Global Ortho Pediatric Devices Market

Market Size in USD Billion

CAGR :

%

USD

48.90 Billion

USD

85.92 Billion

2024

2032

USD

48.90 Billion

USD

85.92 Billion

2024

2032

| 2025 –2032 | |

| USD 48.90 Billion | |

| USD 85.92 Billion | |

|

|

|

|

Ortho Pediatric Devices Market Size

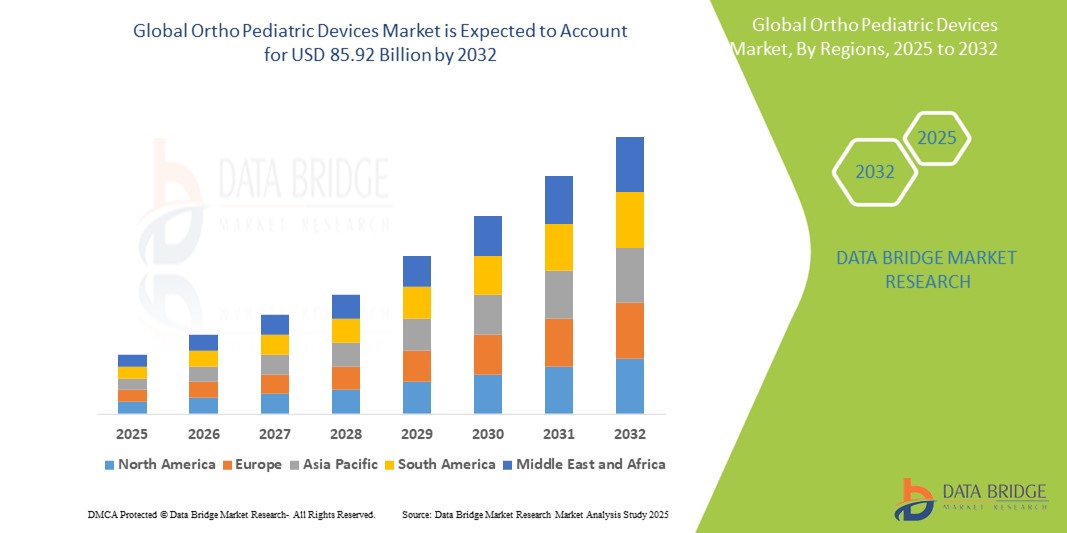

- The global ortho pediatric devices market size was valued at USD 48.90 billion in 2024 and is expected to reach USD 85.92 billion by 2032, at a CAGR of 7.30% during the forecast period

- The market growth is largely fueled by the rising incidence of pediatric orthopedic disorders and trauma injuries, along with increasing awareness and availability of advanced treatment options across developed and emerging economies

- Furthermore, technological advancements in orthopedic implants, growing pediatric population, and improvements in healthcare infrastructure are driving the demand for specialized and age-appropriate orthopedic solutions. These converging factors are accelerating the uptake of ortho pediatric devices, thereby significantly boosting the industry's growth

Ortho Pediatric Devices Market Analysis

- Ortho pediatric devices, designed specifically to treat musculoskeletal issues in children and adolescents, are increasingly vital components of modern pediatric healthcare due to their ability to accommodate the unique anatomical and physiological needs of younger patients, offering tailored solutions for trauma, deformities, and congenital orthopedic conditions

- The escalating demand for ortho pediatric devices is primarily fueled by the rising incidence of pediatric fractures, sports injuries, and congenital deformities, along with greater awareness among caregivers and improved access to pediatric orthopedic care

- North America dominates the ortho pediatric devices market with the largest revenue share of 41.7% in 2024, characterized by advanced healthcare infrastructure, early adoption of innovative medical technologies, and a growing pediatric population requiring orthopedic interventions

- Asia-Pacific is expected to be the fastest growing region in the ortho pediatric devices market during the forecast period due to rising birth rates, expanding healthcare facilities, and growing investments in pediatric care in countries such as China and India

- Trauma and deformities segment dominates the ortho pediatric devices market with a market share of 48.1% in 2024, driven by its high prevalence of fractures and bone growth abnormalities in children, coupled with the availability of minimally invasive surgical solutions and growth-friendly implant technologies

Report Scope and Ortho Pediatric Devices Market Segmentation

|

Attributes |

Ortho Pediatric Devices Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Ortho Pediatric Devices Market Trends

“Technological Advancements and Customization in Pediatric Orthopedic Care”

- A significant and accelerating trend in the global ortho pediatric devices market is the growing technological advancement and customization of orthopedic devices specifically designed to address the anatomical and physiological needs of pediatric patients. These innovations are improving treatment outcomes, enhancing comfort, and minimizing the risk of complications in growing children

- For instance, companies such as OrthoPediatrics are developing growth-friendly implants that allow for continued bone development post-surgery, such as the FEMUR Pediatric Nailing System and Response Spine System, which are engineered for pediatric trauma and deformity correction with minimal invasiveness

- 3D printing technology is increasingly being adopted to produce patient-specific orthopedic implants and surgical guides, enabling more precise fitting and personalized treatment plans, especially in complex deformity cases. For instance, customized spinal implants for scoliosis correction significantly reduce surgical time and improve post-operative alignment

- Smart orthopedic devices equipped with sensors and digital tracking capabilities are emerging, offering real-time monitoring of healing progress and post-operative mobility. These innovations allow physicians to remotely adjust treatment protocols based on patient-specific recovery data, improving outcomes and patient engagement

- Pediatric orthopedic care is also benefiting from minimally invasive surgical (MIS) techniques, which reduce scarring, pain, and recovery time. Tools and implants tailored for smaller anatomical structures are enabling MIS adoption in children, further supporting faster recovery and better compliance

- The integration of these advanced technologies is reshaping expectations within pediatric orthopedic treatment, leading to greater demand for precision, minimally invasive, and child-friendly devices. As a result, leading manufacturers are focusing on developing orthopedic systems that combine biocompatibility, adaptability, and digital compatibility to cater to evolving needs in pediatric musculoskeletal care

- This trend toward more intelligent, minimally invasive, and personalized ortho pediatric solutions is driving innovation and competitive differentiation in the market. It is also pushing healthcare providers and hospitals to adopt digitally enhanced and child-specific orthopedic devices, particularly in developed healthcare ecosystems across North America and Europe

Ortho Pediatric Devices Market Dynamics

Driver

“Rising Incidence of Pediatric Orthopedic Conditions and Advancements in Treatment Solutions”

- The increasing incidence of orthopedic conditions in children—such as fractures, congenital deformities, scoliosis, and sports injuries—is a significant driver for the rising demand for specialized ortho pediatric devices worldwide. This growing medical need is prompting healthcare providers and caregivers to seek advanced, child-specific orthopedic solutions

- For instance, in March 2024, OrthoPediatrics Corp. expanded its portfolio with FDA-approved implants for complex deformity corrections in children, showcasing the industry's commitment to innovation in pediatric care. Such developments by leading players are expected to accelerate market growth during the forecast period

- Children require orthopedic implants and devices tailored to their growing anatomy, which traditional adult-oriented solutions fail to provide. Ortho pediatric devices offer growth-friendly, biocompatible, and minimally invasive options, improving both surgical outcomes and long-term musculoskeletal health

- In addition, technological advancements in 3D printing, bioresorbable materials, and image-guided surgical techniques are enabling more precise, customized, and less invasive treatments. These innovations are helping orthopedic surgeons achieve better alignment, reduce surgical trauma, and shorten recovery periods in pediatric patients

- The increasing awareness among parents, healthcare professionals, and governments about the benefits of early intervention and specialized orthopedic care for children is also contributing to higher diagnosis rates and surgical volumes

- Furthermore, the growing availability of pediatric orthopedic services in specialized hospitals, ambulatory surgical centers, and pediatric clinics—combined with supportive healthcare reimbursement policies in developed regions—is facilitating broader access to these essential devices

- Overall, the confluence of rising demand, technological innovation, and expanded access to pediatric orthopedic care is significantly propelling the adoption of ortho pediatric devices across global healthcare settings

Restraint/Challenge

“Concerns Regarding Cybersecurity and High Initial Costs”

- Concerns surrounding the high initial costs of pediatric-specific orthopedic devices and procedures pose a significant challenge to broader market penetration. As ortho pediatric devices are tailored to meet the unique anatomical needs of growing children, they often involve complex designs, advanced materials, and specialized surgical techniques, which collectively contribute to higher manufacturing and treatment costs

- For instance, advanced growth-friendly implants or deformity correction systems can be significantly more expensive than standard orthopedic devices, making them less accessible in publicly funded or resource-constrained healthcare environments. This cost barrier can deter adoption in developing regions and among low-income populations, despite the clear clinical benefits of early orthopedic intervention

- Addressing these affordability concerns through cost-effective product innovation, streamlined manufacturing processes, and scalable device designs is crucial for enhancing global accessibility. Companies such as OrthoPediatrics and WishBone Medical are focusing on modular systems and cost-conscious product lines to support broader use in underserved markets

- In addition, the limited availability of pediatric orthopedic specialists and underdeveloped healthcare infrastructure in many emerging economies further restrict access to appropriate care. This creates a gap between demand and actual treatment capability, especially in rural or remote areas

- While the global market is gradually improving through international collaborations and awareness campaigns, the perceived complexity and cost of pediatric orthopedic care can still hinder widespread adoption, particularly in healthcare systems where adult orthopedic care remains the primary focus

Ortho Pediatric Devices Market Scope

The market is segmented on the basis of product type and application

- By Product Type

On the basis of product, the global ortho pediatric devices market is segmented into trauma and deformities, smart implants, spine, and sports medicine. The trauma and deformities segment dominates with the largest market revenue share of 48.1% in 2024, driven by the high incidence of pediatric fractures, congenital deformities, and musculoskeletal abnormalities requiring specialized fixation and correction devices.

The sports medicine segment is anticipated to witness fastest growth from 2025 to 2032, driven by increased youth participation in sports and a consequent rise in sports-related injuries. The demand for pediatric braces, supports, and surgical implants tailored for young athletes is expanding in both hospital and clinic settings.

- By Application

On the basis of application, the ortho pediatric devices market is segmented into hospital, clinic, and other. The hospital segment dominates with the largest market share in 2024, driven by the availability of specialized pediatric orthopedic surgeons, advanced surgical infrastructure, and comprehensive post-operative care required for complex pediatric procedures.

The clinic segment is expected to witness fastest growth during 2025 to 2032, supported by the growth of outpatient orthopedic services and early diagnosis and treatment of pediatric conditions. Clinics are increasingly preferred for follow-up care and less invasive treatment options.

Ortho Pediatric Devices Market Regional Analysis

- North America dominates the ortho pediatric devices market with the largest revenue share of 41.7% in 2024, driven by advanced healthcare infrastructure, early adoption of innovative medical technologies, and a growing pediatric population requiring orthopedic interventions

- Healthcare providers and parents in the region highly value advanced, growth-friendly orthopedic devices designed specifically for children, along with the availability of specialized pediatric orthopedic centers and early intervention programs

- This widespread adoption is further supported by favorable reimbursement policies, strong R&D investments, and increasing awareness of pediatric orthopedic conditions, establishing North America as the preferred market for ortho pediatric devices across hospitals, clinics, and specialized care facilities

U.S. Ortho Pediatric Devices Market Insight

The U.S. ortho pediatric devices market captured the largest revenue share in North America in 2024, fueled by the country’s advanced healthcare infrastructure and high investment in pediatric orthopedic research and innovation. Increasing prevalence of pediatric trauma cases and congenital musculoskeletal disorders, along with growing awareness among healthcare providers and parents about early intervention, are key growth drivers. The U.S. market is further propelled by strong reimbursement frameworks, availability of cutting-edge growth-friendly implants, and expanding outpatient orthopedic services. In addition, the rising demand for minimally invasive surgical procedures and smart implant technologies is significantly contributing to market expansion across hospitals and specialty clinics.

Europe Ortho Pediatric Devices Market Insight

The Europe ortho pediatric devices market is projected to expand at a substantial CAGR during the forecast period, primarily driven by increasing prevalence of pediatric musculoskeletal disorders and supportive government healthcare initiatives. Rising investments in pediatric orthopedic research and growing demand for minimally invasive surgical solutions foster adoption. The region sees growth across hospitals, specialty clinics, and rehabilitation centers, with strong uptake in countries such as Germany, the U.K., and France due to advanced healthcare systems and increasing focus on pediatric patient outcome

U.K. Ortho Pediatric Devices Market Insight

The U.K. ortho pediatric devices market is anticipated to grow at a noteworthy CAGR throughout the forecast period, supported by rising government funding for child health programs and the expansion of specialized pediatric orthopedic care centers. Concerns regarding early intervention for deformities and trauma are encouraging healthcare providers to adopt advanced devices tailored for pediatric patients. The U.K.’s well-developed healthcare infrastructure and growing demand for outpatient orthopedic services further stimulate market growth

Germany Ortho Pediatric Devices Market Insight

The Germany ortho pediatric devices market is expected to expand at a considerable CAGR during the forecast period, driven by high healthcare expenditure and increasing incidence of pediatric orthopedic conditions such as scoliosis and congenital deformities. Germany’s focus on innovation and sustainable healthcare solutions promotes the adoption of technologically advanced, growth-friendly implants. The integration of pediatric orthopedic devices into comprehensive treatment protocols in both hospitals and clinics is becoming increasingly prevalent.

Asia-Pacific Ortho Pediatric Devices Market Insight

The Asia-Pacific ortho pediatric devices market is poised to grow at the fastest CAGR during the forecast period, fueled by rapid urbanization, rising healthcare expenditure, and increasing awareness of pediatric orthopedic conditions in emerging economies such as China, India, and Japan. Government initiatives aimed at improving child healthcare infrastructure and expanding access to specialized orthopedic services are key growth drivers. In addition, the rising number of pediatric orthopedic specialists and growing demand for minimally invasive and smart implant technologies contribute to market expansion.

Japan Ortho Pediatric Devices Market Insight

The Japan ortho pediatric devices market is gaining momentum due to the country’s advanced medical technology landscape and strong emphasis on pediatric healthcare. Increasing prevalence of pediatric musculoskeletal disorders and rising demand for smart implants that enable better treatment monitoring are propelling growth. Japan’s aging population is also creating a need for pediatric orthopedic solutions that support improved quality of life for children with mobility challenges.

India Ortho Pediatric Devices Market Insight

The India ortho pediatric devices market accounted for a significant revenue share in Asia-Pacific in 2024, driven by the expanding pediatric population and rising incidence of orthopedic conditions among children. Rapid urbanization, improved healthcare accessibility, and increasing investment in child healthcare programs support market growth. In addition, growing awareness about early intervention and the availability of affordable, pediatric-specific orthopedic devices contribute to India’s rising adoption rates in hospitals and clinics.

Ortho Pediatric Devices Market Share

The ortho pediatric devices industry is primarily led by well-established companies, including:

- OrthoPediatrics Corp. (U.S.)

- Zimmer Biomet. (U.S.)

- Stryker (U.S.)

- Johnson & Johnson Services, Inc. (U.S.)

- Smith+Nephew (U.K.)

- NuVasive, Inc. (U.S.)

- Medtronic (Ireland)

- Pega Medical (Canada)

- B. Braun SE (Germany)

- Orthofix Medical Inc. (U.S.)

- WishBone Medical (U.S.)

- EOS imaging (France)

- Arthrex, Inc. (U.S.)

- Bioretec (Finland)

- K2M Group Holdings, Inc. (U.S.)

- Ortho Solutions UK Ltd. (U.K.)

- Medequip Healthcare Solutions Pvt. Ltd. (India)

- PETER BREHM GmbH (Germany)

Latest Developments in Global Ortho Pediatric Devices Market

- In May 2024, The U.S. Food and Drug Administration granted the "Breakthrough Device" designation to OrthoPediatrics Corp. for its eLLi Growing Rod System. This implant is designed to address severe pathologies associated with Early Onset Scoliosis (EOS) in pediatric patients, facilitating expedited development and review processes

- In March 2024, OrthoPediatrics Corp. announced the launch of its new RESPONSE Rib and Pelvic Fixation System, designed to treat children with Early Onset Scoliosis (EOS). This system represents the company's 71st solution for pediatric orthopedic conditions, aiming to provide comprehensive treatment options for young patients

- In December 2023, OrthoPediatrics Corp. announced the launch of its Specialty Bracing Division (OPSB), focusing on non-surgical interventions in pediatric orthopedics. This division aims to expand the company's reach in providing comprehensive orthopedic solutions for children

- In October 2023, OrthoPediatrics Corp. joined the Alliance for Pediatric Device Innovation (APDI), led by Children's National Hospital. As a strategic advisor, OrthoPediatrics aims to support the development and commercialization of pediatric medical devices, enhancing innovation in the field

- In July 2022, OrthoPediatrics Corp. completed its acquisition of Pega Medical, a company specializing in innovative technologies for pediatric orthopedic conditions. The acquisition includes Pega's Fassier-Duval Telescopic Intramedullary System, enhancing OrthoPediatrics' portfolio in treating osteogenesis imperfecta and other bone deformities

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.