Global Per Diem Nurse Staffing Market

Market Size in USD Billion

CAGR :

%

USD

9.37 Billion

USD

14.28 Billion

2024

2032

USD

9.37 Billion

USD

14.28 Billion

2024

2032

| 2025 –2032 | |

| USD 9.37 Billion | |

| USD 14.28 Billion | |

|

|

|

|

Per Diem Nurse Staffing Market Size

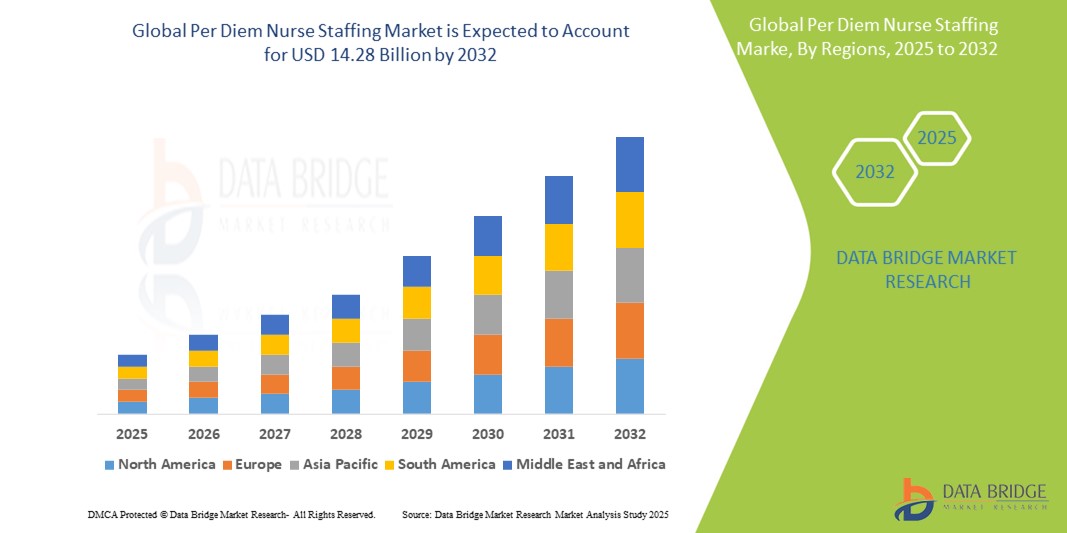

- The global per diem nurse staffing market size was valued at USD 9.37 billion in 2024 and is expected to reach USD 14.28 billion by 2032, at a CAGR of 5.40% during the forecast period

- The market growth is primarily driven by the increasing demand for flexible, cost-effective healthcare staffing solutions amid growing workforce shortages and fluctuating patient volumes in hospitals and clinics

- In addition, the rising preference among healthcare professionals for work-life balance and flexible scheduling is encouraging adoption of per diem staffing models. These evolving dynamics are reshaping hospital workforce strategies, thereby significantly contributing to the industry's expansion

Per Diem Nurse Staffing Market Analysis

- Per diem nurse staffing, which provides flexible, temporary nursing personnel to healthcare facilities, is becoming an essential component in modern healthcare workforce management due to its adaptability, cost-efficiency, and ability to address sudden staffing shortages in both hospitals and outpatient settings

- The growing demand for per diem nurse staffing is primarily driven by persistent nurse shortages, increased patient admissions, and the need for 24/7 care coverage without the long-term financial commitment of full-time hires

- North America dominated the per diem nurse staffing market with the largest revenue share of 41.8% in 2024, characterized by mature healthcare infrastructure, aging population, and the region's strong presence of leading staffing agencies, with the U.S. experiencing notable demand surges in acute care and post-acute settings

- Asia-Pacific is expected to be the fastest growing region in the per diem nurse staffing market during the forecast period due to expanding healthcare infrastructure and a rising demand for skilled medical personnel in urban areas

- Emergency Department segment dominated the per diem nurse staffing market with a market share of 40.3% in 2024, driven by its need for rapid, on-demand staffing to handle unpredictable patient influxes and critical care situations

Report Scope and Per Diem Nurse Staffing Market Segmentation

|

Attributes |

Per Diem Nurse Staffing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Per Diem Nurse Staffing Market Trends

“Digital Platforms and AI-Driven Scheduling for Flexible Workforce Management”

- A significant and accelerating trend in the global per diem nurse staffing market is the integration of digital platforms and artificial intelligence (AI) to optimize nurse scheduling, improve placement efficiency, and ensure timely staffing across healthcare facilities facing fluctuating patient volumes and workforce gaps

- For instance, platforms such as ShiftMed and Aya Healthcare leverage AI-powered algorithms to match available per diem nurses with real-time staffing needs at hospitals and clinics, streamlining the hiring process and minimizing administrative overhead for healthcare providers

- AI integration in staffing platforms enables predictive analytics to forecast peak demand periods, automate shift assignments based on nurse availability and credentialing, and provide actionable insights to enhance workforce planning. This ensures better nurse-to-patient ratios and more responsive care delivery, especially in high-demand areas such as emergency departments and intensive care units

- Digital staffing platforms also enhance transparency and engagement by allowing nurses to view, select, and manage shifts via mobile apps, fostering a flexible work environment and improving job satisfaction. Real-time communication features and instant notifications further strengthen coordination between nurses and administrators

- This trend toward AI-enhanced, app-based staffing models is transforming the traditional nurse staffing process by increasing efficiency, accuracy, and responsiveness. Companies such as Trusted Health and IntelyCare are at the forefront of this shift, offering AI-driven solutions that support flexible nurse staffing across various healthcare settings

- The growing demand for agile, technology-enabled staffing solutions is reshaping expectations in the healthcare workforce sector, especially as providers aim to maintain quality care with limited resources. This evolution is fueling the adoption of per diem nurse staffing platforms across both urban hospitals and rural clinics

Per Diem Nurse Staffing Market Dynamics

Driver

“Rising Healthcare Workforce Shortages and Need for Staffing Flexibility”

- The escalating global shortage of nursing professionals, driven by an aging workforce, increased patient volumes, and post-pandemic burnout, is a key driver fueling demand for per diem nurse staffing solutions across healthcare systems

- For instance, according to the International Council of Nurses (ICN), the global shortfall of nurses could reach 13 million by 2030, prompting hospitals and clinics to increasingly rely on flexible staffing models such as per diem staffing to bridge critical gaps

- Per diem nurses offer healthcare facilities the ability to quickly scale their workforce in response to sudden increases in patient admissions or staff absences without the long-term financial obligations associated with full-time employment

- In addition, healthcare institutions are adopting agile workforce strategies to manage labor costs while maintaining care quality, making per diem staffing a valuable resource for short-term or shift-based requirements in emergency departments, ICUs, and specialty units

- The rise in preference for work-life balance among nurses is also contributing to the popularity of per diem roles, offering greater control over schedules and avoiding burnout associated with traditional full-time roles

- The increasing integration of technology-enabled platforms that simplify scheduling and deployment is further accelerating adoption, allowing healthcare providers to meet dynamic staffing needs effectively and ensuring continuity of care even in resource-constrained environments

Restraint/Challenge

“Regulatory Complexity and Concerns Over Continuity of Care”

- Regulatory and compliance challenges, particularly regarding licensing, credential verification, and labor laws across different regions, pose significant barriers to the broader adoption of per diem nurse staffing models. These complexities often create administrative burdens for healthcare institutions and staffing agencies alike, slowing down deployment and affecting operational efficiency

- For instance, in the U.S., varying state-specific nurse licensing requirements and cross-state practice restrictions limit the mobility and rapid assignment of per diem nurses, especially during times of high demand or crisis

- In addition, concerns over continuity of care and patient safety due to the frequent rotation and limited familiarity of per diem nurses with specific facility protocols and patient histories present a challenge for healthcare administrators. This can lead to hesitancy in over-relying on temporary staff, particularly for critical care roles

- Maintaining consistent quality of care requires strong orientation programs and detailed handoff procedures, which can increase operational costs and administrative workloads for already strained healthcare facilities

- Furthermore, dependence on per diem staffing may be viewed as a short-term solution that fails to address underlying systemic workforce shortages, potentially leading to instability in long-term care planning

- To overcome these barriers, investment in digital credentialing systems, cross-border regulatory harmonization, and robust training frameworks for per diem nurses will be essential to ensure care quality and enable broader adoption of flexible staffing models in the healthcare sector

Per Diem Nurse Staffing Market Scope

The market is segmented on the basis of service and end users.

- By Service

On the basis of service, the global per diem nurse staffing market is segmented into emergency department and home care services. The emergency department segment dominated the market with the largest revenue share of 40.3% in 2024, driven by the acute demand for rapid, short-term staffing solutions in high-pressure environments. Emergency departments frequently experience unpredictable patient volumes, necessitating flexible staffing models. Per diem nurses provide vital support in these situations, helping hospitals maintain optimal nurse-to-patient ratios and care quality during peak periods or staff shortages. The growing incidence of emergency cases, including trauma and infectious diseases, further drives reliance on per diem staff.

The home care services segment is projected to witness the fastest growth rate from 2025 to 2032, owing to the global shift towards in-home patient care, particularly among the aging population and patients with chronic conditions. The flexibility of per diem nurses aligns well with home-based care models, allowing healthcare providers to offer personalized care on-demand. In addition, rising healthcare costs and patient preference for home treatment post-discharge are prompting hospitals and agencies to expand per diem staffing in home settings.

- By End Users

On the basis of end users, the per diem nurse staffing market is segmented into hospitals, clinics, nursing homes, and others. The hospital segment held the largest market share in 2024 due to their high demand for supplemental staffing to manage fluctuating patient admissions, reduce nurse burnout, and meet mandated nurse-patient ratios. Hospitals often rely on per diem nurses to fill scheduling gaps, provide coverage during leaves, and maintain round-the-clock services without long-term employment commitments.

The nursing homes segment is expected to exhibit the fastest growth from 2025 to 2032, driven by the increasing geriatric population and the rising demand for long-term and palliative care. Many nursing homes face chronic staff shortages and tight budgets, making per diem staffing a cost-effective solution to maintain operational efficiency and care quality. Flexible staffing also allows these facilities to manage resident care more effectively while adapting to regulatory staffing requirements.

Per Diem Nurse Staffing Market Regional Analysis

- North America dominated the per diem nurse staffing market with the largest revenue share of 41.8% in 2024, driven by mature healthcare infrastructure, aging population, and the region's strong presence of leading staffing agencies, with the U.S. experiencing notable demand surges in acute care and post-acute settings

- The region’s healthcare system, particularly in the U.S. and Canada, increasingly relies on per diem nurses to address scheduling gaps, manage seasonal surges, and ensure compliance with patient care standards

- In addition, the presence of established staffing agencies, supportive labor regulations, and the adoption of digital platforms for nurse scheduling and workforce management contribute to the strong market performance in North America

U.S. Per Diem Nurse Staffing Market Insight

The U.S. per diem nurse staffing market captured the largest revenue share of 79.3% in 2024 within North America, driven by critical nurse shortages, rising patient admissions, and increased demand for flexible, cost-effective workforce solutions. Hospitals and healthcare providers are leveraging per diem staffing to fill short-term gaps, manage fluctuating patient loads, and maintain compliance with care standards. The proliferation of digital staffing platforms and mobile scheduling apps has further streamlined hiring, increasing accessibility and responsiveness for healthcare employers and professionals alike.

Europe Per Diem Nurse Staffing Market Insight

The Europe per diem nurse staffing market is projected to grow at a steady CAGR throughout the forecast period, supported by evolving healthcare delivery models and rising demand for contingent nursing staff. Economic pressures and labor shortages have encouraged healthcare systems to adopt more flexible workforce strategies, including per diem staffing. Countries such as Germany, France, and the U.K. are increasingly relying on temporary nurses to manage operational costs and maintain quality of care across public and private facilities.

U.K. Per Diem Nurse Staffing Market Insight

The U.K. per diem nurse staffing market is anticipated to grow at a notable CAGR during the forecast period, fueled by the ongoing strain on the NHS and increasing reliance on temporary workforce solutions. Rising patient numbers, workforce burnout, and funding challenges have led to increased hiring of per diem nurses to maintain service levels. The expansion of digital staffing platforms and third-party nurse agencies has also improved access and deployment efficiency, supporting market growth.

Germany Per Diem Nurse Staffing Market Insight

The Germany per diem nurse staffing market is expected to expand at a considerable CAGR during the forecast period, driven by an aging population and growing demand for skilled healthcare workers in hospitals and elder care facilities. Staffing agencies are seeing greater uptake as healthcare administrators prioritize flexible labor solutions to address uneven patient volumes and worker shortages. The country’s emphasis on quality care and worker protection regulations ensures sustained demand for per diem professionals.

Asia-Pacific Per Diem Nurse Staffing Market Insight

The Asia-Pacific per diem nurse staffing market is set to grow at the fastest CAGR from 2025 to 2032, led by increasing healthcare infrastructure investments, workforce gaps, and urbanization across countries such as India, China, and Japan. The region’s expanding hospital network, aging populations, and surge in non-communicable diseases are amplifying the need for short-term nursing staff. Government-led healthcare digitization and the rise of tech-enabled staffing platforms are helping bridge the demand-supply gap efficiently.

Japan Per Diem Nurse Staffing Market Insight

The Japan per diem nurse staffing market is gaining traction due to its rapidly aging population, growing hospital admissions, and increased demand for home-based and elder care services. Healthcare providers are turning to flexible staffing to address fluctuating care needs and reduce permanent workforce strain. The country's focus on high-quality, responsive care combined with technology-driven workforce platforms is supporting market development.

India Per Diem Nurse Staffing Market Insight

The India per diem nurse staffing market accounted for the largest market revenue share in Asia-Pacific in 2024, propelled by the country’s booming healthcare sector, staffing shortages, and urban expansion. Private hospitals and multi-specialty clinics are increasingly adopting flexible nurse staffing models to ensure uninterrupted patient care. In addition, the growth of medical tourism and investment in tier-2 and tier-3 city healthcare infrastructure are expanding demand for per diem nurses across the nation

Per Diem Nurse Staffing Market Share

The Per Diem Nurse Staffing industry is primarily led by well-established companies, including:

- AdeccoGroup (Switzerland)

- AMN Healthcare (U.S.)

- CHG Management, Inc. (U.S.)

- Syneos Health. (U.S.)

- Maxim Healthcare Services (U.S.)

- TeamHealth (U.S.)

- Jackson Healthcare (U.S.)

- Aureus Medical Group (U.S.)

- Aya Healthcare (U.S.)

- InGenesis, Inc. (U.S.)

- CIVCO Medical Solutions (U.S.)

- Envision Physician Services (U.S.)

- MedPro Healthcare Staffing (U.S.)

- The Protocall Group (U.S.)

- HealthTrust Workforce Solutions (U.S.)

- Medix (U.S.)

- FlexCare Medical Staffing (U.S.)

- Nurses PRN (U.S.)

- Trusted Health (U.S.)

What are the Recent Developments in Global Per Diem Nurse Staffing Market?

- In March 2024, Mercy Health, one of the largest health systems in the U.S., reported saving over USD 30 million by adopting an AI-powered workforce management strategy to reduce dependency on premium labor. The approach significantly optimized nurse staffing through predictive scheduling, reducing reliance on agency nurses and aligning shift demand with real-time availability. This shift to strategic flexible staffing underscores the industry's increasing integration of advanced technologies to improve workforce efficiency and reduce costs

- In February 2024, StaffDNA launched a next-generation digital marketplace enabling healthcare facilities and clinicians to interact directly for per diem and travel staffing opportunities. This on-demand self-service platform offers real-time matching, credential management, and shift booking without third-party intervention. The innovation marks a shift toward greater transparency and flexibility in the per diem nurse staffing space, enhancing responsiveness and clinician autonomy

- In May 2024, Travel Nurse Across America (TNAA) announced its merger with TotalMed, forming one of the largest healthcare staffing platforms in the U.S. This strategic consolidation is aimed at expanding national reach, streamlining service offerings, and enhancing capacity to serve both urban and underserved rural facilities through integrated per diem and travel staffing solutions. The merger reflects the market’s trend toward scalability and comprehensive service delivery

- In January 2024, ShiftMed, a major player in flexible nursing workforce solutions, reported significant adoption of its AI-driven scheduling and shift-matching system across major hospital networks. By leveraging real-time analytics and geolocation tools, the platform aligns available nurses with facility demand more accurately, particularly for per diem shifts. This development showcases how technology is being used to improve workforce reliability and reduce scheduling gaps in healthcare

- In December 2023, Nursa, a per diem nursing recruiting platform, secured an USD 80 million Series B funding round led by Drive Capital, bringing its total funding to USD 100 million. With nearly 95,000 nurse users, Nursa aims to enhance on-demand staffing efficiency and reduce costs for healthcare providers

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Table of Content

1 INTRODUCTION

1.1 OBJECTIVES OF THE STUDY

1.2 MARKET DEFINITION

1.3 OVERVIEW OF GLOBAL PER DIEM NURSE STAFFING MARKET

1.4 CURRENCY AND PRICING

1.5 LIMITATION

1.6 MARKETS COVERED

2 MARKET SEGMENTATION

2.1 KEY TAKEAWAYS

2.2 ARRIVING AT THE GLOBAL PER DIEM NURSE STAFFING MARKET SIZE

2.2.1 VENDOR POSITIONING GRID

2.2.2 TECHNOLOGY LIFE LINE CURVE

2.2.3 TRIPOD DATA VALIDATION MODEL

2.2.4 MARKET GUIDE

2.2.5 MULTIVARIATE MODELLING

2.2.6 TOP TO BOTTOM ANALYSIS

2.2.7 CHALLENGE MATRIX

2.2.8 APPLICATION COVERAGE GRID

2.2.9 STANDARDS OF MEASUREMENT

2.2.10 VENDOR SHARE ANALYSIS

2.2.11 DATA POINTS FROM KEY PRIMARY INTERVIEWS

2.2.12 DATA POINTS FROM KEY SECONDARY DATABASES

2.3 GLOBAL PER DIEM NURSE STAFFING MARKET: RESEARCH SNAPSHOT

2.4 ASSUMPTIONS

3 MARKET OVERVIEW

3.1 DRIVERS

3.2 RESTRAINTS

3.3 OPPORTUNITIES

3.4 CHALLENGES

4 EXECUTIVE SUMMARY

5 PREMIUM INSIGHTS

5.1 PESTEL ANALYSIS

5.2 PORTER’S FIVE FORCES MODEL

5.3 SURGERIES/PROCEDURES IN VOLUMES

5.4 HOSPITALS AND UROLOGIST IN MIDDLE EAST REGION

6 INDUSTRY INSIGHTS

6.1 MICRO AND MACRO ECONOMIC FACTORS

6.2 PENETRATION AND GROWTH PROSPECT MAPPING

6.3 KEY PRICING STRATEGIES

6.4 INTERVIEWS WITH SPECIALIST

6.5 ANALYIS AND RECOMMENDATION

7 COST ANALYSIS BREAKDOWN

8 TECHNONLOGY ROADMAP

9 INNOVATION TRACKER AND STRATEGIC ANALYSIS

9.1 MAJOR DEALS AND STRATEGIC ALLIANCES ANALYSIS

9.1.1 JOINT VENTURES

9.1.2 MERGERS AND ACQUISITIONS

9.1.3 LICENSING AND PARTNERSHIP

9.1.4 TECHNOLOGY COLLABORATIONS

9.1.5 STRATEGIC DIVESTMENTS

9.2 INNOVATION STRATEGIES AND METHODOLOGIES

9.3 RISK ASSESSMENT AND MITIGATION

9.4 FUTURE OUTLOOK

10 REGULATORY COMPLIANCE

11 REIMBURSEMENT FRAMEWORK

12 OPPUTUNITY MAP ANALYSIS

13 VALUE CHAIN ANALYSIS

14 HEALTHCARE ECONOMY

14.1 HEALTHCARE EXPENDITURE

14.2 CAPITAL EXPENDITURE

14.3 CAPEX TRENDS

14.4 CAPEX ALLOCATION

14.5 FUNDING SOURCES

14.6 INDUSTRY BENCHMARKS

14.7 GDP RATION IN OVERALL GDP

14.8 HEALTHCARE SYSTEM STRUCTURE

14.9 GOVERNMENT POLICIES

14.1 ECONOMIC DEVELOPMENT

15 DIGITAL HEALTH AND NURSING

15.1 NURSING STAFF STRATEGIES

15.1.1 SKILL MIX OPTIMIZATION

15.1.2 STAFFING RATIOS

15.1.3 FLEXIBLE STAFFING MODELS

15.1.4 PREDICTIVE ANALYTICS

15.1.5 WORKFORCE DEVELOPMENT

15.1.6 COLLABORATIVE DECISION-MAKING:

15.1.7 QUALITY IMPROVEMENT INITIATIVES

15.1.8 OTHERS

15.2 DIGITAL TECHNOLOGY UTILIZATION

15.2.1 INTRODUCTION

15.2.2 HISTORICAL PERSPECTIVE

15.2.3 DIGITAL HEALTH TECHNOLOGIES IN NURSING

15.2.4 IMPLEMENTATION AND INTEGRATION

15.2.5 ETHICAL AND LEGAL CONSIDERATIONS

15.2.6 FUTURE DIRECTIONS

15.2.7 EMERGING TRENDS AND INNOVATIONS

15.2.8 CONCLUSION

16 GLOBAL PER DIEM NURSE STAFFING MARKET, BY PROFESSIONAL

16.1 OVERVIEW

16.2 REGISTERED NURSES (RN)

16.2.1 HOURLY CARE

16.2.2 LIVE –IN CARE

16.2.3 24 HOURS CARE

16.2.4 OTHERS

16.3 LICENSED PRACTICAL NURSES (LPN)

16.3.1 HOURLY CARE

16.3.2 LIVE –IN CARE

16.3.3 24 HOURS CARE

16.3.4 OTHERS

16.4 CERTIFIED NURSING ASSISTANTS (CNA)

16.4.1 HOURLY CARE

16.4.2 LIVE –IN CARE

16.4.3 24 HOURS CARE

16.4.4 OTHERS

16.5 OTHERS

17 GLOBAL PER DIEM NURSE STAFFING MARKET, BY SERVICE

17.1 OVERVIEW

17.2 EMERGENCY DEPARTMENT

17.3 HOME CARE SERVICES

18 GLOBAL PER DIEM NURSE STAFFING MARKET, BY MODE

18.1 OVERVIEW

18.2 HOURLY CARE

18.3 LIVE –IN CARE

18.4 24 HOURS CARE

18.5 OTHERS

19 GLOBAL PER DIEM NURSE STAFFING MARKET, BY PERSONNEL

19.1 OVERVIEW

19.2 MALE NURSING STAFF

19.3 FEMALE NURSING STAFF

20 GLOBAL PER DIEM NURSE STAFFING MARKET, BY END-USER

20.1 OVERVIEW

20.2 HOSPITALS

20.2.1 BY TYPE

20.2.1.1. PRIVATE

20.2.1.2. PUBLIC

20.2.2 BY TYPE

20.2.2.1. TIER 1

20.2.2.2. TIER 2

20.2.2.3. TIER 3

20.2.3 BY PROFESSIONAL

20.2.3.1. REGISTERED NURSES (RN)

20.2.3.1.1. HOURLY CARE

20.2.3.1.2. LIVE –IN CARE

20.2.3.1.3. 24 HOURS CARE

20.2.3.1.4. OTHERS

20.2.3.2. LICENSED PRACTICAL NURSES (LPN)

20.2.3.2.1. HOURLY CARE

20.2.3.2.2. LIVE –IN CARE

20.2.3.2.3. 24 HOURS CARE

20.2.3.2.4. OTHERS

20.2.3.3. CERTIFIED NURSING ASSISTANTS (CNA)

20.2.3.3.1. HOURLY CARE

20.2.3.3.2. LIVE –IN CARE

20.2.3.3.3. 24 HOURS CARE

20.2.3.3.4. OTHERS

20.2.3.4. OTHERS

20.3 CLINICS

20.3.1 BY PROFESSIONAL

20.3.1.1. REGISTERED NURSES (RN)

20.3.1.1.1. HOURLY CARE

20.3.1.1.2. LIVE –IN CARE

20.3.1.1.3. 24 HOURS CARE

20.3.1.1.4. OTHERS

20.3.1.2. LICENSED PRACTICAL NURSES (LPN)

20.3.1.2.1. HOURLY CARE

20.3.1.2.2. LIVE –IN CARE

20.3.1.2.3. 24 HOURS CARE

20.3.1.2.4. OTHERS

20.3.1.3. CERTIFIED NURSING ASSISTANTS (CNA)

20.3.1.3.1. HOURLY CARE

20.3.1.3.2. LIVE –IN CARE

20.3.1.3.3. 24 HOURS CARE

20.3.1.3.4. OTHERS

20.3.1.4. OTHERS

20.4 NURSING HOMES

20.4.1 BY PROFESSIONAL

20.4.1.1. REGISTERED NURSES (RN)

20.4.1.1.1. HOURLY CARE

20.4.1.1.2. LIVE –IN CARE

20.4.1.1.3. 24 HOURS CARE

20.4.1.1.4. OTHERS

20.4.1.2. LICENSED PRACTICAL NURSES (LPN)

20.4.1.2.1. HOURLY CARE

20.4.1.2.2. LIVE –IN CARE

20.4.1.2.3. 24 HOURS CARE

20.4.1.2.4. OTHERS

20.4.1.3. CERTIFIED NURSING ASSISTANTS (CNA)

20.4.1.3.1. HOURLY CARE

20.4.1.3.2. LIVE –IN CARE

20.4.1.3.3. 24 HOURS CARE

20.4.1.3.4. OTHERS

20.4.1.4. OTHERS

20.5 OTHERS

21 GLOBAL PER DIEM NURSE STAFFING MARKET, COMPANY LANDSCAPE

21.1 COMPANY SHARE ANALYSIS: GLOBAL

21.2 COMPANY SHARE ANALYSIS: NORTH AMERICA

21.3 COMPANY SHARE ANALYSIS: EUROPE

21.4 COMPANY SHARE ANALYSIS: ASIA PACIFIC

21.5 MERGERS & ACQUISITIONS

21.6 NEW PRODUCT DEVELOPMENT & APPROVALS

21.7 EXPANSIONS

21.8 REGULATORY CHANGES

21.9 PARTNERSHIP AND OTHER STRATEGIC DEVELOPMENTS

22 GLOBAL PER DIEM NURSE STAFFING MARKET, BY GEOGRAPHY

GLOBAL PER DIEM NURSE STAFFING MARKET, (ALL SEGMENTATION PROVIDED ABOVE IS REPRESENTED IN THIS CHAPTER BY COUNTRY)

22.1 NORTH AMERICA

22.1.1 U.S.

22.1.2 CANADA

22.1.3 MEXICO

22.2 EUROPE

22.2.1 GERMANY

22.2.2 FRANCE

22.2.3 U.K.

22.2.4 HUNGARY

22.2.5 LITHUANIA

22.2.6 AUSTRIA

22.2.7 IRELAND

22.2.8 NORWAY

22.2.9 POLAND

22.2.10 ITALY

22.2.11 SPAIN

22.2.12 RUSSIA

22.2.13 TURKEY

22.2.14 NETHERLANDS

22.2.15 SWITZERLAND

22.2.16 REST OF EUROPE

22.3 ASIA-PACIFIC

22.3.1 JAPAN

22.3.2 CHINA

22.3.3 SOUTH KOREA

22.3.4 INDIA

22.3.5 AUSTRALIA

22.3.6 SINGAPORE

22.3.7 THAILAND

22.3.8 MALAYSIA

22.3.9 INDONESIA

22.3.10 PHILIPPINES

22.3.11 VIETNAM

22.3.12 REST OF ASIA-PACIFIC

22.4 SOUTH AMERICA

22.4.1 BRAZIL

22.4.2 ARGENTINA

22.4.3 CHILE

22.4.4 PERU

22.4.5 COLOMBIA

22.4.6 VENEZUELA

22.4.7 REST OF SOUTH AMERICA

22.5 MIDDLE EAST AND AFRICA

22.5.1 SOUTH AFRICA

22.5.2 SAUDI ARABIA

22.5.3 UAE

22.5.4 EGYPT

22.5.5 KUWAIT

22.5.6 ISRAEL

22.5.7 REST OF MIDDLE EAST AND AFRICA

22.6 KEY PRIMARY INSIGHTS: BY MAJOR COUNTRIES

23 GLOBAL PER DIEM NURSE STAFFING MARKET, SWOT AND DBMR ANALYSIS

24 GLOBAL PER DIEM NURSE STAFFING MARKET, COMPANY PROFILE

25 COMPANY PROFILE FOR WIRELESS TECHNOLOGY BASED DEVICES

25.1 ADECCO USA

25.1.1 COMPANY OVERVIEW

25.1.2 REVENUE ANALYSIS

25.1.3 GEOGRAPHIC PRESENCE

25.1.4 PRODUCT PORTFOLIO

25.1.5 RECENT DEVELOPMENTS

25.2 CROSS COUNTRY HEALTHCARE

25.2.1 COMPANY SNAPSHOT

25.2.2 REVENUE ANALYSIS

25.2.3 GEOGRAPHIC PRESENCE

25.2.4 PRODUCT PORTFOLIO

25.2.5 RECENT DEVELOPMENT

25.3 MAXIM HEALTHCARE GROUP

25.3.1 COMPANY SNAPSHOT

25.3.2 REVENUE ANALYSIS

25.3.3 GEOGRAPHIC PRESENCE

25.3.4 PRODUCT PORTFOLIO

25.3.5 RECENT DEVELOPMENT

25.4 ACCOUNTABLE HEALTHCARE STAFFING

25.4.1 COMPANY SNAPSHOT

25.4.2 REVENUE ANALYSIS

25.4.3 GEOGRAPHIC PRESENCE

25.4.4 PRODUCT PORTFOLIO

25.4.5 RECENT DEVELOPMENT

25.5 HEALTHTRUST WORKFORCE SOLUTIONS

25.5.1 COMPANY SNAPSHOT

25.5.2 REVENUE ANALYSIS

25.5.3 GEOGRAPHIC PRESENCE

25.5.4 PRODUCT PORTFOLIO

25.5.5 RECENT DEVELOPMENT

25.6 SNAPCARE

25.6.1 COMPANY SNAPSHOT

25.6.2 REVENUE ANALYSIS

25.6.3 GEOGRAPHIC PRESENCE

25.6.4 PRODUCT PORTFOLIO

25.6.5 RECENT DEVELOPMENT

25.7 STAFFMAX

25.7.1 COMPANY SNAPSHOT

25.7.2 REVENUE ANALYSIS

25.7.3 GEOGRAPHIC PRESENCE

25.7.4 PRODUCT PORTFOLIO

25.7.5 RECENT DEVELOPMENT

25.8 AMN HEALTHCARE, INC.

25.8.1 COMPANY SNAPSHOT

25.8.2 REVENUE ANALYSIS

25.8.3 GEOGRAPHIC PRESENCE

25.8.4 PRODUCT PORTFOLIO

25.8.5 RECENT DEVELOPMENT

25.9 INTERIM HEALTHCARE INC.

25.9.1 COMPANY SNAPSHOT

25.9.2 REVENUE ANALYSIS

25.9.3 GEOGRAPHIC PRESENCE

25.9.4 PRODUCT PORTFOLIO

25.9.5 RECENT DEVELOPMENT

25.1 GHR HEALTHCARE

25.10.1 COMPANY SNAPSHOT

25.10.2 REVENUE ANALYSIS

25.10.3 GEOGRAPHIC PRESENCE

25.10.4 PRODUCT PORTFOLIO

25.10.5 RECENT DEVELOPMENT

25.11 CAREERSTAFF UNLIMITED

25.11.1 COMPANY SNAPSHOT

25.11.2 REVENUE ANALYSIS

25.11.3 GEOGRAPHIC PRESENCE

25.11.4 PRODUCT PORTFOLIO

25.11.5 RECENT DEVELOPMENT

25.12 CHG MANAGEMENT, INC.

25.12.1 COMPANY SNAPSHOT

25.12.2 REVENUE ANALYSIS

25.12.3 GEOGRAPHIC PRESENCE

25.12.4 PRODUCT PORTFOLIO

25.12.5 RECENT DEVELOPMENT

25.13 JACKSON NURSE PROFESSIONALS, LLC

25.13.1 COMPANY SNAPSHOT

25.13.2 REVENUE ANALYSIS

25.13.3 GEOGRAPHIC PRESENCE

25.13.4 PRODUCT PORTFOLIO

25.13.5 RECENT DEVELOPMENT

25.14 AMERICAN MEDICAL STAFFING

25.14.1 COMPANY SNAPSHOT

25.14.2 REVENUE ANALYSIS

25.14.3 GEOGRAPHIC PRESENCE

25.14.4 PRODUCT PORTFOLIO

25.14.5 RECENT DEVELOPMENT

25.15 ATC HEALTHCARE

25.15.1 COMPANY SNAPSHOT

25.15.2 REVENUE ANALYSIS

25.15.3 GEOGRAPHIC PRESENCE

25.15.4 PRODUCT PORTFOLIO

25.15.5 RECENT DEVELOPMENT

25.16 FAVORITE HEALTHCARE STAFFING INC.

25.16.1 COMPANY SNAPSHOT

25.16.2 REVENUE ANALYSIS

25.16.3 GEOGRAPHIC PRESENCE

25.16.4 PRODUCT PORTFOLIO

25.16.5 RECENT DEVELOPMENT

25.17 NURSING STAFFING FIRM

25.17.1 COMPANY SNAPSHOT

25.17.2 REVENUE ANALYSIS

25.17.3 GEOGRAPHIC PRESENCE

25.17.4 PRODUCT PORTFOLIO

25.17.5 RECENT DEVELOPMENT

25.18 AYA HEALTHCARE, INC

25.18.1 COMPANY SNAPSHOT

25.18.2 REVENUE ANALYSIS

25.18.3 GEOGRAPHIC PRESENCE

25.18.4 PRODUCT PORTFOLIO

25.18.5 RECENT DEVELOPMENT

25.19 INGENESIS, INC

25.19.1 COMPANY SNAPSHOT

25.19.2 REVENUE ANALYSIS

25.19.3 GEOGRAPHIC PRESENCE

25.19.4 PRODUCT PORTFOLIO

25.19.5 RECENT DEVELOPMENT

25.2 MAS MEDICAL STAFFING

25.20.1 COMPANY SNAPSHOT

25.20.2 REVENUE ANALYSIS

25.20.3 GEOGRAPHIC PRESENCE

25.20.4 PRODUCT PORTFOLIO

25.20.5 RECENT DEVELOPMENT

25.21 GIFTED HEALTHCARE

25.21.1 COMPANY SNAPSHOT

25.21.2 REVENUE ANALYSIS

25.21.3 GEOGRAPHIC PRESENCE

25.21.4 PRODUCT PORTFOLIO

25.21.5 RECENT DEVELOPMENT

25.22 PRO MED HEALTHCARE SERVICES

25.22.1 COMPANY SNAPSHOT

25.22.2 REVENUE ANALYSIS

25.22.3 GEOGRAPHIC PRESENCE

25.22.4 PRODUCT PORTFOLIO

25.22.5 RECENT DEVELOPMENT

25.23 ELITECARE MEDICAL STAFFING

25.23.1 COMPANY SNAPSHOT

25.23.2 REVENUE ANALYSIS

25.23.3 GEOGRAPHIC PRESENCE

25.23.4 PRODUCT PORTFOLIO

25.23.5 RECENT DEVELOPMENTS

25.23.6 RECENT DEVELOPMENTS

25.24 MEDPRO HEALTHCARE STAFFING

25.24.1 COMPANY SNAPSHOT

25.24.2 REVENUE ANALYSIS

25.24.3 GEOGRAPHIC PRESENCE

25.24.4 PRODUCT PORTFOLIO

25.24.5 RECENT DEVELOPMENTS

25.24.6 RECENT DEVELOPMENTS

NOTE: THE COMPANIES PROFILED IS NOT EXHAUSTIVE LIST AND IS AS PER OUR PREVIOUS CLIENT REQUIREMENT. WE PROFILE MORE THAN 100 COMPANIES IN OUR STUDY AND HENCE THE LIST OF COMPANIES CAN BE MODIFIED OR REPLACED ON REQUEST

26 RELATED REPORTS

27 QUESTIONNAIRE

28 ABOUT DATA BRIDGE MARKET RESEARCH

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.