Global Overall Equipment Effectiveness Software Market

Market Size in USD Billion

CAGR :

%

USD

75.54 Billion

USD

188.38 Billion

2024

2032

USD

75.54 Billion

USD

188.38 Billion

2024

2032

| 2025 –2032 | |

| USD 75.54 Billion | |

| USD 188.38 Billion | |

|

|

|

|

Overall Equipment Effectiveness Software Market Size

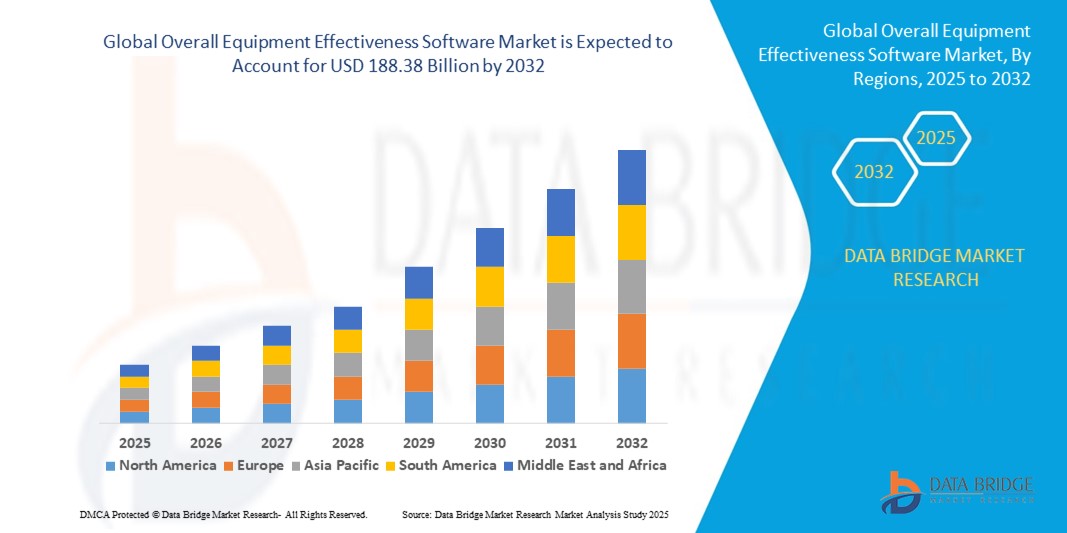

- The global overall equipment effectiveness software market size was valued at USD 75.54 billion in 2024 and is expected to reach USD 188.38 billion by 2032, at a CAGR of 12.10% during the forecast period

- The market growth is largely fueled by the rising need for real-time production monitoring, predictive maintenance, and the optimization of manufacturing operations, driven by Industry 4.0 adoption and smart factory initiatives

- Furthermore, increasing demand for data-driven decision-making tools and integrated manufacturing intelligence systems is positioning OEE software as a core element of digital transformation strategies. These converging factors are accelerating the deployment of OEE solutions, thereby significantly boosting the industry's growth

Overall Equipment Effectiveness Software Market Analysis

- OEE software, designed to measure and improve manufacturing productivity by tracking availability, performance, and quality metrics, is becoming an essential component in modern industrial operations as companies strive to achieve higher operational efficiency and digital integration

- The growing demand for OEE software is primarily driven by the increasing adoption of smart manufacturing practices, the need for real-time equipment performance insights, and the rising emphasis on reducing production downtime and optimizing asset utilization

- North America dominated the overall equipment effectiveness software market with the largest revenue share of 38% in 2024, attributed to the region’s strong manufacturing base, rapid digital transformation across industries, and the early adoption of industrial IoT and analytics platforms, particularly in the U.S., where large enterprises and SMEs alike as are investing in automation and performance optimization tools

- Asia-Pacific is expected to be the fastest growing region in the overall equipment effectiveness software market during the forecast period due to rapid industrialization, government initiatives supporting smart factory developments, and increased awareness of lean manufacturing principles

- The on-premise deployment segment dominated the overall equipment effectiveness software market with a market share of 56.3% in 2024, driven by its perceived data security, customization capabilities, and widespread use in industries with legacy infrastructure systems

Report Scope and Overall Equipment Effectiveness Software Market Segmentation

|

Attributes |

Overall Equipment Effectiveness Software Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Overall Equipment Effectiveness Software Market Trends

AI-Driven Analytics and Predictive Insights Reshaping Manufacturing Efficiency

- A significant and accelerating trend in the global OEE software market is the integration of artificial intelligence (AI) and machine learning (ML) technologies into production monitoring systems, enabling predictive insights and real-time analytics for performance optimization

- For instance, companies such as GE Digital and Siemens have developed AI-enabled OEE modules within their industrial software suites, allowing manufacturers to identify equipment inefficiencies, anticipate maintenance needs, and improve overall plant productivity with data-driven precision

- AI-driven OEE platforms can automatically detect deviations in performance, classify downtime reasons, and offer actionable suggestions based on historical data patterns, allowing for proactive decision-making. Tulip Interfaces, for example, uses AI to improve visibility into shop floor operations and optimize workflows without the need for complex coding

- The integration of these systems with industrial IoT (IIoT), ERP, and MES platforms further enhances centralized control and operational intelligence. Manufacturers can manage productivity, track KPIs, and receive real-time alerts via unified dashboards that enable swift response to anomalies or downtime

- This trend toward intelligent automation and predictive analytics is redefining how manufacturers measure and manage efficiency. As a result, companies such as Prodsmart and MachineMetrics are offering cloud-based, scalable OEE software integrated with edge computing and AI to cater to both SMEs and large enterprises

- The demand for smart OEE solutions that offer AI-based diagnostics, cloud connectivity, and seamless integration is rapidly growing across automotive, electronics, pharmaceuticals, and other industries seeking to boost uptime and maximize operational performance

Overall Equipment Effectiveness Software Market Dynamics

Driver

Rising Demand for Real-Time Manufacturing Visibility and Lean Efficiency

- The increasing need for operational transparency, production optimization, and lean manufacturing practices is a major driver behind the growing demand for OEE software across global industries

- For instance, in March 2024, Rockwell Automation expanded its FactoryTalk ProductionCentre to include real-time OEE analytics and enhanced reporting tools, helping manufacturers reduce waste and improve equipment utilization. Such advancements are expected to fuel market growth during the forecast period

- As companies focus on reducing production downtime, increasing throughput, and maximizing equipment utilization, OEE software offers a strategic toolset to monitor, analyze, and optimize every facet of operational performance

- In addition, the growing adoption of Industry 4.0 and smart factory initiatives is making OEE software a cornerstone of digital transformation strategies, offering integration with industrial IoT devices, SCADA systems, and MES platforms for enhanced automation and insight

- Features such as real-time dashboard reporting, downtime tracking, and performance benchmarking across production lines are becoming indispensable for manufacturers aiming to stay competitive in increasingly dynamic markets. This is driving widespread deployment of both cloud-based and on-premise OEE platforms across industry verticals

Restraint/Challenge

Integration Complexity and Data Security Concerns in Legacy Environments

- The complexity of integrating modern OEE software with legacy production systems and equipment remains a significant barrier to widespread adoption, particularly in traditional manufacturing settings with limited digital infrastructure

- Many manufacturers, especially in developing regions, rely on older machinery lacking IoT connectivity or digital interfaces, making real-time data collection and analysis a technical challenge without significant investment in retrofitting or modernization

- For instance, in December 2023, a report by Smart Industry highlighted how a mid-sized auto parts manufacturer in Eastern Europe experienced project delays and increased costs during an OEE software implementation due to incompatibility with outdated PLC systems and the lack of real-time data streaming capabilities, ultimately requiring external system integrators and hardware upgrades

- Moreover, as OEE software collects and transmits sensitive operational data over networks, concerns over cybersecurity risks and data breaches are rising. These concerns can deter adoption, especially among firms with limited in-house IT capabilities or regulatory oversight on data protection

- To mitigate these challenges, vendors such as SensrTrx and Evocon are focusing on simplified deployment, user-friendly interfaces, and robust data encryption protocols. However, the upfront cost of OEE system implementation and the need for skilled personnel to manage integrations can pose additional hurdles

- Overcoming these challenges will require ongoing industry education, stronger data governance frameworks, and scalable, low-barrier OEE solutions that can adapt to both modern and legacy operational environments

Overall Equipment Effectiveness Software Market Scope

The market is segmented on the basis of type and application.

- By Type

On the basis of type, the overall equipment effectiveness software market is segmented into on-premise and cloud-based solutions. The on-premise segment dominated the market with the largest market revenue share of 56.3% in 2024, owing to its robust data security, greater customization flexibility, and continued demand among large-scale manufacturers with legacy infrastructure. Many industries with strict data compliance requirements or real-time control needs such as pharmaceuticals, aerospace, and automotive—prefer on-premise solutions due to their ability to operate independently of external networks and offer direct integration with factory equipment.

The cloud-based segment is anticipated to witness the fastest growth rate of 17.9% from 2025 to 2032, driven by increasing adoption of scalable and cost-effective digital solutions across SMEs and emerging markets. Cloud-based OEE software allows real-time remote access, simplified deployment, automatic updates, and easy integration with industrial IoT platforms, making it an attractive choice for manufacturers embracing digital transformation. The rising emphasis on data-driven decision-making, combined with growing trust in cloud security protocols, is further fueling demand in this segment.

- By Application

On the basis of application, the overall equipment effectiveness software market is segmented into small and medium-sized enterprises (SMEs) and large enterprises. The large enterprise segment held the largest market revenue share in 2024, primarily due to substantial investment capacities, complex production environments, and higher digital maturity levels. Large organizations are increasingly leveraging OEE software to drive continuous improvement programs, optimize multi-site performance, and comply with rigorous production standards. These enterprises often integrate OEE metrics with broader enterprise resource planning (ERP) and manufacturing execution systems (MES) for end-to-end visibility and automation.

The SMEs segment is expected to witness the fastest CAGR during the forecast period, attributed to the growing affordability and accessibility of cloud-based OEE tools. With increasing awareness of the benefits of real-time productivity tracking and minimal setup requirements, SMEs are turning to OEE software to stay competitive, reduce downtime, and make data-informed operational decisions without needing extensive IT infrastructure or dedicated analysts. The surge in SaaS-based manufacturing platforms tailored to small businesses is further accelerating this adoption.

Overall Equipment Effectiveness Software Market Regional Analysis

- North America dominated the overall equipment effectiveness software market with the largest revenue share of 38% in 2024, attributed to the region’s strong manufacturing base, rapid digital transformation across industries, and the early adoption of industrial IoT and analytics platforms, particularly in the U.S., where large enterprises and SMEs asuch as are investing in automation and performance optimization tools

- Enterprises in the region prioritize real-time performance tracking, automation, and data-driven decision-making, fueling demand for OEE solutions that integrate seamlessly with existing ERP, MES, and IIoT systems

- This regional dominance is further supported by a well-established industrial base, advanced IT infrastructure, and the presence of leading solution providers, making OEE software a critical tool for boosting operational efficiency and competitiveness across industries ranging from automotive to pharmaceuticals

U.S. Overall Equipment Effectiveness Software Market Insight

The U.S. overall equipment effectiveness software market captured the largest revenue share of 79% in 2024 within North America, driven by rapid advancements in industrial automation and a strong push for smart manufacturing initiatives. American manufacturers are increasingly adopting real-time monitoring solutions to reduce downtime, improve asset utilization, and drive lean production. The integration of OEE software with IIoT platforms, ERP systems, and MES is becoming standard, especially in sectors such as automotive, electronics, and food processing. Furthermore, the rising focus on predictive maintenance and digital transformation across small to large enterprises continues to accelerate OEE software adoption.

Europe OEE Software Market Insight

The Europe overall equipment effectiveness software market is projected to expand at a substantial CAGR throughout the forecast period, fueled by regulatory emphasis on industrial efficiency and sustainability. The European Union’s focus on smart industry initiatives, combined with high awareness of operational performance metrics, supports widespread OEE implementation. Manufacturers are leveraging OEE software to meet compliance standards, increase transparency, and enhance resource optimization. Strong adoption is seen across automotive, packaging, and energy sectors, with increasing interest in cloud-based OEE tools supporting remote analytics and multi-plant comparisons.

U.K. OEE Software Market Insight

The U.K. overall equipment effectiveness software market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by robust adoption of Industry 4.0 and demand for real-time productivity analytics. British manufacturers are turning to OEE solutions to modernize aging infrastructure and gain competitive advantages through increased output and efficiency. The country’s strategic focus on digital manufacturing, combined with government support for industrial digitization and sustainability, is further driving demand. Key sectors such as aerospace, pharmaceuticals, and automotive are leading in software adoption.

Germany OEE Software Market Insight

The Germany overall equipment effectiveness software market is expected to expand at a considerable CAGR during the forecast period, driven by the country’s leadership in industrial innovation and automation. As a global manufacturing powerhouse, Germany is investing heavily in digital twin technologies, smart factories, and integrated performance monitoring tools. The growing deployment of IIoT-connected equipment across the automotive and engineering sectors is boosting the need for sophisticated OEE software to reduce downtime and enhance productivity. The focus on precise data analytics and production optimization aligns closely with German industrial standards.

Asia-Pacific OEE Software Market Insight

The Asia-Pacific overall equipment effectiveness software market is poised to grow at the fastest CAGR of 22.1% during 2025 to 2032, supported by rapid industrialization, digital transformation, and the expansion of manufacturing sectors across China, India, and Southeast Asia. As the region becomes a key manufacturing hub, demand for scalable, cost-effective OEE solutions is rising among both SMEs and large enterprises. Government initiatives promoting smart factory adoption, such as "Make in India" and "Made in China 2025," are accelerating implementation. In addition, local and multinational vendors are increasing investment in localized, cloud-based OEE platforms.

Japan OEE Software Market Insight

The Japan overall equipment effectiveness software market is gaining traction due to the country’s high level of automation, aging workforce, and the need for streamlined production monitoring. Japanese manufacturers prioritize precision and efficiency, making OEE a critical metric in continuous improvement strategies. The strong integration of robotics and AI in production environments further complements the use of OEE software. Demand is growing in electronics, automotive, and industrial machinery sectors, with cloud-based deployment models and smart analytics tools becoming increasingly preferred.

India OEE Software Market Insight

The India overall equipment effectiveness software market accounted for the largest revenue share in Asia Pacific in 2024, propelled by growing investments in manufacturing, increased awareness of operational KPIs, and the government’s push toward industrial digitalization. Small and mid-sized enterprises are embracing affordable, cloud-based OEE solutions to improve competitiveness and efficiency. The "Digital India" and "Smart Manufacturing" initiatives are fostering widespread tech adoption, while sectors such as food processing, textiles, and automotive are actively leveraging OEE tools to track performance and minimize downtime across plants.

Overall Equipment Effectiveness Software Market Share

The overall equipment effectiveness software industry is primarily led by well-established companies, including:

- Siemens AG (Germany)

- Rockwell Automation, Inc. (U.S.)

- ABB Ltd (Switzerland)

- General Electric Company (U.S.)

- Honeywell International Inc. (U.S.)

- Schneider Electric SE (France)

- Emerson Electric Co. (U.S.)

- Dassault Systèmes SE (France)

- IBM Corporation (U.S.)

- SAP SE (Germany)

- Oracle Corporation (U.S.)

- PTC Inc. (U.S.)

- MachineMetrics, Inc. (U.S.)

- TULIP Interfaces, Inc. (U.S.)

- Epicor Software Corporation (U.S.)

- iTAC Software AG (Germany)

- ICONICS, Inc. (U.S.)

- SensrTrx, LLC (U.S.)

- Forcam GmbH (Germany)

- Aegis Industrial Software Corporation (U.S.)

What are the Recent Developments in Global Overall Equipment Effectiveness Software Market?

- In June 2023, PTC and Rockwell Automation extended their strategic relationship to accelerate IoT, augmented-reality and industrial software adoption across manufacturing — a move that bolsters integrated OEE and production-performance solutions by making ThingWorx, Kepware and Vuforia capabilities more broadly available through Rockwell’s channels

- In November 2023, Rockwell Automation announced FactoryTalk DataMosaix, an Industrial DataOps solution and low/no-code app builder designed to simplify industrial data pipelines, visualization and analytics — enabling faster deployment of OEE dashboards, root-cause analysis and enterprise reporting

- In June 2023, Siemens Digital Industries Software was recognized as a leader across IDC MarketScape’s 2023 MES reports, reinforcing Siemens’ Opcenter/Opcenter Execution positioning for integrated OEE, MES and production-intelligence use cases in discrete and process industries. This recognition highlighted vendor momentum around embedded OEE and MES-level analytics

- In February 2022, Tulip Interfaces announced general availability of Edge IO, a low-cost edge device to connect machines and sensors to Tulip’s no-code platform — a practical enabler for rapid OEE data capture and plug-and-play OEE applications at the shop floor. Tulip’s device and app templates helped lower the barrier to OEE deployments for SMBs

- In October 2022, Epicor released its Kinetic manufacturing updates (the rebranded Epicor Kinetic releases), which included enhanced manufacturing cloud features and connected services that simplify production monitoring and OEE reporting for mid-market manufacturers migrating to cloud ERP + shop-floor analytics

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Overall Equipment Effectiveness Software Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Overall Equipment Effectiveness Software Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Overall Equipment Effectiveness Software Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.