Global Osteoarthritis Therapeutics Market

Market Size in USD Billion

CAGR :

%

USD

8.67 Billion

USD

17.29 Billion

2024

2032

USD

8.67 Billion

USD

17.29 Billion

2024

2032

| 2025 –2032 | |

| USD 8.67 Billion | |

| USD 17.29 Billion | |

|

|

|

|

Global Osteoarthritis Therapeutics Market Size

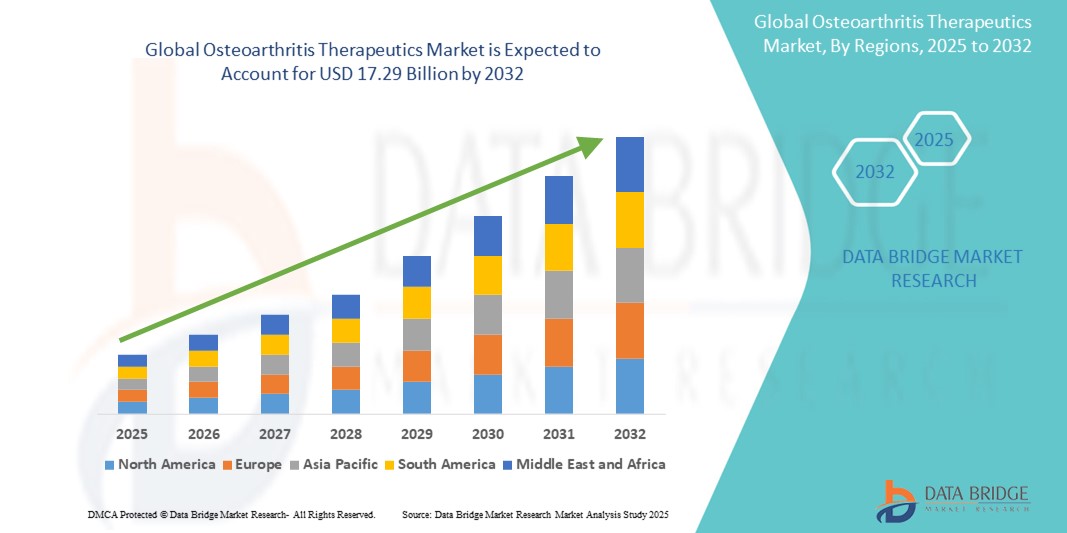

- The global osteoarthritis therapeutics market size was valued at USD 8.67 billion in 2024 and is expected to reach USD 17.29 billion by 2032, at a CAGR of 9.00% during the forecast period

- The market growth is largely fueled by the increasing prevalence of osteoarthritis worldwide, particularly among the aging population, combined with advances in therapeutic development including biologics, cell-based therapies, and disease-modifying osteoarthritis drugs (DMOADs). This trend is driving greater focus on early diagnosis and personalized treatment approaches

- Furthermore, rising patient awareness, improved access to healthcare in emerging markets, and increasing demand for minimally invasive and long-acting treatment options are positioning osteoarthritis therapeutics as a critical component of musculoskeletal care. These converging factors are accelerating the uptake of Osteoarthritis Therapeutics solutions, thereby significantly boosting the industry's growth

Osteoarthritis Therapeutics Market Analysis

- Osteoarthritis therapeutics, including pharmacological agents, biologics, and intra-articular injections, are becoming increasingly vital components of musculoskeletal care in both primary and specialty healthcare settings due to their effectiveness in managing chronic joint pain, improving mobility, and delaying the need for surgical interventions

- The escalating demand for osteoarthritis therapeutics is primarily fueled by the aging global population, rising obesity rates, increasing awareness of joint health, and advancements in regenerative medicine and disease-modifying osteoarthritis drugs (DMOADs)

- North America dominated the osteoarthritis therapeutics market with the largest revenue share of 41.7% in 2024, driven by the high prevalence of osteoarthritis, strong healthcare infrastructure, favorable reimbursement policies, and the presence of major pharmaceutical companies investing in R&D for novel therapies. The U.S. continues to lead the region with widespread adoption of advanced treatment options such as platelet-rich plasma (PRP) injections and viscosupplementation

- Asia-Pacific is expected to be the fastest growing region in the osteoarthritis therapeutics market during the forecast period, with a CAGR of 9.6%, owing to rapidly aging populations, increasing healthcare spending, improving diagnosis rates, and a growing emphasis on non-surgical interventions across countries such as China, India, and Japan

- The viscosupplementation agents segment dominated the osteoarthritis therapeutics market with a market share of 34.5% in 2024, driven by their role in improving joint lubrication and delaying the need for surgical intervention. These agents are particularly effective in treating knee osteoarthritis and are widely adopted due to their minimal side effects

Report Scope and Osteoarthritis Therapeutics Market Segmentation

|

Attributes |

Osteoarthritis Therapeutics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Osteoarthritis Therapeutics Market Trends

“Advancements in Targeted and Personalized Osteoarthritis Treatment Approaches”

- A significant and accelerating trend in the global osteoarthritis therapeutics market is the shift toward targeted biologics and personalized treatment regimens. Innovations in molecular diagnostics and genetic profiling are enabling clinicians to better understand patient-specific disease mechanisms and customize therapies accordingly

- For instance, novel interleukin inhibitors and monoclonal antibodies are being developed and introduced to the market to target specific inflammatory pathways involved in osteoarthritis progression. These therapies aim not just to relieve symptoms but to halt or slow joint degeneration, offering hope for long-term relief and improved quality of life

- The integration of advanced imaging tools and biomarkers allows earlier diagnosis and helps physicians monitor disease progression more accurately, leading to better treatment outcomes. Companies are increasingly investing in companion diagnostics to pair with high-value osteoarthritis drugs, optimizing their effectiveness for distinct patient groups

- Increasing research on regenerative medicine, including stem cell therapy and tissue engineering, is offering new opportunities to restore damaged cartilage, moving beyond pain relief to actual structural repair. Several biotech startups and pharma companies are conducting clinical trials focused on intra-articular regenerative injections that promise fewer side effects and longer-lasting benefits

- The trend toward digital therapeutics and remote patient monitoring tools is also gaining traction, particularly for managing chronic pain and physical therapy adherence. Wearable devices and mobile health apps are helping track joint movement, exercise compliance, and treatment response—allowing for real-time care optimization

- This progression toward more personalized, regenerative, and data-driven treatment strategies is fundamentally reshaping patient expectations and clinical protocols. As a result, major players such as Pfizer, Novartis, Amgen, and Zimmer Biomet are accelerating their investments in targeted osteoarthritis therapies and digital health ecosystems to stay competitive in this evolving landscape

Osteoarthritis Therapeutics Market Dynamics

Driver

“Growing Need Due to Rising Disease Burden and Aging Population”

- The increasing global burden of osteoarthritis, particularly among the aging population, is a major driver fueling demand for effective osteoarthritis therapeutics. The World Health Organization reports that osteoarthritis is among the most disabling diseases in older adults, significantly affecting mobility and quality of life

- For instance, in April 2024, AbbVie Inc. announced the expansion of its R&D program for osteoarthritis, focusing on next-generation anti-inflammatory biologics aimed at halting disease progression rather than just alleviating symptoms. Such strategic developments are expected to drive the osteoarthritis therapeutics industry growth in the forecast period

- As life expectancy increases worldwide, the prevalence of osteoarthritis is expected to rise proportionally. This shift is prompting healthcare systems to invest more heavily in disease management, while pharmaceutical companies focus on creating innovative and long-acting treatment options, including injectable hyaluronic acid, NSAIDs, and biologic therapies

- Moreover, the growing demand for pain management solutions, physical therapy integration, and joint-preserving drugs is making osteoarthritis treatment a priority area within rheumatology and orthopedics

- The convenience of oral, topical, and injectable treatment options, along with ongoing advancements in drug delivery systems and regenerative medicine, is improving patient compliance and expanding therapeutic applications across various care settings

- In addition, the rise in sedentary lifestyles and obesity is increasing the incidence of osteoarthritis among younger demographics, further contributing to market growth and creating new avenues for early intervention therapies and disease-modifying osteoarthritis drugs (DMOADs)

Restraint/Challenge

“High Development Costs and Limited Disease-Modifying Therapies”

- A significant challenge in the osteoarthritis therapeutics market is the limited availability of curative or disease-modifying treatments. Most current therapies are focused on symptom management, such as pain relief and inflammation control, rather than reversing or halting joint degeneration

- For instance, while biologics and stem cell-based therapies show promise, they often face high development costs, extended clinical trial timelines, and complex regulatory pathways, which delay market entry and limit widespread accessibility

- Despite growing investment, few DMOADs have received regulatory approval, and the lack of long-term efficacy data remains a concern. This slows innovation and restricts treatment options for advanced-stage patients seeking alternatives to joint replacement surgery

- Moreover, the cost burden of advanced therapeutics—including biologics, PRP (platelet-rich plasma) injections, and customized implants—can be prohibitive for patients, especially in low- and middle-income regions where healthcare reimbursement is limited

- To overcome these barriers, industry players must focus on streamlining R&D, securing faster regulatory approvals, and developing cost-effective treatment alternatives that can deliver structural benefits alongside symptomatic relief

- Greater collaboration between public and private stakeholders, along with advancements in biomarker identification and early-stage diagnostics, will be essential for the development of breakthrough therapies that can transform the current treatment landscape

Osteoarthritis Therapeutics Market Scope

The market is segmented on the basis of drug type, anatomy, route of administration, sales channel, and end-use.

• By Drug Type

On the basis of drug type, the osteoarthritis therapeutics market is segmented into viscosupplementation agents, nonsteroidal anti-inflammatory drugs, analgesics, corticosteroids, and others. The viscosupplementation agents segment dominated the largest market revenue share of 34.5% in 2024, driven by their role in improving joint lubrication and delaying the need for surgical intervention. These agents are particularly effective in treating knee osteoarthritis and are widely adopted due to their minimal side effects.

The nonsteroidal anti-inflammatory drugs segment is anticipated to witness the fastest growth rate of 9.4% CAGR from 2025 to 2032, attributed to their widespread availability over the counter and increasing demand for pain relief medication. Their affordability and effectiveness for mild to moderate symptoms make them a preferred choice in both developed and developing regions.

• By Anatomy

On the basis of anatomy, the osteoarthritis therapeutics market is segmented into knee osteoarthritis, hip osteoarthritis, hand osteoarthritis, and others. The knee osteoarthritis segment accounted for the largest market revenue share of 47.8% in 2024, due to the high prevalence of knee joint degeneration among the elderly and obese populations. The knee is the most commonly affected joint, and treatment advancements continue to support strong market demand.

The hip osteoarthritis segment is expected to register the fastest CAGR of 8.7% from 2025 to 2032, fueled by increasing aging demographics and rising surgical interventions such as hip replacement procedures.

• By Route of Administration

On the basis of route of administration, the osteoarthritis therapeutics market is segmented into parenteral route, topical route and oral route. The oral route segment held the largest market revenue share of 51.3% in 2024, due to the high convenience and compliance among patients for tablets and capsules. Oral NSAIDs and analgesics are commonly prescribed as first-line treatments.

The parenteral route is anticipated to grow at the fastest CAGR of 9.1% from 2025 to 2032, driven by the increased use of intra-articular injections such as hyaluronic acid and corticosteroids, which provide targeted relief and longer-lasting effects.

• By Sales Channel

On the basis of sales channel, the osteoarthritis therapeutics market is segmented into prescription drugs and over-the-counter drugs. The prescription drugs segment dominated the market with a revenue share of 64.2% in 2024, attributed to physician-prescribed medications for moderate to severe cases and post-operative management.

The over-the-counter drugs segment is projected to grow at the fastest CAGR of 8.9% from 2025 to 2032, owing to the increasing trend of self-medication, rising awareness, and easy availability of NSAIDs and topical pain relief products in pharmacies and retail outlets.

• By End-use

On the basis of end-use, the osteoarthritis therapeutics market is segmented into hospital pharmacies, retail pharmacies, and others. The hospital pharmacies segment held the largest market share of 46.5% in 2024, driven by high patient flow in hospitals, access to advanced injectable treatments, and physician supervision.

The retail pharmacies segment is expected to witness the fastest CAGR of 9.3% from 2025 to 2032, fueled by the increasing availability of OTC medications, expanding pharmacy chains, and the preference for purchasing chronic medications from neighborhood drugstores.

Osteoarthritis Therapeutics Market Regional Analysis

- North America dominated the osteoarthritis therapeutics market with the largest revenue share of 41.7% in 2024, driven by the rising prevalence of osteoarthritis, increasing elderly population, and the widespread availability of advanced treatment options

- The region benefits from well-established healthcare infrastructure, high patient awareness, and strong reimbursement frameworks

- Patients in North America increasingly opt for viscosupplementation, NSAIDs, and corticosteroids, with growing adoption of novel therapies, including regenerative and biological approaches. Furthermore, the rise in obesity and sedentary lifestyles contributes significantly to osteoarthritis incidence, reinforcing the demand for effective therapeutic solutions

U.S. Osteoarthritis Therapeutics Market Insight

The U.S. osteoarthritis therapeutics market captured the largest revenue share of 81% within North America in 2024, fueled by rapid uptake of innovative pharmacological therapies and the growing preference for personalized medicine. The U.S. leads in clinical trials, R&D investments, and approvals for next-generation therapies, supported by the presence of major pharmaceutical players. Moreover, the country’s aging population and increasing number of patients undergoing joint replacement surgeries have driven the demand for both symptomatic and disease-modifying treatments. The availability of over-the-counter pain relievers and strong physician recommendations further bolster the market.

Europe Osteoarthritis Therapeutics Market Insight

The Europe osteoarthritis therapeutics market is projected to expand at a robust CAGR of 8.6% from 2025 to 2032, primarily driven by an aging demographic and rising awareness of early intervention strategies. Countries across Europe are seeing increasing uptake of topical and oral NSAIDs, along with viscosupplementation treatments. Public healthcare initiatives aimed at reducing disability caused by osteoarthritis, combined with supportive reimbursement policies, are promoting adoption. In addition, patient education and non-invasive therapies are gaining popularity across outpatient and homecare settings.

U.K. Osteoarthritis Therapeutics Market Insight

The U.K. osteoarthritis therapeutics market is anticipated to grow at a CAGR of 8.9% from 2025 to 2032, driven by rising demand for non-surgical pain management and government focus on improving access to primary healthcare. The National Health Service (NHS) plays a pivotal role in delivering osteoarthritis care, often encouraging the use of analgesics and physical therapy in early stages. Growing emphasis on reducing joint replacement surgery burden is also increasing reliance on pharmacological therapeutics and early-stage interventions.

Germany Osteoarthritis Therapeutics Market Insight

The Germany osteoarthritis therapeutics market is expected to expand at a CAGR of 8.4% from 2025 to 2032, supported by increasing diagnosis rates and the adoption of biologic therapies for advanced cases. Germany's highly developed healthcare system and the availability of advanced intra-articular injections are driving market growth. In addition, rising awareness campaigns by healthcare organizations and patient support groups are promoting earlier treatment initiation and improved medication adherence.

Asia-Pacific Osteoarthritis Therapeutics Market Insight

The Asia-Pacific osteoarthritis therapeutics market is poised to grow at the fastest CAGR of 9.6% from 2025 to 2032, driven by a combination of aging populations, increasing joint disorders, and healthcare infrastructure development in emerging economies. Countries such as China, Japan, and India are witnessing increasing osteoarthritis diagnoses, with growing use of NSAIDs, corticosteroids, and hyaluronic acid injections. Government health programs and expanding pharmaceutical manufacturing capacities are making treatments more affordable and accessible to larger patient pools across the region.

Japan Osteoarthritis Therapeutics Market Insight

The Japan osteoarthritis therapeutics market is gaining momentum, projected to grow at a CAGR of 10.3% from 2025 to 2032, owing to the country’s rapidly aging population and strong emphasis on geriatric care. Japanese patients favor minimally invasive treatments, including oral and topical NSAIDs. There is a significant push for innovation in cartilage regeneration and joint preservation techniques. Integration of traditional and modern medicine, as well as high per capita health expenditure, supports further market development.

China Osteoarthritis Therapeutics Market Insight

China accounted for the largest market revenue share in Asia Pacific in 2024, contributing 36.5% of the regional revenue, driven by its massive patient base, increasing healthcare access, and investments in domestic drug manufacturing. The market is witnessing a surge in demand for affordable oral and injectable therapies. Rising health awareness, government-led elder care policies, and rapid expansion of hospital infrastructure are accelerating therapeutic adoption. Local pharmaceutical companies are also increasingly active in the osteoarthritis drug pipeline and biosimilar development.

Osteoarthritis Therapeutics Market Share

The osteoarthritis therapeutics industry is primarily led by well-established companies, including:

- Pfizer Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Novartis AG (Switzerland)

- Amgen Inc. (U.S.)

- Boehringer Ingelheim International GmbH (Germany)

- Samsung Bioepis (South Korea)

- Merck & Co., Inc. (U.S.)

- Sun Pharmaceutical Industries Ltd. (India)

- Teva Pharmaceuticals Industries Ltd. (Israel)

- AstraZeneca (U.K.)

- Zimmer Biomet (U.S.)

- Stryker (U.S.)

- Enlivex Therapeutics Ltd. (Israel)

- Anika Therapeutics, Inc. (U.S.)

- Eupraxia Pharmaceuticals (Canada)

- Doron Therapeutics (U.S.)

Latest Developments in Global Osteoarthritis Therapeutics Market

- In April 2024, Eli Lilly and Company announced the launch of a new monoclonal antibody therapy targeting nerve growth factor (NGF) to manage moderate to severe osteoarthritis pain. This innovative therapy, developed in collaboration with a leading biotechnology firm, aims to provide long-lasting pain relief without the adverse effects commonly associated with NSAIDs and opioids, positioning Lilly at the forefront of next-generation osteoarthritis treatment

- In March 2024, Pfizer Inc. initiated Phase III clinical trials for its investigational disease-modifying osteoarthritis drug (DMOAD), designed to slow cartilage degeneration in patients with knee osteoarthritis. This development aligns with the growing global focus on regenerative approaches and personalized medicine in chronic joint conditions

- In February 2024, Johnson & Johnson’s Janssen Pharmaceuticals division received FDA Fast Track designation for its small-molecule inhibitor aimed at halting osteoarthritis progression. The drug targets inflammatory pathways implicated in cartilage breakdown, marking a major advancement in modifying disease progression beyond symptomatic relief

- In January 2024, Sanofi and Regeneron expanded their collaboration to evaluate the potential of Dupilumab in treating osteoarthritis-related inflammation and pain. Preliminary studies demonstrated promising results in reducing joint stiffness and improving mobility, opening new therapeutic possibilities for patients unresponsive to traditional treatments

- In December 2023, GlaxoSmithKline (GSK) launched a novel topical analgesic gel incorporating nanotechnology for enhanced penetration and sustained pain relief. This product, developed for over-the-counter use, is tailored to improve the quality of life for patients with early-stage osteoarthritis and has seen strong market uptake across Europe and Asia-Pacific

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL OSTEOARTHRITIS THERAPEUTICS MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL OSTEOARTHRITIS THERAPEUTICS MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 EPIDEMIOLOGY

2.2.12 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.13 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL OSTEOARTHRITIS THERAPEUTICS MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

6 INDUSTRY INSIGHTS

6.1 PATENT ANALYSIS

6.1.1 PATENT LANDSCAPE

6.1.2 USPTO NUMBER

6.1.3 PATENT EXPIRY

6.1.4 EPIO NUMBER

6.1.5 PATENT STRENGTH AND QUALITY

6.1.6 PATENT CLAIMS

6.1.7 PATENT CITATIONS

6.1.8 PATENT LITIGATION AND LICENSING

6.1.9 FILE OF PATENT

6.1.10 PATENT RECEIVED CONTRIES

6.1.11 TECHNOLOGY BACKGROUND

6.2 DRUG TREATMENT RATE BY MATURED MARKETS

6.3 DEMOGRAPHIC TRENDS: IMPACTS ON ALL INCIDENCE RATES

6.4 PATIENT FLOW DIAGRAM

6.5 KEY PRICING STRATEGIES

6.6 KEY PATIENT ENROLLMENT STRATEGIES

6.7 INTERVIEWS WITH SPECIALIST

6.8 OTHER KOL SNAPSHOTS

7 EPIDEMIOLOGY

7.1 INCIDENCE OF ALL BY GENDER

7.2 TREATMENT RATE

7.3 MORTALITY RATE

7.4 DRUG ADHERENCE AND THERAPY SWITCH MODEL

7.5 PATIENT TREATMENT SUCCESS RATES

8 MERGERS AND ACQUISITION

8.1 LICENSING

8.2 COMMERCIALIZATION AGREEMENTS

9 REGULATORY FRAMEWORK

9.1 REGULATORY APPROVAL PROCESS

9.2 GEOGRAPHIES’ EASE OF REGULATORY APPROVAL

9.3 REGULATORY APPROVAL PATHWAYS

9.4 LICENSING AND REGISTRATION

9.5 POST-MARKETING SURVEILLANCE

9.6 GOOD MANUFACTURING PRACTICES (GMPS) GUIDELINES

10 PIPELINE ANALYSIS

10.1 CLINICAL TRIALS AND PHASE ANALYSIS

10.2 DRUG THERAPY PIPELINE

10.3 PHASE III CANDIDATES

10.4 PHASE II CANDIDATES

10.5 PHASE I CANDIDATES

10.6 OTHERS (PRE-CLINICAL AND RESEARCH)

TABLE 1 GLOBAL CLINICAL TRIAL MARKET FOR OSTEOARTHRITIS THERAPEUTICS MARKET

Company Name Therapeutic Area

XX XX

XX XX

XX XX

XX XX

XX XX

XX XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 2 DISTRIBUTION OF PRODUCTS AND PROJECTS BY PHASE OSTEOARTHRITIS THERAPEUTICS MARKET

Phase Number of Projects

Preclinical/Research Projects XX

Clinical Development XX

Phase I XX

Phase II XX

Phase III XX

U.S. Filed/Approved But Not Yet Marketed XX

Total XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 3 DISTRIBUTION OF PROJECTS BY THERAPEUTIC AREA AND PHASE OSTEOARTHRITIS THERAPEUTICS MARKET

Therapeutic Area Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

TABLE 4 DISTRIBUTION OF PROJECTS BY SCIENTIFIC APPROACH AND PHASE OSTEOARTHRITIS THERAPEUTICS MARKET

Technology Preclinical/ Research Project

XX XX

XX XX

XX XX

XX XX

XX XX

Total Projects XX

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

FIGURE 1 TOP ENTITIES BASED ON R&D GLANCE FOR OSTEOARTHRITIS THERAPEUTICS MARKET

Sources: Press Releases, Annual Reports, SEC Filings, Investor Presentations, Other Government Sources, Analysis Based on Inputs from Secondary, Expert Interviews

11 MARKETED DRUG ANALYSIS

11.1 DRUG

11.1.1 BRAND NAME

11.1.2 GENERICS NAME

11.2 THERAPEUTIC INDICTION

11.3 PHARMACOLOGICAL CLASS OF THE DRUG

11.4 DRUG PRIMARY INDICATION

11.5 MARKET STATUS

11.6 MEDICATION TYPE

11.7 DRUG DOSAGES FORM

11.8 DOSAGES AVAILABILITY

11.9 DRUG ROUTE OF ADMINISTRATION

11.1 DOSING FREQUENCY

11.11 DRUG INSIGHT

11.12 AN OVERVIEW OF THE DRUG DEVELOPMENT ACTIVITIES SUCH AS REGULATORY MILSTONE, SAFETY DATA AND EFFICACY DATA, MARKET EXCLUSIVITY DATA.

11.12.1 FORECAST MARKET OUTLOOK

11.12.2 CROSS COMPETITION

11.12.3 THERAPEUTIC PORTFOLIO

11.12.4 CURRENT DEVELOPMENT SCENARIO

12 MARKET ACCESS

12.1 10-YEAR MARKET FORECAST

12.2 CLINICAL TRIAL RECENT UPDATES

12.3 ANNUAL NEW FDA APPROVED DRUGS

12.4 DRUGS MANUFACTURER AND DEALS

12.5 MAJOR DRUG UPTAKE

12.6 CURRENT TREATMENT PRACTICES

12.7 IMPACT OF UPCOMING THERAPY

13 R & D ANALYSIS

13.1 COMPARATIVE ANALYSIS

13.2 DRUG DEVELOPMENTAL LANDSCAPE

13.3 IN-DEPTH INSIGHTS ON REGULATORY MILESTONES

13.4 THERAPEUTIC ASSESSMENT

13.5 ASSET-BASED COLLABORATIONS AND PARTNERSHIPS

14 MARKET OVERVIEW

14.1 DRIVERS

14.2 RESTRAINTS

14.3 OPPORTUNITIES

14.4 CHALLENGES

15 GLOBAL OSTEOARTHRITIS THERAPEUTICS MARKET, BY ANATOMY

15.1 OVERVIEW

15.2 KNEE

15.3 HIP

15.4 HAND

15.5 SMALL JOINTS (FOOT & ANKLE AND WRIST )

15.6 OTHERS

16 GLOBAL OSTEOARTHRITIS THERAPEUTICS MARKET, BY TYPE

16.1 (MARKET VALUE , VOLUME AND AVERAGE SELLING PRICE FOR EACH SUBSEGMENT OF THIS SEGMENT WILL BE PROVIDED)

16.2 OVERVIEW

16.3 MEDICATION

16.3.1 MARKETED DRUGS

16.3.1.1. ANALGESICS

16.3.1.1.1. ACETAMINOPHEN

16.3.1.1.2. OPIOIDS

16.3.1.1.2.1 CO-CODAMOL

16.3.1.1.2.2 OXYCODONE

16.3.1.1.2.3 TRAMADOL

16.3.1.1.2.4 PROPOXYPHENE

16.3.1.1.2.5 OTHERS

16.3.1.2. NONSTEROIDAL ANTI-INFLAMMATORY DRUGS (NSAIDS)

16.3.1.2.1. CELECOXIB

16.3.1.2.2. PIROXICAM

16.3.1.2.3. IBUPROFEN

16.3.1.2.4. NAPROXEN

16.3.1.2.5. DICLOFENAC

16.3.1.2.5.1 PARENTERAL

16.3.1.2.5.2 ORAL

16.3.1.2.5.2.1. 50 MG

16.3.1.2.5.2.2. 75 MG

16.3.1.2.5.2.3. 100 MG

16.3.1.2.5.2.4. OTHERS

16.3.1.2.5.3 TOPICAL

16.3.1.2.5.3.1. 1.5% TOPICAL

16.3.1.2.5.3.2. 2% TOPICAL

16.3.1.2.5.3.3. OTHERS

16.3.1.2.6. DULOXETINE

16.3.1.2.7. ASPIRIN

16.3.1.2.8. OTHERS

16.3.1.3. COUNTERIRRITANTS

16.3.1.3.1. MENTHOL

16.3.1.3.2. LIDOCAINE

16.3.1.3.3. OTHERS

16.3.1.4. CALCIUM CHANNEL BLOCKER/COX-2 INHIBITOR COMBINATION

16.3.1.4.1. CELECOXIB/AMLODIPINE

16.3.1.4.2. CONSENSI

16.3.1.4.3. OTHERS

16.3.1.5. ANTIDEPRESSANTS

16.3.1.5.1. DULOXETINE

16.3.1.5.2. CYMBALTA

16.3.1.5.3. OTHERS

16.3.1.6. ANALGESIC

16.3.1.6.1. CAPSAICIN

16.3.1.6.2. QUTENZA

16.3.1.6.3. OTHERS

16.3.1.7. CORTICOSTEROIDS/ TRIAMCINOLONE ACETONIDE

16.3.1.7.1. METHYLPREDNISOLONE

16.3.1.7.2. KENALOG 40

16.3.1.7.3. ZILRETTA

16.3.1.7.4. BETAMETHASONE

16.3.1.7.5. OTHERS

16.3.1.8. ANTIRRHEUMATIC

16.3.1.8.1. EUFLEXXA

16.3.1.8.2. HYALGAN

16.3.1.8.3. ORTHOVISC

16.3.1.8.4. SUPARTZ

16.3.1.8.5. SYNVISC

16.3.1.8.6. SYNVISC-ONE

16.3.1.9. SKELETAL MUSCLE RELAXANTS

16.3.1.9.1. CARISOPRODOL

16.3.1.9.2. DANTROLENE

16.3.1.9.3. BACLOFEN

16.3.1.9.4. OTHERS

16.3.1.10. HYALURONIC ACID

16.3.1.11. PLATELET-RICH PLASMA (PRP)

16.3.1.12. OTHERS

16.3.2 PIPELINE DRUGS

16.3.2.1. APC201

16.3.2.2. GNSC-001

16.3.2.3. 4P004

16.3.2.4. DFV890

16.3.2.5. EP-104IAR

16.3.2.6. OTHERS

16.4 THERAPY

16.4.1 PHYSICAL THERAPY

16.4.2 OCCUPATIONAL THERAPY

16.4.3 TRANSCUTANEOUS ELECTRICAL NERVE STIMULATION (TENS)

16.4.4 OTHERS

16.5 SURGICAL PROCEDURES

16.5.1 BONE REALIGNMENT (OSTEOTOMY)

16.5.2 BONE FUSION (ARTHRODESIS)

16.5.3 JOINT REPLACEMENT SURGERY

16.5.4 ARTHROSCOPIC SURGERY

16.5.5 OTHERS

16.6 OTHERS

17 GLOBAL OSTEOARTHRITIS TREATMENT MEDICATION MARKET, BY DRUG TYPE

17.1 OVERVIEW

17.2 BRANDED

17.2.1 EUFLEXXA

17.2.2 SUPARTZ FX

17.2.3 MONOVISC

17.2.4 ZILRETTA

17.2.5 NAPRELAN

17.2.6 DUEXIS

17.2.7 OTHERS

17.3 GENERICS

18 GLOBAL OSTEOARTHRITIS TREATMENT MEDICATION MARKET, BY ROUTE OF ADMINISTRATION

18.1 OVERVIEW

18.2 ORAL

18.2.1 TABLETS

18.2.2 CAPSULES

18.2.3 OTHERS

18.3 TOPICAL

18.3.1 CREAMS

18.3.2 GELS

18.3.3 SOLUTION

18.3.4 OTHERS

18.4 PARENTERAL

18.4.1 SUBCUTANEOUS

18.4.2 INTRA-ARTICULAR

18.4.3 OTHERS

18.5 OTHERS

19 GLOBAL OSTEOARTHRITIS TREATMENT MEDICATION MARKET, BY MODE OF PURCHASE

19.1 OVERVIEW

19.2 PRESCRIPTION

19.3 OVER THE COUNTER (OTC)

20 GLOBAL OSTEOARTHRITIS THERAPEUTICS MARKET, BY POPULATION TYPE

20.1 OVERVIEW

20.2 PEDIATRIC

20.3 ADULTS

20.4 GERIATRIC

21 GLOBAL OSTEOARTHRITIS THERAPEUTICS MARKET, BY END USER

21.1 OVERVIEW

21.2 HOSPITALS

21.2.1 BY TYPE

21.2.1.1. PUBLIC

21.2.1.2. PRIVATE

21.2.2 BY LEVEL

21.2.2.1. TIER 1

21.2.2.2. TIER 2

21.2.2.3. TIER 3

21.3 SPECIALTY CLINICS

21.4 HOME HEALTHCARE

21.5 AMBULATORY SURGICAL CENTERS

21.6 OTHERS

22 GLOBAL OSTEOARTHRITIS THERAPEUTICS MARKET, BY DISTRIBUTION CHANNEL

22.1 OVERVIEW

22.2 DIRECT TENDER

22.3 RETAIL SALES

22.3.1 ONLINE

22.3.1.1. E-STORES

22.3.1.2. COMPANY WEBSITE

22.3.1.3. OTHERS

22.3.2 OFFLINE

22.3.2.1. HOSPITAL PHARMACY

22.3.2.2. MEDICINE STORES

22.3.2.3. OTHERS

22.4 OTHERS

23 GLOBAL OSTEOARTHRITIS THERAPEUTICS MARKET, COMPANY LANDSCAPE

23.1 COMPANY SHARE ANALYSIS: GLOBAL

23.2 MERGERS & ACQUISITIONS

23.3 NEW PRODUCT DEVELOPMENT & APPROVALS

23.4 EXPANSIONS

23.5 REGULATORY CHANGES

23.6 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

24 GLOBAL OSTEOARTHRITIS THERAPEUTICS MARKET, BY GEOGRAPHY

24.1 GLOBAL OSTEOARTHRITIS THERAPEUTICS MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

24.1.1 NORTH AMERICA

24.1.1.1. U.S.

24.1.1.2. CANADA

24.1.1.3. MEXICO

24.1.2 EUROPE

24.1.2.1. GERMANY

24.1.2.2. FRANCE

24.1.2.3. U.K.

24.1.2.4. HUNGARY

24.1.2.5. LITHUANIA

24.1.2.6. AUSTRIA

24.1.2.7. IRELAND

24.1.2.8. NORWAY

24.1.2.9. POLAND

24.1.2.10. ITALY

24.1.2.11. SPAIN

24.1.2.12. RUSSIA

24.1.2.13. TURKEY

24.1.2.14. NETHERLANDS

24.1.2.15. SWITZERLAND

24.1.2.16. REST OF EUROPE

24.1.3 ASIA-PACIFIC

24.1.3.1. JAPAN

24.1.3.2. CHINA

24.1.3.3. SOUTH KOREA

24.1.3.4. INDIA

24.1.3.5. AUSTRALIA

24.1.3.6. SINGAPORE

24.1.3.7. THAILAND

24.1.3.8. MALAYSIA

24.1.3.9. INDONESIA

24.1.3.10. PHILIPPINES

24.1.3.11. VIETNAM

24.1.3.12. REST OF ASIA-PACIFIC

24.1.4 SOUTH AMERICA

24.1.4.1. BRAZIL

24.1.4.2. ARGENTINA

24.1.4.3. PERU

24.1.4.4. REST OF SOUTH AMERICA

24.1.5 MIDDLE EAST AND AFRICA

24.1.5.1. SOUTH AFRICA

24.1.5.2. SAUDI ARABIA

24.1.5.3. UAE

24.1.5.4. EGYPT

24.1.5.5. KUWAIT

24.1.5.6. ISRAEL

24.1.5.7. REST OF MIDDLE EAST AND AFRICA

24.1.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

25 GLOBAL OSTEOARTHRITIS THERAPEUTICS MARKET, SWOT AND DBMR ANALYSIS

26 GLOBAL OSTEOARTHRITIS THERAPEUTICS MARKET, COMPANY PROFILE

26.1 MARKETED DRUG MANUFRACTURE

26.1.1 FERRING B.V.

26.1.1.1. COMPANY OVERVIEW

26.1.1.2. REVENUE ANALYSIS

26.1.1.3. GEOGRAPHIC PRESENCE

26.1.1.4. PRODUCT PORTFOLIO

26.1.1.5. RECENT DEVELOPMENTS

26.1.2 BIOVENTUS

26.1.2.1. COMPANY OVERVIEW

26.1.2.2. REVENUE ANALYSIS

26.1.2.3. GEOGRAPHIC PRESENCE

26.1.2.4. PRODUCT PORTFOLIO

26.1.2.5. RECENT DEVELOPMENTS

26.1.3 SANOFI-AVENTIS U.S. LLC, A SANOFI COMPANY

26.1.3.1. COMPANY OVERVIEW

26.1.3.2. REVENUE ANALYSIS

26.1.3.3. GEOGRAPHIC PRESENCE

26.1.3.4. PRODUCT PORTFOLIO

26.1.3.5. RECENT DEVELOPMENTS

26.1.4 FIDIA PHARMA USA INC.

26.1.4.1. COMPANY OVERVIEW

26.1.4.2. REVENUE ANALYSIS

26.1.4.3. GEOGRAPHIC PRESENCE

26.1.4.4. PRODUCT PORTFOLIO

26.1.4.5. RECENT DEVELOPMENTS

26.1.5 ANIKA THERAPEUTICS, INC.

26.1.5.1. COMPANY OVERVIEW

26.1.5.2. REVENUE ANALYSIS

26.1.5.3. GEOGRAPHIC PRESENCE

26.1.5.4. PRODUCT PORTFOLIO

26.1.5.5. RECENT DEVELOPMENTS

26.1.6 PFIZER INC.

26.1.6.1. COMPANY OVERVIEW

26.1.6.2. REVENUE ANALYSIS

26.1.6.3. GEOGRAPHIC PRESENCE

26.1.6.4. PRODUCT PORTFOLIO

26.1.6.5. RECENT DEVELOPMENTS

26.1.7 PERRIGO COMPANY PLC.

26.1.7.1. COMPANY OVERVIEW

26.1.7.2. REVENUE ANALYSIS

26.1.7.3. GEOGRAPHIC PRESENCE

26.1.7.4. PRODUCT PORTFOLIO

26.1.7.5. RECENT DEVELOPMENTS

26.1.8 TAJ PHARMA GROUP

26.1.8.1. COMPANY OVERVIEW

26.1.8.2. REVENUE ANALYSIS

26.1.8.3. GEOGRAPHIC PRESENCE

26.1.8.4. PRODUCT PORTFOLIO

26.1.8.5. RECENT DEVELOPMENTS

26.1.9 WELLONA PHARMA

26.1.9.1. COMPANY OVERVIEW

26.1.9.2. REVENUE ANALYSIS

26.1.9.3. GEOGRAPHIC PRESENCE

26.1.9.4. PRODUCT PORTFOLIO

26.1.9.5. RECENT DEVELOPMENTS

26.1.10 BASF CORPORATION

26.1.10.1. COMPANY OVERVIEW

26.1.10.2. REVENUE ANALYSIS

26.1.10.3. GEOGRAPHIC PRESENCE

26.1.10.4. PRODUCT PORTFOLIO

26.1.10.5. RECENT DEVELOPMENTS

26.1.11 ADVACARE PHARMA

26.1.11.1. COMPANY OVERVIEW

26.1.11.2. REVENUE ANALYSIS

26.1.11.3. GEOGRAPHIC PRESENCE

26.1.11.4. PRODUCT PORTFOLIO

26.1.11.5. RECENT DEVELOPMENTS

26.1.12 ZIMMER BIOMET

26.1.12.1. COMPANY OVERVIEW

26.1.12.2. REVENUE ANALYSIS

26.1.12.3. GEOGRAPHIC PRESENCE

26.1.12.4. PRODUCT PORTFOLIO

26.1.12.5. RECENT DEVELOPMENTS

26.1.13 SAPHNIX LIFE SCIENCES

26.1.13.1. COMPANY OVERVIEW

26.1.13.2. REVENUE ANALYSIS

26.1.13.3. GEOGRAPHIC PRESENCE

26.1.13.4. PRODUCT PORTFOLIO

26.1.13.5. RECENT DEVELOPMENTS

26.1.14 JANSSEN PHARMACEUTICALS, INC.

26.1.14.1. COMPANY OVERVIEW

26.1.14.2. REVENUE ANALYSIS

26.1.14.3. GEOGRAPHIC PRESENCE

26.1.14.4. PRODUCT PORTFOLIO

26.1.14.5. RECENT DEVELOPMENTS

26.1.15 AMNEAL PHARMACEUTICALS NY LLC

26.1.15.1. COMPANY OVERVIEW

26.1.15.2. REVENUE ANALYSIS

26.1.15.3. GEOGRAPHIC PRESENCE

26.1.15.4. PRODUCT PORTFOLIO

26.1.15.5. RECENT DEVELOPMENTS

26.1.16 APOTEX INC

26.1.16.1. COMPANY OVERVIEW

26.1.16.2. REVENUE ANALYSIS

26.1.16.3. GEOGRAPHIC PRESENCE

26.1.16.4. PRODUCT PORTFOLIO

26.1.16.5. RECENT DEVELOPMENTS

26.1.17 TEVA PHARMACEUTICALS USA, INC.

26.1.17.1. COMPANY OVERVIEW

26.1.17.2. REVENUE ANALYSIS

26.1.17.3. GEOGRAPHIC PRESENCE

26.1.17.4. PRODUCT PORTFOLIO

26.1.17.5. RECENT DEVELOPMENTS

26.1.18 MERCK SHARP & DOHME CORP., A SUBSIDIARY OF MERCK & CO., INC.

26.1.18.1. COMPANY OVERVIEW

26.1.18.2. REVENUE ANALYSIS

26.1.18.3. GEOGRAPHIC PRESENCE

26.1.18.4. PRODUCT PORTFOLIO

26.1.18.5. RECENT DEVELOPMENTS

26.1.19 KOLON TISSUEGENE, INC.

26.1.19.1. COMPANY OVERVIEW

26.1.19.2. REVENUE ANALYSIS

26.1.19.3. GEOGRAPHIC PRESENCE

26.1.19.4. PRODUCT PORTFOLIO

26.1.19.5. RECENT DEVELOPMENTS

26.1.20 AMPIO PHARMACEUTICALS INC.

26.1.20.1. COMPANY OVERVIEW

26.1.20.2. REVENUE ANALYSIS

26.1.20.3. GEOGRAPHIC PRESENCE

26.1.20.4. PRODUCT PORTFOLIO

26.1.20.5. RECENT DEVELOPMENTS

26.1.21 REGENERON PHARMACEUTICALS INC

26.1.21.1. COMPANY OVERVIEW

26.1.21.2. REVENUE ANALYSIS

26.1.21.3. GEOGRAPHIC PRESENCE

26.1.21.4. PRODUCT PORTFOLIO

26.1.21.5. RECENT DEVELOPMENTS

26.1.22 SMITH & NEPHEW

26.1.22.1. COMPANY OVERVIEW

26.1.22.2. REVENUE ANALYSIS

26.1.22.3. GEOGRAPHIC PRESENCE

26.1.22.4. PRODUCT PORTFOLIO

26.1.22.5. RECENT DEVELOPMENTS

26.1.23 PURDUE PHARMACEUTICALS L.P.

26.1.23.1. COMPANY OVERVIEW

26.1.23.2. REVENUE ANALYSIS

26.1.23.3. GEOGRAPHIC PRESENCE

26.1.23.4. PRODUCT PORTFOLIO

26.1.23.5. RECENT DEVELOPMENTS

26.1.24 BAYER AG

26.1.24.1. COMPANY OVERVIEW

26.1.24.2. REVENUE ANALYSIS

26.1.24.3. GEOGRAPHIC PRESENCE

26.1.24.4. PRODUCT PORTFOLIO

26.1.24.5. RECENT DEVELOPMENTS

26.1.25 BRISTOL LABORATORIES LTD

26.1.25.1. COMPANY OVERVIEW

26.1.25.2. GEOGRAPHIC PRESENCE

26.1.25.3. PRODUCT PORTFOLIO

26.1.25.4. RECENT DEVELOPMENTS

26.1.26 NOVARTIS AG

26.1.26.1. COMPANY OVERVIEW

26.1.26.2. REVENUE ANALYSIS

26.1.26.3. GEOGRAPHIC PRESENCE

26.1.26.4. PRODUCT PORTFOLIO

26.1.26.5. RECENT DEVELOPMENTS

26.1.27 LUPIN PHARMACEUTICALS, INC.

26.1.27.1. COMPANY OVERVIEW

26.1.27.2. REVENUE ANALYSIS

26.1.27.3. GEOGRAPHIC PRESENCE

26.1.27.4. PRODUCT PORTFOLIO

26.1.27.5. RECENT DEVELOPMENTS

26.1.28 GSK PLC.

26.1.28.1. COMPANY OVERVIEW

26.1.28.2. REVENUE ANALYSIS

26.1.28.3. GEOGRAPHIC PRESENCE

26.1.28.4. PRODUCT PORTFOLIO

26.1.28.5. RECENT DEVELOPMENTS

26.2 PIPELINE DRUG MANUFRACTURES

26.2.1 GENASCENCE

26.2.1.1. COMPANY OVERVIEW

26.2.1.2. REVENUE ANALYSIS

26.2.1.3. GEOGRAPHIC PRESENCE

26.2.1.4. PRODUCT PORTFOLIO

26.2.1.5. RECENT DEVELOPMENTS

26.2.2 4P PHARMA

26.2.2.1. COMPANY OVERVIEW

26.2.2.2. REVENUE ANALYSIS

26.2.2.3. GEOGRAPHIC PRESENCE

26.2.2.4. PRODUCT PORTFOLIO

26.2.2.5. RECENT DEVELOPMENTS

26.2.3 NOVARTIS AG

26.2.3.1. COMPANY OVERVIEW

26.2.3.2. REVENUE ANALYSIS

26.2.3.3. GEOGRAPHIC PRESENCE

26.2.3.4. PRODUCT PORTFOLIO

26.2.3.5. RECENT DEVELOPMENTS

26.2.4 BIOSPLICE THERAPEUTICS, INC.

26.2.4.1. COMPANY OVERVIEW

26.2.4.2. REVENUE ANALYSIS

26.2.4.3. GEOGRAPHIC PRESENCE

26.2.4.4. PRODUCT PORTFOLIO

26.2.4.5. RECENT DEVELOPMENTS

26.2.5 EUPRAXIA PHARMACEUTICALS

26.2.5.1. COMPANY OVERVIEW

26.2.5.2. REVENUE ANALYSIS

26.2.5.3. GEOGRAPHIC PRESENCE

26.2.5.4. PRODUCT PORTFOLIO

26.2.5.5. RECENT DEVELOPMENTS

26.2.6 ANDROS PHARMACEUTICALS CO., LTD

26.2.6.1. COMPANY OVERVIEW

26.2.6.2. REVENUE ANALYSIS

26.2.6.3. GEOGRAPHIC PRESENCE

26.2.6.4. PRODUCT PORTFOLIO

26.2.6.5. RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

27 RELATED REPORTS

28 CONCLUSION

29 QUESTIONNAIRE

30 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.