Global Pet Wearable Market

Market Size in USD Billion

CAGR :

%

USD

3.66 Billion

USD

6.88 Billion

2024

2032

USD

3.66 Billion

USD

6.88 Billion

2024

2032

| 2025 –2032 | |

| USD 3.66 Billion | |

| USD 6.88 Billion | |

|

|

|

|

Pet Wearable Market Analysis

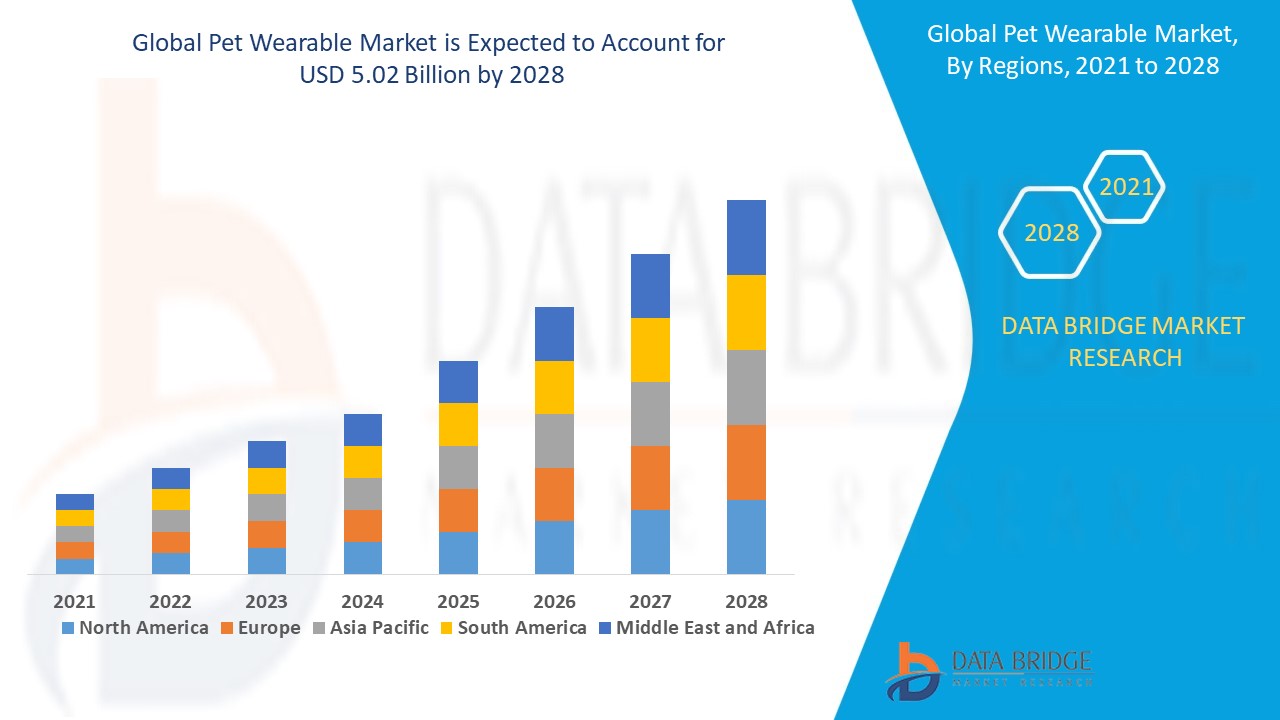

The pet wearable market is experiencing rapid growth, driven by technological advancements, increasing pet ownership, and rising awareness about pet health and safety. Pet wearables, including smart collars, GPS trackers, health monitors, and behavior analysis devices, are transforming the way pet owners interact with their animals. These devices use GPS, RFID, Bluetooth, and advanced sensors to track location, monitor vital signs, and provide real-time updates on pet activity and well-being. The growing trend of pet humanization and the rising expenditure on pet care have fueled demand for smart, connected pet products. Technological advancements, such as AI-powered health monitoring, real-time GPS tracking, and cloud-based data storage, are enhancing product functionality and accuracy. For instance, AI-driven pet health monitors can detect abnormalities in heart rate, stress levels, and activity patterns, allowing early disease detection. In addition, the integration of IoT and mobile apps has made pet monitoring more accessible and convenient for owners. North America dominates the market due to high pet adoption rates and advanced tech infrastructure, while Asia-Pacific is witnessing rapid growth due to increasing pet ownership and rising disposable incomes.

Pet Wearable Market Size

The global pet wearable market size was valued at USD 3.66 billion in 2024 and is projected to reach USD 6.88 billion by 2032, with a CAGR of8.20% during the forecast period of 2025 to 2032. In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand.

Pet Wearable Market Trends

“Increasing Integration of AI-Powered Health Monitoring”

The pet wearable market is witnessing significant growth, with AI-powered health monitoring emerging as a key trend. Modern pet health wearables, such as smart collars and biometric sensors, now incorporate artificial intelligence (AI) and machine learning to track a pet’s vital signs, detect behavioral changes, and provide predictive health insights. These AI-driven pet wearables analyze data patterns to identify early signs of stress, anxiety, heart issues, or potential illnesses, helping pet owners take proactive measures. For instance, PetPace’s smart collar uses AI algorithms to monitor a pet’s heart rate, temperature, and respiration, alerting owners to abnormal health conditions via a mobile app. This advancement is particularly beneficial for aging pets and breeds prone to health issues. The integration of real-time tracking, cloud-based analytics, and AI-enhanced diagnostics is revolutionizing pet healthcare and safety, making AI-powered monitoring a crucial innovation in the pet wearable industry.

Report Scope and Pet Wearable Market Segmentation

|

Attributes |

Pet Wearable Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America |

|

Key Market Players |

Merck & Co., Inc. (U.S.), Avid Identification Systems, Inc. (U.S.), Datamars (Switzerland), FitBark Inc. (U.S.), MIT International Group FZE (U.A.E.), Radio Systems Corporation (U.S.), Whistle (U.S.), Link My Pet (U.S.), Loc8tor Ltd. (U.K.), Motorola Mobility LLC (U.S.), Tractive (Austria), Trovan Ltd. (U.K.), DooWa Technology (South Korea), Kickstarter, PBC (U.S.), Dogtra (U.S.), PetPace (U.S.), Wix.com, Inc. (Israel), DAIRYMASTER (Ireland), Gibi Technologies Inc. (U.S.), Peacock Technology Ltd. (India), and inupathy (Japan) |

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, geographically represented company-wise production and capacity, network layouts of distributors and partners, detailed and updated price trend analysis and deficit analysis of supply chain and demand. |

Pet Wearable Market Definition

A pet wearable is a smart device designed to be worn by pets to monitor their health, location, activity, and behavior using advanced technologies such as GPS, RFID, sensors, AI, and Bluetooth. These devices include smart collars, health monitors, GPS trackers, and behavior analysis tools, enabling pet owners to track vital signs, detect anomalies, and enhance pet safety.

Pet Wearable Market Dynamics

Drivers

- Increasing Pet Ownership and Humanization of Pets

The rising global pet ownership and the growing humanization of pets have significantly impacted the demand for smart pet wearables. Many pet owners now treat their pets as family members, leading to increased spending on pet safety, health, and well-being. This shift in perception has fueled the adoption of GPS trackers, smart collars, and health monitoring devices that allow owners to monitor their pets in real time. For instance, Tractive GPS trackers offer live tracking and activity monitoring, ensuring pets remain safe while giving owners peace of mind. The trend is particularly strong in urban areas, where busy pet owners rely on technology-driven solutions to care for their animals remotely. As pet adoption rates continue to rise, particularly in single-person households and aging populations, the demand for smart pet wearables is expected to grow, making it a key market driver.

- Rising Concerns About Pet Health and Safety

Pet owners are becoming increasingly concerned about their pets' health and safety, leading to a surge in demand for advanced wearable solutions. Smart devices such as biometric collars and health monitors help track vital signs, detect early symptoms of illnesses, and analyze activity patterns, ensuring proactive pet care. For instance, PetPace’s Health 2.0 smart collar continuously monitors a pet’s heart rate, temperature, respiratory rate, and sleep quality, helping owners detect health anomalies before they escalate into serious conditions. This is particularly beneficial for aging pets and breeds prone to genetic disorders, as early intervention can improve longevity and quality of life. The demand for real-time health tracking solutions is also growing among veterinarians and pet insurance providers, further driving the pet wearable market forward.

Opportunities

- Increasing Adoption of Smart Technologies in Pet Care

The growing integration of AI, IoT, and sensor-based technologies in pet wearables is transforming the pet care industry, creating new market opportunities. Smart pet devices now feature AI-powered health monitoring, RFID-based identification, and real-time tracking, allowing pet owners to make data-driven decisions about their pets' well-being. For instance, the PetPace Health 2.0 smart collar leverages AI to analyze a pet’s heart rate, respiratory patterns, and activity levels, enabling early disease detection and preventive care. In addition, IoT-enabled smart pet feeders and communication systems allow pet owners to remotely monitor and interact with their pets via mobile applications. The growing reliance on connected pet technologies presents a significant market opportunity, as companies continue developing innovative solutions to cater to tech-savvy pet owners who prioritize smart, automated pet care solutions.

- Rising Disposable Income and Willingness to Spend on Pet Products

The increasing disposable income in developed economies and emerging markets has led to higher spending on premium pet care products, creating lucrative market opportunities for pet wearable manufacturers. Pet owners are now investing in high-end tracking, health monitoring, and behavior analysis devices to ensure their pets' safety, health, and happiness. For instance, Invoxia’s Smart Dog Collar, a biometric health-tracking collar, offers continuous heart and respiratory rate monitoring, providing pet owners with real-time health insights. The demand for luxury and technologically advanced pet products is particularly strong in North America and Europe, where consumers are willing to spend on cutting-edge pet technology. As pet owners prioritize convenience and efficiency, the market for smart pet wearables is expected to expand significantly, offering businesses new revenue streams through premium product offerings.

Restraints/Challenges

- High Cost of Smart Pet Wearables

One of the significant challenges in the pet wearable market is the high cost of smart pet wearables, which limits their adoption, particularly in price-sensitive regions. Advanced pet wearables equipped with GPS tracking, AI-powered health monitoring, and biometric sensors require sophisticated technology, making them expensive. For instance, PetPace smart collars monitor a pet’s heart rate, temperature, and respiration, while premium GPS trackers such as Fi Smart Dog Collar Series 3 offer advanced tracking features, but both come with hefty price tags and additional subscription fees. The cost of software updates, battery replacements, and maintenance further adds to the long-term expenses for pet owners. This financial burden makes it difficult for many consumers to justify investing in such devices, especially when lower-cost alternatives, such as traditional ID tags or microchips, are available. The high initial investment and recurring costs pose a major barrier to market expansion, particularly in developing regions.

- Data Privacy and Security Concerns

As pet wearables become more advanced, data privacy and security concerns are emerging as a significant market challenge. These smart devices collect and transmit real-time location, health data, and behavioral insights through cloud-based platforms and mobile apps, raising concerns about unauthorized access, data breaches, and misuse of sensitive information. For instance, GPS-enabled pet trackers store location history, which, if compromised, could expose pet owners’ movements to cyber threats. In addition, biometric health data from AI-powered wearables could be vulnerable to hacking, potentially leading to identity theft or unauthorized profiling. A lack of strong cybersecurity regulations for pet tech devices makes these concerns even more pressing. If consumers lose trust in the security of smart pet wearables, it could slow market growth, forcing manufacturers to invest in robust encryption technologies and stricter data protection measures to maintain consumer confidence.

This market report provides details of new recent developments, trade regulations, import-export analysis, production analysis, value chain optimization, market share, impact of domestic and localized market players, analyses opportunities in terms of emerging revenue pockets, changes in market regulations, strategic market growth analysis, market size, category market growths, application niches and dominance, product approvals, product launches, geographic expansions, technological innovations in the market. To gain more info on the market contact Data Bridge Market Research for an Analyst Brief, our team will help you take an informed market decision to achieve market growth.

Pet Wearable Market Scope

The market is segmented on the basis of product, technology, animal type, application, and end-use. The growth amongst these segments will help you analyse meagre growth segments in the industries and provide the users with a valuable market overview and market insights to help them make strategic decisions for identifying core market applications.

Product

- Smart Collar

- Smart Camera

- Smart Harness & Vest

- Tags

- Monitors

- Trackers

- Translators

Technology

- RFID

- GPS

- Sensors

- Others

Animal Type

- Companion

- Livestock

Application

- Identification & Tracking

- Behaviour Monitoring & Control

- Facilitation, Safety & Security

- Medical Diagnosis & Treatment

End-Use

- Commercial

- Household

Pet Wearable Market Regional Analysis

The market is analysed and market size insights and trends are provided by country, product, technology, animal type, application, and end-use as referenced above.

The countries covered in the market report are U.S., Canada and Mexico in North America, Germany, France, U.K., Netherlands, Switzerland, Belgium, Russia, Italy, Spain, Turkey, Rest of Europe in Europe, China, Japan, India, South Korea, Singapore, Malaysia, Australia, Thailand, Indonesia, Philippines, Rest of Asia-Pacific (APAC) in the Asia-Pacific (APAC), Saudi Arabia, U.A.E., South Africa, Egypt, Israel, Rest of Middle East and Africa (MEA) as a part of Middle East and Africa (MEA), Brazil, Argentina and Rest of South America as part of South America.

North America dominates the pet wearable market, driven by the growing adoption of GPS-enabled tracking devices for pet safety and location monitoring. The region is witnessing a surge in demand for heat detection technologies, helping pet owners and livestock managers monitor temperature fluctuations for better health management. In addition, the increasing use of identification and tagging solutions is enhancing pet security and facilitating lost pet recovery. With rising pet ownership and advancements in smart pet technologies, North America continues to be a key market for innovative pet wearables.

Asia-Pacific is projected to witness fastest growth in the pet wearable market, driven by increasing awareness about pet fitness and overall health monitoring. Pet owners are increasingly adopting smart collars, trackers, and health monitoring devices to ensure the well-being of their companion animals. The region is also experiencing a rise in pet adoption rates, particularly in urban areas, leading to higher demand for wearable technologies that enhance pet safety and care. With advancements in smart pet technology and a growing focus on pet health, Asia-Pacific is emerging as a key market for pet wearables.

The country section of the report also provides individual market impacting factors and changes in regulation in the market domestically that impacts the current and future trends of the market. Data points such as down-stream and upstream value chain analysis, technical trends and porter's five forces analysis, case studies are some of the pointers used to forecast the market scenario for individual countries. Also, the presence and availability of global brands and their challenges faced due to large or scarce competition from local and domestic brands, impact of domestic tariffs and trade routes are considered while providing forecast analysis of the country data.

Pet Wearable Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

Pet Wearable Market Leaders Operating in the Market Are:

- Merck & Co., Inc. (U.S.)

- Avid Identification Systems, Inc. (U.S.)

- Datamars (Switzerland)

- FitBark Inc. (U.S.)

- MIT International Group FZE (U.A.E.)

- Radio Systems Corporation (U.S.)

- Whistle (U.S.)

- Link My Pet (U.S.)

- Loc8tor Ltd. (U.K.)

- Motorola Mobility LLC (U.S.)

- Tractive (Austria)

- Trovan Ltd. (U.K.)

- DooWa Technology (South Korea)

- Kickstarter, PBC (U.S.)

- Dogtra (U.S.)

- PetPace (U.S.)

- Wix.com, Inc. (Israel)

- DAIRYMASTER (Ireland)

- Gibi Technologies Inc. (U.S.)

- Peacock Technology Ltd. (India)

- inupathy (Japan)

Latest Developments in Pet Wearable Market

- In January 2024, Tractive introduced pet insurance policies, exclusively available to dog and cat owners in the U.K. following the establishment of Tractive Pet U.K. Ltd., a subsidiary of the Austrian company Tractive, which specializes in pet tracking and health solutions. The newly launched insurance offers comprehensive coverage for accidents, illness, and dental treatment

- In November 2023, PetPace partnered with Veterinary Health Research Centers (VHRC) to conduct research on Canine Alzheimer’s Disease through an initiative named Dogs Overcoming Geriatric Memory and Aging (DOGMA). To support this study, biometric collars from PetPace are being utilized to track and analyze the health and behavior of aging dogs, helping identify similarities between Alzheimer’s in humans and canines

- In October 2023, PetPace launched its next-generation Health 2.0 smart dog collar, which features early symptom detection, location tracking, disease management, and continuous health monitoring. The AI-powered technology provides vital medical insights for pet owners, particularly those with sick, elderly, or at-risk pets. The Health 2.0 collar measures heart rate variability (HRV), activity levels, posture, sleep quality, pulse, respiratory rate, and internal temperature, along with features such as a wellness index, health profile, pain indicator, and workout intensity assessment

- In May 2023, Datamars successfully acquired Kippy S.r.l., further strengthening its market-leading pet identification and tracking solutions. This collaboration enhances Datamars' ability to identify over 50 million pets and reunite lost animals with their owners. The Kippy collar, equipped with GPS tracking and activity monitoring, allows pet owners to track their pets in real time via a smartphone app and assess whether their pets are getting sufficient physical activity. In addition, Kippy offers engagement and communication features, including personal messaging and in-app social networking

- In January 2022, Invoxia, a U.S.-based tech company, introduced the Invoxia Smart Dog Collar, designed to monitor a dog’s vital signs, activity, and location 24/7. It became the first biometric health collar for dogs, offering real-time health tracking to ensure optimal pet well-being

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pet Wearable Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pet Wearable Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pet Wearable Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.