Global Pharmaceutical Contract Packaging Market

Market Size in USD Billion

CAGR :

%

USD

18.48 Billion

USD

50.62 Billion

2024

2032

USD

18.48 Billion

USD

50.62 Billion

2024

2032

| 2025 –2032 | |

| USD 18.48 Billion | |

| USD 50.62 Billion | |

|

|

|

|

What is the Global Pharmaceutical Contract Packaging Market Size and Growth Rate?

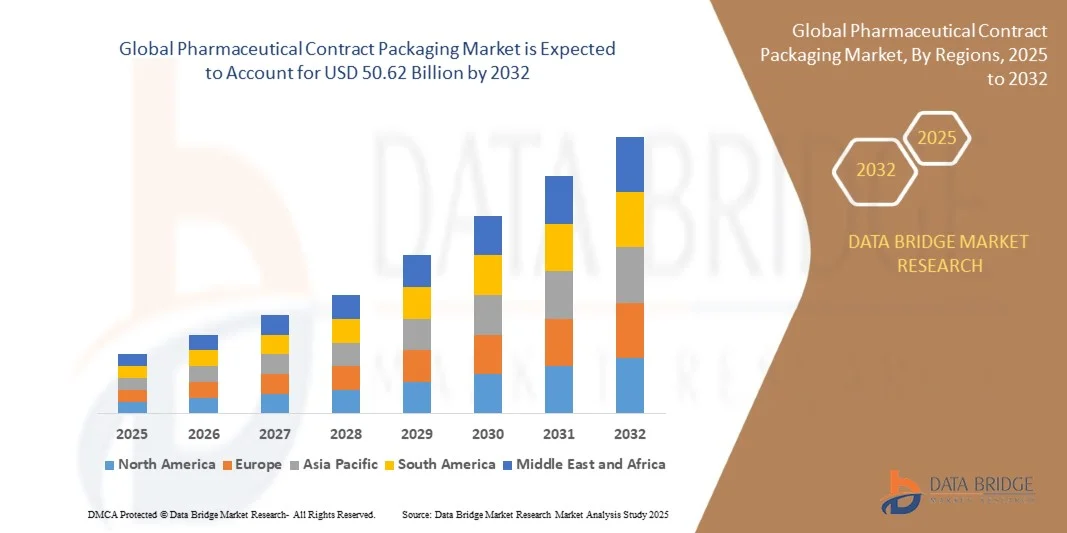

- The global pharmaceutical contract packaging market size was valued at USD 18.48 billion in 2024 and is expected to reach USD 50.62 billion by 2032, at a CAGR of 13.42% during the forecast period

- Rise in the number of new medicines in the market is the major factor escalating the market growth, also rise in the geriatric population, increase in the strict protocols associated with the packaging, increase in the demand for biological therapies, rise in the growth in the nuclear medicine sector and rise in the demand for cell and gene therapies are the major factors among others propelling the growth of pharmaceutical contract packaging market

What are the Major Takeaways of Pharmaceutical Contract Packaging Market?

- Rise in the research and development activities to develop advanced plastics and increase in the development of patient-specific implants and 3D printed devices will further create new opportunities for the pharmaceutical contract packaging market

- However, rise in the risk associated with the poor quality of the product and restricted information sharing with contract packagers are the major factors among others restraining the market growth, and will further challenge the growth of pharmaceutical contract packaging market

- North America dominated the pharmaceutical contract packaging Market with the largest revenue share of 41.2% in 2024, driven by the strong presence of leading pharmaceutical manufacturers, high R&D expenditure, and increasing outsourcing of packaging operations to specialized service providers

- The Asia-Pacific (APAC) pharmaceutical contract packaging market is expected to grow at the fastest CAGR of 9.8% from 2025 to 2032, driven by expanding pharmaceutical manufacturing, cost-effective labor, and growing adoption of outsourcing by Western drug makers

- The Flexible Packaging segment dominated the market with the largest revenue share of 42.6% in 2024, driven by its lightweight nature, cost efficiency, and ability to protect drugs from moisture, contamination, and oxygen exposure

Report Scope and Pharmaceutical Contract Packaging Market Segmentation

|

Attributes |

Pharmaceutical Contract Packaging Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

What is the Key Trend in the Pharmaceutical Contract Packaging Market?

“Integration of Automation and Sustainable Packaging Solutions”

- A major emerging trend in the global Pharmaceutical Contract Packaging market is the growing integration of automation technologies and eco-friendly materials to enhance efficiency, accuracy, and sustainability in packaging processes. Automation is helping companies streamline operations, minimize human error, and ensure compliance with stringent pharmaceutical standards

- For instance, in May 2024, Catalent, Inc. introduced new automated packaging lines equipped with vision inspection and robotic handling systems to improve quality assurance and speed up production timelines. Similarly, Gerresheimer AG expanded its sustainable packaging portfolio by incorporating recyclable and bio-based materials into its pharmaceutical packaging range

- The adoption of artificial intelligence (AI) and machine learning (ML) in packaging lines allows real-time monitoring, predictive maintenance, and data-driven decision-making. This helps optimize production efficiency and ensures product safety throughout the supply chain

- Furthermore, sustainability has become a key competitive advantage, with leading companies emphasizing recyclable materials, reduced plastic content, and carbon-neutral operations. For instance, Berlin Packaging has launched multiple initiatives under its “Sustainability for the Future” program, offering eco-conscious solutions for pharma clients

- This trend of combining automation with sustainable packaging practices is transforming the industry landscape by enabling faster turnaround, greater compliance, and lower environmental impact. As a result, pharmaceutical companies are increasingly choosing contract packagers that can deliver both innovation and eco-responsibility

What are the Key Drivers of Pharmaceutical Contract Packaging Market?

- The global pharmaceutical contract packaging market is primarily driven by the growing trend of outsourcing packaging services by pharmaceutical companies to focus on core competencies such as drug development and manufacturing. This allows them to leverage the technical expertise, flexibility, and regulatory compliance capabilities of specialized contract packagers

- For instance, in February 2024, Catalent, Inc. expanded its packaging capacity in the U.S. to meet rising demand for biologics and sterile injectables. Such expansions by major players underscore the growing reliance on external partners for scalable and compliant packaging solutions

- In addition, the surge in biopharmaceutical production, personalized medicines, and injectable therapies is driving demand for specialized and small-batch packaging formats that require high precision and traceability

- The introduction of smart packaging technologies—including RFID tagging, serialization, and tamper-evident features—is further accelerating market growth by improving patient safety and supply chain transparency

- Furthermore, the rising regulatory pressures from authorities such as the FDA and EMA, along with the need for sustainable and cost-effective packaging, are compelling companies to partner with contract packagers who can ensure compliance and innovation simultaneously

- The combination of cost efficiency, technological advancement, and flexibility in production scaling continues to make contract packaging a strategic priority for pharmaceutical manufacturers worldwide

Which Factor is Challenging the Growth of the Pharmaceutical Contract Packaging Market?

- Despite strong growth, the Pharmaceutical Contract Packaging market faces challenges related to stringent regulatory compliance, data security, and high operational costs. Meeting evolving packaging and labeling regulations across different countries increases complexity for global contract packagers

- For instance, compliance with the U.S. Drug Supply Chain Security Act (DSCSA) and EU Falsified Medicines Directive (FMD) requires extensive serialization and traceability, leading to significant investment in digital infrastructure and tracking systems

- Maintaining cold chain integrity and preventing contamination during packaging of biologics and vaccines also present operational challenges. Even minor errors can result in product recalls or compliance violations, affecting brand reputation and financial stability

- In addition, rising raw material costs, especially for medical-grade plastics and aluminum foils, pose pricing pressures. Many mid-tier contract packaging firms struggle to absorb these costs while remaining competitive against large players such as Pfizer or AbbVie that have in-house capabilities

- Cybersecurity is another growing concern as digital technologies, including serialization databases and cloud-based logistics, become integral to pharmaceutical packaging operations. Ensuring the protection of sensitive data and patient information remains a top priority

- To overcome these challenges, companies are investing in regulatory technology (RegTech), advanced analytics, and workforce training to maintain compliance and enhance efficiency. Continuous innovation and sustainable practices will be critical for long-term competitiveness in this sector

How is the Pharmaceutical Contract Packaging Market Segmented?

The market is segmented on the basis of type, communication protocol, unlocking mechanism, and application.

• By Products

On the basis of products, the Pharmaceutical Contract Packaging market is segmented into Flexible Packaging, Plastic Containers, Glass Containers, and Caps/Closures. The Flexible Packaging segment dominated the market with the largest revenue share of 42.6% in 2024, driven by its lightweight nature, cost efficiency, and ability to protect drugs from moisture, contamination, and oxygen exposure. Its adaptability to various drug forms and the trend toward sustainable packaging further bolster its demand.

The Plastic Containers segment is projected to witness the fastest CAGR from 2025 to 2032, owing to advancements in polymer technologies and increased use in liquid and solid dosage packaging. Their durability, reusability, and compatibility with tamper-evident designs make them increasingly preferred in both prescription and OTC drugs. Overall, rising demand for convenience, safety, and sustainability is reshaping product preferences within contract pharmaceutical packaging.

• By Drug Type

On the basis of drug type, the market is categorized into Autacoids and Related Drugs, Contraceptives, Hormone Replacement, Cardiovascular Medicines, and Cancer Therapies. The Cancer Therapies segment held the largest market share of 37.4% in 2024, attributed to the growing demand for personalized and targeted oncology treatments that require specialized, sterile packaging. Pharmaceutical firms increasingly rely on contract packaging providers to maintain stringent quality and safety standards.

Meanwhile, the Hormone Replacement segment is anticipated to witness the fastest CAGR from 2025 to 2032, fueled by rising awareness of hormonal disorders and the growing elderly population. Packaging innovations supporting dose precision and controlled release enhance segment growth. Overall, the diversification of pharmaceutical pipelines, coupled with a rise in chronic diseases, is intensifying the demand for advanced, compliant packaging solutions across drug categories.

• By Drug Form

Based on drug form, the market is segmented into Injectable and Oral formulations. The Injectable segment dominated the market with the largest revenue share of 55.3% in 2024, driven by the increasing use of biologics and parenteral drugs that require sterile, high-integrity packaging. Contract packagers provide expertise in aseptic filling, cold-chain management, and tamper-proof sealing to meet global regulatory standards.

The Oral segment is expected to record the fastest CAGR from 2025 to 2032, owing to the steady demand for tablets, capsules, and liquid orals across chronic and lifestyle-related therapies. Technological improvements in blister and strip packaging for oral dosage forms further enhance this segment’s growth. In summary, while injectables dominate in value due to complexity, oral dosage forms continue to expand rapidly due to convenience and patient adherence advantages.

• By Industry

On the basis of industry, the market is segmented into Small Molecule, Biopharmaceutical, and Vaccine sectors. The Small Molecule segment accounted for the largest revenue share of 47.8% in 2024, supported by its widespread use in generic and over-the-counter (OTC) drugs, where contract packaging ensures efficiency and scalability. These products benefit from mature production techniques and strong regulatory alignment.

The Biopharmaceutical segment is expected to witness the fastest CAGR from 2025 to 2032, driven by the rising demand for biologics and biosimilars that require specialized, sterile, and temperature-controlled packaging solutions. The pandemic further accelerated the adoption of contract services for biologics and vaccines. Overall, as the pharmaceutical industry transitions toward advanced therapies, contract packaging partners are playing a critical role in ensuring compliance, efficiency, and quality assurance across diverse drug classes.

• By Type

On the basis of type, the Pharmaceutical Contract Packaging market is segmented into Sterile and Non-Sterile packaging. The Sterile segment dominated the market with the largest revenue share of 60.2% in 2024, primarily due to the growing prevalence of injectable formulations, biologics, and vaccines that require aseptic processing and contamination-free environments. Regulatory emphasis on patient safety and integrity of sterile drugs drives consistent outsourcing of sterile packaging operations.

The Non-Sterile segment is projected to register the fastest CAGR from 2025 to 2032, led by the increasing production of oral solids, ointments, and liquids, particularly in generic and OTC formulations. Contract packagers are expanding capabilities in automated labeling and serialization for non-sterile drugs.

Which Region Holds the Largest Share of the Pharmaceutical Contract Packaging Market?

- North America dominated the pharmaceutical contract packaging Market with the largest revenue share of 41.2% in 2024, driven by the strong presence of leading pharmaceutical manufacturers, high R&D expenditure, and increasing outsourcing of packaging operations to specialized service providers

- The region’s robust regulatory framework, coupled with advanced technological capabilities in serialization, labeling, and tamper-evident packaging, enhances market reliability and compliance

- Furthermore, the growing demand for biologics, personalized medicines, and sustainable packaging solutions supports continuous innovation and expansion of contract packaging services across the region, solidifying North America’s leadership position

U.S. Pharmaceutical Contract Packaging Market Insight

The U.S. pharmaceutical contract packaging market captured the largest share of 62% within North America in 2024, fueled by the strong demand for high-quality, regulatory-compliant packaging for biologics and specialty drugs. The country’s well-established pharmaceutical manufacturing base and increased FDA emphasis on supply chain traceability are driving investments in contract packaging. In addition, rising demand for prefilled syringes, sterile vials, and unit-dose packaging is spurring innovation. The growing preference for outsourcing to reduce operational costs and focus on core R&D activities is further strengthening the U.S. market. The nation’s leadership in technological advancements ensures continued dominance in global contract packaging services.

Europe Pharmaceutical Contract Packaging Market Insight

The Europe pharmaceutical contract packaging market is projected to expand steadily throughout the forecast period, supported by stringent regulatory standards, increased demand for eco-friendly packaging, and the growth of biologics production. The region’s emphasis on GMP-compliant and serializable packaging processes enhances traceability and safety in drug distribution. Moreover, the presence of established pharmaceutical hubs such as Germany, Switzerland, and the U.K. contributes to the market’s maturity. Contract packaging firms in Europe are also investing heavily in automation, labeling technologies, and recyclable materials, making the region a leader in sustainable pharmaceutical packaging solutions.

U.K. Pharmaceutical Contract Packaging Market Insight

The U.K. pharmaceutical contract packaging market is anticipated to grow at a notable CAGR during 2025–2032, driven by the strong pharmaceutical manufacturing base and increasing regulatory compliance requirements post-Brexit. The country’s focus on innovation, combined with rising investments in biologics and clinical trials, has intensified the need for flexible, small-batch packaging solutions. Moreover, the growing adoption of serialized and tamper-evident systems ensures drug safety and authenticity. The U.K.’s strategic position as a European logistics hub, alongside increasing demand from contract research organizations (CROs), is expected to further boost the market’s expansion in the coming years.

Germany Pharmaceutical Contract Packaging Market Insight

The Germany pharmaceutical contract packaging market is expected to expand at a considerable CAGR during the forecast period, fueled by its strong pharmaceutical and chemical manufacturing sector. Germany’s high emphasis on automation, precision, and sustainability drives innovation in secondary and tertiary packaging. The growing production of generics and biosimilars, coupled with the adoption of smart labeling technologies, enhances the market’s competitiveness. Moreover, the country’s strict adherence to EU packaging regulations and increased demand for serialization-ready solutions ensure quality and compliance. Germany remains a key hub for advanced packaging technologies catering to global pharmaceutical exports.

Which Region is the Fastest Growing in the Pharmaceutical Contract Packaging Market?

The Asia-Pacific (APAC) pharmaceutical contract packaging market is expected to grow at the fastest CAGR of 9.8% from 2025 to 2032, driven by expanding pharmaceutical manufacturing, cost-effective labor, and growing adoption of outsourcing by Western drug makers. Countries such as China, India, and Japan are leading this growth due to their rapidly expanding production capacities and rising healthcare expenditure. Government initiatives supporting domestic drug manufacturing and quality compliance are further strengthening APAC’s position as a global packaging hub. Increasing demand for biologics, vaccines, and generic drugs is expected to accelerate market penetration across the region.

Japan Pharmaceutical Contract Packaging Market Insight

The Japan pharmaceutical contract packaging market is gaining significant traction, supported by advanced manufacturing technologies, high regulatory standards, and increasing pharmaceutical exports. The country’s aging population is driving demand for user-friendly, prefilled, and unit-dose packaging solutions that ensure patient safety and convenience. In addition, the integration of automation and robotics in packaging lines is enhancing productivity and precision. Japan’s focus on innovation and quality compliance positions it as a major player in the Asia-Pacific pharmaceutical packaging landscape, with contract packagers increasingly catering to both domestic and global pharmaceutical companies.

China Pharmaceutical Contract Packaging Market Insight

The China pharmaceutical contract packaging market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to its massive pharmaceutical production base and growing domestic consumption. The country’s shift toward high-value biologics, coupled with increasing regulatory alignment with international GMP standards, is driving the adoption of professional contract packaging services. Local companies are rapidly modernizing packaging infrastructure, investing in serialization, and expanding export capabilities. Furthermore, rising healthcare investments and government-led initiatives promoting drug quality and safety are fueling market growth, making China a central hub for affordable and scalable contract packaging services.

Which are the Top Companies in Pharmaceutical Contract Packaging Market?

The pharmaceutical contract packaging industry is primarily led by well-established companies, including:

- BALL CORPORATION (U.S.)

- Berlin Packaging (U.S.)

- CCL Industries (Canada)

- Co-Pak (Canada)

- Signode India (India)

- ROPACK INC (Canada)

- Reelvision (U.K.)

- PCI Pharma Services (U.S.)

- Multi-Pack Solutions LLC (U.S.)

- Unicep (U.S.)

- Sharp (U.S.)

- Reed-Lane (U.S.)

- Aphena Pharma Solutions (U.S.)

- Southwest Packaging (U.S.)

- Catalent, Inc. (U.S.)

- AbbVie Inc. (U.S.)

- Pfizer Inc. (U.S.)

- Daito Pharmaceutical Co., Ltd. (Japan)

- NIPRO (Japan)

- Cradel Pharmaceuticals Pvt. Ltd. (India)

- Gerresheimer AG (Germany)

What are the Recent Developments in Global Pharmaceutical Contract Packaging Market?

- In December 2024, Novo Holdings completed a USD 16.5 billion acquisition of Catalent, while Novo Nordisk acquired three of Catalent’s fill-finish sites for USD 11 billion. This strategic move strengthens Novo Holdings’ and Novo Nordisk’s global manufacturing and packaging capabilities, enhancing their control over critical supply chain processes. The acquisition is expected to boost operational efficiency and accelerate the delivery of innovative biologic therapies worldwide

- In October 2024, Syntegon successfully finalized its merger with Telstar, combining their aseptic processing and packaging equipment portfolios under one integrated platform. This merger enables the companies to deliver more comprehensive solutions for pharmaceutical packaging and sterile manufacturing. The collaboration is set to enhance global competitiveness and expand both firms’ technological footprints in the life sciences sector

- In October 2024, Nipro Corporation launched its innovative D2F (Direct-to-Fill) glass vials, designed to improve the efficiency and safety of pharmaceutical packaging operations. These vials minimize handling, reduce contamination risks, and support sustainable manufacturing through a streamlined filling process. The launch reinforces Nipro’s commitment to innovation and sustainability in high-quality pharmaceutical packaging solutions

- In September 2024, PCI Pharma Services announced a USD 365 million expansion across the U.S. and EU, focusing on advanced injectables and drug-device combination systems. This investment aims to meet the growing global demand for complex parenteral delivery formats. The expansion strengthens PCI’s position as a leading end-to-end solutions provider in pharmaceutical packaging and supply chain management

- In April 2024, Amcor introduced a new line of sustainable packaging solutions tailored for the pharmaceutical industry. The range emphasizes recyclable materials and reduced plastic use while maintaining product safety and efficacy. This initiative aligns with global sustainability goals and demonstrates Amcor’s leadership in advancing eco-friendly pharmaceutical packaging technologies

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Pharmaceutical Contract Packaging Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Pharmaceutical Contract Packaging Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Pharmaceutical Contract Packaging Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.