Global Oral Rinse Drugs Market

Market Size in USD Billion

CAGR :

%

USD

8.37 Billion

USD

12.56 Billion

2024

2032

USD

8.37 Billion

USD

12.56 Billion

2024

2032

| 2025 –2032 | |

| USD 8.37 Billion | |

| USD 12.56 Billion | |

|

|

|

|

Oral Rinse Drugs Market Size

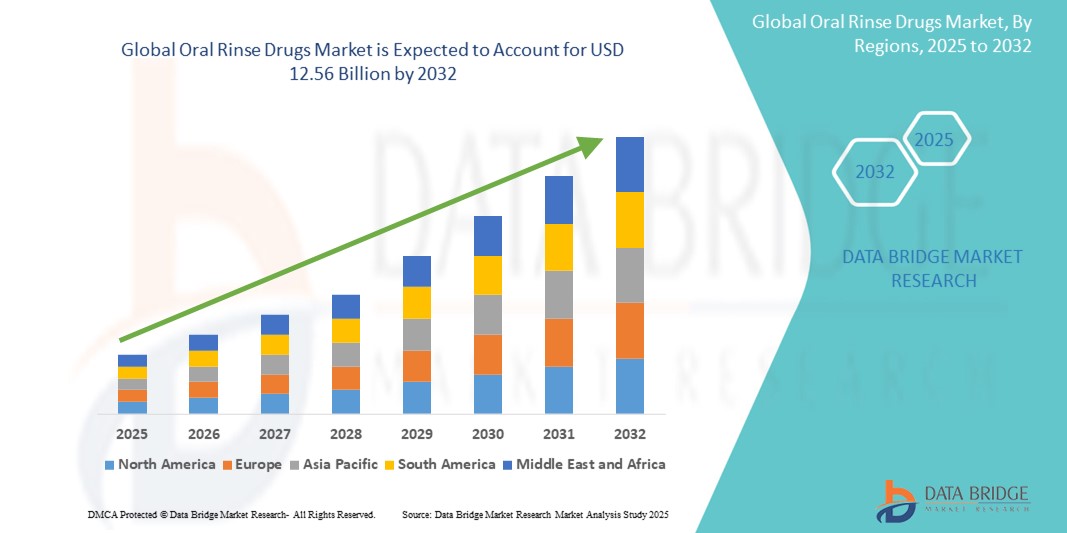

- The global oral rinse drugs market size was valued at USD 8.37 billion in 2024 and is expected to reach USD 12.56 billion by 2032, at a CAGR of 5.20% during the forecast period

- The market growth is largely fueled by the increasing prevalence of oral diseases such as gingivitis, periodontitis, and oral mucositis, coupled with rising awareness about oral hygiene and preventive care among the global population

- Furthermore, growing demand for therapeutic and cosmetic oral rinses, along with advancements in formulation technologies and a rise in dental care expenditure, is establishing oral rinse drugs as an essential adjunct to daily oral hygiene routines. These converging factors are accelerating the adoption of medicated mouthwashes, thereby significantly boosting the industry's growth

Oral Rinse Drugs Market Analysis

- Oral rinse drugs, encompassing therapeutic and antimicrobial mouthwashes, are increasingly integral to oral healthcare regimens in both clinical and at-home settings due to their effectiveness in reducing plaque, controlling halitosis, and managing oral infections and inflammation

- The rising demand for oral rinse drugs is primarily fueled by the growing prevalence of oral diseases, rising awareness of oral hygiene, and increased recommendations by dental professionals for adjunctive use alongside routine brushing and flossing

- North America dominated the oral rinse drugs market with the largest revenue share of 39.2% in 2024, supported by a high incidence of dental disorders, strong consumer spending on oral care products, and robust marketing by pharmaceutical and personal care companies, particularly in the U.S. where prescription-based and OTC therapeutic rinses are widely adopted

- Asia-Pacific is expected to be the fastest growing region in the oral rinse drugs market during the forecast period due to increasing dental awareness, rapid urbanization, and expanding access to oral healthcare in countries such as China and India

- Therapeutic Mouthwash segment dominated the oral rinse drugs market with a market share of 61.8% in 2024, driven by its proven efficacy in treating oral conditions such as gingivitis, plaque, and mouth ulcers, and strong endorsement by dental professionals

Report Scope and Oral Rinse Drugs Market Segmentation

|

Attributes |

Oral Rinse Drugs Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oral Rinse Drugs Market Trends

“Growing Shift Toward Natural and Alcohol-Free Formulations”

- A prominent and accelerating trend in the global oral rinse drugs market is the consumer shift toward natural, alcohol-free, and chemical-free formulations, driven by rising health consciousness and demand for gentler yet effective oral care solutions. This trend is reshaping product development and marketing strategies across the industry

- For instance, brands such as CloSYS and Biotène have launched alcohol-free therapeutic mouthwashes designed for sensitive mouths and dry mouth relief, providing clinical efficacy without the burning sensation often associated with alcohol-based rinses. Similarly, The Natural Dentist and Hello Oral Care offer herbal and fluoride-free options, catering to consumers looking for plant-based alternatives

- These formulations often contain ingredients such as aloe vera, tea tree oil, xylitol, and essential oils, which are perceived as safer and more sustainable. They appeal particularly to consumers with sensitivities, children, and the aging population, who may be more susceptible to the harsh effects of alcohol and synthetic chemicals

- In addition, the growing preference for eco-friendly and cruelty-free products is pushing companies to align their offerings with ethical and sustainable standards. Products with certifications such as vegan, organic, and non-GMO are gaining traction in retail and online channels

- The trend toward natural and alcohol-free oral rinse drugs is not only expanding the consumer base but also encouraging innovations in formulation science and packaging sustainability. As a result, major companies are investing in research to combine natural efficacy with therapeutic strength, leading to a new generation of oral rinse products that are both clinically effective and consumer-friendly

- The demand for mouthwashes that align with clean-label and wellness trends is rapidly rising, with both established players and new entrants launching novel formulations to meet the evolving expectations of global consumers

Oral Rinse Drugs Market Dynamics

Driver

“Rising Oral Health Awareness and Preventive Dental Care”

- The growing awareness of oral hygiene’s role in overall health, along with increased emphasis on preventive dental care, is a significant driver of the global oral rinse drugs market

- For instance, global health initiatives by organizations such as the WHO and national dental associations promote the use of therapeutic rinses for conditions such as gingivitis, halitosis, and plaque control, reinforcing regular rinsing as part of daily oral care routines

- As consumers become more informed about the links between oral health and systemic conditions such as cardiovascular disease and diabetes, the demand for evidence-based, clinically proven mouthwashes continues to increase

- Moreover, the rising number of dental check-ups and professional recommendations for adjunctive rinsing therapy is fueling market growth. Dentists frequently prescribe antimicrobial or fluoride-based mouthwashes to manage post-surgical hygiene or prevent recurring oral issues

- The market also benefits from growing demand in pediatric and geriatric populations, who often require specialized mouthwash formulations for conditions such as dry mouth or sensitive gums. The increasing availability of mouth rinses across retail, hospital, and online channels further boosts their accessibility and adoption

Restraint/Challenge

“Adverse Effects and Regulatory Limitations”

- Despite growing adoption, concerns over the long-term use of chemical-based oral rinse drugs and potential side effects such as taste alteration, mucosal irritation, and tooth staining act as restraints to market growth

- For instance, chlorhexidine-based mouthwashes, while effective against gingivitis, are associated with adverse effects such as brown staining of teeth and tongue, leading to lower compliance rates among long-term users

- In addition, the presence of alcohol and synthetic additives in many commercial mouthwashes raises safety concerns, especially for children, pregnant women, and individuals with medical conditions. This limits their acceptability and use in certain consumer segments

- Regulatory compliance also poses a challenge, as therapeutic mouthwashes often require approvals from agencies such as the FDA or EMA before market entry. The need for clinical trials, efficacy data, and adherence to strict labeling requirements can delay product launches and increase development costs

- These challenges are pushing manufacturers to invest in safer, non-irritant formulations and to ensure transparent labeling to gain regulatory and consumer trust. Enhanced research into long-term safety, combined with clear regulatory frameworks, will be essential for future product innovations and sustained market expansion

Oral Rinse Drugs Market Scope

The market is segmented on the basis of type, product type, flavour, indication, and distribution channel.

- By Type

On the basis of type, the oral rinse drugs market is segmented into cosmetic mouthwash and therapeutic mouthwash. The therapeutic mouthwash segment dominated the market with the largest revenue share of 61.8% in 2024, driven by its clinical efficacy in treating oral health conditions such as gingivitis, plaque buildup, and mouth ulcers. These mouthwashes are often prescribed or recommended by dental professionals for their antibacterial, anti-inflammatory, and fluoride-enhancing properties, making them a core component of preventive and post-treatment dental care routines.

The cosmetic mouthwash segment is expected to witness the fastest CAGR from 2025 to 2032, supported by increasing consumer demand for fresh breath solutions and over-the-counter products that enhance daily oral hygiene without the need for a prescription. Their appeal lies in accessibility, affordability, and mild formulations for routine use.

- By Product Type

On the basis of product type, the oral rinse drugs market is segmented into fluoride, cosmetics, antiseptics, total care, and natural. The antiseptics segment led the market with a 35.8% share in 2024, fueled by high effectiveness in eliminating oral bacteria, reducing inflammation, and preventing infections. Products in this segment, including chlorhexidine and cetylpyridinium chloride formulations, are frequently used in dental practices and recommended for home use after procedures or for managing chronic oral conditions.

The natural segment is projected to witness the fastest growth from 2025 to 2032, driven by increasing consumer preference for chemical-free and plant-based formulations. These products often incorporate herbal ingredients such as tea tree oil, neem, and aloe vera and appeal to users seeking safer, environmentally conscious oral care options.

- By Flavour

On the basis of flavour, the oral rinse drugs market is segmented into active salt, mint, fresh tea, and others. The mint segment dominated with a 46.7% share in 2024, driven by widespread consumer preference for its cooling sensation and long-lasting freshness. Mint-flavoured rinses are widely accepted across both therapeutic and cosmetic categories, making them the most common choice for daily use.

The fresh tea segment is expected to witness the fastest CAGR from 2025 to 2032, due to rising interest in mild, herbal-tasting formulations, particularly among consumers looking for gentle alternatives to strong chemical flavours.

- By Indication

On the basis of indication, the oral rinse drugs market is segmented into periodontitis, mouth ulcers, gingivitis, and dry mouth. The gingivitis segment dominated the market with the largest revenue share of 39.2% in 2024, owing to its high global prevalence and the critical role of oral rinses in managing gum inflammation and bacterial control. Therapeutic mouthwashes targeting gingivitis are often prescribed alongside mechanical cleaning to enhance treatment outcomes.

The dry mouth segment is expected to witness the fastest CAGR from 2025 to 2032, due to increasing cases related to aging populations, medication side effects, and chronic health conditions.

- By Distribution Channel

On the basis of distribution channel, the oral rinse drugs market is segmented into hospital pharmacy, supermarkets, retail pharmacy, online pharmacy, and others. The retail pharmacy segment held the highest share of 37.4% in 2024, supported by broad accessibility, professional consultation, and strong consumer trust in pharmacist recommendations. These outlets remain the go-to choice for both OTC and prescription-based oral rinse drugs.

The online pharmacy segment is expected to exhibit the fastest growth through 2032, driven by the convenience of e-commerce, increasing digital adoption, and the availability of a wide product range with customer reviews and doorstep delivery.

Oral Rinse Drugs Market Regional Analysis

- North America dominated the oral rinse drugs market with the largest revenue share of 39.2% in 2024, supported by a high incidence of dental disorders, strong consumer spending on oral care products, and robust marketing by pharmaceutical and personal care companies, particularly in the U.S. where prescription-based and OTC therapeutic rinses are widely adopted

- Consumers in North America actively seek clinically effective and professionally recommended mouthwash solutions, including therapeutic formulations for conditions such as gingivitis, halitosis, and dry mouth

- This strong demand is further supported by high dental expenditure, widespread access to oral healthcare services, and the presence of leading pharmaceutical and personal care brands, positioning oral rinse drugs as a vital component of daily oral health routines in both prescription and over-the-counter segments

U.S. Oral Rinse Drugs Market Insight

The U.S. oral rinse drugs market captured the largest revenue share of 79.4% in North America in 2024, driven by high oral care awareness, frequent dental visits, and strong demand for therapeutic mouthwashes. Consumers are increasingly seeking dentist-recommended rinses for conditions such as gingivitis and halitosis, boosting both OTC and prescription product sales. The presence of leading oral care brands, coupled with widespread retail and online access, significantly contributes to the market’s growth.

Europe Oral Rinse Drugs Market Insight

The Europe oral rinse drugs market is projected to expand at a steady CAGR during the forecast period, fueled by increasing awareness of oral hygiene and preventive dental care across the region. The rising incidence of periodontal diseases and the preference for alcohol-free, natural formulations are enhancing demand. Growing investment in dental wellness and the integration of oral care into daily health routines are supporting strong growth in countries such as Germany, France, and Italy.

U.K. Oral Rinse Drugs Market Insight

The U.K. oral rinse drugs market is anticipated to grow at a notable CAGR during the forecast period, supported by the population’s increasing focus on dental hygiene and rising demand for advanced therapeutic mouthwashes. The NHS’s initiatives on preventive oral health and increased product availability in pharmacies and supermarkets are boosting sales. In addition, consumer interest in gentle, fluoride-based or herbal rinses is expanding, especially among families and older adults.

Germany Oral Rinse Drugs Market Insight

The Germany oral rinse drugs market is expected to grow steadily during the forecast period, driven by strong dental care infrastructure, regular dental checkups, and preference for clinically approved, high-quality mouth rinses. Germany’s emphasis on preventive care, along with a health-conscious population, supports growing demand for antiseptic and therapeutic formulations. Eco-friendly and alcohol-free mouthwashes are also gaining traction in line with consumer expectations for safer, sustainable options.

Asia-Pacific Oral Rinse Drugs Market Insight

The Asia-Pacific oral rinse drugs market is poised to grow at the fastest CAGR from 2025 to 2032, driven by increasing awareness of oral hygiene, growing healthcare spending, and urbanization in countries such as China, India, and Japan. Rising dental disease incidence and government-led oral health programs are supporting market expansion. The availability of cost-effective products and rising consumer education are widening the market’s reach across both urban and rural populations.

Japan Oral Rinse Drugs Market Insight

The Japan oral rinse drugs market is gaining momentum due to the country’s emphasis on preventive health and hygiene. A technologically advanced and aging population is fueling demand for gentle, alcohol-free rinses suitable for sensitive mouths. Japanese consumers prefer clinically backed, multifunctional mouthwashes that support daily oral hygiene, with integration of oral care into wellness routines driving consistent market growth.

India Oral Rinse Drugs Market Insight

The India oral rinse drugs market accounted for the largest market revenue share in Asia Pacific in 2024, supported by rising oral health awareness, a rapidly expanding middle class, and improved access to dental products. The growth of retail pharmacy chains and online platforms has made both therapeutic and cosmetic mouthwashes widely available. Government health initiatives and an increase in preventive care practices are further accelerating market demand across urban and semi-urban regions.

Oral Rinse Drugs Market Share

The oral rinse drugs industry is primarily led by well-established companies, including:

- Colgate-Palmolive Company (U.S.)

- Procter & Gamble (U.S.)

- GSK plc (U.K.)

- Unilever PLC (U.K.)

- Sunstar Suisse S.A. (Switzerland)

- Church & Dwight Co., Inc. (U.S.)

- Dabur India Ltd. (India)

- Lion Corporation (Japan)

- Kao Corporation (Japan)

- Himalaya Global Holdings Ltd. (India)

- Reckitt Benckiser Group plc (U.K.)

- Amway Corporation (U.S.)

- Weleda AG (Switzerland)

- BioFresh Ltd. (Bulgaria)

- Rowpar Pharmaceuticals, Inc. (U.S.)

- Nature’s Answer, Inc. (U.S.)

- Sanofi (France)

What are the Recent Developments in Global Oral Rinse Drugs Market?

- In April 2023, Johnson & Johnson Consumer Health expanded its Listerine portfolio with the launch of Listerine Total Care Sensitive, formulated specifically for users with sensitive teeth and gums. The new variant combines therapeutic fluoride protection with a gentler alcohol-free formulation, highlighting the brand’s commitment to developing inclusive oral care solutions that meet evolving consumer needs and sensitivity concerns across global markets

- In March 2023, Colgate-Palmolive Company introduced a herbal mouthwash line under the Colgate Vedshakti brand in India, targeting the growing demand for natural and Ayurvedic oral care. Infused with clove, mint, and eucalyptus extracts, the launch reflects the company’s strategy to cater to consumer preferences for chemical-free and plant-based alternatives while expanding its footprint in high-growth emerging markets

- In February 2023, Procter & Gamble (P&G) unveiled its Oral-B Clinical Rinse, a new addition to its Oral-B professional range, designed to target plaque and bacteria with long-lasting antibacterial protection. This innovation leverages chlorhexidine-based efficacy in a user-friendly formulation, reinforcing P&G’s efforts to address professional and consumer segments with high-performance therapeutic solutions

- In February 2023, Crest, another P&G brand, launched Crest Pro-Health Advanced Mouthwash in North America, featuring new dual-action technology aimed at combating bad breath and reducing early gum disease symptoms. The launch supports Crest’s positioning in the preventive oral care space, responding to increasing demand for multi-benefit rinses among health-conscious consumers

- In January 2023, TheraBreath (a Church & Dwight brand) extended its premium mouthwash range into Europe with the launch of TheraBreath Fresh Breath Oral Rinse across major pharmacy chains in the UK and Germany. Known for its dentist-formulated, alcohol-free solutions, the brand’s expansion underscores rising European demand for clinically backed and sensitivity-friendly oral hygiene products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.