Global Oyster Sauces Market

Market Size in USD Billion

CAGR :

%

USD

3.71 Billion

USD

5.34 Billion

2024

2032

USD

3.71 Billion

USD

5.34 Billion

2024

2032

| 2025 –2032 | |

| USD 3.71 Billion | |

| USD 5.34 Billion | |

|

|

|

|

Oyster Sauces Market Size

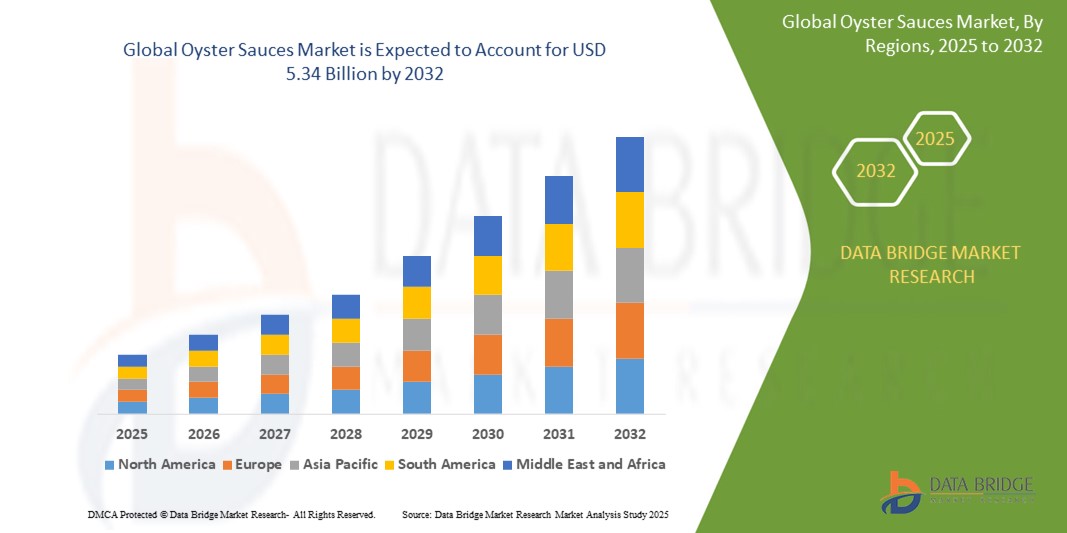

- The global oyster sauces market size was valued at USD 3.71 billion in 2024 and is expected to reach USD 5.34 billion by 2032, at a CAGR of 4.67% during the forecast period

- The market growth is primarily driven by increasing consumer preference for umami flavors, growing popularity of Asian cuisine globally, and rising demand for clean-label and healthier sauce alternatives such as non-MSG and vegetarian oyster sauces

- Rising awareness of culinary diversity and the incorporation of oyster sauces in fusion cuisines are further boosting demand across retail and foodservice sectors

Oyster Sauces Market Analysis

- The oyster sauces market is experiencing steady growth due to the rising popularity of Asian-inspired dishes and the increasing use of oyster sauce as a versatile ingredient in both traditional and fusion cooking

- The demand for non-MSG and vegetarian oyster sauces is growing, driven by health-conscious consumers and dietary preferences, encouraging manufacturers to innovate with natural and plant-based formulations

- Asia-Pacific dominates the oyster sauces market with the largest revenue share of 42.3% in 2024, driven by the strong presence of the automotive original equipment manufacturer (OEM) market, high consumption of oyster sauce in traditional cuisines, and increasing culinary exports

- North America is projected to be the fastest-growing region during the forecast period, fueled by the rising popularity of Asian cuisine, growing multicultural populations, and increasing availability of oyster sauces through online and retail channels

- The foodservice segment dominated the market with a revenue share of 55% in 2024, driven by the increasing number of restaurants and the use of oyster sauce for flavor enhancement, menu variety, and cost-efficiency

Report Scope and Oyster Sauces Market Segmentation

|

Attributes |

Oyster Sauces Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework |

Oyster Sauces Market Trends

“Growing Popularity of Non-MSG and Vegetarian Oyster Sauces”

- Increasing consumer demand for healthier, additive-free condiments is driving the popularity of non-MSG oyster sauces, which retain authentic umami flavor without monosodium glutamate

- Mushroom-based and plant-based variants are gaining traction among vegan and vegetarian consumers, particularly in health-conscious markets such as North America

- High-income and urban consumers are seeking premium and organic oyster sauces, aligning with clean-label and sustainable trends

- In instance, Kikkoman’s 100% vegetarian oyster-flavored sauce launched in India in 2022 targets both vegetarian and non-vegetarian consumers

- Supermarkets and foodservice providers promote non-MSG and vegetarian options as premium products, with U.S. retailers such as Whole Foods emphasizing organic variants

Oyster Sauces Market Dynamics

Driver

“Rising Demand for Asian Cuisine and Convenient Condiments”

- The growing appeal of Chinese, Thai, and Vietnamese dishes is increasing demand for oyster sauces as a versatile ingredient in stir-fries, marinades, and dipping sauces

- Oyster sauces reduce preparation time, appealing to busy consumers in urban areas with fast-paced lifestyles

- Higher incomes in Asia-Pacific and North America encourage experimentation with premium culinary ingredients

- Chains such as Panda Express in the U.S. incorporate oyster sauce into menus, boosting commercial demand

- Partnerships with platforms such as Amazon enhance accessibility, driving sales of both traditional and vegetarian oyster sauces

- The rise of plant-based diets is increasing demand for vegetarian oyster sauces, aligning with sustainable food choices

Restraint/Challenge

“Supply Chain Vulnerabilities and Regulatory Concerns”

- Reliance on oyster supply is vulnerable to environmental changes, overfishing, and contamination, causing production disruptions and price volatility

- Differing regional regulations on MSG and food labeling complicate global standardization for manufacturers

- Shellfish allergies and high sodium content limit consumption, particularly in health-conscious markets such as the U.S. and Europe

- Environmental issues related to oyster farming may deter eco-conscious consumers, especially in North America

- These challenges increase compliance costs and restrict market expansion, requiring investment in sustainable and allergen-free alternatives

Oyster Sauces Market Scope

The market is segmented on the basis of product type, end user, and distribution channel.

- By Product Type

On the basis of product type, the oyster sauces market is segmented into non-MSG oyster sauce and vegetarian oyster sauce. The non-MSG oyster sauce segment held the largest market revenue share of approximately 60% in 2024, driven by growing consumer preference for healthier, additive-free condiments. The demand for non-MSG variants, including regular and organic subsegments, is fueled by increasing health awareness and the desire for clean-label products. These sauces appeal to consumers seeking authentic flavors without artificial additives.

The vegetarian oyster sauce segment is expected to witness the fastest growth rate of 7.2% from 2025 to 2032, driven by the rising popularity of plant-based diets and veganism. Innovations such as mushroom-based and plant-based vegetarian oyster sauces, such as Kikkoman’s 100% vegetarian oyster flavor sauce launched in India in May 2022, cater to vegetarian and vegan consumers while maintaining the umami flavor profile of traditional oyster sauce.

- By End User

On the basis of end user, the oyster sauces market is segmented into retail, foodservice, and others. The foodservice segment dominated the market with a revenue share of 55% in 2024, driven by the increasing number of restaurants and the use of oyster sauce for flavor enhancement, menu variety, and cost-efficiency. The global rise in restaurant numbers, such as the UK’s increase from 95,060 in 2021 to 101,785 in 2022, supports this segment’s growth.

The retail segment is anticipated to experience the fastest growth rate of 6.8% from 2025 to 2032, fueled by rising consumer interest in home cooking and the availability of ready-made recipes featuring oyster sauce. The shift toward healthier eating habits and the popularity of Asian-inspired dishes further drive retail demand.

- By Distribution Channel

On the basis of distribution channel, the oyster sauces market is segmented into independent retailers, online retailers, supermarkets and hypermarkets, and convenience stores. The supermarkets and hypermarkets segment held the largest market revenue share of 62% in 2024, attributed to their extensive reach, wide variety of brands, and attractive promotions. The availability of diverse oyster sauce variants, including premium and health-conscious options, enhances consumer access and drives sales.

The online retailers segment is expected to witness the fastest growth rate of 8.1% from 2025 to 2032, driven by the rise of e-commerce platforms and consumer preference for convenient home delivery. Online platforms offer detailed product information and reviews, boosting consumer confidence and adoption.

Oyster Sauces Market Regional Analysis

- Asia-Pacific dominates the oyster sauces market with the largest revenue share of 42.3% in 2024, driven by the strong presence of the automotive original equipment manufacturer (OEM) market, high consumption of oyster sauce in traditional cuisines, and increasing culinary exports

- North America is projected to be the fastest-growing region during the forecast period, fueled by the rising popularity of Asian cuisine, growing multicultural populations, and increasing availability of oyster sauces through online and retail channels

U.S. Oyster Sauces Market Insight

The U.S. is expected to lead growth in the North American oyster sauces market, driven by increasing consumer interest in Asian and fusion cuisines, particularly Chinese and Thai dishes. The rise in home cooking, supported by food media and cooking shows, boosts retail demand. Partnerships such as Lee Kum Kee’s collaboration with Kyuramen in May 2024 to incorporate oyster sauce into restaurant menus further enhance market penetration.

Europe Oyster Sauces Market Insight

The European market is anticipated to witness significant growth, driven by growing consumer interest in international flavors and the expansion of Asian restaurant chains. Countries such as Germany and France show strong uptake due to the increasing availability of oyster sauces in supermarkets and hypermarkets. The demand for vegetarian and low-sodium variants aligns with Europe’s focus on health-conscious eating.

U.K. Oyster Sauces Market Insight

The U.K. market is expected to experience steady growth, driven by consumer demand for convenient and flavorful condiments in urban and suburban settings. The increasing popularity of home-cooked Asian meals and the availability of oyster sauce through online retailers and supermarkets fuel adoption. Regulatory emphasis on food safety and clean-label products further supports market expansion.

Germany Oyster Sauces Market Insight

Germany is poised for robust growth in the oyster sauces market, driven by its strong food retail sector and consumer preference for high-quality, health-conscious condiments. The demand for vegetarian and Non-MSG oyster sauces is rising, supported by the country’s focus on sustainability and healthy eating. Major retailers and e-commerce platforms enhance product accessibility, contributing to market growth.

Asia-Pacific Oyster Sauces Market Insight

The Asia-Pacific region is expected to maintain its dominance with a 57.16% revenue share in 2024, driven by high production and consumption in countries such as China, Japan, and Thailand. Rapid urbanization, rising disposable incomes, and the integration of oyster sauce in traditional and fusion cuisines support market growth. Government-backed food safety initiatives and strong manufacturer-supplier networks further bolster the market.

Japan Oyster Sauces Market Insight

Japan’s oyster sauces market is expected to witness strong growth, driven by consumer demand for premium and authentic condiments. Major players such as Kikkoman, with its vegetarian oyster flavor sauce, cater to evolving dietary preferences. The presence of advanced retail infrastructure and a strong culinary culture enhances market penetration.

China Oyster Sauces Market Insight

China holds the largest share of the Asia-Pacific oyster sauces market, driven by rapid urbanization, a growing middle class, and high demand for umami-rich condiments. Domestic manufacturers such as foshan Haitian flavoring & food co. ltd. and strong e-commerce platforms ensure competitive pricing and accessibility, supporting robust market growth.

Oyster Sauces Market Share

The oyster sauces industry is primarily led by well-established companies, including:

- Ajinomoto Co., Inc. (Japan)

- Foshan Haitian Flavoring & Food Co. Ltd. (China)

- Specialty Food Association, Inc. (U.S.)

- Nestlé (Switzerland)

- KAKUSAN SHOKUHIN (Japan)

- Yuen Chun Industries Sdn Bhd (Malaysia)

- THAIPREEDA GROUP (Thailand)

- Marine Resources Development Co., Ltd. (Japan)

- Malabar Food Products (India)

- Foodex Manufacturer Co., LTD. (Thailand)

- McCormick & Company Inc. (U.S.)

- The Kraft Heinz Company (U.S.)

- Unilever (U.K.)

Latest Developments in Global Oyster Sauces Market

- In June 2024, Lee Kum Kee Sauce Group announced investment to establish a new manufacturing facility in LaGrange, Georgia. This expansion strengthens Lee Kum Kee’s production capabilities, supporting its growth in the North American market and meeting the rising demand for premium Asian condiments. The facility will create up to 267 jobs and feature intelligent factory solutions, digitalization, product innovation, and R&D capabilities. It marks a significant milestone in Lee Kum Kee’s commitment to authentic Asian flavors

- In May 2024, Lee Kum Kee partnered with Kyuramen, a popular U.S.-based ramen restaurant chain, to introduce authentic Hong Kong flavors to American diners. This collaboration launched three exclusive menu items across 26 Kyuramen locations, featuring Lee Kum Kee’s Premium Oyster Sauce, Black Pepper Sauce, Sriracha Mayo, and Chiu Chow Style Chili Crisp. The partnership strengthens Lee Kum Kee’s presence in the U.S. foodservice sector, leveraging Kyuramen’s growing popularity to showcase innovative Asian-inspired dishes

- In April 2024, Kikkoman Corporation introduced its first 100% vegetarian oyster-flavored sauce in India, catering to both vegetarian and non-vegetarian consumers. This innovative product expands Kikkoman’s market reach, addressing the significant vegetarian population in the region. The sauce is crafted using Kikkoman Soy Sauce as a base ingredient, ensuring an authentic umami flavor that rivals traditional non-vegetarian oyster sauces. Developed through extensive R&D across Japan, Singapore, and India, it offers a balanced taste profile suitable for stir-fries, noodles, paneer, and tofu dishes

- In June 2023, Nestlé Thailand launched a low-sodium oyster sauce with 60% less sodium, alongside a low-sodium cooking sauce with 40% less sodium. This initiative supports health-conscious consumers looking to reduce salt intake, aligning with global trends in healthier eating. The launch strengthens Nestlé’s presence in the Thai market, addressing demand for flavorful yet health-focused condiments. The product competes with other sodium-reduced offerings from brands such as Roza, Good Life, and Oyster Light

- In December 2020, Fraser & Neave Holdings Bhd (F&N) acquired Sri Nona Food Industries Sdn Bhd, Sri Nona Industries Sdn Bhd, and Lee Shun Hing Sauce Industries Sdn Bhd. This strategic move strengthens F&N’s presence in the oyster sauce market, expanding its market share and operational capacity in Southeast Asia. The acquisition aligns with F&N’s ambition to be a stable and sustainable F&B leader, adding renowned Malaysian household brands to its portfolio

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Oyster Sauces Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Oyster Sauces Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Oyster Sauces Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.