Global Pharmaceutical Continuous Manufacturing Market

Market Size in USD Billion

CAGR :

%

USD

5.19 Billion

USD

614.33 Billion

2024

2032

USD

5.19 Billion

USD

614.33 Billion

2024

2032

| 2025 –2032 | |

| USD 5.19 Billion | |

| USD 614.33 Billion | |

|

|

|

|

Pharmaceutical Continuous Manufacturing Market Size

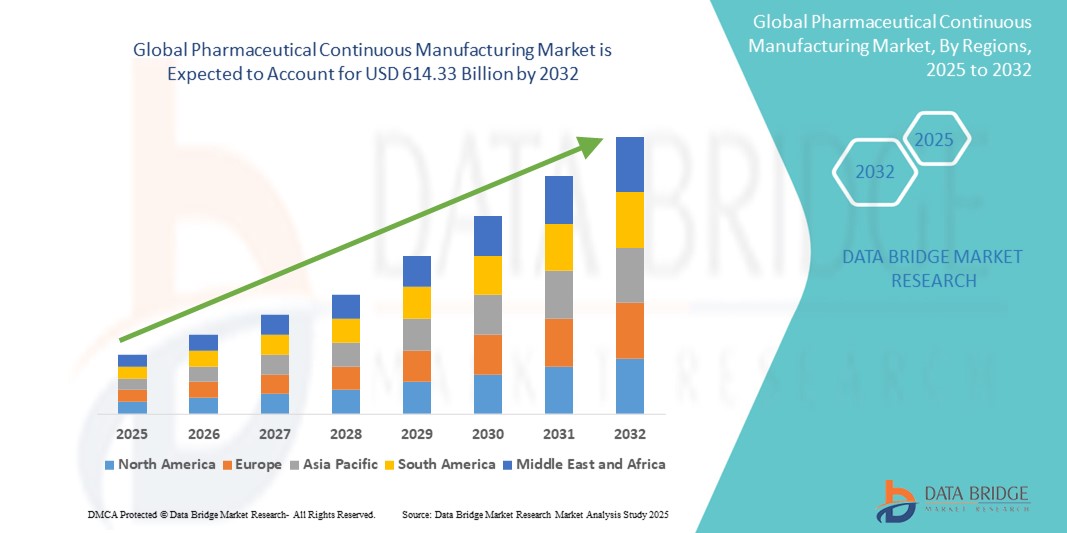

- The global pharmaceutical continuous manufacturing market size was valued at USD 5.19 billion in 2024 and is expected to reach USD 614.33 billion by 2032, at a CAGR of 81.60% during the forecast period

- The market growth is largely fueled by the growing adoption and technological progress within advanced manufacturing technologies and Industry 4.0 practices, leading to increased digitalization and process automation across pharmaceutical production environments. Continuous manufacturing allows for uninterrupted drug production processes, offering real-time quality control and higher efficiency compared to traditional batch production systems

- Furthermore, rising demand for cost-effective, high-quality, and scalable drug manufacturing solutions is positioning continuous manufacturing as a preferred choice among pharmaceutical companies. These converging factors are accelerating the uptake of Pharmaceutical Continuous Manufacturing solutions, thereby significantly boosting the industry's growth. Key benefits such as reduced production times, lower operational costs, and improved product consistency are encouraging both large pharmaceutical firms and CDMOs (Contract Development and Manufacturing Organizations) to invest in this transformative approach

Pharmaceutical Continuous Manufacturing Market Analysis

- Pharmaceutical continuous manufacturing offers a streamlined, end-to-end production process where raw materials are continuously fed into the system, and finished products are consistently produced, significantly reducing production time, costs, and human errors. This method is increasingly becoming vital in the pharmaceutical industry due to its ability to enhance efficiency, scalability, and regulatory compliance

- The growing demand for faster drug production cycles, improved product quality, and real-time process monitoring is fueling the adoption of continuous manufacturing technologies across the pharmaceutical sector. Regulatory support from agencies such as the FDA and EMA has further accelerated this shift, encouraging drug manufacturers to adopt innovative, data-driven production approaches

- North America dominated the pharmaceutical continuous manufacturing market with the largest revenue share of 44.7% in 2024, driven by the strong presence of major pharmaceutical companies, high R&D investments, and favorable regulatory support. The U.S., in particular, has witnessed widespread implementation of continuous manufacturing systems, supported by FDA initiatives promoting modernization in pharmaceutical production

- Asia-Pacific is expected to be the fastest-growing region in the pharmaceutical continuous manufacturing market during the forecast period with a projected CAGR of 12.6%. This growth is attributed to increasing government investments in pharmaceutical infrastructure, rising generic drug production, and the expanding pharmaceutical industries in countries such as India, China, and South Korea

- The integrated systems segment dominated the market with the largest revenue share of 36.4% in 2024, due to the rising preference for automation, reduced processing time, and fewer manual interventions.

Report Scope and Pharmaceutical Continuous Manufacturing Market Segmentation

|

Attributes |

Pharmaceutical Continuous Manufacturing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmaceutical Continuous Manufacturing Market Trends

“Growing Shift Toward Integrated and Efficient Production Models”

- A significant and accelerating trend in the global pharmaceutical continuous manufacturing market is the growing shift from traditional batch processing to continuous production technologies. This transition is driven by the need for improved efficiency, consistent product quality, and real-time process monitoring. Continuous manufacturing allows for uninterrupted production, which reduces downtime, enhances scalability, and minimizes waste

- For instance, in 2024, Thermo Fisher Scientific expanded its continuous manufacturing capabilities in North America through a multimillion-dollar investment in its API development and production plant. This expansion is aimed at meeting rising demand for high-quality drug substances and faster turnaround times, reinforcing the industry’s pivot toward efficient and integrated production models.

- The application of continuous manufacturing in producing active pharmaceutical ingredients (APIs) and solid dosage forms is witnessing strong growth, especially as regulatory bodies such as the FDA and EMA increasingly support the adoption of continuous processes. These regulatory endorsements reduce compliance uncertainty, encouraging pharmaceutical companies to modernize their production systems

- Moreover, the COVID-19 pandemic further accelerated the adoption of Pharmaceutical Continuous Manufacturing technologies, highlighting the importance of flexible, scalable, and rapid production capabilities to ensure uninterrupted drug supply chains during health emergencies

- Leading players are focusing on integrating advanced analytics and process control systems into continuous manufacturing lines, ensuring high precision, minimal deviations, and rapid detection of defects. These innovations are crucial for maintaining consistent product quality across large volumes

- The market is also witnessing a rise in partnerships between pharmaceutical companies and contract manufacturing organizations (CMOs) and contract research organizations (CROs) to deploy modular continuous manufacturing systems for both clinical and commercial-scale production. This is particularly prevalent in biologics and complex small molecules, where speed and precision are critical

Pharmaceutical Continuous Manufacturing Market Dynamics

Driver

“Growing Need Due to Rising Demand for Process Efficiency and Drug Quality”

- The increasing demand for efficient, scalable, and cost-effective drug production, especially for high-demand medications, is a significant driver fueling the growth of the Pharmaceutical Continuous Manufacturing market

- For instance, in April 2024, Thermo Fisher Scientific Inc. announced a strategic expansion of its continuous manufacturing capabilities to meet rising pharmaceutical production needs. The company invested in integrating advanced sensors and automated control systems to streamline real-time quality assurance, boosting operational efficiency and reducing production cycle times. Such strategies by key players are expected to drive the market's growth during the forecast period

- As pharmaceutical companies aim to reduce production bottlenecks, minimize human error, and ensure batch consistency, continuous manufacturing offers a compelling upgrade over traditional batch processes. It provides uninterrupted production, greater flexibility, and immediate process monitoring, which significantly reduces waste and enhances product quality

- Furthermore, regulatory support from agencies such as the U.S. FDA and European Medicines Agency (EMA) for continuous manufacturing is encouraging adoption, particularly in small-molecule drug manufacturing and active pharmaceutical ingredient (API) production

- The adoption of continuous systems also allows pharmaceutical manufacturers to quickly scale up production during public health emergencies or global supply disruptions, making the model especially attractive for both commercial-scale production and R&D-scale deployments

Restraint/Challenge

“High Capital Costs and Complex Implementation Barriers”

- Despite its numerous benefits, the high capital investment required for setting up continuous manufacturing infrastructure poses a major challenge to market expansion. This includes the cost of integrating automation systems, real-time analytics, and high-precision control equipment

- Moreover, the complex transition from batch to continuous processing demands extensive revalidation, training, and regulatory approval, which can slow adoption among mid-sized or generic pharmaceutical companie

- For instance, companies often face hurdles in integrating legacy systems with modern continuous platforms, leading to delays and increased operational costs during transition phases

- In addition, regulatory uncertainty in some emerging markets regarding continuous production standards and validation procedures creates hesitancy among pharmaceutical manufacturers

- To overcome these restraints, companies must invest in modular and scalable continuous manufacturing solutions, provide workforce training programs, and collaborate with regulatory bodies to streamline compliance processes. Supportive government policies and industry-academic partnerships can also help accelerate the market's evolution toward continuous models

Pharmaceutical Continuous Manufacturing Market Scope

The market is segmented on the basis of product type, application type, distribution channel, and end user.

• By Product Type

On the basis of product type, the pharmaceutical continuous manufacturing market is segmented into integrated systems, semi-continuous systems and controls, continuous granulators, continuous coaters, continuous blenders, continuous dryers, and other semi-continuous systems. The integrated systems segment dominated the market with the largest revenue share of 36.4% in 2024, due to the rising preference for automation, reduced processing time, and fewer manual interventions.

The continuous granulators segment is expected to register the fastest CAGR of 13.9% from 2025 to 2032, owing to growing demand in solid dosage production and enhanced process stability.

• By Application Type

On the basis of application type, the pharmaceutical continuous manufacturing market is segmented into active pharmaceutical ingredient (API), dry powders, biologics, end product manufacturing, and solid dosage. The solid dosage segment accounted for the largest market share of 41.1% in 2024, attributed to the high global consumption of tablets and capsules.

The biologics segment is projected to witness the fastest CAGR of 14.6% during 2025–2032, driven by rising investments in biologic drug development and bioprocessing technologies.

• By Distribution Channel

On the basis of distribution channel, the pharmaceutical continuous manufacturing market is segmented into hospital pharmacy, retail pharmacy, and online pharmacy. The hospital pharmacy segment led the market with a share of 47.3% in 2024, supported by consistent pharmaceutical demand across in-patient and out-patient services.

The online pharmacy segment is expected to grow at the fastest CAGR of 12.4% from 2025 to 2032, due to the increasing shift toward digital platforms and convenience of remote ordering.

• By End User

On the basis of end user, the pharmaceutical continuous manufacturing market is segmented into research and development departments and full-scale manufacturing companies, contract manufacturing organizations (CMOs), pharmaceutical companies, research institutes, and contract research organizations (CROs). The pharmaceutical companies segment held the largest revenue share of 39.8% in 2024, driven by the widespread adoption of continuous manufacturing for commercial production.

The contract manufacturing organizations (CMOs) segment is projected to record the fastest CAGR of 13.1% from 2025 to 2032, due to growing outsourcing trends and cost efficiency.

Pharmaceutical Continuous Manufacturing Market Regional Analysis

- North America dominated the pharmaceutical continuous manufacturing market with the largest revenue share of 44.7% in 2024, driven by the rapid adoption of advanced manufacturing technologies

- Favorable regulatory support from the U.S. FDA, and the presence of major pharmaceutical manufacturers and contract manufacturing organizations (CMOs)

- The shift from batch to continuous processes is being actively supported by government initiatives to streamline drug production, improve quality, and reduce supply chain disruptions

U.S. Pharmaceutical Continuous Manufacturing Market Insight

The U.S. pharmaceutical continuous manufacturing market accounted for the largest revenue share of 81.05% in 2024 within North America, propelled by early adoption of continuous technologies and active collaboration between pharmaceutical companies, academia, and regulatory agencies. The FDA’s support through initiatives such as Emerging Technology Programs has encouraged manufacturers to adopt continuous production platforms for solid dosage forms and APIs.

Europe Pharmaceutical Continuous Manufacturing Market Insight

The Europe pharmaceutical continuous manufacturing market is projected to expand at a robust CAGR during the forecast period, driven by increasing investments in pharmaceutical R&D and growing demand for flexible, cost-efficient production systems. The European Medicines Agency (EMA) has issued favorable guidance for continuous manufacturing, leading to broader regional adoption.

U.K. Pharmaceutical Continuous Manufacturing Market Insight

The U.K. pharmaceutical continuous manufacturing market is expected to grow significantly during the forecast period, due to increasing government funding for life sciences innovation, such as the UK Life Sciences Vision program. This initiative aims to position the country as a global leader in life sciences by fostering partnerships between government, academia, and industry. Additionally, the rising need to reduce production timelines and increase flexibility in drug manufacturing is driving the shift from traditional batch processes to continuous manufacturing. Supportive regulatory frameworks and increased investments in pharmaceutical R&D further contribute to market expansion in the U.K.

Germany Pharmaceutical Continuous Manufacturing Market Insight

The Germany pharmaceutical continuous manufacturing market is poised for steady growth during the forecast period, driven by a strong industrial base, a skilled workforce, and high R&D expenditure. Germany’s pharmaceutical sector emphasizes advanced manufacturing solutions to enhance operational efficiency, product consistency, and scalability. With the presence of leading pharmaceutical companies and contract manufacturing organizations (CMOs), the country is increasingly investing in automation, digital twins, and process analytical technologies (PAT) to optimize production. Regulatory harmonization across the EU and sustainable production goals are also contributing to the adoption of continuous manufacturing in the German market.

Asia-Pacific Pharmaceutical Continuous Manufacturing Market Insight

The Asia-Pacific pharmaceutical continuous manufacturing market is anticipated to grow at the fastest CAGR of 12.6% from 2025 to 2032, fueled by expanding pharmaceutical production in countries such as China, India, and Japan. The region is witnessing rising demand for cost-efficient, high-throughput manufacturing technologies amid the growth of generic drug manufacturing and biosimilars. Government initiatives supporting pharmaceutical innovation, improved regulatory infrastructure, and increasing foreign direct investments are accelerating the adoption of continuous manufacturing across the region. Additionally, local manufacturers are increasingly collaborating with global technology providers to implement modular and scalable production platforms.

Japan Pharmaceutical Continuous Manufacturing Market Insight

The Japan pharmaceutical continuous manufacturing market contributed 27.1% to the Asia-Pacific regional revenue in 2024, gaining momentum due to the country’s high focus on automation, digitalization, and pharmaceutical innovation. Japan is actively promoting the adoption of advanced manufacturing technologies to enhance drug quality, reduce waste, and ensure a stable supply of essential medicines. Regulatory agencies such as the PMDA are supporting continuous manufacturing through streamlined approval processes and guidance frameworks. The market is further supported by an aging population, rising healthcare demands, and strong collaborations between academic institutions and pharmaceutical manufacturers to accelerate innovation.

China Pharmaceutical Continuous Manufacturing Market Insight

The China pharmaceutical continuous manufacturing market held the largest share in Asia-Pacific with 45.6% of the regional revenue in 2024, driven by massive investments in pharmaceutical manufacturing capabilities, an expanding middle class, and supportive policies for advanced manufacturing. The Chinese government has prioritized pharmaceutical innovation and industrial modernization under initiatives such as “Made in China 2025,” which encourages the adoption of smart and continuous manufacturing technologies across the life sciences sector. Additionally, the rapid expansion of the country’s generic and branded drug production—along with rising demand for high-quality medicines—has prompted both domestic and international players to invest heavily in continuous processing facilities.

Pharmaceutical Continuous Manufacturing Market Share

The pharmaceutical continuous manufacturing industry is primarily led by well-established companies, including:

- GEA Group Aktiengesellschaft (Germany)

- Thermo Fisher Scientific Inc. (U.S.)

- Hosokawa Micron Group (Japan)

- Robert Bosch GmbH (Germany)

- Glatt GmbH (Germany)

- Siemens (Germany)

- Coperion GmbH (Germany)

- Aurobindo Pharma (India)

- L.B. Bohle Maschinen und Verfahren GmbH (Germany)

- Dr. Reddy’s Laboratories Ltd. (India)

- Novartis AG (Switzerland)

- Sanofi (France)

Latest Developments in Global Pharmaceutical Continuous Manufacturing Market

- In March 2025, during DCAT Week, leading pharmaceutical manufacturers highlighted a major transition towards continuous biologics manufacturing. Companies such as Enzene Biosciences unveiled fully connected continuous bioprocessing platforms, which integrate upstream and downstream operations, enabling up to 10-fold increases in productivity and cost reductions—marking a transformative step for biopharmaceutical production

- In March 2022, USP India extended its presence in Hyderabad, announcing plans for a new continuous manufacturing facility with an added capital injection of USD 20 million. This expansion underscores USP's commitment to enhancing its operations and services in India's pharmaceutical sector

- In March 2022, Phlow Corp, a U.S. based public benefit company specializing in essential medicines, partnered with Virginia Commonwealth University (VCU) Medicines for All Institute and AMPAC Fine Chemicals. The collaboration aims to offer contract research and development services for small molecule pharmaceutical products, focusing on continuous manufacturing, thereby bolstering the pharmaceutical industry's capabilities and innovation

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.