Global Oviposition Deterring Pheromones Market

Market Size in USD Billion

CAGR :

%

USD

3.75 Billion

USD

5.54 Billion

2024

2032

USD

3.75 Billion

USD

5.54 Billion

2024

2032

| 2025 –2032 | |

| USD 3.75 Billion | |

| USD 5.54 Billion | |

|

|

|

|

Oviposition-Deterring Pheromones Market Size

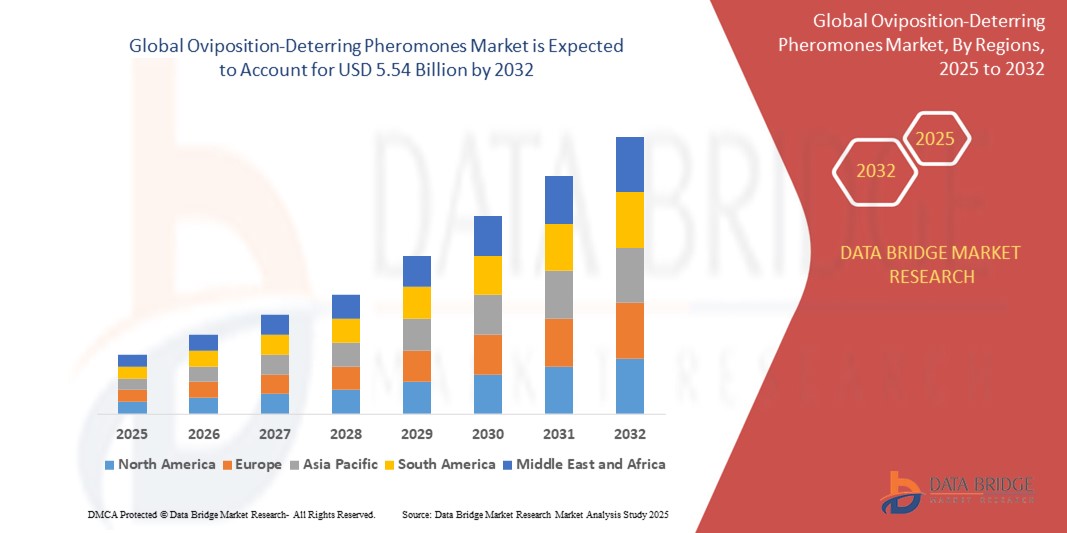

- The global oviposition-deterring pheromones market size was valued at USD 3.75 billion in 2024 and is expected to reach USD 5.54 billion by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely fueled by increasing demand for sustainable and eco-friendly pest control methods, driven by growing concerns over the environmental and health impacts of conventional pesticides and regulatory restrictions on chemical usage in agriculture

- Furthermore, rising adoption of integrated pest management (IPM) practices, along with heightened awareness among farmers regarding crop yield protection and biodiversity conservation, is establishing oviposition-deterring pheromones as a preferred biological solution. These converging factors are accelerating the deployment of pheromone-based products, thereby significantly boosting the industry's growth

Oviposition-Deterring Pheromones Market Analysis

- Oviposition-deterring pheromones, which function by preventing pest insects from laying eggs on treated crops, are becoming increasingly critical components of sustainable pest management strategies across agricultural settings due to their targeted action, environmental safety, and compatibility with organic farming standards

- The escalating demand for oviposition-deterring pheromones is primarily fueled by growing concerns over pesticide resistance, stringent regulatory frameworks against chemical pesticides, and a rising preference among farmers and agribusinesses for residue-free, eco-friendly crop protection solutions

- North America dominated the oviposition-deterring pheromones market with a share of 41.4% in 2024, due to rapid adoption of sustainable pest control technologies and the region's strong emphasis on environmentally responsible farming practices

- Asia-Pacific is expected to be the fastest growing region in the oviposition-deterring pheromones market during the forecast period due to rapid agricultural expansion, growing pest pressures, and increasing acceptance of eco-friendly alternatives across developing economies

- Crops protection segment dominated the oviposition-deterring pheromones market with a market share of 53.1% in 2024, due to increasing emphasis on sustainable agriculture and the reduction of chemical pesticide usage. Oviposition-deterring pheromones serve as an eco-friendly solution to protect crops from pest infestation by disrupting the reproductive cycle of insects, thus reducing larval populations without harming beneficial insects or the environment

Report Scope and Oviposition-Deterring Pheromones Market Segmentation

|

Attributes |

Oviposition-Deterring Pheromones Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Oviposition-Deterring Pheromones Market Trends

“Rising Adoption of Biopesticides”

- A significant and accelerating trend in the global oviposition-deterring pheromones market is the rising adoption of biopesticides as sustainable alternatives to chemical pesticides. This shift is transforming crop protection strategies by promoting eco-friendly, residue-free solutions aligned with integrated pest management (IPM) practices

- For instance, Suterra LLC has developed pheromone-based dispensers that deter egg-laying in key pests such as codling moth and oriental fruit moth in orchards, while ISCA Technologies offers semiochemical solutions tailored for vegetable and fruit crops, enabling targeted pest deterrence without harming beneficial species

- These pheromone-based biopesticides are gaining traction due to their species-specific action, reduced environmental impact, and compatibility with organic farming standards, making them ideal for modern sustainable agriculture

- The use of biopesticides, including oviposition-deterring pheromones, is increasingly supported by favorable regulatory frameworks and organic certification standards across regions such as North America and Europe. Governments are encouraging their use through grants and inclusion in sustainable agriculture programs

- The adoption of oviposition-deterring pheromones is further supported by favorable regulatory policies and increasing farmer awareness about the long-term benefits of biological crop protection

- As global agricultural systems shift toward ecological safety and regulatory compliance, the demand for natural deterrents is accelerating, prompting leading companies to expand their pheromone product lines and invest in scalable, field-ready application technologies

Oviposition-Deterring Pheromones Market Dynamics

Driver

“Increasing Demand for Sustainable Agriculture”

- The increasing global focus on sustainable agriculture practices, driven by environmental concerns and regulatory pressure to reduce chemical pesticide usage, is a significant driver for the growing demand for oviposition-deterring pheromones

- For instance, ISCA Technologies launched a new line of biodegradable pheromone dispensers targeting key lepidopteran pests in fruit and vegetable crops, reinforcing its commitment to sustainable pest control solutions and helping farmers comply with organic certification standards

- As farmers and agribusinesses seek alternatives that protect yields while preserving soil health and biodiversity, pheromone-based solutions offer precise, non-toxic pest management, making them increasingly essential in integrated pest management (IPM) frameworks

- Furthermore, the rising consumer demand for residue-free produce and the tightening of maximum residue limits (MRLs) in export markets are pushing growers to adopt biologically based crop protection strategies, boosting the appeal of pheromone solutions

- The cost-effectiveness of pheromones over time, combined with their environmental safety, is making them a preferred choice in both high-value horticulture and large-scale field crop operations. With support from government programs and increasing investment by companies such as Suterra LLC and Russell IPM, the market is poised for strong and sustained growth

Restraint/Challenge

“Stringent Registration and Approval Processes”

- Stringent regulatory requirements for the registration and approval of oviposition-deterring pheromones pose a significant challenge to market expansion. These biologically derived products must undergo extensive evaluation to meet safety, efficacy, and environmental standards, which can be time-consuming and costly for manufacturers

- For instance, companies such as Suterra LLC and Russell IPM often face delays in launching new pheromone formulations across different countries due to varying regulatory frameworks and slow approval timelines, particularly in regions with underdeveloped biopesticide guidelines

- Navigating complex and inconsistent regulatory environments across global markets requires significant investment in compliance, documentation, and field trials, which may deter smaller players or slow innovation

- Moreover, the limited harmonization between international agencies creates uncertainty for companies aiming to commercialize products globally, reducing agility in responding to emerging pest pressures or market opportunities

- To overcome this challenge, industry stakeholders are advocating for streamlined regulatory pathways and increased alignment of biopesticide approval processes, while also investing in collaborative research to support the safety and performance data required by authorities

Oviposition-Deterring Pheromones Market Scope

The market is segmented on the basis of application, crop type, function, and mode of application.

- By Application

On the basis of application, the oviposition-deterring pheromones market is segmented into insect monitoring, insect population control, and crops protection. The crops protection segment held the largest market revenue share of 53.1% in 2024, primarily driven by the increasing emphasis on sustainable agriculture and the reduction of chemical pesticide usage. Oviposition-deterring pheromones serve as an eco-friendly solution to protect crops from pest infestation by disrupting the reproductive cycle of insects, thus reducing larval populations without harming beneficial insects or the environment. Farmers across major agricultural economies are adopting this method as part of integrated pest management (IPM) programs to enhance yield and meet regulatory standards.

The insect population control segment is expected to witness the fastest CAGR from 2025 to 2032, owing to rising concerns over resistance development in insects against traditional pesticides and the growing demand for targeted, species-specific control methods. These pheromones help suppress pest populations over time by altering oviposition behavior, contributing to long-term pest suppression and reduced crop damage.

- By Crop Type

On the basis of crop type, the market is segmented into field crops, fruits and nuts, and vegetable crops. The field crops segment accounted for the largest market share in 2024, supported by the widespread cultivation of crops such as corn, wheat, and soybeans that are highly susceptible to pests such as stem borers and armyworms. Adoption of oviposition-deterring pheromones in these high-acreage crops has gained momentum due to increasing pest pressures and the need for sustainable yield enhancement.

The fruits and nuts segment is projected to grow at the fastest rate during the forecast period, driven by the high commercial value of these crops and their vulnerability to pest-induced quality degradation. Crops such as apples, almonds, and citrus are increasingly protected using pheromone-based methods to maintain export quality standards and reduce pesticide residues, which are tightly regulated in global markets.

- By Function

On the basis of function, the market is segmented into mating disruption, mass trapping, and detection and monitoring. The mating disruption segment dominated the market in 2024, attributed to its proven effectiveness in reducing pest reproduction without the use of toxic agents. By preventing female insects from receiving or interpreting mating cues, pheromones significantly reduce egg-laying activity, offering a long-term pest control method with minimal ecological disruption.

The detection and monitoring segment is expected to register the highest growth rate from 2025 to 2032. This growth is fueled by advancements in precision agriculture and the increasing integration of pheromone traps with digital tools for real-time pest surveillance. Farmers and agronomists are leveraging these systems to optimize treatment timing, reduce unnecessary pesticide application, and improve cost efficiency.

- By Mode of Application

On the basis of mode of application, the oviposition-deterring pheromones market is categorized into traps, dispensers, and sprays. The dispensers segment held the highest revenue share in 2024, owing to their ability to provide sustained pheromone release over extended periods. These are widely used in orchards and vineyards, where consistent pest control is required throughout the growing season, and their compatibility with automated deployment systems increases operational efficiency.

The sprays segment is anticipated to witness the fastest CAGR from 2025 to 2032, as they allow for more flexible and wide-area coverage, especially in field crops. Sprayable pheromones are gaining traction due to their ease of application, cost-effectiveness, and compatibility with existing farm machinery, offering a scalable alternative for large-scale pest management.

Oviposition-Deterring Pheromones Market Regional Analysis

- North America dominated the oviposition-deterring pheromones market with the largest revenue share of 41.4% in 2024, driven by rapid adoption of sustainable pest control technologies and the region's strong emphasis on environmentally responsible farming practices

- The presence of large-scale agricultural operations, especially in the U.S. and Canada, coupled with rising awareness regarding the negative impact of synthetic pesticides, is significantly driving demand

- North American farmers are increasingly adopting pheromone-based solutions for pest management, supported by favorable government policies, extensive IPM implementation, and advanced research and extension networks

U.S. Oviposition-Deterring Pheromones Market Insight

The U.S. market captured a revenue share in 2024 within North America, driven by expanding applications in row crops such as corn, cotton, and soybeans. Farmers are rapidly integrating pheromones into pest management programs to enhance yield quality and reduce chemical residues. Governmental support, research funding, and proactive adoption of precision agriculture technologies are playing key roles in this growth

Europe Oviposition-Deterring Pheromones Market Insight

The Europe market is projected to grow at a robust CAGR during the forecast period, fueled by stringent environmental regulations, growing demand for organic produce, and a strong policy framework under the EU Green Deal. Countries such as France, Germany, and Spain are leading adoption due to established pheromone deployment practices and government subsidies promoting biocontrol methods

Germany Oviposition-Deterring Pheromones Market Insight

The Germany market is expanding steadily, supported by a mature organic farming sector and heightened focus on biodiversity preservation. German agriculture emphasizes reduced pesticide reliance, and pheromone-based solutions are being adopted across vineyards, orchards, and field crops for early pest prevention and crop integrity

France Oviposition-Deterring Pheromones Market Insight

France is witnessing growing integration of oviposition-deterring pheromones, especially in fruit and wine-producing regions. The push toward sustainable viticulture and orchard protection is a major growth driver, along with widespread farmer education and availability of cost-effective dispenser systems

Asia-Pacific Oviposition-Deterring Pheromones Market Insight

The Asia-Pacific market is expected to register the fastest CAGR from 2025 to 2032, fueled by rapid agricultural expansion, growing pest pressures, and increasing acceptance of eco-friendly alternatives across developing economies. Rising food demand and government support for sustainable agriculture in China, India, and Japan are key market enablers

China Oviposition-Deterring Pheromones Market Insight

China held the largest revenue share in Asia-Pacific in 2024, driven by vast agricultural acreage, growing environmental concerns, and rapid urbanization. The country is scaling up pheromone-based pest control in fruit, rice, and vegetable cultivation, supported by public-private R&D and regional pilot projects for bio-pesticide alternatives

India Oviposition-Deterring Pheromones Market Insight

India is emerging as a promising market, with increasing adoption of pheromone traps and sprays in cotton, sugarcane, and vegetable farming. Government subsidies under the National Mission on Sustainable Agriculture (NMSA) and state-led initiatives for IPM are facilitating pheromone penetration into mainstream crop protection

Oviposition-Deterring Pheromones Market Share

The oviposition-deterring pheromones industry is primarily led by well-established companies, including:

- Trécé Inc. (U.S.)

- Syngenta Crop Protection AG (Switzerland)

- Semios (Canada)

- Bioline AgroSciences Ltd (U.K.)

- International Pheromone Systems (U.K.)

- Pacific Biocontrol Corporation (U.S.)

- AgBiTech (Australia)

- Shin-Etsu Chemical Co., Ltd. (Japan)

- BASF (Germany)

- Koppert (Netherlands)

- Biobest Group NV (Belgium)

- Agrisense (U.K.)

- Laboratorio Agrochem, S.L. (Spain)

- Rovensa Next (Portugal)

- Novagrica (Italy)

- Russell IPM Ltd (U.K.)

- Hercon Environmental (U.S.)

- Andermatt Group AG (Switzerland)

Latest Developments in Global Oviposition-Deterring Pheromones Market

- In May 2023, scientists developed a next-generation ODP dispenser with enhanced release control mechanisms designed to improve the consistency and precision of pheromone emissions, aiming to increase the effectiveness, longevity, and operational efficiency of ODP-based pest management strategies in both agricultural and urban settings

- In September 2022, researchers published a study demonstrating the efficacy of ODPs against a newly emerging pest species, highlighting the potential of microencapsulated bioactive compounds—particularly plant-derived extracts and essential oils—as an effective approach for sustainable pest management, reinforcing the expanding role of ODP technologies in modern integrated pest control systems

- In July 2021, BASF announced the acquisition of Zodiac Enterprises LLC, a company specializing in catalyst recycling, as part of its strategic expansion, although no direct connection to ODP (Oviposition Deterrent Pheromone) production was publicly confirmed at the time, leaving its implications for pheromone-based pest control open for future clarification

- In March 2020, Trécé Inc. introduced their innovative microencapsulated pheromone formulation, CIDETRAK® IMM MEC™, designed to enhance control of the Indian Meal Moth, utilizing advanced microencapsulation technology to improve release stability and longevity, offering a more efficient and longer-lasting pest management solution with reduced application frequency in stored product environments

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oviposition Deterring Pheromones Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oviposition Deterring Pheromones Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oviposition Deterring Pheromones Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.