The Personal Care segment is expected to witness the fastest CAGR from 2025 to 2032, fueled by rising demand for high-quality cosmetic and hygiene products with enhanced visual appeal and texture. Opacifiers are increasingly used in shampoos, lotions, creams, and toothpaste to improve product aesthetics and formulation consistency, especially in premium and natural personal care lines.

Opacifiers Market Regional Analysis

- North America dominates the Opacifiers market with the largest revenue share of 38.2% in 2024, driven by robust demand from the paints & coatings, plastics, and personal care sectors, alongside increased infrastructure development and renovation activities.

- The region benefits from advanced manufacturing capabilities, strong R&D investment, and the presence of major industry players producing high-performance opacifying agents such as titanium dioxide and opaque polymers.

- Environmental awareness and regulatory compliance regarding sustainable formulations are also pushing innovation in the development of eco-friendly opacifiers.

U.S. Opacifiers Market Insight

The U.S. Opacifiers market captured the largest revenue share of over 80% within North America in 2025, supported by the country’s dominant construction and automotive industries—key consumers of paints, plastics, and ceramics. Growth in the personal care segment also contributes significantly, with major cosmetics and hygiene product manufacturers relying on TiO₂ and opaque polymers to enhance product aesthetics. Additionally, favorable EPA guidelines for specific opacifying formulations promote cleaner production and sustainable practices, further driving market maturity in the U.S..

Europe Opacifiers Market Insight

The European Opacifiers market is projected to grow steadily throughout the forecast period, propelled by strict environmental regulations (such as REACH), growing demand for non-toxic and sustainable materials, and increasing use of opacifiers in ceramics, packaging, and cosmetic formulations. Rising renovation activity and adoption of high-quality coatings in construction are key drivers across the region. bSustainable innovation is a strong regional trend, especially in Germany, France, and the Nordic countries, where eco-friendly alternatives to titanium dioxide are gaining traction.

U.K. Opacifiers Market Insight

The U.K. market is expected to grow at a notable CAGR, driven by rising demand for personal care and home care products, as well as the ongoing need for durable, high-performance paints and coatings in infrastructure and housing projects. Growing concern over TiO₂ classification has also led manufacturers to seek alternative formulations, fostering R&D activity.

Germany Opacifiers Market Insight

Germany’s Opacifiers market is poised for strong growth, backed by the country’s leadership in high-end manufacturing, automotive, and industrial coatings. Environmental consciousness and innovation in material science support a shift toward bio-based and safer opacifiers, enhancing Germany’s influence on regional trends.

Asia-Pacific Opacifiers Market Insight

The Asia-Pacific Opacifiers market is projected to grow at the fastest CAGR of over 25% in 2025, driven by rapid industrialization, expanding middle-class consumer base, and increasing urban infrastructure projects in countries such as China, India, and Southeast Asian nations. The region is also a major hub for TiO₂ production, benefiting from lower raw material and labor costs, making it attractive for both production and consumption. Strong growth in packaging, cosmetics, and construction materials further supports demand.

Japan Opacifiers Market Insight

Japan's Opacifiers market is experiencing growth due to rising demand for high-quality, functional coatings and personal care products. Japanese consumers place emphasis on product quality, safety, and aesthetics, which drives the adoption of premium-grade opacifiers in domestic manufacturing.

China Opacifiers Market Insight

China accounted for the largest revenue share in Asia-Pacific in 2025, driven by massive consumption across paints & coatings, paper, ceramics, and plastic industries. Strong domestic manufacturing capacity, government-backed urban development, and the expansion of smart city projects fuel demand for construction materials requiring high-performance opacifiers. Additionally, Chinese manufacturers are increasingly focusing on expanding TiO₂ production capacity, securing the country’s leadership in both domestic and export markets.

Opacifiers Market Share

The Opacifiers industry is primarily led by well-established companies, including:

- DuPont (U.S.)

- Arkema (France)

- Ashland (U.S.)

- TAYCA (Japan)

- The Chemours Company (U.S.)

- Tronox Holdings plc (U.S.)

- KRONOS Worldwide, Inc. (U.S.)

- Alkane Resources Ltd (Australia)

- HANKUCK LATICES Co., Ltd. (South Korea)

- Organik Kimya (Turkey)

- Croda International Plc (U.K.)

- Evonik Industries AG (Germany)

- CINKARNA Celje d.d. (Slovenia)

- Lomon Billions (China)

- ISHIHARA SANGYO KAISHA, LTD. (Japan)

- Grupa Azoty (Poland)

- Precheza (Czech Republic)

- Argex Titanium Inc. (Canada)

- Cera-Chem Pvt. Ltd. (India)

- Greentech Industries (India) Private Limited (India)

Latest Developments in Global Opacifiers Market

- In 2024, Clariant, a leading specialty chemicals company, launched Planta Sens OP 95, a new opacifier derived from natural sources and designed for easy biodegradability. This innovation caters to the growing demand for eco-friendly alternatives in personal care and cosmetic formulations, aligning with global sustainability trends

- In late 2024, VTT Technical Research Centre of Finland, in partnership with industry leaders, initiated the CELLIGHT project to develop cellulose-based opacifiers as sustainable replacements for titanium dioxide (TiO₂). This initiative aims to reduce CO₂ emissions by approximately 31–50 million tons annually, addressing both environmental concerns and regulatory pressures

- In November 2023, the Miracare brand introduced a natural and biodegradable opacifier which can be used in use in laundry and other home care applications

- In April 2023, Dow and Avery Dennison collaborated to develop an innovative hotmelt label adhesive solution that facilitates the mechanical recycling of polyolefin filmic labels and polypropylene (PP) or polyethylene (PE) packaging in a single stream. This pioneering olefinic hotmelt adhesive, the first of its kind in the label market, is specifically designed for chilled food applications and has received approval from Recyclass for recycling in the HDPE colored stream in European markets

- In June 2022, Clariant introduced a natural-derived, readily biodegradable opacifier, Plantasens OP 95, to support personal care formulators in minimizing the environmental impact of shampoos, conditioners, handwashes, and other rinse-off shower and bath products on marine and river life

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Opacifiers Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Opacifiers Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Opacifiers Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.