Global Pathological Examination Market

Market Size in USD Million

CAGR :

%

USD

468.79 Million

USD

1,316.75 Million

2025

2033

USD

468.79 Million

USD

1,316.75 Million

2025

2033

| 2026 –2033 | |

| USD 468.79 Million | |

| USD 1,316.75 Million | |

|

|

|

|

Pathological Examination Market Size

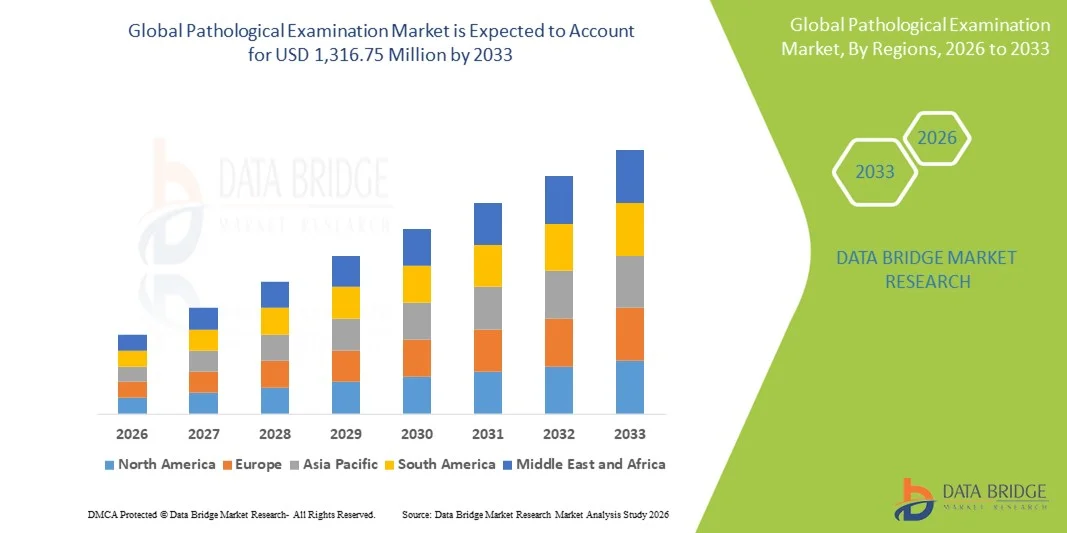

- The global pathological examination market size was valued at USD 468.79 million in 2025 and is expected to reach USD 1,316.75 million by 2033, at a CAGR of 13.78% during the forecast period

- The market expansion is primarily driven by the rising prevalence of chronic diseases, cancer, and infectious disorders, alongside increasing reliance on laboratory-based diagnostics for accurate disease detection and treatment planning

- In addition, continuous advancements in diagnostic technologies, automation in pathology laboratories, and growing demand for early and precise diagnosis across hospitals, diagnostic labs, and research institutions are positioning pathological examinations as a cornerstone of modern healthcare, thereby substantially accelerating market growth

Pathological Examination Market Analysis

- Pathological examinations, encompassing laboratory-based analysis of tissues, blood, and bodily fluids for disease diagnosis and monitoring, are increasingly critical to modern healthcare systems due to their central role in early detection, accurate diagnosis, and personalized treatment planning across hospitals, diagnostic laboratories, and research institutions

- The growing demand for pathological examination services is primarily driven by the rising global burden of chronic diseases, cancer, infectious diseases, and lifestyle-related disorders, coupled with increasing awareness of preventive healthcare and routine diagnostic testing

- North America dominated the pathological examination market with the largest revenue share of 38.6% in 2025, supported by a well-established healthcare infrastructure, high diagnostic testing volumes, favorable reimbursement frameworks, and strong adoption of advanced laboratory technologies, with the U.S. experiencing significant growth in molecular diagnostics, histopathology, and companion diagnostics

- Asia-Pacific is expected to be the fastest-growing region in the pathological examination market during the forecast period, driven by expanding healthcare access, rapid urbanization, increasing healthcare expenditure, and rising investments in diagnostic laboratory infrastructure across emerging economies such as China and India

- Clinical pathology segment dominated the pathological examination market with a market share of 45.8% in 2025, attributed to its extensive utilization in routine diagnostic testing and its critical role in disease screening, monitoring, and treatment assessment

Report Scope and Pathological Examination Market Segmentation

|

Attributes |

Pathological Examination Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, patient epidemiology, pipeline analysis, pricing analysis, and regulatory framework |

Pathological Examination Market Trends

Rapid Advancement of Digital and AI-Enabled Pathology

- A significant and accelerating trend in the global pathological examination market is the increasing adoption of digital pathology and artificial intelligence (AI)–based diagnostic tools, which are transforming traditional slide-based workflows into data-driven, highly efficient diagnostic systems across hospitals and diagnostic laboratories

- For instance, AI-powered image analysis platforms are being integrated into pathology workflows to assist pathologists in detecting cancerous cells, grading tumors, and identifying subtle abnormalities in histopathology slides with improved speed and consistency

- AI integration in pathological examinations enables features such as automated slide scanning, pattern recognition, and decision-support analytics, helping reduce diagnostic errors and inter-observer variability. For instance, certain AI algorithms can flag suspicious regions on whole-slide images, allowing pathologists to focus on high-risk areas and improve diagnostic accuracy

- The growing use of digital pathology platforms also facilitates remote diagnostics and telepathology, enabling specialists to review cases across geographies and supporting faster turnaround times for complex diagnostic cases

- This shift toward digitized, AI-assisted pathology workflows is reshaping laboratory operations by enhancing productivity, standardization, and scalability. Consequently, diagnostic laboratories and hospitals are increasingly investing in advanced pathology software, scanners, and cloud-based data management systems

- The demand for intelligent and automated pathological examination solutions is rising steadily across both developed and emerging healthcare markets, as providers prioritize diagnostic precision, workflow efficiency, and timely clinical decision-making

Pathological Examination Market Dynamics

Driver

Rising Disease Burden and Growing Demand for Early Diagnosis

- The increasing prevalence of chronic diseases, cancer, infectious diseases, and age-related conditions, combined with the growing emphasis on early and accurate diagnosis, is a major driver fueling demand for pathological examination services worldwide

- For instance, the rising global incidence of cancer has significantly increased the volume of biopsy, histopathology, and cytology tests, making pathological examinations indispensable for disease confirmation, staging, and treatment planning

- As healthcare systems shift toward preventive and personalized medicine, pathological testing plays a critical role in screening, risk assessment, and therapy selection, driving higher utilization across hospitals and diagnostic laboratories

- Furthermore, expanding healthcare infrastructure, improved access to diagnostic services, and increasing health awareness among populations are contributing to higher testing volumes in both urban and semi-urban regions

- The growing reliance of clinicians on laboratory-based evidence for clinical decision-making, along with advancements in molecular and genetic testing, continues to strongly propel the growth of the pathological examination market

Restraint/Challenge

High Cost of Advanced Testing and Skilled Workforce Constraints

- The high cost associated with advanced pathological examinations, including molecular diagnostics, genetic testing, and digital pathology systems, poses a significant challenge to market expansion, particularly in cost-sensitive and low-resource settings

- For instance, the implementation of AI-enabled pathology platforms and automated laboratory equipment requires substantial capital investment, which may limit adoption among small and mid-sized diagnostic laboratories

- In addition, a shortage of skilled pathologists and trained laboratory professionals in several regions can lead to increased workloads, longer turnaround times, and diagnostic bottlenecks, restricting service scalability

- Variability in regulatory frameworks, accreditation standards, and quality control requirements across countries further complicates laboratory operations and increases compliance costs for pathology service providers

- Addressing these challenges through workforce training programs, cost-effective diagnostic solutions, standardized regulatory policies, and supportive healthcare reimbursement structures will be essential to ensure sustained growth and equitable access to pathological examination services globally

Pathological Examination Market Scope

The market is segmented on the basis of type, service, and application.

- By Type

On the basis of type, the global pathological examination market is segmented into digital pathology and traditional pathology. The traditional pathology segment dominated the market with the largest revenue share in 2025, driven by its long-established use in hospitals and diagnostic laboratories worldwide. Conventional microscopy-based pathology remains the gold standard for routine histopathology, cytology, and surgical pathology examinations due to its proven diagnostic reliability and widespread acceptance among pathologists. Many healthcare facilities, particularly in developing and cost-sensitive regions, continue to rely heavily on traditional pathology owing to lower initial infrastructure requirements and familiarity with established workflows. In addition, regulatory approvals and clinical guidelines in several countries are still primarily aligned with traditional pathology methods. The extensive availability of trained professionals and standardized procedures further supports the continued dominance of this segment.

The digital pathology segment is expected to witness the fastest growth rate during the forecast period, fueled by rapid technological advancements and increasing adoption of AI-enabled diagnostic solutions. Digital pathology enables whole-slide imaging, remote case sharing, and integration with advanced analytics, significantly improving workflow efficiency and diagnostic accuracy. Growing demand for telepathology, particularly in regions facing shortages of skilled pathologists, is accelerating the uptake of digital platforms. Furthermore, rising investments by hospitals and diagnostic laboratories in automation and cloud-based data management are supporting segment growth. The expanding role of digital pathology in research, education, and precision medicine further reinforces its strong growth trajectory.

- By Service

On the basis of service, the pathological examination market is segmented into anatomic pathology, surgical pathology, cytopathology, and clinical pathology. The clinical pathology segment dominated the market in 2025 with a market share of 45.8%, owing to its extensive use in routine diagnostic testing such as hematology, clinical chemistry, immunology, and microbiology. Clinical pathology services are essential for disease screening, monitoring, and treatment evaluation across a wide range of medical conditions. The high testing volumes generated by routine blood and urine tests in hospitals and diagnostic laboratories significantly contribute to this segment’s revenue dominance. In addition, the growing emphasis on preventive healthcare and regular health check-ups continues to drive demand for clinical pathology services. The scalability and automation of clinical pathology laboratories further support their widespread adoption.

The anatomic pathology segment is projected to grow at the fastest rate during the forecast period, driven by the rising incidence of cancer and chronic diseases requiring tissue-based diagnosis. Anatomic pathology plays a critical role in tumor identification, grading, and staging, making it indispensable for oncology care. Increasing adoption of advanced techniques such as immunohistochemistry and molecular pathology is enhancing diagnostic precision within this segment. The integration of digital pathology and AI tools into anatomic pathology workflows is further improving efficiency and turnaround times. Growing demand for personalized medicine and targeted therapies is also accelerating growth in this segment.

- By Application

On the basis of application, the pathological examination market is segmented into digestive organ and other applications. The other applications segment dominated the market in 2025, encompassing a broad range of diagnostic areas including respiratory, genitourinary, breast, skin, and hematological disorders. The wide scope of this segment results in consistently high testing volumes across hospitals and diagnostic laboratories. Increasing prevalence of lifestyle-related diseases, infections, and age-associated conditions contributes significantly to demand within this category. In addition, routine pathology testing for multiple organ systems during general health assessments supports sustained growth. The diversity of applications ensures stable revenue generation and reinforces the segment’s dominant position.

The digestive organ segment is expected to register the fastest growth during the forecast period, driven by the rising incidence of gastrointestinal disorders, liver diseases, and digestive tract cancers. Increasing awareness of early detection for conditions such as colorectal cancer and inflammatory bowel disease is boosting demand for biopsy and histopathological examinations. Advancements in endoscopic biopsy techniques and molecular diagnostics are improving diagnostic accuracy for digestive organ diseases. Furthermore, lifestyle changes, dietary habits, and growing geriatric populations are contributing to higher disease prevalence. These factors collectively position the digestive organ segment as a key growth driver within the pathological examination market.

Pathological Examination Market Regional Analysis

- North America dominated the pathological examination market with the largest revenue share of 38.6% in 2025, supported by a well-established healthcare infrastructure, high diagnostic testing volumes, favorable reimbursement frameworks, and strong adoption of advanced laboratory technologies, with the U.S. experiencing significant growth in molecular diagnostics, histopathology, and companion diagnostics

- Healthcare providers in the region place significant emphasis on early disease detection, preventive screening, and evidence-based clinical decision-making, resulting in sustained demand for pathological examination services across hospitals and diagnostic laboratories

- This widespread utilization is further supported by favorable reimbursement policies, high healthcare expenditure, and a strong presence of well-established diagnostic service providers and reference laboratories, positioning pathological examinations as a core component of healthcare delivery in both clinical and research settings

U.S. Pathological Examination Market Insight

The U.S. pathological examination market captured the largest revenue share within North America in 2025, driven by high diagnostic testing volumes, advanced laboratory infrastructure, and strong emphasis on early disease detection. Healthcare providers increasingly rely on pathology services for cancer diagnosis, chronic disease monitoring, and preventive screening. The widespread adoption of molecular diagnostics, digital pathology, and AI-assisted analysis further strengthens market growth. Moreover, favorable reimbursement frameworks and a strong presence of large reference laboratories and academic medical centers continue to propel market expansion.

Europe Pathological Examination Market Insight

The Europe pathological examination market is projected to expand at a steady CAGR throughout the forecast period, primarily driven by stringent clinical guidelines, standardized diagnostic protocols, and rising demand for accurate disease diagnosis. Increasing prevalence of cancer and age-related diseases, along with expanding public healthcare systems, is boosting pathology testing volumes. European healthcare providers are increasingly adopting advanced diagnostic technologies to improve efficiency and outcomes. Growth is evident across hospital-based laboratories, private diagnostic centers, and national screening programs.

U.K. Pathological Examination Market Insight

The U.K. pathological examination market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by strong government-backed healthcare services and increasing focus on early diagnosis. Rising cancer incidence and national screening initiatives are driving demand for histopathology and cytopathology services. The adoption of digital pathology within the National Health Service (NHS) is improving workflow efficiency and turnaround times. In addition, investments in centralized laboratory services are contributing to sustained market growth.

Germany Pathological Examination Market Insight

The Germany pathological examination market is expected to expand at a considerable CAGR during the forecast period, fueled by a robust healthcare infrastructure and high diagnostic standards. Germany’s strong emphasis on precision medicine and evidence-based clinical decision-making supports extensive utilization of pathology services. Increasing adoption of molecular diagnostics and automation in laboratories is enhancing diagnostic accuracy and efficiency. The country’s focus on quality assurance and regulatory compliance further strengthens demand for advanced pathology examinations.

Asia-Pacific Pathological Examination Market Insight

The Asia-Pacific pathological examination market is poised to grow at the fastest CAGR during the forecast period, driven by expanding healthcare access, rapid urbanization, and rising healthcare expenditure in countries such as China, Japan, and India. Growing awareness of early disease diagnosis and increasing burden of chronic and infectious diseases are significantly boosting testing volumes. Government investments in healthcare infrastructure and diagnostic services are accelerating market growth. In addition, the expansion of private diagnostic laboratories is improving accessibility to pathology services across the region.

Japan Pathological Examination Market Insight

The Japan pathological examination market is gaining momentum due to the country’s advanced healthcare system, aging population, and high demand for accurate diagnostics. Rising incidence of cancer and age-related disorders is increasing reliance on pathology services for early and precise diagnosis. Japan’s strong adoption of advanced laboratory technologies and automation supports efficient diagnostic workflows. Furthermore, the integration of digital pathology and molecular testing is enhancing diagnostic capabilities in both hospital and reference laboratories.

India Pathological Examination Market Insight

The India pathological examination market accounted for a significant revenue share in Asia-Pacific in 2025, driven by rapid urbanization, a growing middle-class population, and increasing health awareness. India represents one of the fastest-growing markets for diagnostic services, with rising demand from hospitals, standalone laboratories, and preventive health check-up centers. Expansion of private diagnostic chains and improvements in laboratory infrastructure are enhancing service availability. Government initiatives aimed at strengthening healthcare access and early disease detection are further propelling market growth in India.

Pathological Examination Market Share

The Pathological Examination industry is primarily led by well-established companies, including:

- 3DHISTECH Ltd. (Hungary)

- GE Healthcare (U.S.)

- Olympus Corporation (Japan)

- NeoGenomics Laboratories, Inc. (U.S.)

- F. Hoffmann-La Roche Ltd (Switzerland)

- Hamamatsu Photonics K.K. (Japan)

- Proscia, Inc. (U.S.)

- Ibex Medical Analytics (Israel)

- Visiopharm A/S (Denmark)

- Huron Digital Pathology Inc. (Canada)

- OptraSCAN Inc. (U.S.)

- Indica Labs (U.S.)

- Akoya Biosciences Inc. (U.S.)

- Sectra AB (Sweden)

- Applied Spectral Imaging (U.S.)

- Agilus Diagnostics (India)

- Leica Biosystems (Germany)

- PathAI, Inc. (U.S.)

- Quest Diagnostics Incorporated (U.S.)

What are the Recent Developments in Global Pathological Examination Market?

- In August 2025, PathAI expanded FDA clearance for its AISight® Dx platform to include support for Roche VENTANA DP 200 and DP 600 whole slide scanners, broadening scanner compatibility and advancing digital pathology interoperability across more laboratory hardware. This expansion leverages the FDA’s PCCP framework, allowing validated updates while maintaining regulatory compliance and enhancing flexibility for pathology labs adopting digital workflows

- In July 2025, PathAI launched the Precision Pathology Network (PPN), a first-of-its-kind ecosystem of digital anatomic pathology laboratories powered by its AISight platform to enable early access to new AI-powered pathology tools, real-world data collaboration, and accelerated clinical research integration. The initiative aims to expand access to advanced AI diagnostics and support evidence generation for biopharma clinical programs

- In June 2025, PathAI received 510(k) clearance from the U.S. Food and Drug Administration (FDA) for its AISight® Dx digital pathology image management system, authorizing its use in primary clinical diagnosis and marking a key regulatory milestone for AI-enabled pathology workflows in clinical settings. The system supports cloud-native slide review, intelligent case management, and collaborative diagnostics, helping labs optimize turnaround times and enhance diagnostic consistency

- In March 2025, Royal Philips and Ibex Medical Analytics expanded their partnership to enhance AI-enabled digital pathology workflows, integrating AI into Philips’ IntelliSite Pathology Solution (PIPS) to improve cancer diagnostic reporting efficiency and confidence. The collaboration aims to streamline pathology workflows with stronger interoperability and enhanced AI tools for prostate, breast, and gastric cancer diagnostics to support faster and more accurate clinical decisions

- In March 2024, Royal Philips announced a collaboration with Amazon Web Services (AWS) to advance cloud-based digital pathology solutions, enhancing diagnostic workflow integration, data management, and scalability for pathology labs. This partnership is designed to support secure, scalable storage and computing infrastructure, enabling broader adoption of digital pathology workflows and improved clinical productivity

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.