Global Over The Counter Otc Electromagnetic Pulse Therapy Market

Market Size in USD Billion

CAGR :

%

USD

964.12 Billion

USD

1,402.89 Billion

2024

2032

USD

964.12 Billion

USD

1,402.89 Billion

2024

2032

| 2025 –2032 | |

| USD 964.12 Billion | |

| USD 1,402.89 Billion | |

|

|

|

|

Over-the-Counter (OTC) Electromagnetic Pulse Therapy Market Size

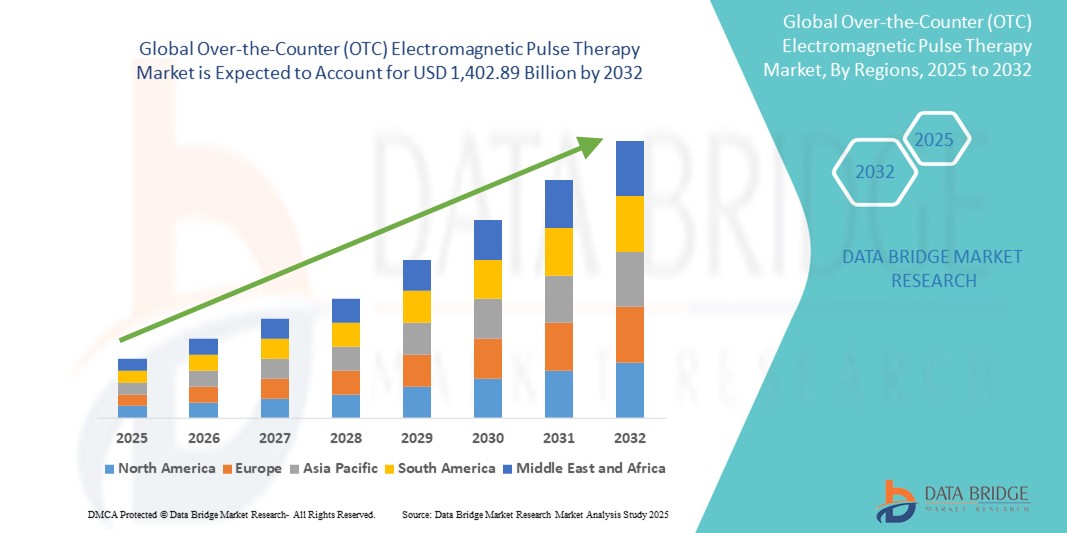

- The global over-the-counter (OTC) electromagnetic pulse therapy market size was valued at USD 964.12 billion in 2024 and is expected to reach USD 1,402.89 billion by 2032, at a CAGR of 4.80% during the forecast period

- The market growth is largely fueled by increasing consumer preference for non-invasive, drug-free pain management solutions and the expanding accessibility of wearable EMP therapy devices through retail and online channels

- Furthermore, rising awareness of chronic pain conditions and musculoskeletal disorders, coupled with growing trust in self-managed healthcare technologies, is positioning OTC EMP therapy as a viable and attractive solution. These converging factors are accelerating the demand for user-friendly electromagnetic pulse devices, thereby significantly boosting the industry's growth

Over-the-Counter (OTC) Electromagnetic Pulse Therapy Market Analysis

- OTC electromagnetic pulse (EMP) therapy devices, which deliver low-frequency electromagnetic fields for pain relief and tissue recovery, are becoming increasingly important in home-based wellness and rehabilitation due to their non-invasive nature, ease of use, and drug-free therapeutic benefits

- The growing demand for EMP therapy solutions is primarily driven by increasing prevalence of chronic pain, rising consumer inclination toward self-care products, and a shift away from opioid-based pain management strategies

- North America dominated the over-the-counter (OTC) electromagnetic pulse therapy market with the largest revenue share of 39% in 2024, supported by a well-established home healthcare infrastructure, growing geriatric population, and strong market presence of key wellness and medical device brands offering FDA-cleared EMP products

- Asia-Pacific is expected to be the fastest growing region in the over-the-counter (OTC) electromagnetic pulse therapy market during the forecast period, fueled by increasing healthcare awareness, expanding middle-class populations, and growing acceptance of wearable and home-use therapeutic technologies

- Low-frequency PEMF Devices segment dominated the over-the-counter (OTC) electromagnetic pulse therapy market with a market share of 49.1% in 2024, driven by its superior safety profile, effectiveness in managing chronic pain, and suitability for long-term home use

Report Scope and Over-the-Counter (OTC) Electromagnetic Pulse Therapy Market Segmentation

|

Attributes |

Over-the-Counter (OTC) Electromagnetic Pulse Therapy Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Over-the-Counter (OTC) Electromagnetic Pulse Therapy Market Trends

“Rising Consumer Preference for Wearable and Portable Pain Relief Devices”

- A significant and accelerating trend in the global OTC electromagnetic pulse (EMP) therapy market is the increasing consumer preference for compact, wearable, and portable EMP devices that provide drug-free pain relief. These devices are designed for convenience, enabling users to manage chronic or acute pain discreetly at home, at work, or on the go

- For instance, products such as the Oska Pulse and ActiPatch are wearable, non-invasive devices that use pulsed electromagnetic fields to reduce pain and inflammation without the side effects commonly associated with pharmaceuticals

- Modern wearable EMP devices are being developed with rechargeable batteries, user-friendly interfaces, and programmable settings, offering tailored therapy sessions based on the user’s condition and lifestyle. In addition, many devices are now Bluetooth-enabled, allowing users to track usage and effectiveness through companion mobile apps

- The shift toward self-managed healthcare is further driving interest in portable EMP therapy solutions. Patients with arthritis, back pain, and post-operative discomfort increasingly opt for EMP devices as part of daily pain management routines

- This trend toward smart, portable EMP therapy solutions is reshaping expectations in pain management by offering accessible, continuous, and safe alternatives to traditional treatment. As a result, companies such as BioElectronics Corporation are actively expanding their OTC wearable EMP offerings to meet the growing demand

- The growing preference for wearable EMP devices reflects a broader movement toward home-based and consumer-friendly wellness technologies, prompting innovation and rapid product diversification in the market

Over-the-Counter (OTC) Electromagnetic Pulse Therapy Market Dynamics

Driver

“Increasing Demand for Non-Invasive, Drug-Free Pain Management”

- The rising global burden of chronic pain and growing consumer demand for safe, non-invasive treatment options are key drivers of the OTC electromagnetic pulse therapy market. As patients seek to reduce dependence on pain medications, especially opioids, EMP devices offer an attractive alternative for effective pain relief without adverse side effects

- For instance, in January 2024, BioElectronics Corporation expanded distribution of its ActiPatch devices through large retail chains across North America and Europe, reflecting surging demand for accessible, over-the-counter pain solutions

- The aging global population, along with a growing preference for self-care and preventive health, is fueling adoption of EMP devices in home care settings

- With increasing awareness of the benefits of PEMF therapy including improved circulation, reduced inflammation, and accelerated healing consumers are turning to wearable EMP devices as part of their daily wellness routines

- In addition, the availability of compact, affordable, and FDA-cleared EMP products at pharmacies and online platforms is enhancing market accessibility and accelerating adoption rates

Restraint/Challenge

“Lack of Clinical Awareness and Standardization in OTC Applications”

- A significant challenge to the widespread adoption of OTC electromagnetic pulse therapy devices is the limited clinical awareness and standardization regarding their efficacy and use

- While EMP therapy has documented therapeutic benefits, inconsistent clinical guidance and varying product quality can lead to consumer skepticism

- For instance, some health professionals remain cautious in recommending OTC EMP devices due to a lack of universal clinical guidelines and variability in product performance across brands and models

- In addition, the absence of uniform regulatory oversight in certain markets may lead to the circulation of unverified or low-efficacy products, potentially harming consumer trust. As a result, established manufacturers must invest in educational campaigns and clinical research to validate claims and enhance credibility

- Price sensitivity in emerging markets and the perception that EMP therapy devices are premium wellness products may also limit adoption, particularly among lower-income or rural populations

- Addressing these barriers through targeted awareness programs, clinical validation, and affordable device offerings will be essential for long-term market expansion

Over-the-Counter (OTC) Electromagnetic Pulse Therapy Market Scope

The market is segmented on the basis of device type and end-user.

- By Device

On the basis of device type, the over-the-counter (OTC) electromagnetic pulse therapy market is segmented into high-frequency PEMF devices, mid-frequency PEMF devices, and low-frequency PEMF devices. The low-frequency PEMF devices segment dominated the market with the largest market revenue share of 49.1% in 2024, driven by its well-established safety profile and effectiveness in managing chronic pain. These devices are particularly favored for at-home use due to their lower intensity, making them safer for continuous or long-duration therapies without medical supervision. The rising prevalence of musculoskeletal disorders and consumer preference for non-invasive, easy-to-use therapeutic solutions further support the dominance of this segment.

The mid-frequency PEMF devices segment is expected to witness the fastest growth rate from 2025 to 2032, fueled by their expanding application in soft tissue recovery and broader therapeutic utility. These devices offer a balance between intensity and user comfort, making them suitable for sports recovery and moderate pain management. Advancements in portable device design and greater awareness of mid-frequency therapy benefits are contributing to their increasing adoption.

- By End-user

On the basis of end-user, the over-the-counter (OTC) electromagnetic pulse therapy market is segmented into hospitals & clinics, diagnostic centers, home care settings, and others. The home care settings segment led the market with the largest revenue share of 51.3% in 2024, owing to the growing trend of self-care and increasing demand for portable, over-the-counter therapeutic devices. The convenience of at-home pain management, especially among the aging population and individuals with chronic conditions, is driving widespread adoption of EMP therapy in residential settings. In addition, the availability of wearable EMP devices through e-commerce and pharmacy channels supports the dominance of this segment.

The hospitals & clinics segment is expected to witness the fastest growth rate from 2025 to 2032, supported by increasing integration of PEMF therapy into physical rehabilitation and outpatient care protocols. The medical-grade credibility of such devices and their proven efficacy in accelerating recovery processes are encouraging their use in clinical environments for acute and post-surgical pain management.

Over-the-Counter (OTC) Electromagnetic Pulse Therapy Market Regional Analysis

- North America dominated the over-the-counter (OTC) electromagnetic pulse therapy market with the largest revenue share of 39% in 2024, supported by a well-established home healthcare infrastructure, growing geriatric population, and strong market presence of key wellness and medical device brands offering FDA-cleared EMP products

- Consumers in the region increasingly prioritize drug-free therapeutic alternatives for chronic pain, and appreciate the ease of use, portability, and safety features offered by OTC EMP devices, especially for home care applications

- This high adoption rate is further supported by strong healthcare infrastructure, growing consumer awareness of PEMF therapy benefits, and a shift toward self-managed care, positioning EMP devices as a key component of modern wellness and rehabilitation strategies

U.S. Over-the-Counter (OTC) Electromagnetic Pulse Therapy Market Insight

The U.S. over-the-counter (OTC) electromagnetic pulse therapy market captured the largest revenue share of 79% in 2024 within North America, fueled by the growing adoption of drug-free, non-invasive pain relief solutions and increasing awareness of wearable PEMF therapy devices. Consumers are prioritizing at-home wellness technologies to manage chronic conditions such as arthritis and back pain. The strong presence of FDA-cleared devices, combined with robust e-commerce distribution and rising healthcare consumerism, further supports the market’s expansion.

Europe OTC Electromagnetic Pulse Therapy Market Insight

The Europe over-the-counter (OTC) electromagnetic pulse therapy market is projected to grow at a substantial CAGR throughout the forecast period, primarily driven by rising healthcare awareness and a strong preference for non-pharmaceutical pain relief alternatives. Regulatory support for wellness technologies and growing adoption of self-managed care across aging populations are key growth drivers. Consumers across the region are turning to wearable PEMF solutions for daily pain relief and mobility enhancement, contributing to broader acceptance in both urban and rural settings.

U.K. OTC Electromagnetic Pulse Therapy Market Insight

The U.K. over-the-counter (OTC) electromagnetic pulse therapy market is expected to grow at a noteworthy CAGR during the forecast period, supported by increasing demand for accessible and affordable pain management solutions. Growing public awareness of PEMF therapy benefits and expanding retail availability through pharmacies and online platforms are accelerating adoption. Rising concerns over opioid dependency and chronic pain management are also encouraging consumers to opt for wearable, drug-free alternatives.

Germany OTC Electromagnetic Pulse Therapy Market Insight

The Germany over-the-counter (OTC) electromagnetic pulse therapy market is expected to expand at a considerable CAGR during the forecast period, driven by rising interest in advanced wellness technologies and preventive healthcare. Germany’s strong regulatory framework and consumer preference for clinically validated, eco-conscious solutions are fostering trust in PEMF devices. The integration of EMP therapy into home-based care routines and rehabilitation programs is gaining popularity, particularly among the elderly population.

Asia-Pacific OTC Electromagnetic Pulse Therapy Market Insight

The Asia-Pacific over-the-counter (OTC) electromagnetic pulse therapy market is poised to grow at the fastest CAGR of 22.3% during the forecast period of 2025 to 2032, fueled by growing urbanization, rising healthcare spending, and a surge in chronic pain conditions. Countries such as China, India, and Japan are witnessing increased adoption of wearable health devices, supported by expanding retail channels and digital health awareness. Regional manufacturing capabilities and affordability are making EMP therapy solutions more accessible to a broader consumer base.

Japan OTC Electromagnetic Pulse Therapy Market Insight

The Japan over-the-counter (OTC) electromagnetic pulse therapy market is gaining traction due to its aging population and emphasis on non-invasive healthcare solutions. Consumers in Japan value convenience and technological sophistication, leading to increased adoption of compact, wearable PEMF devices. Integration with mobile apps and smart home healthcare systems is also encouraging usage, particularly among elderly and mobility-impaired users seeking daily pain relief and improved quality of life.

India OTC Electromagnetic Pulse Therapy Market Insight

The India over-the-counter (OTC) electromagnetic pulse therapy market accounted for the largest revenue share in Asia Pacific in 2024, driven by growing public awareness of alternative pain therapies and rising penetration of wearable health devices. The expanding middle class, increasing chronic disease burden, and rising digital literacy are fueling demand for easy-to-use, affordable EMP devices. Government initiatives promoting home-based care and local manufacturing also support strong market growth across both urban and rural areas.

Over-the-Counter (OTC) Electromagnetic Pulse Therapy Market Share

The Over-the-Counter (OTC) electromagnetic pulse therapy industry is primarily led by well-established companies, including:

- BioElectronics Corporation (U.S.)

- Oska Wellness, Inc. (U.S.)

- BEMER International AG (Liechtenstein)

- Orthometrix, Inc. (U.S.)

- HealthyLine LLC (U.S.)

- Sana Therapeutics LLC (U.S.)

- Medithera AG (Germany)

- NewMed Ltd. (U.K.)

- OMI Ltd. (Oxford Medical Instruments) (Hungary)

- Swiss Bionic Solutions AG (Switzerland)

- Sota Instruments Inc. (Canada)

- EarthPulse Technologies LLC (U.S.)

- Neurobiologix, Inc. (U.S.)

- Tuned Wellness LLC (U.S.)

- Neurocare Systems, Inc. (U.S.)

- QRS International AG (Switzerland)

- iMRS Systems (Germany)

- PEMF Systems, Inc. (U.S.)

- Aura Wellness Systems Pvt. Ltd. (India)

What are the Recent Developments in Global Over-the-Counter (OTC) Electromagnetic Pulse Therapy Market?

- In May 2024, BioElectronics Corporation, a leading innovator in wearable medical devices, announced expanded retail partnerships in the U.S. and Europe for its ActiPatch product line. These electromagnetic pulse therapy devices are designed for drug-free pain relief and are now available in major pharmacy chains, increasing consumer accessibility. This move reflects the company’s strategic focus on growing its global OTC footprint and addressing rising demand for non-invasive pain management solutions

- In April 2024, Oska Wellness, a U.S.-based medical technology company, introduced the Oska Pulse Gen3, a next-generation wearable EMP therapy device with improved battery life, enhanced portability, and app connectivity for personalized pain management. This product launch highlights Oska's dedication to user-centric innovation and reinforces its position in the growing wearable pain relief segment

- In March 2024, Orthometrix, Inc. entered a distribution agreement with a leading Asian wellness retail chain to introduce its Magcell PEMF therapy devices in high-demand markets such as India, Malaysia, and Singapore. The agreement aims to tap into the rising consumer interest in drug-free alternatives and expands the company’s presence across the Asia-Pacific region, one of the fastest-growing markets for home-use therapeutic technologies

- In February 2024, Curavi Health, a digital health and rehabilitation firm, launched its direct-to-consumer online platform offering subscription-based access to low-frequency PEMF therapy devices. These products cater to individuals managing chronic musculoskeletal pain and are designed for home use. This initiative supports the growing trend of digital health integration with wearable therapy and emphasizes the company’s commitment to accessible self-managed care solutions

- In January 2024, BEMER Group, a Switzerland-based company specializing in microcirculation therapy, unveiled clinical trial results showcasing the efficacy of its OTC PEMF devices in improving circulation and reducing pain in patients with osteoarthritis. The findings strengthen BEMER’s scientific credibility and support the clinical adoption of EMP therapy in broader wellness and home care applications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.