Global Phosphate Chemical Reagents Market

Market Size in USD Billion

CAGR :

%

USD

2.73 Billion

USD

4.06 Billion

2024

2032

USD

2.73 Billion

USD

4.06 Billion

2024

2032

| 2025 –2032 | |

| USD 2.73 Billion | |

| USD 4.06 Billion | |

|

|

|

|

Phosphate Chemical Reagents Market Size

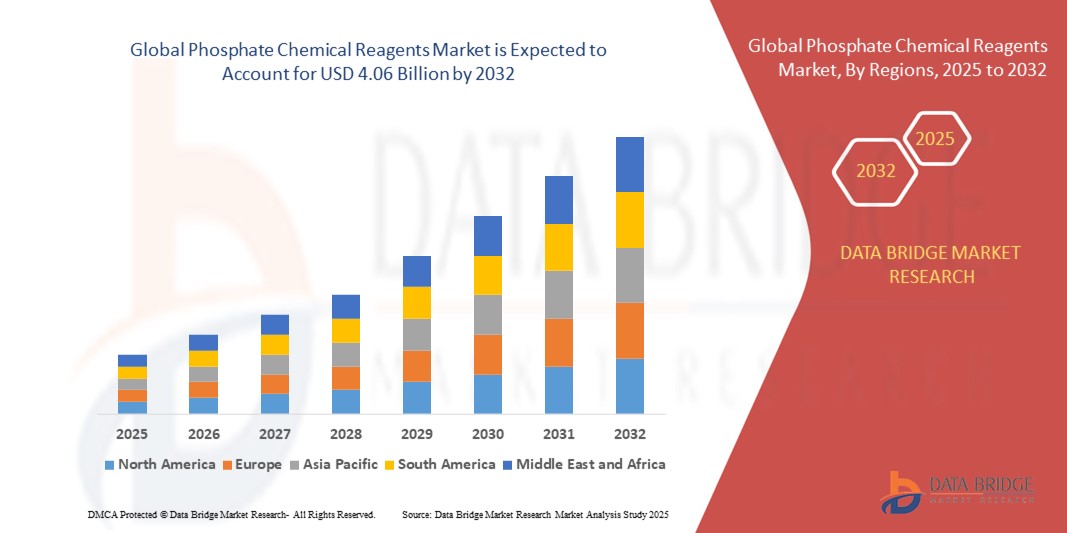

- The global phosphate chemical reagents market size was valued at USD 2.73 billion in 2024 and is expected to reach USD 4.06 billion by 2032, at a CAGR of 5.10% during the forecast period

- The market growth is largely driven by increasing demand for phosphate-based solutions across agriculture, food processing, water treatment, and pharmaceutical sectors, supported by rising global emphasis on food security, water quality, and industrial productivity

- Furthermore, expanding usage of high-purity phosphate reagents in analytical testing, chemical processing, and biotechnology is accelerating the development and commercialization of advanced formulations, further propelling market expansion

Phosphate Chemical Reagents Market Analysis

- Phosphate chemical reagents are inorganic compounds used in various industrial and laboratory applications, including fertilizers, food additives, pH regulation, corrosion control, and mineral processing. These reagents play a crucial role in enhancing chemical stability, nutrient delivery, and process efficiency across sectors

- The growing demand for these reagents is primarily fueled by the need for precision agriculture, stringent food and water safety regulations, and the ongoing shift toward sustainable chemical practices in manufacturing and environmental management

- Asia-Pacific dominated the phosphate chemical reagents market in 2024, due to growing agricultural demand, expanding food processing industries, and rising investments in water treatment infrastructure

- North America is expected to be the fastest growing region in the phosphate chemical reagents market during the forecast period due to rising demand in agriculture, industrial cleaning, and food safety applications

- Purity above 99.00% segment dominated the market with a market share of 62.9% in 2024, due to its widespread use in analytical chemistry, pharmaceutical formulations, and food-grade applications where high precision and minimal contaminants are essential. These high-purity reagents ensure accuracy and compliance with international safety and quality standards, making them indispensable in regulated environments. Growth in scientific research, stringent product testing, and demand for lab-certified materials further support segment expansion across developed markets

Report Scope and Phosphate Chemical Reagents Market Segmentation

|

Attributes |

Phosphate Chemical Reagents Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include import export analysis, production capacity overview, production consumption analysis, price trend analysis, climate change scenario, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Phosphate Chemical Reagents Market Trends

Growing Use of Nano and Specialty Phosphate Formulations

- The phosphate chemical reagents market is evolving with increasing incorporation of nano-sized and specialty phosphate formulations that provide enhanced reactivity, targeted performance, and reduced environmental impact in various industrial applications

- For instance, companies such as Thermo Fisher Scientific and Merck KGaA are developing advanced nano-phosphate reagents used in high-precision agriculture and water treatment to improve nutrient delivery and contaminant removal efficiency

- Rising demand for eco-friendly and specialty reagents is driven by stricter environmental regulations and sustainability goals across agriculture, food processing, and water treatment industries

- The development of customized phosphate blends with improved solubility, controlled release, and multifunctional properties supports precision agriculture techniques and enhances soil health management

- Increasing application of phosphate reagents in water treatment for scale prevention, corrosion control, and heavy metal sequestration is promoting innovation in reagent formulations and delivery methods

- Growth in research and development activities focusing on nano and specialty phosphates is enabling new product introductions that cater to specific industrial challenges such as bioavailability and environmental safety

Phosphate Chemical Reagents Market Dynamics

Driver

Rising Demand in Water Treatment and Food Safety

- Increasing global emphasis on clean water supply and food safety is significantly driving demand for phosphate chemical reagents used for water purification, pathogen control, and food preservation

- For instance, Kemira Corporation supplies phosphate-based reagents to municipal water treatment plants worldwide, improving water quality by controlling hardness and preventing contamination

- Expanding food processing and packaging industries use phosphate reagents as preservatives, stabilizers, and pH regulators to extend shelf life and ensure product quality

- Growth in emerging economies with rising urbanization and industrialization pushes investments in water infrastructure and safety standards, boosting phosphate reagent consumption in treatment facilities

- Regulatory standards mandating stringent water and food safety protocols increase the adoption of phosphate chemical reagents in compliance-driven markets

Restraint/Challenge

Raw Material Fluctuations and Environmental Concerns

- Price volatility and supply chain dependencies on phosphate rock and related raw materials disrupt production costs and availability, posing challenges for manufacturers and end-users

- For instance, geopolitical and environmental factors affecting major phosphate producers in Morocco, China, and the US have led to fluctuations in phosphate supply and pricing, impacting global reagent markets

- Environmental regulations targeting phosphate mining and runoff due to eutrophication concerns restrict expansion and impose costly compliance measures on reagent producers

- The high environmental impact associated with phosphate extraction and processing, including waste generation and potential contamination, necessitates investment in greener technologies that raise operational costs

- Manufacturers face pressure to balance cost-efficiency with sustainability efforts by developing low-impact reagents and recycling strategies to mitigate environmental footprint

Phosphate Chemical Reagents Market Scope

The market is segmented on the basis of product, type, and application.

- By Product

On the basis of product, the phosphate chemical reagents market is segmented into Purity Above 99.00% and Purity Below 99.00%. The Purity Above 99.00% segment held the largest revenue share of 62.9% in 2024, driven by its widespread use in analytical chemistry, pharmaceutical formulations, and food-grade applications where high precision and minimal contaminants are essential. These high-purity reagents ensure accuracy and compliance with international safety and quality standards, making them indispensable in regulated environments. Growth in scientific research, stringent product testing, and demand for lab-certified materials further support segment expansion across developed markets.

The Purity Below 99.00% segment is projected to witness the fastest growth from 2025 to 2032 due to its suitability for bulk industrial processes where ultra-high purity is not mandatory. It is commonly used in agriculture, detergent manufacturing, and water treatment plants where functional performance and cost-efficiency take precedence over purity thresholds. Rising adoption of phosphate-based formulations in cost-sensitive sectors, especially across Asia-Pacific and Latin America, is expected to fuel demand. The segment also benefits from growing awareness of sustainable water and soil management practices in developing economies.

- By Type

On the basis of type, the market is segmented into Ammonium Phosphate, Calcium Phosphate, Phosphoric Acid, Sodium Phosphate, Potassium Phosphate, and Others. Phosphoric Acid dominated the largest market share in 2024 owing to its strong role in fertilizer manufacturing, industrial cleaning agents, and food acidulants. Its high reactivity and solubility enable its use across multiple downstream applications in agriculture and surface treatment. The segment is driven by the global need to enhance agricultural productivity, growing food processing industries, and the continued reliance on phosphoric acid for rust removal and metal conditioning in industrial operations.

Potassium Phosphate is expected to witness the fastest growth rate from 2025 to 2032, driven by its growing application in pharmaceutical preparations, intravenous fluids, food preservation, and water-soluble fertilizers. Its dual benefits as a buffering agent and a nutrient source make it an ideal component in both healthcare and agricultural sectors. With increasing focus on micronutrient fortification, precision farming, and clinical nutrition, the segment is seeing rapid uptake in both developed and emerging markets. The rising shift toward plant-based and health-focused diets is further amplifying demand for potassium-based reagents.

- By Application

On the basis of application, the phosphate chemical reagents market is segmented into Food and Beverage, Agriculture, Water Treatment, Detergent, and Others. The Agriculture segment captured the largest market share in 2024 due to extensive use of phosphate-based reagents in fertilizers, soil amendments, and nutrient formulations. As global food production faces the dual challenge of growing population and declining soil fertility, phosphate reagents are critical in supporting crop yield and plant health. Government subsidies, increasing adoption of precision agriculture techniques, and expansion of agribusiness in emerging economies are major factors driving growth in this segment.

The Water Treatment segment is projected to witness the fastest growth from 2025 to 2032, fueled by growing concerns over water quality, increasing industrial discharge, and tightening environmental regulations. Phosphate chemical reagents play a key role in scale inhibition, corrosion control, and sequestration of metals in both potable and wastewater treatment systems. Rapid urbanization and industrialization in Asia-Pacific and Africa are driving infrastructure investments in water treatment facilities. In addition, increasing adoption of phosphate blends in municipal treatment processes to extend pipeline lifespan and reduce lead contamination supports accelerated demand.

Phosphate Chemical Reagents Market Regional Analysis

- Asia-Pacific dominated the phosphate chemical reagents market with the largest revenue share in 2024, driven by growing agricultural demand, expanding food processing industries, and rising investments in water treatment infrastructure

- The region’s cost-competitive manufacturing, availability of raw materials, and increasing deployment of phosphate-based fertilizers and chemicals are fueling market expansion

- Supportive government policies, rising environmental awareness, and rapid industrialization across countries such as China and India are further boosting adoption across key applications

China Phosphate Chemical Reagents Market Insight

China held the largest share in the Asia-Pacific phosphate chemical reagents market in 2024, supported by its dominant position in fertilizer production and broad industrial base. Strong demand from agriculture, water treatment, and food processing sectors is propelling growth. Favorable government policies, abundant phosphate rock reserves, and the presence of major chemical manufacturers reinforce China’s leadership in the regional market.

India Phosphate Chemical Reagents Market Insight

India is witnessing the fastest growth in the Asia-Pacific region, driven by increased usage of phosphate-based fertilizers, growing focus on clean water initiatives, and expansion in the food and beverage industry. Government-led agricultural reform programs and initiatives such as “Smart Cities” and “Har Ghar Jal” are boosting demand. Rising industrial output and infrastructure development are further contributing to market acceleration.

Europe Phosphate Chemical Reagents Market Insight

The Europe phosphate chemical reagents market is expanding steadily, driven by strong demand from food safety, pharmaceutical, and environmental applications. Stringent regulatory standards regarding water and food quality are encouraging the use of high-purity phosphate reagents. Emphasis on sustainable agriculture, innovation in formulation technologies, and well-established industrial infrastructure support ongoing growth across the region.

Germany Phosphate Chemical Reagents Market Insight

Germany’s market is driven by high-purity reagent demand in pharmaceuticals, biotechnology, and analytical testing. The country’s advanced chemical manufacturing capabilities, stringent product quality norms, and leadership in lab-based industries make it a key player in Europe. Its strong focus on innovation and R&D fosters the development of premium-grade phosphate formulations for critical applications.

U.K. Phosphate Chemical Reagents Market Insight

The U.K. market is supported by growing requirements for food-grade and analytical phosphate reagents, along with rising investments in water treatment and pharmaceutical research. Increasing compliance with health and safety standards and focus on product traceability are enhancing adoption. Continued modernization of chemical processing facilities and environmental safeguards are shaping market development.

North America Phosphate Chemical Reagents Market Insight

North America is projected to grow at a strong CAGR from 2025 to 2032, fueled by rising demand in agriculture, industrial cleaning, and food safety applications. Upgrades in water infrastructure, adoption of precision farming, and a shift toward high-purity chemicals are driving growth. Supportive regulatory policies and the modernization of manufacturing capabilities are enhancing market prospects across the region.

U.S. Phosphate Chemical Reagents Market Insight

The U.S. accounted for the largest share in the North America phosphate chemical reagents market in 2024, owing to its advanced agricultural practices, extensive food and beverage industry, and well-established pharmaceutical sector. Strong investments in water treatment and stringent regulatory standards are contributing to sustained demand. Presence of leading chemical manufacturers and technological innovation further bolster the U.S.’s market leadership.

Phosphate Chemical Reagents Market Share

The phosphate chemical reagents industry is primarily led by well-established companies, including:

- AAT Bioquest, Inc. (U.S.)

- Thermo Fisher Scientific Inc. (U.S.)

- Biosystems S.A. (Spain)

- Cayman Chemical (U.S.)

- Geno Technology Inc., USA (U.S.)

- High Purity Laboratory Chemicals Pvt. Ltd (India)

- HiMedia Laboratories Pvt. Ltd. (India)

- Honeywell International Inc. (U.S.)

- ICL Group (Israel)

- KYORITSU CHEMICAL-CHECK Lab. Corp (Japan)

- Sigma-Aldrich, Inc. (U.S.)

- Tintometer GmbH (Germany)

- Xilong Scientific Co., Ltd. (China)

- Innophos Holdings, Inc. (U.S.)

- Prayon S.A. (Belgium)

- OCP (Morocco)

- LANXESS (Germany)

- Haifa Group (Israel)

- Italmatch Chemicals (Italy)

- Arkema S.A. (France)

- Jordan Phosphate Mines Company (PLC) (Jordan)

- Recochem Inc. (Canada)

- TKI Hrashtnik (Slovenia)

- Varna Products (U.S.)

- Nutrien Ltd. (Canada)

- Changshu New-Tech Chemicals Co., Ltd. (China)

Latest Developments in Global Phosphate Chemical Reagents Market

- In March 2024, EuroChem inaugurated a new phosphate fertilizer manufacturing plant in Serra do Salitre, Minas Gerais, Brazil—a project worth nearly USD 1 billion. With an annual production capacity of 1 million tonnes of advanced phosphate fertilizers, this investment significantly bolsters Brazil's domestic supply reliability and reinforces EuroChem’s footprint in Latin America's phosphate sector

- In November 2023, First Phosphate Corp entered into a memorandum of understanding with Sun Chemical Corporation to collaboratively develop intermediates for lithium iron phosphate-based cathode active materials—key components in the battery industry. Leveraging First Phosphate’s material expertise and Sun Chemical’s existing production capabilities, the partnership aims to support growing demand for phosphate-based battery technologies in North America and Europe

- In June 2023, ICL launched a new line of water-soluble fertilizer products—branded under Nova—which includes flagship offerings such as Nova FINISH, Nova PULSE, Nova ELEVATE, and Nova FLOW. These innovative foliar and fertigation solutions cater to efficient nutrient delivery systems in North American agriculture, driving uptake of advanced phosphate reagent formulations

- In April 2023, IFFCO introduced the world’s first Nano Di-ammonium Phosphate (DAP) liquid fertilizer, marking a significant advancement in phosphate-based agricultural inputs. This innovation is poised to enhance nutrient absorption efficiency and reduce environmental impact, while supporting higher crop productivity for farmers. By establishing manufacturing facilities at Kandla (Gujarat) and Paradeep (Odisha), IFFCO aims to scale production and improve accessibility, thereby strengthening India’s position in the global phosphate fertilizer market and accelerating the shift toward advanced, sustainable agri-nutrient solutions

- In September 2020, Axis House expanded its phosphate reagent portfolio by launching defoamer and decadmiation products, complementing its existing Rinkalore collector range used in phosphate flotation. This development reflects the company's strategic move to offer comprehensive chemical solutions across the entire phosphate processing chain, from flotation to phosphoric acid production. The enhanced range is expected to improve operational efficiency and mineral recovery in phosphate beneficiation plants, thereby boosting Axis House’s competitiveness and meeting evolving industry demands for process-specific reagents

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Phosphate Chemical Reagents Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Phosphate Chemical Reagents Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Phosphate Chemical Reagents Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.