Global Pharmacy Benefit Management Services Market

Market Size in USD Billion

CAGR :

%

USD

633.83 Billion

USD

1,033.24 Billion

2024

2032

USD

633.83 Billion

USD

1,033.24 Billion

2024

2032

| 2025 –2032 | |

| USD 633.83 Billion | |

| USD 1,033.24 Billion | |

|

|

|

|

Pharmacy Benefit Management Services Market Size

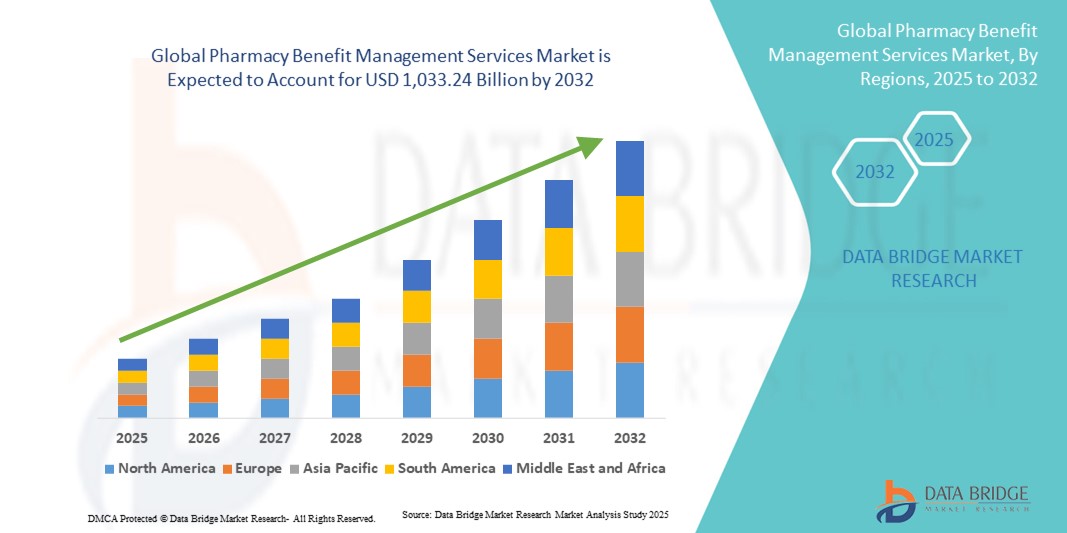

- The global pharmacy benefit management services market size was valued at USD 633.83 billion in 2024 and is expected to reach USD 1,033.24 billion by 2032, at a CAGR of 6.30% during the forecast period

- The market growth is primarily driven by the rising demand for cost-effective prescription drug plans, the increasing burden of chronic diseases, and the need for streamlined drug distribution and claims management across healthcare systems

- In addition, the growing integration of data analytics, digital health platforms, and value-based care models within PBM services is enhancing efficiency and transparency. These factors are positioning PBM providers as critical players in managing drug costs and improving patient outcomes, thereby fueling strong market expansion

Pharmacy Benefit Management Services Market Analysis

- Pharmacy benefit management (PBM) services, which administer prescription drug programs for health plans, employers, and government agencies, are becoming indispensable to modern healthcare systems due to their role in reducing drug costs, optimizing formulary management, and improving patient access to medications

- The growing demand for PBM services is primarily fueled by rising prescription drug spending, the increasing prevalence of chronic diseases, and the need for efficient claims processing and transparent pricing models

- North America dominated the pharmacy benefit management services market with the largest revenue share of 52.8% in 2024, supported by the strong presence of established PBM providers, integration of value-based care strategies, and regulatory efforts to improve drug pricing transparency, with the U.S. driving significant adoption across employer-sponsored health plans and Medicare

- Asia-Pacific is expected to be the fastest growing region in the pharmacy benefit management services market during the forecast period, propelled by expanding healthcare infrastructure, increasing government focus on cost containment, and growing private insurance penetration

- Specialty pharmacy services segment dominated the pharmacy benefit management services market with a market share of 47.2% in 2024, driven by the surging demand for high-cost specialty drugs and the critical need for coordinated patient support services

Report Scope and Pharmacy Benefit Management Services Market Segmentation

|

Attributes |

Pharmacy Benefit Management Services Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Pharmacy Benefit Management Services Market Trends

Digital Transformation Through AI and Advanced Analytics

- A significant and accelerating trend in the global PBM services market is the integration of artificial intelligence (AI), big data, and advanced analytics into prescription management and drug cost optimization. This fusion of technologies is greatly enhancing transparency, efficiency, and personalized patient care

- For instance, CVS Health has deployed AI-driven adherence monitoring tools that send proactive reminders to patients, while Cigna’s Express Scripts leverages predictive analytics to recommend lower-cost therapeutic alternatives and optimize formulary structures

- AI integration enables PBMs to analyze massive datasets from claims, electronic health records, and patient behavior, helping identify at-risk patients, predict drug utilization patterns, and improve care coordination. Furthermore, digital apps and portals now allow members to track prescriptions, compare drug costs, and receive real-time benefit information

- The seamless integration of PBM services with telehealth, virtual care, and specialty pharmacy solutions is creating unified healthcare ecosystems where patients can access consultations, prescriptions, and cost management tools through a single platform

- This trend toward intelligent, data-driven, and patient-centered PBM services is fundamentally reshaping payer expectations. Consequently, companies such as OptumRx are investing heavily in AI-powered platforms that combine clinical insights with cost management features to enhance affordability and outcomes

- The growing demand for PBM services that offer advanced digital integration and personalized transparency is rapidly expanding across employer-sponsored health plans, government programs, and commercial insurers worldwide

Pharmacy Benefit Management Services Market Dynamics

Driver

Escalating Prescription Drug Costs and Chronic Disease Burden

- The rising cost of prescription medications, coupled with the global increase in chronic illnesses, is a key driver fueling the demand for PBM services as healthcare stakeholders seek more cost-efficient solutions

- For instance, in February 2024, Prime Therapeutics expanded its specialty drug management programs, aiming to lower costs for high-value therapies while improving access for patients with long-term conditions such as diabetes, cancer, and autoimmune disorders

- PBMs provide vital cost-control mechanisms such as formulary management, rebate negotiations with drug manufacturers, and prior authorization programs. These solutions help payers reduce overall drug spending while ensuring appropriate access to life-saving medications

- As specialty drugs account for a growing share of total drug spending, PBM services are increasingly viewed as essential partners in balancing affordability with patient care

- The growing need for integrated healthcare solutions, where PBM services align with digital tools, adherence monitoring, and value-based care models, further strengthens the market’s expansion

Restraint/Challenge

Regulatory Scrutiny and Transparency Issues

- The heightened regulatory and political scrutiny over PBM practices, particularly surrounding rebate structures, spread pricing, and opaque contracting, poses a significant challenge to market growth

- For instance, in 2023–2024, U.S. policymakers proposed reforms targeting PBMs, including bans on spread pricing and requirements for greater transparency in rebate pass-through, reflecting mounting concerns about whether PBMs genuinely reduce costs for patients

- These transparency concerns have led to skepticism among healthcare stakeholders, with some questioning the role of PBMs in contributing to high drug prices. Compliance with evolving regulations adds complexity, particularly for global PBMs navigating varied healthcare policies across regions

- Moreover, growing pressure to shift toward pass-through or transparent pricing models is reshaping the competitive landscape, pushing PBMs to adopt more open practices

- Overcoming these challenges through technology-enabled reporting, proactive compliance measures, and transparent value demonstration will be vital to maintaining payer trust and securing sustainable growth in the PBM services market

Pharmacy Benefit Management Services Market Scope

The market is segmented on the basis of type, business model, application, service, and end-user.

- By Type

On the basis of type, the pharmacy benefit management services market is segmented into commercial health plans, self-insured employer plans, medicare part d plans, federal employees health benefits program, and state government employee plans. The Commercial Health Plans segment dominated the market in 2024, owing to its strong penetration among private insurers seeking effective cost-containment solutions. These plans rely heavily on PBM services for drug formulary management, rebate negotiations, and ensuring patients’ access to affordable medicines. Commercial health insurers often serve large insured populations, magnifying the impact of PBMs in reducing costs and improving access. Moreover, the collaboration of PBMs with major insurers such as CVS Health, Express Scripts, and OptumRx ensures large-scale efficiency and operational strength. This dominance is reinforced by increasing chronic disease prevalence, which requires long-term prescription coverage within private health plans.

The Medicare Part D Plans segment is expected to grow at the fastest CAGR from 2025 to 2032, driven by a rapidly aging global population and the growing prevalence of chronic conditions among seniors. Medicare beneficiaries are highly dependent on PBMs to manage specialty drugs and provide cost-effective mail-order services for long-term therapies. Rising enrollment in Medicare programs, particularly in the U.S., is fueling demand for PBM services tailored to older adults. In addition, recent government efforts to lower out-of-pocket drug costs for seniors are increasing PBM involvement in Medicare programs. This trend makes Medicare Part D a high-growth subsegment with critical importance for the future of the PBM services market.

- By Business Model

On the basis of business model, the pharmacy benefit management services market is segmented into government health programs, employer-sponsored programs, and health insurance management. The Employer-Sponsored Programs segment dominated the market in 2024, accounting for the largest revenue share, as employers across industries prioritize cost containment while ensuring comprehensive healthcare coverage. Employers partner with PBMs to design customized benefit plans, negotiate rebates, and manage both retail and mail-order pharmacy networks. Large corporations in North America and Europe particularly depend on PBMs to optimize healthcare expenditure without compromising employee access to needed drugs. Growing competition for workforce retention also drives employers to enhance their healthcare offerings, making PBM partnerships indispensable. The integration of analytics tools in employer-sponsored PBM programs further strengthens this segment’s dominance by ensuring cost transparency and better outcomes.

The Government Health Programs segment is projected to witness the fastest growth during 2025–2032, propelled by expanding healthcare coverage initiatives and government efforts to lower national drug spending. In the U.S., programs such as Medicare and Medicaid already rely heavily on PBMs, while emerging economies in Asia-Pacific are adopting similar structures as they expand universal health coverage. Governments are increasingly turning to PBMs for efficient prescription drug management, formulary standardization, and cost containment strategies. In addition, policy reforms aimed at improving transparency and reducing drug price inflation are such asly to expand PBM adoption in public health programs. This rising demand from the public sector is expected to significantly reshape the global PBM services landscape.

- By Application

On the basis of application, the pharmacy benefit management services market is segmented into mail-order pharmacy services and non-mail pharmacy services. The Non-Mail Pharmacy Services segment dominated the market in 2024, supported by the widespread presence of retail pharmacy networks worldwide. Patients often prefer in-person pharmacy visits for convenience, counseling, and immediate drug fulfillment. PBMs play a crucial role in managing claims, negotiating with pharmacy networks, and ensuring formulary compliance within retail settings. This model remains particularly strong in regions where digital adoption is limited, and physical pharmacies serve as the primary point of access for prescriptions. The strong reliance on retail pharmacies in both developed and developing economies has made this the dominant application area for PBM services. In addition, PBMs enhance efficiency in non-mail settings by automating claims and streamlining benefit processing for millions of patients.

The Mail-Order Pharmacy Services segment is anticipated to grow at the fastest rate during 2025–2032, owing to increasing consumer preference for convenience, home delivery, and long-term prescription management. PBMs are increasingly integrating digital platforms, AI-driven logistics, and subscription-based delivery models to boost adherence and improve patient outcomes. This segment gained significant momentum during the COVID-19 pandemic, when patients shifted to mail-order services for safety and convenience, and the trend has continued post-pandemic. Chronic care patients requiring monthly or quarterly refills increasingly prefer mail-order services due to cost savings and delivery reliability. Furthermore, insurers and PBMs promote mail-order options as a cost-efficient solution, fueling its rapid growth trajectory globally.

- By Service

On the basis of service, the pharmacy benefit management services market is segmented into retail pharmacy services, specialty pharmacy services, benefit plan design and consultation, network-pharmacy claims processing, home delivery pharmacy care, drug utilization review, drug formulary management, medical and drug data analysis services, and others. The Specialty Pharmacy Services segment dominated the market in 2024 with a market share of 47.2%, driven by the growing demand for high-cost specialty drugs in oncology, immunology, and rare disease treatments. Specialty drugs account for a disproportionately large share of overall prescription spending, making PBM support essential for managing access and costs. PBMs provide critical services such as adherence monitoring, patient education, and coordination with healthcare providers, which are vital in specialty care. The rise in chronic diseases and genetic therapies further strengthens this segment’s dominance. In addition, PBMs help payers manage the financial burden of specialty medications by negotiating discounts and optimizing formularies, keeping this service category at the forefront.

The Drug Utilization Review (DUR) segment is projected to experience the fastest growth during 2025–2032, as healthcare systems worldwide prioritize evidence-based prescribing and patient safety. DUR services allow PBMs to analyze prescription patterns, identify potential drug interactions, and ensure clinical appropriateness. These programs significantly reduce healthcare costs by minimizing adverse drug events and preventing unnecessary prescriptions. With the shift toward value-based care and outcome-driven healthcare systems, DUR is becoming a critical tool for payers and providers. In addition, the integration of AI and real-time analytics in DUR programs is making them more effective and predictive, further fueling growth. As payers and regulators demand higher quality and accountability, the adoption of DUR services is expected to accelerate.

- By End-User

On the basis of end-user, the pharmacy benefit management services market is segmented into healthcare providers, employers, drug manufacturers, and others. The Employers segment dominated the market in 2024, supported by the widespread reliance of businesses on PBMs to provide cost-efficient prescription coverage for their employees. Employers seek PBM partnerships to negotiate rebates, design flexible benefit plans, and manage healthcare costs while maintaining employee satisfaction. Large corporations, particularly in North America, are the primary drivers of demand in this subsegment. The focus on improving workforce health and reducing absenteeism through effective drug management further reinforces the dominance of this category. Moreover, employers are increasingly integrating PBM services with wellness programs, expanding the role of PBMs beyond cost savings into overall employee healthcare management.

The Healthcare Providers segment is projected to grow at the fastest rate during 2025–2032, as hospitals, clinics, and integrated health systems increasingly collaborate with PBMs to optimize drug prescribing and reduce costs. Providers benefit from PBM services by gaining better access to drug utilization data, cost transparency, and coordinated specialty care management. The rising demand for integrated clinical-pharmacy partnerships in value-based care models is a key driver of this growth. Providers also rely on PBMs for improving patient adherence through targeted interventions and digital tools. As healthcare delivery models become more data-driven and outcomes-focused, the role of PBMs in supporting providers is expected to expand rapidly. This makes healthcare providers the fastest-growing PBM end-user segment globally.

Pharmacy Benefit Management Services Market Regional Analysis

- North America dominated the pharmacy benefit management services market with the largest revenue share of 52.8% in 2024, supported by the strong presence of established PBM providers, integration of value-based care strategies, and regulatory efforts to improve drug pricing transparency, with the U.S. driving significant adoption across employer-sponsored health plans and Medicare

- Employers, insurers, and government programs in the region increasingly rely on PBMs to negotiate drug prices, manage formularies, and enhance patient access to cost-effective therapies, strengthening their role within the U.S. healthcare system

- This dominance is further supported by the rising prevalence of chronic diseases, growing demand for specialty drugs, and policy reforms aimed at reducing prescription drug costs, firmly positioning North America as the leading PBM services hub globally

U.S. Pharmacy Benefit Management Services Market Insight

The U.S. pharmacy benefit management services market captured the largest revenue share of 87% in 2024 within North America, fueled by the dominance of leading players such as CVS Health, Cigna’s Express Scripts, and UnitedHealth’s OptumRx. Employers, insurers, and government programs increasingly depend on PBMs to negotiate drug prices, manage formularies, and ensure affordable access to high-cost specialty medications. The rise in chronic disease prevalence, coupled with an aging population and the growing demand for mail-order and specialty pharmacy services, is further boosting the market. In addition, regulatory scrutiny around drug pricing is encouraging PBMs to adopt more transparent business models, consolidating their role as critical intermediaries in the U.S. healthcare system.

Europe Pharmacy Benefit Management Services Market Insight

The Europe pharmacy benefit management services market is projected to expand at a substantial CAGR throughout the forecast period, primarily driven by rising healthcare expenditures and the growing adoption of cost-control mechanisms in prescription drug management. Increasing chronic disease incidence and demand for specialty drugs are prompting healthcare systems to adopt PBM-such as models for optimizing drug distribution and pricing. The region is also witnessing a gradual rise in employer-sponsored health programs and third-party healthcare administrators, fostering market expansion. Europe’s evolving regulatory frameworks and growing focus on affordability and efficiency are further propelling PBM adoption across multiple healthcare delivery settings.

U.K. Pharmacy Benefit Management Services Market Insight

The U.K. pharmacy benefit management services market is anticipated to grow at a noteworthy CAGR during the forecast period, supported by the rising demand for efficient drug cost management and value-based healthcare models. Increasing reliance on specialty medications, combined with heightened pressure on the National Health Service (NHS) to reduce pharmaceutical expenses, is driving the adoption of PBM-style services. Moreover, growing partnerships between private health insurers, employers, and third-party administrators are creating opportunities for PBM expansion. The U.K.’s strong digital health infrastructure and focus on integrated care delivery further strengthen its market potential.

Germany Pharmacy Benefit Management Services Market Insight

The Germany pharmacy benefit management services market is expected to expand at a considerable CAGR during the forecast period, fueled by rising demand for drug utilization review, formulary management, and specialty pharmacy services. Germany’s emphasis on cost-efficient healthcare, along with strong regulatory oversight, is encouraging the adoption of PBM services to streamline prescription drug spending. Pharmaceutical innovation and the rapid rise of specialty therapies are also driving payers and healthcare providers to seek PBM support in optimizing therapy access. Furthermore, Germany’s advanced healthcare infrastructure and focus on data-driven decision-making underpin its growing PBM services landscape.

Asia-Pacific Pharmacy Benefit Management Services Market Insight

The Asia-Pacific pharmacy benefit management services market is poised to grow at the fastest CAGR of 22% during the forecast period of 2025 to 2032, driven by expanding healthcare coverage, increasing prevalence of chronic conditions, and rising drug expenditures in countries such as China, Japan, and India. Government initiatives promoting affordable healthcare and the adoption of digital health solutions are supporting PBM penetration in the region. As healthcare systems modernize and private insurance expands, demand for drug formulary management, claims processing, and mail-order pharmacy services is rising sharply. The affordability and scalability of PBM models are opening new opportunities across emerging economies.

Japan Pharmacy Benefit Management Services Market Insight

The Japan pharmacy benefit management services market is gaining momentum due to the country’s aging population, rising demand for specialty drugs, and strong focus on healthcare efficiency. Japanese healthcare providers and insurers are increasingly adopting PBM-such as services to manage high drug expenditures while ensuring timely patient access to innovative therapies. Integration of PBM services with Japan’s advanced digital health infrastructure and growing reliance on data analytics are enhancing cost optimization. Moreover, the government’s focus on sustainable healthcare spending is accelerating demand for formulary management and drug utilization review services.

India Pharmacy Benefit Management Services Market Insight

The India pharmacy benefit management services market accounted for the largest revenue share in Asia-Pacific in 2024, attributed to its rapidly growing healthcare insurance sector, increasing pharmaceutical demand, and government-driven digital health initiatives. India’s expanding middle-class population, rising prevalence of chronic diseases, and push toward universal healthcare are creating a strong need for PBM services to optimize drug access and affordability. The country is also witnessing a surge in employer-sponsored health programs and private insurance penetration, driving demand for claims processing and benefit plan design. Affordable, tech-enabled PBM solutions are expected to make India one of the most dynamic PBM markets in the region

Pharmacy Benefit Management Services Market Share

The pharmacy benefit management services industry is primarily led by well-established companies, including:

- CVS Caremark. (U.S.)

- Express Scripts. (U.S.)

- Optum, Inc. (U.S.)

- Prime Therapeutics LLC (U.S.)

- MedImpact (U.S.)

- Navitus Health Solutions (U.S.)

- Capital Rx Inc. (U.S.)

- EmpiRx Health, LLC (U.S.)

- Northwind Pharmaceuticals (U.S.)

- WellDyneRx (U.S.)

- LucyRx (U.S.)

- CerpassRX (U.S.)

- CarelonRx (U.S.)

- PDCRx (U.S.)

- Benecard. (U.S.)

- CaptureRx (U.S.)

- Abarca Health LLC. (U.S.)

- Maxor National Pharmacy Services, LLC (U.S.)

- PerformRx (U.S.)

What are the Recent Developments in Global Pharmacy Benefit Management Services Market?

- In April 2025, EmpiRx Health introduced AllyRx, the first-ever national pharmacy care network tailored specifically for pharmacy and grocery retailers. Built around a pharmacist-led service model and advanced technology platform, AllyRx aims to help retailers enhance their employees’ health outcomes while reducing prescription drug costs—offering a meaningful alternative to traditional PBM approaches

- In March 2025, Healthee (an AI-powered benefits navigation platform) formed a strategic partnership with Northwind Pharmaceuticals, a transparent, pass-through PBM. This collaboration equips employers with enhanced oversight and control over prescription spends, improving data insights and ensuring greater rebate transparency within the Healthee ecosystem

- In January 2025, Capital Rx revealed it had signed over 80 new partnerships covering iconic brands, employer groups, universities, and health systems, expanding its reach to more than three million PBM lives. It also introduced M3P (Medicare Prescription Payment Plan) powered by its JUDI platform, marking a significant launch in Medicare-focused PBM innovation

- In January 2025, Capital Rx deployed Judi Health, the industry’s first Unified Claims Processing platform capable of simultaneously processing both pharmacy and medical claims (with plans to eventually include dental and vision). This innovation aims to minimize administrative inefficiencies in healthcare (estimated at over USD 1 trillion in waste) by providing a “single source of truth” for benefits administration, enhancing accuracy and streamlining cost management

- In August 2024, Capital Rx launched Never Move Again, a new Pharmacy Benefit Administrator (PBA) model that leverages its JUDI claims adjudication platform and offers employers stable drug pricing without disruptions such as benefit vendor changes or card reissuance. This model emphasizes financial transparency, modular service integration, and flexibility allowing employers to seamlessly interact with retail networks, mail-order pharmacies, or specialty partners

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.