Global Otr Tires Market

Market Size in USD Billion

CAGR :

%

USD

7.31 Billion

USD

11.22 Billion

2024

2032

USD

7.31 Billion

USD

11.22 Billion

2024

2032

| 2025 –2032 | |

| USD 7.31 Billion | |

| USD 11.22 Billion | |

|

|

|

|

Off the Road (OTR) Tires Market Size

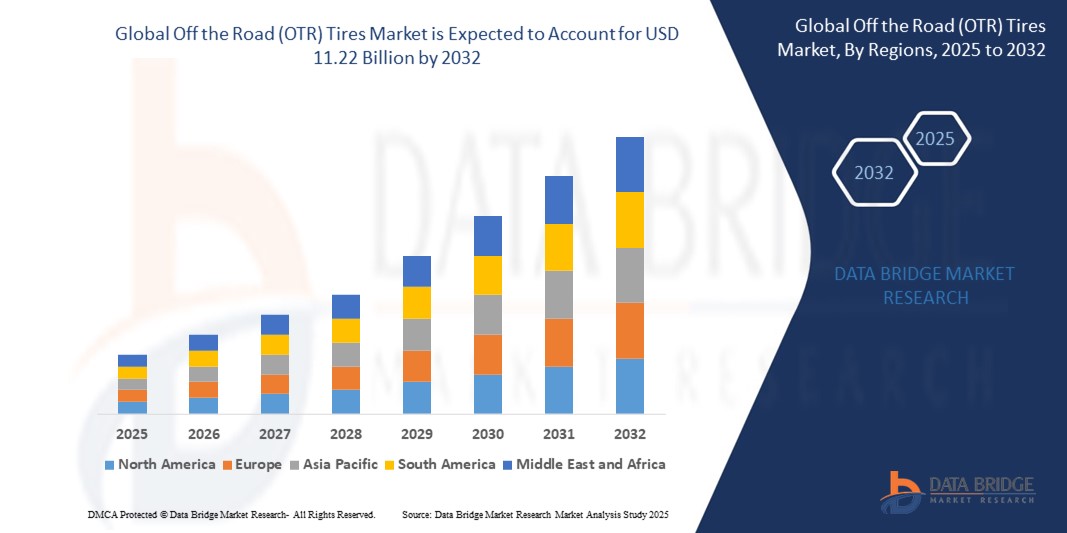

- The global off the road (OTR) tires market size was valued at USD 7.31 billion in 2024 and is expected to reach USD 11.22 billion by 2032, at a CAGR of 5.50% during the forecast period

- The market growth is largely fuelled by the increasing demand from construction, mining, and agricultural sectors for durable and high-performance tires capable of operating in harsh terrains

- Technological advancements in tire manufacturing, such as the development of wear-resistant compounds and smart tire monitoring systems, are further propelling market expansion

Off the Road (OTR) Tires Market Analysis

- Increasing demand from agriculture, construction, and mining industries is driving consistent growth in the off the road tires market

- Heavy-duty vehicles require durable tires that can handle rough terrains and high loads, boosting the need for advanced tire solutions

- Asia-Pacific dominates the OTR tires market with the largest revenue share of 39.8% in 2024, driven by rapid industrialization, urbanization, and increasing infrastructure and mining activities in countries such as China, India, and Japan

- Europe region is expected to witness the highest growth rate in the global off the road (OTR) tires market, driven by rising infrastructure development, increased mining activities, and the adoption of advanced agricultural machinery. Government incentives for sustainable practices and the growing presence of OEMs are further accelerating market expansion across the region

- The bias tires segment held the largest market revenue share in 2024, driven by its robustness and cost-effectiveness for heavy machinery operating in challenging environments. These tires offer strong sidewall resistance and flexibility, making them well-suited for applications involving rough terrains and heavy loads. Their simpler construction also allows for easier repairs and lower replacement costs, which appeals to budget-conscious operators

Report Scope and Off the Road (OTR) Tires Market Segmentation

|

Attributes |

Off the Road (OTR) Tires Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the market insights such as market value, growth rate, market segments, geographical coverage, market players, and market scenario, the market report curated by the Data Bridge Market Research team includes in-depth expert analysis, import/export analysis, pricing analysis, production consumption analysis, and pestle analysis. |

Off the Road (OTR) Tires Market Trends

“Growing Adoption of Sustainable and Eco-Friendly OTR Tires”

- The off the road tires market is shifting toward sustainable and eco-friendly tire solutions as environmental concerns increase

- Manufacturers are investing in green manufacturing processes and recyclable materials to meet stricter environmental standards

- For instance, Michelin have introduced OTR tires made with sustainable rubber compounds to enhance durability and reduce environmental impact

- Demand is growing for recyclable and energy-efficient tire models, driven by industries facing tighter emissions and waste regulations

- Eco-friendly tires are becoming an important factor in procurement decisions, offering businesses a competitive advantage in sustainability efforts

Off the Road (OTR) Tires Market Dynamics

Driver

“Rising Demand from Construction and Mining Sectors”

- The construction and mining industries are major drivers of the OTR tires market due to their reliance on heavy-duty equipment operating in harsh environments

- Increased investments in infrastructure development, especially in developing countries, are boosting demand for robust tires used in road, housing, and industrial projects

- Expanding global mining operations to meet the demand for minerals and metals are creating consistent requirements for high-performance off the road tires

- Mechanization in agriculture is also contributing to OTR tire sales, with tractors, harvesters, and related machinery requiring durable tire solutions

- For instance, in India and Brazil, large-scale mining and construction projects are accelerating the adoption of specialized tires to ensure equipment performance and reliability

Restraint/Challenge

“High Cost of Specialized Tires and Maintenance”

- The high cost of specialized OTR tires, driven by advanced materials and engineering, poses a financial challenge for many buyers

- Small construction firms and independent contractors often struggle with the expense of replacing or upgrading full tire sets

- Specialized servicing and repair requirements increase long-term ownership costs due to the technical complexity and size of these tires

- Downtime from tire failures can lead to operational disruptions and additional maintenance expenses in critical sectors

- For instance, mining companies in remote areas face extra logistical costs for repairs and spares, making frequent maintenance difficult and costly

Off the Road (OTR) Tires Market Scope

The market is segmented on the basis of product type, thread pattern, tire weight, tire size, rim size, vehicle type, process, application, and distribution channel.

- By Product Type

On the basis of product type, the OTR tires market is segmented into bias tires, radial tires, and non-pneumatic tires. The bias tires segment held the largest market revenue share in 2024, driven by its robustness and cost-effectiveness for heavy machinery operating in challenging environments. These tires offer strong sidewall resistance and flexibility, making them well-suited for applications involving rough terrains and heavy loads. Their simpler construction also allows for easier repairs and lower replacement costs, which appeals to budget-conscious operators.

The radial tires segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its superior performance characteristics such as better fuel efficiency, improved traction, and longer tread life. These tires provide enhanced stability and load-carrying capacity, making them ideal for heavy-duty off-road applications. Growing preference for radial tires in construction and mining equipment, due to their ability to reduce downtime and maintenance costs, is further fuelling market growth. In addition, technological advancements in radial tire manufacturing are leading to more durable and environmentally friendly products, increasing their appeal among end users.

- By Thread Pattern

On the basis of thread pattern, the OTR tires market is segmented into traction, rock, rib, block, and smooth. The traction segment commanded the largest market share in 2024, owing to its superior grip and performance on rough and muddy terrains, widely used in loaders and dozers. Its deep tread design enhances stability and safety, making it a preferred choice for heavy machinery operating in construction and agriculture. The durability and ability to handle varying surfaces contribute to its sustained demand across multiple industries.

The rock thread pattern segment is expected to witness the fastest growth rate from 2025 to 2032, driven by its resistance to cuts and punctures, making it suitable for rocky and harsh mining environments. Its rugged construction helps extend tire life and reduce downtime, which is critical in mining operations. Increasing mining activities worldwide and the need for reliable tires in extreme conditions are further boosting the adoption of rock tread patterns.

- By Tire Weight

On the basis of tire weight, the OTR tires market is segmented into under 2000 pounds, 2000-4000 pounds, 4000 pounds, and above 4000 pounds. The 2000-4000 pounds segment accounted for the highest market revenue share in 2024, preferred for balancing durability and maneuverability in medium-sized machinery. This segment caters to a wide range of equipment used in construction and agriculture, where both strength and ease of movement are crucial. Its versatility makes it a favored choice for various applications requiring reliable performance on uneven terrains.

The above 4000 pounds segment is expected to witness the fastest growth rate from 2025 to 2032, fuelled by demand in heavy-duty mining equipment requiring extra load capacity. As mining operations expand and equipment grows larger, tires in this weight category are essential to handle extreme loads and harsh working conditions. The segment’s growth is supported by technological advancements in tire materials that enhance strength without compromising durability.

- By Tire Size

On the basis of tire size, the OTR tires market is segmented into 31 inches, 31-40 inches, 41-45 inches, and above 45 inches. The 31-40 inches segment held the largest market revenue share in 2024 due to its versatile application across graders, loaders, and earthmovers. This size range offers an optimal balance between performance and compatibility, making it suitable for a broad array of machinery in various industries. Its widespread adoption is attributed to its ability to handle diverse terrains and operational demands effectively.

The above 45 inches segment is expected to witness the fastest growth rate from 2025 to 2032, driven by expanding heavy machinery use in mining and construction sectors. Larger tire sizes are essential for supporting the increasing size and weight of modern equipment, providing enhanced stability and load-bearing capacity. Innovations in tire technology are also contributing to the segment’s rapid growth by improving durability and efficiency for these massive machines.

- By Rim Size

On the basis of rim size, the OTR tires market is segmented into less than 25 inches, 29-41 inches, and 51-63 inches. The 29-41 inches segment dominates the market with the highest revenue share in 2024, offering an optimal fit for a variety of vehicles such as graders, loaders, and earthmovers. This rim size balances performance, durability, and compatibility, making it a preferred choice across multiple applications. Its versatility supports widespread use in construction, mining, and agricultural machinery.

The 51-63 inches segment is expected to witness the fastest growth rate from 2025 to 2032, owing to the increasing deployment of large earthmoving and mining vehicles requiring specialized tires. The rising demand for heavy-duty equipment capable of handling extreme loads and harsh environments drives growth in this segment. Advances in tire technology further enhance the performance and lifespan of these large-sized tires, fuelling their adoption.

- By Vehicle Type

On the basis of vehicle type, the OTR tires market is segmented into graders, earthmovers, loaders and dozers, agriculture equipment, and tractors. Loaders and dozers accounted for the largest market revenue share in 2024, supported by their extensive use in construction and mining industries. These vehicles require durable and high-performance OTR tries to operate efficiently in rough terrains and demanding conditions. Their critical role in earthmoving and material handling drives sustained demand for specialized tires.

Agriculture equipment is expected to witness the fastest growth rate from 2025 to 2032 due to mechanization trends in farming. Increasing adoption of advanced machinery and automated equipment in agriculture is boosting the need for reliable OTR tires tailored for farm operations. Rising investments in modern agricultural practices and expansion of arable land further contribute to this growth.

- By Process

On the basis of process, the OTR tires market is segmented into pre-cure and mold cure. The pre-cure segment held the largest market revenue share in 2024, attributed to cost-efficiency and simpler manufacturing techniques. Pre-cure tires benefit from faster production times and lower capital investment, making them a preferred choice for many OEMs and aftermarket suppliers. Their standardized designs also contribute to steady demand across various vehicle types.

The mold cure segment is expected to witness the fastest growth rate from 2025 to 2032, driven by demand for customized tire designs offering enhanced performance. Mold cure technology allows for greater flexibility in tread patterns and tire construction, improving durability and traction in specific applications. This innovation is particularly valued in industries requiring specialized tires for extreme conditions, such as mining and heavy construction.

- By Application

On the basis of application, the OTR tires market is segmented into construction and mining, agriculture, and industrial. The construction and mining segment captured the largest market revenue share in 2024, propelled by growing infrastructure projects and mineral extraction activities globally. The increasing demand for durable and high-performance OTR tires in these sectors supports continuous market growth. Heavy machinery used in these industries requires tires capable of withstanding harsh terrains and heavy loads, further boosting segment demand.

The agriculture segment is expected to witness the fastest growth rate from 2025 to 2032 due to rising adoption of mechanized farming equipment. As farmers seek to improve efficiency and productivity, the need for specialized OTR tires designed for agricultural vehicles is increasing. This trend is supported by advancements in tire technology aimed at enhancing soil protection and fuel efficiency in agricultural operations.

- By Distribution Channel

On the basis of distribution channel, the OTR tires market is segmented into original equipment manufacturers and aftermarket. The aftermarket segment dominated the market in 2024, fuelled by the demand for replacement tires and servicing in existing fleets. The growing number of operational heavy vehicles requiring regular tire maintenance and replacements sustains strong aftermarket activity. In addition, extended equipment lifecycles and the availability of cost-effective tire solutions further boost this segment.

The original equipment manufacturer (OEM) segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing production of heavy machinery fitted with new tires. As construction and mining sectors expand globally, demand for OEM tires rises in tandem with new vehicle sales. OEM partnerships and advancements in tire customization also contribute to the segment’s rapid growth.

Off the Road (OTR) Tires Market Regional Analysis

- Asia-Pacific dominates the OTR tires market with the largest revenue share of 39.8% in 2024, driven by rapid industrialization, urbanization, and increasing infrastructure and mining activities in countries such as China, India, and Japan

- The region’s growing construction and agriculture sectors are boosting demand for durable, high-performance OTR tires

- In addition, local manufacturers provide cost-competitive options, making tires more accessible to a wider customer base

- Government initiatives to develop rural and urban infrastructure also support steady market expansion. Strong aftermarket services further strengthen the regional market position

China OTR Tires Market Insight

China holds the largest market revenue share within Asia-Pacific in 2024, propelled by an extensive construction boom and mining activities. The country benefits from significant government investments in infrastructure and urban development projects. Domestic manufacturers are innovating with fuel-efficient and long-lasting tires tailored to local needs. The rise of smart tire technology and the expansion of aftermarket services contribute to increasing market penetration. Affordable pricing and strong distribution networks enhance tire accessibility for various heavy machinery segments.

Japan OTR Tires Market Insight

Japan’s OTR tires market is expected to witness the fastest growth rate from 2025 to 2032, supported by advanced technological infrastructure and high standards for quality and safety. Mechanization trends in agriculture and automation in construction encourage use of specialized tires designed for performance and longevity. Japanese manufacturers focus on producing smart tires with integrated monitoring systems. The aging population also increases demand for easier maintenance and safer equipment. Continued investments in R&D promote innovation in eco-friendly and energy-efficient tire solutions.

Europe OTR Tires Market Insight

The Europe is expected to witness the fastest growth rate from 2025 to 2032, fuelled by modernization in mining and infrastructure sectors in countries such as Germany, the U.K., and France. The region’s strict environmental regulations push manufacturers to develop energy-efficient and eco-friendly tire solutions. Increased adoption of advanced tire technologies and rising demand in construction, agriculture, and industrial applications contribute to growth. Europe’s well-established industrial base and high safety standards support continuous innovation. Investments in refurbishment and recycling initiatives further enhance sustainable market development.

Germany OTR Tires Market Insight

The Germany plays a key role in Europe’s OTR tires market, supported by a strong automotive and manufacturing sector. The country emphasizes sustainability, with a growing demand for eco-friendly, high-performance tires in agricultural and industrial applications. Government policies promoting green technology accelerate the adoption of innovative tire designs. Manufacturers focus on durability, fuel efficiency, and customization to meet the needs of German heavy machinery users. Integration of smart tire monitoring systems is becoming more prevalent to enhance operational efficiency.

U.K. OTR Tires Market Insight

The U.K. OTR tires market is expected to witness the fastest growth rate from 2025 to 2032, driven by increasing infrastructure projects and the mechanization of agriculture and mining. The demand for energy-efficient and robust tires continues to rise across construction and industrial sectors. A well-established aftermarket network provides easy access to replacement tires and maintenance services. Government focus on sustainability and safety also influences tire selection in the region. The growing trend of digitization in fleet management encourages adoption of smart tire solutions.

North America OTR Tires Market Insight

The North America holds a significant market share due to extensive mining and infrastructure activities, especially in the U.S. and Canada. The region benefits from high adoption of advanced technologies and strong aftermarket support. Rising investments in construction projects and modernization of mining equipment fuel demand for specialized OTR tires. Increasing emphasis on fuel efficiency and emission reduction drives tire innovation. The presence of leading global tire manufacturers and distributors supports consistent market growth.

U.S. OTR Tires Market Insight

The U.S. dominates the North American market, backed by significant construction and mining activities. The market is driven by growing demand for durable, fuel-efficient tires tailored for heavy machinery. Innovations in tire compounds and design help improve performance and reduce operational costs. A strong aftermarket for replacement tires and maintenance services fosters ongoing demand. The integration of tire monitoring systems aligns with increasing focus on fleet safety and efficiency.

Off the Road (OTR) Tires Market Share

The Off the Road (OTR) Tires industry is primarily led by well-established companies, including:

- Continental AG (Germany)

- Bridgestone Corporation (Japan)

- Michelin (France)

- The Goodyear Tire & Rubber Company (U.S.)

- Yokohama Tire Corporation (Japan)

- Hankook Tire & Technology Co.,Ltd. (South Korea)

- Nokian Tyres plc. (Finland)

- Apollo Tyres Ltd (India)

- Kumho Tire (South Korea)

- Pirelli & C. S.p.A. (Italy)

- Sumitomo Rubber Industries, Ltd. (Japan)

- Toyo Tire Corporation (Japan)

- China National Tire & Rubber Co.,Ltd. (China)

- Trelleborg AB (Sweden)

- Prometeon Tyre Group S.R.L. (Italy)

- JK Tyre & Industries Ltd. (India)

- Qingdao Rhino Tyre Co., Ltd. (China)

- Titan International, Inc. (U.S.)

- Balkrishna Industries Limited (BKT) (India)

- Triangle Tires (China)

Latest Developments in Global Off the Road (OTR) Tires Market

-

In September 2024, Michelin introduced two new tire sizes, VF900/65R46 CFO and VF800/70R46 CFO, in collaboration with New Holland for the CR11 combine harvester. This product development integrates ULTRAFLEX technology to reduce soil compaction, improve fuel efficiency, and enhance overall productivity. With a 23% larger footprint and 7% lower ground pressure, these tires offer a 10 km/h cyclic load bonus, setting new standards for agricultural performance

- In March 2024, Bridgestone Americas launched its VZT 25" construction tire at the AGG1 Expo in Nashville, designed specifically for loaders and graders. This innovation improves durability and traction while supporting Bridgestone’s E8 sustainability values. The product strengthens the company’s construction portfolio and underlines its focus on reducing operational costs through engineering-driven solutions

- In April 2024, Michelin released the MICHELIN XTRA DEFEND E4 L4 tire range for loaders and articulated dump trucks. This new tire line offers enhanced load capacity of up to 25,400 kg, improved speed of 14 kph, and greater robustness with 50% more metal mass. Available in six sizes and retreadable, the range increases versatility and cost-effectiveness for high-productivity operations in quarry environments

- In March 2024, Pirelli & C. S.p.A. launched the Pirelli PHP agriculture OTR tire tailored for the European market. The tire focuses on fuel savings, extended lifespan, reduced soil compaction, and improved safety and ride comfort. Leveraging Pirelli's expertise, this product is positioned to strengthen its presence in the agricultural segment while meeting evolving demands for sustainability and efficiency

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.