Optically Clear Adhesive Market Analysis and Size

The primary end-user in the optically clear adhesive market is the electronics industry. Optically clear adhesive (OCA) is primarily used in display and touchscreen applications. Applications are expected to improve as mobile devices, televisions, tablets, phones, and laptops transition to touch screens.

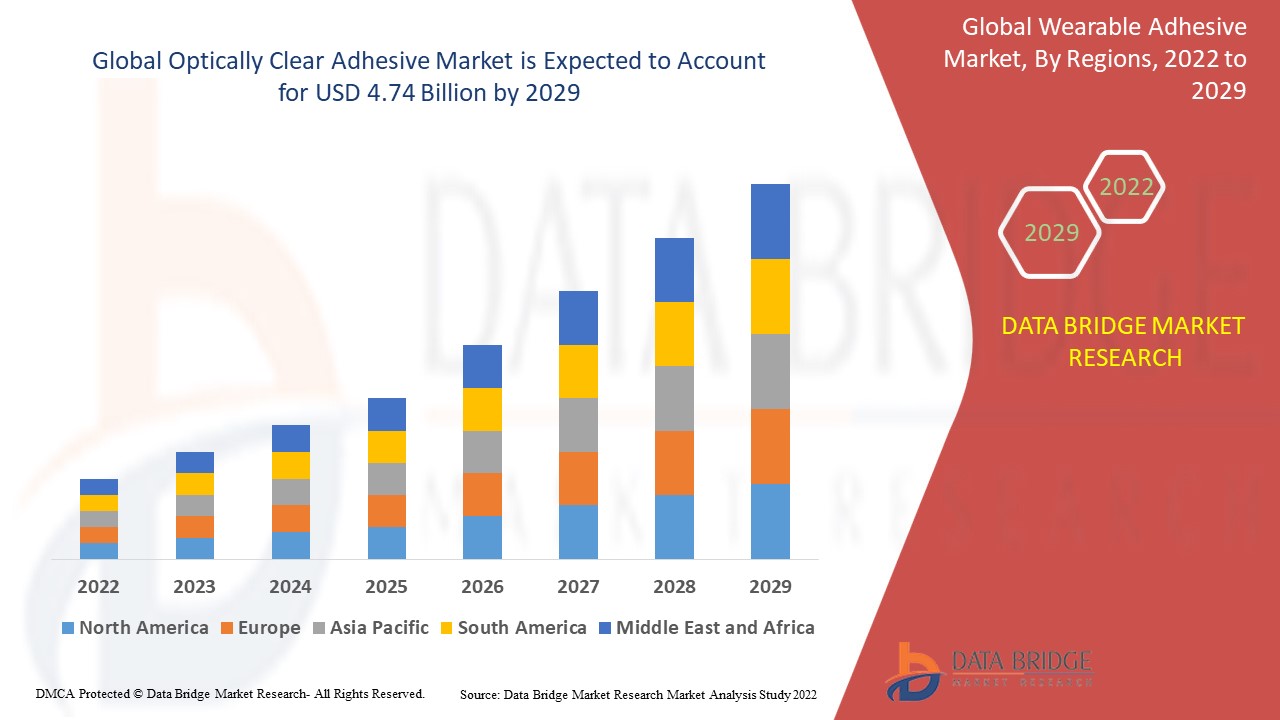

Data Bridge Market Research analyses that the optically clear adhesive market was growing at a value of 2.07 billion in 2021 and is expected to reach the value of USD 4.74 billion by 2029, at a CAGR of 10.9% during the forecast period. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Optically Clear Adhesive Market Scope and Segmentation

|

Report Metric |

Details |

|

Forecast Period |

2022 to 2029 |

|

Base Year |

2021 |

|

Historic Years |

2020 (Customizable to 2014 - 2019) |

|

Quantitative Units |

Revenue in USD Billion, Volumes in Units, Pricing in USD |

|

Segments Covered |

Type (Acrylics, Polyvinyl Acetate, Silicone, Polyurethane, Epoxy, Others), Adhesive Thickness (Less Than 1MM, 1-2 MM, 2-3 MM, 3-4 MM, 4-5 MM, Others), Substrate (Metal, Glass, ITO Glass, Polyethylene Terephthalate (PET), Polymethyl Methacrylate (PMMA), Poly Carbonate (PC), Others), Application (Mobile Phones, Tablets, Monitors, Television, Outdoor Signage, Automotive, Wearable Devices, Electronic Blackboards, OLED, Others) |

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Market Players Covered |

Henkel Adhesives Technologies India Private Limited (Germany), 3M (U.S.), tesa Tapes (India) Private Limited (India), Dow (U.S.), NITTO DENKO CORPORATION. (Japan), LINTEC Corporation (Japan), SAINT-GOBAIN (France), Dymax (U.S.), Hitachi, Ltd. (Japan), DELO Industrie Klebstoffe GmbH & Co. KGaA (Germany), DuPont (U.S.), Cyberbond. (U.S.), TORAY INDUSTRIES, INC. (Japan), Scapa Group Ltd (U.S.), Master Bond Inc. (U.S.), Adhesives Research Inc. (U.S.), and Norland Products (U.S.) |

|

Opportunities |

|

Market Definition

Optically clear adhesives (OCA) are transparent and uncolored adhesives that allow the bonding of a screen's entire surface area to the device without causing display distortion. These adhesives' optical clarity is important because they are clean and transparent and thus used in the most critical applications. It improves durability, optical properties, adhesive strength, reliability, and bonding strength. It connects display devices, touch panels, plastic, cover lenses, and other optical materials, such as the primary sensor unit, to provide a clear visual appearance.

Global Optically Clear Adhesive Market Dynamics

Drivers

- High prevalence of smart devices

Rising demand for the latest technology-based smart devices, smartphones, tablets, smartphones, computers, display screens of medical devices, television sets, and LCD screens is driving the market. According to the International Monetary Fund, smartphone sales in 2019 reached around 1.37 million units globally, and more than half of the world's population, or more than 5 billion people, own mobile devices. The optically clear adhesive binds the transparent layer in devices to protect them from harsh chemicals, damage, and scratches. It also improves the mechanical, optical, and electrical performance of the display module and device, as well as its viewability, readability, and contrast in both indoor and outdoor devices.

- Online shopping and growth in e-commerce sales

The growing adoption of optically clear adhesive by the electronics device manufacturing industries for transparent bonding, combined with growing E-commerce website sales from Flipkart, Amazon, and others, drives the growth of the OCA market. According to the UNCTAD, in 2018, global e-commerce sales reached around US$ 25.6 trillion, up 7% from 2017, and over 1.4 billion people shopped online. Consumer electronics such as smartphones, tablets, televisions, LED screens, and so on were purchased. It resulted in a surge in demand for the OCA used by OEMs to manufacture and package these devices.

Opportunities

- Technological advancements and new product offerings

The increasing global adoption of advanced technology devices, as several leading players launch novel electronic devices with significantly increased investment for producing newly developed products, may create a massive opportunity for the growth of the OCA market. For instance, on September 11th, 2018. Samsung has designed the world's first Optically Clear Adhesives for its foldable smartphones and panels.

Restraints

- Difficulty in application process

The main disadvantage of optically clear adhesives such as epoxy is the difficult application process. Unprepared, contaminated, or damaged surfaces cannot be used with optically clear adhesive. To ensure the long life of the optical coating, the surface must be cleaned. Furthermore, bonding a display panel to a three-dimensional cover glass using optically clear adhesive is difficult in display assembly. Thus, the growth of the optically clear adhesive market will be hampered during the forecast period due to difficulties in the application process.

This optically clear adhesive market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the optically clear adhesive market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Impact and Current Market Scenario of Raw Material Shortage and Shipping Delays

Data Bridge Market Research offers a high-level analysis of the market and delivers information by keeping in account the impact and current market environment of raw material shortage and shipping delays. This translates into assessing strategic possibilities, creating effective action plans, and assisting businesses in making important decisions.

Apart from the standard report, we also offer in-depth analysis of the procurement level from forecasted shipping delays, distributor mapping by region, commodity analysis, production analysis, price mapping trends, sourcing, category performance analysis, supply chain risk management solutions, advanced benchmarking, and other services for procurement and strategic support.

COVID-19 Impact on Global Optically Clear Adhesive Market Dynamics

During the Covid-19 pandemic, the global optically clear adhesive market was slightly down, as several leading manufacturing plants were closed due to lockdown in many countries. Automobile and consumer electronics sales were also lower in the first three months of 2020. As several institutions, schools, and colleges closed in April 2020, the demand for online class propellers increased, increasing the OCA market. Furthermore, the OCA market remained constant in August 2020 and will recover as soon as the pandemic is over.

Expected Impact of Economic Slowdown on the Pricing and Availability of Products

When economic activity slows, industries begin to suffer. The forecasted effects of the economic downturn on the pricing and accessibility of the products are taken into account in the market insight reports and intelligence services provided by DBMR. With this, our clients can typically keep one step ahead of their competitors, project their sales and revenue, and estimate their profit and loss expenditures.

Recent Developments

- On July 5, 2019 PANACOL announced the development of an optically clear adhesive, Vitralit 50004. UV-curable acrylic adhesive has a very low viscosity and is used to laminate optics as well as bond various display systems and devices. It has a high adhesion capacity and is compatible with a wide range of substrates, including coated glass and plastics.

Global Optically Clear Adhesive Market Scope

The optically clear adhesive market is segmented on the basis of type, adhesive thickness, substrate and application. The growth amongst these segments will help you analyze meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Type

- Acrylics

- Polyvinyl Acetate

- Silicone

- Polyurethane

- Epoxy

- Others

Adhesive Thickness

- Less Than 1MM

- 1-2 MM

- 2-3 MM

- 3-4 MM

- 4-5 MM

- Others

Substrate

- Metal

- Glass

- ITO Glass

- Polyethylene Terephthalate (PET)

- Polymethyl Methacrylate (PMMA)

- Poly Carbonate (PC)

- Others

Application

- Mobile Phones

- Tablets

- Monitors

- Television

- Outdoor Signage

- Automotive

- Wearable Devices

- Electronic Blackboards

- OLED

- Others

Optically Clear Adhesive Market Regional Analysis/Insights

The optically clear adhesive market is analyzed and market size insights and trends are provided by country, type, adhesive thickness, substrate and application as referenced above.

The countries covered in the optically clear adhesive market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E, South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

The optically clear adhesive is dominating in the Asia-Pacific region due to the region's wide developing economies and the presence of countries such as China, South Korea, and India as dynamic consumers of electronics devices due to the countries' rapid adoption of new technology in electronics devices. As the largest manufacturer and consumer of electronics devices such as smartphones, tablets, LED, LCD screens, and automotive industries in Asia-Pacific, China and India contribute the most.

The country section of the report also provides individual market impacting factors and changes in market regulation that impact the current and future trends of the market. Data points like down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Competitive Landscape and Optically Clear Adhesive Market Share Analysis

The optically clear adhesive market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to optically clear adhesive market.

Some of the major players operating in the optically clear adhesive market are:

- Henkel Adhesives Technologies India Private Limited (Germany)

- 3M (U.S.)

- tesa Tapes (India) Private Limited (India)

- Dow (U.S.)

- NITTO DENKO CORPORATION.(Japan)

- LINTEC Corporation (Japan)

- SAINT-GOBAIN (France)

- Dymax (U.S.)

- Hitachi, Ltd. (Japan)

- DELO Industrie Klebstoffe GmbH & Co. KGaA (Germany)

- DuPont (U.S.)

- Cyberbond. (U.S.)

- TORAY INDUSTRIES, INC. (Japan)

- Scapa Group Ltd (U.S.)

- Master Bond Inc. (U.S.)

- Adhesives Research Inc. (U.S.)

- Norland Products (U.S.)

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL OPTICALLY CLEAR ADHESIVE MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL OPTICALLY CLEAR ADHESIVE MARKET SIZE

2.3 VENDOR POSITIONING GRID

2.4 MARKETS COVERED

2.5 GEOGRAPHIC SCOPE

2.6 YEARS CONSIDERED FOR THE STUDY

2.7 RESEARCH METHODOLOGY

2.8 TECHNOLOGY LIFE LINE CURVE

2.9 MULTIVARIATE MODELLING

2.1 PRIMARY INTERVIEWS WITH KEY OPINION LEADERS

2.11 DBMR MARKET POSITION GRID

2.12 MARKET APPLICATION COVERAGE GRID

2.13 DBMR MARKET CHALLENGE MATRIX

2.14 IMPORT AND EXPORT DATA

2.15 SECONDARY SOURCES

2.16 GLOBAL OPTICALLY CLEAR ADHESIVE MARKET : RESEARCH SNAPSHOT

2.17 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PRODUCTION CONSUMPTION ANALYSIS

5.2 IMPORT EXPORT SCENARIO

5.3 RAW MATERIAL PRODUCTION COVERAGE

5.4 TECHNOLOGICAL ADVANCEMENT BY MANUFACTURERS

5.5 LIST OF KEY BUYERS, BY REGION

5.5.1 NORTH AMERICA

5.5.2 EUROPE

5.5.3 ASIA PACIFIC

5.5.4 SOUTH AMERICA

5.5.5 MIDDLE EAST & AFRICA

5.6 PORTER’S FIVE FORCES

5.7 VENDOR SELECTION CRITERIA

5.8 PESTEL ANALYSIS

5.9 REGULATION COVERAGE

6 GLOBAL OPTICALLY CLEAR ADHESIVE MARKET, BY TYPE, (2020-2029) (USD MILLION) (KILO TONS)

6.1 OVERVIEW

6.2 ACRYLICS

6.3 POLYVINYL ACETATE

6.4 SILICONE

6.5 POLYURETHANE

6.6 EPOXY

6.7 OTHERS

7 GLOBAL OPTICALLY CLEAR ADHESIVE MARKET, BY ADHESIVE THICKNESS, (2020-2029) (USD MILLION) (KILO TONS)

7.1 OVERVIEW

7.2 MM

7.3 1-2 MM

7.4 2-3 MM

7.5 3-4 MM

7.6 4-5 MM

7.7 OTHERS

8 GLOBAL OPTICALLY CLEAR ADHESIVE MARKET, BY SUBSTRATE, (2020-2029) (USD MILLION) (KILO TONS)

8.1 OVERVIEW

8.2 METAL

8.3 GLASS

8.4 ITO GLASS

8.5 POLYETHYLENE TEREPHTHALATE (PET)

8.6 POLYMETHYL METHACRYLATE (PMMA)

8.7 POLY CARBONATE (PC)

8.8 OTHERS

9 GLOBAL OPTICALLY CLEAR ADHESIVE MARKET, BY APPLICATION, (2020-2029) (USD MILLION) (KILO TONS)

9.1 OVERVIEW

9.2 MOBILE PHONES

9.2.1 MOBILE PHONES, BY TYPE

9.2.1.1. ACRYLICS

9.2.1.2. POLYVINYL ACETATE

9.2.1.3. SILICONE

9.2.1.4. POLYURETHANE

9.2.1.5. EPOXY

9.2.1.6. OTHERS

9.3 TABLETS

9.3.1 TABLETS, BY TYPE

9.3.1.1. ACRYLICS

9.3.1.2. POLYVINYL ACETATE

9.3.1.3. SILICONE

9.3.1.4. POLYURETHANE

9.3.1.5. EPOXY

9.3.1.6. OTHERS

9.4 MONITORS

9.4.1 MONITORS, BY TYPE

9.4.1.1. ACRYLICS

9.4.1.2. POLYVINYL ACETATE

9.4.1.3. SILICONE

9.4.1.4. POLYURETHANE

9.4.1.5. EPOXY

9.4.1.6. OTHERS

9.5 TELEVISION

9.5.1 TELEVISION, BY TYPE

9.5.1.1. ACRYLICS

9.5.1.2. POLYVINYL ACETATE

9.5.1.3. SILICONE

9.5.1.4. POLYURETHANE

9.5.1.5. EPOXY

9.5.1.6. OTHERS

9.6 OUTDOOR SIGNAGE

9.6.1 OUTDOOR SIGNAGE, BY TYPE

9.6.1.1. ACRYLICS

9.6.1.2. POLYVINYL ACETATE

9.6.1.3. SILICONE

9.6.1.4. POLYURETHANE

9.6.1.5. EPOXY

9.6.1.6. OTHERS

9.7 AUTOMOTIVE

9.7.1 AUTOMOTIVE, BY TYPE

9.7.1.1. ACRYLICS

9.7.1.2. POLYVINYL ACETATE

9.7.1.3. SILICONE

9.7.1.4. POLYURETHANE

9.7.1.5. EPOXY

9.7.1.6. OTHERS

9.8 WEARABLE DEVICES

9.8.1 WEARABLE DEVICES, BY TYPE

9.8.1.1. ACRYLICS

9.8.1.2. POLYVINYL ACETATE

9.8.1.3. SILICONE

9.8.1.4. POLYURETHANE

9.8.1.5. EPOXY

9.8.1.6. OTHERS

9.9 ELECTRONIC BLACKBOARDS

9.9.1 ELECTRONIC BLACKBOARDS, BY TYPE

9.9.1.1. ACRYLICS

9.9.1.2. POLYVINYL ACETATE

9.9.1.3. SILICONE

9.9.1.4. POLYURETHANE

9.9.1.5. EPOXY

9.9.1.6. OTHERS

9.1 OLED

9.10.1 OLED, BY TYPE

9.10.1.1. ACRYLICS

9.10.1.2. POLYVINYL ACETATE

9.10.1.3. SILICONE

9.10.1.4. POLYURETHANE

9.10.1.5. EPOXY

9.10.1.6. OTHERS

9.11 OTHERS

9.11.1 OTHERS, BY TYPE

9.11.1.1. ACRYLICS

9.11.1.2. POLYVINYL ACETATE

9.11.1.3. SILICONE

9.11.1.4. POLYURETHANE

9.11.1.5. EPOXY

9.11.1.6. OTHERS

10 GLOBAL OPTICALLY CLEAR ADHESIVE MARKET, BY GEOGRAPHY (2020-2029) (USD MILLION) (KILO TONS)

10.1 GLOBAL OPTICALLY CLEAR ADHESIVE MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

10.2 NORTH AMERICA

10.2.1 U.S.

10.2.2 CANADA

10.2.3 MEXICO

10.3 EUROPE

10.3.1 GERMANY

10.3.2 U.K.

10.3.3 ITALY

10.3.4 FRANCE

10.3.5 SPAIN

10.3.6 SWITZERLAND

10.3.7 RUSSIA

10.3.8 TURKEY

10.3.9 BELGIUM

10.3.10 NETHERLANDS

10.3.11 REST OF EUROPE

10.4 ASIA-PACIFIC

10.4.1 JAPAN

10.4.2 CHINA

10.4.3 SOUTH KOREA

10.4.4 INDIA

10.4.5 SINGAPORE

10.4.6 THAILAND

10.4.7 INDONESIA

10.4.8 MALAYSIA

10.4.9 PHILIPPINES

10.4.10 AUSTRALIA AND NEW ZEALAND

10.4.11 HONG KONG

10.4.12 TAIWAN

10.4.13 REST OF ASIA-PACIFIC

10.5 SOUTH AMERICA

10.5.1 BRAZIL

10.5.2 ARGENTINA

10.5.3 REST OF SOUTH AMERICA

10.6 MIDDLE EAST AND AFRICA

10.6.1 SOUTH AFRICA

10.6.2 EGYPT

10.6.3 SAUDI ARABIA

10.6.4 UNITED ARAB EMIRATES

10.6.5 ISRAEL

10.6.6 REST OF MIDDLE EAST AND AMERICA

11 GLOBAL OPTICALLY CLEAR ADHESIVE MARKET, COMPANY LANDSCAPE

11.1 COMPANY SHARE ANALYSIS: GLOBAL

11.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

11.3 COMPANY SHARE ANALYSIS: EUROPE

11.4 COMPANY SHARE ANALYSIS: ASIA-PACIFIC

11.5 MERGERS AND ACQUISITIONS

11.6 NEW PRODUCT DEVELOPMENT AND APPROVALS

11.7 EXPANSIONS

11.8 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

12 SWOT ANALYSIS AND DATABRIDGE MARKET RESEARCH ANALYSIS

13 GLOBAL OPTICALLY CLEAR ADHESIVE MARKET – COMPANY PROFILE

13.1 3 M COMPANY

13.1.1 COMPANY SNAPSHOT

13.1.2 REVENUE ANALYSIS

13.1.3 PRODUCT PORTFOLIO

13.1.4 RECENT UPDATES

13.2 HENKEL AG & COMPANY

13.2.1 COMPANY SNAPSHOT

13.2.2 REVENUE ANALYSIS

13.2.3 PRODUCT PORTFOLIO

13.2.4 RECENT UPDATES

13.3 TESA SE

13.3.1 COMPANY SNAPSHOT

13.3.2 REVENUE ANALYSIS

13.3.3 PRODUCT PORTFOLIO

13.3.4 RECENT UPDATES

13.4 DOW CORNING

13.4.1 COMPANY SNAPSHOT

13.4.2 REVENUE ANALYSIS

13.4.3 PRODUCT PORTFOLIO

13.4.4 RECENT UPDATES

13.5 NITTO DENKO CORPORATION

13.5.1 COMPANY SNAPSHOT

13.5.2 REVENUE ANALYSIS

13.5.3 PRODUCT PORTFOLIO

13.5.4 RECENT UPDATES

13.6 LINTEC CORPORATION

13.6.1 COMPANY SNAPSHOT

13.6.2 REVENUE ANALYSIS

13.6.3 PRODUCT PORTFOLIO

13.6.4 RECENT UPDATES

13.7 SAINT-GOBAIN SA

13.7.1 COMPANY SNAPSHOT

13.7.2 REVENUE ANALYSIS

13.7.3 PRODUCT PORTFOLIO

13.7.4 RECENT UPDATES

13.8 DYMAX CORPORATION

13.8.1 COMPANY SNAPSHOT

13.8.2 REVENUE ANALYSIS

13.8.3 PRODUCT PORTFOLIO

13.8.4 RECENT UPDATES

13.9 HITACHI CHEMICAL COMPANY, LTD

13.9.1 COMPANY SNAPSHOT

13.9.2 REVENUE ANALYSIS

13.9.3 PRODUCT PORTFOLIO

13.9.4 RECENT UPDATES

13.1 DELO INDUSTRIAL ADHESIVES LLC

13.10.1 COMPANY SNAPSHOT

13.10.2 REVENUE ANALYSIS

13.10.3 PRODUCT PORTFOLIO

13.10.4 RECENT UPDATES

13.11 E. I. DU PONT DE NEMOURS AND COMPANY

13.11.1 COMPANY SNAPSHOT

13.11.2 REVENUE ANALYSIS

13.11.3 PRODUCT PORTFOLIO

13.11.4 RECENT UPDATES

13.12 CYBERBOND LLC

13.12.1 COMPANY SNAPSHOT

13.12.2 REVENUE ANALYSIS

13.12.3 PRODUCT PORTFOLIO

13.12.4 RECENT UPDATES

13.13 TORAY INDUSTRIES

13.13.1 COMPANY SNAPSHOT

13.13.2 REVENUE ANALYSIS

13.13.3 PRODUCT PORTFOLIO

13.13.4 RECENT UPDATES

13.14 SCAPA

13.14.1 COMPANY SNAPSHOT

13.14.2 REVENUE ANALYSIS

13.14.3 PRODUCT PORTFOLIO

13.14.4 RECENT UPDATES

13.15 MASTER BOND INC.

13.15.1 COMPANY SNAPSHOT

13.15.2 REVENUE ANALYSIS

13.15.3 PRODUCT PORTFOLIO

13.15.4 RECENT UPDATES

13.16 ADHESIVES RESEARCH INC.

13.16.1 COMPANY SNAPSHOT

13.16.2 REVENUE ANALYSIS

13.16.3 PRODUCT PORTFOLIO

13.16.4 RECENT UPDATES

13.17 NORLAND PRODUCTS INCORPORATED

13.17.1 COMPANY SNAPSHOT

13.17.2 REVENUE ANALYSIS

13.17.3 PRODUCT PORTFOLIO

13.17.4 RECENT UPDATES

13.18 PARAFIX TAPES & CONVERSIONS LTD.

13.18.1 COMPANY SNAPSHOT

13.18.2 REVENUE ANALYSIS

13.18.3 PRODUCT PORTFOLIO

13.18.4 RECENT UPDATES

13.19 MITSUBISHI CHEMICAL CORPORATION

13.19.1 COMPANY SNAPSHOT

13.19.2 REVENUE ANALYSIS

13.19.3 PRODUCT PORTFOLIO

13.19.4 RECENT UPDATES

13.2 PERMABOND

13.20.1 COMPANY SNAPSHOT

13.20.2 REVENUE ANALYSIS

13.20.3 PRODUCT PORTFOLIO

13.20.4 RECENT UPDATES

*NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

14 CONCLUSION

15 QUESTIONNAIRE

16 RELATED REPORTS

17 ABOUT DATA BRIDGE MARKET RESEARCH

Global Optically Clear Adhesive Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Optically Clear Adhesive Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Optically Clear Adhesive Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.