Global Phentermine Hydrochloride Market

Market Size in USD Billion

CAGR :

%

USD

417.03 Billion

USD

675.28 Billion

2024

2032

USD

417.03 Billion

USD

675.28 Billion

2024

2032

| 2025 –2032 | |

| USD 417.03 Billion | |

| USD 675.28 Billion | |

|

|

|

|

Phentermine Hydrochloride Market Size

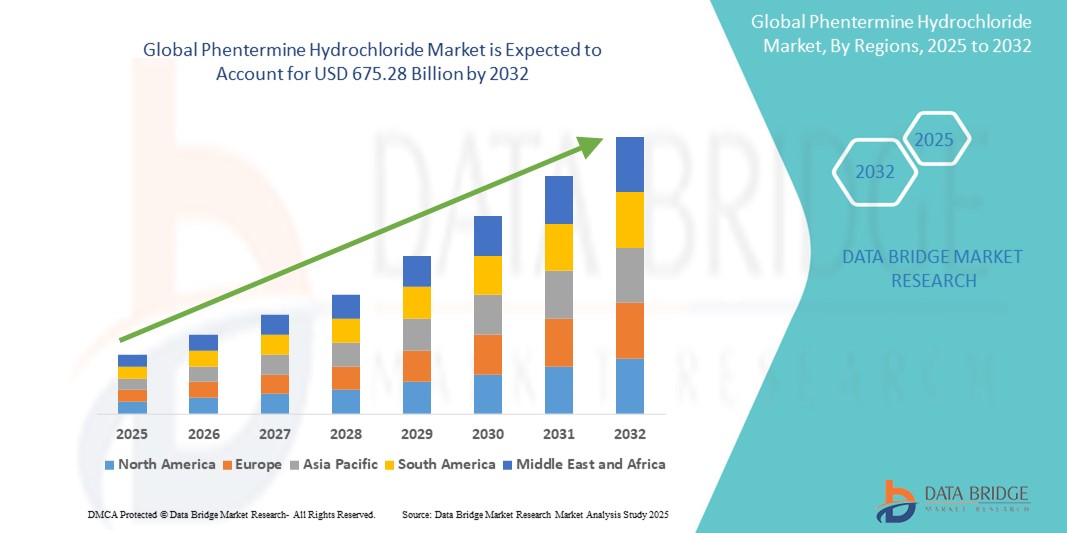

- The global phentermine hydrochloride market size was valued at USD 417.03 billion in 2024 and is expected to reach USD 675.28 billion by 2032, at a CAGR of 6.21% during the forecast period

- The market growth is largely fueled by the rising prevalence of obesity and overweight conditions across the globe, which is increasing the demand for effective weight management medications such as phentermine hydrochloride. The growing burden of lifestyle-related disorders, such as diabetes and cardiovascular diseases, further emphasizes the need for pharmacological interventions in obesity treatment

- Furthermore, increasing consumer awareness of weight loss therapies, supportive government health initiatives, and expanding access to obesity management programs are driving the adoption of phentermine hydrochloride. These converging factors are significantly accelerating the uptake of this drug across both developed and emerging markets, thereby boosting the overall growth of the Phentermine Hydrochloride industry

Phentermine Hydrochloride Market Analysis

- Phentermine Hydrochloride, a prescription medication used for short-term weight loss, is increasingly important due to the global rise in obesity and overweight conditions

- The rising prevalence of obesity, combined with greater awareness of medical weight-loss solutions and expanded healthcare access, is driving the demand for Phentermine Hydrochloride globally

- North America dominated the phentermine hydrochloride market with 39.7% share in 2024, reflecting high obesity rates, comprehensive insurance coverage, robust healthcare infrastructure, and significant use of prescription weight-loss drugs

- Asia-Pacific is expected to be the fastest growing region in the phentermine hydrochloride market during the forecast period, driven by increased healthcare spending, greater access to generics, rising obesity awareness, and rising incomes in countries such as China, India, and Japan

- Tablets dominated the phentermine hydrochloride market with a market share of 60.6% in 2024, supported by patient preference, convenience, and the availability of generic tablet formulations

Report Scope and Phentermine Hydrochloride Market Segmentation

|

Attributes |

Phentermine Hydrochloride Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Phentermine Hydrochloride Market Trends

“Enhanced Treatment Support Through Digital Health Integration”

- A significant and accelerating trend in the global phentermine hydrochloride market is the integration of telehealth platforms, mobile apps, and wearable devices to support patient adherence, weight tracking, and lifestyle management. These digital tools are enhancing convenience, engagement, and outcomes for individuals undergoing phentermine treatment

- For instance, telemedicine-based weight loss clinics provide patients with mobile apps and Bluetooth-enabled scales to monitor weight, meals, activity levels, and medication intake, enabling healthcare providers to offer timely guidance

- In addition, research shows that consistent dietary self-monitoring via smartphone apps leads to better weight reduction—4.6 kg over 6 months versus 2.9 kg with traditional methods—highlighting the efficiency of digital support tools

- Advanced medication adherence technologies—such as electronic pill bottles and ingestible sensors—are being evaluated to improve management of prescribed phentermine regimens. AI-driven forecasts from wearable data have demonstrated the potential to identify non-adherence with up to 93% accuracy

- Such integrated digital ecosystems allow patients to receive smart reminders, track lifestyle metrics, and engage in two-way communication with providers—all contributing to better compliance and sustained weight-loss outcomes with phentermine

- As digital health adoption grows, companies and clinics offering Phentermine Hydrochloride are investing in comprehensive patient-support platforms. The expanding demand for telemedicine-facilitated treatment protocols and digital adherence solutions is redefining expectations for obesity management, making integrated care essential to market differentiation

Phentermine Hydrochloride Market Dynamics

Driver

“Growing Need Due to Rising Obesity Rates and Preference for Medical Weight Loss Solutions”

- The increasing prevalence of obesity and overweight conditions globally, combined with growing health awareness and demand for non-surgical weight loss interventions, is significantly driving the demand for phentermine hydrochloride

- For instance, according to the World Health Organization (WHO), over 1 billion people globally were classified as obese in 2022, including 650 million adults, 340 million adolescents, and 39 million children. This alarming trend has heightened the need for clinically approved, effective anti-obesity medications such as Phentermine Hydrochloride

- Phentermine Hydrochloride, being an FDA-approved appetite suppressant, is frequently prescribed as part of comprehensive weight loss programs, especially for individuals with obesity-related complications such as diabetes and hypertension

- Furthermore, the growing preference for short-term medical weight loss interventions, as opposed to long-term lifestyle modifications or invasive surgical procedures, is bolstering the adoption of Phentermine Hydrochloride in clinical practice

- Increasing telehealth availability and online weight loss clinics offering prescription access to medications such as Phentermine are also boosting demand. These platforms enhance patient convenience and accessibility, particularly in underserved or rural areas, contributing to market growth

Restraint/Challenge

“Potential Side Effects and Regulatory Limitations”

- Despite its effectiveness, the use of phentermine hydrochloride is associated with potential side effects such as increased blood pressure, insomnia, and dependency risks, which can deter both prescribers and users. These concerns present a significant challenge to broader market penetration

- Moreover, regulatory bodies often limit the duration of Phentermine prescriptions to short-term use (usually 12 weeks or less), restricting its long-term commercial potential in weight management. In several regions, stringent approval and prescription regulations act as a barrier for over-the-counter availability, thereby limiting widespread access

- Growing scrutiny from health authorities regarding stimulant-based appetite suppressants also affects the market outlook, especially as the healthcare industry shifts focus toward holistic and sustainable weight loss methods

- In addition, the emergence of new-generation obesity drugs, such as GLP-1 receptor agonists (such as, semaglutide), which show superior efficacy and are backed by strong marketing campaigns, poses competitive pressure on the Phentermine Hydrochloride segment

- To address these challenges, market players are investing in research for combination therapies, reformulated dosage forms, and better patient education to minimize misuse and highlight safe administration practices

Phentermine Hydrochloride Market Scope

The market is segmented on the basis of type, dosage strength, distribution channel, application, and end user.

• By Type

On the basis of type, the phentermine hydrochloride market is segmented into capsules, tablets, orally disintegrating tablets, and others. The tablets segment dominated the market with the largest revenue share of 60.6% in 2024, owing to their ease of administration, wide availability, and standardization in dosing for adult obesity treatment. Tablets are commonly prescribed by healthcare professionals and are preferred for their cost-effectiveness and convenience in long-term medication plans.

The orally disintegrating tablets segment is expected to witness the fastest growth rate of 22.4% from 2025 to 2032, driven by increasing patient preference for easily consumable formulations that do not require water, particularly among geriatric and pediatric populations or those with swallowing difficulties. ODTs also support improved compliance and convenience in outpatient and homecare settings.

• By Dosage Strength

On the basis of dosage strength, the market is segmented into 15 mg, 30 mg, 37.5 mg, and others. The 37.5 mg segment held the largest revenue share of 56.7% in 2024, being the most commonly prescribed strength for short-term weight loss therapy. Its proven efficacy in appetite suppression and frequent use in clinical settings has reinforced its market dominance.

The 15 mg segment is projected to witness the highest CAGR of 20.1% from 2025 to 2032, as it is often prescribed for individuals with cardiovascular risk or for initial titration. The demand is rising in low-BMI obese patients and those requiring a gradual introduction to phentermine therapy to minimize side effects.

• By Distribution Channel

On the basis of distribution channel, the phentermine hydrochloride market is segmented into hospital pharmacies, retail pharmacies, online pharmacies, and others. The retail pharmacies segment captured the largest market revenue share of 42.9% in 2024, due to widespread accessibility, ease of prescription fulfillment, and pharmacist-guided dosage counseling.

The online pharmacies segment is expected to grow at the fastest CAGR of 24.3% from 2025 to 2032, fueled by the expansion of telemedicine platforms and growing preference for doorstep delivery and privacy in obesity-related treatments. The digital health trend has enabled more direct-to-consumer access with verified online consultations and e-prescriptions.

• By Application

On the basis of application, the phentermine hydrochloride market is segmented into obesity management, weight reduction, and others. The obesity management segment accounted for the highest market revenue share of 61.5% in 2024, supported by the rising global prevalence of obesity and related chronic conditions such as type 2 diabetes and hypertension. Phentermine is widely used as part of comprehensive weight loss programs for individuals classified as clinically obese.

The weight reduction segment is expected to register the highest CAGR of 21.6% from 2025 to 2032, as it includes individuals who are overweight but not obese and are prescribed Phentermine for aesthetic or preventive health reasons under controlled conditions.

• By End User

On the basis of end user, the phentermine hydrochloride market is segmented into hospitals, clinics, homecare settings, and others. The clinics segment held the largest market share of 45.2% in 2024, driven by the high number of outpatient obesity treatment centers and medically supervised weight loss programs that prescribe Phentermine. These include wellness clinics, weight management centers, and bariatric specialists.

The homecare settings segment is projected to witness the fastest CAGR of 23.8% from 2025 to 2032, owing to growing preference for at-home treatment protocols, increasing telehealth services, and improved access to Phentermine through online consultations and pharmacies.

Phentermine Hydrochloride Market Regional Analysis

- North America dominated the phentermine hydrochloride market with the largest revenue share of 39.7% in 2024, driven by the increasing prevalence of obesity, a well-established healthcare infrastructure, and the rising number of medically supervised weight loss programs

- The region's dominance is further supported by the presence of leading pharmaceutical companies, high healthcare spending, and strong consumer awareness regarding weight management solutions, including prescription-based anti-obesity drugs such as Phentermine Hydrochloride

- In addition, favorable regulatory approvals and the growing integration of telehealth services in the U.S. and Canada have made it more convenient for patients to access prescriptions for Phentermine Hydrochloride, strengthening its adoption across both clinical and homecare settings

U.S. Phentermine Hydrochloride Market Insight

The U.S. phentermine hydrochloride market accounted for 80.20% of the North American phentermine hydrochloride market in 2024, maintaining a commanding lead due to the country’s widespread obesity crisis and early adoption of prescription-based weight-loss solutions. The combination of robust healthcare infrastructure, high physician prescribing rates, and broad insurance coverage continues to foster market expansion. Increasing adoption of telemedicine and e-prescriptions has also improved accessibility, particularly in rural and underserved areas. Integration of digital weight management tools and rising consumer awareness about obesity-related risks are further accelerating demand.

Europe Phentermine Hydrochloride Market Insight

The Europe phentermine hydrochloride market is expected to expand at a CAGR of 6.7% during the forecast period. Growth is driven by increased healthcare spending, an aging population, and greater acceptance of medical obesity interventions. Countries such as the U.K., Germany, and France are leading the charge due to supportive reimbursement systems and growing pressure on national health services to manage lifestyle-related diseases. There is a growing emphasis on integrating pharmacological treatments with lifestyle modification and digital health monitoring for holistic obesity care.

U.K. Phentermine Hydrochloride Market Insight

The U.K. phentermine hydrochloride market is expected to register a CAGR of 6.9% from 2025 to 2032, driven by rising consumer awareness, favorable telehealth regulations, and robust digital pharmacy networks. National obesity prevention strategies, along with a rising demand for non-surgical interventions, have made short-term prescription drugs such as Phentermine Hydrochloride more accessible through both public and private channels.

Germany Phentermine Hydrochloride Market Insight

The Germany phentermine hydrochloride market is projected to grow at a CAGR of 6.5% during the forecast period. Germany’s healthcare policies increasingly emphasize digitalization and personalized care, creating a conducive environment for structured obesity management programs involving pharmacologic agents. Public and private insurers are slowly expanding coverage for medically supervised weight-loss therapies, driving demand for safe and cost-effective drugs such as Phentermine Hydrochloride.

Asia-Pacific Phentermine Hydrochloride Market Insight

The Asia-Pacific phentermine hydrochloride market is forecasted to grow at the fastest CAGR of 24.0% from 2025 to 2032. Factors such as rapid urbanization, growing health awareness, and rising middle-class income are fueling demand for obesity treatments. The region is also benefiting from improvements in digital healthcare access and a booming pharmaceutical manufacturing base that ensures affordability and availability of generic formulations of Phentermine Hydrochloride. Countries such as China and India are driving the majority of the region's growth.

Japan Phentermine Hydrochloride Market Insight

The Japan phentermine hydrochloride market represented about 13.4% of the Asia-Pacific market in 2024 and is expected to grow at a CAGR of 7.4% over the forecast period. Cultural shifts toward preventive health, increasing rates of metabolic syndrome, and the aging population's demand for non-invasive, medically managed weight-loss solutions are all contributing to market growth. Japan’s integration of IoT-driven health platforms and personalized care models is also enabling wider adoption of pharmaceutical interventions such as Phentermine Hydrochloride.

China Phentermine Hydrochloride Market Insight

The China phentermine hydrochloride market projected to grow at a CAGR of 8.2% through 2032, supported by strong domestic pharmaceutical manufacturing, increasing urban health consciousness, and a fast-expanding obese population. Digital healthcare initiatives, especially in Tier 1 and Tier 2 cities, are driving awareness and access to prescription-based weight-loss treatments. Moreover, the affordability of locally manufactured Phentermine Hydrochloride enhances its appeal in price-sensitive consumer segments.

Phentermine Hydrochloride Market Share

The phentermine hydrochloride industry is primarily led by well-established companies, including:

- Teva Pharmaceutical Industries Ltd. (Israel)

- Cipla (India)

- Aurobindo Pharma Limited (India)

- Zydus Group (India)

- Sun Pharmaceutical Industries Ltd. (India)

- KVK Tech, Inc. (U.S.)

- EliteLabs LLC. (U.S.)

- Citius Pharmaceuticals, Inc. (U.S.)

- Lannett (U.S.)

- Merro Pharmaceutical Co.,Ltd (China)

- UCB S.A. (Belgium)

- NOVAST (China)

- INova Pharmaceuticals (Singapore)

Latest Developments in Global Phentermine Hydrochloride Market

- In April 2024, Teva Pharmaceuticals, one of the major players in the weight management space, announced the expansion of its generic Phentermine Hydrochloride product line in Latin America, aiming to address the increasing prevalence of obesity across emerging economies. This strategic move enhances Teva’s footprint in cost-sensitive markets while improving access to effective, affordable weight-loss medications

- In March 2024, KVK-Tech, Inc., a leading U.S.-based manufacturer of Phentermine Hydrochloride, received FDA approval for its newly reformulated extended-release capsules. The updated formulation is designed to offer longer appetite suppression with fewer side effects, improving patient compliance and treatment outcomes. This development highlights the ongoing innovation within the generic pharmaceutical landscape for obesity treatment

- In February 2024, Lannett Company, Inc. initiated a strategic collaboration with a digital health platform to deliver telemedicine-integrated weight-loss programs combining Phentermine Hydrochloride prescriptions with personalized nutrition and activity tracking. This hybrid approach underscores the growing trend of pairing pharmaceuticals with digital therapeutic ecosystems for enhanced patient engagement and efficacy

- In January 2024, Avanthi Med Care, an Indian pharmaceutical firm, launched its Phentermine Hydrochloride tablets in key Asian markets including India, Vietnam, and Indonesia, capitalizing on rising obesity rates and the increasing demand for medical weight-loss solutions in the region. The launch was accompanied by a robust awareness campaign emphasizing safe, supervised use of the medication

- In December 2023, Lupin Limited announced that it had completed a Phase IV real-world study on the long-term effectiveness and tolerability of Phentermine Hydrochloride among obese patients with comorbid conditions such as type 2 diabetes and hypertension. The results, presented at the International Obesity Conference, affirmed the drug’s utility as part of a comprehensive weight management plan, potentially influencing physician prescribing behavior

- In November 2023, Hetero Labs Ltd., a global pharmaceutical manufacturer based in India, entered into a strategic partnership with South African distributors to penetrate the sub-Saharan African market with its generic Phentermine Hydrochloride portfolio. The initiative aims to address the growing health burden of obesity in developing regions through cost-effective pharmacological interventions

- In October 2023, Chemo Group (Exeltis) expanded its Phentermine Hydrochloride offerings across Spain and Eastern Europe, introducing a dual-marketing strategy targeting both public healthcare systems and private wellness clinics. This approach reflects the shifting dynamics in obesity treatment, wherein pharmaceutical support is becoming a mainstream part of non-surgical weight-loss programs

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.