Global Plant Based Meat Market

Market Size in USD Billion

CAGR :

%

USD

12.70 Billion

USD

33.46 Billion

2024

2032

USD

12.70 Billion

USD

33.46 Billion

2024

2032

| 2025 –2032 | |

| USD 12.70 Billion | |

| USD 33.46 Billion | |

|

|

|

|

Plant-Based Meat Market Size

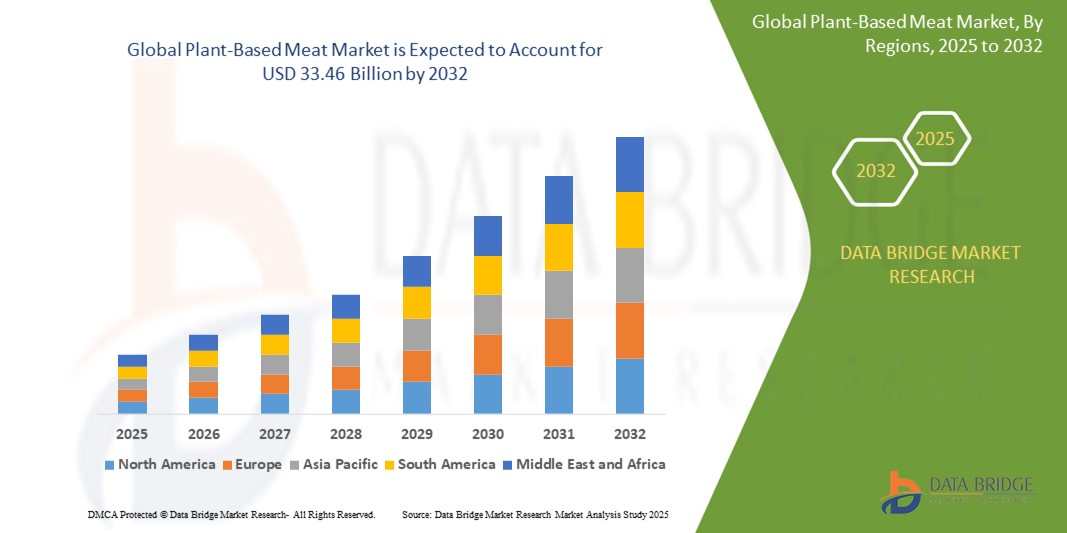

- The global plant-based meat market was valued at USD 12.70 billion in 2024 and is expected to reach USD 33.46 billion by 2032

- During the forecast period of 2025 to 2032 the market is such as to grow at a CAGR of 12.74%, primarily driven by the increasing consumer preference for healthier, sustainable, and ethical food alternatives

- This growth is driven by factors such as the rising awareness about the environmental impact of animal farming and the health benefits of plant-based diets

Plant-Based Meat Market Analysis

- The plant-based meat market is growing steadily as more consumers adopt plant-based diets, driven by increasing awareness of health, sustainability, and animal welfare concerns

- Companies are leveraging advanced food technologies such as fermentation and extrusion to improve the taste, texture, and nutritional value of plant-based meats, bringing them closer to the experience of traditional animal-based products

- The market is seeing a broadening of product categories, with plant-based meats now available in a variety of formats such as burgers, sausages, and nuggets, appealing to a wide range of consumer preferences

- There is an increasing focus on cleaner labels and minimal processing in plant-based meat products, as consumers demand transparency and simplicity in ingredients, driving companies to innovate with whole foods and natural ingredients

- For instance, a leading food company recently launched a plant-based version of a classic fast food item, the meatball sub, using pea protein as the base ingredient, providing a familiar taste while maintaining plant-based integrity

- In conclusion, the plant-based meat market is evolving with technological advancements and changing consumer preferences, offering more variety and accessibility to meet the growing demand for healthier, sustainable, and cruelty-free alternatives

Report Scope and Plant-Based Meat Market Segmentation

|

Attributes |

Plant-Based Meat Key Market Insights |

|

Segments Covered |

|

|

Countries Covered |

North America

Europe

Asia-Pacific

Middle East and Africa

South America

|

|

Key Market Players |

|

|

Market Opportunities |

|

|

Value Added Data Infosets |

In addition to the insights on market scenarios such as market value, growth rate, segmentation, geographical coverage, and major players, the market reports curated by the Data Bridge Market Research also include in-depth expert analysis, pricing analysis, brand share analysis, consumer survey, demography analysis, supply chain analysis, value chain analysis, raw material/consumables overview, vendor selection criteria, PESTLE Analysis, Porter Analysis, and regulatory framework. |

Plant-Based Meat Market Trends

“Increased Availability of Plant-Based Meat Options”

- Manufacturers are expanding their product portfolios to include a variety of plant-based meat options, such as burgers, sausages, and nuggets, catering to a broader range of consumer preferences

- Plant-based meat products are increasingly available in supermarkets, restaurants, and fast-food chains, enhancing consumer accessibility and convenience

- The market has seen significant investments and collaborations aimed at scaling production and distribution of plant-based meat products, indicating growing confidence in the sector's potential

- Innovations in food technology have improved the taste, texture, and appearance of plant-based meat products, making them closer in resemblance to traditional meat and appealing to a broader audience

- Many consumers opt for plant-based alternatives due to health concerns, as plant-based meats typically contain lower levels of saturated fat and cholesterol compared to animal-based meats

- In conclusion, these trends highlight the dynamic nature of the plant-based meat market, driven by innovation, consumer demand, and strategic industry developments

Plant-Based Meat Market Dynamics

Driver

“Increased Consumer Demand for Healthier Options”

- The rising awareness about the health risks associated with red meat, such as heart disease, diabetes, and cancer, is driving consumers to seek healthier alternatives

- Plant-based meats offer a similar taste and texture to traditional meat while being lower in saturated fats and cholesterol, making them an attractive choice for health-conscious individuals

- These products are typically higher in fiber, vitamins, and antioxidants, which appeal to consumers looking to improve their overall nutrition and well-being

- Millennials and Generation Z are more inclined to adopt plant-based diets due to concerns about personal health and the environmental impact of animal farming

- For instance, the ethical and environmental issues associated with animal farming, such as animal cruelty and high carbon emissions, are encouraging consumers to choose plant-based products to reduce their carbon footprint

- In conclusion, as health concerns and sustainability issues continue to rise, the demand for plant-based meat is expected to grow steadily with consumers prioritizing both personal well-being and environmental responsibility

Opportunity

“Increase in Product Innovation and New Flavors”

- A major opportunity in the plant-based meat market lies in expanding product variety, particularly in creating alternatives to products beyond the traditional burgers and sausages

- Consumers are seeking plant-based options that replicate the taste, texture, and experience of traditional meats in a wider range of products, such as chicken, seafood, and deli meats

- Companies have the chance to innovate by using unique ingredients such as jackfruit, mushrooms, and legumes to create more diverse offerings

- There is potential to introduce new and bold flavor profiles, including spicy, smoky, or ethnic flavors, that appeal to diverse consumer preferences

- For instance, the inclusion of functional ingredients such as added protein, omega-3 fatty acids, and probiotics can meet the growing consumer demand for healthier, more beneficial plant-based options

- In conclusion, as consumer demand for more varied and health-focused products rises, the plant-based meat market holds significant potential for innovation and diversification, offering companies an opportunity to capture a larger and more diverse customer base.

Restraint/Challenge

“High Production Costs of Plant-Based Meat Alternatives”

- One of the primary challenges in the plant-based meat market is the high production cost, which results in higher retail prices compared to traditional meats

- Sourcing high-quality plant-based ingredients such as peas, soy, and wheat is expensive, making it more costly than using animal-derived proteins

- Advanced food technologies such as fermentation, extrusion, and high-pressure processing, required to create realistic textures and flavors, add significant production costs

- Smaller companies face difficulties competing with larger manufacturers, especially in regions where consumers are more price-sensitive

- The lack of sufficient processing facilities and infrastructure in some regions limits supply chain efficiency, adding another layer of complexity to the market

- In conclusion, to overcome these challenges, manufacturers must explore ways to streamline production processes, reduce ingredient costs, and scale up production to lower prices and make plant-based meat alternatives more competitive in the market.

Plant-Based Meat Market Scope

The market is segmented on the basis of source, type, product type, process, distribution channel, storage, and end user.

|

Segmentation |

Sub-Segmentation |

|

By Source |

|

|

By Type |

|

|

By Product Type |

|

|

By Process |

|

|

By Distribution Channel |

|

|

By Storage |

|

|

By End User |

|

Plant-Based Meat Market Regional Analysis

“North America is the Dominant Region in the Plant-Based Meat Market”

- North America continues to lead the global plant-based meat market, with the United States holding a significant share

- The region benefits from high consumer awareness regarding health and environmental concerns, driving demand for plant-based alternatives

- Established infrastructure and a supportive regulatory environment facilitate the growth of plant-based meat companies

- Major foodservice chains and retailers in North America increasingly offer plant-based options, enhancing product accessibility

- The presence of leading companies such as Beyond Meat and Impossible Foods contributes to the region's dominance

- In conclusion, the plant-based meat market is experiencing strong growth, with regions around the world embracing these alternatives for both health and environmental reasons

“Asia-Pacific is Projected to Register the Highest Growth Rate”

- The Asia-Pacific region is experiencing rapid growth in the plant-based meat market

- Countries such as China and Japan are witnessing increased consumer interest in plant-based products due to health and environmental considerations

- Traditional plant-based foods in these countries provide a strong foundation for the adoption of meat alternatives

- Government initiatives promoting sustainable diets and reducing meat consumption support market expansion

- The growing middle class and urbanization in the region further drive the demand for plant-based meat products

- In conclusion, Asia-Pacific region is rapidly catching up as consumers seek more sustainable food choices. As consumer interest grows globally, innovations in product offerings and improved availability continue to shape the market's future

Plant-Based Meat Market Share

The market competitive landscape provides details by competitor. Details included are company overview, company financials, revenue generated, market potential, investment in research and development, new market initiatives, global presence, production sites and facilities, production capacities, company strengths and weaknesses, product launch, product width and breadth, application dominance. The above data points provided are only related to the companies' focus related to market.

The Major Market Leaders Operating in the Market Are:

- Beyond Meat. (U.S.)

- Impossible Foods Inc. (U.S.)

- Maple Leaf Foods. (canada)

- Unilever. (Netherlands)

- Conagra Brands, Inc U.S.)

- Kellogg Co. (U.S.)

- Tofurky (U.S.)

- Valio Oy(Finland)

- Sunfed (New Zealand)

- VBites Foods Ltd (U.K)

- The Kraft Heinz Company. (U.S.)

- Yves Veggie Cuisine (U.S)

- Ojah B.V. (Netherlands)

- Moving Mountains Foods (U.S.)

- Eat Just, Inc. (U.S.)

- LIVEKINDLY Collective (Germany)

- Gooddot (India)

- No Evil Foods (U.S.)

Latest Developments in Global Plant-Based Meat Market

- In March 2024, Kraft Heinz and Not Co announced their collaboration to launch their first plant-based meat products. The new line includes plant-based versions of classic meat items such as burgers and sausages. This partnership combines Kraft Heinz's market presence with Not Co's innovative food technology to offer sustainable and delicious meat alternatives to a broader consumer base

- In June 2024, Plantaway introduced India's first plant-based chicken fillet, named Chick'n Fillet, crafted from pea protein. This innovative product offers 19g of protein per pack and is free from soy, preservatives, artificial colors, and flavors. Designed to replicate the taste and texture of traditional chicken, it caters to health-conscious consumers seeking nutritious and sustainable alternatives

- In January 2024, Nestlé India introduced its first-ever frozen plant-based Maggi offerings in collaboration with SOCIAL and BOSS Burger. This limited-time menu, available across select outlets in cities such as Delhi NCR, Mumbai, Bengaluru, Pune, Dehradun, and Chandigarh, features plant-based burger patties and mince designed to replicate the taste and texture of chicken

- In September 2023, Novozymes introduced Vertera ProBite, a biosolution designed to enhance the texture of plant-based meat products. This innovation addresses consumer concerns about texture and ingredient transparency by providing a natural alternative to traditional texturizers

- In January 2022, in response to India's increasing appetite for meatless meals, ITC announced plans to develop a range of plant-based meat products, including vegan burgers and chicken-flavored patties. This initiative positions ITC to tap into the largest market for plant-based substitutes in India, catering to a growing demographic seeking healthier options. With this launch, ITC aims to become a key player in the evolving meat alternatives sector

SKU-

Get online access to the report on the World's First Market Intelligence Cloud

- Interactive Data Analysis Dashboard

- Company Analysis Dashboard for high growth potential opportunities

- Research Analyst Access for customization & queries

- Competitor Analysis with Interactive dashboard

- Latest News, Updates & Trend analysis

- Harness the Power of Benchmark Analysis for Comprehensive Competitor Tracking

Global Plant Based Meat Market, Supply Chain Analysis and Ecosystem Framework

To support market growth and help clients navigate the impact of geopolitical shifts, DBMR has integrated in-depth supply chain analysis into its Global Plant Based Meat Market research reports. This addition empowers clients to respond effectively to global changes affecting their industries. The supply chain analysis section includes detailed insights such as Global Plant Based Meat Market consumption and production by country, price trend analysis, the impact of tariffs and geopolitical developments, and import and export trends by country and HSN code. It also highlights major suppliers with data on production capacity and company profiles, as well as key importers and exporters. In addition to research, DBMR offers specialized supply chain consulting services backed by over a decade of experience, providing solutions like supplier discovery, supplier risk assessment, price trend analysis, impact evaluation of inflation and trade route changes, and comprehensive market trend analysis.

Research Methodology

Data collection and base year analysis are done using data collection modules with large sample sizes. The stage includes obtaining market information or related data through various sources and strategies. It includes examining and planning all the data acquired from the past in advance. It likewise envelops the examination of information inconsistencies seen across different information sources. The market data is analysed and estimated using market statistical and coherent models. Also, market share analysis and key trend analysis are the major success factors in the market report. To know more, please request an analyst call or drop down your inquiry.

The key research methodology used by DBMR research team is data triangulation which involves data mining, analysis of the impact of data variables on the market and primary (industry expert) validation. Data models include Vendor Positioning Grid, Market Time Line Analysis, Market Overview and Guide, Company Positioning Grid, Patent Analysis, Pricing Analysis, Company Market Share Analysis, Standards of Measurement, Global versus Regional and Vendor Share Analysis. To know more about the research methodology, drop in an inquiry to speak to our industry experts.

Customization Available

Data Bridge Market Research is a leader in advanced formative research. We take pride in servicing our existing and new customers with data and analysis that match and suits their goal. The report can be customized to include price trend analysis of target brands understanding the market for additional countries (ask for the list of countries), clinical trial results data, literature review, refurbished market and product base analysis. Market analysis of target competitors can be analyzed from technology-based analysis to market portfolio strategies. We can add as many competitors that you require data about in the format and data style you are looking for. Our team of analysts can also provide you data in crude raw excel files pivot tables (Fact book) or can assist you in creating presentations from the data sets available in the report.