Global Pet Food Preservatives Market

Market Size in USD Million

CAGR :

%

USD

625.36 Million

USD

1,034.96 Million

2024

2032

USD

625.36 Million

USD

1,034.96 Million

2024

2032

| 2025 –2032 | |

| USD 625.36 Million | |

| USD 1,034.96 Million | |

|

|

|

|

What is the Global Pet Food Preservatives Market Size and Growth Rate?

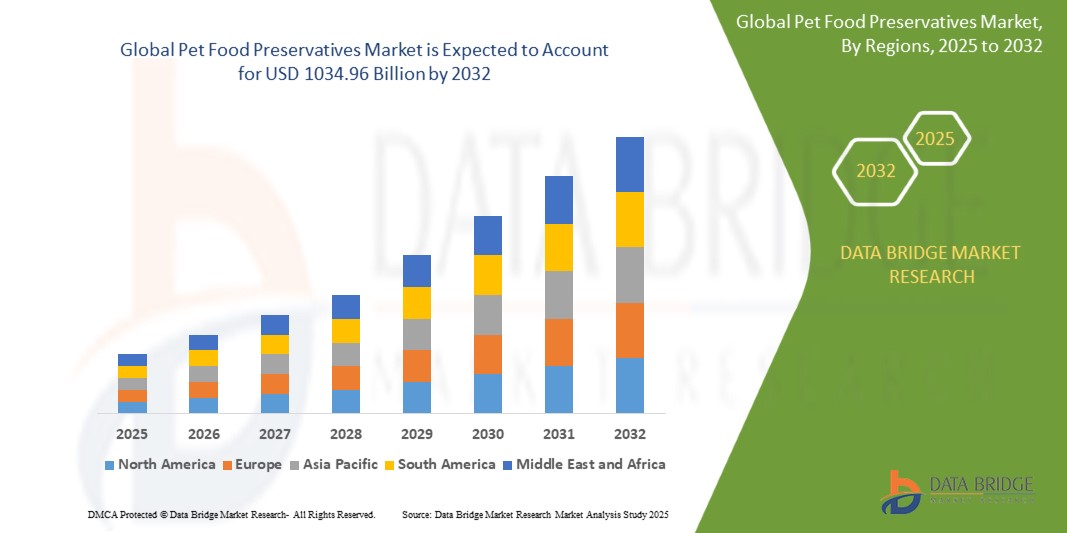

- The global pet food preservatives market size was valued at USD 625.36 million in 2024 and is expected to reach USD 1034.96 million by 2032, at a CAGR of 6.50% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within connected home devices and smart home technology, leading to increased digitalization in both residential and commercial settings

- Furthermore, rising consumer demand for secure, user-friendly, and integrated solutions for their homes and businesses is establishing Pet Food Preservatives as the modern access control system of choice. These converging factors are accelerating the uptake of Pet Food Preservatives solutions, thereby significantly boosting the industry's growth

What are the Major Takeaways of Pet Food Preservatives Market?

- Pet Food Preservatives, offering electronic or digital access control for doors and gates, are increasingly vital components of modern home security and automation systems in both residential and commercial settings due to their enhanced convenience, remote access capabilities, and seamless integration with smart home ecosystems

- The escalating demand for pet food preservatives is primarily fueled by the widespread adoption of smart home technologies, growing security concerns among consumers, and a rising preference for the convenience of keyless entry

- North America dominated the pet food preservatives market with the largest revenue share of 38.9% in 2024, driven by the rising pet ownership, strong demand for premium pet food products, and increasing consumer focus on pet health and nutrition

- Asia-Pacific pet food preservatives market is projected to grow at the fastest CAGR of 8.9% from 2025 to 2032, driven by rapid urbanization, increasing pet ownership, and growing awareness regarding pet nutrition and food safety across emerging economies such as China, India, and Southeast Asia

- The Dogs segment dominated the pet food preservatives market with the largest market revenue share of 47.5% in 2024, driven by the significant global dog population, rising pet humanization trends, and increasing demand for premium, high-quality dog food products with extended shelf life

Report Scope and Pet Food Preservatives Market Segmentation

|

Attributes |

Pet Food Preservatives Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Pet Food Preservatives Market?

“Growing Demand for Natural and Clean-Label Pet Food Preservative”

- A major emerging trend in the global pet food preservatives market is the rapid shift towards natural, clean-label, and plant-based preservatives, driven by increasing consumer awareness of pet health and safety. Pet owners are becoming more cautious about artificial additives, prompting manufacturers to seek safer, naturally derived alternatives

- For instance, companies such as Kemin Industries have introduced botanical and antioxidant-based preservatives, providing effective shelf-life extension while aligning with consumer preference for cleaner formulations

- The trend reflects growing demand for transparency, with pet food brands highlighting "no artificial preservatives" labels, and integrating natural ingredients such as rosemary extract, tocopherols, and citrus-derived compounds for preservation

- Rising cases of pet allergies, digestive sensitivities, and lifestyle changes among pet owners are fueling this market shift, especially in premium and specialty pet food categories

- Major players are investing in R&D for multifunctional preservative solutions, ensuring microbial stability while retaining nutritional value and flavor, to meet evolving consumer expectations for high-quality, safe, and sustainable pet food

- This focus on natural, functional, and clean-label preservatives is expected to remain central to product innovation, reshaping the competitive landscape of the pet food preservatives market in the coming years

What are the Key Drivers of Pet Food Preservatives Market?

- The rising global pet humanization trend, where pets are treated as family members, significantly boosts demand for high-quality, safe, and preservative-controlled pet food. Consumers seek products that align with their own dietary preferences, including clean-label and chemical-free options

- For instance, in March 2024, BASF SE introduced new natural antioxidant solutions for pet food, designed to extend product shelf life while adhering to stringent safety and quality standards, reflecting growing demand for natural preservatives

- In addition, the surge in pet ownership worldwide, coupled with growing awareness about foodborne illnesses and spoilage, is driving manufacturers to incorporate effective preservation methods to ensure product safety and longer shelf life

- Increased demand for premium, grain-free, organic, and refrigerated pet food, which requires advanced preservation solutions to maintain freshness and prevent microbial growth, is further accelerating market growth

- The shift towards e-commerce and global distribution of pet food products also amplifies the need for reliable, long-lasting preservatives, ensuring product quality across extended supply chains

Which Factor is challenging the Growth of the Pet Food Preservatives Market?

- The market faces significant challenges regarding regulatory scrutiny and health concerns associated with synthetic preservatives such as BHA, BHT, and ethoxyquin. Growing consumer skepticism towards chemical additives restricts their usage, pressuring manufacturers to reformulate with safer alternatives

- For instance, consumer backlash and regulatory limitations on certain synthetic preservatives have led major brands to transition towards natural alternatives, though this can increase production costs and affect product shelf life

- Another key barrier is the higher cost of natural preservatives, which can elevate final product prices, limiting adoption in price-sensitive markets, particularly in developing regions. Manufacturers must balance cost, functionality, and consumer expectations

- Furthermore, achieving equivalent efficacy with natural preservatives can be technically challenging, as they may offer lower antimicrobial effectiveness or shorter shelf life compared to synthetic options. This poses hurdles for maintaining product safety in mass-market and long-distribution products

- Overcoming these challenges will require continued innovation, transparent labeling practices, and cost optimization to support widespread adoption of natural, effective, and regulatory-compliant preservatives in the pet food industry

How is the Pet Food Preservatives Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

• By Animal Type

On the basis of animal type, the pet food preservatives market is segmented into Dogs, Cats, Fish, and Others. The Dogs segment dominated the pet food preservatives market with the largest market revenue share of 47.5% in 2024, driven by the significant global dog population, rising pet humanization trends, and increasing demand for premium, high-quality dog food products with extended shelf life. Consumers often prioritize pet food safety for dogs, which drives strong adoption of preservatives across dry, wet, and treat-based dog food categories.

The Cats segment is anticipated to witness the fastest growth rate of 8.9% from 2025 to 2032, fueled by growing urban pet ownership, rising disposable incomes, and increased demand for convenient, long-lasting cat food options. Manufacturers are responding to this demand with tailored preservative solutions that ensure freshness and safety across cat food products, including wet food, kibble, and treats.

• By Preservative Type

On the basis of preservative type, the pet food preservatives market is segmented into Mold Inhibitors, Antimicrobials, Pellet Binders, Grain Conditioners, Toxin Binders, Acidifiers, Colorants, Ethoxyquin, Butylated Hydroxyanisole (BHA), Butylated Hydroxytoluene (BHT), and Others. The Mold Inhibitors segment held the largest market revenue share of 31.4% in 2024, driven by the critical role of mold inhibitors in preventing spoilage, especially in humid climates and long shelf-life dry food products. Rising awareness of food safety and storage stability across pet food categories has fueled consistent demand for mold inhibitors.

The Antimicrobials segment is projected to witness the fastest CAGR from 2025 to 2032, supported by growing concerns about microbial contamination in high-moisture and premium pet food formulations. Innovations in natural antimicrobial agents are also boosting adoption, particularly among health-conscious pet owners.

• By Source

On the basis of source, the pet food preservatives market is segmented into Plant and Animal. The Plant segment dominated the Pet Food Preservatives market with the largest revenue share of 58.2% in 2024, driven by the surging demand for natural, plant-based preservative solutions that align with clean-label trends and rising pet health awareness. Plant-derived preservatives, including antioxidants and botanical extracts, are increasingly favored for their safety, functionality, and market appeal.

The Animal segment is expected to register notable growth through 2032, owing to the demand for animal-derived ingredients in specific preservative applications, particularly in premium and protein-focused pet food products.

• By Function

On the basis of function, the pet food preservatives market is segmented into Preservation and Processing and Nutrition. The Preservation segment accounted for the largest market revenue share of 69.6% in 2024, as ensuring product shelf life, preventing spoilage, and maintaining food safety remain the primary functions of preservatives in the pet food industry. Growing global distribution networks and consumer expectations for product freshness support the dominance of this segment.

The Processing and Nutrition segment is anticipated to witness the fastest growth from 2025 to 2032, fueled by the increasing trend of multifunctional preservatives that extend shelf life and contribute to the nutritional profile and overall health benefits of pet food products.

• By Form

On the basis of form, the pet food preservatives market is segmented into Powder and Liquid. The Powder segment held the largest market revenue share of 63.9% in 2024, driven by ease of handling, longer shelf life, and compatibility with a wide range of pet food formulations, particularly dry kibble and treats. Powdered preservatives also offer cost-effective solutions for large-scale production environments.

The Liquid segment is projected to witness the fastest CAGR from 2025 to 2032, supported by increasing applications in wet food, semi-moist products, and premium pet food categories where precise dosing and effective dispersion are essential.

Which Region Holds the Largest Share of the Pet Food Preservatives Market?

- North America dominated the pet food preservatives market with the largest revenue share of 38.9% in 2024, driven by the rising pet ownership, strong demand for premium pet food products, and increasing consumer focus on pet health and nutrition

- Consumers in the region highly prioritize product quality, extended shelf life, and food safety, fueling demand for effective preservative solutions across dry, wet, and treat-based pet food categories

- The widespread availability of innovative preservative technologies, combined with high disposable incomes and well-established pet food manufacturing infrastructure, positions North America as the leading region in the pet food preservatives market

U.S. Pet Food Preservatives Market Insight

The U.S. pet food preservatives market accounted for the largest revenue share within North America in 2024, supported by growing awareness of pet food safety, increased preference for clean-label and natural ingredients, and significant investments by major pet food manufacturers. The trend toward premium, functional, and long-lasting pet food products is accelerating the demand for preservative solutions that maintain freshness and quality. Moreover, the rising popularity of e-commerce channels and private-label pet food brands is contributing to the expansion of the U.S. Pet Food Preservatives market.

Canada Pet Food Preservatives Market Insight

The Canada pet food preservatives market is experiencing steady growth, fueled by increasing pet humanization trends, rising disposable incomes, and the growing demand for nutritious, safe, and long-shelf-life pet food products. Canadian consumers show a strong inclination toward natural and functional preservative solutions, particularly in premium pet food segments. In addition, supportive regulatory standards and an expanding domestic pet food manufacturing sector are propelling market growth across the country.

Which Region is the Fastest Growing Region in the Pet Food Preservatives Market?

Asia-Pacific pet food preservatives market is projected to grow at the fastest CAGR of 8.9% from 2025 to 2032, driven by rapid urbanization, increasing pet ownership, and growing awareness regarding pet nutrition and food safety across emerging economies such as China, India, and Southeast Asia. Rising disposable incomes, changing consumer lifestyles, and expanding pet food manufacturing capabilities are accelerating demand for preservative solutions that ensure freshness, safety, and product longevity. The affordability of preservative technologies and supportive government initiatives toward improving food safety standards are further boosting market expansion in the region.

China Pet Food Preservatives Market Insight

The China pet food preservatives market held the largest revenue share within Asia-Pacific in 2024, driven by the country's rapidly expanding middle class, growing pet ownership rates, and significant focus on food safety and quality. China's status as one of the leading pet food manufacturing hubs, coupled with a strong demand for premium and imported pet food products, continues to fuel adoption of advanced preservative solutions across the domestic market.

India Pet Food Preservatives Market Insight

The India pet food preservatives market is witnessing robust growth, supported by rising urbanization, increasing pet ownership, and growing awareness regarding the importance of safe, nutritious, and long-lasting pet food. The market is benefiting from the growing demand for packaged and premium pet food products, particularly in metropolitan areas. In addition, the rising preference for natural and plant-based preservatives aligns with evolving consumer preferences, driving further market expansion.

Japan Pet Food Preservatives Market Insight

The Japan pet food preservatives market is expanding steadily, driven by a mature pet food industry, strong consumer demand for premium and health-focused pet food products, and strict quality and safety standards. Japanese consumers are increasingly opting for preservative solutions that ensure product freshness while meeting the demand for natural, functional, and eco-friendly ingredients. The country's aging pet population and focus on specialized diets are also contributing to the rising adoption of preservative technologies.

Which are the Top Companies in Pet Food Preservatives Market?

The pet food preservatives industry is primarily led by well-established companies, including:

- Altrafine Gums (India)

- BASF SE (Germany)

- Balchem Inc. (U.S.)

- Bentoli (U.S.)

- Bill Barr & Company (U.S.)

- Caldic B.V. (Netherlands)

- PFIAA (Australia)

- Kerry Inc. (Ireland)

- Cargill, Incorporated (U.S.)

- Camlin Fine Sciences Ltd. (India)

- Denes Natural Pet Care Ltd. (U.K.)

- DSM (Netherlands)

- PetCoach (U.S.)

- Kemin Industries, Inc. (U.S.)

- Trouw Nutrition USA, LLC. (U.S.)

- DuPont (U.S.)

What are the Recent Developments in Global Pet Food Preservatives Market?

- In February 2024, Coop Italia expanded its pet food portfolio by introducing over 200 new products enriched with innovative ingredients such as insect flour, proteins, and superfoods, strengthening its position in the sustainable and health-focused pet food market

- In November 2023, Corbion launched a sustainable, nutrient-rich pet food solution, while Bully Max introduced a new puppy food formula featuring TruMune technology, designed to promote gut health and preserve nutritional value, reflecting the growing demand for functional pet nutrition products

- In November 2023, IFF and BASF’s Pharma Solutions divisions announced a strategic partnership to integrate IFF’s leading excipient brands into BASF’s digital platform, Zoom Lab, aimed at accelerating pharmaceutical formulation development through AI-driven excipient recommendations, supporting innovation in drug manufacturing

- In November 2023, BASF Services Europe GmbH invested in developing a modern, efficient, and sustainable working environment for approximately 2,800 employees, reinforcing its commitment to enhancing operational efficiency and employee well-being

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pet Food Preservatives Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pet Food Preservatives Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pet Food Preservatives Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.