Global Peach Flavored Hard Tea Market

Market Size in USD Million

CAGR :

%

USD

119.20 Million

USD

1,680.31 Million

2024

2032

USD

119.20 Million

USD

1,680.31 Million

2024

2032

| 2025 –2032 | |

| USD 119.20 Million | |

| USD 1,680.31 Million | |

|

|

|

|

What is the Global Peach-Flavored Hard Tea Market Size and Growth Rate?

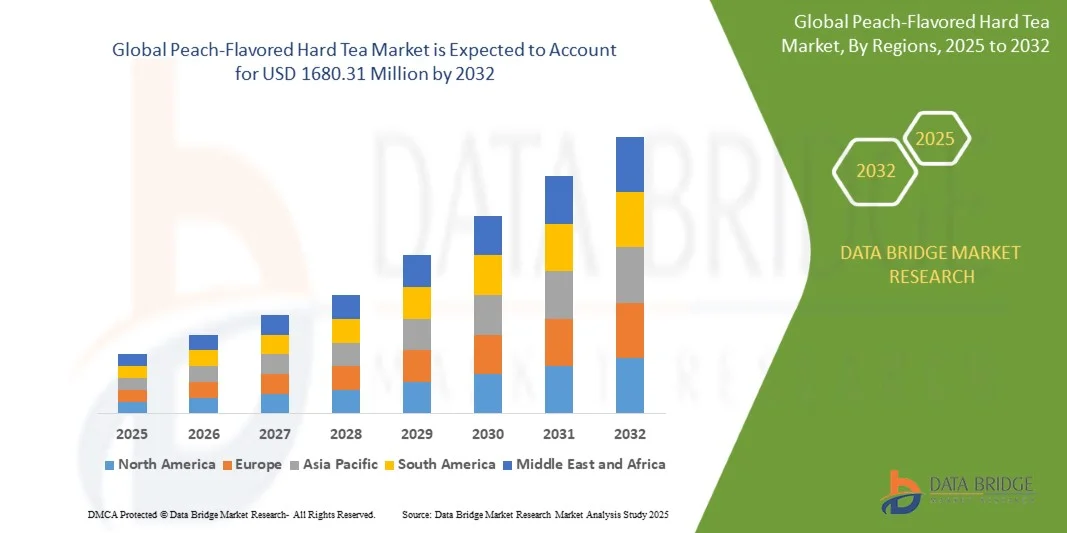

- The global peach-flavored hard tea market size was valued at USD 119.2 million in 2024 and is expected to reach USD 1680.31 million by 2032, at a CAGR of 39.2% during the forecast period

- The market growth is driven by the increasing consumer inclination toward flavored alcoholic beverages, coupled with the rising popularity of low-alcohol and refreshing drink alternatives among millennials and Gen Z consumer

- In addition, innovative product launches, expanding retail availability, and growing demand for convenient ready-to-drink (RTD) options are accelerating global adoption, positioning Peach-Flavored Hard Tea as a leading choice in the evolving flavored alcoholic beverage segment

What are the Major Takeaways of Peach-Flavored Hard Tea Market?

- Peach-Flavored Hard Tea combines the smoothness of tea with the zest of alcohol, offering a balanced and refreshing drink experience that appeals to both casual and social drinkers seeking flavor diversity

- The market’s growth is being propelled by the increasing demand for flavored RTD alcoholic beverages, rising consumer focus on natural ingredients, and expanding product portfolios by major beverage companies

- Moreover, premiumization trends, the emergence of craft-based hard tea brands, and growing distribution through online and retail channels are shaping the future landscape of the peach-flavored hard tea market worldwide

- North America dominated the peach-flavored hard tea market with the largest revenue share of 29.35% in 2024, driven by the rising popularity of flavored alcoholic beverages and the growing demand for refreshing, low-ABV drinks among younger consumers

- The Europe peach-flavored hard tea market is anticipated to register the fastest CAGR of 28.8% from 2025 to 2032, driven by rapid product innovation, increasing health awareness, and growing acceptance of flavored alcoholic beverages

- The 2%–5% ABV segment dominated the market with the largest revenue share of 61.4% in 2024, driven by the growing consumer preference for light, refreshing beverages with moderate alcohol content

Report Scope and Peach-Flavored Hard Tea Market Segmentation

|

Attributes |

Peach-Flavored Hard Tea Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Peach-Flavored Hard Tea Market?

“Rising Popularity of Low-Calorie and Natural Ingredient-Based Offerings”

- A major trend driving the Peach-Flavored Hard Tea market is the shift toward health-conscious alcoholic beverages made with natural flavors, organic ingredients, and reduced sugar. Consumers are increasingly drawn to drinks that combine refreshment, flavor, and wellness

- Brands are introducing low-calorie, gluten-free, and vegan-friendly peach-flavored hard teas to meet this evolving demand. For instance, Boston Beer Company (U.S.) expanded its Twisted Tea Light range featuring peach variants with fewer calories and carbs

- Manufacturers are emphasizing clean labels and natural sweeteners such as stevia and monk fruit instead of artificial additives, catering to the mindful drinking trend among millennials and Gen Z consumers

- This growing focus on natural ingredients and lighter alcohol content is reshaping innovation strategies, with producers targeting consumers seeking balance between indulgence and wellness

- The trend is expected to accelerate as health awareness rises, making better-for-you hard teas a major growth catalyst across global beverage portfolios

What are the Key Drivers of Peach-Flavored Hard Tea Market?

- The rising consumer demand for flavored alcoholic beverages and the growing acceptance of ready-to-drink (RTD) alcoholic products are key drivers of the Peach-Flavored Hard Tea market

- For instance, in March 2024, Pabst Brewing Company (U.S.) launched its Lipton Hard Iced Tea Peach flavor, expanding its RTD alcohol segment and targeting young adult consumers seeking convenience and novelty

- The market benefits from increasing urbanization, premiumization, and social drinking culture, especially among health-conscious consumers who prefer lower alcohol-by-volume (ABV) beverages

- Peach flavor’s natural sweetness and refreshing profile make it highly adaptable in RTD alcoholic blends, attracting both male and female consumers across demographics

- In addition, the expansion of distribution through online channels, bars, and convenience stores is improving market accessibility, supporting continuous growth in both developed and emerging regions

Which Factor is Challenging the Growth of the Peach-Flavored Hard Tea Market?

- A key challenge in the peach-flavored hard tea market is the stringent regulatory framework and taxation on alcoholic beverages, which affects pricing, labeling, and product placement in several countries

- For instance, varying excise duty rates and alcohol content restrictions across markets such as the U.S., Canada, and parts of Europe create distribution and compliance challenges for manufacturers

- Another significant restraint is flavor saturation and brand competition, with numerous beverage players launching similar fruit-flavored hard teas, leading to reduced differentiation

- Moreover, seasonal consumption patterns and limited shelf stability due to natural ingredients pose logistical and storage challenges for retailers

- Addressing these issues through innovative packaging, shelf-life extension technologies, and diversified flavor portfolios will be crucial for companies to maintain competitiveness and consumer loyalty

How is the Peach-Flavored Hard Tea Market Segmented?

The market is segmented on the basis of ABV, distribution channel, and packaging.

- By ABV (Alcohol by Volume)

On the basis of ABV, the peach-flavored hard tea market is segmented into 2%–5% and more than 5.1%. The 2%–5% ABV segment dominated the market with the largest revenue share of 61.4% in 2024, driven by the growing consumer preference for light, refreshing beverages with moderate alcohol content. These products cater to health-conscious consumers seeking flavorful yet easy-drinking options suitable for casual or daytime consumption. In addition, low-ABV beverages align with the global moderation trend, appealing to younger demographics and social drinkers.

The more than 5.1% ABV segment is projected to witness the fastest growth rate from 2025 to 2032, driven by rising demand among consumers seeking a stronger flavor profile and higher alcohol kick. Manufacturers are introducing peach-flavored variants with slightly elevated ABV levels to balance indulgence and refreshment, supporting product diversification across premium RTD alcoholic beverage categories.

- By Distribution Channel

On the basis of distribution channel, the peach-flavored hard tea market is segmented into hypermarkets/supermarkets, convenience stores, online stores, and others. The hypermarket/supermarket segment held the largest market revenue share of 47.8% in 2024, owing to the wide availability of diverse brands, product sampling options, and promotional discounts attracting impulse buyers. These outlets serve as the primary sales channel for alcoholic RTD beverages, enabling broad consumer reach and product visibility.

The online store segment is anticipated to register the fastest CAGR from 2025 to 2032, driven by the growing adoption of e-commerce platforms and digital retailing for alcoholic beverages. Rising smartphone penetration, easy payment options, and doorstep delivery convenience have significantly boosted online sales of Peach-Flavored Hard Teas. E-retailers and brand websites are leveraging digital marketing and targeted campaigns to engage millennial consumers seeking premium, ready-to-drink peach variants at competitive prices.

- By Packaging

On the basis of packaging, the peach-flavored hard tea market is segmented into bottles and cans. The cans segment dominated the market with the largest revenue share of 58.6% in 2024, driven by their lightweight, portable, and recyclable nature, making them ideal for on-the-go consumption and outdoor events. Canned formats are also preferred by retailers for their extended shelf life and easier storage, enhancing distribution efficiency. In addition, manufacturers favor cans for branding flexibility and appealing aesthetics that attract younger consumers.

The bottles segment is projected to witness the fastest growth rate from 2025 to 2032, fueled by increasing demand for premium and artisanal Peach-Flavored Hard Teas. Glass bottles are often associated with superior quality and sustainability, resonating with eco-conscious and upscale buyers. Premium brands are investing in innovative bottle designs and recyclable materials to strengthen brand identity while aligning with sustainability goals.

Which Region Holds the Largest Share of the Peach-Flavored Hard Tea Market?

- North America dominated the peach-flavored hard tea market with the largest revenue share of 29.35% in 2024, driven by the rising popularity of flavored alcoholic beverages and the growing demand for refreshing, low-ABV drinks among younger consumers

- The region benefits from a strong distribution network, established RTD beverage culture, and increasing innovation by major brands introducing peach-infused hard teas

- This trend is further supported by premiumization and evolving consumer preferences toward natural fruit-based flavors and healthier alcoholic options

U.S. Peach-Flavored Hard Tea Market Insight

The U.S. captured the largest share of 82% within North America in 2024, propelled by the strong dominance of leading RTD beverage companies and the growing consumer inclination toward convenient, flavorful alcohol options. The increasing adoption of peach-flavored hard teas among millennials and Gen Z, who favor fruit-forward, light, and sessionable drinks, is a key growth factor. Expanding e-commerce channels and innovative product launches by key players continue to fuel market expansion across the country.

Europe Peach-Flavored Hard Tea Market Insight

The Europe peach-flavored hard tea market is projected to grow at the fastest CAGR during 2025–2032, driven by rising consumer interest in flavored alcoholic beverages and the increasing demand for low-alcohol, premium RTD drinks. The region’s preference for naturally brewed, fruit-infused beverages and sustainable packaging solutions further enhances market growth. Leading European beverage manufacturers are expanding their RTD portfolios to include peach-flavored variants, particularly appealing to health-conscious and socially active consumers.

U.K. Peach-Flavored Hard Tea Market Insight

The U.K. peach-flavored hard tea market is witnessing strong growth, driven by the rising popularity of ready-to-drink cocktails and fruit-flavored alcoholic beverages. Younger consumers are increasingly seeking low-calorie and gluten-free alternatives to beer and cider, making peach-flavored hard teas an attractive choice. The robust retail presence, supported by pubs and online alcohol delivery platforms, is further accelerating adoption. Innovations in flavor diversity and packaging appeal are key contributors to market momentum.

Germany Peach-Flavored Hard Tea Market Insight

The Germany peach-flavored hard tea market is expected to expand steadily during the forecast period, supported by growing consumer awareness of light alcoholic drinks and the ongoing shift toward flavored and low-ABV beverages. German consumers value authenticity, natural ingredients, and refreshing flavor profiles, which align well with peach-infused hard teas. The strong presence of breweries and beverage manufacturers focusing on sustainable production and innovative formulations further contributes to the market’s consistent growth.

Which Region is the Fastest Growing Region in the Peach-Flavored Hard Tea Market?

The Europe peach-flavored hard tea market is anticipated to register the fastest CAGR of 28.8% from 2025 to 2032, driven by rapid product innovation, increasing health awareness, and growing acceptance of flavored alcoholic beverages. The rise of social drinking culture, coupled with eco-friendly packaging and low-sugar formulations, supports market expansion. In addition, growing investments by international beverage companies to introduce new peach-based RTD variants strengthen Europe’s position as the fastest-growing regional market.

France Peach-Flavored Hard Tea Market Insight

The France peach-flavored hard tea market is gaining traction as consumers increasingly prefer sophisticated yet refreshing alcoholic beverages. The trend toward natural ingredients and artisan-style brewing aligns with local consumption habits. French consumers’ openness to experimenting with new flavors, combined with the expansion of RTD offerings in cafes and supermarkets, boosts sales. Marketing efforts emphasizing premium quality and peach’s fruity aroma are positioning these beverages as a chic alternative to wine coolers and cocktails.

Italy Peach-Flavored Hard Tea Market Insight

The Italy peach-flavored hard tea market is expanding rapidly, fueled by the rising popularity of light, fruity alcoholic beverages that fit well with the Mediterranean lifestyle. Italian consumers appreciate beverages that balance refreshment and sophistication, making peach-flavored hard tea a favored choice for social occasions. The market is also benefiting from the country’s vibrant café culture and growing retail penetration of imported RTD brands, contributing to strong sales across both urban and tourist-driven regions.

Which are the Top Companies in Peach-Flavored Hard Tea Market?

The peach-flavored hard tea industry is primarily led by well-established companies, including:

- The Boston Beer Company (U.S.)

- Molson Coors Beverage Company (U.S.)

- AB InBev (Belgium)

- Heineken N.V. (Netherlands)

- Diageo plc (U.K.)

- Pabst Brewing Company (U.S.)

- Two Chicks Drinks, LLC (U.S.)

- Cisco Brewers (U.S.)

- Blue Point Brewing (U.S.)

- LoverBoy Inc. (U.S.)

- Double Brew, LLC (U.S.)

- Crook & Marker LLC (U.S.)

- Nude Beverage (Canada)

- Bold Rock Hard Cider (U.S.)

- Constellation Brands, Inc. (U.S.)

- Mark Anthony Brands International (Canada)

- Asahi Group Holdings, Ltd. (Japan)

- Suntory Holdings Limited (Japan)

- Carlsberg Group (Denmark)

- Kirin Holdings Company, Limited (Japan)

- Brown-Forman Corporation (U.S.)

- Pernod Ricard (France)

- BrewDog plc (U.K.)

- Red Bull GmbH (Austria)

- PepsiCo, Inc. (U.S.)

- Coca-Cola Company (U.S.)

What are the Recent Developments in Peach-Flavored Hard Tea Market?

- In March 2023, Diageo plc announced the introduction of a new line of hard teas under its Captain Morgan brand, expanding its RTD portfolio and catering to growing consumer demand for flavored alcoholic beverages. This launch strengthens Diageo’s presence in the hard tea segment and enhances brand visibility

- In February 2023, Wild Leaf unveiled a new series of organic hard teas made with plant-based ingredients, targeting health-conscious consumers seeking natural and sustainable beverage options. The launch highlights the growing trend toward clean-label, eco-friendly RTD products

- In January 2023, Wandering Whistler launched a collection of hard tea blends crafted using locally sourced ingredients, emphasizing authenticity, freshness, and artisanal quality. This initiative supports local sourcing and appeals to consumers seeking premium, small-batch beverages

- In July 2022, New Age Beverages Corporation introduced a new line of hard tea seltzers made with real tea leaves, combining traditional flavors with modern ready-to-drink convenience. This launch reflects the increasing popularity of seltzer-style alcoholic beverages

- In June 2022, Pure Leaf announced the release of a new line of hard tea seltzers in the United States, providing consumers with a refreshing, lightly alcoholic option made from premium tea leaves. The launch reinforced Pure Leaf’s position in the expanding RTD hard tea market

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Peach Flavored Hard Tea Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Peach Flavored Hard Tea Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Peach Flavored Hard Tea Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.