Global Pharmaceutical Equipment Testing Market

Market Size in USD Billion

CAGR :

%

USD

11.02 Billion

USD

16.28 Billion

2024

2032

USD

11.02 Billion

USD

16.28 Billion

2024

2032

| 2025 –2032 | |

| USD 11.02 Billion | |

| USD 16.28 Billion | |

|

|

|

|

Pharmaceutical Equipment Testing Market Size

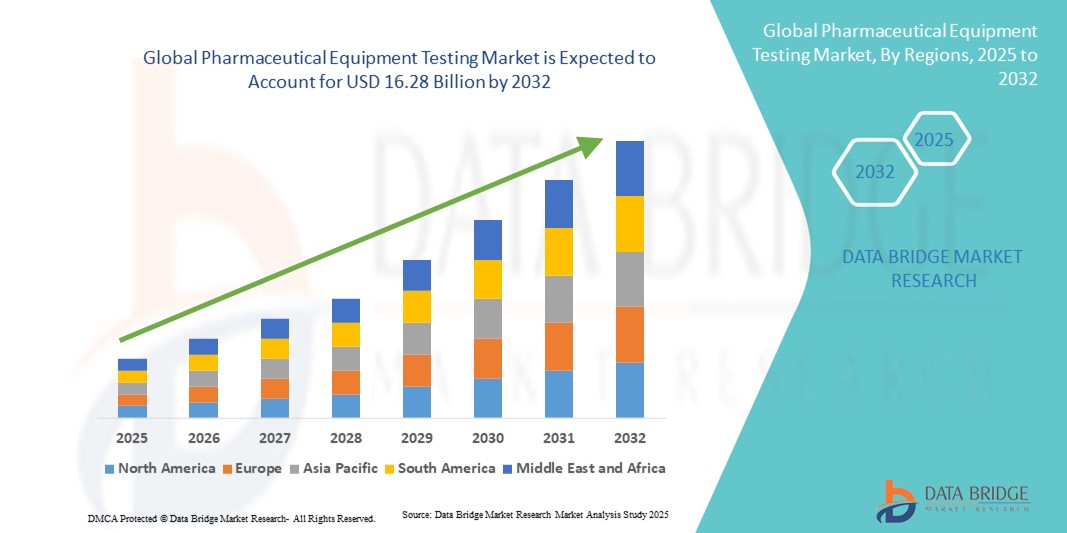

- The global pharmaceutical equipment testing market size was valued at USD 11.02 billion in 2024 and is expected to reach USD 16.28 billion by 2032, at a CAGR of 5.00% during the forecast period

- The market growth is largely fueled by increasing demand for high-quality, safe, and efficient pharmaceutical manufacturing processes, coupled with rising regulatory standards for drug safety and efficacy

- Furthermore, advancements in analytical technologies, automation, and validation protocols are driving the adoption of pharmaceutical equipment testing solutions. These factors are enabling manufacturers to ensure compliance, maintain product quality, and reduce production risks, thereby significantly boosting the industry's growth

Pharmaceutical Equipment Testing Market Analysis

- Pharmaceutical equipment testing solutions, including analytical and validation instruments, are increasingly vital components of modern pharmaceutical manufacturing and quality control processes in both commercial and research settings due to their enhanced accuracy, compliance assurance, and seamless integration with automated production and laboratory systems

- The escalating demand for pharmaceutical equipment testing is primarily driven by stringent regulatory standards, increasing pharmaceutical production, and the critical need for ensuring product quality and safety throughout the drug manufacturing process. Advanced testing solutions are increasingly essential for pharmaceutical companies, contract manufacturing organizations (CMOs), and quality control laboratories to maintain compliance, ensure accurate results, and uphold product reliability

- North America dominated the pharmaceutical equipment testing market with the largest revenue share of 22.7% in 2024, supported by advanced healthcare infrastructure, strong R&D activities, early adoption of innovative testing technologies, and strict regulatory oversight. The U.S. remains the largest contributor within the region, experiencing substantial growth due to widespread deployment of automated analytical instruments, high-throughput testing platforms, and integrated quality control systems across pharmaceutical manufacturing and research facilities

- Asia-Pacific is expected to be the fastest-growing region in the pharmaceutical equipment testing market during the forecast period, driven by expanding pharmaceutical production, rising healthcare access, and growing regulatory requirements in emerging economies such as China, India, and Japan. Government initiatives promoting drug safety, increasing investments in laboratory infrastructure, and growing adoption of advanced testing technologies are further accelerating market growth

- The gas permeation tester segment dominated the pharmaceutical equipment testing market with the largest market revenue share of 44.6% in 2024, owing to its crucial role in ensuring the integrity and barrier properties of pharmaceutical packaging. It is widely employed to evaluate the permeability of gases such as oxygen, carbon dioxide, and nitrogen, which is essential for maintaining drug stability, potency, and shelf life

Report Scope and Pharmaceutical Equipment Testing Market Segmentation

|

Attributes |

Pharmaceutical Equipment Testing Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmaceutical Equipment Testing Market Trends

Advancements in Automation and Analytical Accuracy

- A significant and accelerating trend in the global pharmaceutical equipment testing market is the increasing adoption of automated and high-precision testing instruments, which enhance efficiency, reduce human error, and improve compliance with regulatory standards

- For instance, advanced HPLC (High-Performance Liquid Chromatography) and mass spectrometry systems are being integrated into pharmaceutical laboratories to enable more accurate identification, quantification, and analysis of active pharmaceutical ingredients (APIs) and excipients

- Automation in pharmaceutical equipment testing allows laboratories to streamline repetitive tasks such as sample preparation, dissolution testing, and stability studies, improving throughput while maintaining high data integrity

- The integration of real-time monitoring and digital reporting in testing instruments facilitates faster decision-making, ensures consistent quality across production batches, and reduces the risk of regulatory non-compliance

- Manufacturers and laboratories are increasingly investing in modular and flexible testing platforms that can be adapted for multiple analytical techniques, reducing downtime and enabling multi-product testing in a single setup

- This trend towards more automated, accurate, and interconnected testing systems is fundamentally reshaping expectations in pharmaceutical quality control, ensuring higher product reliability and safety

- The demand for advanced pharmaceutical equipment testing solutions is growing rapidly across both large-scale manufacturing facilities and contract research organizations, as stakeholders increasingly prioritize precision, regulatory compliance, and operational efficiency

Pharmaceutical Equipment Testing Market Dynamics

Driver

Growing Need Due to Stringent Regulatory Standards and Quality Assurance

- The increasing emphasis on regulatory compliance, product safety, and quality assurance across the pharmaceutical industry is a significant driver for the heightened demand for advanced Pharmaceutical Equipment Testing solutions

- For instance, in March 2023, Agilent Technologies expanded its portfolio of automated testing solutions, including high-throughput liquid chromatography and spectroscopy instruments, aimed at enhancing precision and efficiency in pharmaceutical analysis. Such strategies by key companies are expected to drive the Pharmaceutical Equipment Testing industry growth during the forecast period

- Pharmaceutical manufacturers are focusing on ensuring the consistent quality of drugs and biologics, which necessitates reliable testing for active pharmaceutical ingredients (APIs), excipients, and final formulations. Advanced testing equipment enables accurate detection of impurities, contaminants, and batch-to-batch variations, providing a critical safeguard for patient safety

- The growing adoption of automated and high-throughput testing systems reduces manual intervention, accelerates sample processing, and enhances reproducibility, making these solutions increasingly indispensable in both research and production settings

- Furthermore, the expansion of contract research organizations (CROs), specialized analytical labs, and pharmaceutical R&D centers is contributing to the rising demand for modular and scalable testing platforms capable of handling diverse pharmaceutical products and formulations

- The convenience of integrated reporting, real-time monitoring, and compliance tracking is also a key factor propelling the adoption of pharmaceutical equipment testing systems, enabling laboratories to meet stringent regulatory guidelines from bodies such as the FDA, EMA, and ICH

- Overall, the growing need for stringent quality control, rapid testing capabilities, and operational efficiency is shaping the market dynamics, driving sustained growth and continuous innovation in the Pharmaceutical Equipment Testing sector

Restraint/Challenge

High Capital Investment and Technical Expertise Requirements

- The relatively high initial investment required for advanced pharmaceutical testing equipment poses a notable challenge for widespread adoption, particularly for small and medium-sized pharmaceutical manufacturers and laboratories in developing regions

- Many sophisticated systems require trained personnel and specialized technical expertise for operation, maintenance, and calibration, which can limit deployment in resource-constrained settings

- Addressing these challenges through equipment leasing, service contracts, and training programs is crucial for expanding market penetration and ensuring optimal utilization of complex testing instruments

- In addition, maintenance costs, calibration requirements, and regulatory compliance expenses can further add to the total cost of ownership, making cost management a key consideration for potential adopters

- While technological advancements are gradually improving affordability and ease of use, the perceived premium and operational complexities can still hinder adoption, especially among budget-conscious pharmaceutical companies

- Overcoming these barriers through cost-effective solutions, simplified user interfaces, and comprehensive technical support will be vital for sustaining growth in the global Pharmaceutical Equipment Testing market

Pharmaceutical Equipment Testing Market Scope

The market is segmented on the basis of equipment, services, and end use.

- By Equipment

On the basis of equipment, the pharmaceutical equipment testing market is segmented into gas permeation tester, container gas permeability tester, permeability analyzer, gas transmission rate instrument, creasing and stiffness tester, package drop tester, moisture meter, package vibration tester, and texture analyzer. The Gas Permeation Tester segment dominated the largest market revenue share of 44.6% in 2024, owing to its crucial role in ensuring the integrity and barrier properties of pharmaceutical packaging. It is widely employed to evaluate the permeability of gases such as oxygen, carbon dioxide, and nitrogen, which is essential for maintaining drug stability, potency, and shelf life. Pharmaceutical companies and contract testing labs rely heavily on this equipment for high-precision, reproducible, and automated testing solutions. Continuous advancements in sensor technology, data analytics, and integration with laboratory information management systems further enhance its reliability and adoption. The segment is also supported by stringent regulatory requirements across global markets, making it a critical component in quality assurance and compliance workflows.

The Package Drop Tester segment is expected to witness the fastest CAGR of 19.3% from 2025 to 2032, fueled by the increasing need to maintain product integrity during transit and logistics. Drop testing is vital for simulating real-world shocks, vibrations, and mechanical stresses that pharmaceutical packages encounter during handling, shipping, and storage. The rising prevalence of e-commerce pharmaceutical distribution, combined with regulatory mandates for transport stability, is driving widespread adoption. Modern drop testers with automated and programmable features provide enhanced accuracy, repeatability, and efficiency, supporting both small-scale and large-scale operations. Manufacturers and CROs increasingly prefer these solutions for risk mitigation and cost-effective quality control.

- By Services

On the basis of services, the market is segmented into container testing, container closure integrity testing, life testing, visual inspection, functional testing, stability testing, raw material testing, method validation, microbial testing, environmental monitoring, physical chemical characterization, and batch-release testing. The container closure integrity testing segment dominated the largest market revenue share of 41.8% in 2024, driven by the critical requirement to ensure sterile and leak-proof packaging for parenteral drugs, biologics, and high-value pharmaceuticals. This service is vital for preventing contamination, ensuring patient safety, and complying with regulatory standards across multiple regions. The segment’s growth is supported by the adoption of advanced non-destructive testing methods, high-throughput automated solutions, and integration with laboratory information systems. Pharmaceutical companies and testing laboratories leverage these services to validate packaging, reduce recalls, and maintain consistent product quality, further reinforcing the segment’s leadership in the market.

The microbial testing segment is expected to witness the fastest CAGR of 20.1% from 2025 to 2032, driven by the growing emphasis on sterility assurance and contamination control in the production of injectable drugs, biologics, and sterile formulations. Microbial testing enables rapid identification of bacteria, fungi, and other contaminants, ensuring compliance with pharmacopeial standards and regulatory requirements. The segment is further bolstered by technological innovations in rapid microbial detection, automated systems, and integration with data management platforms, which enhance throughput and accuracy. Rising awareness about patient safety, stringent quality control protocols, and the expansion of biologics manufacturing globally contribute to the accelerated adoption of microbial testing services.

- By End Use

On the basis of end use, the market is segmented into pharmaceutical companies, contract research organizations, government organizations, research institutes, and testing laboratories. The Pharmaceutical Companies segment dominated the largest market revenue share of 52.3% in 2024, fueled by the pressing need for rigorous quality assurance, regulatory compliance, and efficient batch-release processes. Pharmaceutical manufacturers are increasingly investing in sophisticated testing equipment and comprehensive services to ensure product safety, optimize production workflows, and meet global standards. The segment is reinforced by automation, advanced analytics, and continuous process improvement initiatives. Growing demand for biologics, specialty drugs, and complex formulations further underlines the critical role of pharmaceutical companies as the dominant end-users in this market.

The contract research organizations (CROs) segment is expected to witness the fastest CAGR of 21.4% from 2025 to 2032, driven by the outsourcing of analytical and testing services by pharmaceutical companies aiming to reduce costs and accelerate drug development timelines. CROs provide specialized expertise in method validation, stability testing, microbial analysis, and container integrity evaluation, catering to the evolving needs of both innovator and generic drug manufacturers. The segment benefits from increasing investments in laboratory automation, integrated testing platforms, and advanced analytical technologies. Expansion into emerging markets, government support for clinical research, and growing demand for rapid and reliable testing solutions further propel the growth of CROs within the pharmaceutical equipment testing ecosystem.

Pharmaceutical Equipment Testing Market Regional Analysis

- North America dominated the pharmaceutical equipment testing market with the largest revenue share of 22.7% in 2024, supported by advanced healthcare infrastructure, strong R&D activities, early adoption of innovative testing technologies, and strict regulatory oversight

- The region, experiencing substantial growth due to widespread deployment of automated analytical instruments, high-throughput testing platforms, and integrated quality control systems across pharmaceutical manufacturing and research facilities

- In addition, the presence of key industry players and continuous investments in laboratory modernization further strengthen the regional market position

U.S. Pharmaceutical Equipment Testing Market Insight

The U.S. pharmaceutical equipment testing market captured the largest revenue share within North America in 2024, driven by the need for accurate quality control, stringent compliance with FDA and ICH regulations, and adoption of advanced analytical techniques. Pharmaceutical manufacturers and CROs are increasingly investing in high-throughput testing systems, automated sample preparation units, and real-time monitoring solutions to improve efficiency, reproducibility, and safety across drug development and production processes. Moreover, technological innovations in spectroscopy, chromatography, and molecular testing platforms are significantly enhancing the capabilities of U.S.-based laboratories.

Europe Pharmaceutical Equipment Testing Market Insight

The Europe pharmaceutical equipment testing market is projected to expand at a substantial CAGR throughout the forecast period, fueled by stringent regulatory requirements, the growing need for quality assurance, and increasing R&D expenditure across the pharmaceutical sector. The demand for advanced testing solutions is particularly strong in countries such as Germany, France, and Switzerland, where pharmaceutical production is concentrated. Investments in automated testing platforms, integration of digital data management systems, and adherence to EU regulatory standards are driving growth in both research and commercial manufacturing segments.

U.K. Pharmaceutical Equipment Testing Market Insight

The U.K. pharmaceutical equipment testing market is anticipated to grow steadily during the forecast period, driven by strong government regulations, increasing focus on drug safety, and the modernization of laboratory facilities. The adoption of automated analytical systems, cloud-based data tracking, and high-throughput testing technologies is enhancing operational efficiency and compliance with MHRA guidelines. In addition, the U.K. market is seeing increased collaboration between pharmaceutical companies and technology providers, fostering innovation in testing protocols and analytical solutions.

Germany Pharmaceutical Equipment Testing Market Insight

The Germany pharmaceutical equipment testing market is expected to expand at a considerable CAGR during the forecast period, owing to the country’s well-established pharmaceutical industry, emphasis on precision and quality, and strong R&D ecosystem. Investments in automated analytical instruments, laboratory robotics, and advanced spectroscopy and chromatography systems are key factors contributing to market growth. Germany’s regulatory environment and focus on sustainable laboratory practices further encourage the adoption of state-of-the-art testing solutions across pharmaceutical production and research facilities.

Asia Pacific Pharmaceutical Equipment Testing Market Insight

The Asia-Pacific pharmaceutical equipment testing market is expected to be the fastest-growing region in the market during the forecast period, driven by expanding pharmaceutical production, rising healthcare access, and growing regulatory requirements in emerging economies such as China, India, and Japan. Government initiatives promoting drug safety, increasing investments in laboratory infrastructure, and growing adoption of advanced testing technologies are further accelerating market growth.

Japan Pharmaceutical Equipment Testing Market Insight

The Japan pharmaceutical equipment testing market is witnessing significant growth due to the country’s advanced pharmaceutical manufacturing sector, stringent quality standards, and continuous investment in analytical and diagnostic equipment. Adoption of automated testing platforms, integration of digital quality management systems, and focus on precision medicine are contributing to robust demand. In addition, Japan’s regulatory emphasis on safety and efficacy encourages pharmaceutical companies to invest in innovative testing solutions, ensuring compliance and maintaining product quality.

China Pharmaceutical Equipment Testing Market Insight

The China pharmaceutical equipment testing market accounted for the largest market revenue share in Asia-Pacific in 2024, attributed to rapid expansion in pharmaceutical production, increasing regulatory oversight, and government initiatives supporting laboratory modernization. The growing domestic pharmaceutical industry, combined with investments in high-throughput analytical instruments, spectroscopy, chromatography, and molecular testing platforms, is fueling market demand. The country’s emphasis on quality assurance, compliance with international regulatory standards, and rising adoption of advanced testing technologies are key drivers for sustained growth in the region.

Pharmaceutical Equipment Testing Market Share

The pharmaceutical equipment testing industry is primarily led by well-established companies, including:

- TASI Group (U.S.)

- West Pharmaceutical Services, Inc. (U.S.)

- Edwards Lifesciences Corporation. (U.K.)

- NSF (U.S.)

- Eurofins Scientific (Luxembourg)

- SGS Société Générale de Surveillance SA (Switzerland)

- Thermo Fisher Scientific Inc. (U.S.)

- Pace Analytical Services, LLC (U.S.)

- Intertek Group plc (U.K.)

- Dynalabs (U.S.)

- RD Laboratories Inc. (U.S.)

- ADPEN Laboratories (U.S.)

- BA Sciences (U.S.)

- Microbac Laboratories Inc. (U.S.)

- Charles River Laboratories (U.S.)

- ARL Bio Pharma, Inc. (U.S.)

Latest Developments in Global Pharmaceutical Equipment Testing Market

- In December 2023, TASI Group restructured into two individual organizations: TASI Test and Automation, and TASI Measurement. This strategic restructuring was aimed at providing each entity with a more focused approach toward their respective market segments. By separating operations, TASI Group intends to enhance operational efficiency, improve service offerings, and drive growth in both pharmaceutical equipment testing and measurement solutions, thereby catering more effectively to client-specific requirements and industry demands

- In August 2025, Thermo Fisher Scientific inaugurated a new Manufacturing Center of Excellence in North Carolina, designed to significantly strengthen its capabilities in pharmaceutical manufacturing and testing. The facility is equipped with advanced technologies and state-of-the-art infrastructure, enabling more efficient production workflows, high-quality testing, and support for innovative drug development processes. This expansion underscores Thermo Fisher’s commitment to enhancing precision, reliability, and scalability in pharmaceutical equipment testing

- In August 2025, SGS reported robust first-half 2025 results, reflecting strong operational performance and accelerated progress under its Strategy 27 initiative. The company’s acquisition of ATS further bolstered its capabilities in pharmaceutical testing and compliance services, enabling SGS to provide more comprehensive, end-to-end solutions. This milestone highlights SGS’s focus on growth, innovation, and strengthening its market position in global pharmaceutical quality assurance and regulatory compliance

- In May 2025, Eurofins BioPharma Product Testing released its Spring 2025 newsletter, showcasing the launch of new services and advanced analytical techniques in pharmaceutical testing. The update emphasized enhancements in testing methodologies, faster turnaround times, and improved accuracy, reinforcing Eurofins’ role as a leader in biopharmaceutical quality control. These developments aim to better support clients in achieving regulatory compliance, ensuring product safety, and accelerating time-to-market for pharmaceutical products

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.