Global Pcr Based Transplant Diagnostics Market

Market Size in USD Million

CAGR :

%

USD

652.31 Million

USD

1,079.57 Million

2024

2032

USD

652.31 Million

USD

1,079.57 Million

2024

2032

| 2025 –2032 | |

| USD 652.31 Million | |

| USD 1,079.57 Million | |

|

|

|

|

PCR Based Transplant Diagnostics Market Size

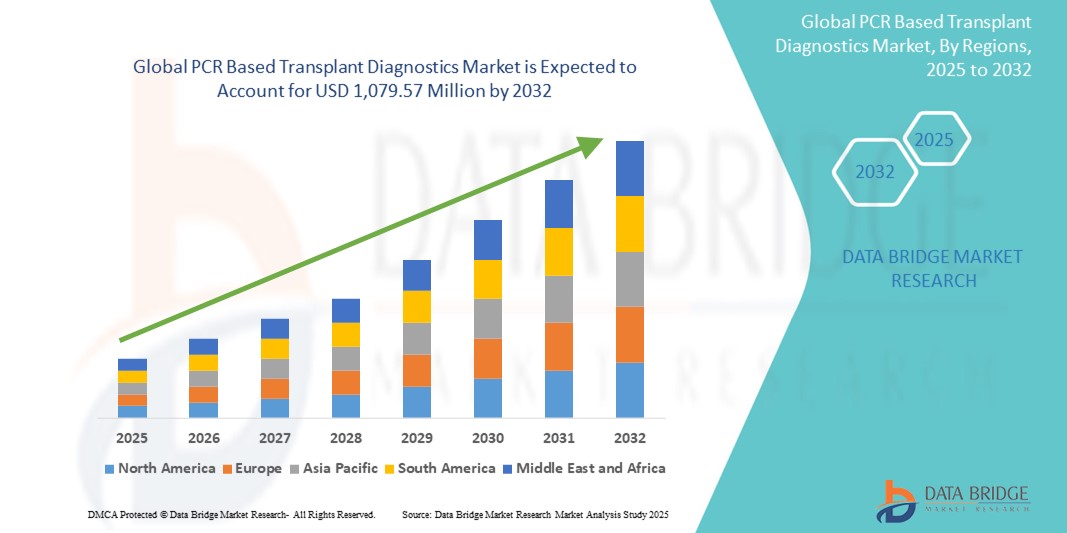

- The global PCR based transplant diagnostics market size was valued at USD 652.31 million in 2024 and is expected to reach USD 1,079.57 million by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within molecular diagnostics and precision medicine, leading to increased digitalization and accuracy in pre- and post-transplant procedures across hospitals and diagnostic laboratories

- Furthermore, rising demand for secure, user-friendly, and reliable transplant compatibility solutions is establishing PCR based transplant diagnostics as the preferred method for HLA typing and donor-recipient matching. These converging factors are accelerating the uptake of PCR Based Transplant Diagnostics solutions, thereby significantly boosting the industry's growth

PCR Based Transplant Diagnostics Market Analysis

- PCR-based transplant diagnostics, which utilize polymerase chain reaction technology for high-precision genetic matching and detection of donor-recipient compatibility, are becoming increasingly critical in improving transplant success rates and early detection of graft rejection. These tools enable sensitive, specific, and rapid HLA typing and post-transplant monitoring, significantly enhancing transplant outcomes

- The escalating demand for PCR-based transplant diagnostics is primarily driven by the growing number of organ transplants globally, rising prevalence of chronic diseases leading to organ failure, and the increasing adoption of molecular diagnostics in clinical laboratories

- North America dominated the PCR based transplant diagnostics market with the largest revenue share of 41.65% in 2024, attributed to its advanced healthcare infrastructure, rising organ transplantation procedures, and early adoption of molecular diagnostic technologies. The U.S., in particular, has witnessed substantial growth in transplant diagnostic innovations, supported by favorable regulatory policies and strong R&D investments from major biotech firms

- Asia-Pacific is expected to be the fastest growing region in the PCR based transplant diagnostics market during the forecast period, driven by expanding healthcare access, increasing transplant volumes, and improving awareness regarding personalized medicine in countries such as China, India, and Japan. Government initiatives supporting organ donation and diagnostic innovation are also propelling regional growth

- The Diagnostic Applications segment dominated the PCR based transplant diagnostics market with a market share of 72.4% in 2024, owing to the widespread use of PCR testing in routine transplant patient management and monitoring. These applications play a crucial role in early detection of viral infections, graft rejection risks, and treatment response, making them essential tools in improving post-transplant outcomes and patient survival rates

Report Scope and PCR Based Transplant Diagnostics Market Segmentation

|

Attributes |

PCR Based Transplant Diagnostics Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

PCR Based Transplant Diagnostics Market Trends

“Enhanced Convenience Through Advanced Molecular Technologies and Automation”

- A significant and accelerating trend in the global PCR based transplant diagnostics market is the integration of advanced molecular technologies with automated diagnostic platforms, enabling faster, more precise, and highly sensitive detection of post-transplant infections and complications. This advancement is significantly enhancing workflow efficiency and clinical decision-making

- For instance, leading diagnostic platforms now offer real-time PCR-based assays for viruses such as CMV, EBV, and BKV, which are commonly monitored in transplant patients. These solutions allow for high-throughput screening and early detection, thereby enabling timely intervention and improving transplant outcomes

- Automation in PCR diagnostics reduces the risk of human error, ensures consistent results, and supports continuous monitoring of viral loads in immunocompromised transplant recipients. Many systems also support multiplex testing, allowing simultaneous detection of multiple pathogens in a single assay

- The seamless integration of PCR diagnostic tools into laboratory information systems (LIS) and hospital electronic medical records (EMR) enables streamlined data flow, better tracking of patient status, and more informed treatment decisions

- This trend towards more intelligent and automated diagnostic systems is fundamentally reshaping expectations in transplant medicine. As a result, companies are continuously developing advanced PCR kits with improved sensitivity, faster turnaround times, and broader pathogen coverage to meet the evolving needs of hospitals, research centers, and transplant laboratories

- The demand for PCR-based transplant diagnostics is rapidly increasing across both public and private healthcare sectors, as stakeholders prioritize early detection, operational efficiency, and improved patient care in transplant settings

PCR Based Transplant Diagnostics Market Dynamics

Driver

“Growing Need Due to Increasing Transplantation Procedures and Technological Advancements”

- The global rise in organ and stem cell transplantations, driven by an aging population and the prevalence of chronic diseases such as kidney failure and blood cancers, is significantly boosting demand for accurate and rapid PCR-based transplant diagnostics

- For instance, in February 2024, Eurofins Viracor launched a next-generation PCR-based assay for early detection of BK virus in kidney transplant patients, aiming to reduce the risk of transplant rejection. Such technological innovations are expected to drive market growth by enhancing diagnostic accuracy and turnaround times

- The ability of PCR diagnostics to deliver fast, sensitive, and specific results makes them vital in both pre-transplant compatibility testing and post-transplant monitoring, especially in critical cases

- Furthermore, increased awareness among clinicians and patients about the importance of early detection and immune monitoring is contributing to broader adoption of PCR-based tests in transplant settings

- Ongoing collaborations between diagnostic companies and transplant centers, combined with growing investments in molecular diagnostics, are creating an ecosystem conducive to rapid market expansion, especially as demand for personalized transplant care intensifies

Restraint/Challenge

“Cost Constraints and Reimbursement Challenges in Low-Income Settings”

- The relatively high cost of PCR-based diagnostic tests compared to traditional serological methods presents a barrier, particularly in developing countries where healthcare budgets are limited and access to advanced molecular testing is uneven

- For instance, transplant centers in emerging economies often struggle with inconsistent reimbursement policies for advanced diagnostic techniques, including PCR-based assays, delaying their widespread clinical adoption

- Infrastructure limitations, such as a lack of advanced molecular laboratories or trained personnel, further hinder the rollout of PCR testing in resource-limited settings

- Addressing these barriers requires not only pricing reforms and government support but also greater public-private partnerships to expand laboratory infrastructure and technician training

- In addition, harmonizing global regulatory frameworks and insurance reimbursement policies will be essential to unlock the full potential of PCR-based transplant diagnostics and promote equitable access across diverse markets

PCR Based Transplant Diagnostics Market Scope

The market is segmented on the basis of test type, transplant type, application, and end user.

- By Test Type

On the basis of test type, the PCR based transplant diagnostics market is segmented into CMV PCR Test, EBV PCR Test, BKV PCR Test, VZV PCR Test, HSV1 PCR Test, HSV2 PCR Test, Parvovirus B19 PCR Test, P. Jirovecii PCR Test, JCV PCR Test, Adenovirus PCR Test, and Aspergillus Spp PCR Test. The CMV PCR Test segment dominated the market with the largest revenue share of 28.7% in 2024, owing to the critical need for CMV monitoring in solid organ and hematopoietic stem cell transplant recipients.

The BKV PCR Test segment is projected to grow at the highest CAGR of 16.2% from 2025 to 2032, fueled by increasing awareness of BKV nephropathy in kidney transplant patients and growing utilization of quantitative PCR diagnostics.

- By Transplant Type

On the basis of transplant type, the market is segmented into kidney transplantation, liver transplantation, heart transplantation, lung transplantation, pancreas transplantation, and other transplantations. The kidney transplantation segment held the largest market share of 39.5% in 2024, supported by the high global volume of kidney transplants and the routine use of PCR diagnostics for post-operative monitoring.

The heart transplantation segment is expected to expand at the fastest CAGR of 14.3% from 2025 to 2032, due to the rising number of procedures and the critical need for infection surveillance and immune response evaluation.

- By Application

On the basis of application, the PCR based transplant diagnostics market is segmented into diagnostic applications and research applications. The diagnostic applications segment accounted for the largest revenue share of 72.4% in 2024, owing to the widespread use of PCR testing in routine transplant patient management and monitoring.

The research applications segment is anticipated to grow at the fastest CAGR of 13.6% during the forecast period, driven by increasing R&D investments and clinical studies targeting transplant rejection and infection pathways.

- By End User

On the basis of end user, the market is segmented into hospitals and transplant centers, commercial service providers, research laboratories, and academic institutes. The hospitals and transplant centers segment led the market with the highest share of 46.8% in 2024, due to their integral role in post-transplant monitoring and direct patient care.

The commercial service providers segment is expected to witness the fastest CAGR of 15.1% from 2025 to 2032, as diagnostic outsourcing and specialized testing services gain traction across developed and emerging markets.

PCR Based Transplant Diagnostics Market Regional Analysis

- North America dominated the PCR based transplant diagnostics market with the largest revenue share of 41.65% in 2024, driven by the rising prevalence of chronic diseases, high volume of organ transplants, and the early adoption of advanced molecular diagnostics. The region benefits from well-established healthcare infrastructure, favorable reimbursement policies, and strong presence of key players offering innovative PCR testing solutions

- The growing emphasis on precision medicine and personalized post-transplant care further supports the region's dominance. Technological advancements in PCR platforms and regulatory approvals for novel transplant diagnostics also accelerate market growth in North America

- Moreover, increasing awareness among clinicians and patients about the importance of early graft rejection detection and viral monitoring after transplantation fuels demand for accurate and rapid PCR-based testing methods

U.S. PCR Based Transplant Diagnostics Market Insight

The U.S. PCR based transplant diagnostics market captured the largest revenue share of 68% within North America in 2024, attributed to the high rate of solid organ and bone marrow transplants and a technologically advanced diagnostic landscape. The presence of leading diagnostic companies, along with robust research funding and favorable regulatory pathways, fosters innovation and accessibility. Key initiatives from national organizations, such as the American Society of Transplantation, further promote the use of molecular diagnostics in improving transplant outcomes.

Europe PCR Based Transplant Diagnostics Market Insight

The Europe PCR Based Transplant Diagnostics market is projected to expand at a substantial CAGR during the forecast period, driven by increasing healthcare expenditures, well-developed healthcare systems, and the growing need for post-transplant monitoring. The region’s emphasis on adopting innovative molecular diagnostics for viral load monitoring (e.g., CMV, EBV) and rejection markers in transplant patients contributes significantly to market growth. The market is also benefiting from strong governmental support and clinical research collaboration across countries such as Germany, France, and the U.K.

U.K. PCR Based Transplant Diagnostics Market Insight

The U.K. PCR based transplant diagnostics market is expected to grow at a noteworthy CAGR, owing to enhanced national transplant programs and increasing demand for non-invasive, highly sensitive transplant diagnostics. Adoption of PCR-based HLA typing and viral monitoring tests is rising in both public and private labs. The NHS’s strategic emphasis on improving transplant outcomes and reducing waiting times is also expected to fuel demand for these diagnostics.

Germany PCR Based Transplant Diagnostics Market Insight

Germany PCR based transplant diagnostics market is anticipated to witness considerable market growth over the forecast period due to its strong clinical research infrastructure, high rate of transplant procedures, and rapid adoption of molecular testing. The market is supported by proactive investments in digital pathology and genomics, and German laboratories are among the earliest adopters of real-time PCR systems for donor-recipient matching and post-transplant monitoring.

Asia-Pacific PCR Based Transplant Diagnostics Market Insight

The Asia-Pacific PCR based transplant diagnostics market is poised to grow at the fastest CAGR of 24% during 2025–2032, driven by increasing healthcare spending, rising transplantation rates, and improvements in laboratory infrastructure in countries such as China, Japan, and India. Growing awareness about transplant complications and the importance of early detection through PCR diagnostics is fueling demand. Additionally, government-backed organ donation initiatives and collaborations with global diagnostics firms are opening new growth avenues in the region.

Japan PCR Based Transplant Diagnostics Market Insight

The Japan PCR based transplant diagnostics market is gaining momentum due to its aging population, advanced healthcare technologies, and strong focus on personalized medicine. PCR-based diagnostic methods are increasingly being used in transplantation centers to detect viral infections and donor-recipient compatibility with high precision. The country’s national health insurance support and integration of automated molecular platforms are making diagnostics more accessible across leading hospitals and transplant units.

China PCR Based Transplant Diagnostics Market Insight

The China PCR based transplant diagnostics market accounted for the largest market revenue share in Asia-Pacific in 2024, driven by rapid urbanization, increasing transplant volumes, and government investments in healthcare modernization. Local and international diagnostic firms are expanding their presence to meet the demand for PCR-based viral load tests, tissue typing, and monitoring of immune responses post-transplant.

The push for healthcare digitalization and improved lab capabilities

PCR Based Transplant Diagnostics Market Share

The PCR based transplant diagnostics industry is primarily led by well-established companies, including:

- Quest Diagnostics Incorporated

- Laboratory Corporation of America Holdings (Labcorp)

- Eurofins Viracor, LLC

- Sonic Healthcare USA

- ARUP Laboratories

- Ambar Lab

- Dr. Lal PathLabs

Latest Developments in Global PCR Based Transplant Diagnostics Market

- In June 2025, Insight Molecular Diagnostics (iMDx) announced a landmark study comparing its digital PCR–based GraftAssureIQ assay against an NGS-based commercial test in 96 kidney transplant patients. The study, conducted at University Hospital Heidelberg, found the results were clinically equivalent, while digital PCR showed higher sensitivity in detecting low levels of donor‑derived cell‑free DNA (dd‑cfDNA)

- In January 2024, Laboratory Corporation of America Holdings launched a new test for preeclampsia in pregnant women which represents a significant advancement in maternal healthcare. This advanced diagnostic tools, healthcare providers can identify women at higher risk of severe preeclampsia earlier in their pregnancies. This allows the company for more vigilant monitoring and proactive medical intervention, potentially reducing the risk of complications and improving maternal and fetal outcomes

- In September 2023, Sonic Healthcare's acquired Healius Ltd., to provide development in the Australian healthcare landscape. This acquisition further solidifies Sonic's position as a global leader in pathology, strengthening its competitive edge against other international players. It signifies the company's commitment to expansion and consolidation within the industry, potentially paving the way for similar mergers in other regions

- In October 2023, Sonic Healthcare's invested in PaigeAI, an AI-powered pathology company, underscores their commitment to harnessing cutting-edge technology for improved diagnostic accuracy and efficiency in the field of pathology. This move holds significant implications for the future of medical diagnostics. This precision approach can lead to more effective treatments and potentially reduce the risk of side effects from unnecessary medications

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.